Basic provisions

Employees who are unable to work are not able to work satisfactorily until recovery occurs. According to the law, the manager is obliged to pay the employee money due to temporary disability (Article 183 of the Labor Code of the Russian Federation) .

Disability has its own specific characteristics. Taking into account these signs , we can conclude that the possibility of active work has been lost:

- the nature of the actions performed;

- work tempo;

- what is the physical and nervous stress in a work environment;

- what are the working conditions;

- special hazards in connection with the profession.

If an employee gets sick, but does not stop going to work, then during this period he is not considered incapacitated.

It is permissible to call incapacitated only the period when an employee does not go to work and he has lost the ability to perform his job duties.

Types of temporary disability

There are several types of temporary disability. The most common is temporary disability due to maternity, illness, injury, surgery and its consequences, in the case of vacation. We will talk about these and other types of temporary disability in more detail below.

Disease

Illness is one of the causes of temporary disability according to the Labor Code of the Russian Federation (Article 183). During illness, an employee has the right to take paid sick leave.

The employee may lose partial ability to work. In such cases, he continues to work, but only part-time. Disability can also be complete when an employee is unable to go to work and perform his job duties.

The duration of temporary disability varies depending on the type of illness:

- Intestinal infections – from 5 to 40 days.

- Bacterial diseases – from 15 to 40 days (in some cases this period increases to 60 days).

- Diseases of the lacrimal ducts and eyelids – from 7 to 20 days.

Important: if the loss of ability to work was related to alcohol, the amount of the benefit is significantly reduced.

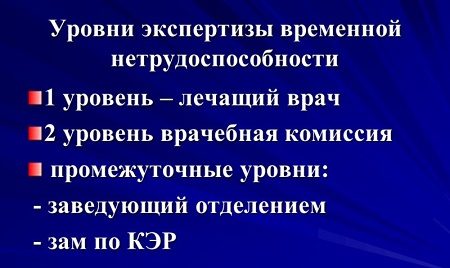

Temporary disability is determined by the attending physician during an examination. After this, the patient is given a sheet with a conclusion and indicating the time frame of incapacity for work.

Accident

Registered employees regularly pay insurance premiums in case of temporary disability. If an employee becomes ill, gives birth to a child, retires, or is injured, benefits are paid from this fund.

It happens that workers temporarily lose their ability to work due to an accident. In such situations, the employee needs to see a doctor to obtain a special sick leave. The period of disability and the amount of compensation depends on the type and severity of the injuries.

Pregnancy, abortion and childbirth

Pregnancy, childbirth or abortion are a number of reasons why a woman may temporarily lose her ability to work. The Labor Code of the Russian Federation guarantees that you will receive compensation during this time.

The main document certifying temporary disability will be a sick leave certificate. It can be permanent or displaced.

In 2021, sick leave for pregnancy is calculated based on:

- The amount of payments based on which contributions to the social fund were made.

- Average daily earnings.

If at the time of going on vacation a woman had officially worked for at least a few days, she must be paid compensation. If the employee’s work experience is more than 6 months, the amount of accruals will not depend on the insurance period. In this case, the amount of monthly compensation is equal to the amount of wages. If the employee has worked at the company for less than 6 months, the benefit will be equal to the minimum wage (minimum wage).

Quarantine announcement

The Federal Law on temporary disability states that all those persons who had contact with the patient can count on benefits. If a person is a carrier of an infectious disease, he also temporarily loses his ability to work. At the initiative of the employer, the entire enterprise may be closed for quarantine if many employees become ill.

Suspension from work

An employee may be suspended from work if he does not pass a medical examination or technical instruction, gets sick, skips work, comes to work while intoxicated, or for other reasons. In such cases, the employee will not receive wages, but can count on state benefits.

