General terms

Regardless of what product is offered by a Russian bank (and there are many of them), you will need to fill out an application. This operation is carried out in the following ways:

- Fill out the application online on the official website. For this purpose, there is a special tab “Application form for a mortgage”.

- Visit a bank branch in person to familiarize yourself with the conditions and fill out an application.

The lender puts forward requirements similar to those in force in other banks:

- Availability of official work for 3 months;

- Russian citizenship is not necessary. But preference is given to Russians and citizens of CIS countries;

- The work experience is generally 12 months, not in one place, but for the last vacancy it was six months.

VTB 24 also has the following conditions for all clients:

- VTB is one of the largest lenders, therefore it offers loan products for all categories of people. When compared with other banking institutions, VTB’s mortgage conditions are more favorable.

- Borrowers have the right to choose future housing on the primary or secondary market. VTB does not limit the type of residential property, since in 2021 there are programs for apartments, houses or plots for construction.

- For participants in financial programs, preferential provisions apply to repay loan debt. If you choose a military mortgage program or a maternity certificate, the difference in percentage is greater.

- The initial average payment is a quarter of the price for the purchased property. But, if the borrower is a military man, a pensioner or a student, the following interest rates apply to him: 15%, 9.2%. A loan can be issued using two documents, but then the down payment will reach 40% of the housing price.

- The purchased property must be registered in order to prevent possible risks. The borrower is also offered to take out comprehensive insurance, which allows him to insure himself with the property. If you agree to take out comprehensive insurance, you can receive a lower tariff.

- But you cannot take out a large loan in another currency. The minimum amount is 600 thousand rubles, and the maximum is 30 years.

Another positive thing is that with a mortgage, a guarantee is not required. But to increase the amount, the borrower can invite an additional guarantor. Then, in the process of issuing loan funds, the total income will be summed up.

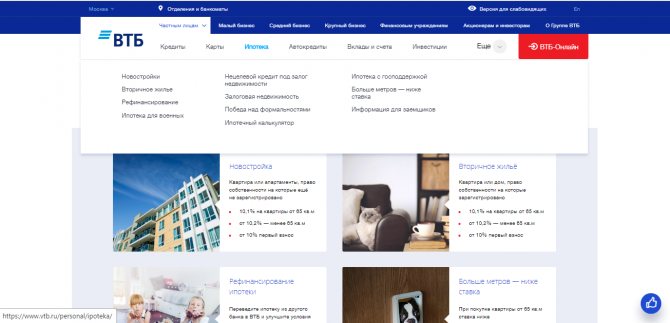

How to submit an online application for a mortgage at VTB

An example application form for a VTB mortgage.

Before submitting an application, it is recommended that you carefully read the requirements of the financial institution for clients, the terms of the loan, and the list of required documents. If the requirements and conditions are acceptable, you can fill out an application form and send it to the lender for consideration.

Sequence of online application:

- You need to go to your personal account on the VTB portal, select the “Loans” category, and then the appropriate product, having previously calculated it on the loan calculator.

- Next to the selected loan program, click “Complete Application”.

- A form will open in which you need to enter all the information requested by the bank: passport details, contact phone number, residence (registration) address, email address, information about the employer, loan amount, loan period, down payment amount and data on the property being purchased.

- After filling out the form, click “Submit”.

After reviewing the application, the bank employee calls the client back to clarify the information and invites him to come with the documentation to draw up a loan agreement at the branch of the financial company.

Based on an online application, the banking institution makes a preliminary decision, and the main decision is announced only after a thorough check of the client and consideration of the documents submitted by him. The lender may refuse to provide a loan without specifying reasons.

To increase your chances of getting a mortgage loan, it is recommended to submit online applications simultaneously to several lending institutions. You can track your results remotely via online banking.

Mortgage programs

VTB has been providing lending for many years, so it has managed to develop mortgage products that are in demand among different categories of citizens. Each program has its own characteristics and limitations.

Buying a home

Refers to the classic mortgage program, which is available to every citizen. It does not offer benefits, but due to its affordability, 40% of borrowers choose it.

The general conditions are as follows:

- Rate – 10.7% – 11%;

- Down payment – 20%;

- Amount from 600 thousand rubles for 30 years, regardless of whether it is primary or secondary housing.

This type is available in rubles or other currencies offered by the bank.

