Accounting for deductions from employee wages is carried out in accordance with laws, regulations and accounting rules adopted and currently in force in Russia. Deduction from wages at the request of an employee is the transfer of part of a citizen’s wages, vacation pay, and sick leave payments in favor of other people or organizations based on his written application submitted to the employer.

This is convenient for the employee, since there is no need to once again go to the bank or other institution involved in transferring funds in order to make the necessary payments. But it is not always acceptable for the employer, since this is an additional burden for the accountant, and sending each payment order costs money. All deductions from wages are divided into three groups:

- necessary, which are approved by law;

- at the request of the employer;

- at the initiative of a citizen.

First, funds are collected in favor of the state. These include personal income tax, other transfers under writs of execution and court orders (alimony in favor of relatives, compensation for damage in connection with damage to property, harm to the health of another person, etc.). After this, deductions are made in favor of the employer (if necessary). This could be a refund of money according to an advance report, compensation for damage, repayment of a loan, etc. Only then, from the remaining amount, transfers can be made at the request of the employee in any amount.

Withholding of unearned advances issued on account of wages

The employer has the right to withhold the unearned advance payment no later than one month from the date of expiration of the period established for its return.

Since withholding is possible only if the employee does not dispute its grounds and amounts, the employer must obtain the employee’s written consent. Such consent to retention is drawn up in free form.

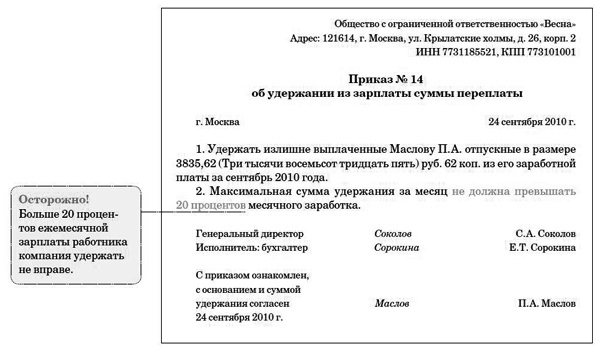

The decision to withhold is formalized by order (instruction). Since there is no unified form for such an order (instruction), it is issued in free form.

Holding Features

You can transfer money to an employee through a cash register in cash or transfer it to a bank card. The employee is required to report on how and how much money was spent. He will have to give the employer papers that certify the expenses incurred (checks, receipts), as well as return the remaining funds.

The employer sets the period for which the money is issued independently in the company's LNA. The return (report) period is 3 business days from the expiration of the period for which they were received, or from the day the employee returned to work after a business trip (clause 6.3 of the Central Bank Instructions of March 11, 2014 No. 3210-U).

If the employee does not return the money on time, you can, by agreement with him, withhold it from his salary. To do this, you need to issue an appropriate order, but there is only 1 month from the expiration date for the refund of the amount.

For your information! If the deadline has passed and the employer has not bothered about returning the money or the employee does not agree with the withholding, then to obtain a refund you will need to go to court (Article 137 of the Labor Code of the Russian Federation).

The law sets a limit on the amount to be withheld. It should not exceed 20% of wages after excluding income tax from it (Article 138 of the Labor Code of the Russian Federation). That is, the deduction can be made for several months if the employee’s debt exceeds 20% of his salary.

An employee can express his consent to the withholding by putting his signature on the order or writing a statement. If he wrote a statement, then an order is issued on its basis.

Attention! An employee can write such a statement even if the retention period has passed.

Deduction for unworked vacation days upon dismissal

Situations often arise when the dismissed employee has already used vacation for the current working year, which was not fully worked out by him. According to Art. 137 of the Labor Code of the Russian Federation, the employer has the right to withhold from the employee’s salary accrued upon dismissal, his debt for unworked vacation days that were provided in advance.

The working year may not coincide with the calendar year, since for each employee it begins from the day on which the employee began performing his job duties.

For example, the working year of an employee hired on 09/01/2009 expires on 08/31/2010. Example 2 When dismissing an employee, can an employer withhold 100 percent of the cost of uniform from his salary?

