A mortgage from Gazprombank in 2021 has the following advantages:

- some programs provide for the complete absence of a down payment, which becomes possible due to the active construction of housing at the expense of bank funds;

- there is no fee for opening a one-time account to accrue mortgage funds;

- The processing time for applications in most cases is no more than one working day;

- there is a special mortgage program for the military;

- mortgage loan is available to all citizens of the Russian Federation under the age of 30;

- there is a program for obtaining a targeted loan (for example, for apartment renovation);

- mortgages are issued to all categories of the population: legal entities and individuals, as well as individual entrepreneurs.

Mortgage at Gazprombank - conditions in 2021

In 2021, you can get a mortgage from Gazprombank at an interest rate of 0.9% per annum. You can take out a mortgage from Gazprombank on general terms, on a promotional basis, or use a special affiliate program. Currently, the bank has 4 mortgage programs with different lending conditions: a “product” for the “New Settlers” promotion, a family mortgage with the lowest rate, a military mortgage, and an offer to refinance a loan taken from a third-party bank.

In 2021, Gazprombank offers borrowers several types of mortgage programs, among which each borrower will be able to choose a suitable offer, depending on the terms of the loan and the rate:

- targeted loans for the purchase of land or a garage, as well as for the purchase of housing under construction or renovation of existing housing;

- non-targeted loans secured by real estate;

- refinancing an existing loan on more favorable terms for the borrower;

- loan to improve housing conditions.

Offers are valid for all regions of the Russian Federation. To obtain a mortgage, it is enough to have at least one bank branch in a specific subject of the Federation. In addition to the main programs, Gazprombank has several more specialized offers.

What papers will the bank require from the seller?

When applying for a loan program, not only Gazprombank will require certificates from applicants. For sellers of real estate who are individuals. persons have developed a list of documentation for mortgages:

- Passport (civilian).

- Birth certificate (if the seller has not reached the age of majority).

- Translation of a (civilian) passport/birth certificate certified by a notary for persons who are not citizens of the Russian Federation.

- Certificate of marriage/divorce.

- Written consent from the spouse to sell the property. If at the time of execution of the transaction the seller is not legally married, then he must write a corresponding statement.

- If persons under the age of majority are registered in the apartment/house, then written consent from the guardianship authorities will be required.

- When selling apartments, you will need to document the seller’s capacity. In this case, you can provide a permit to carry a weapon, a medical certificate, or a driver’s license.

READ What should a client do if he has forgotten or lost the PIN code for his Gazprombank card

If the seller is a business entity, then Gazprombank will request the following documents from him:

- Charter

- Constituent documents.

- Extract from the Unified State Register of Legal Entities.

- Certificate of registration of a business entity with the Federal Tax Service as a tax payer.

- An order granting an employee the authority to conduct real estate sales transactions on behalf of the company.

- Power of attorney in the name of an authorized person.

- If an organization is selling apartments or a garage, it will be required to provide a letter stating that the transaction is not large in size and does not involve interested parties.

If a business entity sells a real estate property under construction, it must additionally transfer to the financial institution:

- Developer's questionnaire.

- Order on the appointment of an employee to the position of General Director.

- Insurance policy.

- A document recording the interaction between the housing cooperative and the developer.

- An extract received from the JSC register.

If the property under construction is accredited by the bank, then all certificates can be provided in the form of scanned copies (except for extracts from the Unified State Register of Legal Entities). This procedure is regulated by Federal Law No. 214.

Mortgage program “New settlers” (from 7.5%)

The loan is issued for the following purposes: purchase of an apartment in a residential building under construction, purchase of an apartment (or townhouse) with registered ownership, purchase of non-residential premises (apartments) in buildings under construction. The minimum rate under the New Residents program is 7.50% per annum.

Lending terms

- Currency : Russian rubles;

- Minimum amount : 100,000 rubles (but not less than 15% of the value of the property);

- Maximum amount : 60,000,000 rubles – when purchasing real estate in Moscow and St. Petersburg, and 45,000,000 rubles – when purchasing housing in other cities of Russia;

- Loan term : from 1 year to 30 years;

- Down payment : from 10%;

- Issuance fee : not charged;

- Review period : from 1 to 10 working days (counting from the moment the full package of documents is submitted to the bank);

- Insurance : real estate insurance is mandatory. Personal and title insurance - at the request of the borrower;

- Collateral : collateral for a property purchased using credit funds.