Caring for a sick family member or relative

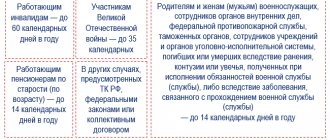

Temporary disability benefits are also available to those persons who are forced to stop working due to caring for a child, sick family member or relative. There is a classification that determines the period of disability depending on the age of the patient and the severity of the disease.

| Patient's age | Period of temporary incapacity for work |

| Up to 7 years | If a parent or guardian is undergoing outpatient or inpatient treatment with a child, this period is usually no more than 60 days. This period can increase to 90 days if the child suffers from burns, epilepsy, cancer, mental and other diseases included in Order No. 84N of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008. |

| 7-15 years | Maximum 15 days (at one time), if the parent/guardian and the child are undergoing inpatient or outpatient treatment. Important: you can be temporarily disabled for no more than 45 days a year. |

| Disabled child under 18 years of age | Maximum 120 days per year. |

| Other clinical cases with outpatient treatment. | 7 days for each case of illness, but not more than 30 days a year. |

If a person is caring for a child under 18 years of age who suffers from serious illnesses (HIV, oncology, post-vaccination lesions, etc.), there are no restrictions on the period of working ability.

The maximum amount of temporary disability benefits in 2021 is calculated in the same way as in all other cases. It depends on the working and insurance experience.

Spa treatment, prosthetics and rehabilitation after medical procedures

All of these cases also cause temporary disability. If a citizen is recovering from medical procedures, has undergone prosthetics, or has undergone sanatorium-resort treatment, he is entitled to payment of benefits.

The main criterion for the amount of monthly benefits is length of service:

- 8 or more years – 100% of salary;

- from 5 to 8 years – 80% of salary;

- up to 5 years – 60% of salary.

Important: the concept of “salary” implies the average monthly salary.

Adoption of foster children

All citizens of the Russian Federation are subject to compulsory social insurance. According to its rules, persons who have adopted or taken custody of a child are entitled to benefits.

A person who is an adoptive parent is issued a certificate of temporary disability based on a court order and the child’s birth certificate. The period of incapacity for work can range from 56 to 90 calendar days (depending on the number of adopted/taken guardianship children).

Periods and deadlines

Life periods that prevent a worker from actively performing his job duties include the following circumstances:

- Partial loss of ability to work. In this case, the employee can remain in his position, but work part-time.

- Absolute loss of ability to work. At the same time, the employee has absolutely no opportunity to continue to fulfill his duties and go to work. He requires treatment (inpatient, outpatient, etc.).

- The employee cannot carry out work activities and will have to be absent for some time. This may be due to caring for a loved one, or other circumstances prescribed by law.

In addition, there is also a definition in the law, which is considered a long-term loss of the ability to work, but this is already a disability .

Such citizens have the right to perform their job duties on a reduced working day. This loss of ability to work is not considered temporary.

Average periods of temporary disability for certain diseases:

- For intestinal infections, the period of disability can range from five to forty days.

- For bacterial diseases, the period of incapacity can be from fifteen to forty days (in some cases up to sixty).

- For diseases of the eyelids and lacrimal ducts, the period of incapacity for work ranges from seven to twenty days.

Loss of ability to work as a result of harm to health

Labor disputes are one of the most common, since the vast majority of the population “works”. At the same time, no one is insured against injuries and injuries, including in the workplace. Unfortunately, some injuries lead to the inability to perform one’s job duties and, therefore, to ensure one’s livelihood. In particular, such consequences occur after injuries, when general ability to work is “lost.”

General ability to work involves engaging in work activities that do not require special training.

Who do we pay and what? Law A system of generally binding social norms, protected by the power of the state, providing legal regulation of social relations throughout society for compensation for moral damage. Who will determine the degree? Practice

Causes of disability

It's no secret that a person spends a significant part of his time at work. The employer is obliged to provide its employees with safety in the workplace.

It must be understood that this duty is not always fulfilled, which becomes the main cause of injuries and injuries at work. If an employee is injured for one reason or another, he must be compensated for his earnings and additional expenses.

First of all, such payments are made by the Social Insurance Fund.

After all, one of the guarantees of the right to compensation for harm when the ability to work is lost is compulsory insurance.

Who do we pay and what? Who is subject to social accident insurance?

- employees who are in labor relations with the organization;

- employees who are in civil legal relations with the organization (if the contract stipulates the employer’s obligation to pay insurance premiums).

Payment forms:

- temporary disability benefits;

- one-time and monthly insurance payments;

- payment of additional expenses associated with rehabilitation.

The amount of losses depends on:

- degree of lost ability to work;

- average employee earnings for 12 months.

The right to compensation begins from the date of injury, and not from the moment the claim is filed.

