Labor relations at enterprises are regulated by many laws of the Constitution of the Russian Federation. One of the main ones is the Federal Law “On compulsory social insurance against accidents at work and occupational diseases” (dated July 24, 1998, No. 125 FZ (as amended on December 25, 2015)) and the law “On compulsory social insurance in case of temporary disability and connections with motherhood" (dated December 29, 2006 No. 255-FZ (as amended on March 9, 2016)). It is on their basis that every employee has the opportunity to receive insurance during his absence from work due to temporary disability, and therefore not be left without a livelihood. According to these laws, compensation is paid to the insured person in the following cases:

- when an employee becomes ill;

- when he or she is injured (not at work);

- due to caring for a sick family member;

- quarantine of an employee, his child or incapacitated relative;

- during follow-up treatment in a sanatorium or resort;

- on pregnancy and childbirth.

As a result of these factors, the employee receives a sick leave certificate (disability certificate) from a medical institution, which is a mandatory element of insurance. It is presented in the form of an official form containing all the necessary information, certified by seals and signatures.

Such a form proves the authenticity of the employee’s excused absence from work on specific days and makes it possible for the accounting department to accurately calculate the amount of the insurance benefit.

A small share of compensation payments falls on the organization itself, the main share goes to the Social Insurance Fund (SIF).

Each employee is required to pay benefits, as stated in the Labor Code of the Russian Federation. Articles 21 and 183 of this Code provide that any organization is obliged to provide insurance to employees without fail, and its effect begins from the moment the worker signs the contract and begins to perform his duties.

Upon expiration of the employment contract, the opportunity to obtain insurance remains for another 30 calendar days.

Many enterprises have a Standard Regulation (according to Decree of the Federal Insurance Service of the Russian Federation dated July 15, 1994 No. 556a), on the basis of which worker insurance is regulated by a special commissioner or insurance commission . They are elected at a general meeting from representatives of the personnel department, labor collective or accounting department. They are required to develop the Regulations on the Commission. The main function of the commission or commissioner is to monitor the timely and full payment of hospital benefits and resolve disputes.

Each party has its own rights in accordance with the Regulations on the Social Insurance Fund of the Russian Federation and the Law “On the Fundamentals of Compulsory Social Insurance”.

Rights of the recipient of temporary disability compensation:

- receiving free information on insurance issues;

- timely receipt of benefits in accordance with the legally established procedure;

- protection of your rights personally or through legal representatives.

Rights of the FSS of the Russian Federation:

- conducting an examination to clarify the occurrence of an insured event;

- verification of accounting documents and transfer of insurance premiums;

- providing social insurance to people who are self-employed.

The FSS also has its responsibilities :

- carrying out timely payment of benefits;

- regulation of the procedure and accuracy of calculating security and payment of the amount for sick leave.

If complex controversial issues arise, every person who has social insurance can contact the Federal Social Insurance Fund of the Russian Federation to resolve them, and if the situation remains unresolved, they can turn to the court or a higher authority.

Legal relations of Social Insurance for entrepreneurs and organizations are regulated by a separate Law, since they apply their own tax regimes. But the process of calculating and paying benefits to employees follows general rules.

Keep in mind! If a person works in several organizations at once, then in case of illness he can receive benefits from each of them. From the date of closing the certificate of incapacity for work, you can apply for payment within six months.

Accounting department's calculation of the amount of compensation for sick leave

In order for the Social Insurance Fund to be able to pay the required amount to an employee due to his temporary disability, the organization’s accounting department must first establish the amount of compensation individually for a specific employee, since the amount of the benefit depends on many factors - length of service, average earnings and the cause of disability.

Sick leave due to illness

To calculate such sick leave, accounting takes into account two criteria - “average annual” earnings and “average daily” earnings.

The first is determined by income for the previous two full years of work, that is, if an employee went on sick leave in 2015, then the accountant will calculate the average earnings for 2013 and 2014. This results in one total amount.

Now, based on this amount, the average daily earnings are calculated - the resulting amount of average annual earnings must be divided by the total number of days for two years, i.e. by 730, and then multiply by a percentage depending on the insurance period. The longer the work experience, the higher this percentage. In accounting, the following criteria apply for its definition:

- of experience or less - 60 percent;

- experience of at least 5 years, but no more than 8 years - 80 percent;

- experience of 8 years or more - 100 percent.

The resulting amount is the average daily earnings. In order to calculate the amount of the benefit, all that remains is to count the number of sick days and multiply the resulting value by this number.