Requirements for borrowers (co-borrowers)

- Citizenship – Russian Federation;

- Registration and permanent residence in Russia;

- Good credit history;

- Borrower's age is from 20 to 65 years;

- Continuous work experience in the last place - at least 3 months. Total work experience – at least 1 year;

- The client's income must be sufficient to repay the loan debt.

How are interest rates calculated?

- A rate of 7.50% per annum is valid for the loan amount: from 10,000,000 rubles – when purchasing housing in Moscow and Moscow Region, St. Petersburg and Leningrad Region, from 5,000,000 rubles – when purchasing real estate in other regions of Russia;

- A rate of 8.20% per annum is valid for the loan amount: from 6,000,000 rubles – when purchasing housing in Moscow and Moscow Region, St. Petersburg and Leningrad Region, from 3,000,000 rubles – for other regions of Russia;

- A rate of 8.70% per annum is valid for a loan amount of up to 6,000,000 rubles – when purchasing housing in Moscow and Moscow Region, and for St. Petersburg and Leningrad Region, up to 3,000,000 rubles – when purchasing real estate in other regions of the Russian Federation.

Increases to the rate:

- + 1.00% – if the borrower does not have insurance for the risk of death or disability;

- + 0.30% – added to all borrowers, except for salary clients or those purchasing real estate from Gazprombank partner companies;

- + 0.50% – added if the initial payment was less than 20%.

Required documents for a mortgage loan

- Application for a mortgage loan;

- Original and copy of the borrower’s passport (a copy of all completed pages is made);

- You will need a SNILS individual personal account number (you must indicate the number in the application form);

- A copy of the work book, certified by the employer’s seal;

- Document confirming income (certificate in bank form, certificate of income and tax amounts of an individual, original statement of deposit account, received salary).

FAQ

When applying for a mortgage, various questions arise that require clarification. Below are the most frequently asked questions from borrowers:

How to make payments?

Repayment is made in equal payments. Information about the upcoming payment can be viewed in the personal account of the Telecard mobile account.

Is there any provision for early repayment?

The terms of the agreement provide for the right to return the entire amount of the debt at any time by sending an application through your personal account the day before the scheduled payment.

Where can I get a certificate or bank statement about debt repayment?

To obtain documents, contact a Gazprombank branch.

Do I need to take out personal insurance?

According to the law on mortgage lending, insurance of the purchased property is mandatory. The bank recommends taking out a personal policy to increase guarantees of successful debt repayment and reduce the interest rate.

How to confirm insurance renewal?

There is no need to come to the office specially. It is enough to submit a scanned copy of the new policy by email to [email protected]

To take advantage of a free consultation from a qualified specialist and get answers to your questions, go to the official website of the selected financial institution, find and fill out the form (Name and phone number). They will call you back and advise you within 10 minutes.

“Family Mortgage” program (from 4.7%)

Mortgage offer with the lowest rate - 4.70% per annum. The mortgage program is designed for families in which a second or subsequent child was born from January 1, 2018 to December 31, 2022. Down payment – from 20% of the cost of the purchased property. It should be noted that maternity capital funds can be used as a down payment (in full or in part).

In case of termination of insurance during the subsidy period (Resolution No. 1711): personal insurance and residential insurance, the mortgage interest is set at the key rate of the Central Bank of the Russian Federation (on the day the mortgage was issued) + 4 percentage points. The procedure for obtaining a mortgage loan under the Family Mortgage program is as follows:

- Fill out the application remotely from the official website of Gazprombank or at any bank branch. Bank employees will inform you about the decision on your application within 1 to 10 working days;

- Next, you will need to draw up an equity participation agreement for the purchase of a property under construction with the developer, and provide the bank with documents on the property to agree on the terms of the loan agreement and the individual features of the upcoming transaction;

- Open a current account. Sign loan documentation with the bank;

- Submit the share participation agreement for state registration to the registration chamber;

- Provide the insurance company with the necessary documents (on the borrower and the property under construction), and draw up the necessary insurance contracts;

- After submitting a registered share participation agreement and an insurance agreement to the bank, the bank will transfer funds to pay for the cost of the purchased property.