Mortgage without proof of income

It is not necessary to have an official income in order to get a large loan to purchase real estate. Citizens who are unable to document their income must make a down payment of 30-35% of the price of the property on the market. In this case, the chances of receiving a positive answer increase.

Due to the fact that the banking institution is at significant risk, the conditions for obtaining a mortgage at VTB are becoming more stringent. Every month, citizens will be forced to pay a high percentage when compared with officially employed clients.

More meters less rate

The positive thing about this type of lending is that the loan is issued for cozy and spacious apartments with an area exceeding 65 sq.m. This program is used most often by families with children.

Standard conditions:

- The amount is up to 60 million rubles;

- Percentage – 9.2%;

- Down payment – 20%;

- The loan itself is taken for 30 years.

Look at the same topic: What is a military mortgage and who is entitled to it? Conditions for obtaining a military mortgage in [y] year

But there is one nuance in the form of mandatory registration of comprehensive insurance. You should also pay a down payment in the amount of a quarter of the loan amount.

Military mortgage VTB 24

Persons liable for military service, serving in the army or working in law enforcement agencies can participate in the savings-mortgage system. Every year this category of people counts on benefits and benefits. These funds are targeted, so the money can be used to pay off the mortgage. But there is one caveat: clients with 3 years of military service experience are allowed to participate in the program.

Mortgage for salary clients

Citizens who are already clients of the bank and receive wages through it have privileges. To obtain a mortgage, you do not need to prove your solvency or bring additional documents. During the period of cooperation, the bank itself can offer people favorable offers. The interest rate is 10%, and the money is borrowed for 30 years with a down payment of 10%.

VTB mortgage with government support

This banking support was created with the help of the state to provide less protected segments of the population with real estate. Depending on the status of borrowers, benefits are calculated for them. There is one drawback: a mortgage with government support requires a long process of filling out an application and concluding a deal, which can take several weeks.

Mortgage for young families

Spouses who have not reached 35 years of age belong to the category of a young family. A profitable mortgage is available to them from VTB under a preferential program. Instead of the initial payment, the couple can pay a subsidy from the state. If a couple has a child, the contribution amount will be 40%, and childless couples pay 35%.

Mortgage using maternity capital

Maternity capital is an auxiliary amount for mothers who have given birth to more than one child. Payments of targeted state assistance are made when the child reaches three years of age. But, if the money is transferred to pay the mortgage, you can not expect to reach this age. VTB allows you to pay the first installment or existing debt with maternity capital.

Mortgages for young professionals

To support the development of science, the state creates favorable conditions for beginners and specialists. VTB 24 clients can obtain a loan at a reduced annual rate with the ability to pay off the debt over 30 years.

Collateral property

This program involves a loan for the purchase of residential property that is pledged and subsequently sold.

General terms and Conditions:

- Interest – 10.6% exclusively on collateral property;

- Down payment of 20%;

- A loan of up to 60 million rubles is issued for terms of up to 30 years.

The financial service is unprofitable due to lengthy legal decisions.

Refinancing

Refinancing at VTB Bank is offered according to the following requirements:

- The constant percentage is 8.8%;

- The mortgage loan is refinanced exclusively in Russian rubles;

- The loan is 80% of the purchased property;

- The terms are 30 years.

You can repay the loan early, and no penalties will be imposed.

Mortgage online

The continuous development of the financial and banking industry in our country is making many products and services that previously seemed complex more accessible and beneficial to customers. Therefore, today online mortgages at VTB are one of the most popular areas among consumers. The service allows you to buy real estate in the shortest possible time, and then gradually pay off the debt over a certain period of time. This is why most people choose to participate in the program instead of saving for a long time.

However, when making a decision, you need to take into account various nuances.

For example, companies have different requirements and restrictions. Accordingly, before selecting real estate, clarify in advance all the parameters of the cost and location of the objects.

Requirements

- availability of a valid passport of a citizen of the Russian Federation with permanent registration;

- stable income for at least six months and official employment;

- legal purity of the selected property. It should not be pledged or have any other restrictions for carrying out purchase and sale transactions;

- positive credit history of the potential borrower. It is checked without fail when submitting an application; the bank makes a request to the BKI. If the client has previously had long delays, the company may make a negative decision on the issue.

Clients who have already joined the online mortgage program at VTB can highlight certain advantages:

- Sending and completing an application does not take much time. All you have to do is fill out the form correctly and wait for a response. After the first approval, you can select a property and collect a package of documents for it.