This case of deduction does not comply with current legislation, therefore the employer cannot deduct the full cost of uniforms from the employee’s salary upon dismissal. Article 137 of the Labor Code of the Russian Federation contains an exhaustive list of cases of deduction from an employee’s salary. This article does not provide grounds for forced deduction of the cost of uniforms from an employee’s salary. However, by agreement with the employee, it is possible to withhold any amounts, for example, expenses for training the employee. In the situation under consideration, it should be taken into account that deduction is possible only on the basis of the employee’s application, provided that the period for wearing uniforms has not expired. If these conditions are not met, the employee may legally demand the return of illegally withheld amounts.

During the working year, the employee must be provided with annual paid leave, and labor legislation does not contain rules that would allow such leave to be provided in proportion to the time worked by the employee and other periods included in the length of service giving the right to leave in accordance with Part 1 of Art. 121 Labor Code of the Russian Federation.

If an employee is dismissed before the end of the working year, for which he has already used annual paid and (or) additional leave, the employer has the right to withhold part of the payment for the leave provided in advance.

The Labor Code of the Russian Federation contains restrictions on withholding for leave granted in advance. Thus, deduction is not made when an employee is dismissed for the following reasons:

- the employee’s refusal to transfer to another job, which is necessary for him in accordance with the medical report, or the employer does not have the appropriate job;

- liquidation of an organization or termination of activities by an individual entrepreneur;

- reduction in the number or staff of employees of an organization or individual entrepreneur;

- change of owner of the organization’s property - in relation to the head of the organization, his deputies and the chief accountant;

- conscription of an employee for military service or sending him to alternative civilian service;

- reinstatement of an employee who previously performed this work by decision of the state labor inspectorate or court;

- recognition of the employee as completely incapable of work in accordance with a medical report;

- death of an employee or employer - an individual, as well as recognition by a court of an employee or employer - an individual as deceased or missing;

- the occurrence of emergency circumstances that prevent the continuation of labor relations (military operations, catastrophe, natural disaster, major accident, epidemic and other emergency circumstances), if this circumstance is recognized by a decision of the Government of the Russian Federation or a government body of a constituent entity of the Russian Federation.

Of the payments due to an employee upon dismissal, the employer has the right to withhold no more than 20 percent of the amount after deducting personal income tax. If the amount of debt exceeds 20 percent of wages, then the excess amount is repaid by the employee voluntarily or the employer recovers it through civil proceedings as unjust enrichment. However, the latter seems difficult, since by virtue of clause 3 of Art. 1109 of the Civil Code of the Russian Federation, wages and other payments provided to a citizen as a means of subsistence, in the absence of dishonesty on his part and an accounting error, are not subject to return as unjust enrichment. Consequently, these funds cannot be recovered from the employee to whose personal account they were transferred.

Thus, if at the time of dismissal the employee still has amounts of unearned vacation pay, the employer can withhold them without his consent in the amount of 20 percent of the payments due to the employee. To repay the remaining amount, the employer can obtain from the employee an application for consent to withhold from the calculation upon dismissal an amount exceeding 20 percent, or agree with the employee on the voluntary return of the overpaid amount of vacation pay to the organization's cash desk. In addition, the employer has the right to “forgive” the employee’s debt for unworked vacation days.

Is it permissible to deduct accountable amounts from wages?

The duty of the accountable person to report on spent funds within three days. An advance report is drawn up, which shows how much money was spent and on what. In addition, documents confirming expenses are attached.

Often the money received is not completely spent. In this case, the employer needs to return the difference between the amount received and the amount spent.

The best option for returning unspent money is to deposit it directly into the organization’s cash desk in cash. If this is not possible, then the employer has the right to withhold the balance from the salary of the accountable person. This is normal practice, there are no violations of the Labor Code of the Russian Federation here.

Article 137 of the Labor Code of the Russian Federation contains rules for withholding sums of money from an employee’s salary; this article states that the employer has the right to withhold unreturned advance payments from staff salaries.

