The legislative framework

The norms of legal relations between employers of various forms of ownership of enterprises, organizations, individual entrepreneurs and hired workers are regulated by:

- labor legislation;

- other federal laws relating to labor;

- government regulations;

- presidential decrees;

- interdepartmental agreements;

- collective agreement;

- local legal acts of internal effect.

Duties and responsibilities of the employer

When hiring employees, the employer must formally enter into an employment contract.

In addition to the duties and responsibilities of the parties, it is necessary to document:

- the amount of earnings (based on the current regulations on remuneration);

- specific dates of monthly payments (at least twice, every 15 days worked).

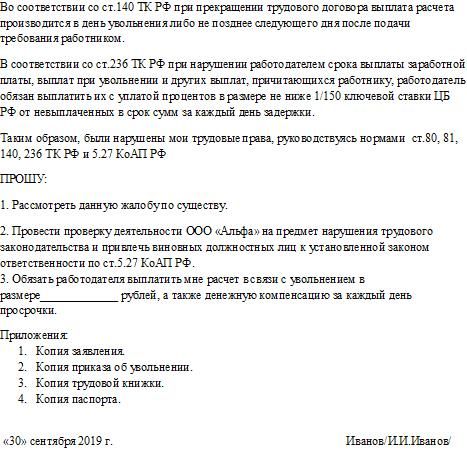

Regardless of how much time remains before the planned salary payment day for the enterprise, settlements are made with the dismissed worker by directly terminating the employment relationship (Article 140 of the Labor Code of the Russian Federation).

In cases provided for by law, upon dismissal, severance pay is paid in addition to the amounts due.

Untimely settlement with a dismissed employee is fraught for the employer not only with additional costs for paying penalties for each day of delay in payments (at least 1/150 of the Central Bank rate), but also with liability.

| Responsibility | Link to legislative acts | Penalties |

| Administrative | clause 6, clause 7 art. 5.27 Code of Administrative Offenses of the Russian Federation | Penalties for guilty officials (taking into account whether they were previously held accountable for similar offenses) – 10-30 thousand rubles. At the same time, an organization acting as a legal entity may suffer losses by paying 30-100 thousand rubles to the state. The director and chief accountant of an organization may be disqualified for 1-3 years. |

| Criminal (if there is criminal intent and acts subject to criminal prosecution) | Art. 145.1 of the Criminal Code of the Russian Federation | Depending on the partial or complete non-payment of the amounts due, the grave consequences that occurred for the former employee due to the lack of earned funds: ∙ the amount of the fine can reach 500 thousand rubles; ∙ faces a ban on engaging in certain types of activities for a period of up to 5 years; ∙ it is possible to serve a sentence in prison for a period of 2-5 years. |

What can an employee expect?

The calculations include:

- wages for the period worked after the last payment;

- compensation payments and additional payments for work in special, harmful working conditions in proportion to the actual time worked;

- the appropriate amount of incentive and incentive bonuses paid in accordance with the current regulations on the remuneration system;

- compensation for unused days of paid leave.

From the amounts accrued during the calculation, the following may be withheld:

- vacation pay paid in advance;

- damage caused by the guilty actions of the employee, if an additional liability agreement has been concluded with him (the amount cannot exceed his average monthly earnings, Article 241 of the Labor Code of the Russian Federation).

A dismissed employee is paid severance pay if:

- he was subject to reduction in staff or numbers;

- the enterprise ceased its activities, was liquidated by decision of the owner, or declared bankrupt by a court decision;

- he was called up for military service;

- according to a medical report, he cannot continue to work under the same conditions, refused to be transferred to light work, or the employer does not have suitable vacancies;

- termination of employment relations is due to other reasons provided for in Art. 178 Labor Code of the Russian Federation.

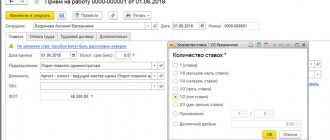

Calculation upon dismissal from work

According to the requirements of the Labor Code of the Russian Federation, in the event of dismissal from a position and upon dismissal from an organization, the employer is obliged to pay the person, that is, to pay him the amounts due.

The entire process of care is inextricably linked with the payment of due money. In this case, you can count on receiving funds if two conditions are met:

- the person must have the right to receive funds. Such funds include not only earnings, but also other monetary guarantees provided for workers by current legislation;

- the money should not be received by the worker on the day of his departure.