- There is no need to constantly go to the office; all consultations are carried out remotely.

- The monthly payment amount and interest rate remain fixed throughout the entire term.

- Early repayment is permitted without penalty.

Independent service Banki.ru

Banki.ru today is one of the most popular portals on the Internet. Thanks to reliable information on the site, you can monitor offers and choose the most suitable one for your family wallet. Using the calculator, by specifying the amount and term, you can calculate approximate monthly payments. The site provides all services completely free of charge, and every novice user can use the portal.

Online calculator

There is a calculator for doing your own mortgage payment calculations. The service on the bank’s official website will help you consider the option of early repayment and taking into account maternity funds. To do this, you will need to enter the following data: loan amount, type of payment, interest rate, presence or absence of maternity capital, date of issue and term.

Requirements for borrowers

With available client-oriented programs, obtaining a loan is not available to every person. The bank puts forward certain requirements, since purchasing an apartment or house is a serious financial risk.

Citizens who meet banking requirements can count on a lower interest rate. What requirements does the bank impose on its potential borrowers:

- A mortgage agreement is issued to citizens who are over 21 years old. This age is considered sufficient to have a stable official income and responsibility for assigned responsibilities. Mortgages are available for registration to citizens who have not reached the age of pension accruals, since at the time of completion of the debt the person must be no more than 65 years old.

- Work experience includes 1 year in all official places of work. At the last job this indicator is at least 3 months.

- Preferably, citizenship of the Russian Federation. But CIS citizenship is allowed. For foreigners, additional conditions are put forward: a permanent workplace in the country and legal residence in its territory.

- Credit history without arrears. During the process of drawing up a mortgage agreement, the borrower should not have financial obligations to other banks or microfinance organizations.

Look at the same topic: How to remove the encumbrance from an apartment after repaying the mortgage at the MFC?

The data is checked over three days. After this period, the borrower receives a decision on his application by email or after a telephone call. If the bank makes a positive decision, a financial transaction is expected to be concluded. The agreement contains all the information about the loan being issued with an individual payment schedule, as well as a reminder for clients. After this, the funds can be transferred to the card or issued in person.

Delay in payment

In relation to clients who make late payments, VTB has a clearly regulated algorithm of actions:

- The borrower is notified that he has made a late payment. This is done through phone calls, SMS messages, and emails. The notification period can last from 7 days from the moment of delay.

- If the client ignores bank employees and does nothing to repay the debt, fines begin to accrue in the amount specified in the agreement.

- The bank takes the case to court. Usually the judicial authorities side with the creditor, and the apartment is transferred in favor of the bank.

It is very important, after repaying the entire debt, to obtain a certificate stating that there is no debt to the bank. The certificate is required to be presented to Rosreestr. Based on this, the encumbrance is removed from the property and it becomes the full property of the borrower.

Real estate requirements

VTB Bank has certain requirements with restrictions for purchased housing, regardless of its type. The main condition for a positive decision is the high liquidity of real estate. Liquidity is a characteristic that allows the bank to sell an apartment or house if there is arrears.

The ideal option for concluding a credit transaction is an apartment in a new building. But it is permissible to acquire secondary property under the following conditions:

- The apartment must be equipped with basic utilities. Plumbing, electricity, gas and electricity must be provided.

- Existing redevelopment and repair work must have legal permission and be officially confirmed.

- An apartment building should not be in an uninhabitable condition. The acceptable wear level is 70%.

- The real estate must not be encumbered; other registered residents are not allowed in it.

- The area of a one-room apartment should be from 32 square meters. m, if it is a two-room apartment - from 41 sq.m., a three-room apartment - 55 sq.m.

VTB gives the client 3 months to search for suitable residential property. According to a special program, money will be allocated for construction. The main requirement for such property is the absence of encumbrance on the land plot located around the house. Funds for building a house are given in stages. The house will be thoroughly inspected after construction is completed.