An important point is that the decision to deduct from wages must be made within one month from the date of receipt of the advance report from the employee, provided that the accountant himself does not dispute the amount to be returned.

You can withhold no more than 20% of your salary. If this is not enough to return the unspent advance, then deduction is made in subsequent months in the amount of no more than 20% of the salary payable until the debt is fully repaid.

Not only accountable amounts can be withheld from your salary, but also alimony and damages.

How to file an application for deduction of alimony from wages?

Do I need to fill out an employee application?

The employer has the right to recover an unspent advance from the salary of the accountable person if he himself has not returned it. However, two rules from Article 137 of the Labor Code of the Russian Federation must be observed:

- Make a decision to deduct from wages no later than one month from the date of receipt of the report from the employee.

- Obtain the consent of the accountable person that he does not object to the withholding of the amount declared by the employer.

It is better to obtain consent in writing to avoid possible problems in the future. The employee should be asked to write a statement stating that he agrees with the deduction of a certain amount of money from his salary due to the fact that it is an unspent advance issued for certain purposes, for example, travel allowances.

It must be remembered that one advance report, where the unspent balance of the accountable amount is visible, is not enough to deduct from the salary. There must be a statement of consent on the basis of which the order is drawn up.

If the employee does not provide consent, it means that the money can only be returned through the courts. The employer draws up a statement of claim, which, together with supporting documents, is submitted to the judicial authorities for subsequent proceedings. If the court takes the employer’s side, then the document basis for collecting money from the employee will be a writ of execution or a court order.

We recommend reading: How to write applications to reduce salary deductions?

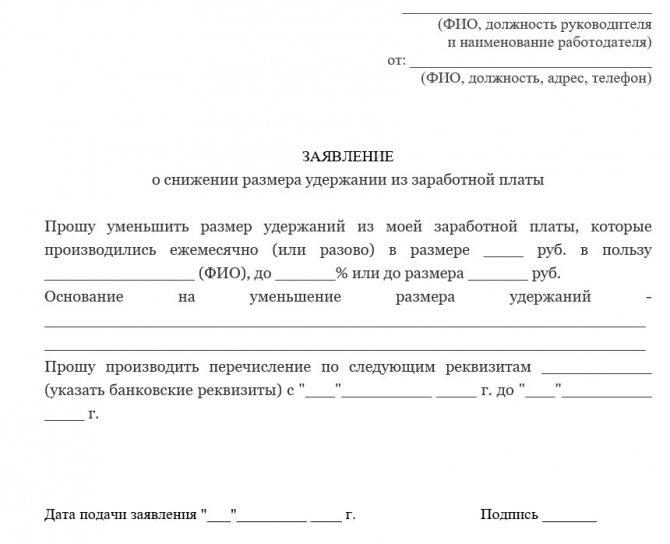

Application to reduce the amount of deduction from wages - sample

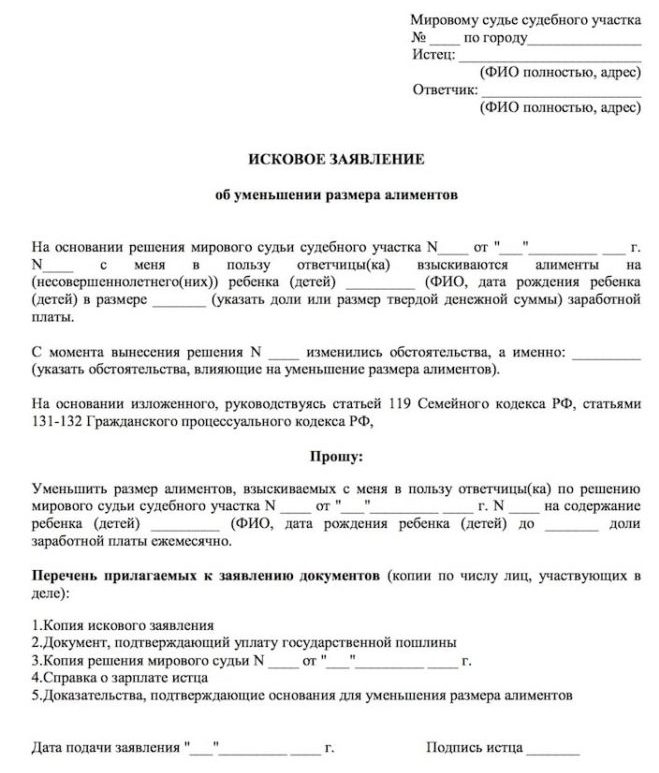

A claim is filed with the court to reduce the amount of deductions from wages.

