Award of disability

Today, recognition of a person as disabled is carried out through a special medical and social examination. This issue is regulated by official government decree. It is indicated that disability is issued for a certain period:

- Two years - 1 group;

- Year – 2nd and 3rd group.

According to the same resolution, disability is established strictly until the 1st day of the month following the month in which the ITU was assigned. If this commission recognizes a person as disabled, he is issued a special certificate . It contains information such as the group of the awarded disability and the prescribed rehabilitation program.

This document must be provided to the employer. He checks the correctness of its completion, the presence of the required information and its veracity. After this, a decision is made regarding the subsequent or initial employment of the employee.

Determination of disability

The relationship between citizens and the state is always ordered and subject to legal acts. To put it simply, there are documents regulating each procedure.

Thus, benefits for disabled people of group 2 are provided only after a medical and social examination (MSE). And it, in turn, is prescribed only to people suffering from certain ailments.

Their list and characteristics are established by Order of the Ministry of Labor No. 1024n dated December 17, 2015.

Download to view and print

Order of the Ministry of Labor of Russia No. 1024n dated December 17, 2015

Disorders leading to the establishment of disability of the 2nd group

- Moderately limited ability to move independently. Regular partial assistance from other persons is required, using auxiliary technical means if necessary. That is, a person is not able to:

- walk freely;

- maintain balance;

- use public transport.

- Inability to adequately perceive the environment, determine time and location.

- Incomplete ability to communicate independently. That is, a person needs outside help to exchange information.

- Limitation of the opportunity to learn. Training is possible with the conclusion of a psychological, medical and pedagogical commission. It is necessary to create special conditions for receiving education, according to adapted educational programs, if necessary, studying at home or using distance learning technologies.

- Inability to work normally. That is, a disabled person is able to take part in the production process only when special conditions are created and with the use of auxiliary technical means.

- Ability to self-care with regular partial assistance from others. Use of auxiliary technical means if necessary. Self-care refers to the fulfillment of basic physiological needs, the performance of daily household activities, including the use of personal hygiene skills.

- Inability to control your behavior. A constant decrease in criticism of one’s behavior and environment, with the possibility of partial correction only with the regular help of other people.

Each restriction is set officially by medical professionals. The citizen or his representative is given a corresponding document.

Diseases leading to disability

The list of ailments due to which group 2 can be assigned is wide.

These include, in particular:

- disorders: mental functions;

- language functions and speech, including stuttering, problems with voice formation;

- loss of vision, hearing, smell;

- respiratory;

- disproportionate sizes of body parts;

The second disability group is working. Only disabled people of the 1st group are considered completely unable to work.

Criteria for group assignment

Disability is assigned to a person if the following conditions are met:

- He was diagnosed with a disorder of body functions in the range of 70-80%, caused by:

- diseases;

- injuries;

- defects.

- They lead to a limitation of his normal life activities.

- A person needs rehabilitation and social protection.

The process of examining a patient for the fact of being assigned a disability must be initiated by him personally or by his representative. Medical institutions only respond to citizens’ requests on this issue.

Dismissal of a disabled person

If there is a need to fire a person, this process is carried out strictly in accordance with the rules prescribed in clause 5, part 1, art. 83 Labor Code of the Russian Federation. The documentary basis in such a case is the official conclusion of the ITU.

If a person has become disabled as a result of his work at a given enterprise, if he has received a certain occupational disease, upon dismissal he is paid expenses for the following types of rehabilitation:

- Social;

- Medical;

- Professional.

In this case, the volume, types and general conditions for the provision of payments are prescribed in legislation No. 125-FZ and 165-FZ.

Transfer to another position

If a person is of a certain value to the enterprise, if his health condition allows him to work in lighter types of activity, he must be transferred. Only if the employee is not satisfied with the new position, he can be fired. This rule is spelled out in clause 8, part 1, art. 77 Labor Code of the Russian Federation.

Expert opinion

A person with a disability can only be fired in two cases. The first is the lack of a suitable position at the enterprise. The employee’s refusal to accept the options provided. In this case, in any case, the employee is paid compensation in the amount of two weeks’ average salary.

Employee of the social protection organization, Moscow, Lyudmila Dmitrievna Cherenkova.

Other required compensation

Along with monetary compensation equal to two months' salary, a dismissed employee has the right to receive payment for unworked vacation days. If a person is transferred to another place of work due to disability, he must retain the salary received in his previous position. This is not an indefinite accrual:

- If it is clear that the employee will not recover, that the disability will last throughout his life, then the additional payment is made within a month from the date of transfer;

- If there is reason to believe that the person will recover, additional payment will be made until recovery.

