What is a study holiday: general points

Not all employees who work in the company received education before employment. Often, employees go to school while working. At the same time, they need to be given time to pass exams, and the registration of such a period of release from work is the direct responsibility of the organization.

Leave is granted in the following cases:

- If an employee receives higher education in any of three areas or just enters a university (Article 173 of the Labor Code of the Russian Federation)

- If an employee receives a higher qualification at a university (Article 173.1 of the Labor Code of the Russian Federation)

- If the employee studies at an educational institution where he receives secondary vocational education or is just entering it (Article 174 of the Labor Code of the Russian Federation)

- Receives full-time and correspondence education at school (Article 176 of the Labor Code of the Russian Federation)

Also, when applying for study leave, you need to consider the following points:

- The employer provides all guarantees and payments only if the employee receives a certain level of education for the first time (Article 177 of the Labor Code of the Russian Federation)

- If an employee is studying in 2 places at once, then all payments and guarantees due to him are made only at one place of study

- The institution providing education must have a license

- In order to receive study leave, you must provide a certificate - calculation

- Study leave is granted for a certain period established by law and only at the main place of employment. The employer has the right to provide study leave for a longer period than provided by law

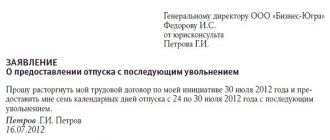

To apply for study leave, the employee must bring to the organization’s accounting department:

- Certificate - payment from the educational institution where the employee is studying

- Application for granting study leave for the period corresponding to the certificate - calculation

During the period of study leave, the employee is entitled to average earnings. It is calculated according to the same rules as for calculating regular vacations. The duration of vacation is calculated in calendar days, and all holidays that fall within the vacation period are subject to payment.

One of the documents that serves as the basis for providing time to take the exam is a certificate of payment from the educational institution. It has a strictly regulated form.

Legislative norms

To improve their skills and for career growth, many enterprise employees seek to obtain higher education.

During the period of passing exams or dissertations, student leave is required, but no one can guarantee that at such a crucial moment a working student will not get sick. According to current legislation, it is permissible to extend annual paid leave or transfer part of it to another period if an employee falls ill while on legal vacation.

But, if a subordinate’s incapacity for work occurs during vacation due to passing a session or defending a diploma at a university, then enterprise managers have questions regarding the extension of days of release from work and the calculation of benefits. To clarify such situations, you need to know what regulations govern the provision of student leave and their payment.

The legal framework is given below:

- Labor Code of the Russian Federation of December 30, 2001. In particular, we are talking about articles No. 124, 173-177, 183, 287;

- Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity”, adopted on December 29, 2006;

- Federal Law No. 323 “On the fundamentals of protecting the health of citizens in the Russian Federation” of November 21, 2011;

- Order of the Ministry of Health of the Russian Federation No. 624 “On approval of the procedure for issuing certificates of incapacity for work” dated June 29, 2011.

Sick leave is issued to all insured citizens of Russia. On its basis, the employee of the enterprise is issued a release from work and is awarded temporary disability benefits.

Sick leave for employees: general provisions

In 2021, there have been changes related to sick leave.

A sick leave certificate is a document that gives the right to receive monetary payment for the period when the employee was unable to work due to illness.

The payment of such benefits is enshrined in law, in Article 39 of the Constitution. The employer’s obligation to pay compensation for sick days in the presence of sick leave is prescribed in Article 183 of the Labor Code of the Russian Federation.

As a general rule, sick leave due to an employee’s illness is paid for the first 3 days by the employer himself, and the remaining days are paid for by the Social Insurance Fund. In most regions, direct payments are currently made, directly from the Fund directly to the employee.

The calculation is made for the last 2 years. The billing period is 730 days.

Sick leave is issued only to those employees who work officially and for whom contributions to the Social Insurance Fund are deducted.

Other cases when payment and transfer of vacation are not possible

Sick leave issued during maternity leave, as well as extraordinary unpaid leave, is not paid.

This is explained by the fact that payment for incapacity for work is already carried out during the period of maternity leave.

Sickness benefits during leave at your own expense are paid only after its completion, and the leave is not extended or postponed.

Also, study leave is not paid and cannot be transferred if sick leave was taken at that time.