And earnings will be subject to compensation for the entire time until working capacity is restored. The Social Insurance Fund cannot always fully compensate for the harm caused to an employee.

The employer will still be liable for harm caused to the employee “together” with the Social Insurance Fund.

The right to compensation for moral damage

It must be understood that the Social Insurance Fund will not compensate for moral damage. Therefore, such a requirement should be addressed directly to the employer (when it is his fault).

Moral harm Physical or moral suffering (Article 151 of the Civil Code of the Russian Federation). It is possible to compensate even in the absence of the employer’s fault, but then the harm must be caused by a source of increased danger (for example, a car).

In this case, the court will consider that moral damage is expected.

You only need to set its size. Who will determine the degree? The degree of loss of general ability to work is determined through an examination carried out in medical institutions of the state health care system.

Persistent loss of general ability to work characterizes the infliction of serious harm to health, when the loss of ability to work is more than 30%.

The degree of loss is determined by experts taking into account objective data. In the case of industrial injuries or occupational diseases, the degree is determined by medical and labor expert commissions.

The purpose of the VTEK’s work is to determine disability groups, while forensic experts are called upon to determine the degree of disability, depending on the requirements of the courts.

When calculating the amount of permanent disability, a special table is used that displays the percentage of disability due to certain injuries.

As a rule, an examination is appointed by a court decision to establish the correctness or degree of guilt of one of the parties.

Practice Our client filed a lawsuit to recover lost earnings for a period of temporary disability and moral damage.

During the trial, it turned out that our client had an accident at work. The defendant’s guilt is confirmed by the documents, but the employer refuses to make the payment.

As a result, our client restored her health at her own expense, purchasing expensive medications.

The court satisfied our client’s demands, citing the fact that during the period of temporary incapacity for work, the employee retains his average earnings.

The complexity of the case was that, based on medical indications, our client was transferred to an easier, and as a result, less paid job.

But the court explained that when transferring to another job, due to work-related health damage, the employer cannot reduce the amount of earnings.

As a result, the court recovered in favor of our client earnings for the period of incapacity based on her previous salary.

Signs and factors of temporary disability

All necessary information for doctors to determine a patient’s disability is prescribed in Federal Law No. 323 . Chapter 7, Article 58, Clause 1 of this law speaks of the need to determine the connection between the cause and the unsatisfactory state of health of the employee.

It is imperative to find out this data, because... It may turn out that the employee was under the influence of alcohol, which means that he is entitled to much lower benefit payments.

The basis for the examination to identify signs of inability to work is found in Article 59 of Federal Law No. 323 .

Factors include the following:

- disease;

- intoxication;

- due to pregnancy and childbirth;

- quarantine period;

- caring for a sick relative;

- baby care.

If such an event is not carried out, then a certificate of incapacity for work cannot be issued to the patient.

According to Article 59, a certificate of incapacity for work has the right to be issued by a general practitioner, attending physician, or dentist.

The procedure for its establishment and determination

The usual procedure for issuing certificates of incapacity for work is established by Order of the Ministry of Health and Social Development No. 624 .

Sick leave is available to insured citizens of the Russian Federation, or those living on its territory but not having citizenship.

A disability examination is carried out immediately as soon as a citizen goes to the clinic. It is usually carried out by a single doctor, who records all the data in the patient’s personal record.

During the examination, the doctor comes to the conclusion whether a particular patient needs a sick leave. The duration of the certificate of incapacity for work will depend on the condition of the patient .

Sick leave cannot be extended for more than fifteen days.

During these two weeks, the doctor will monitor the patient’s health status, making adjustments to treatment if necessary.

If the patient has recovered, the certificate of incapacity for work is closed and a record is made about this. The sick leave certificate is stamped and the doctor signs it. If a person works, then the sick leave record records the date from which he can start working.

The period of temporary incapacity for work of an employee does not always end with his full recovery. Often, after a sick leave, a worker is recognized as conditionally able to work - with the assignment of a degree of loss of professional ability and even disability. Very often this is caused by the consequences of industrial accidents and occupational diseases. In such situations, the accountant needs to be very careful when calculating temporary disability benefits assigned in connection with an industrial accident or occupational disease at the expense of compulsory insurance against industrial accidents and occupational diseases, in order to prevent unreasonable overspending of these funds.

