Whatever field the company operates in, whatever work its full-time or freelance employees do, the first and main issue that worries them is wages and everything that concerns it. Neither working conditions, nor the availability of social guarantees, nor any other factors concern hired personnel as much as payment of earned money. And here the primary role is played by the financial culture of the enterprise, its honesty and decency in relations with employees, as well as law-abidingness in relations with the state.

How and in what order wages should be paid is established by the Labor Code of the Russian Federation. 136 of its article precisely regulates the terms of payment of salaries to employees of enterprises and organizations. In particular, it states that salaries should be paid at least twice a month, with a desirable interval of 15 days.

Some time ago, a number of legislators proposed introducing a weekly payment option, but this amendment has not yet received government approval. But, let's start in order.

Question: How to reflect in an organization’s accounting the accrual and payment of monetary compensation to employees for failure to pay wages on time? Wages for the past month were paid to employees in violation of the terms established by the collective agreement for their payment. The amount of compensation for delayed payment of wages, calculated based on the minimum amount established by the Labor Code of the Russian Federation and the number of calendar days of delayed payment, is 12,478 rubles. Compensation due to employees was transferred to the employees' bank accounts. Operations related to the calculation and payment of wages are not considered in this consultation. For the purposes of tax accounting of income and expenses, the organization uses the accrual method. View answer

The concept of a payslip

In accordance with the Labor Code of the Russian Federation, each employer must provide the employee with a payslip when issuing wages. In practice, however, this requirement is not observed by all employers. To understand the essence of the pay slip and its significance for labor relations, let us turn directly to the issue of its appearance, form, and the need to comply with the rules contained in Article 136 of the Labor Code of the Russian Federation.

Wages are essentially a reward for work, which is determined by the professionalism of the employee, the complexity, quality, quantity and conditions of the work performed (Article 129 of the Labor Code). The salary consists of:

- compensating payments (additional payments and allowances, including for work that differs in its conditions from normal, for example, in non-standard climatic conditions or in radioactively contaminated (RB) territory);

- incentive payments (additional payments and percentage allowances, accruals that perform an incentive function, for example, bonuses).

Article 136 of the Labor Code of the Russian Federation obliges the employer to send written notice to the employee about the shares of wages due to him. This requirement applies not only to main workers and employees, but also to part-time workers and temporary employees.

When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2021, legislators have determined the exact day by which wages must be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

Form of pay slip and its contents

Labor accounting documentation includes various document forms adopted by the State Committee on Statistics of the Russian Federation. At the same time, the form of the payslip is not defined and therefore employers have to independently develop and approve it for their organizations.

Article 136 of the Labor Code establishes the provision that the payslip must include information:

- on the structural parts of wages that are payable to workers and employees for a certain period of time;

- on the amount, percentages and grounds of deductions made;

- about the total amount of money prepared for payment.

In other words, the payslip must document the procedure, place and timing of payment of wages.

According to the amendments to the Labor Code of the Russian Federation introduced by the Federal Law of April 23. 2012 No. 35 Federal Law, the administration is obliged to include other amounts due to the employee on the payslip. Thus, the new law includes:

- payments, including monetary compensation for violation by the employer;

- deadlines for payment of wages;

- vacation pay;

- accounting for severance pay upon dismissal;

- some other payments that must be placed on separate lines of the document.

The worksheet form developed by the employer must be approved by the employee's representative body and after that it can be implemented as an official form (form).

Legal basis

Despite the fact that the right to set a specific day on which salaries are paid to employees is reserved to the employer, officials have provided a number of key rules. Thus, in accordance with Article 136 of the Labor Code of the Russian Federation, the employer is obliged to:

- Make settlements with employees at least twice a month, every 15 calendar days.

- Pay wages for the first half of the month no later than the last day of the current month.

- Pay wages for the second part of the month no later than the 15th day of the next month.

IMPORTANT!

The employer has the right to set different deadlines for transferring payments for each structural unit of the organization. For example, if an institution has a complex structure (several structural units, departments, workshops), it employs a large number of full-time and freelance specialists. In this case, the employer can set different days for each department. However, deadlines cannot violate Art. 136 Labor Code of the Russian Federation.

Place of payment of wages

Traditionally, employees are paid their salaries at the place where they perform their work functions. However, in some cases, an employee works in enterprises and organizations located in different places. In such a situation, the administration is obliged to ensure that wages are paid to the employee exactly in the place where he performs his labor functions.

The issue is resolved in a similar way in cases where an employee performs his duties in another company or is on a business trip.

A collective agreement often includes an indication of where wages will be paid to employees of various divisions of an organization or enterprise.

An employee's salary is also made by transfer to his personal bank account or by postal transfer through a post office. This can only be done at the employee’s own request. In this case, the employer is obliged to pay for banking services for transferring wages to the employee.

