During the reorganization, the work of employees, as a rule, does not change; they continue to perform it at their workplaces, without feeling the changes taking place in the company.

At the same time, the accountant draws up a plan of action for renewing employment contracts with employees, paying them vacation pay and benefits, if any, and correctly calculating insurance premiums and personal income tax.

When the reorganization comes to completion, the rights and obligations of the reorganized company (in the text we will call it “old” or “previous”) will transfer to the successor company (“new”).

As you know, labor legislation ensures the protection of workers' rights; during the reorganization of a company, the employer needs to resolve many important personnel issues. He will be able to do this based on material from the following articles of the Labor Code of the Russian Federation:

Article 72.1 of the Labor Code of the Russian Federation

It discusses the principles of transferring an employee to another job when he agrees to the transfer. However, this aspect is not fully taken into account in the article, because in fact, the previous place of work ceases to exist.

Article 74 of the Labor Code of the Russian Federation

It discusses changes to the terms of the employment contract in the event of a company reorganization. This article approves the requirement for mandatory advance warning of employees about proposed changes, including reorganization.

Article 75 of the Labor Code of the Russian Federation

It examines the ways of conducting labor relations when the ownership of a business entity is changed, as well as issues related to the reluctance of employees to work in a new company.

Article 77 of the Labor Code of the Russian Federation

The article lists a list of possible grounds for terminating the employment relationship between an employee and an employer.

Reorganization in itself is not a reason to terminate employment relations with employees. Consequently, the employment contract does not terminate. Even written consent from the employee to continue working with the new employer is not required by law.

However, there are employers who formalize the dismissal of employees from the “old” company, and then hire them to the new one. You understand that such manipulations will lead to additional expenses ; in this case, employees will need to be paid compensation for days of unused vacation. 127 Labor Code of the Russian Federation. In addition, dismissed employees are paid severance pay in the amount of average monthly earnings.

And if the employee does not find a new job, then he has the right to receive benefits for the second month. All he needs is to provide a work record book and an application. In my opinion, these actions do not provide any practical benefit to anyone and should not be done.

When changing not only the employer, but also the working conditions (except for job responsibilities) of an employee as a result of reorganization, the employer is obliged to notify the employee in writing about the changes at least 2 months in advance, Art. 74 Labor Code of the Russian Federation.

A special case is when, during the reorganization, the employee’s job responsibilities also change, but he does not agree with the changes. Then there is a need to lay off such an employee. But at the same time, he also needs to be warned in writing about the upcoming reorganization at least 2 months before the dismissal of the employee. 180 Labor Code of the Russian Federation.

According to paragraph 6 of Art. 77 of the Labor Code of the Russian Federation, an employee himself can refuse to work in a “new” organization and write a letter of resignation. There is no specific deadline for terminating an employment contract. But it is important for employees to understand that in this case there will be no payment of severance pay, as in the case of layoffs.

The new owner of the company, within three months from the date of acquisition of his ownership rights, has the right to terminate employment contracts with the head of the organization, his deputies and the chief accountant. At the same time, he is obliged not only to pay them severance pay, but also to comply with all the agreements that were specified in the contract with the “old” organization. For example, an additional “golden parachute”.

As you and I can see, under any circumstances it is imperative to warn employees about the upcoming reorganization. But there are some other features of the reorganization. More on them later.

Vacation of employees

There is no need to calculate and pay compensation for unused vacation days to employees, since you do not terminate the employment contract with them.

The vacation experience of employees in the “new” company includes work in the previous company, and the calculation of vacation pay will take into account their wages in both companies. The vacation schedule also remains valid.

There are cases when the “old” company does not transfer information about employees to the legal successor; the amount of vacation pay will need to be calculated only based on the earnings received from the legal successor.

FSS benefits

The assignee pays for all sick leave for employees of the previous company, issued before and after its reorganization, but only on the condition that the region is not a participant in the Social Insurance Fund pilot project. There is nothing wrong with the fact that these certificates of incapacity for work indicate the previous company , since they could have been issued before the reorganization. After all, in relation to employees, the new employer is the legal successor.

Calculation of benefits in full takes into account the wages of employees during the entire billing period in the old company. In turn, this company transmits all information on employee salaries and salary certificates from other employers presented when these employees were hired.

There are cases that information on wages was not transferred to the legal successor. Then the employees write you a statement asking you to make a request to the Pension Fund to receive salary data from the previous company. Before receiving information from the authority, calculate the amount of sick leave based on available salary data. And after you receive the data from the Pension Fund, recalculate and pay additional benefits.

