Is it possible not to allow an employee to go on vacation before dismissal?

First of all, let’s figure out whether the employer is obliged to let the employee go on vacation in such a situation. Let us say right away that in most cases such an obligation does not arise. There are only two circumstances when an employee must be given leave before dismissal:

- The company has approved a vacation schedule, and the vacation of the resigning employee falls exactly at the time before dismissal . That is, in fact, the employee decided to work until the vacation included in the schedule in advance, and after that not to go to work.

- The employee is a parent, guardian or trustee of a disabled child under the age of 18 or belongs to another category of persons entitled to leave at a time convenient for them .

If the situation is different, then the employer does not have an obligation to allow the employee to go on vacation before dismissal. The parties must come to an agreement.

If the resigning person goes AWOL, this will be considered absenteeism . As a result, an employee may be fired for absenteeism in accordance with paragraph 6 of part 1 of Article 81 of the Labor Code. The rightness of the employer who fired the absentee employee is confirmed by the letter of Rostrud dated December 24, 2007 No. 5277-6-1, as well as judicial practice, for example, the appeal ruling of the Supreme Court of the Sakha Republic dated June 3, 2015 No. 33–1849/15.

Next, we will consider the situation if the employer and employee managed to agree on the provision of leave before dismissal.

Responsibilities on the employee's last day of work

On the day of termination of an employment contract with a resigning employee, the legislation of the Russian Federation imposed many obligations on the employer. But before we turn to their consideration, let us clarify exactly when the specified event occurs.

Last day of work The day of termination of the employment contract in accordance with Article 84.1 of the Labor Code of the Russian Federation is always the last day of work of the employee, except for cases when he did not actually work, but according to the Labor Code of the Russian Federation or other federal law, his place of work (position) was retained. Thus, the date of dismissal indicated in the order to terminate the employment contract with the employee must be his working day.

An employee, as is known, has the right to terminate an employment contract by notifying the employer in writing no later than two weeks in advance.

The specified period begins the next day after the employer receives the employee’s resignation letter (paragraph 1 of article 80 of the Labor Code of the Russian Federation).

It is possible that the end of this period will fall on Saturday or Sunday, which are general days off for the employer.

Employees of Rostrud recommended that in such circumstances, turn to Article 14 of the Labor Code of the Russian Federation (letter of Rostrud dated June 18, 2012 No. 863-6-1), which establishes the procedure for calculating deadlines. If the last day of the term falls on a non-working day, then the day of expiration of the term, by virtue of the mentioned norm, is considered to be the next working day following it. Accordingly, if the dismissal falls on Saturday or Sunday, which are general days off for the employer, then the quitter will have to go to work on Monday. But the employer has no right to force him to work on this day.

When dismissing an employee on the eve of the weekend, the employer violates labor laws. During the period of validity of the employment contract on weekends, the employee retains his workplace and all labor rights, including the right to withdraw his resignation letter (paragraph 4 of article 80 of the Labor Code of the Russian Federation). By dismissing an employee on Friday, the employer will deprive him of this right.

Dismissal of an employee on the eve of the weekend will be legal if the employee and the employer come to an agreement to terminate the employment contract before the expiration of the notice period for dismissal (paragraph 2 of Article 80 of the Labor Code of the Russian Federation).

At the same time, it is necessary to take into account which days are considered working days for the employee. If an employment contract is terminated with an employee who has a shift work schedule, the date of termination of the employment contract is the date of the last working day, including those falling on a weekend or non-working holiday. And in this case, the employer will need to go to work on the weekend in order to formalize the dismissal of the employee.

Uncertainty may arise when determining the last day of work and upon dismissal due to a reduction in the number or staff of employees (Clause 2, Part 1, Article 81 of the Labor Code of the Russian Federation), if information about the upcoming dismissal is communicated to employees on December 29 or 30 in normal years and 30 December is a leap year.

As is known, the employer must notify each employee personally against signature at least two months before the dismissal (paragraph 2 of Article 180 of the Labor Code of the Russian Federation) about the upcoming dismissal due to the liquidation of the organization, reduction in the number or staff of employees. Terms calculated in months expire on the corresponding date of the last month of the term (paragraph 3 of article 14 of the Labor Code of the Russian Federation).