Important! The calculation of the benefit amount takes into account, in addition to the salary accrued for 2 years, quarterly bonuses and vacation pay, that is, all those payments with which insurance contributions are calculated (therefore, other sick leave and maternity leave are not included here).

Sick leave for pregnancy and childbirth

The average annual earnings in this case are calculated as in the previous one, but the method for determining the average daily earnings is slightly different.

Average annual earnings are divided not by 730, but by the total number of calendar days for the two previous years, taking into account the deduction from them of the number of days when the employee was on sick leave, on maternity leave, on paid days off, caring for disabled children, on vacation for childbirth and child care, and other paid days provided for by the law of the Russian Federation.

The resulting value is always multiplied by 100 percent. This is how the final benefit payment amount is obtained.

EXAMPLE . Employee Kovalev S.A. I was sick from July 5 to July 9, 2021. His experience is 6 years. In 2014, his income was 242 thousand rubles, and in 2015 - 315 thousand. We make the calculation: Average annual earnings: 242,000 + 315,000 = 557,000 Average daily earnings: 557,000/730 = 763 Benefits: 763*0.8 *5=3052 Tax accounting: 3052*13%=396.76, i.e. (3052-396.76) = 2655.24 Thus, Kovalev S.A. will receive benefits in the amount of 2655.4 rubles for 5 days of absence from work due to illness.

General procedure for calculating sick leave from the minimum wage

As a general rule, sick leave benefits are calculated based on wages, bonuses and other payments to the employee for the last 2 years.

But in some cases, the minimum wage is used to calculate benefits. It is necessary if

- the employee had no income during the billing period;

- the average employee’s earnings for a full calendar month turned out to be lower than the minimum wage established on the day the employee began to become ill.

In addition, the minimum wage affects the limitation of the amount of benefits if:

- the employee's insurance period is less than 6 months;

- there are grounds for reducing the benefit amount. For example, an employee brought a sick leave note with a note indicating a violation of the incapacity regime.

To calculate sick leave benefits you need to determine:

- average daily earnings based on the minimum wage;

- the amount of daily disability benefits;

- the amount of benefit for the period of incapacity paid by the organization. These are the first three days of an employee's illness.

At the same time, if in your area a regional coefficient is applied to wages, then when calculating benefits for it, the minimum wage must be increased.

As a result, if the amount of temporary disability benefits calculated for a full calendar month is less than the minimum wage, then the benefit must be calculated based on the minimum wage.

Previously on the topic:

The Ministry of Labor explained in which cases the amount of temporary disability benefits will be reduced