If your company has employees who are on maternity leave at the time of reorganization, and their number of vacation days has been extended, then in this case you will need to pay extra for the additional days. Calculate the amount of the additional payment based on the same average earnings as in the original document.

Also, the reorganized company may have an employee on staff who is on parental leave. Such an employee does not need to write any new applications for leave and transfer of benefits. If the employee still receives monthly child care benefits for up to one and a half years, the “old” company accrues and pays it until the termination of operations, and the successor company begins to pay it in the same amount from the day the employee transfers to it.

Reorganization in the form of division

At first glance, it may seem that in the reorganization of a joint-stock company, enterprise or firm, everything is quite simple: two or more independent organizations merge and continue to work successfully as one whole. Or, for example, what could be simpler than dividing one enterprise into two or more, so that all newly created organizations work independently. In fact, reorganization is a rather complex and time-consuming process. In this article I will try to draw your attention to the most important points of reorganization through separation.

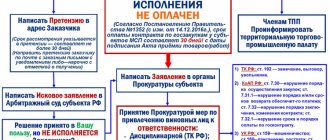

It is worth remembering that there is a procedure established by current legislation, violation of which leads to unpleasant consequences. This procedure is approved in several legislative acts, such as Ch. 4 tbsp. 57 of the Civil Code of the Russian Federation and a number of other articles. There are relevant laws on joint stock companies, tax code, etc. There are also rules for the interaction of bodies during state registration of legal entities in cases of reorganization, which were approved by Government Resolution No. 110 of February 26, 2004.

When reorganizing enterprises through division, the activities of this legal entity are immediately terminated, as well as the transfer of all its duties and rights to newly created legal entities (LEs).

The separation procedure includes:

- Preparation of the protocol;

- Publication of information in periodicals;

- Payment of state duties;

- Registration of changes in the reorganized joint stock company;

- Registration of newly created legal entities;

- Registration of newly created legal entities for tax registration;

- Registration of changes in extra-budgetary funds;

- Registration of legal entities in extra-budgetary funds.

Documents required for separation of legal entities:

- Certificate of registration of changes;

- Certificate of inclusion in the Unified State Register of Legal Entities (USRLE);

- Memorandum of Association, Charter;

- Letter of registration in the Unified State Register of Pools;

- Notice from the policyholder's funds;

- Certificate of registration;

- A written statement of the balance sheet as of the latest reporting date;

- Decoding debts;

- Notifications for joint stock companies regarding registration of shares issue.

Documents required for registration of legal entities newly created during reorganization through division:

- For founders of legal entities:

- certificate of registration in the Unified State Register of Legal Entities (USRLE);

- certificate of registration of MCI;

- decision or protocol on the appointment of the general director;

- bank certificate confirming payment of the authorized capital and availability of a current account;

- certificate of assignment of OKVED codes;

- certificate of assignment of identification number and registration;

- For individual founders:

- power of attorney certified by a notary to grant interests;

- photocopy of passport;

The following information will also be needed:

Personal income tax and deductions

According to the Ministry of Finance, the former company itself must provide information about the income of employees in Form 2-NDFL from the beginning of the year until the moment of termination of activity, and not the successor (Letter of the Ministry of Finance dated July 19, 2011 No. 03-04-06/8-173).

The successor company will provide employees with standard tax deductions from the moment they began working for that company, taking into account wages received from the beginning of the calendar year in which the reorganization was carried out.

What to do with an employee who received a property deduction from his previous employer? As you know, the notification issued by the Federal Tax Service confirming the right to deduction includes the name of a specific employer. Therefore, in order to receive the rest of the deduction, the employee needs to receive another notice and give it to the accountant of the new company. The deduction will be provided from the month in which the employee brought a new notice and wrote an application for the deduction.

Reorganization: definition and why it is needed

There are three main organizational and legal forms of registration of private enterprises: LLC (stands for “limited liability company”), CJSC and OJSC (closed/open joint stock company). However, a registered business may undergo significant changes over time. Production volumes decrease or increase, the specifics of activities and management structure change. This leads to the need for innovation in terms of organization.

If the enterprise is unprofitable, something needs to be changed. If the initial goals set by the company’s management have already been achieved, it’s time to move to a new level, which is associated with expanding the sales market and powers, and improving relations with partners. It happens that the OPF no longer corresponds to the format established by law. In each of these situations, a “political” measure such as reorganization can help.

Reorganization

- this is the completion of the enterprise’s activities, which is accompanied by the transfer of its obligations and rights to another company. This measure leads to the formation of one/several newly formed enterprises, which “inherit” the property and other rights, as well as the obligations of the reorganized person.

