Non-payment of wages is a problematic issue for any employee. There are often cases when wages are not paid by the employer, and for a long time. The manager refers to the lack of funds for salaries or promises to make a payment someday.

What should employees do in this case? One of the options for resolving this issue is to file a lawsuit in court.

ATTENTION : our Ekaterinburg labor dispute lawyer will help protect the rights of the employee and draw up a statement of claim for the recovery of wages: professionally, on favorable terms and on time. Call today!!!

How to file a claim for recovery of wages?

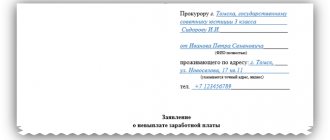

The statement of claim must comply with the general requirements of the civil procedural code, and must indicate:

- name of the court in which you plan to file the pending claim.

- information about the plaintiff , that is, the person who files a claim in court. The specified data includes full name and place of residence. You can also provide a phone number and email.

- information about the defendant , that is, the name of the employer against whom the claim is brought and the address of its location.

- The text of the application indicates directly what the violation of your rights is . In this case, the plaintiff’s rights to receive timely remuneration for his work are violated, that is, if the plaintiff works under an employment contract, the employer is obliged to pay him for his work on time.

Next, it is necessary to set out all the circumstances in connection with which the plaintiff is filing a claim in court, and refer to the relevant evidence that will be attached to the application. That is, it is necessary to indicate when the employment contract was concluded, what amount of wages is determined by the contract, within what period wages are due, and from what period wages are not paid.

INSTRUCTIONS : collection of wages in court via the link

How to draw up a document correctly

The initiator of the legal proceedings sets out his demands on the opposite party and the facts proving their validity, as well as the history of labor relations with the employer, in a statement of claim (claim).

All stages of any judicial process are thoroughly regulated by procedural codes. Including the procedure for drawing up and filing a statement of claim, the Civil Procedure Code of the Russian Federation is established in Article 131.

Can an employer refuse to dismiss at his own request?

What to do if you work unofficially and the employer does not pay your salary, read here.

How to recover black wages from an employer, read the link:

It lists the mandatory points that the statement of claim must comply with, namely:

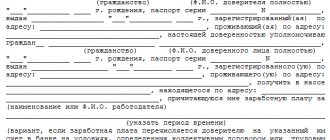

- The header must indicate in which court the claim is being filed, as well as its address. Next, you should clarify the identity of the applicant. The word “Plaintiff” is written, his last name, first name, patronymic and address. Then you also need to describe the opposite side. After the word “Defendant” its full name, organizational and legal form, legal and actual address are indicated;

- Below, the plaintiff independently indicates the amount of the claim for which he is claiming. It includes actual arrears of wages, a penalty equal to 1/150 of the Central Bank rate for each day of delay, and moral damage, if any;

- followed by the title of the document. In this case, a STATEMENT OF CLAIM (for recovery of wages).

Advice from a labor lawyer from our law firm

- The claim must be accompanied by copies of the employment contract, payslips for the months in which wages were paid, you can attach a printout from the salary card confirming the absence of transfers from the employer for the disputed period and other copies of documents, if the plaintiff has them. If you do not have any documents, please contact your employer in writing to obtain them. If the employer does not provide the requested copies of documents, then during the trial process, petition the court to request copies of the documents from the defendant.

- The statement of claim should indicate the price of the claim, that is, the amount that the plaintiff demands from the defendant. It is also necessary to provide a calculation of the stated requirements, indicating how the amount of wages that the employer must pay is determined. If there are other claims, for example, for payment of compensation for delayed wages, these amounts are also included in the cost of the claim and it is necessary to provide a calculation of the corresponding amounts.

- Indicate and attach documents (if any) in support of the pre-trial procedure for resolving the dispute, that is, that the plaintiff contacted the defendant regarding the issue of non-payment of wages. However, compliance with pre-trial procedures in this category of cases is not mandatory.

- Further, in the pleading part of the claim, it is necessary to indicate the demands directly stated by the plaintiff, namely, to recover unpaid wages from the defendant in such and such an amount. You can also specify other additional requirements related to non-payment of wages.

- After the requirements, you should indicate a list of copies of documents that are attached to the claim.