Along with the required cash payments, the employee who remains at the enterprise will be entitled to other benefits. They are worth studying in more detail.

Procedure for conducting ITU

The office responsible for the examination must be located at the applicant's place of residence (in the nearest city).

If necessary, specialists will visit your home.

The examination consists of studying and analyzing:

- provided documentation;

- the applicant's physical and mental condition;

- social and living conditions of his residence;

- human labor capabilities.

The objectives of the medical and social examination are:

- establishing a disability group, the category “disabled child”;

- establishing the causes of disability, the time of onset and duration of disability;

- determination of the degree of loss of professional ability as a percentage;

- determining the need for constant care due to health reasons;

- development of an individual rehabilitation or habilitation program for a disabled person;

- issuance of a new certificate or a duplicate certificate confirming the fact of disability;

- other goals.

Package of documents for passing the ITU

A citizen must go to the hospital in order to undergo a medical and social examination (MSE). But first he must collect a package of documents.

It includes:

- Referral to medical examination, issued by the attending physician. This paper must contain information about:

- state of human health;

- describe the degree of dysfunction of his body;

- compensatory capabilities of the body;

- results of medical examinations;

- rehabilitation measures that have already been carried out to restore the affected function.

- Application for passing the ITU, written in your own hand. Parents (guardians) fill it out for their children.

- Copy and original of passport (birth certificate).

- Work record book (original and copy), if available.

- Certificate of income, if available.

- Outpatient card.

- An act of receiving an industrial injury or occupational disease, if the damage occurred as a result of work activity.

- Characteristics from the employer or head of the educational institution.

A referral to ITU can be issued by the local branch of the Pension Fund or social protection of the population. The same package of documents is submitted there. Upon receipt of a refusal to issue a referral from the above-mentioned authorities, a citizen has the right to independently contact the bureau dealing with ITU.

Contents of the protocol

During the MSE, a detailed protocol is kept.

The applicant himself must be familiar with its contents.

The document is drawn up in accordance with the form approved by order of the Ministry of Labor of Russia dated October 17, 2012 No. 322n.

It includes the following information:

- Dates:

- filing an application;

- conducting an examination.

- Exact time of inspection.

- Individual data of the candidate for disability assignment:

- FULL NAME;

- date of birth;

- floor;

- residential address;

- citizenship;

- contact information;

- passport details.

- Information on the progress of the examination:

- grounds;

- location;

- information about the initial or repeated MSE;

- objectives of the examination;

- examination results;

- duration and disability group.

- Social details:

- Family status;

- its characteristics;

- number of family members;

- having your own home.

- Information about the education received.

- Professional details of the applicant.

- Clinical and functional information established during the examination.

- The conclusion reached by experts during the ITU.

- Cause of disability.

The protocol is signed by each member of the commission. The document must indicate the position, surname and initials of the specialists, and bear the seal of the bureau.

Medical and social examination report

Activities to conduct ITU end with the preparation of a corresponding document. Its form was approved by order of the Ministry of Health and Social Development of Russia No. 373n dated April 17, 2012.

It includes the following data:

- Information about a candidate for disability.

- The decision of the bureau for conducting the ITU, namely:

- description of the type and degree of health disorders;

- conclusion about limitations in life activities;

- approved disability group or reasons for refusal;

- causes of disability;

- date of the next survey;

- if established, the fact of recognition of permanent disability;

- information about the degree of disability.

In case of refusal, the citizen has the right to appeal.

To do this, you must write a corresponding application within a month from the date of receipt of the act. The act is filled out by specialists conducting a medical and social examination of the citizen and signed by the head of the ITU bureau.

Download to view and print

Order of the Ministry of Health and Social Development of Russia No. 373n dated April 17, 2012

Re-examination for disabled people of the 2nd group

According to the law, this type of disability is established only for a calendar year. After this period, the benefits end. The citizen must go through the entire ITU procedure again.

The date of re-examination is indicated in the report.

Guarantees for disabled employees

As noted above, an employee with a disability can be officially transferred to easier work if appropriate positions are available. In such a case, the employer must provide certain guarantees. They are described in more detail in the table.

| Benefit name | The essence of the benefit |

| Working hours per week | For employees with disability group 2, the working week is reduced from 40 hours to 35 |

| Daily working hours | Shift time depends on medical report |

| Involvement in overtime work, night shifts and weekends | Employees with disabilities may be involved in such work only with their written consent. An additional condition is the absence of a prohibition on the part of medical indications. It is an employee’s legal right to refuse such shifts. |

Despite the fact that disabled people work for a reduced period of time, they fully retain the required wages. The employer does not have the right to reduce the salary in relation to the actual time worked. The listed rules and requirements for financial support for disabled people are prescribed in Federal Law No. 181.

