Legal order

These funds can be spent on improving living conditions - buying an apartment or house, building housing or participating in shared construction, however, subject to certain rules. And one of them concerns the ownership of real estate purchased or built with the help of maternity capital. The residential premises must be registered as the common property of parents and children, with the size of shares determined by agreement. This is the main problem that you may encounter when purchasing a home previously acquired with the help of maternity capital.

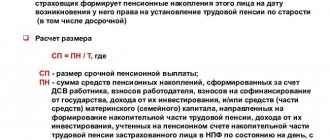

Current practice

The thing is that parents who use maternity capital to improve their living conditions do not always have the opportunity to allocate a share in real estate to their minor children. For example, if housing under construction is purchased or maternity capital funds are used to participate in shared construction, ownership can only be registered when the object is put into operation, and accordingly, until this moment comes, it is impossible to allocate a share to children. The same is true when buying a home with a mortgage: “The bank will not provide a loan for the purchase of real estate, the owners of which, along with adults, will be minor children,” says Pavel Lepish, general director. Homes purchased on credit become collateral, and if borrowers cannot repay the debt, the collateral is sold to cover the loan. However, when there are minors among the homeowners, the issue of sale must be agreed upon with the guardianship and trusteeship authorities, and according to the law, minor children must be provided with other housing corresponding to their shares in the property being sold, or paid an amount equivalent to the value of these shares. “Guardianship authorities monitor compliance with the property interests of minors, including the size of property shares, living space, technical condition and level of improvement of residential premises,” says Maria Polyakova, director of the department of innovation, methodology and standardization of AHML. Therefore, it is very difficult to sell real estate whose owner is a minor. And naturally, banks don’t need such troubles at all.

This is actually why holders of maternity capital were allowed to divide real estate between family members not immediately when completing the transaction, but later: “If, when using maternity capital funds for the purchase/construction of residential premises, the spouse of the manager of maternity capital and children were not included among the owners, then the manager submits to the Pension Fund of the Russian Federation a notarized obligation to allocate shares to them in the future,” says Maria Polyakova (AHML). It must be completed within six months after the transfer of maternal (family) capital or commissioning of real estate (for projects under construction), and in the case of a mortgage - 6 months after the removal of the encumbrance, which usually occurs after payment of the last installment.

In standard purchase and sale transactions there are no such difficulties, since the shares of parents and children can be allocated when registering property rights, but adults do not always agree to this. Some people simply don’t want to share, while others have plans to resell their home as soon as possible, which means that when allocating shares to minors, they will have to agree on a deal with the guardianship authorities and allocate the children shares in the new home or transfer the appropriate money to their accounts. Therefore, very often, even during a regular purchase and sale, the holder of a certificate for maternity capital does not allocate shares to other members of his family, but gives a notarized obligation to register housing as shared ownership of spouses and children within 6 months from the date of transfer of “maternity” money.

Possible risks

In itself, the above obligation is quite harmless, but there is one thing. There is no control over its compliance, so “this condition is not met more often than it is met,” assures Maria Polyakova (AHML). This is due to banal laziness, when you do not want to take additional actions to allocate shares, and with the reluctance in the future - in the case of resale of housing - to face the guardianship and trusteeship authorities and the obligation to provide minors with other housing in place of the one being sold. This is especially not beneficial if, with the help of maternity capital, housing is purchased for investment purposes or for cashing out money (the property is bought and immediately sold). And for the buyer of real estate previously acquired with the help of maternity capital, all this can have very unpleasant consequences.

“If the legal requirements have not been met, the transaction may be declared voidable and invalid,” assures Pavel Lepish (“Domus Finance”). To challenge it, as Maria Polyakova (AHML) reports, the territorial body of the Pension Fund of the Russian Federation, which stores the notarized obligation of the manager of maternity capital funds to allocate shares to children and the spouse, or the guardianship and trusteeship authorities, if they become aware of the fact, have the right to challenge it depriving minors of shares in residential premises. “True, the legislation and regulations do not establish a procedure for control by the Pension Fund of the Russian Federation over the fulfillment of obligations given by managers of maternity capital. And also there is no connection between the Pension Fund and the guardianship and trusteeship authorities,” reports Maria Polyakova (AHML), so the likelihood of the above-described outcome is low.