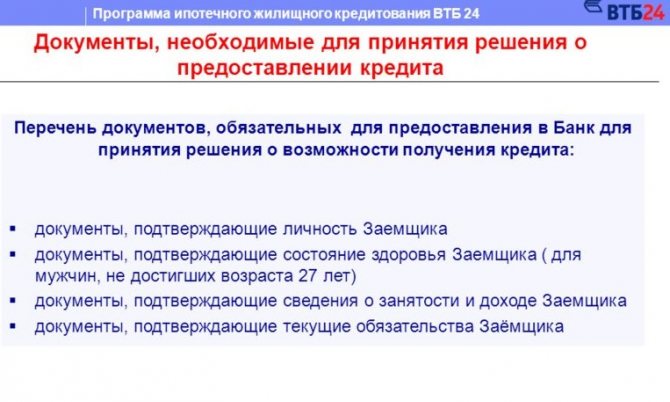

Required documents

To complete the documentation at the bank, the required papers must be collected:

- Passport details indicating citizenship;

- Insurance;

- Certificate 2-NDFL;

- Document of purchase and sale confirming the fact of purchase;

- application in free or blank form;

- Data on registration of relationships and passport details of children, if there is a maternal certificate;

- Housing military certificate, if the client participates in the savings system.

Depending on the case, other documents may be required in the form of statements of accounts or a certificate of receipt of ownership of the property.

Early repayment

In certain cases, VTB Bank allows early repayment of the mortgage. This reduces the bank’s overpayment so that the client can fully use the property in a shorter period of time. Early repayment of the loan is carried out as follows:

- The required down payment is reduced;

- Payment terms are reduced.

The banking institution does not impose a penalty on early repayment of the loan, so the borrower is allowed to write an application for early repayment.

Is it worth taking out a mortgage VTB-24

VTB 24 allows consumers to receive money for housing on favorable terms. Additional advantages that influence the bank’s popularity in Russia include:

- Possibility of paying early without additional fees or penalties.

- Participation of wages received from the bank in the payment of the obligatory payment every month.

- Minimum requirements for obtaining a loan.

- A large number of programs for different segments of the population.

- Reduced interest rate for those who are clients of AHML JSC.

- Bonus programs.

- When applying for a targeted loan, the processing time for the application does not exceed three days.

The bank, wanting to maintain its positive reputation, does not lead to litigation, but meets people halfway. If difficulties arise in paying the mortgage payment regularly, you can consider an alternative option (temporarily “freeze” payments, extend the term, etc.). When considering and analyzing all factors, as well as checking the flexibility of loan products with the speed of decision-making, we can consider a mortgage from VTB one of the most profitable options on the credit market.

The bank's main requirement for clients

Individuals wishing to obtain a home loan from VTB 24 must meet the following requirements:

- Russian citizenship is not necessary, i.e. Even foreign citizens legally residing in the Russian Federation can receive a loan;

- having a positive credit history;

- official employment;

- work experience: total - from 1 year, in the current workplace - more than 1 month;

- 50% of the applicant's monthly income must completely cover the required monthly loan payment.

The borrower must confirm his income with relevant documents. If there are not enough of them to provide the stated loan amount, the financial company allows the involvement of co-borrowers, but no more than 4 people.

Required documents

The following is required:

- passport of a citizen of the Russian Federation (foreigners with the right to reside in Russia provide any identification document);

- a correctly completed application, without errors or corrections, signed by the client;

- pension insurance;

- documents confirming the official employment and solvency of the applicant;

- men of military age (up to 27 years) must provide a military ID;

- documentation for residential real estate purchased with a mortgage, or for personal property registered as collateral.

If a mortgage is issued using maternity capital, the borrower provides the lender with a corresponding certificate and an extract from the Pension Fund of the Russian Federation on the balance of state assistance.

Additionally you may need:

- documents on family composition: marriage (divorce) certificates, birth certificates (for children);

- marriage agreement, if such a document was drawn up;

- documentation for liquid property that is the property of the borrower.

Required documents when registering using 2 documents

Documents required for obtaining a mortgage loan.

VTB24 Bank offers clients a special lending program “Victory over formalities”, under the terms of which you can receive borrowed funds with only 2 documents: a passport and SNILS.

But the minimum down payment in this case is 40% of the market value of the purchased apartment or 50% of the price of the apartment. Registration of a mortgage at the VTB branch

An application for a home loan can be submitted directly at the office of the financial company.

The procedure for submitting a VTB mortgage application through the office:

- Preliminary study of banking products, selection of a suitable lending program.

- Collection of necessary documentation.

- Visiting the office of a financial company, filling out an application form proposed by a bank employee.

- Submitting the application with a package of documents to the manager of the credit institution.

After reviewing the application and checking the client’s information, the lender may request additional documentation confirming the client’s solvency.