Sick leave during study leave

Sickness benefit is a payment that is designed to support an employee at a time when he is unable to perform his work duties. Thus, in accordance with subparagraph 1 of paragraph 1 of Article 9 of Law No. 255-FZ, it is established that in the case when the employee’s earnings are retained, partially or in full, sick leave is not paid.

| IMPORTANT! If an employee falls ill during the non-working period for taking a session, then payment of sick leave benefits during this period is not provided. None of the legislative acts provides for such an obligation. |

Questions regarding sick leave pay during study leave may arise if the situation concerns sick leave due to pregnancy. However, here too the legislation puts an end to the disputes. According to FSS letter No. 02-10/11-6671 and Law No. 165-FZ, compensation is not accrued or paid during such a period.

All issues related to obtaining a second higher education are regulated by the employer himself. He can, at his own request, grant release from work, as well as keep his salary for the agreed time. .

Sick leave on unpaid or study leave

If an employee’s illness began during the period of study (or unpaid) leave and continued after it, then sick leave is paid from the day the employee was supposed to go to work. A situation is possible when an employee began to get sick while on educational or unpaid leave and returned to work after it ended. How much should the company pay him temporary disability benefits in this case?

The law defines calendar days for which sick leave is not paid *(1). Thus, it is not accrued for periods of release from work while maintaining average earnings (full or partial). The same rule is applied when releasing a person from work without maintaining average earnings. Consequently, during the period an employee is on study leave or on leave at his own expense, sick leave is not accrued or paid, unlike annual paid leave. If the illness occurs during this period, then benefits are accrued in the general manner.

An employee may fall ill during study (or unpaid) leave and continue to be on sick leave after it. In this case, all calendar days of illness are paid from the date when the employee was supposed to start work until the moment of his recovery. Example A company is engaged in manufacturing. She belongs to the 3rd class of professional risk and pays contributions for “injuries” at a rate of 0.4%, contributions for compulsory social insurance in the amount of 30%. Let’s assume that the company’s employees are not entitled to personal income tax deductions and are classified as persons born in 1967. and younger. Contributions paid to the Pension Fund are divided into financing the insurance (16%) and funded parts of the labor pension (6%). An employee of the main production took leave at his own expense for the period from 09/05/2012 to 09/11/2012. At the same time, on September 7 he fell ill. And I closed my sick leave on September 21. The duration of illness according to the certificate of incapacity for work was 15 calendar days. The employee's salary is set at RUB 55,000. per month. His insurance experience exceeds 8 years. Consequently, he receives benefits in the amount of 100% of his earnings. In this case, the employee is entitled to benefits for the period from September 12 to September 21 (10 calendar days). Sick days on unpaid leave (5 calendar days) are not subject to payment. The entire amount of the benefit is paid at the expense of the Federal Social Insurance Fund of Russia, since the benefit for the first three days of illness, which the company should have paid, is not paid to the employee. The company pays for days of temporary disability based on the legal maximum. Additional payments up to actual average earnings are not accrued. Let’s assume that the average employee’s earnings taken into account when determining the amount of benefits were: - in 2010 - 518,000 rubles; — in 2011 — 532,000 rubles. When calculating benefits reimbursed from the funds of the Federal Social Insurance Fund of Russia, the employee’s earnings are taken into account only within the legal maximum (in 2010 - 415,000 rubles, in 2011 - 463,000 rubles). The total amount of earnings taken into account will be: 415,000 + 463,000 = 878,000 rubles. Average daily earnings will be: 878,000 rubles. : 730 days = 1202.74 rub./day. The amount of benefits paid by the Russian Social Insurance Fund (10 calendar days) will be: 1202.74 rubles/day. x 100% x 10 k. days. = 12,027.4 rub. In September 2012, 20 working days. The employee actually worked 7 working days. Consequently, he will be accrued a salary in the amount of: 55,000 rubles/month. : 20 work. days x 7 work. days = 19,250 rub. These payments will be reflected in the company's accounting records: Debit 69 Credit 70 - 12,027.4 rubles. — the employee has received a benefit paid at the expense of the Federal Social Insurance Fund of Russia; Debit 20 Credit 70 - 19,250 rub. — the employee has received his salary for September; Debit 20 Credit 69 - 5852 rub. (RUB 19,250 x 30.4%) - social insurance and “injury” contributions to the Federal Social Insurance Fund of Russia are accrued from the employee’s salary; Debit 70 Credit 68 - 4066.06 rubles. ((RUB 12,027.4 + RUB 19,250) x 13%) - income tax is withheld from payments to the employee; Debit 70 Credit 50 (51) - RUB 27,211.34. (12,027.4 + 19,250 - 4066.06) - the employee was paid wages and benefits. Opinion. Additional payment up to average earnings. Are we included in expenses? Elena Sorokina, methodologist at the outsourcing division of BDO : The company paid for sick days based on the legal maximum. It turned out to be less than the actual average earnings, an additional payment was made. When making additional payments that improve the situation of employees, the company usually fixes them in collective or labor agreements. The additional payments prescribed in these documents make it possible to classify them as other types of expenses (clause 25 of Article 255 of the Tax Code of the Russian Federation), classify them as labor costs and include them in the calculation of the income tax base. The Russian Ministry of Finance, confirming this position, recalls that the list of costs established by Article 255 of the Tax Code is not closed (letter of the Russian Ministry of Finance dated 02/09/2011 N 03-03-06/2/30). Additional payments provided for by collective or labor agreements immediately fall into the number of payments made within the framework of labor relations and are subject to insurance premiums (Article 7 of the Federal Law of July 24, 2009 N 212-FZ). What if additional payments before actual earnings are not mentioned in any local act of the company? To prove that an employee’s income lies outside the scope of the employment relationship, it must be confirmed by an agreement establishing another type of legal relationship (for example, a lease or gift agreement). If such a document is missing, the employment relationship is the only framework within which the employee’s income can be considered. Therefore, additional payments before actual earnings during sick leave are subject to insurance premiums (letter of the Ministry of Health and Social Development of Russia dated March 23, 2010 N 647-19). The only exceptions are the amounts specified in Article 9 of Law No. 212-FZ. *(1) art. 9 of the Federal Law of December 29, 2006 N 255-FZ