Rather, family members who have not received their shares can apply to the court to invalidate the transaction. “Moreover, the statute of limitations for adults is 3 years from the moment they learned or could find out about the infringement of their rights (i.e., in fact, from the moment they purchased housing with the help of maternity capital. - Ed.), and for children who were minors at the time of the transaction - 3 years after their 18th birthday. Thus, the new owners actually find themselves on a time bomb,” says Irina Kazhikina, head of the mortgage service. The mine will explode, and you can be left without an apartment and without the money paid for it. “If the transaction is declared invalid, then each party will return to the other everything that was received under it (i.e., the buyer will return the property, and the seller will return the money. - From the editor). But by the time the children reach adulthood and begin to challenge the deal, the cost of housing will probably have time to rise significantly, so the buyer will remain a loser,” argues Pavel Lepish (“Domus Finance”). Moreover, children and their parents who have reached the age of majority may not have sufficient funds to reimburse the cost of real estate, because it is clear that the money once raised will already be spent. And then the court will most likely oblige them to make deductions from each salary, and payments will take years, or even decades.

Based on all of the above, the most reasonable thing that can be done is to prevent such a situation. “To do this, you need to conduct an additional check of the seller and the residential premises,” advises Maria Polyakova (AHML). “First of all, you need to find out how many children the seller has and whether he has children born since January 1, 2007, i.e. whether he had the right to maternal (family) capital. And if it was, then it is necessary to find out whether he used maternity capital funds when buying a home,” explains Pavel Lepish (“Domus Finance”). A positive answer means that the property must be owned by the holder of the maternity capital certificate, his spouse and all children. If this is not the case, then, most likely, an obligation was given to register the property as common property, which remained unfulfilled, i.e. the risk described above arises, and it is not worth buying such an object. By the way, if you are purchasing real estate with a long history, and the maternity capital funds were used not by the current seller, but by any of the previous owners, then the risk will be no less, therefore, if there is any suspicion of a violation of the law on the use of maternity capital, it is better to refuse the transaction.

Of course, not all sellers answer honestly whether they used maternity capital or not. Therefore, it is better to check this fact: “When it is clear from the certificate of state registration of property rights or an extract from the unified state register of rights that one of the spouses and children are not the owners of the residential premises, it is recommended to request an additional document from the seller - a certificate from the territorial office of the Pension Fund RF about the balance of maternity capital. If it is equal to the amount of maternity capital established by law at the time of concluding the purchase and sale transaction (in 2012 it was 387,640.3 rubles), then the seller did not exercise his right to maternity capital, which means he could purchase residential premises without allocating shares to the spouse (wife) and children. But if the balance of funds is less than the specified amount or even equal to zero, then we can assume that the funds (part of the funds) of the MSC were spent on improving housing conditions. Consequently, the seller had to allocate shares to the spouse and children,” says Maria Polyakova (AHML). In the latter case, it is better to refuse to purchase real estate, or the seller must be obliged to divide the property in an appropriate manner before the transaction is completed.

When real estate was purchased with the help of maternity capital, you should not enter into an agreement for the assignment of the right to claim under an agreement for participation in shared construction. Of course, while the house is being built, it is impossible to allocate shares to all family members, and, in principle, the seller does not violate the obligation given to the Pension Fund, but it is better not to risk it and purchase another property.

If the housing being sold, purchased at one time using maternity capital funds, is owned by all family members, including minors, then the transaction can be concluded, but it is necessary to check whether the seller has received permission to sell from the guardianship and trusteeship authorities, which is required in such cases. Without this permission, the seller does not have the right to sell the property, and buying real estate from him is risky.