Lending terms

- Currency : Russian rubles;

- Minimum amount : 100,000 rubles (but not less than 15% of the value of the property);

- Maximum amount : 12,000,000 rubles – when purchasing real estate in Moscow and St. Petersburg, and 6,000,000 rubles – when purchasing housing in other regions of the Russian Federation;

- Loan term : from 1 year to 30 years;

- Down payment : from 15%;

- Issuance fee : not charged;

- Review period : from 1 to 10 working days (counting from the moment the full package of documents is submitted to the bank);

- Insurance : real estate insurance is mandatory. Personal (loss of life and disability) and title insurance (restrictions or encumbrances on property rights) - at the request of the borrower;

- Collateral : collateral for a property purchased using credit funds.

Requirements for borrowers

- Only Russian citizens will be able to get a mortgage;

- Registered and residing in the Russian Federation;

- The borrower must not have a bad credit history;

- Age at the date of granting the mortgage is at least 20 years. Age at the date of full repayment of loan obligations to the bank – 65 years;

- Continuous work experience at the last place of work (current) - at least 3 months (total work experience must be at least 1 year);

- The borrower's income must be sufficient to service the mortgage loan.

Mortgage documents

- Application for a mortgage loan;

- Original and copy of the borrower’s passport (you must provide the bank with copies of all completed pages of the passport);

- Insurance certificate of state pension insurance (it is enough to indicate only the SNILS number in the application form);

- A copy of the work book, certified by the employer’s seal (salary clients of Gazprombank do not need to present it);

- A document confirming the borrower's income (this can be a certificate in the form of a bank, a certificate of income and tax amounts of an individual, the original is a bank account statement).

In addition, you must provide the bank with documents confirming your right to receive a mortgage loan under the Family Mortgage program:

- Birth certificates of all existing children (including adults), with a stamp confirming the fact of Russian Federation Citizenship;

- If there is no such stamp on the Birth Certificate, then in this case we present a document confirming Russian Citizenship.

What is needed for refinancing

When refinancing a mortgage loan issued by another bank, the package of documents for the property remains unchanged. It is similar to the list that is required to purchase an apartment with registered ownership (described above). The borrower’s personal documents (including certificates confirming solvency) are provided on a general basis, which are discussed in detail at the beginning of the article.

Additionally, you must provide loan documentation, which includes:

- a valid contract;

- certificate of debt balance (valid for 30 days).

Applying for a mortgage loan, including from Gazprombank, requires a fairly extensive list of documents. This is due to the fact that papers are requested separately for each participant in the transaction, as well as for the property.

“Military Mortgage” program (from 7.8%)

A special lending program for participants in the savings-mortgage system (NIS) for housing provision for military personnel for the purchase of:

- Apartments with registered ownership;

- Apartments in a residential building under construction under an agreement for participation in shared construction (the agreement must be concluded in full compliance with the requirements of Federal Law No. 214-FZ);

- Refinancing secured by an apartment for which ownership is registered (providing credit funds to fully repay the debt on a mortgage loan from another bank);

- Purchase of real estate at a rate of 4.70% per annum under the Family Mortgage program (subject to compliance with bank requirements).

Lending terms

- Currency : Russian rubles;

- Minimum amount : none;

- Interest rate : from 7.80% per annum;

- Maximum amount : 2,746,000 rubles;

- Loan term : from 1 year to 25 years;

- Down payment : from 20%;

- Issuance fee : not charged;

- Review period : from 1 to 10 working days (counting from the moment the full package of documents is submitted to the bank);

- Insurance : real estate insurance is mandatory. Personal (loss of life and disability) and title insurance (restrictions or encumbrances on property rights) - at the request of the borrower;

- Collateral : collateral for a property purchased using credit funds.

As a source of the down payment, funds from a targeted housing loan are used, which is provided to the borrower by the Federal State Institution “Rosvoenipoteka”, and including the borrower’s own funds.