You can read the full version of the article in the journal “Actual Accounting”, N 9, September 2012.

Extension of study leave during illness: possible or not

As you know, if an employee gets sick or takes sick leave at the time of annual leave, then the rest time will increase by the number of days of illness. Does this rule apply to study leaves?

Study leave is a special type of leave. To provide it, the employee brings to his employer a special document - a certificate - a summons. It indicates the duration of the period required to pass the session . In this case, the deadline for taking the next exam or defending a diploma is not postponed due to the student’s illness. An open sick leave cannot in any way affect educational activities. In this regard, payment is not made for the entire period of illness that coincides with study leave, and the leave itself is not extended.

Extension of leave for the period of illness is not enshrined in any legal act.

However, in case of serious illness, an employee has the opportunity to ask the institution where he is studying to extend his study leave. In this case, it is necessary to obtain a new certificate - a summons. In this case, the number of vacation days remains the same, and the employer provides the employee with the rest of the vacation.

Does sick leave during study leave affect the duration of the vacation?

Additional leave taken at one's own expense is not extended due to an employee's illness, just as the main annual leave is not extended due to receipt of a special certificate of incapacity for work to care for a sick child or relative.

Study leave, although not the main one, cannot be called additional, since the employer pays for it. Therefore, the law does not oblige employers to extend student leave due to the onset of a period of incapacity automatically, like annual leave. But when an employee presents a summons certificate taken from the university, which contains information about the extension of leave, the manager is obliged to increase its duration.

Questions are sometimes raised by the accounting procedure and payment of holidays that took place during the period of study leave. Please note that:

- holidays must be paid;

- Holidays do not increase the length of student leave.

An example of how sick leave issued during study leave can be paid

Despite the fact that sick leave during study leave is not payable, the following situation may arise.

Employee Petrov provided a certificate - a summons and wrote an application to be given time to take exams from June 25 to July 24. During this period, the employer paid the employee the average salary. From July 20 to July 29, the employee issued a sick leave. Thus, from July 20 to July 24, sick leave is not paid. The benefit is due for the period from July 25 to July 29.

Is sick time paid?

Study leave can be with or without pay. There are often situations when, during the period of release from work due to passing a test or preparing to enter a university, an employee falls ill and issues a sick leave.

When a subordinate provides the management of an enterprise with a certificate of temporary disability in order to pay for days of outpatient treatment, then the question arises whether benefits are due in such a case.

In accordance with the first part of the first paragraph of Article 9 of Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity”, sickness benefits are accrued only during the period of work or while on annual paid rest.

Study leave is an additional type of exemption from work, so benefits when passing an intermediate session or state exams are not provided by law. If you are absent from the workplace on weekdays, your salary is not provided, therefore, there is nothing to make contributions to the Social Insurance authorities, and accordingly, such a period cannot be compensated financially.

But it should be noted that in a collective agreement or regulatory act, the company’s management may provide for payment of sick leave during the period of student leave. In this case, money will be paid to the employee from the enterprise budget. But, as a rule, organizations do not make such changes regarding the payment of sick leave.

It is impractical and pointless to issue sick leave during study leave. Especially if a person is released from work for a long time and has time to regain the ability to work before the end of the vacation.