Calculation of insurance period for sick leave benefits

Sick leave if the employee’s work experience is less than 6 months

The procedure for calculating minimum sick leave benefits has changed

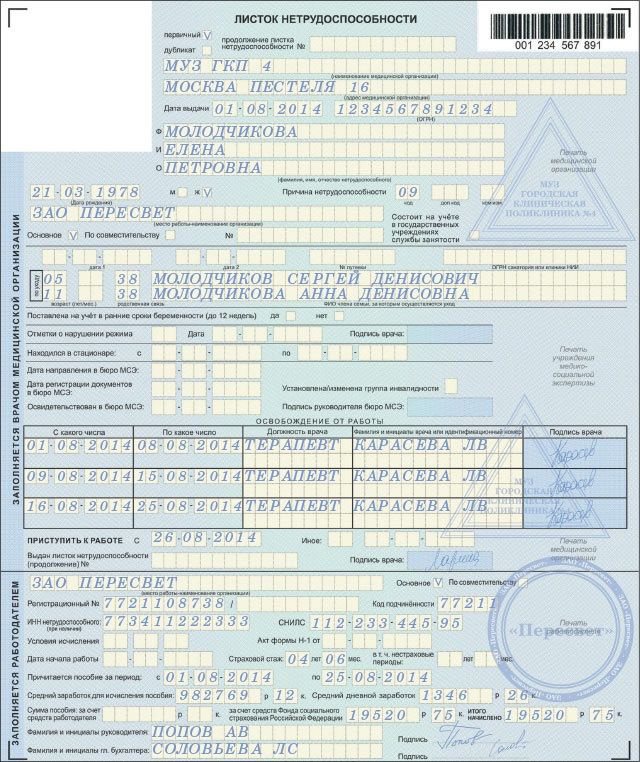

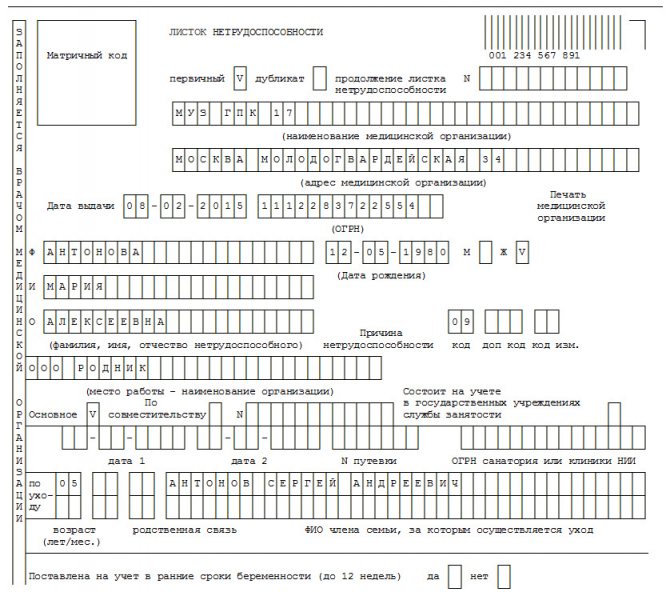

Rules and examples of filling out sick leave

The form of the certificate of incapacity for work is filled out manually or on a printer using a special FSS program. If you fill it out using the second method, the task becomes much easier, since the process is programmed.

Below are examples of filling out a sick leave certificate:

FILES

If manually, then the following basic rules must be observed:

- You can only write with a black gel pen;

- the filling must be neat, not extending beyond the cells;

- writing is allowed only in Russian;

- you need to start writing without skipping cells;

- all words must be written in block capital letters;

- in the doctor’s name, an empty cell should be left between his last name and initials (and sometimes between them) (for example, SVIRIDOV□A.G. or SVIRIDOV□A.□G., but SVIRIDOVA.G. is not allowed).

FILES

The certificate of incapacity for work is filled out in two stages - first in a medical institution by a doctor, and then by an accountant of the organization where the employee works.

How to fill out a paper sick leave certificate

The rules for filling out sick leave are given in Section IX of the Procedure, approved by Order of the Ministry of Health of the Russian Federation dated September 1, 2020 No. 925n.

1. Entries must be made in capital block letters using printing devices or using a gel, capillary, or fountain pen with black ink. You cannot use a ballpoint pen.

2. A combined option is allowed, when part of the information on the sick leave is entered using a printing device, and part is written in with a fountain pen (letter of the Federal Social Insurance Fund of the Russian Federation dated October 23, 2014 No. 17-03-09/06-3841P).

3. All entries must start from the first cell and not go beyond the boundaries of the fields.

4. Seals of the medical organization and the employer may go beyond the boundaries of the designated spaces, but should not overlap the fields with information.

5. If the employer makes a mistake when filling out a sick leave certificate, it can be corrected without replacing the form (clause 72 of order No. 925n). To do this you should:

- cross out the erroneous entry;

- make the correct entry on the back of the form;

- certify the correct entry with the employer’s signature and seal.

When correcting, you cannot use a corrector or other similar means.

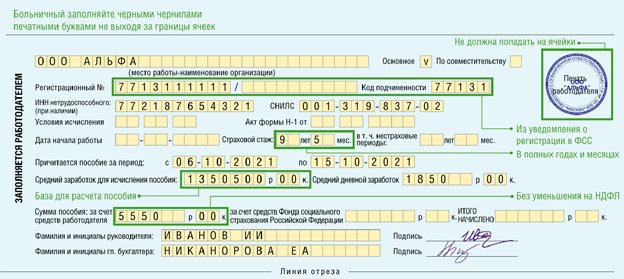

The employer enters the following data in the section of the sick leave sheet “TO BE COMPLETED BY THE INSURER”.

1. Information about the place of work:

- name - here it is better to indicate a short name, since there may not be enough cells for the full one;

- status of the employee’s place of work - main or part-time. This is important, since the part-time worker issues sick leave for each place of work;

- employer registration number in the Social Insurance Fund;

- subordination code - the number of the FSS branch where the employer is registered.

2. Employee identification codes: TIN and SNILS.

3. Special conditions for calculating sick leave:

- codes for various special conditions under which sick leave is calculated according to separate rules. For example, disabled people affected by radiation, etc.;

- the date of drawing up the act in form N-1, if sick leave was issued due to an industrial injury.

If none of the listed special conditions exist, all of these fields must be left blank.