It can be formatted like this:

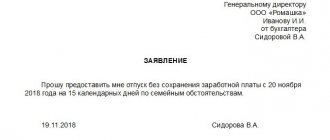

The employer may submit an application to reduce the amount of deduction from wages if the deduction was assigned at the initiative of the employee.

The application form will be slightly different:

A ready-made application form for reducing the amount of deduction from wages is available free of charge.

An application to reduce the amount of deductions from wages must include the following information:

- The name of the authority to which the claim is filed.

- Information about the employer, the company where the employee is officially employed.

- Information about the applicant, his position, residential address, contact phone number.

- Request to reduce the amount of deductions.

- Details of deductions paid by the employee, on what basis, in what amount, in what period.

- Information on the grounds for reducing the amount of deductions.

- In the claim, at the end of the document, a list of documents is drawn up that are attached to the application.

Be sure to include at the end of the document the date you are submitting the application and your signature with a transcript.

Salary deductions

Cases of illegal reductions in employee wages are not uncommon and are due to the fact that officials (including HR specialists) do not know the rules of the current federal legislation, including the rules on liability for illegal deductions. Sometimes an employer deliberately ignores the law, hoping that the employee will not challenge the withholding, and when checking, this fact will not “come up” or seem insignificant. However, such a position leads to negative consequences both for the employer itself and for individual officials.

Among the most typical errors and violations when making deductions from wages are the following:

1. Reduction of wages in cases not provided for by the Labor Code of the Russian Federation and other federal laws.

Many organizations try to establish the possibility of application of “fines” for smoking on the territory of the organization, being late for work, etc.

However, these documents in the relevant part are not subject to application and do not entail any consequences for employees, because the employer has the right to bring the employee only to certain types of legal liability: disciplinary and financial.

The employer has the right to apply the following disciplinary sanctions: reprimand, reprimand and dismissal on appropriate grounds (Article 192 of the Labor Code of the Russian Federation). Other types of disciplinary sanctions can be established for certain categories of employees only by federal laws, charters and regulations on discipline. But labor legislation does not provide for such “fines” as disciplinary liability.

If an employee causes direct actual damage to the employer, then he faces financial liability. The concept of direct actual damage is formulated in Article 238 of the Labor Code of the Russian Federation and does not provide grounds for the application of any “fines”.

A fine as a type of unfavorable consequences for an employee of committing an offense is characteristic of administrative (established by the Code of Administrative Offenses of the Russian Federation (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation), laws of the constituent entities of the Russian Federation) and criminal (established by the Criminal Code of the Russian Federation) liability, which:

- are applied only by authorized public authorities according to a special procedure;

- provide for recovery in favor of the state and not the employer;

- this “fine” is essentially a deduction from wages, which is not provided for either by the Labor Code of the Russian Federation or other federal laws;

- the norms of local regulations that worsen the situation of workers in comparison with established labor legislation are not subject to application (Part 4 of Article 8 of the Labor Code of the Russian Federation), as well as the terms of collective and labor agreements that limit the rights or reduce the level of guarantees of workers in comparison with the established labor legislation (part 2 of article 9 of the Labor Code of the Russian Federation).

Consequently, the “fines” established by the employer do not relate to any of the types of liability permitted by law.