“In general, when purchasing real estate acquired by previous owners with the help of maternity capital, you need to be careful and monitor the proper implementation of the law and the allocation of property to all family members, especially since there have been many cases of cashing out family capital through the purchase of housing. That is, apartments and houses were sold very quickly and without observing all the rules and obligations,” sums up Irina Kazhikina (“RELIGHT-Real Estate”).

On January 1, 2007, the Federal Law “On additional measures of state support for families with children” No. 256-FZ came into force in the Russian Federation. The specified legal regulation is the main one in the field of legal regulation of relations within the framework of maternity capital. In short: in accordance with its provisions, after the birth of the SECOND child, a Russian family has the right to receive monetary assistance - maternity capital. The size of the described maternity capital by the end of 2017 is 453,026 rubles . You can receive the specified amount only ONE time (for the birth of a third or fourth child, maternity capital payments are not made). It is already known that, unfortunately, this amount will not be indexed and changed by 2021. The maternity capital payment program ends on December 31, 2021. The program was initially designed for 10 years, it was extended for 2 years, however, the question of extending the program after 2021 currently remains open. Let's consider all the questions in more detail.

Who has the right to maternity capital

The following persons are eligible to receive funds:

- women who gave birth/adopted a second or third child - in the case of a third child, the right can only be exercised if the funds were not received after the birth/adoption of the second baby;

- men who adopted the second, third and subsequent children - the described right can be exercised here only once.

A prerequisite is that recipients of maternity capital have Russian citizenship. This condition implies an exception: the father of the child (citizen of the Russian Federation) can count on receiving assistance if the mother (citizen of the Russian Federation) is deprived of parental rights or sentenced to imprisonment for a term of more than 3 years.

If after the right to receive funds arises the woman dies, then in this case the funds will be received by the father (adoptive parent). The presence or absence of any citizenship in this case will not matter (Article 3). It is also important to note that the right to capital, regardless of the mechanism, must arise after January 1, 2007 and before December 31, 2018 - the validity period of the program .

Amount of maternity capital in 2021

Initially, the amount of maternity capital was 250,000 rubles. In the disposition of Art. 6 of the Federal Law “On additional measures of state support for families with children” No. 256-FZ states that the amount of targeted assistance is annually indexed - that is, revised upward. In 2021, the amount is 453,026 rubles . The same meaning has been true throughout 2021.

The specified amount is not tied to a territorial basis. A citizen of the Russian Federation can live in any region of the country, and the amount of maternity capital always remains fixed. In any case, from 2021 until the end (suspension) of the program, this value will neither be reduced nor increased. Future mothers can be sure of this.

If the right arises, for example, on December 20, 2021 (the birthday of the second / third child), then it (the right) will remain after the end of the program. Funds are provided not in cash, but in the form of a certificate, which can subsequently be used as an alternative to cash for any acceptable use of capital - more on this below.

Where and how can you get maternity capital?

The issue of actual receipt of maternity capital is under the jurisdiction of the Pension Fund of the Russian Federation. A person who has the right to receive appropriate assistance must contact the territorial office with a package of documents. Today, a package of documents can be submitted through the territorial multifunctional center (MFC). Moreover, this option will help to significantly save time.

The documents can be submitted by the persons who have this right, the legal representative of the child (for example, the guardianship and trusteeship authority), one of the children, provided that at this moment he is already an adult. In the classic form, in the case of a normal and complete Russian family, documents for obtaining a certificate are submitted, as a rule, by the mother of the children.

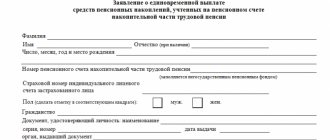

What documents should I submit?

Regardless of where the documents are submitted (MFC or directly to the Pension Fund), the list will always be the same. Employees of these departments are prohibited from demanding the provision of additional papers beyond those that must be in the applicant’s hands. The required package includes the following papers:

- the original internal Russian passport of the applicant with a copy of the second spouse’s passport, if any;

- documents for each child - passports (if available); birth certificates; adoption documents if one or more children are adopted;

- original SNILS of the applicant (if available);

- application of the established form - all mandatory data and details are indicated here, as well as the method for obtaining the certificate.