In practice, accountants have the following question: should they take into account the day when an employee’s permanent loss of professional ability to work (disability) is determined when determining the paid period for assigning temporary disability benefits in connection with an industrial accident or occupational disease at the expense of compulsory accident insurance at work? production and occupational diseases (hereinafter referred to as the benefit)?

The benefit in question is one of the types of insurance payments for compulsory insurance against industrial accidents and occupational diseases, the procedure and conditions for which are regulated by the Regulations on insurance activities in the Republic of Belarus, approved by Decree of the President of the Republic of Belarus dated August 25, 2006 No. 530 “On insurance activities” ( hereinafter referred to as Regulation No. 530).

D-t 76-2 – K-t 70 – benefits have been accrued in connection with an accident at work or an occupational disease;

Dt 70 – Dt 50 – benefits have been paid*. __________________________ * Correspondence accounts compiled by the editors.

General procedure for payment of benefits

The benefit is assigned and paid by the insurer for the entire period of temporary disability of the insured until his recovery or establishment of permanent loss of professional ability, as well as in case of exacerbation of diseases associated with the consequences of industrial accidents and occupational diseases after his recovery or establishment of permanent loss of professional ability, in the amount of 100 % of his average daily (average hourly) earnings, calculated and paid in accordance with the legislation on temporary disability benefits, for working days (hours) according to the insured’s work schedule (clause 268 of Regulation No. 530).

Regulation No. 530 does not contain any other rules regulating the procedure for providing the benefits in question.

As we see, clause 268 of Regulation No. 530, the paid period for the benefit we are considering is strictly limited to the period of temporary disability of the insured person.

The question posed concerns such a component of determining the paid period as its end date.

General rule for determining the end date of the paid period

In the event of the recovery of the insured person without a permanent loss of professional ability (disability) being established, the general rule applies for determining the last date on the basis of which the paid period is determined: this is the date preceding the day of the employee’s recovery (the last day of release from work, indicated in the second column “By which date”). number inclusive” in the “Exemption from work” section of the certificate of incapacity for work).

In general, the end date of the paid period coincides with the end date of the period of temporary disability of the insured person.

In case of loss of ability to work, the last day of the period of temporary disability is not included in the paid period

If the insured person is diagnosed with a permanent loss of professional ability to work (disability), the above coincidence does not occur, and the last day of the period of temporary disability is not included in the paid period.

This is due to the fact that clause 268 of Regulation No. 530 provides for the determination of the paid period until the date of permanent loss of professional work capacity for the insured person (with the meaning “not inclusive”), while the current procedure for determining and confirming the period of temporary disability, taking into account the rule for determining the date establishing permanent loss of professional ability to work and disability, provided for by special acts of legislation in this area, includes this date in the period of temporary disability as its last day.

In particular, a certificate of incapacity for work is issued for the entire period of temporary disability until its restoration or establishment of disability (clause 22 of the Instruction on the procedure for issuing and issuing certificates of incapacity for work and certificates of temporary disability, approved by Resolution of the Ministry of Health and the Ministry of Labor and Social Protection of the Republic of Belarus dated 07/09/2002 No. 52/ 97 (hereinafter referred to as Instruction No. 52/97)). However, Instruction No. 52/97 contains a special clause explaining the content of the expression “before the establishment of disability” in relation to determining the period of temporary disability: if a patient during a period of temporary disability during an initial examination or re-examination is recognized as disabled without making work recommendations, the medical advisory commission (MCC) extends the certificate of incapacity for work, incl. and on the day of disability determination (the day of registration of documents with the medical and rehabilitation expert commission (MREC)) (part two, clause 24).

If a patient is recognized as incapable of work during examination by the MREC, in the line of the certificate of incapacity for work “Conclusion on work ability”, the entry “Unable to work (in words, the date and month of disability determination) is disabled of group I (II) is made” (clause 76 of Instruction No. 52/97).