- At the end of the application, the date is indicated, the plaintiff puts a signature, and next to it is a transcript of the signature.

- The statement of claim with documents must be submitted to the court in two copies if there is only a plaintiff and a defendant in the case. Don't forget to make one copy for yourself.

PLEASE NOTE : failure to comply with the claim form will result in its abandonment, that is, the court will set a deadline for the plaintiff to eliminate inconsistencies in the claim form. If the comments are not corrected, the application will be returned to the plaintiff.

Grounds for application

It is possible to file a claim for collection of arrears of wages in the following cases:

- delay in the date of payment of wages specified in the employment contract;

- failure to pay the employee in full upon dismissal;

- wages are not paid in full;

- deduction of part of wages upon dismissal without sufficient grounds.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The period for going to court is 1 year

If an employee makes one demand for the recovery of wages that have been accrued but not paid, the amount of the demands does not exceed 500,000 rubles and is indisputable, in this case the employee must apply to the magistrate in the order of writ proceedings. More information on the issue of the limitation period for the collection of wages is available on our website by following the link.

REMEMBER : it is better to record all your actions to contact your employer regarding non-payment of wages in writing, by submitting applications with the employer marking the receipt of this or that application on your copy.

State duty on a claim for recovery of wages

For this category of disputes, plaintiffs do not pay state fees.

What documents will be needed

A prerequisite for winning in court is a worthy evidence base that will confirm the rightness of the plaintiff and sway the court on his side.

Therefore, it is necessary to collect documents in advance that will serve as evidence of the employer’s illegal actions:

- An employment contract is the main document when hiring; it must indicate the amount and terms of payment of wages. In such situations, the importance and significance of the employment contract are visible especially clearly; it is the main witness of the labor relationship and mutual obligations of the employee and the employer;

- a copy of the order for employment, as well as transfers to other positions, if any;

- a certificate from the accounting department about the average earnings of the plaintiff, including bonuses, one-time payments, additional payments to the basic salary;

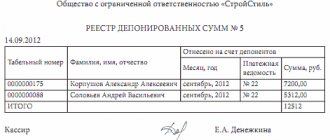

- a document confirming the absence or discrepancy of wage payments for the period specified in the statement of claim. This could be a bank statement if the salary is credited to a bank card;

- certificate of existence and amount of wage arrears;

- It would not be superfluous to record the testimony of witnesses and also provide them to the court;

- a certificate confirming the damage suffered, moral damage, if the plaintiff claims compensation.

Where to file a claim for the collection of arrears of wages?

If the employer and the plaintiff are located in different localities, then in this case the law gives the plaintiff the opportunity to choose in which court he will file the corresponding claim. There are two options:

- file a lawsuit at the location of the defendant;

- file a lawsuit at the place of residence of the plaintiff.

USEFUL : watch the VIDEO with advice from a lawyer on labor issues and learn how to properly file a claim in court for the recovery of wages, write your question in the comments of the video

What claims can be submitted simultaneously with the salary debt?

In addition to the demand for recovery of wages, the plaintiff has the right to simultaneously file demands for recovery of compensation for delayed payment of wages, as well as recovery of moral damages.

The legislation does not limit the plaintiff in the amount of compensation for moral damage, in connection with which the plaintiff has the right to declare any amount, but this does not mean that the court will recover the full amount of the declared amount of compensation. In this case, the court, at its discretion, will determine the amount of compensation if there are grounds for collecting it from the defendant.

Regarding claims for the recovery of interest for delayed wages, if the main claim related to non-payment of wages is proven, the claim for compensation must also be satisfied, since wages were not paid on time.

In any case, the employer MUST pay interest not lower than 1/150 of the refinancing rate of the Central Bank of the Russian Federation.

PLEASE NOTE : Salaries must be paid every half month.

Collective lawsuit of workers against the employer

To recover wages through the court, the labor collective can act together. To do this, it is necessary to appoint a coordinator for the claim filing process, i.e. proactive employee. Features of consideration of collective claims against an employer are:

- consideration at the location of the defendant;

- by virtue of clause 5 of Art. 244.20 of the Code of Civil Procedure of the Russian Federation in the case of labor disputes regarding the protection of the rights of a group of persons (collective dispute), at least 20 plaintiffs must participate in the claim (the more, the greater the chances of a successful outcome of the case);

- The period for consideration of a collective claim is 4 times longer than that of an individual labor dispute, i.e. about 8 months

When drawing up a class action, it is necessary to take into account the requirements of Art. 131 Code of Civil Procedure of the Russian Federation. In addition, the statement of claim must be accompanied by a justification for the involvement of all parties to the dispute in the case under consideration. Otherwise, the process of collecting and submitting documents is similar to an individual dispute.