Requirements for the borrower

- A loan can only be approved for a military personnel with Russian Federation citizenship, who is undergoing military service, is included in the register of NIS participants and has the appropriate certificate;

- Permanent registration in Moscow or Moscow Region, or other regions where Gazprombank is located;

- The borrower must have a positive credit history;

- Age from 21 to 50 years for men, and up to 45 years for female military personnel;

- Participation of a military personnel in the NIS for 3 years.

Loan documents

- Application for a mortgage;

- Copies of all completed pages of the passport or other identification document;

- In the application form you must indicate the insurance number of your individual personal account, so you must have SNILS with you;

- Certificate of the right of a participant in the NIS of housing provision for military personnel to receive a targeted housing loan.

Procedure for obtaining a “Military Mortgage”

- First of all, you need to apply for a mortgage loan. This can be done on the bank’s official website (online) or at the Gazprombank branch itself. The application will be reviewed within 1 – 10 working days. You will be informed about the decision at the contact details specified in the application form;

- If you purchase real estate on the secondary housing market, be sure to contact an independent appraisal company to evaluate the selected property. Next, you need to submit real estate valuation reports to the bank;

- Submit documents on the property and the Property Seller to the Gazprombank branch;

- Open a “Military Mortgage (MCM)” current account and a “Credit” current account. Next, sign the mortgage documents and a targeted housing loan agreement with the bank;

- Wait until you receive a signed housing loan agreement from the Federal State Institution “Rosvoenipoteka”, and the receipt of loan funds (as a down payment) to your current account “Military Mortgage (MCH)”;

- If available, deposit your own funds into the current “Credit” account and sign a purchase and sale agreement or an agreement for participation in shared construction with the Seller. Submit the signed agreement to the registration chamber;

- Provide the insurance company with a package of documents regarding the borrower and the property, and sign the necessary insurance contracts;

- After submitting to the bank’s office a purchase and sale agreement or an agreement for participation in shared construction, which was received at the registration chamber, and insurance agreements, Gazprombank will transfer loan funds to pay for the cost of real estate (from the current accounts “Credit” and “Military Mortgage (MCM)" "

Why calculate your debt load?

In a situation where the monthly mortgage loan payment exceeds 50% of wages, the banking organization becomes concerned about the solvency of the potential client. This circumstance must be taken into account when submitting an application for the allocation of borrowed funds for the purchase of residential real estate.

The Central Bank has not yet established requirements for banking organizations to take into account the debt burden of clients when considering mortgage applications. But internal banking policy may require different terms of service.

It is recommended to apply for a mortgage so that the monthly payment is no more than half of the borrower's official monthly income. When issuing large mortgage loans, banking organizations are focused on solvent clients who can withstand a long-term financial burden.

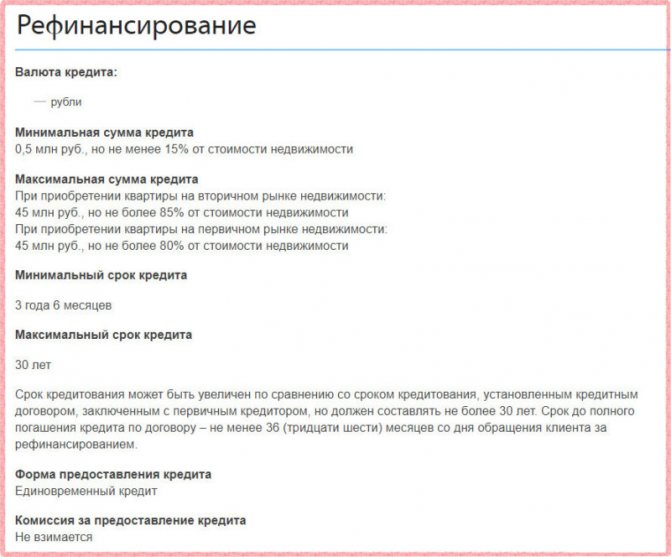

“Mortgage refinancing” program (from 8.3%)

Purpose of a mortgage loan: refinancing secured by an apartment (for which ownership is registered), refinancing secured by property rights of claim (under an equity participation/assignment agreement).