If any of the specified conditions are not met, you can not count on receiving money.

It should be noted that if a person caused damage to the company or is obliged to pay funds for the maintenance of other people, for example, his children, then such amounts will be deducted from the final calculation.

The final financial calculation consists of several components.

The calculation procedure provides, first of all, for the payment of wages, that is, the money that must be paid to the worker for the performance of duties in his position. This includes not only the official salary, but also allowances of various types, for example, for dangerous and harmful conditions.

We invite you to read: Final payment upon dismissal of an employee

Also, unused vacation periods must be compensated in monetary terms. It should be noted that the employee can take unused days off before leaving, but in most cases people take monetary compensation.

The current regulations provide for a minimum duration of annual vacation of twenty-eight days. Such time cannot be replaced with money; it must be used. Only additional vacation days can be compensated. But in the case of dismissal, everything is different. You can receive monetary compensation for all unused paid days, regardless of whether they relate to the main leave or additional leave. In case of dismissal, a worker from any category of workers can replace the required paid rest.

Another type of payment is severance pay. Its amount is equal to average monthly earnings. Such funds are not paid to all dismissed workers, but only to those who were relieved of their positions due to the liquidation of the organization or reduction in staff.

Payment deadline

When a person is dismissed, his salary, as well as other types of money due, must be paid to him within the period established by current legislation.

The moment of payment is the day of dismissal. In this case, such a date may not coincide with the last working day, for example, if a person works on a shift basis.

The day of departure is the date specified in the manager’s order to release the worker from his position and expel him from the company’s staff. Accordingly, on such a day, the worker must be paid all the funds due to him.

Where to complain in case of non-payment

You can protect your interests and violated rights by any non-prohibited means. The procedure depends on the choice of method to ensure that the employer repays the amounts due.

We'll tell you what you can do if you haven't paid not only your estimated wages, but also your wages (while you continue to work).

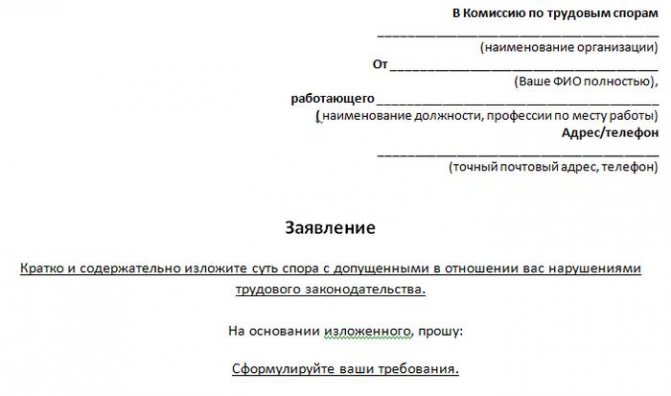

Self-defense and powers of commissions operating at the employer (CTS)

You can try to resolve the conflict on the spot by submitting a written complaint to the employer. The application must be submitted in person or sent by registered mail with notification of its delivery to the addressee.

It is advisable to leave confirmation of your request.

Prepare 2 copies of the application with the requirement to pay the amount of the debt by the specified date with the accrued penalty for late payment.

When contacting in person, the secretary registers incoming correspondence by marking your copy with the date of receipt and registration number.

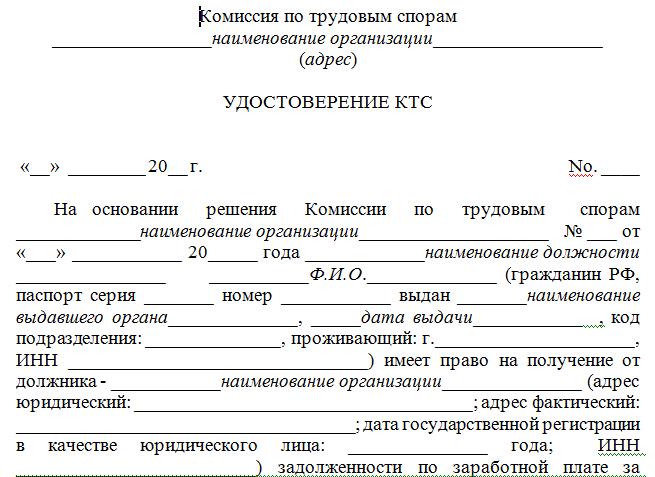

If the manager ignores legal requirements, a commission created from representatives of the administration and the workforce to resolve disputes can provide assistance.