For a successful outcome of the case, it is better to trust trusted lawyers. International experts with many years of experience will represent the interests of the applicant in an individual or class action against the employer at any stage. To contact a labor law lawyer, call 8 (800) 222-24-50 or fill out an application at rosco.su.

Sample statement of claim for recovery of wages after dismissal

To the Federal Court of the Kirovsky District

city of Yekaterinburg.

PLAINTIFF:

G.

DEFENDANT : Titan LLC

Cost of claim : 54,974 rubles

State duty : exempt in accordance with the Tax Code of the Russian Federation

Statement of claim

about non-payment of payment upon dismissal

An employment contract was concluded between me and the defendant, according to which I was hired for the position of “receiver foreman”, the official salary was set at 15,000 rubles per month, the regional coefficient was 1.15. Since March, the defendant stopped paying wages, as a result of which the employer incurred a debt.

On April 30, due to non-payment of wages, I resigned “of my own free will.” On the day of dismissal, the defendant had accumulated wage arrears in the following amount:

- For March, wages in the amount of 15,000 rubles were not paid.

- For April, wages in the amount of 15,000 rubles were not paid.

- Taking into account the regional coefficient of 1.15, the total amount of debt amounted to 34,500 rubles.

- On the day of dismissal, the defendant had not paid me the accumulated wage arrears in the amount of 34,500 rubles.

According to Art. 37 of the Constitution of the Russian Federation, everyone has the right to remuneration for work. In accordance with Art. 1 of the Labor Code of the Russian Federation, labor legislation protects both the rights of employees and the rights of employers.

According to Art. 16 of the Labor Code of the Russian Federation, labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with this Code.

According to Part 4 of Art. 21 of the Labor Code of the Russian Federation, an employee has the right to timely and full payment of wages in accordance with his qualifications, complexity of work, quantity and quality of work performed.

In accordance with Part 5 of Art. 80 of the Labor Code of the Russian Federation, on the last day of work, the employer is obliged to make a final settlement with the employee.

According to page 135 of the Labor Code of the Russian Federation: “The employee’s wages are established by the employment contract in accordance with the current wage systems of the employer.”

In accordance with Art. 140 of the Labor Code of the Russian Federation: “upon termination of an employment contract, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment.”

On the day of dismissal, the defendant did not fulfill the obligation provided for by these standards and did not pay me the arrears of wages, and therefore, I am forced to collect wages in court.

USEFUL : watch the video and find out why it is better to correct any sample claim, complaint or claim with our lawyer, write a question in the comments of the video

In accordance with Article 237 of the Code, compensation for moral damage is compensated in cash in an amount determined by agreement between the employee and the employer, and in the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation are determined by the court, regardless of the property damage to be compensated.

The amount of compensation for moral damage is determined by the court based on the specific circumstances of each case, taking into account the volume and nature of moral or physical suffering caused to the employee, the degree of guilt of the employer, other noteworthy circumstances, as well as the requirements of reasonableness and fairness.”

As a result of the defendants’ failure to fulfill their obligations, I was inflicted with moral suffering associated with the inability to receive my wages for a long time - moral damage, which I estimate in the amount of 15,000 rubles.

In support of claims for compensation for moral damage in the amount of 15,000 rubles, I refer to the employer’s violation of the provisions of labor legislation regarding illegal and long-term non-payment of wages due to me during the period of work and upon dismissal, long periods of delay in legally required wage payments, deliberate refusal the defendant from paying the money due, which caused me physical suffering, mental distress, and moral suffering.

In addition, according to Art. 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid monetary compensation for all unused vacations:

- My average salary was 17,250 rubles per month, therefore, 17,250 / 29.4 = 586.73 rubles is the average daily earnings.

- Number of unused days 9.33

- Compensation for all unused vacations amounted to 586.73 * 9.33 = 5,474 rubles.