Salary payment procedure

Any entrepreneur or enterprise, when hiring a citizen, is obliged to pay him wages. When calculating employee wages, it is necessary not only to correctly calculate the amount due to each employee, but also to pay it correctly.

One of the problematic issues in this regard is the payment of advances to employees. Should an external part-time worker receive an advance or how to calculate the advance if the final payment amount is small? You can try to answer this question.

According to the Labor Code, the employer is responsible for non-payment of wages every half month.

It must be emphasized that the Labor Code does not operate with such a concept, previously known as “advance”. However, due to logical premises, the law recognizes wages for the first half of the month in advance. It should be remembered that the indication of the law on the payment of wages within the appropriate time frame is mandatory for any employer to comply with in relation to each employee. For failure to comply with the law, the employer is subject to punishment in the form of a fine. Thus, the procedure for paying wages is subject to mandatory adoption by any employer.

How to formalize the change correctly?

According to Art. 57 and 136 of the Labor Code, the employer has no obligation to indicate specific days for payment of wages in the employment contract. He has the right to prescribe them in the internal regulations of the enterprise or a collective agreement.

The procedure for postponing the date of payment of wages directly depends on which document specifies the specific deadlines.

For ease of perception of information, we will consider each of the options in the form of a tabular document:

| The date of receipt of wages is fixed in the document | Procedure for rescheduling |

| Internal regulations (IVR) | The transfer of dates occurs on the basis of an order issued by the enterprise. After the changes, every employed citizen must be familiarized with them against signature. Since PVRs are local regulatory documents, decisions on changes are made by the employer without the consent of employees. If there is a trade union in the company, its opinion must be taken into account when making changes. |

| Collective agreements | If the collective agreement does not contain a clause regarding the procedure for making changes to it, then they are implemented through negotiations. Typically, a special commission is created to amend such agreements. It should include representatives of both parties: the employer and the employees. The results are recorded in a special additional agreement. It contains a free form, but must include new deadlines for receiving payment for work. The additional agreement is sent to the territorial labor authority for registration no later than seven days after signing. The document comes into force from the moment of its publication, not registration. |

| Employment contracts | According to Art. 72 of the Labor Code of the Russian Federation, when the date of salary payment changes, it is carried out by concluding an additional agreement with each employee. If a person does not agree with the change in the terms of the contract, the organization will have to settle it with payment of severance pay in the amount of two weeks’ earnings. With this option, it is imperative to notify employees of the upcoming changes two months in writing. The notification must contain not only the new dates for payment of wages, but also the reasons for the changes being introduced and explanations why the previous deadlines cannot be maintained. |

If dates are recorded in two or three documents at the same time, then changes will have to be made to each of them.

For example, when the date is specified in the rules of procedure and employment contracts, an order is issued and notices are sent to employees two months in advance.

After which additional agreements to the employment contracts are concluded.

Is notice required for employees to reschedule?

An organization is obliged to notify staff about the transfer of wages for work only if a specific payment period is specified in the employment contracts.

Written notices are sent to employees no later than two months in advance.

When the deadlines for receiving payment for labor are agreed upon by the PVR, there is no need to ask the employees for consent; changes are made by order.

However, the employer is obliged to familiarize all personnel with the order.

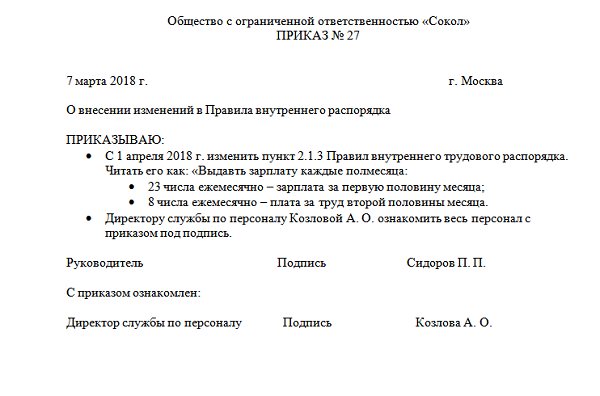

order

An order to postpone the date of payment of wages is drawn up if the deadlines are determined by the temporary residence permit.

The law does not approve a special form for this document.

However, it must contain the information:

- name of the company and document;

- date and city of compilation;

- in one sentence - what the order is about;

- in which document the changes are introduced and their essence, the date from which the changes are made;

- responsible persons for making changes are appointed;

- manager's signature;

- a list of persons who must familiarize themselves with the order and their visas.

order to change the timing of payment of wages - word.

To familiarize employees, familiarization sheets are attached to the order, and personnel visas are included in them.

Salary calculation procedure

Salaries at the enterprise are calculated in the manner established by the enterprise. Every worker and employee must be familiar with this procedure. When calculating the amount of wages, it is necessary to take into account the existing remuneration system in a given organization, established specifically for a specific category of employees, social and other benefits, penalties and incentives.