When such information is brought to the attention of employees on December 29, the period begins to count from the 30th of that month. The two-month period in this case ends on February 29. But in normal years there are only 28 days in February.

The legislator in Article 14 of the Labor Code of the Russian Federation did not provide for a special provision on determining the end of the period falling on a date that is absent in the month. Therefore, it is quite logical to turn to Article 192 of the Civil Code of the Russian Federation, which establishes the procedure for calculating the end of a period determined by a period of time.

If the end of a period calculated in months falls on a month in which there is no corresponding date, then the period, in accordance with paragraph 3 of Article 192 of the Civil Code of the Russian Federation, expires on the last day of this month.

Based on this, the last day of work for dismissed workers due to a reduction in their number in the case under consideration becomes February 28 in normal years and February 29 in leap years.

Doubts regarding the last working day may also arise if an employee applies for leave with subsequent dismissal. Article 127 of the Labor Code of the Russian Federation, in particular, allows an employee, instead of receiving compensation for unused vacation days, to take them off before dismissal, without returning to work. But such dismissal is possible only upon a written application from the employee and with the consent of the employer. The day of dismissal is considered to be the last day of vacation (paragraph 2 of article 127 of the Labor Code of the Russian Federation). But it is quite problematic for the employer to formalize the termination of the contract and fulfill the obligations arising in connection with this on this day, since the employee is absent from work.

The Constitutional Court of the Russian Federation, in its ruling dated January 25, 2007 No. 131-O-O, indicated that in this case, the employee’s last day of work should be considered not the day of his dismissal (the last day of vacation), but the day preceding the first day of vacation. Taking this into account, the employer must carry out all procedures related to the registration of termination of employment relations even before the employee goes on vacation.

Emerging Responsibilities

Issuance of an order Termination of an employment contract is formalized by an order (instruction) of the employer. Such an order is issued in a unified form No. T-8 or T-8a (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

When dismissal is initiated by an employee (clause 3, part 1, article 77 of the Labor Code of the Russian Federation), it is logical to issue an order on this on the last working day. If you issue such an order earlier, sign it with the manager, and inform the employee, there is a possibility that it will have to be cancelled. After all, the employee, as mentioned above, can exercise his right to withdraw his resignation letter on the last day of the two-week period.

The date of issue of the order and the date of dismissal may still not coincide. Thus, when carrying out measures to reduce the number or staff of employees, a dismissal order may be issued earlier than the last working day. When granting leave followed by dismissal, the date of issuance of the order and the date of dismissal always do not coincide.

The employer must familiarize the employee with the dismissal order against signature (paragraph 2 of article 84.1 of the Labor Code of the Russian Federation). The deadlines for this Labor Code of the Russian Federation have not been established. This usually happens on the last day of work of the dismissed person, with the exception of cases where the employee did not actually work, but retained his place of work (position). For example, an employee asks to be dismissed at his own request while on vacation.

If an employee refuses to read the order, a note about this must be made on the document. The same should be done if the order to terminate the employment contract cannot be brought to the attention of the employee. The entry may look like this: “It is impossible to familiarize against signature due to the reason...”.

If an employee refuses to familiarize himself with the order, in addition to writing it down on the document, it is advisable to draw up an act of refusal to familiarize himself with the order. This act may subsequently come in handy if the dismissal is carried out at the initiative of the employer. The act is drawn up in any form by a personnel employee or other person in the presence of at least two witnesses.

In the line (column) of forms No. T-8 and T-8a “Grounds for termination (termination) of an employment contract (dismissal)” an entry is made in strict accordance with the wording of the current legislation with reference to the relevant article. In the line (column) “Document, number and date” a reference is made to the document on the basis of which the order is prepared and the employment contract is terminated, indicating its date and number (employee statement, medical report, memo, summons to the military registration and enlistment office and other documents ).

Sometimes certain documents must be attached to the order. Thus, the Instructions for the use and completion of forms of primary accounting documentation for the accounting of labor and its payment (approved by the aforementioned Resolution of the State Statistics Committee of Russia No. 1) require that a document stating that there are no material claims against the employee be attached to the order if the person being dismissed is a financially responsible person. When terminating an employment contract at the initiative of the employer, in some cases an integral part of the order is the reasoned opinion of the elected trade union body (if there is one) of the organization, set out in writing.