By the way, since, according to Article 129 of the Labor Code of the Russian Federation, bonuses and other incentive payments are an integral part of wages, the deprivation of a bonus or a reduction in its size will also be an illegal deduction from wages in cases where:

- the amount of the bonus to be paid is provided for by the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation), a local regulatory act adopted in the manner established by the Labor Code of the Russian Federation (Article 135 of the Labor Code of the Russian Federation), a collective agreement (Part 2 of Article 41 of the Labor Code of the Russian Federation) and

- These documents do not establish a list of indicators and conditions for bonuses, depending on which the specific amount of the bonus for each employee is determined, as well as omissions in work in which the employee has the right to receive a bonus in a smaller amount or does not have the right to receive a bonus at all.

This means that in this case, the employer can actually reduce the amount of wages paid to the employee only in relation to the bonus part of the wage (if any) by:

- inclusion in the employment contract of a condition for the payment of bonuses in the amount, manner and on the terms established by the collective agreement or a specific local regulatory act regulating bonus issues (“Regulations on bonuses”, “Regulations on remuneration”, etc.) and

- establishing in the specified documents clear indicators and conditions for bonuses, a list of omissions in work (for example, being late for work), which allow each time to calculate the amount of the employee’s bonus depending on the results of his work, his compliance with labor discipline, etc.6.

As a result, the reduction or deprivation of the bonus will no longer be a deduction from wages.

2. Failure to comply with deadlines, other conditions and the procedure for deductions from wages (for example, if the employee was not required to provide a written explanation to establish the cause of the damage, then this is a failure to comply with the established procedure for collecting damages. Or if the employer withheld from the salary of an employee dismissed due to reduction in numbers or state, money for unworked days of “time off” vacation).

3. Deduction from wages in a larger amount than allowed by labor legislation or other federal laws (for example, the employer deducted more than 50 percent of wages in cases where the amount is limited to 50 percent).

Thus, if the employer “fined” the staff for smoking on the territory of the organization, being late for work, etc., unreasonably deprived the employee of a bonus and committed other violations that led to an illegal reduction in wages, then, in addition to the obligation to return the deducted amounts, he threaten:

- administrative liability under Article 5.27 of the Code of Administrative Offenses of the Russian Federation for violation of labor legislation in the form of a fine from the employer (if the employer is an organization, an official who is guilty of violating labor legislation may be fined), and in case of repeated violation of labor legislation, the corresponding official may be completely disqualified;

- financial liability to the employee for delay in payment of wages (monetary compensation) in the amount of not less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts unpaid on time for each day of delay, starting from the next day after the established payment deadline until the actual day calculation inclusive (Article 236 of the Labor Code of the Russian Federation);

- compensation for moral damage caused to an employee by the unlawful actions of the employer, in the amount determined by agreement of the parties to the employment contract, and if there is a dispute, the fact of causing moral damage and the amount of compensation for it are determined by the court (Article 237 of the Labor Code of the Russian Federation).