Important! If a disabled person was involved in the night shift, the total working time will not be reduced.

It is believed that the absence of medical contraindications, as well as one’s own consent, allows one to work a full night shift.

Basic material benefits

Disabled people have the right to a shortened working week, which is established in clause 3, article 23, Federal Law of November 24, 1995 No. 181-FZ and in clause 1, art. 92, Labor Code of the Russian Federation.

This measure applies exclusively to disabled people of the first and second groups.

A shortened work week means no more than 35 working hours for the entire week. The employer is obliged to take this aspect into account when drawing up a work schedule, as well as an employment contract. In this case, the length of the working day is determined according to a medical report.

The same aspect is taken into account when calculating wages - it cannot be less than that of other citizens working a “full” 40-hour week. Shortened shifts for disabled people are not grounds for a pay cut.

The employer does not have the right to calculate wages based on the number of hours actually worked. That is, a disabled employee is required to receive regular wages on an equal basis with everyone else.

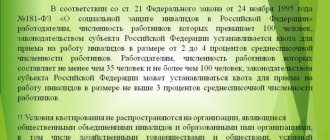

Quotas have been established for hiring people with disabilities, and each enterprise and institution has its own quotas, which are determined at the regional level (Part 2 of Article 22 of Law No. 181-FZ). The employer is obliged to create such places, as well as specially equip them for the employment of disabled people (Part 1, Article 22 of Law No. 181-FZ).

The employer must create working conditions (including work hours) in accordance with the individual rehabilitation program for a disabled person. Including the maximum daily working hours is set by this program.

Download to view and print

Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ

Federal Law No. 181-FZ of November 24, 1995 – On the social protection of disabled people in the Russian Federation

Vacation pay for disabled people

According to the general rules prescribed in Art. 115 of the Labor Code, the total time of standard vacation should not be less than 28 days. For citizens who have disabilities, this rest period is automatically increased by two days .

This change in the total vacation time must be specified in the employment agreement. In order for a decision to be made, the employee must provide disability certificates.

Based on an official written application, the employee is granted leave without pay. The duration depends on how the employee and his boss agree. This period can be any, but not more than 60 days.

Based on the legal provisions established today, we can conclude that leave without pay is divided into two categories:

- Provided at the discretion of the manager. This is a period of rest that is given on the basis of family extenuating circumstances;

- Provided at the request of the employee. They apply to certain categories of employees who have a second group disability.

Special conditions are provided to disabled people when it comes time to undergo the next medical examination. For this period, a person does not need to arrange a vacation at his own expense . The frequency of such a commission may vary:

- First disability group – once every two years.

- The second and third groups - once a year.

- During the period of change in the vocational rehabilitation program.

- If the general labor or clinical prognosis worsens.

In the extreme two cases, the person is sent to ITU. The transit time does not matter in this case. Also, the disability group awarded earlier does not matter.

Are there any benefits for disabled people of group 2?

State support for people with disabilities is provided both at the federal and regional levels. Among the benefits for disabled people of 2 groups, the following are distinguished:

- disability pension;

- monthly cash payments and a set of social services;

- benefits when paying utility bills;

- discounts on public transport;

- tax preferences;

- free medical care;

- other benefits and benefits. Let's take a closer look at what a group 2 disabled person is entitled to and how to get these privileges.

Payments and benefits for Chernobyl victims

This is a special category of employees. They are entitled to annual fully paid leave. You can go on vacation at any convenient time. At the same time, this category of employees can count on additional leave of 14 days. Its provision and payment are carried out on the basis of the Law of the Russian Federation of May 15, 1991 No. 1244-1.

To receive such additional leave, the head of the enterprise must give the person a certificate about the amount of the average salary. The amount due for payment must be indicated.

It is registered with taxes deducted for the period when the person will be on vacation. This certificate must be signed by the chief accountant and the official head of the company in which the Chernobyl worker works.

Benefits and preferences granted to this group of citizens

Benefits and other benefits provided to disabled people of the 2nd group are described in Federal Law No. 181-FZ “On the social protection of disabled people in the Russian Federation”. These include various discounts on payment for services, provision of additional benefits, and more.

Pension provision

This category of citizens is assigned two types of state support. It depends on availability:

- work experience;

- dependents.

In 2021, the pension for disabled people in this group was equal to:

- social — 5,283.84 rubles;

- disabled children - 12,681.89 rubles;

- labor (fixed):

- in the absence of dependents - 5,334.19 rubles;

- one dependent - 7,112.25 rubles;

- two - 8,890.31 rubles;

- three - 10,668.37 rub.