Lending terms

- Currency : Russian rubles;

- Minimum amount : 100,000 rubles, but not less than 15% of the cost of the apartment;

- Interest rate : from 8.30% per annum;

- Maximum amount : 45,000,000 rubles;

- Loan term : from 1 year (for the purchase of a mortgage in residential buildings under construction), and from 3.6 years (for housing with registered ownership) to 30 years;

- Down payment : not required;

- Issuance fee : not charged;

- Review period : from 1 to 10 working days (counting from the moment the full package of documents is submitted to the bank);

- Insurance : real estate insurance is mandatory. Personal (loss of life and disability) and title insurance (restrictions or encumbrances on property rights) - at the request of the borrower;

- Collateral : collateral for a property purchased using credit funds.

To obtain a loan for refinancing, you must have, before the date of application to Gazprombank, no more than two overdue payments for a period of no more than 29 days for the actual period of servicing the refinanced loan, but no more than 12 months.

The interest rate for refinancing a mortgage loan is 8.30% per annum. Another percentage point will be added to the rate if the borrower refuses insurance for the risk of death or disability (accident risk) and title insurance.

Requirements for borrowers

- Citizenship – Russian Federation;

- Registration and permanent residence in Russia;

- Borrower's age is from 20 to 65 years;

- Having a positive credit history;

- Continuous work experience at the last place of employment for at least 3 months. Total work experience of at least 1 year.

Required documents for a mortgage

- Application for a mortgage loan;

- Original and copies of all completed pages of the passport or other identity document;

- A copy of the work book, certified by the employer’s seal;

- A document confirming income (this can be: a certificate in the bank form, a certificate of income and tax amounts of an individual, an original statement of a bank account opened in any bank containing information about the received salary, certified by the bank’s stamp;

- In the application form, you must indicate the insurance number of your individual personal account. To do this, you need to have SNILS with you.

Procedure for obtaining a loan for refinancing

- Apply for mortgage refinancing. This can be done at a Gazprombank branch or on the bank’s official website (remotely). The application will be reviewed within 1 – 10 working days. Bank employees will notify you of the decision on your application;

- Use the help of an independent appraisal company to conduct a real estate appraisal. The bank can accept the report of any appraisal company;

- Sign the required loan documentation, and the bank will transfer the loan funds to pay off the debt on the primary mortgage;

- Complete the state registration of the mortgage, as well as the transfer of the pledge of the property from the primary credit institution to Gazprombank in the registration chamber.

Calculate your mortgage payments using an online calculator.

Mortgage

Confirmation of the intended use of the loan

After registering ownership, you must obtain credit funds. The mortgage client provides the bank with confirmation of the transfer of the first installment to the seller and an extract from the register of real estate rights. The paper from Rosreestr now contains his name and a pledge in favor of Gazprombank.

Recommended article: Military mortgage at Svyaz Bank

What documents are needed for a Gazprombank mortgage when registering ownership of a constructed apartment? The lender needs to register a mortgage on this property, although the encumbrance is automatically placed on it under the terms of the construction contract. The client submits to the bank an extract from Rosreestr, technical documents, an assessment report and other papers if necessary. After this, a mortgage is drawn up and registered in the prescribed manner.

When receiving a mortgage from Gazprombank, the list of documents can be clarified with the credit manager. He will tell you exactly what is needed in your case.

In addition, every year it is necessary to provide an insurance policy for the collateral. This is a mandatory requirement by law (). Life and health insurance of the borrower is voluntary, but the interest rate depends on it. If you have insured your mortgage, you should also take a financial protection policy to the bank.

What documents will the bank require when refinancing a mortgage?

Gazprombank offers physical. persons facing financial difficulties that affect their ability to pay monthly mortgage payments can participate in the refinancing program. Its essence lies in the fact that the bank reduces the amount of mandatory payments by increasing the term of the loan.

To refinance an existing mortgage, the client must provide:

- Agreement.

- Passport (civilian) of the borrower.

- TIN.

- Certificate of income.

- Certificate of debt balance.

How to quickly collect a package of documents

To quickly create a package of documentation for participation in the mortgage program, individuals. individuals should contact a lawyer. You will have to enter into an agreement with a highly specialized specialist and pay for his services. A power of attorney must be written out in his name and certified at a notary office, on the basis of which he will apply to government agencies and private organizations for certificates.

READ Gazprombank Travel Miles cards: accrual conditions, balance check, ways to spend miles