If a citizen is recognized as disabled, the date of establishment of disability is considered to be the date of registration with the commission of referral for a medical and social examination, provided that the citizen is examined no later than 60 days from the above date (clause 15 of the Instructions on the procedure and criteria for determining the group and cause of disability, the list of medical indications giving the right to receive a social pension for disabled children under the age of 18, and the degree of loss of their health, approved by Resolution of the Ministry of Health of the Republic of Belarus dated October 25, 2007 No. 97 (hereinafter referred to as Instruction No. 97)).

The date of registration with the commission of referral for a medical and social examination is the date of commencement of the medical and social examination (clause 9 of Instruction No. 97).

However, the concept of “permanent loss of professional ability to work” is not identical to the concept of “disability” (the second, as a rule, presupposes the first, but not always vice versa).

Clause 1 of the Rules for determining the degree of loss of professional ability to work as a result of industrial accidents and occupational diseases, approved by Resolution of the Council of Ministers of the Republic of Belarus dated October 10, 2003 No. 1299 (hereinafter referred to as Rules No. 1299), determines that the degree of loss of professional ability to work is established as a percentage at the time of examination victim.

There are no other rules for determining the moment of establishing permanent loss of professional ability to work, neither Rule No. 1299, nor the Instruction developed for the purpose of their implementation on determining the criteria for the degree of loss of professional ability to work as a result of industrial accidents and occupational diseases, approved by the resolution of the Ministry of Health and the Ministry of Labor and Social Protection of the Republic of Belarus dated 01/09/2004 No. 1/1, nor Instruction No. 97 do not contain.

Taking into account the established procedure for conducting a medical and social examination, the date of establishment of a permanent loss of professional ability to work is determined in a manner similar to the procedure for determining the date of establishment of disability, as the date of registration in the MREC of a referral for a medical and social examination.

Based on this, the last day of release of the insured person from work, indicated in the second column “Up to and including” of the section “Exemption from work” of the certificate of incapacity for work, in the situation under consideration will be the day of establishment of permanent loss of professional ability, which is not subject to inclusion in the paid period (p 268 Regulations No. 530).

If a permanent loss of professional ability to work is established, the entire period of examination by MREC is not included in the paid period

Having analyzed the norms of the above acts of legislation in more detail (part five, clause 76 of Instruction No. 52/97, part four, clause 14, part four, clause 10 of Instruction No. 97), we come to the conclusion: when assigning the benefit in question to insured persons for whom the MREK has established a stable loss of professional ability to work (including disability) with a work recommendation, not only the day of establishment of permanent loss of ability to work (disability), but also the entire period of examination by the Ministry of Economic Development and Trade, based on the results of which this decision was made, cannot be included in the paid period.

Thus, the entire period from the date of establishment of permanent loss of professional ability (disability) (the start date of the examination) to the date from which the patient is ordered to begin work (the end date of the examination) will be included in the period of his temporary incapacity for work and in the section of the certificate of incapacity for work " Release from work,” but not during the paid period for the assignment of the benefit in question (clause 268 of Regulation No. 530).

Instead of temporary disability benefits, the employee is assigned a monthly insurance payment

Despite the fact that the earnings lost by the insured person as a result of an industrial accident or occupational disease from the date of his permanent loss of professional ability to work are not compensated by temporary disability benefits assigned by the insured, it is fully compensated by another type of insurance payments - monthly insurance payments, appointed directly by the insurer (Belgosstrakh) precisely from the specified date.

Example 1

On January 3, 2012, the employee had an accident at work, as a result of which he received a serious work injury. The employee's temporary disability lasted more than 1.5 months. From February 27, 2012, by the conclusion of the MREC, he was established with a permanent loss of professional working capacity in the amount of 100% for a period of 1 year, followed by re-examination after 1 year with the establishment of disability group I. In the line “Beginning of incapacity for work” (positions 08–13) of the certificate of incapacity for work, code 030112 is indicated, corresponding to the date January 3, 2012. The same date is indicated as the first in the first column “From what date” of the section “Exemption from work” of the certificate of incapacity for work. As the last day of release from work, the date February 27, 2012 is indicated in the second column “Up to and including” of the “Exemption from work” section of the certificate of incapacity for work. In the line “Conclusion on work ability” of the certificate of incapacity, the entry “Disabled, February twenty-seventh, disabled” was made Group I." The employee’s work schedule is determined by a 5-day work week, taking into account working hours in working days. The paid period for temporary disability benefits due to an industrial accident will be 39 working days (excluding the working day falling on February 27, 2012) . From February 27, 2012, employees are subject to monthly insurance payments made directly by Belgosstrakh.