Payment upon dismissal Upon termination of an employment contract, payment of all amounts due to the employee, by virtue of Article 140 of the Labor Code of the Russian Federation, is made on the day of his dismissal. In addition to the wages due to the employee for working days worked in the month of termination of the employment contract, upon dismissal, quite often it is necessary to pay compensation for unused vacation, if any. This compensation is paid regardless of the grounds for dismissal (letter of Rostrud dated 07/02/09 No. 1917-6-1).

Employees receive compensation based on the number of unused vacation days they are entitled to while working for the employer. Rostrud specialists recommended determining compensation by multiplying the employee’s average daily earnings for the billing period by the number of such days. The days of unused vacation, in turn, are determined based on the calculation of 2.33 days of vacation for 1 month of work (28 days: 12 months) (letter of Rostrud dated July 26, 2006 No. 1133-6).

The procedure for calculating average daily earnings to pay compensation for unused vacations is identical to the procedure used when calculating this earnings when going on vacation. Average daily earnings are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (paragraph 4 of Article 139 of the Labor Code of the Russian Federation).

When calculating average earnings, the time specified in paragraph 5 of the Peculiarities of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922) is excluded from the calculation period, as well as the amounts accrued during this time.

The provision for calculating length of service giving the right to annual paid leave is established by Article 121 of the Labor Code of the Russian Federation. The specified length of service, in particular, includes the time of unpaid leave granted at the request of the employee, not exceeding 14 calendar days during the working year.

Calculation of the number of vacation days for which compensation is required to be paid to the employee is carried out in accordance with the Rules on regular and additional vacations (approved by the NCT of the USSR on April 30, 2030). If an employee worked for less than half a month, this time is excluded from the calculation, and if half or more than half a month was worked, these periods are rounded up to a full month (clause 35 of these rules).

Also, the dismissed person must be paid severance pay and other compensation if they are provided for by the Labor Code of the Russian Federation, local regulations or an employment contract.

In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the undisputed amount on the last day of work (paragraph 2 of Article 140 of the Tax Code of the Russian Federation).

If the employee did not work on the day of dismissal, then the corresponding amounts must be paid to him no later than the next day after he submits a request for payment.

If the employer violates the established deadline for payments, including upon dismissal, he is obliged to compensate them with the payment of interest (monetary compensation).

Their size is one three-hundredth of the refinancing rate of the Bank of Russia in effect at that time on amounts not paid on time for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault (Article 236 of the Labor Code of the Russian Federation).

Delay in payment of wages is an administrative offense. For violation of labor legislation, an administrative fine may be imposed (Clause 1, Article 5.27 of the Code of Administrative Offenses of the Russian Federation): • on officials and individual entrepreneurs - in the amount of 1,000 to 5,000 rubles; • for legal entities - from 30,000 to 50,000 rubles.

When paying wages, the employer, as is known, is obliged to notify each employee in writing: • about the components of the wages due to him for the corresponding period; • on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; • about the amounts and reasons for the deductions made; • about the total amount of money to be paid.

This information is reflected in the pay slip (paragraphs 1-6 of Article 136 of the Labor Code of the Russian Federation). Typically, a payslip is issued to the employee at the end of the month. When dismissing an employee, the pay slip must be given to him on the last day of work.

Issuance of a work book On the employee’s last day of work, in accordance with the general procedure for registering termination of an employment contract, he must be issued his work book (paragraph 4 of Article 84.1 of the Labor Code of the Russian Federation). The Labor Code of the Russian Federation has not established any grounds for postponing the issuance of a work book. Consequently, it is unlawful to withhold the document in question for any reason - until the transfer of business to a successor, repayment of a debt to the employer, in connection with an unissued bypass sheet, etc. If such actions lead to the fact that the former employee will not be able to start working in another place, the employer, due to his obligation to compensate the employee for material damage caused as a result of the illegal deprivation of his opportunity to work, will have to compensate him for the earnings he did not receive during the illegal deprivation his ability to work, that is, during the delay in issuing a work book (paragraph 9 of article 165, paragraph 4 of article 234 of the Labor Code of the Russian Federation).