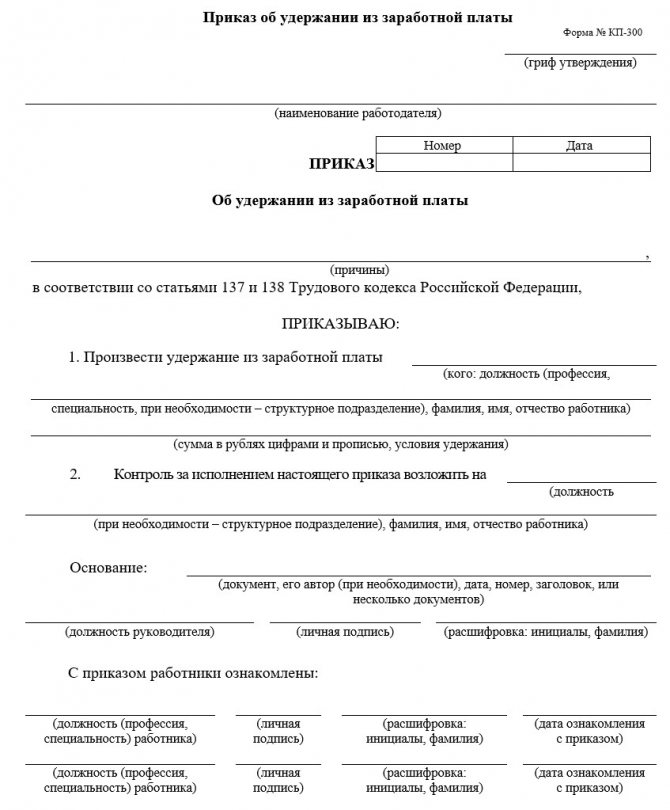

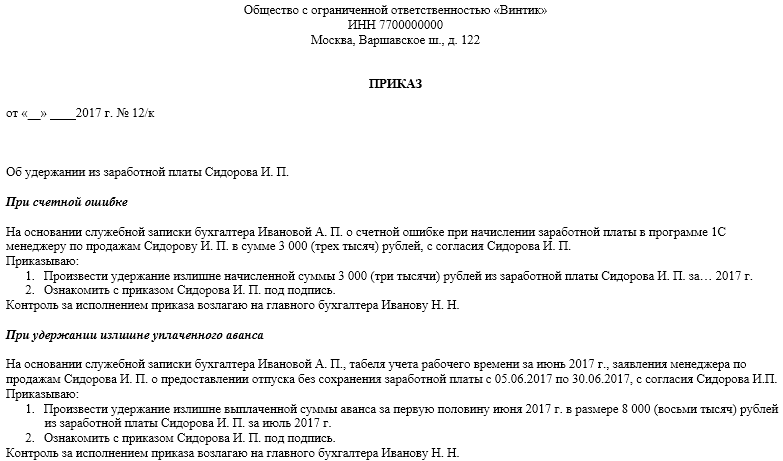

Samples of an order to deduct from an employee’s salary

The employer, in turn, must issue an order confirming the appointment of deductions from the salary of a specific employee.

A sample order for deduction from salary is as follows:

A ready-made form for an order to deduct from an employee’s salary is available for free.

Here are examples of issued orders in different situations.

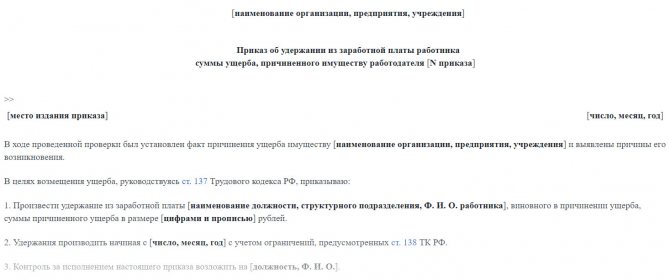

Order to withhold from the employee’s salary the amount of damage caused to the employer’s property

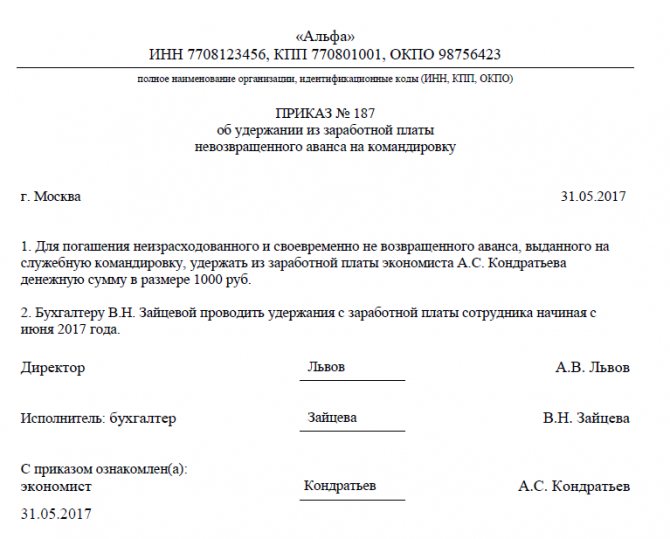

Order to deduct from salary unspent funds allocated for a business trip

Order to deduct from salary in case of a counting error or in case of an overpaid advance

Order to deduct overpaid vacation pay from salary