Pension and insurance contributions are paid from the employer's own reserves. Wages should be calculated from the first day the employee joins the service.

After the employee submits his application and all the necessary documents to the HR department, he receives the right to sign an employment contract with the employer.

This document should indicate in detail all aspects of the employment relationship - from the working hours to the payment of the thirteenth salary, as well as the conditions associated with termination of the contract. An order regarding the timing of payment of wages must also be communicated to him.

When calculating wages, you should take into account the wage system - time-based, piece-rate or mixed. For dismissed employees, the date of dismissal is required, as well as information about unused vacation days.

The last salary changes were in 2016

From October 3, 2021, a new version of Article 136 of the Labor Code of the Russian Federation is in force (in connection with the entry into force of Federal Law No. 272-FZ dated June 3, 2016). In connection with this change, it makes sense for the accountant to immediately pay attention to how many consequences, namely:

- salaries cannot be paid later than the 15th day of the month of the next month (See “New deadlines for paying salaries in 2021: what has changed”);

- difficulties may arise in meeting the deadlines for paying bonuses for periods worked (See “Terms for paying bonuses under the new wage law: what has changed”);

- you will need to control the periods between the advance and the main salary (See “Salary and advance in 2021: how many days between payments”).

Deadlines for payment of wages

The Labor Code has not developed specific deadlines for payment of wages. The administration can determine the deadlines itself by fixing them in the clauses of the collective agreement or labor agreement with the employee. But in any case, employees of the enterprise must receive salaries at least every half month.

Federal law may establish other deadlines for a certain category of persons. If the payment of wages falls on a weekend or holiday, then it should be paid on the eve of such a day. Vacation must be paid three days before it starts.

Violation of the terms of payment of wages entails financial liability for the employer, which is provided for by law.

It consists of the administration paying the amounts due to the employee with additional monetary compensation, the amount of which is set at 1/300 of the current refinancing rate of the Central Bank of the Russian Federation for unpaid amounts for each day of delay.

Monetary compensation can be increased according to a collective agreement or employment contract. In addition, violation of deadlines for payment of wages entails, depending on the situation, administrative or even criminal liability.

Author of the article

Responsibility

It is extremely unprofitable for employers to delay or evade payment of wages. If the management of an enterprise periodically or systematically violates the deadlines for paying wages, then it bears administrative and sometimes even criminal liability for this.

The fines are very high - they can reach half a million rubles, and in particularly serious cases, such violations can lead to imprisonment for up to two years and a ban on holding high positions for a certain period of time.

In addition to the payment of wages, there are a number of mandatory payments that the management of the enterprise must provide to employees in certain cases within strictly defined periods.

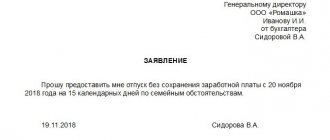

- Vacation pay: According to the Law, the employer must pay vacation pay no later than three calendar days before the start of the employee’s vacation. But sometimes employees take urgent leave and then, in order to avoid violations of this part of the law, they should meet their superiors halfway and resort to the following options:

- For the first three days, take time off to account for future unused vacation;

- For the first three days, go on unpaid leave, and after three days, as required by law, go on regular paid leave;

- Take a vacation, as required by law, in three days, but go on vacation when necessary, and then leave the vacation three days before its formal end.

- Sick leave. As the Law states, payment of maternity benefits, as well as sick leave, must be made no later than 10 working days after it reaches the organization’s accounting department. As a rule, accounting departments try not to violate this rule and sick leave is paid on the nearest day of payment of wages.

- Awards. Not always, but quite often, collective and employment agreements stipulate the terms and procedures for paying bonuses. Since bonuses are voluntary for employers, the law does not provide clear instructions on limiting the timing of these payments. However, if in the contract management undertakes to pay bonuses, but for some reason avoids doing so, employees have the right to go to court to protect their rights.

- Business trips. This type of payment can be made in two ways. If an employee receives daily allowances, they must be paid immediately before the business trip in full for the entire period. If travel allowances are calculated based on average earnings during a business trip, then the traveler receives the money in his first salary after the trip.

- Dismissal. According to the law, an employee who has decided to quit and notified his superiors about this in advance must receive settlement funds on the last day of performance of his work duties. Moreover, this amount should include not only payment for days actually worked, but compensation for unused vacation. If the company from which the employee is leaving provided cash bonuses and incentives, the employer has the right to pay them later. More specific deadlines in this case are not specified by law.

Thus, the timing of payment of wages and other payments to employees is strictly and in sufficient detail stipulated in the Law of the Russian Federation. Violation of these deadlines entails the most serious consequences, including administrative and criminal liability. Therefore, it is very important for enterprises to observe labor discipline and the letter of the law.