At the same time, the employer cannot in any way influence the employee so that he takes away his work book. Sending it by mail is possible only with the consent of the former employee (clause 36 of the rules of conduct). The legislator, foreseeing the possibility of a situation arising when it is not possible to issue a work book to an employee on the day of termination of the employment contract, provided a special norm in the Labor Code of the Russian Federation. If it is impossible to issue it due to the employee’s absence or refusal to receive it, the employer is obliged to send him a notice of the need to appear for the document or agree to send the book by mail. From the moment such notification is sent, the employer is released from liability for the delay in issuing the work book on time (paragraph 6 of Article 84.1 of the Labor Code of the Russian Federation).

The employer is also not responsible for the delay in issuing a work book in cases where the last day of work does not coincide with the day of registration of termination of employment upon dismissal: • under subparagraph “a” of paragraph 6 of part 1 of Article 81 of the Labor Code of the Russian Federation for absenteeism, that is, absence from the workplace without good reason during the entire working day (shift), regardless of its duration, as well as in the case of absence from the workplace without good reason for more than four hours in a row during the working day (shift); • under clause 4 of part 1 of Article 83 of the Labor Code of the Russian Federation, the conviction of an employee to a punishment that precludes the continuation of his previous work, in accordance with a court verdict that has entered into legal force; • women whose employment contract was extended until the end of pregnancy in accordance with Article 261 of the Labor Code of the Russian Federation (if a fixed-term employment contract expires during the woman’s pregnancy, the employer is obliged, upon her written application and upon presentation of a medical certificate confirming the state of pregnancy, to extend the period validity of the employment contract until the end of pregnancy).

The rules for maintaining and storing work books (approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225) (hereinafter referred to as the rules for maintaining) clarify that on the day of dismissal (the last day of work) of an employee, the employer is obliged to issue his work book with a notice of dismissal included in it (clause 35 of the rules of conduct).

An entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of the Labor Code of the Russian Federation or other federal law and with reference to the relevant article, part of the article, paragraph of the article of the code or other federal law.

To correctly complete an entry in a work book, you must refer to the rules for maintaining and Instructions for filling out work books (approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69). All entries in the work book are made on the basis of the relevant order (instruction) of the employer no later than a week, and in case of dismissal - on the day of dismissal and must exactly correspond to the text of the order (instruction) (clause 10 of the rules of conduct). After making an entry about the reasons and grounds for termination of the employment contract, all entries made in the employee’s work book during his time working for this employer are certified by the signature of the employer or the person responsible for maintaining work books, the seal of the employer and the signature of the employee himself (clause 35 of the rules of maintenance) .

Incorrect formulation of the reason for dismissal in the work book is equivalent to a delay in issuing it, since both prevent the employee from starting a new job. And this, as mentioned above, entails financial liability of the employer. However, if an incorrect formulation of the reason for dismissal was entered into the work book upon dismissal, which did not interfere with the employee’s employment, then the employer is released from financial liability (paragraph 7 of Article 394 of the Labor Code of the Russian Federation).

Upon written request from an employee who has not received a work book after dismissal, the employer is obliged to issue it no later than three working days from the date of application (paragraph 6 of Article 84.1 of the Labor Code of the Russian Federation).

The fact that a work book was issued to an employee must be recorded. In the book for recording the movement of work books and inserts in them (the form of the book is given in Appendix No. 3 to the aforementioned Resolution of the Ministry of Labor No. 69), special columns are provided for this: in column 12 the date of issue of the book is indicated, in column 13 the employee signs for its receipt.

In addition, the employee is required to sign a personal card (form No. T-2, approved by the cited resolution of the State Statistics Committee of Russia No. 1) (clause 41 of the rules of maintenance). The HR employee, in section XI of the personal card of the dismissed employee, makes a record of dismissal, indicating the basis for termination of the employment contract, the date of dismissal and the order number.

Issuance of other documents The amount of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity, in particular benefits for temporary disability due to illness, maternity benefits, child care benefits until the child is one and a half years old, is calculated based on from the average earnings of the insured person (clause 1 of article 14 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”).