4. Information for calculating benefits:

- insurance experience;

- non-insurance periods that are deducted from the insurance period;

- the period for which the benefit must be calculated - the opening and closing dates of the sick leave;

- average earnings for the previous two years and per day;

- the amount of benefit at the expense of the employer;

- the amount of benefits from the Social Insurance Fund;

- total accrued.

When paying benefits directly through the Social Insurance Fund, you do not need to fill out the last two lines (clause 73 of order No. 925n).

The employer certifies the sick leave with the signature of the manager and chief accountant, as well as a seal, if any.

How to fill out the form at a medical institution

Typically, a sick leave certificate is issued to a patient on the day of his discharge, but according to the new rules, the patient can pick it up on the first day. The medical employee fills out all the information about the patient and the medical institution. He writes the name and number of the hospital, the address of its location, the date of issue, the full name of the patient to whom this sheet is issued, his date of birth, the name of the organization where the sheet is required, the name of the attending physician, his position, the date of admission of the patient and the date of discharge, as well as the date on which the employee is required to start work.

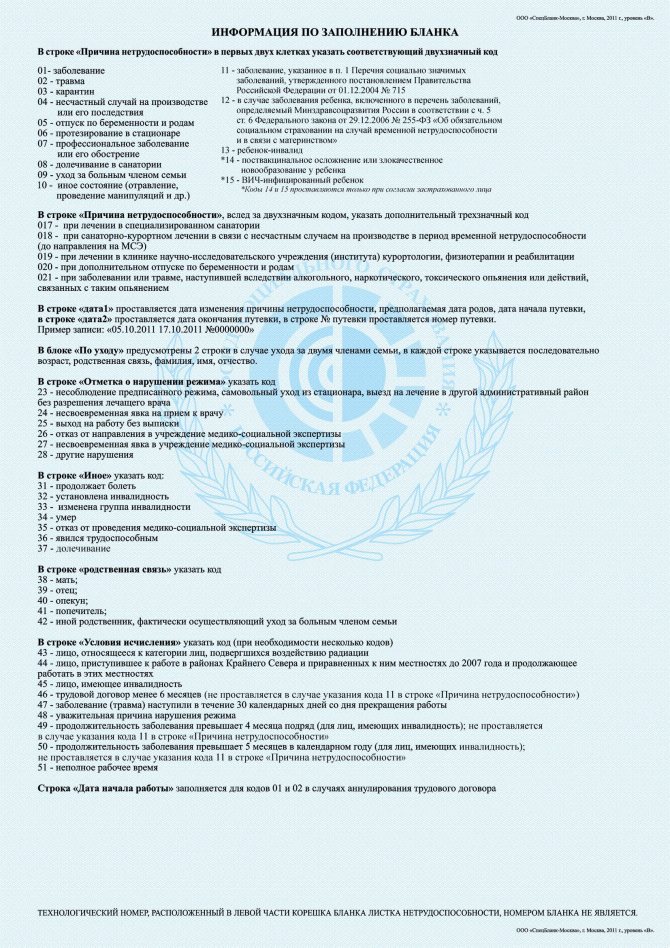

The form also contains a column indicating the reason for the disability, which is also filled out by the doctor. But if earlier the name of the disease itself was written there, now it is customary to write a conditional code to which a particular disease is assigned (for example, 01, 02, 03, which means disease, injury and quarantine, respectively). This allows you to maintain medical confidentiality.

After discharge, the patient receives a form and submits it to the accounting department. But before doing this, he must carefully check all the data to eliminate possible errors and make sure that all signatures and seals are present, otherwise the form will be invalid and benefits will not be accrued on it.

How to fill out a form in the accounting department

After the sick leave certificate reaches the responsible person of the organization, he first checks it, and then carefully and accurately fills out the rest of the form - the bottom column. In it, the accountant must enter the following: name of the organization, registration number, department code, employee data (TIN, SNILS), his full insurance record, number of paid sick days (according to the start and end date of sick leave), the amount of average annual and average daily income , the amount of the organization's benefit, the amount of the Social Insurance Fund, the total amount of payment. At the very bottom, the names of the head of the organization and the accountant are indicated, necessarily secured with their signatures and seal.

Important! A prerequisite is to fill out the sick leave form correctly and accurately. So, if a medical worker makes a mistake, the accounting department will not accept the form, and the employee will have to take a new one. If an accountant makes a mistake, it leads to even bigger problems, since the Social Insurance Fund will not pay benefits, and the accounting department will have to change all reporting and calculations in accordance with the Social Insurance Fund budget.