The exception is situations when the illness is protracted or a person develops at the end of the vacation period.

If an employee needs to begin performing his job duties, but is unable to due to a pathology, then a sick leave certificate is issued. According to it, days of incapacity for work after the end of student leave will be paid in the standard manner.

For example, Sergey Ivanovich Komarov, a leading specialist in the sales department, was on student leave for one month to take an intermediate session from January 25, 2021 to February 22, 2019. At the end of the holiday period, on February 20, 2021, he fell ill with the flu and took out sick leave.

The doctor issued a certificate of temporary disability to Sergei Ivanovich Komarov for the period from 02/20/2019 to 02/27/2019. The employee submitted a sick leave certificate to the Stroysvet enterprise in order to provide him with additional days off and payment of benefits. The head of the company issued a registration for S.I. Komarova. release from work from February 23 to 27. The employee was paid for this period based on the ballot.

Expert opinion

Irina Vasilyeva

Civil law expert

During study leave, all sick leave is not subject to financial compensation: those issued due to the illness of the employee himself or his child or close relative.

Fundamentals of legislation regulating the area under consideration

The main legislative acts that regulate the issue of sick leave payment during study leave are presented in the table.

| Rule of law | What regulates |

| Articles 173, 174, 176 of the Labor Code of the Russian Federation | Payment for study leave in the amount of the average salary |

| Law No. 255-FZ of December 29, 2006 | No benefits for sickness during study leave |

| Article 177 | Possibility of granting extraordinary study leave |

How is sick leave taken during study leave paid? If the period of temporary incapacity for work falls on the days of study leave, then benefits for these days are not paid. Sick leave is paid from the next day after the end of study leave. For employees who are sent for training by the employer or who independently enroll in state-accredited bachelor's degree programs, specialty programs or master's programs in part-time and part-time forms of study and who successfully master these programs, the employer provides additional leave while maintaining average earnings (Art. Art. 173, 174 Labor Code of the Russian Federation). In case of loss of ability to work due to illness or injury, employees are paid temporary disability benefits (Clause 1, Part 1, Article 5 of Federal Law No. 255-FZ of December 29, 2006). Temporary disability benefits in the cases specified in clause 1, part 1, art. 5 of Law N 255-FZ, is paid to insured persons (with the exception of insured persons who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 4.5 of Law N 255-FZ) for the first three days of temporary disability at the expense of the policyholder, and for the remaining period, starting from the 4th day of temporary disability, at the expense of the budget of the Social Insurance Fund of the Russian Federation (clause 1, part 2, article 3 of Law No. 255-FZ). The calculation of sick leave pay days begins from the date indicated on the certificate of incapacity for work (Resolution of the Eleventh Arbitration Court of Appeal dated July 22, 2019 No. 11AP-8125/2019 in case No. A65-2652/2019). The benefit is paid for calendar days falling during the period of incapacity for work, with the exception of certain periods. If the days of incapacity for work coincided with the period when the employee was released from work with full or partial retention of wages or without payment, then such days of incapacity for work are not subject to payment. The only exception is annual paid leave (Part 8, Article 6, Clause 1, Part 1, Article 9 of Law No. 255-FZ). In addition, the insured risk, that is, the alleged event associated with the onset of negative consequences for the insured person, is temporary loss of earnings (Part 1, Article 1.3 of Law No. 255-FZ). The onset of temporary disability during the period of study leave does not entail a loss of earnings for the employee, since the employee retains his average earnings during the period of study leave. Thus, during the period of study leave, temporary disability benefits are not assigned to the employee, since he was released from work while maintaining his average earnings. This benefit must be accrued to the employee from the next day after the end of study leave. At the same time, since the first three days of temporary disability are paid at the expense of the employer, the benefit for the remaining days is paid in full from the funds of the Federal Social Insurance Fund of the Russian Federation (clause 2, part 1, article 1.2, clause 1, part 2, article 1.3, clause 1 Part 2 of Article 3 of Law No. 255-FZ). The legislation of the Russian Federation does not provide for the extension of study leave for a period of temporary incapacity for work.

Example. Payment for sick leave opened during study leave

The employee wrote an application for study leave from December 25 to January 21, attaching a summons certificate. Vacation pay is calculated and paid to the employee. At the end of the study leave, the employee did not return to work, and on January 29 he brought a certificate of incapacity for work, according to which he was ill from January 16 to January 28. For the period from January 16 to January 21, temporary disability benefits are not assigned to the employee. The benefit must be accrued to the employee within seven calendar days - from January 22 to January 28.