Since the beginning of 2011, in general, average earnings have been determined based on payments in favor of an individual received by him for two calendar years preceding the occurrence of an insured event, for which insurance contributions were calculated to the Social Insurance Fund of Russia in accordance with Federal Law dated July 24, 2009 No. 212- Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.” When calculating, payments accrued for the specified period by other employers are also taken into account if the employee was hired after the beginning of the specified period.

Based on this, in many cases, to calculate the amount of benefits, an employee will need information about payments accrued to him by the employers for whom he previously worked. In connection with this, the legislator has established the employer’s obligation to issue employees on the day of dismissal (or upon their written request) a certificate of the amount of earnings for the two calendar years preceding the year of termination of work, as well as for the current calendar year (subclause 3, clause 2, art. 4.1 of Law No. 255-FZ).

Form of a certificate on the amount of wages, other payments and remunerations for which insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity were calculated, for two calendar years preceding the year of termination of work (service, other activity) or the year of application for a certificate, and the current calendar year and the procedure for filling it out are given in Appendices No. 1 and 2 to the order of the Ministry of Health and Social Development of Russia dated January 17, 2011 No. 4n.

The issuance of such a certificate, as mentioned above, is carried out on the day of termination of work. If it is impossible to deliver the certificate directly on the day of termination of work, the policyholder sends the insured person a notice of the need to appear for it or to give consent to send it by mail (clause 2 of the procedure). As you can see, this provision is identical to the rule used when issuing a work book.

When an employee submits a written application for the issuance of such a certificate after termination of work, the employer must issue it no later than three working days from the date of receipt of the application (subclause 3, clause 4.1 of Law No. 255-FZ, clause 3 of the procedure).

Paragraph 4 of Article 11 of Federal Law No. 27-FZ dated 01.04.96 “On individual (personalized) accounting in the compulsory pension insurance system” establishes the employer’s obligation to issue to the employee on the day of his dismissal information about his length of service, earnings (remuneration), income and accrued in relation to his insurance contributions for compulsory pension insurance. To do this, use the individual form SZV-6-1 “Information on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of the insured person” (approved by Resolution of the Pension Fund of the Russian Federation Board of July 31, 2006 No. 192p).

Article 15 of Law No. 27-FZ requires the policyholder to provide each insured person with a copy of the information sent to the territorial office of the Pension Fund for individual (personalized) accounting. Moreover, this should be done together with the submission of information to the Pension Fund.

Personalized information is submitted to the Pension Fund quarterly along with calculations for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund (form RSV-1 Pension Fund) (clause 9 of Article 15 of the law No. 212-FZ).

Therefore, if the policyholder quarterly provides employees with copies of personalized accounting information sent to the Pension Fund of the Russian Federation, then on the day of his dismissal the employer must submit form SZV-6-1, completed for the past months of the quarter in which the employment agreement with the employee is terminated.

If the specified copies were not issued, then form SZV-6-1 is filled out for the period from the beginning of the calendar year to the month of dismissal, inclusive.

When transmitting information to an employee, you must obtain written confirmation from him of receipt of this information. However, Law No. 27-FZ does not specify in what form this should be done. So the employer has the right to use for this purpose the document he uses to record issued certificates.

The legislator obligated tax agents who accrue income included in the taxable base for personal income tax to issue to individuals, upon their applications, certificates of income received by individuals and withheld tax amounts (clause 3 of Article 230 of the Tax Code of the Russian Federation). For this, form 2-NDFL “Certificate of income of an individual for the year 20_” is used (approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/611).

This certificate is sometimes asked at the new place of work of a resigned employee to provide a standard tax deduction for children. Therefore, upon dismissal, many employers issue quitters with certificates about the income they received and the amounts of personal income tax withheld.

Upon a written application from the dismissed person, the employer is obliged to issue duly certified copies of documents related to the work (paragraph 4 of article 84.1 of the Labor Code of the Russian Federation). In Article 62 of the Labor Code of the Russian Federation, which determines the procedure for issuing copies of work-related documents, among these the legislator mentioned, in particular, orders for hiring, orders for transfers to another job, orders for dismissal from work, extracts from the work record book, certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance, and the period of work with this employer. In general, the employer is given three working days from the date of submission of the written application to provide the employee with copies of work-related documents. In our opinion, the employer can adhere to this deadline even if he receives a written application for the issuance of copies on the last day of work, since it does not clearly follow from the norm of paragraph 4 of Article 84.1 of the Labor Code of the Russian Federation that copies should be issued precisely on the day of termination of the employment contract.