Currently, CTS has lost its significance and rarely operates in organizations. You can initiate its creation by contacting trade unions designed to defend the interests of workers.

If within 3 days the employer does not voluntarily comply with the decision made by the commission to pay the amounts due, the interested person receives a certificate.

Since the CTS certificate is equivalent to a writ of execution, it is used by bailiffs to force the collection of settlement and accrued penalties for late payments.

Contacting the territorial labor inspectorate

The norms of Art. 2 Federal Law No. 59 (latest current version with amendments and additions dated December 27, 2018), enshrines the right of citizens to contact government bodies authorized to make socially significant decisions.

The fulfillment by employers of guaranteed workers' rights is controlled by the state by the federal labor inspectorate. The supervisory authority performs its functions locally through territorial inspections.

Filing a complaint about non-payment of settlement pay upon dismissal:

- taken personally to the territorial body of Rostrud at the place of registration of the employer acting as a legal entity, or the actual location of the entrepreneur;

- sent by registered mail (it can be simple, but it will not be known when it was delivered and whether it even reached the addressee);

- sent via the Internet by filling out a specially designated form in the “online inspection” section on the official website of Rostrud.

The inspectorate is competent to conduct an unscheduled inspection of the employer by requesting the necessary documents or visiting the place of business. Upon confirmation of the specified facts of non-payment of wages:

- guilty officials will be held accountable;

- the employer will be issued an order setting a deadline for eliminating violations.

Sample:

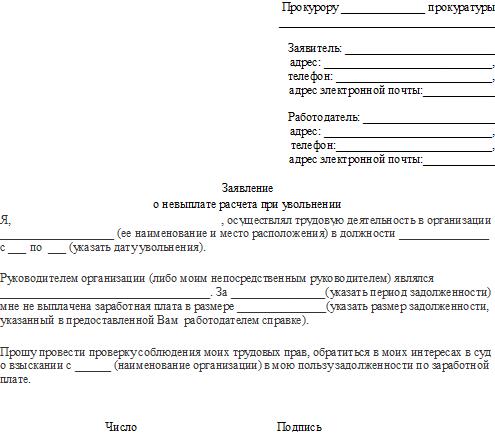

Filing a complaint to the prosecutor's office

The prosecutor's office is another government body that can help protect interests and hold the employer accountable.

Having a wider range of powers, the prosecutor's office has the right to monitor the implementation of any laws in force in the country.

Upon application for non-payment upon dismissal of all or part of the funds due:

- a prosecutor's investigation is carried out;

- documents can be forwarded to the territorial inspection that controls the employer to take effective measures to eliminate violations.

An application, similar to an application to the inspectorate, is written arbitrarily. You just need to follow the basic rules of business writing.

Unacceptable:

- use of obscene language;

- insult, threats against officials (or their relatives).

Sample:

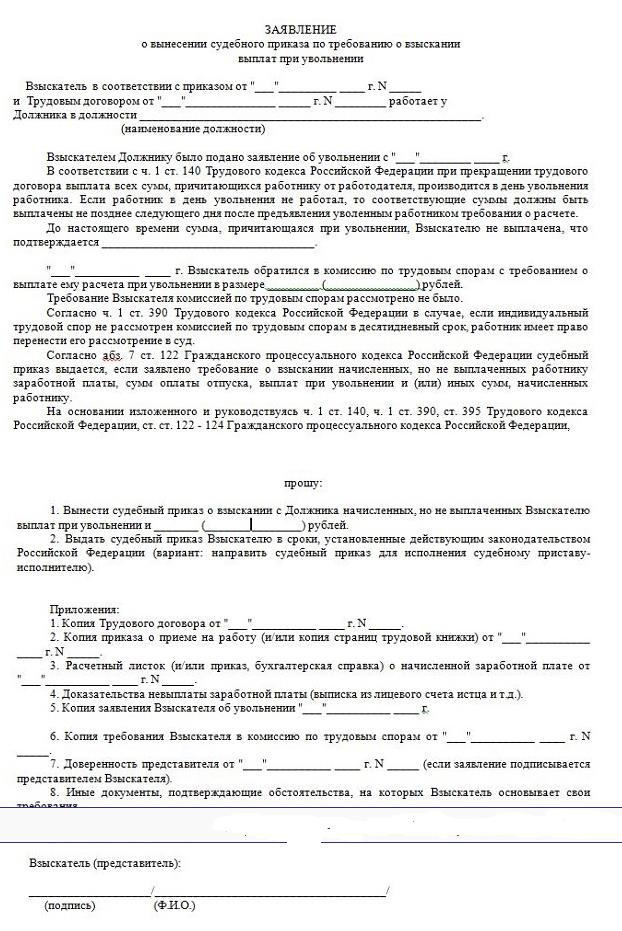

Going to court

Any individual conflicts are resolved in court. To file a claim, it is not necessary to present evidence of pre-trial settlement of the dispute or contact the supervisory authorities.

The application is drawn up taking into account the requirements for content and form. As a rule, 3 copies are prepared:

- for court;

- an employer who is a defendant in legal proceedings;

- one copy remains with the plaintiff.

In contrast to appealing violations of legal rights to supervisory authorities, where there is no need to provide evidence of these facts, since they will be verified by a labor inspector or prosecutor when drawing up a statement of claim:

- it is necessary to indicate the rules of law violated by the employer;

- justify the requirements presented;

- attach documents confirming the legal relationship with the employer (their termination) and certificates of arrears in payments.

Sample:

What to do if you haven’t paid a gray or black salary

It is, of course, much more difficult for an unofficial employee to count on reimbursement of unpaid wages. Many employers willingly take advantage of this and deceive their subordinates in every possible way.

If you work without an employment contract, the law may also protect you. To do this, you will need to file a complaint with the labor inspectorate or prosecutor's office. But be prepared for the fact that you will have to prove in a special manner the fact that there really was an employment relationship between you and the employer. This is quite problematic to do, since you do not have any written evidence that you worked in this organization.

However, your application will still be subject to verification. The head of a company can be held accountable only on the basis of its results. In addition, you can recover from him the entire amount due to you in court. Remember one important thing: a good result is preceded by careful preparation.

Limitation of actions

With regard to the employer's arrears of wages and other amounts due during employment, claims can be filed in court within 3 years from the date established for payment.

Since we are talking about non-payment of settlement, you need to focus on the date of dismissal, even if some part of the amount due was paid.

Despite the fact that the time frame for contacting the supervisory authorities is not limited by legislative acts, it is accepted by default that the application is considered on its merits if submitted during the period when the conflict can be resolved through the court.

An exception for the consideration of individual disputes by labor dispute commissions operating within organizations. The time limit for resolving CCC disputes is much shorter.

The application can be submitted within 3 months from the day it became known about violations of legal rights by the employer, if there is confirmation that it was not possible to resolve the conflict peacefully.

What decision can be made on a complaint?

After the complaint has been received by the inspectorate, it is sent to the official (inspector) whose territory the employer belongs to. Next, the inspectorate officer checks the facts recorded in the application. If information about a violation is confirmed, he issues an appropriate order and sets a period during which the employer must eliminate all detected violations.

ATTENTION! Look at the completed sample application to invalidate the decision of the state labor inspectorate, adopted based on the results of consideration of a complaint against the actions (inaction) of the organization conducting a special assessment of working conditions:

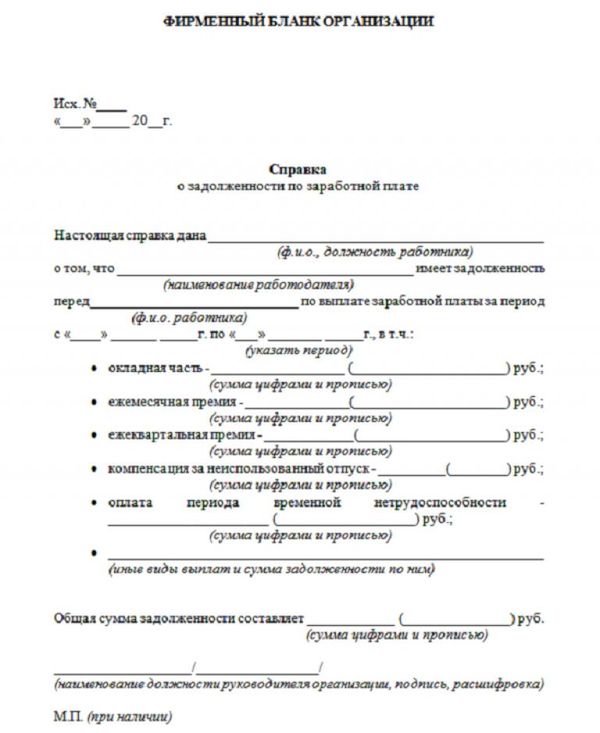

Evidence base

The advantages of contacting supervisory authorities (prosecutor's office or territorial labor inspectorate) with a request to provide assistance in protecting labor rights and receiving the required settlement payments include:

- it is not necessary to present any documents confirming the accuracy of the specified facts of non-payment of wages and other amounts upon dismissal, since they will request documents for verification from the employer on their own;

- there is no need for the personal presence of the interested person when carrying out control activities;

- within a month from the date of application, the applicant will receive a substantiated response.

If conflicts are resolved through court, the plaintiff must provide all evidence of the validity of his claims.

The following can be submitted as documents confirming violation of guaranteed rights:

- a copy of the contract with the employer or work record book;

- copies of written orders, from which it is clear that the person was hired and the employment relationship was terminated (or extracts from orders);

- a certificate from the accounting department about the amount of official salary (or tariff rate):

- a certificate of the amount of debt at the time of filing the claim.

If the employer does not issue orders and certificates at the request of the dismissed employee, when filing a claim, you must apply for the documents necessary to consider the dispute.

Judicial practice 2020

Statistics on court decisions on labor conflicts show that cases involving the collection of accrued but unpaid funds due on time are a win-win situation.

In addition, the costs of paying a lawyer are reimbursed by the employer.

Employees very often go to court because the employer did not pay the required amount of money upon dismissal. And most often the court takes the employee’s side in this matter. But it is necessary to take into account all the features of the situation.

The first thing to remember is the statute of limitations. In case of disputes related to dismissal, it is only 1 month from the moment the employee signs the dismissal order or receives his or her employment certificate.

If you miss this period, the judge will accept the application for consideration, but will immediately close it due to the expiration of the specified period. In some cases, this period can be restored.

But it will be necessary to provide truly undeniable evidence that there was no possibility of filing a claim at that time (for example, he was unconscious in the hospital, or was forbidden to get up, etc.).

In addition to all debts, the court can also be asked to award compensation for material damage. Its size is not set and you can request any amount. However, the judge will still assign it at his discretion based on the severity of the violation. As a rule, you can count on 10-50 thousand rubles.

Attention! However, there are also situations in which the actions are correct, but the employee interprets labor legislation incorrectly. For example, an employee sued the employer because, according to the employee, he did not pay compensation for unused rest days.

During the trial, the company proved that before the dismissal the employee was on vacation, and therefore such a right had not yet arisen at the time of dismissal.

Separately, it is necessary to dwell on legal proceedings due to settlement, but when the employee worked at the enterprise not officially and there is no employment contract.

Such trials usually end in favor of the employer, since the employee cannot provide sufficient evidence not only of his performance of work duties, but also of the amount of the established unofficial salary.

A bill on the collection of wages by the labor inspectorate without court

Currently, the only way to obtain payment of earned money is through the courts. But the consideration of a claim can last for months, and even longer if the employer has a strong legal service. As practice shows, sometimes judicial red tape stretches for up to a year. The transfer of the writ of execution to the bailiffs also does not happen instantly. Thus, the dismissed employee is left without a livelihood and, in addition, is forced to bear the costs of paying for legal services.

To alleviate this situation, the Government has prepared changes that will expand the powers of supervisory authorities. On November 14, 2019, a bill amending the Federal Law “on enforcement proceedings” was adopted in the first reading.

According to the innovation, labor inspectorates themselves, without the participation of the court, will be able to forcibly recover the amounts due from the employer in favor of the employee. If the employer has not complied with the order to correct violations on time, the inspector adopts a corresponding resolution and transfers it to the bailiff service. Such a simplified collection procedure will protect the rights of employees and significantly reduce the time frame for debt payment.

Thus, the dismissed employee will be able to decide for himself how to pursue unpaid wages - through the court or the labor inspectorate.

Order a free legal consultation