Issuing a certificate of incapacity for work retroactively

There are often cases when an employee tries to get sick leave retroactively. This usually occurs if an employee has missed several working days for any reason other than illness. But according to the legislation of the Russian Federation, it is impossible to officially issue such a sick leave. This is clearly and clearly indicated in the Order of the Ministry of Health and Social Development of Russia No. 624n dated 06/29/11 and in the Decision of the Supreme Court of the Russian Federation No. AKPI14-105 dated 04/25/14.

That is, according to the law, if an employee decides to obtain a sick leave certificate retroactively in some way, not only he will be responsible for this, but also the one (medical employee or special organization) who issued him the document.

Due to the fact that previously employees could calmly bring a certificate of incapacity to work retroactively, while they themselves were healthy and simply did not come to work, in 2011 the certificate form adopted a new form that is still used today. It describes all the data in more detail, which complicates the task of applying for sick leave retroactively, which means employees bear a huge risk when trying to hide behind such a document.

By the way! If an employee came to work, worked for some time, but then fell ill, then sick leave can only be opened from the next day, since the organization cannot compensate for the day on which the employee was present at work through insurance.

How to check a sick leave certificate before filling it out

Having received a sick leave certificate on paper, the employer must check three parameters.

1. Form number in the FSS database. But here you need to keep in mind that the fund updates the list of stolen and lost sick leave forms on average once a month. Therefore, this check does not provide a complete guarantee against counterfeiting.

2. Authenticity of the form based on external features:

- the color should be blue, darker at the edges and lighter in the center;

- the paper should be thick and resemble the texture of a banknote;

- The watermarks - the FSS logo - should be visible in the light;

- the form number must be convex to the touch;

- The underline under the signatures of the doctor, manager and chief accountant should consist of microtext “certificate of incapacity for work”, which can be distinguished with a magnifying glass.

3. The accuracy of the information filled out by the doctor. In particular, the name of the medical institution must be the same as on the seal, the employee’s full name must correspond to his passport details. But there may be typos in the name of the company, since the doctor enters this information from the words of the employee. In this case, there is no need to replace the sick leave; the employer just needs to enter the company name and registration number in its section without errors (letter of the Moscow regional branch of the Federal Social Insurance Fund of the Russian Federation dated July 14, 2020 No. 14-15/7710-1110-LNK).

If the employer still has doubts after all the checks, he can send a request to his FSS department, attaching the original of the disputed sick leave (letter of the FSS of the Russian Federation dated September 30, 2011 No. 14-03-11/15-11575). When issuing an electronic sick leave certificate, the employer only needs to check its number. If there is this sick leave in the FSS database, then the document is real.

Some details of issuing sick leave

A certificate of incapacity for work is issued for any health impairment (except for injuries received at work). If sick leave was issued while caring for a family member in need of care, then sick leave benefits are paid in the following order:

- if the child is under seven years old, then a total of 60 days a year will be paid in full;

- if child care is required for more than 7 but less than 15 years, then a maximum of 45 days per year and 15 days per case are paid;

- if care is provided for a disabled child, then 120 days are paid in full for the year;

- in all other cases, it is possible to pay sick leave for no more than 30 days a year and a maximum of 7 days at a time.

In some cases, there are reasons why the Social Insurance Fund has the right to reduce benefits , namely:

- if the patient violated the doctor’s recommendations;

- if the disease occurs due to alcohol or drug intoxication;

- if the patient did not come to the doctor for examination;

- if the court has proven that the disease arose due to intentional infliction of damage to health.

Sick leave period in 2021

A citizen employed in the public service or in a private company, when going on sick leave, has the right to be paid for missed days by the employer. This rule was introduced to provide social guarantees for citizens who temporarily become unable to work due to illness, injury, or the need to look after a child or dependent relative.

However, the amount of benefit payments does not have a fixed value for each person. The exact amount of payments depends on how much sick leave insurance the employee has. Let's take a closer look at how this works in practice and what rules apply when calculating.

To simplify calculations, you can use the calculator on our website.

It is enough to indicate the date of entry into service and dismissal from it, and you will receive accurate information that can be used in the future.

What is taken into account when calculating payments

The most important factor when calculating the amount to be paid for a period of incapacity for work for health reasons is the length of service of the citizen. Upon closer examination, you may be faced with the fact that there are two options for length of service used in determining working periods:

- Insurance – all periods of labor activity during which payments were made to the pension fund and social insurance fund are taken into account. It includes time periods when a citizen could be registered as an employee, individual entrepreneur or legal entity. The main thing is that insurance deductions are made;

- Labor – in this case, periods of work in the presence of an employment contract are taken into account. Thus, if a citizen was engaged in commercial activities as an individual entrepreneur, then this time is not taken into account.