If you have work experience, pension benefits are calculated using a formula.

Its size is higher than indicated. A monthly cash payment (MCP) is made if the beneficiary refuses to receive social services:

- sanatorium treatment;

- discounts on medicines;

- use of discounts on rail travel.

Its size depends on the wishes of the citizen himself and relevant government regulations. From 02/01/2019, the EDV amount is 2,701.62 rubles.

The amount of EDV depends on whether the beneficiary uses a package of social services. Their cost is deducted from the total amount if the person has not officially renounced them.

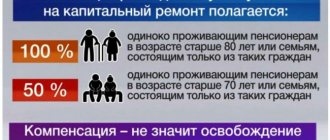

Discounts on housing and communal services

Disabled people of the 2nd group are provided with the following preferences at the expense of budget funds:

- 50% discount on bills for:

- rental and maintenance of residential premises;

- gas;

- water supply and sanitation;

- garbage removal;

- electricity;

- other utilities.

- Reducing fuel prices by 50% if there is no central heating.

- Compensation of half of the contribution for major repairs.

For preferences, a citizen must contact the social protection authorities. They are not provided automatically. Discounts are awarded only to disabled people and do not apply to family members.

Housing

The government has determined a list of cases in which citizens of this category receive state support to resolve the housing issue.

These include the following situations:

- when a person does not have his own property, he lives under sublease or rented housing for a long time;

- when a disabled person lives in a hostel (except for periods of study, seasonal work);

- when a beneficiary is forced to share one apartment with a family not related to him;

- if a citizen shares an apartment with other families, one of which includes a sick person, and living next to him is difficult;

- the citizen’s apartment does not meet: technical or sanitary requirements;

- social security standards of the region.

State support is provided in the following ways:

- Provision of apartments from the housing stock of the constituent entity of the federation.

- Providing a subsidy for the purchase of a house or apartment.

When providing housing for beneficiaries, government agencies proceed from social norms (18 sq. m per person).

Features of housing provided to disabled people:

- Apartments and houses are selected taking into account the health status of all family members. They are allocated in order of priority.

- The area of housing allocated under a social tenancy agreement may exceed social norms.

- The house may be provided with special devices necessary for rehabilitation.

- The beneficiary can receive a plot for individual construction instead of housing.

To resolve the housing issue, you must submit an application to the district administration. The list of documents for registration may vary depending on the region. Typically, the following documents are attached to the application:

- statement;

- certificate of family composition;

- preferential certificate;

- passport;

- BTI certificate.

The applicant is obliged to stand in line as someone in need of improved living conditions.

Medical benefits

Citizens of the described preferential category have the right to preferences for the purchase of medicines.

They are provided in the following sizes:

- Free for disabled people of group 2 as part of an individual rehabilitation program.

- With a 50% discount for employed people, if this is prescribed by the regional program.

- Prosthetics at public expense, if necessary, within the framework of a regional program, if one exists.

Discounts on medications are indicated on the prescription. There the doctor is obliged to write down the details of the pharmacy. When purchasing products, only a prescription is required. Requiring other documents is illegal.

Disabled people are entitled to sanatorium-resort treatment as part of an individual rehabilitation program. You should contact your doctor for a voucher. The doctor issues a referral indicating:

- type of sanatorium;

- reasons for providing a trip.

Copies should be attached to this document:

- passports;

- ITU certificate;

- individual rehabilitation program.

The package of these papers is transferred to the branch of the Social Insurance Fund of the Russian Federation at the place of residence along with the corresponding application. Employees of this body are required to provide a response within 14 days.

Transport discounts and preferences

Citizens of the described category are provided with the following benefits:

- They travel in urban and rural transport free of charge or on preferential terms; such a right must be stipulated in regional legislation (except for taxis and private minibuses).

- Once a year, tickets to the place of spa treatment (round trip) are issued without payment. To receive them, you must have a voucher issued on the basis of an individual rehabilitation program.

- Exemption from payment of transport tax for a car with special devices, such a right is also secured by regional law (power no more than 100 hp).

Transport preferences are issued at the Pension Fund branch. To do this, you must have with you documents confirming your preferential category and identification.

Other benefits

Disabled people of the 2nd group enjoy a number of advantages in the provision of services, taxation and others.

These include:

- Exemption from property tax for individuals on one property.

- Reduction of land tax.

- Exemption from paying state duty when going to court (if the claimed damage is less than 1 million rubles).

- 50% discount on notary fees.

- Non-competitive enrollment in universities and secondary specialized educational institutions, subject to successful passing of entrance examinations.

- Children raised in families where both parents have disabilities receive two free meals a day at school.