Example 2

On January 3, 2012, the employee had an accident at work, as a result of which he received a moderate work-related injury. The employee's temporary disability lasted more than a month. From February 13, 2012, by the conclusion of the MREC, he was established with a permanent loss of professional working capacity in the amount of 40% for a period of 1 year, followed by re-examination after 1 year with the establishment of disability group III. The conclusion of the MREC was issued on February 21, 2012. In the line “Beginning of incapacity for work” (positions 08–13) of the certificate of incapacity for work, code 030112 is indicated, corresponding to the date January 3, 2012. The same date is indicated as the first in the first column “From what date” of the section “ Exemption from work" certificate of incapacity for work. The last day of release from work in the second column “Up to and including” of the “Exemption from work” section of the certificate of incapacity for work indicates the date February 21, 2012. In the line “Conclusion on work ability” of the certificate of incapacity, the entry “To work from February 22, disabled” is made Group III." The employee’s work schedule is determined by a 5-day work week, taking into account working hours in working days. The paid period for temporary disability benefits due to an industrial accident will be 29 working days (excluding working days falling during the period of temporary disability from February 13 to February 21, 2012) . From February 13, 2012, employees are subject to monthly insurance payments made directly by Belgosstrakh.

Documents confirming incapacity for work

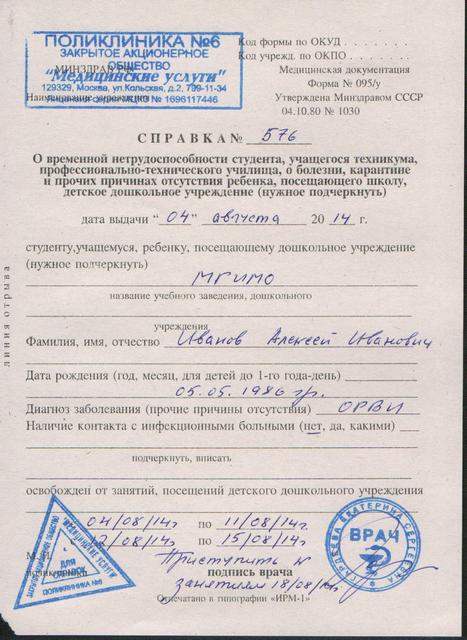

Such documents are:

- Temporary certificate of incapacity for work, which is based on a specific period.

- For students, their academic leave and exemption from study, an additional medical history extract is required. Such an extract is issued in form No. 027/027у.

- Certificate of sample No. 095/095у.

The certificate can be issued in any form, but it must be supported by the seal of a medical institution .

Ballots are issued exclusively in accordance with the strict regulations of the Procedure, supported by Order of the Ministry of Health and Social Development of the Russian Federation No. 624. This document can be issued only to certain citizens (Procedure Rules No. 624). The document can be issued by doctors only on the basis of a certain license.

Insurance

Insurance is a mandatory program that provides certain benefits to an employee that were lost due to circumstances or due to the occurrence of an insured event.

Insurance is necessary when applying for a job, so that the employee knows that any life problem will not add headaches regarding finances.

The following cases are insured:

- Loss of ability to work for a certain period due to injury, illness or disability.

- Caring for a relative.

- Recovery in a sanatorium.

- Quarantine.

Leave for temporary disability

If an employee is declared incapacitated, this means he is released from work, and he may also be entitled to leave for treatment or recovery. Leave due to illness is granted by the attending physician, except for private practitioners.

The doctor’s decision to grant leave to the patient can be controlled by the authority. The maximum duration of vacation is 14 days . Also, the vacation can be five days, or one week.

If the illness lasts longer and the patient needs an extension of leave, then he is sent to the medical control commission.

Duration of temporary disability

The concept of “duration of temporary disability” is a very ambiguous term. The duration of this period can start from two weeks and reach up to 120 calendar days.

Each cause of temporary disability has its own time intervals. For example, if disability occurs due to pregnancy, the woman will receive benefits for approximately 140 days. If disability occurs due to a fracture, the person may be unable to work for 50-60 calendar days.