The specified package of documents along with the application will be reviewed and verified within a month from the date of submission. During this period, the authorized commission of the Pension Fund of Russia will certify the relevance of all data provided by the parent (adoptive parent).

During the data check, information will be requested from territorial guardianship and trusteeship authorities, as well as from other government bodies. Special checks are aimed at persons who:

- had their own child (children), after which they became adoptive parents, and it was adoption that became the reason for the emergence of the right to receive maternity capital - in this regard, the state is interested in minimizing abuses on the part of citizens;

- alternately adopted two or more children.

If during the inspection any inconsistencies arise or the information is provided in insufficient form, the territorial bodies of the Pension Fund of the Russian Federation may request additional data from the applicant, the provision of which does not contradict the content of Article 5 of Federal Law No. 256. The applicant will be required to provide additional data within a reasonable time. Failure to comply with the requirement on the part of the Pension Fund will be regarded as the impossibility of providing data. Therefore, obtaining maternity capital will become impossible - the application will be refused (clause 4 of article 5).

In what cases can payment be refused?

The same article of Federal Law-256 also provides for other reasons why a refusal may be received by the territorial bodies of the Pension Fund of the Russian Federation. The exhaustive list is as follows:

- the applicant was not initially entitled to receive state support;

- the package of documents is not complete, and the request to send additional papers was ignored by the applicant;

- indication of knowingly false / unreliable data - inconsistencies that are not significant or not intentionally made can be eliminated by explanations on the part of the applicant, or by sending additional documents, but if the forgery is intentional (which is detected quite quickly), then the decision will be negative;

- the citizen support program has ceased to operate - for example, if a child is born (adopted) after December 31, 2018;

- the applicant’s rights have ceased - even if the case of deprivation of parental rights is at the stage of consideration, then at this time the parent will not be able to act as an applicant for receiving the described maternity capital, and the already made decision on deprivation of parental rights makes it impossible to act as an applicant until rights will not be restored;

- the applicant has limited rights to raise the child.

The decision of the Pension Fund of Russia body is sent to the applicant within 5 working days from the date of its adoption (Clause 5 of Article 5). If it is negative, then its reason and grounds must be specified in detailed written form. The applicant reserves the right to appeal the decision to a higher authority. For example, if the refusal came from the city Pension Fund, then you need to appeal it to the regional/territorial/republican Pension Fund. In addition, on a general basis, the applicant is given the right to appeal the decision to the court or the prosecutor's office.

If the decision is positive, the applicant is issued a maternal certificate. The total waiting period for a decision is approximately 25 working days - 20 of them are allocated for verification activities, and 5 days for sending notification of the decision.

Summary

The use of maternal (family) capital may pose a threat to subsequent property owners. If “maternal” funds are used to purchase housing, it must be divided among all family members, including minor children. But sometimes, for example, in the case of a mortgage, this is simply impossible, and sometimes you don’t want to do it right away, and then the manager of maternity capital gives the Pension Fund an obligation to give his spouse and children shares in the apartment or house later. But this obligation is not fulfilled very often, i.e. the law is violated, which means that subsequent purchase and sale transactions of real estate acquired with the help of maternity capital can be challenged and declared invalid, and then the new owner is left without housing. To save yourself from such a risk, you should always find out whether maternity capital was involved in previous transactions with this real estate and whether it was used lawfully.

Maternity capital: 2021

This year the amount of capital for the mother is 453,026 rubles. The state will not be able to provide parents with a larger amount; it cannot be used to pay off loan debts. It is imperative to find out the telephone number of the Maternity Capital Pension Fund and inquire about information and ask questions.

Refusal to provide assistance from the state usually occurs if inappropriate use is revealed. For example, if a mother is deprived of the right to raise children, she has a debt balance that is less than the amount of capital or takes out a mortgage on a company that does not have the right to do so.

To exclude a negative response from employees, employees have the right to provide advice on maternity capital by phone - Pension Fund 8 – 800 – 555 – 40 – 70.