Preferences and discounts are provided only if you have documents confirming the category.

Benefits when downsizing

In Moscow and the region there are certain advantages when reducing the total number of employees. In such a situation, preference is given to the following categories:

- Employees who received certain injuries or an occupational disease in the course of their work;

- Disabled combat veterans who took part in operations to defend the country.

If for some reason these employees cannot be kept at work, they must be provided with other vacant jobs. They are not necessarily qualified, but may be inferior and paid at lower rates. In the process of choosing an alternative place of work, the general physical condition of the employee must be taken into account .

How to get benefits in 2021

In order for rights and benefits to be realized, a citizen is first of all obliged to confirm his status as a disabled person. For this purpose, a special commission is held in a medical institution, based on the results of which a corresponding certificate is issued.

This is exactly what needs to be provided to a working disabled person:

- at the place of work;

- to the Department of Social Protection of the Population;

- another body providing benefits.

The employer is obliged to take into account the certificate according to which the employee is classified as a disabled citizen, and, taking it into account, draw up an additional agreement to the employment contract or a new employment contract. In addition, based on the certificate, the employer undertakes to organize decent working conditions for the employee.

An employer does not have the right to assign an employee with disabilities to night shifts unless the latter has expressed his consent to this in writing, or when this is contrary to medical indications. On weekends and overtime, a disabled employee also has the right not to work on completely legal grounds.

It is noteworthy that the legislation of the Russian Federation provides for special quotas for places for citizens with disabilities.

The size of quotas is established by regional legislation.

So, if an organization or enterprise employs more than 100 people, then the quota is subject to implementation; the average number of jobs for disabled people is set from 2% to 4%. If the company employs less than 100 people, then hiring a disabled person remains the right of the employer, and not an obligation.

If there is no quota, a management representative has the right to refuse employment on legal grounds. If the employer has not exercised his right to a quota, if it exists, then he is obliged to pay the appropriate taxes and fees to the state. Exceptions are enterprises with harmful or dangerous working conditions.

A disabled person who is not hired by an organization that has a quota has the right to go to court without paying a state fee.

Workplace equipment

If a manager has an employee with a disability at an enterprise, he must ensure that appropriate conditions are created for working.

Appropriate equipment must be available at the workplace. This rule is spelled out in Part 1 of Art. 22 No. 181-FZ. When arranging a workplace, such important factors as the functions and limitations a person has must be taken into account.

According to modern legislation, employers who employ disabled people in their enterprises receive certain tax benefits. Many Moscow entrepreneurs at one time began to abuse this situation and hired a large number of such employees to the enterprise.

For this reason, provisions related to the minimum number of posts were established and adopted. For each specific enterprise, quotas have been determined for the admission of people with disabilities.

Objectives of protection of persons with disabilities

The purpose of social protection of disabled people. Why do people with disabilities need help?

- improving working conditions and labor protection for disabled people

- creation and preservation of jobs for people with disabilities (purchase and installation of equipment, including organizing the work of homeworkers)

- training (including new professions and work methods) and employment of people with disabilities

- production and repair of prosthetic products

- acquisition and maintenance of technical rehabilitation equipment (including acquisition of guide dogs)

- sanatorium and resort services for disabled people, as well as persons accompanying group I disabled people and disabled children

- protection of the rights and legitimate interests of people with disabilities

- events for the integration of disabled people into society (including cultural, sports and other similar events)

- ensuring disabled people have equal opportunities with other citizens (including transport services for persons accompanying group I disabled people and disabled children)

- acquisition and distribution of printed publications of public organizations of disabled people among disabled people

- acquisition and distribution of video materials with subtitles or sign language translation among disabled people

- contributions sent by these organizations to public organizations of disabled people for their maintenance

When determining the total number of disabled people, the average number of employees does not include disabled people working part-time, under contract contracts and other civil law contracts.

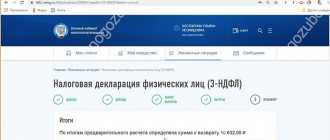

Personal income tax on payments received

In accordance with paragraphs. 2 p. 1 art. 218 of the Tax Code, in the process of establishing the size of the total tax base, each taxpayer has the opportunity to receive deductions.

Important! For persons with disabilities of the second group, a deduction is provided equal to 500 rubles for each month of the reporting period.

Such relief is provided in each month of the reporting year. The amount of annual profit and salary does not matter. In other cases, the operation of calculating and withholding tax is the same as in relation to ordinary employees.

EDV and NSU

What other disability benefits is a person entitled to besides a pension? Disabled people of group 2, along with pension payments, are accrued 1,515.05 rubles per month indefinitely.