The calculation takes into account the insurance period, the length of service for sick leave during which contributions were made to the state pension and social insurance fund. Based on the available information, the percentage of sick leave from the length of service is determined.

The total time of activity accompanied by insurance payments is taken into account. The amount of deductions depends on the total years of insurance coverage, while sick leave is paid taking into account the average daily earnings. The following accrual scale applies based on the insurance period:

| Did not find an answer to your question? Call a lawyer! Moscow: +7 (499) 110-89-42 St. Petersburg: +7 (812) 385-56-34 Russia: +7 (499) 755-96-84 |

- 6 months – 5 years – 60% of the average daily earnings for each day;

- From 5 to 8 years – 80% of the average wage;

- Over 8 years – 100% accrual from the average level.

If a period of incapacity for work arose due to an industrial injury or as a result of an illness resulting from hazardous production, then 100% of the average wage per day is paid. The same rule applies when paying maternity benefits.

Please note that the length of service required to pay sick leave in 2021 is determined based on all periods of insurance contributions, and not just on the last place of work. If a citizen moved to a new job and stayed there for 4 years, but before that he worked in other places and has a total work experience exceeding 8 years, then the employer does not have the right to pay benefits at the minimum rate. On the contrary, accruals must be made in 100% volume, since the employee has the necessary years of work with contributions to the Pension Fund and the Federal Social Security Service.

How to confirm your experience

In some cases, an employer may try to relieve itself of responsibility for paying benefits for new employees who have been with the company for 5 years or less by offering a minimum level of pay. If the employee’s total insurance coverage exceeds 8 years or more, then the existence of this period will need to be proven.

For confirmation, entries in the citizen’s work book are used, indicating the places and terms of employment. If the book is missing, filled out incorrectly or not filled out at all, then the following documents can be used for confirmation:

- Employment contracts with a standardized type of filling;

- Certificates from previous employers;

- Personal accounts indicating the transfer of funds;

- Extracts taken from orders for the enrollment and dismissal of an employee.

The main factor confirming the correctness of filling out the documents is the presence in them of the employee’s name, surname and patronymic, as well as the exact dates of entry and dismissal from service. In this case, the documents can be used to calculate the insurance period. If the company’s management refuses to recalculate even after providing the data, the problem can be resolved in court or pre-trial by submitting a complaint to the appropriate authorities. Confirmation may also be required for the Social Insurance Fund.

How to calculate length of service for sick leave

First of all, you will need to determine the total number of years with insurance contributions. These include the following periods:

- Official employment under contract;

- Self-employment as an individual entrepreneur or in another form of organizational activity, when contributions were made to the Social Insurance Fund and the Pension Fund of the Russian Federation;

- Child care - up to 1.5 years per child, but not more than 6 in total;

- Completion of military service.

If at one time a citizen was employed in several full-time or part-time jobs, then the period of time in only one organization is taken into account. An employee can independently choose the most beneficial option for him.

When making calculations, you need to be careful, since a discrepancy even of several days may attract the attention of FSS employees and require a re-count. To obtain accurate data, it is necessary to determine the exact number of working days for all periods, then calculate the number of months, taking into account that 1 month includes 30 calendar days, and 12 months make up 1 year. Further, based on the obtained figures, you can apply for one or another size of the sickness benefit payment coefficient.

Payment of sick leave to the unemployed

An unemployed person also has the right to receive benefits on a certificate of incapacity for work, but only if he is registered with the employment service (SZN).

The amount of insurance will depend on how long it has been registered. The long period of his registration makes it possible to calculate insurance based on the income that the employment service paid him. If the registration period is short, then the unemployed can contact the accounting department of his last place of work, where he will be given a certificate of income for the last two years. Benefits will be calculated based on them.

It happens that a person, while registered with the employment service, has had no income for the last two years. Then the compensation will be calculated according to the minimum wage (minimum wage), which will be 173.5 rubles per day.

As you can see, several structures are involved in the chain from the onset of temporary disability of an employee to the payment of compensation to him: a medical organization, an employer, and the Social Insurance Fund. In order to receive money on time, the recipient of the certificate of incapacity for work needs to be vigilant himself, trying to eliminate possible errors where he can check the data entered on the sick leave certificate.