The accuracy of the copy of the document is evidenced by the signature of the head or authorized official and the seal (clause 1 of the decree of the Presidium of the Supreme Soviet of the USSR dated 08/04/83 No. 9779-X “On the procedure for issuing and certification by enterprises, institutions and organizations of copies of documents relating to the rights of citizens "). When certifying that a copy of a document corresponds to the original, below the “Signature” requisite, the certification inscription “True”, the position of the person who certified the copy, a personal signature, a transcript of the signature (initials, surname), and the date of certification are affixed. It is allowed to certify a copy of the document with a seal determined at the discretion of the organization (clause 3.26 GOST R 6.30-2003. State standard of the Russian Federation. Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for document preparation).

IMPORTANT:

The date of dismissal indicated in the order to terminate the employment contract with the employee must be his working day.

Termination of an employment contract is formalized by order (instruction) of the employer. Such an order is issued in a unified form No. T-8 or T-8a (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

The employer must familiarize the employee with the dismissal order against signature (paragraph 2 of article 84.1 of the Labor Code of the Russian Federation). The deadlines for this Labor Code of the Russian Federation have not been established. This usually happens on the last day of work of the dismissed person, with the exception of cases where the employee did not actually work, but retained his place of work (position).

When calculating average earnings, the time specified in paragraph 5 of the Peculiarities of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922) is excluded from the calculation period, as well as the amounts accrued during this time.

An entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of the Labor Code of the Russian Federation or other federal law and with reference to the relevant article, part of the article, paragraph of the article of the code or other federal law.

Upon written request from an employee who has not received a work book after dismissal, the employer is obliged to issue it no later than three working days from the date of application (paragraph 6 of Article 84.1 of the Labor Code of the Russian Federation).

Article 15 of Law No. 27-FZ requires the policyholder to provide each insured person with a copy of the information sent to the territorial office of the Pension Fund of the Russian Federation for individual (personalized) accounting. Moreover, this should be done together with the submission of information to the Pension Fund.

Upon a written application from the dismissed person, the employer is obliged to issue duly certified copies of documents related to the work (paragraph 4 of article 84.1 of the Labor Code of the Russian Federation).

Oleg MITRIC, auditor

Application for leave and dismissal

In one of the previous articles, we examined the issue of the need to draw up a vacation application and came to the conclusion that it is necessary to write it if the vacation schedule has not been approved. But this applies to cases when an employee plans to return to work after vacation. If leave is taken before dismissal, it is necessary to take an application from the employee . This is directly stated in Article 127 of the Labor Code.

So, the employee must write an application addressed to the manager, in which he sets out his request for leave from a certain date . The application must also indicate that the leave is taken before dismissal of one's own free will . The application form is not regulated, but you can use the following example:

Employer's actions

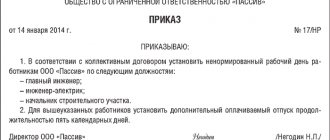

Issuance of an order

Having received such a statement, the employer determines whether it can release the employee on vacation. If a positive decision is made, an order is created to grant leave followed by dismissal . Most often, companies develop separate forms of orders for granting leave and for dismissal, so two orders are drawn up.

Calculation

Now you need to calculate how much the employer must pay the resigning employee. In this case, vacation pay is paid and full payment is made, as in the case of dismissal. It should be taken into account that in accordance with Part 2 of Article 127 of the Labor Code of the Russian Federation, the day of dismissal of an employee will be considered the last day of his vacation. It is this date that you need to focus on when calculating the amounts due to him.

Vacation is non-working time, calculated in calendar days.

By virtue of Articles 106-107 of the Labor Code of the Russian Federation, vacation refers to rest time, that is, to the time during which the employee is free from performing work duties and which he can use at his own discretion. This is non-working time. All days falling on vacation are non-working days for the employee and the sliding schedule does not apply to an employee on vacation.

The annual basic paid leave is calculated in calendar days (Article 120 of the Labor Code of the Russian Federation) and its duration is 28 calendar days (Article 115 of the Labor Code of the Russian Federation).