According to my calculation, monetary compensation for all unused vacations amounted to 5,474 rubles. I have the right to recover the said compensation.

Based on the aforesaid and guided by Article. 135, 140 of the Labor Code of the Russian Federation, Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”

ASK:

- to recover from Titan LLC in my favor arrears in payment of wages in the amount of 34,500 rubles. with deduction of mandatory payments due.

- recover from Titan LLC in my favor an amount of 15,000 rubles. as compensation for moral damage

- recover from Titan LLC in my favor the amount of 5,474 rubles. as monetary compensation for all unused vacations with deduction of mandatory payments due.

- recover legal costs in the amount of 2,500 rubles from Titan LLC in my favor.

Date, signature

Responsibility of the employer under the Labor Code of the Russian Federation

Based on Part 6 of Art. 136 of the Labor Code of the Russian Federation, LLCs and individual entrepreneurs operating on the territory of the Russian Federation are required to pay wages to hired employees at least once every 15 days. The exact date of payment is fixed:

- PVTR organizations;

- contract (labor or collective agreement).

As a general rule, funds are transferred before the 15th day of the month for the previous billing period (1 calendar month). For certain categories of personnel, the Federal Law may establish other accrual periods. So, according to Part 1 of Art. 140 of the Labor Code of the Russian Federation, the employer’s representative is obliged to make settlements with the person on the day of his dismissal.

According to Part 2 of Art. 22 of the Labor Code of the Russian Federation, it is necessary to pay salaries to staff on time and in full. For violation of the deadlines approved by the Labor Code of the Russian Federation for the accrual of funds under the salary project, LLCs and individual entrepreneurs with hired personnel incur administrative and obscene penalties. responsibility (see Part 1 of Article 142 of the Labor Code of the Russian Federation).

According to Art. 236 of the Labor Code of the Russian Federation, the guilty employer will have to compensate the employee for payments with additional payment. percent. Compensation is calculated in the amount of no less than 1/150 of the current rate of the Central Bank of the Russian Federation in force at the time of downtime, of the salary for each day of non-payment. The calculation of compensation begins with the following. days after the planned payment date and keep track of the actual day. calculation.

When payments are transferred to the employee's account on time, but not in full, % is calculated based on the unpaid amounts. To accurately calculate the debt by % under Art. 236 of the Labor Code of the Russian Federation, you can use a special calculator available on the Internet. Compensation may be increased based on the provisions of the collective agreement, corporate regulations or agreement with the employee. It is characteristic that the obligation to pay compensation to personnel does not depend on the fault of the organization’s management (this follows from Part 2 of Article 236 of the Labor Code of the Russian Federation).

In addition to monetary liability, the perpetrators may be charged under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, and in some cases under Art. 145.1 of the Criminal Code of the Russian Federation, when dissatisfied personnel file claims in labor disputes.

Recommendations for an employee if he needs to collect a salary debt from his employer

When filing a claim to recover back wages, there are several important things to keep in mind. The first of them is that the state fee for filing a claim is not paid.

Second point. If the salary is accrued according to documents, but not paid, you should take a different route. It involves filing not a lawsuit, but an application for a court order. The magistrate can also accept it for his proceedings.

Regardless of whether a claim or documents are filed for a court order, the author of the appeal (employee) has the right to choose the court where to apply. This may also be the authority at the place of residence of the plaintiff.

Below we will provide a few more practical recommendations that will help a citizen defend his labor rights. That's their essence.

- In court, you can recover not only wages, but also related payments provided for by labor legislation and the collective agreement adopted by the organization. For example, this applies to severance pay, compensation for lost vacation

- You need to be prepared for the fact that the trial, including an appeal from the employer, may take several months. Therefore, you can first notify the competent authorities of a violation of your own labor rights by writing a complaint to the prosecutor’s office against the employer.

- The claim may also include a claim for penalties due to untimely payment of wages. It is 1/150 of the Central Bank key rate for each day of delay (Article 236 of the Labor Code of the Russian Federation).

- Additionally, you can raise the question of material damage, its existence, the size must be justified.

This is also important to know:

Debt collection under a contract

But you should also remember about the timing of going to court. They amount to one year from the date on which the settlement date came. Therefore, you need to have a clear understanding of the company’s existing employee payment dates.