Often reorganization is carried out instead of liquidation. This is due to the economic inexpediency of the bankruptcy procedure and the possibility of preserving the main assets.

There are several types of reorganization. They differ in the structure and scope of transferred rights.

Insurance premiums

The base for insurance premiums is calculated on an accrual basis from the beginning of the year. After the base reaches the maximum value (in 2021 - 1,392,000 rubles), contributions will be calculated at a rate of 10%. Hence, the question very often arises: is it possible for a successor organization, when determining the base for insurance premiums, to offset employee payments for the same year, but from the previous organization?

Alas, the answer will not please you - you can’t do this. According to the Ministry of Health and Social Development of Russia, in the event of reorganization, the successor organization does not have the right to take into account the base for calculating insurance premiums formed before the reorganization. It turns out that if before the reorganization the employee’s insurance premium base reached the limit (the previous company applied a 10% tariff), then after the reorganization the successor will have to apply a 22% tariff to him (if there is no right to benefits).

Reporting

The old company, when filling out the DAM report, includes the amounts of payments to employees until the end of the reorganization. In turn, the new employer reflects the amount of payments of such employees from the first day of work with him in the calculation.

The reorganized company must provide personalized accounting information to the Federal Tax Service within 1 month from the date of approval of the transfer act in relation to dismissed employees.

As you and I can see, the accountant of the reorganized company has urgent matters to submit reports on personal income tax and insurance contributions before the organization ceases to operate. And the accountant of the successor company will not have any difficulties if the previous company transfers to it all the documents regarding the employees.

Reorganization in the form of merger

Merger is a process by which a company or several companies cease to exist and transfer all duties and rights to another company. In accordance with the approved transfer act, all privileges of the affiliated organizations are transferred to the new company.

A deed of transfer is a document that is created not only during the planned merger of companies, firms, enterprises, but also during the transformation and merger of companies. The act contains provisions on succession. The transfer deed is of great importance, since if it is incomplete or missing, you will be denied registration of a new legal entity.

Reorganization in the form of a merger can be regarded as both an option for creating a new enterprise and an option for liquidating an enterprise.

Documents and data required for reorganization in the form of merger:

- A document containing the composition of the company's participants and information on the distribution of the authorized capital;

- Information on the amount of the entire authorized capital;

- Form of authorized capital and its size;

- A copy of the passport of the general director of the company;

- Information about the passport details of the company's chief accountant.

The following documents must be collected from enterprises:

- All certificates of registration of various changes;

- Latest accounting report;

- Constituent documents with amendments;

- A document confirming the tax registration of the enterprise;

- Registration record in the Unified State Register of Legal Entities;

- Fund notice to the policyholder;

- For a company that wants to join - decryption of loan debt;

- Document on registration of shares issued for joint stock companies.

This is not a complete list of the documents you need; only the main papers are listed here. These and other documents must be submitted to the body where the registration takes place, located where the legal entity to which the merger is being carried out is located.

Enterprise reorganization

by joining takes about 2 months.

The accession process can be structured by points:

- It is necessary to notify the Federal Tax Service that the reorganization procedure has begun;

- A rule has been established in the event of reorganization to submit an application for publication in the journal “Bulletin of State Registration”. You need to wait for 2 publications, so the wait will last 2 months;

- After the above, you can finally submit an application for reorganization of the company to the MIFTS;

- Next, you receive a conclusion that the organization has been deregistered;

- Next, you can start changing the members of the company.

In order not to waste time collecting documents on your own and going through various authorities, you can entrust this task to our company.

When reorganizing an affiliation, special attention should be paid to the material and legal side of the issue. The transfer of property and rights during the reorganization process has its own specifics, because it is not an act of donation, not just a transfer or sale of an asset. The transfer of all rights to another legal entity can be characterized as a special process of alienation of assets and all property, occurring on the basis of legal succession. For this reason, no taxes are collected from a legal entity transferring its tangible and intangible rights. Property transferred and received is also not taken into account in the total amount of income of the receiving party.

Actions of the reorganized company

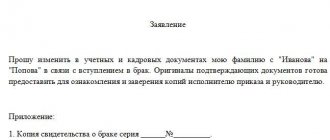

1. Notify each employee in writing about the upcoming reorganization. You can create a notification in any form.

2. Take a resignation letter from the employees in case of refusal to work for the successor. They can write the application in any form.

3. Formalize dismissals. Create orders for the dismissal of such employees. Based on these orders, make entries in the work book of workers who refused to work for the successor. If employees have switched to electronic work books, they must send the SZV-TD form to the Pension Fund with a record of dismissal.