In addition, a set of free social services is offered, which includes:

- medicines;

- vouchers to a sanatorium for treatment and rehabilitation with compensation for railway travel and air tickets;

- suburban and intercity transport.

A person with a disability may refuse one, several, or all benefits at once and receive monetary compensation for this.

Compensation for the first service is 828.14 rubles, for the second – 128.11 rubles, for the third – 118.94 rubles.

Thus, for refusing all services you can get 1,075.19 rubles, then the total amount per month will be 2,590.24 rubles. The decision can be changed every year until October 1.

The application for receipt is submitted as part of a set of documents for a pension or separately. Based on the result of choosing services, PF employees issue a certificate with a list of benefits provided.

Insurance transfers

Despite certain tax breaks, the employer does not have similar benefits in the area of contributions. According to modern legislation, there are no reduced rates for standard contributions. At the moment, the head of the enterprise is obliged to deduct such amounts.

To the Pension Fund

22%. This is the amount that is transferred within the limits of the basic base for the calculation of required insurance premiums. They go towards standard pension insurance.

10% above the maximum limit for required contributions to pension insurance.

In the FSS

2.9% is transferred here within the limits of the amount for calculating required contributions for the necessary insurance. This applies directly to periods of temporary disability or due to maternity.

In FFOMS

5.1% are transferred in this direction. The company must transfer such contributions from the entire amount of transferred remuneration. The maximum value has not yet been approved.

Types of preferential incentives for disabled people of group II

Citizens with psychophysiological disorders and limited legal capacity are subject to continuous support provided by the state. In addition to the mandatory pension payments, disabled people of the second group have always been provided and are entitled, as of 2021, to a certain set of preferential benefits at all levels of the government organization.

Incentives for disabled people of the second group are informally divided into:

- Measures to satisfy social needs. Social support measures

- Tax preferential conditions. Disabled people of group 2 are entitled to tax benefits

- Labor incentives and labor protection. Disabled people are entitled to labor incentives and labor protection

- Medical benefits and concessions.

Pension provision

For disabled people of the second group, 3 regular monthly cash incomes are provided.

The idea of a social pension involves payments from budgets of different levels, aimed at economically equipping disabled citizens. It is assigned under those life circumstances if the individual does not have grounds to receive both a labor and state pension.

Its total indicator is a fixed final payment provided monthly.

Category of disability Payment as of 01/01/2018 Payment as of 01/04. 2021, taking into account indexation

| II disability group | 5034.36 rubles | The Minister of Labor and Social Protection of the Russian Federation M.A. Topilin officially announced that 01.04. In 2021, this payment will be indexed by 4.1%. Its final size will be 5240.76 |

| Group II disability since childhood | 10314.68 rubles | Its final size will be 10737.59 |

This payment is assigned to disabled men upon reaching the age of sixty, and to women no earlier than fifty-five years of age. The main source of financing for social pensions is general taxation. The main source of financing for social pensions is general taxation

Insurance pension

This financial support is provided directly from the Pension Fund of the Russian Federation. Its appointment is carried out exclusively for individuals registered in accordance with all the rules in the pension system.

The right to receive this financial assistance arises if a citizen is recognized as disabled and in order to compensate him for earnings or other income.

There are several criteria for persons who wish to become recipients of this type of pension equipment.

- Those wishing to do so are required to register with the pension system.

- Their legal status must meet the criteria of limited ability to work on the basis of federal law.

- For such individuals, one of three categories of disability must be established.

Types of insurance pension

A disability insurance pension is established regardless of the reasons for a person’s inability to work, the length of his insurance period, or the total amount of work activity.

The size of this payment is directly related to the salary received. In addition to insurance material support, a portion of the amount of a fixed amount is allocated; its volume will vary depending on the category.

For disabled individuals of group II, the amount of fixed payment of group II is 4,758.98 rubles. The disability insurance pension is established regardless of the reasons for the person’s incapacity for work.

Labor pension

It is paid monthly and is aimed at compensating citizens for wages and other material income. For its purpose, it is necessary to embody a couple of facts:

- Recognition on the basis of a medical report of a disability status of the first, second or third category in combination with limited ability to perform a labor function.

- A formalized conclusion of a medical and social examination on recognition as a disabled person.