Reasons why you can file a claim for payment

A claim for recovery of wages is drawn up in accordance with Art.

131 Code of Civil Procedure of the Russian Federation. Failure to pay wages and other required payments to a dismissed employee must be confirmed by relevant documents. According to Art. 136 of the Labor Code of the Russian Federation, wages are paid every half of the month. If an employee resigns, the final payment is made on his last day of work.

The reasons why you can file a lawsuit to recover wages are the following:

- The employer did not pay the dismissed employee (plaintiff) wages on the day of dismissal or paid it in full, without taking into account the regional coefficient (Article 140 of the Labor Code of the Russian Federation). As evidence confirming these circumstances of the case, the court is presented with pay slips, a note of calculation, etc.

- The employer did not pay the dismissed employee severance pay , if it is due - in case of staff reduction, liquidation of a company or individual entrepreneur, by agreement of the parties (what payments are due upon dismissal by agreement of the parties?).

- The employer did not pay compensation for unused vacation to the dismissed employee. As evidence in the case, you can present explanations from company employees or other persons confirming the fact that the dismissed employee did not use vacation in full. Also confirmed will be the lack of documentation about the use of all vacation days by the dismissed employee. Find out how to apply for leave with compensation for unused vacation and how to calculate the amount if the employee worked for 11 months or less.

An employee can also make monetary claims against an employer in the following cases:

- illegal dismissal of an employee - during forced absence, the employer must pay wages to the former employee;

- delay in issuing a work book - the employee needs to be compensated for the time during which he could not get a new job (Article 234 of the Labor Code of the Russian Federation);

- if during the period of work the dismissed employee received a disability group for a corresponding occupational disease, and the amount of lost earnings exceeds the amount of the corresponding insurance payment under social insurance.

Only those dismissed workers who were officially employed can file a lawsuit to recover wages.

Those who worked without an employment contract will first have to prove to the court the existence of an actual employment relationship.

What to do if the statute of limitations has expired?

The expiration of the statute of limitations does not mean the employee loses the right to appeal to the CCC or court. The rules of work of the labor dispute commission established by the Labor Code of the Russian Federation provide this body with the opportunity to restore the deadline and consider the conflict situation on its merits. To do this, it is enough that the reasons for missing time to contact the employee are recognized as valid.

The court is also obliged to accept the employee’s statement of claim and open a case, within the framework of which the issue of the statute of limitations is considered. The decision made is based on two factors. The first is the presence of a statement from the employer about the expiration of the statute of limitations, and the second is the reasons for the delay and the employee’s petition for its reinstatement.

If the employer does not submit the specified document, the court considers the case in the general manner. If there is an application from the employer, which happens most often, the reasons for the delay are first examined. They must be indicated in the petition to restore the statute of limitations filed by the employee.

If the petition is not completed, there is a high probability of refusal to satisfy the claim. If the document is drawn up accordingly and found to be justified, the period is restored, after which the case is considered on its merits in the usual manner.

Deadlines for filing a claim

An employee has the right to apply to a court for resolution of an individual labor dispute regarding non-payment or incomplete payment of wages within a year from the date of the established deadline for payment of wages (Article 392 of the Labor Code of the Russian Federation).

The limitation period in this case is longer than the period established for other types of disputes: 3 months from the day the employee learned or should have learned about the violation of his right, and for disputes about dismissal - within one month from the date he was given a copy of the dismissal order. And a claim for recovery of wages after dismissal is filed within a year from the date of delivery of the order, since on this day a full settlement is made with the employee (Article 140 of the Labor Code).

But if the plaintiff missed the deadline for a good reason: illness, being on a business trip, force majeure, the need to care for seriously ill family members (resolution of the plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2) - if the initial application for the said dispute was filed on time (resolution of the plenum of the Supreme Court of the Russian Federation dated May 29, 2018 No. 15), then the judge will restore it at the request of the applicant.

Salaries are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued (Article 136 of the Labor Code).

If the employer violates the established deadline for the payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/150 of the key rate of the Central Bank in force at that time Bank of the Russian Federation from amounts not paid on time for each day of delay, starting from the next day after the established payment deadline until the day of actual settlement inclusive (Article 236 of the Labor Code).