When the right to this material assistance arises, it does not matter whether the disabled individual continues to perform labor functions and also the moment of the onset of disability is not important. It can occur during the production process, before it is carried out, or after leaving service. Amount of disability pension

The fixed amount of this state payment in connection with group 2 disability is 2,771 rubles per month. At the same time, citizens in respect of whom this payment is assigned should not have anyone as a dependent, since in the presence of this legal fact, the amount of benefits is subject to a significant increase.

| The condition of a person of category II limitation of physical and mental abilities, dependent on disabled family members | 1. Financial care for a single dependent - 3512 rubles per month; 2. Providing for a couple of people who are part of the family - 4313 rubles per month; 3. For financial assistance to three or more dependent persons - 5237 rubles per month |

| Disabled people who have worked for fifteen years (minimum) in the harsh climate of the Arctic zone and have a work experience of at least twenty-five years for men and twenty for women | Such persons with category II disability receive 3,671 rubles per month |

| Disabled people working for fifteen years (minimum) in the Far North, dependent on disabled family members | 1. A person who is dependent and disabled in the first category - 9102 rubles per month. 2. A person who is dependent and disabled in the second category - 5,321 rubles per month. 3. A person who is dependent and is disabled of the third category - 3404.50 rubles per month |

Common Mistakes

Error 1. A person became disabled and became depressed from lack of money and hopelessness.

Even if the second disability group is accepted, there is no need to despair. There are many enterprises in Moscow and other Russian cities that hire people with disabilities. This is beneficial for employers. By providing a couple of jobs, they receive tax benefits.

Error 2. Registration of sick leave for medical examination.

Leave for this event is not issued. This is a valid reason for absence from work. The person leaves for the duration of the commission and is listed on the report card as temporarily disabled.

Tax benefits

Disabled people of the second group can take advantage of the following tax benefits:

- for transport tax – exemption for vehicles up to 100 hp. when purchasing it through social security authorities;

- for land – exemption from payment for a land plot measuring 600 square meters. m.;

- for property – tax exemption for one object of each type;

- Personal income tax is not calculated on pensions, benefits and benefits.

To register, you must submit an application to the tax service at any time, attaching a copy of the results of the medical examination. The review takes place within 30 calendar days, after which a decision is sent to the citizen.

Taxes

Tax incentives are also available from local authorities, so you may want to check your local laws. Follow this link to find out about tax incentives in your region.

Property tax

Disabled people of groups I and II do not pay tax on property and real estate received as an inheritance.

Transport tax

There is no transport tax on cars specially equipped for use by disabled people. This tax is paid at 50% if the car was purchased through social security authorities and the power does not exceed 100 hp.

Transport guarantees

Citizens who, for health reasons, are not allowed to perform work of a certain volume and quality are guaranteed the right to privileged use of public and private vehicles.

The list of benefits is reflected at the municipal level. Because of this, the number, type and volume of payments are subject to variability depending on the place of residence. In the Moscow region, the authorities provide the following list of preferences:

- Free travel on passenger transport in the city with the exception of taxi services.

- Providing for disabled persons, which is equipped with a lifting mechanism for transporting disabled people and specialized means for landing.

- Reduction of transport tax by fifty percent when registering a vehicle with a non-system power unit of up to one hundred and fifty horsepower.

- Unpaid transportation by land and air when purchasing a ticket to the place of rehabilitation or treatment and back.

A disabled person of group 2 has the right to free travel on passenger transport in the city

Land tax

When calculating land tax, the tax base is reduced by the cadastral value of 600 square meters (6 acres) of the area of land owned, permanent (perpetual) use or lifetime inheritable possession by the following categories of citizens:

- disabled people of groups 1 and 2 (registered before 2004) disability

- disabled since childhood

- veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations

- who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology

Discount conditions in the housing and communal services sector

Communal benefits for people with disabilities have been constantly subject to legislative amendments. Such instability is directly related to the unstable position of current tariffs.

As of 2021, disabled people of the second category are provided with a fifty percent discount when paying for this complex of economic sectors. Thus, a reduction in the cost of a certain type of service applies to:

- Utility payments.

- Contributions for capital repairs of the structure.

Keep in mind that this cost reduction only applies to people who are on benefits. Members of his family are not subject to similar rights, even if they live at the same address.

Tax deductions

The following tax deductions apply in 2021.

When calculating the taxable amount, it is reduced:

- in the amount of 3,000 rubles for each month of the current year applies to the following categories of taxpayers:

- citizens who became disabled as a result of the disaster at the Chernobyl nuclear power plant, military personnel and military personnel who performed work related to the liquidation of the consequences of the Chernobyl disaster, evacuees from the exclusion zone, resettled from the resettlement zone or those who left this zone, persons who donated bone marrow to save injured people due to the Chernobyl disaster

- disabled people who received or suffered radiation sickness and other diseases as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River, persons who were directly involved in the work to eliminate the consequences of the accident in 1957 at the Mayak production association, as well as those employed in carrying out protective measures and rehabilitation of radioactively contaminated areas along the Techa River in 1949 - 1956, persons evacuated, as well as those who voluntarily left populated areas, including children, including children who were in a state of emergency at the time of evacuation intrauterine development

- disabled people of the Great Patriotic War

- disabled military personnel who became disabled in groups I, II and III as a result of wounds, contusions or mutilations received while defending the USSR, the Russian Federation or while performing other military service duties, or received as a result of a disease associated with being at the front, or from among former partisans, as well as other categories of disabled people equal in pension provision to the specified categories of military personnel

- A tax deduction of 500 rubles for each month of the current year applies to the following categories of taxpayers:

- disabled people since childhood, as well as disabled people of groups I and II

- tax deduction for each month of the tax period applies to the parent, spouse of the parent, adoptive parent, guardian, custodian, foster parent, spouse of the foster parent who support the child, in the amount of 3,000 rubles - for each child in the case , if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II

Benefits for people enrolling in educational institutions

Every individual living on the territory of the Russian Federation has the right to receive education and health problems should not become an obstacle to the exercise of this right. Therefore, the state has established a number of guaranteed conditions for such categories of persons.

Applicants for whom a disability has been established can study in secondary vocational and higher education programs on a budgetary basis.

The only criterion for selection for such citizens should be passing exams at the proper level.

Local regulations of most educational institutions establish the priority right to admit disabled students to students. For such persons, several measures apply in relation to their training:

- The educational process takes place in an adapted manner, based on the student’s health status.

- The rehabilitation program of a disabled student is taken into account.

Every individual living on the territory of the Russian Federation has the right to receive education

For disabled students of the second category, the level of scholarship contributions increases by fifty percent.

Privileges for applicants with disabilities

In Russia, in June 2021, a new law was considered regarding the right of a disabled applicant to apply for admission to several educational institutions of his choice at once. It implies non-competitive admission, including to universities within the existing quotas. If they are exceeded, then enrollment in the institution is carried out on a competitive basis. The selection is made from the same beneficiaries.

This admission procedure does not guarantee admission to a university for children with disabilities, even if they successfully pass all tests (exams). This led to the development of this law, which allows applications to be submitted to several universities at the same time, which significantly increases the chance for such teenagers to continue their studies.

This law applies not only to disabled children after school, but also to persons who became disabled during military service

Preferential admission for this group of people is also possible in universities, where applicants are admitted not only according to the results of the Unified State Examination, but also according to the grades obtained in additional exams of both creative and specialized orientation.

State fees

The following are exempt from paying state duty:

- Benefits for disabled people and participants of the Great Patriotic War, made in cases considered by courts of general jurisdiction, arbitration courts, magistrates, the Supreme Court of the Russian Federation, the Constitutional Court of the Russian Federation, when applying to authorities and notaries

- Benefits for disabled people, participants of the Great Patriotic War, disabled people of the Great Patriotic War (a team of authors, copyright holders, each member of which is a disabled person, a participant in the Second World War, a disabled person during the Great Patriotic War), who is the sole author of a computer program, database, topology of an integrated circuit and the copyright holder for it, who wants to obtain a certificate of registration in his name

Disabled people of groups I and II are exempt from paying state fees in cases considered by the Supreme Court of the Russian Federation, courts of general jurisdiction, and justices of the peace.

Benefits for disabled people when applying for notarial acts are provided to disabled people of groups I and II - 50 percent for all types (applies only to the fee)

Labor privileges for disabled people of category II

For disabled people who continue to work, special working conditions are guaranteed. These rules are mandatory for every employer and failure to comply may result in administrative or criminal penalties. The following preferential conditions are provided:

- The length of the working week should not cross the line of thirty-five hours. Otherwise, this will constitute a violation.

- Temporary release from work on weekdays should be at least thirty days. Leave for a shorter period is not permitted.

- Priority right to determine the desired rest time;

- For workers, a rule has been established to reduce the tax base when calculating remuneration for labor and increases to it.

- Taking into account the opinion of a disabled person when performing overtime a number of operations and functions during non-working hours. The state of his physical, mental and social situation must also be taken into account.

- A link in the production process of a particular disabled person must be coordinated with a set of measures for the rehabilitation of the individual.

Additional payments for disabled people of group II

Additional assistance is received by those citizens who have dependents (minor children, retired parents). The size of payments directly depends on their quantity:

| Number of dependents | 2018 | 2020 |

| basic | RUB 4,982.90 | RUB 5,334.19 |

| for one | RUB 6,643.87 | RUB 7,112.25 |

| for two | RUB 8,304.84 | RUB 8,890.32 |

| for three or more | RUB 9,965.81 | RUB 10,668.32 |