Article of labor legislation regarding dismissal by agreement of the parties.

The basis for terminating an employment contract under Article 78 of the Labor Code of the Russian Federation “agreement of the parties” suggests that you can quit at any time previously agreed upon by both parties to the labor relationship.

There are a huge number of reasons that can initiate an employee’s dismissal by agreement of the parties, for example, taking another job, conflicts with company employees, etc.

An employer can also fire an employee for various reasons, if he is not satisfied with the quality of the employee’s work, it is intended to use more advanced production technologies, thereby reducing the number of employees, etc.

Something to remember! If the employment contract is terminated according to the wording “agreement of the parties,” neither the employee nor the employer is required to indicate a specific reason for dismissal.

Situation 3: an employee went on sick leave on the day of dismissal

Is it possible to fire me in this case?

An employer cannot, on its own initiative, fire an employee who is on sick leave (Part 6 of Article 81 of the Labor Code of the Russian Federation). But if this is the initiative of the employee himself, there are no obstacles (Article 80 of the Labor Code of the Russian Federation). Rostrud specialists confirm this (explanation on one situation and a similar one).

How to calculate the payout

When calculating, two circumstances must be taken into account.

First: the amount of benefits depends on the length of insurance coverage. If the employee’s insurance coverage is 8 years, then sick leave is paid in the amount of 100% of average earnings (Clause 1, Part 1, Article 7 of Federal Law No. 255-FZ of December 29, 2006). On the day of dismissal, the employment contract is still in force, which means you calculate benefits as if the employee were still working for you.

Send the FSS register via Extern for free

Second: if you first paid the employee, and then found out about sick leave, make sure that you do not pay for the same period twice. Sick leave compensates for the earnings that the employee lost due to illness. And if you have already paid him for this period as worked, it turns out that the earnings have already been received.

This position is confirmed by information from the official website of the FSS of the Russian Federation and judicial practice (Resolution of the Arbitration Court of the Ural District dated 08/15/2018 in case No. A76-27843/2017; Resolution of the Eighth Arbitration Court of Appeal dated 07/17/2019 in case No. A46-5081/2019). The court concluded that the day for which the salary was accrued is counted towards the three days for which the employer pays benefits.

Is it necessary for a resigning employee to work out his last full day at work?

The employee retains the obligation to work the last day at the enterprise in full and in the future, leave his work duties in accordance with the requirements of the labor regulations within the organization. If the person leaving does not do this, then, as a rule, the employer will not punish for this.

Are there any separate categories of citizens who can exercise the right to resign under the article “agreement of the parties”

This article of labor law applies to absolutely all employees.

Important! When registering a dismissal by agreement of the parties, you must obtain all the necessary signatures on the documents.

How long is sick leave paid after dismissal?

The calculation is carried out within a month from the date of submission of the sheet issued by doctors. If the form of this document does not comply with legal requirements, the employer has the right to return it to the employee to eliminate the deficiencies. After which a new month is given to calculate the payment.

The payment procedure is the same in all cases of termination of the relationship between the employee and the organization, that is, when a sheet is issued in the event of a reduction in staff, absenteeism, or agreement of the parties.

What are the positive aspects for an employee upon dismissal by agreement of the parties?

– the employee has the right not to work working days upon dismissal;

– the application may not indicate the reason for your dismissal;

– with an entry about dismissal in the work book “by agreement of the parties,” the employee’s positive reputation will be preserved;

– after dismissal for this reason, the employee will have another month of work experience;

– the wording of dismissal under consideration gives the right to contact the employment center and receive benefits for some time if another job is not found.

How is sick leave paid after dismissal?

When a person falls ill after dismissal, you should know that he may well have the right to payment for the sick leave received.

But each of the following conditions must be met:

- A medical document confirming the presence of illness must be issued within a month from the date of dismissal. More precisely, within the established 30 days;

- The benefit can be obtained by submitting a correctly executed medical document to the last employer, with whom the employment contract was terminated no more than six months ago;

- The former employee should not be employed; to confirm this fact, the employer must provide his passport or work book;

- A sick leave can only be your own, that is, such a document for caring for a relative or a child will not be paid after the termination of an existing employment contract (you can find out more about the procedure for calculating payment for sick leave for child care here:). The former employee will not achieve accrual even if the situation is difficult and the child or relative is in the hospital, where care needs to be provided. This is required by the law regulating this area, number 255-FZ.

The reason for dismissal can be any (own desire, absenteeism, staff reduction, agreement of the parties), the only exception is maternity leave, since this situation is regulated by other legal norms.

In view of all of the above, we can accurately state that the established opinion that sick leave is paid within a month after dismissal is far from the most accurate and objective information for those who recently terminated their employment agreement and fell ill.

If a citizen, after dismissal, is registered with any employment center, then he received the status of unemployed. And until a suitable job is found, this government body is obliged to make various social and insurance payments, including the situation when a person submits sick leave. Payment for disability at the employment center is required in an amount similar to unemployment payments.

Payment of sick leave after dismissal by agreement of the parties

The case of termination of an existing employment contract by agreement of the parties is special, since the company can terminate relations with the employee upon reaching the previously agreed date and the person’s health status will not play any role.

But the organization will still have the obligation to pay for the issued sick leave. Moreover, the procedure will be standard - the employer is obliged to pay the necessary funds if the doctor reports illness within the period established by domestic legislation - 30 days from the date of dismissal. You also need to remember that sick leave should be brought to the organization within six months. If this period is overdue by even a couple of days, then the former employee has nothing to hope for.

After dismissal, sick pay for child care will also not be paid. Since after the termination of the relationship by agreement of the parties, in fact, as in any similar situation, the law allows the organization to pay only for the illness of the employee himself. Calculation, accrual, payment will be completed within a month.

About payment in case of violation of the hospital regime, read the article:

Will sick leave be paid upon dismissal due to staff reduction?

In this situation, difficulties may arise, for example, if the employer ceases to exist, then within the month, and even more so in the six-month period allocated by law for payments, both in case of staff reductions and in any other case, the citizen will have no one to turn to.

In such a situation, you will need to go to the territorial body of the Social Insurance Fund, which will carry out the required calculations, accruals, and payments, and within the prescribed monthly period. Reduction of staff, in contrast to the agreement of the parties, is noteworthy in that the patient cannot be fired, at least the payment of the patient occurs at the very last moment.

In case of dismissal for absenteeism, is sick leave paid?

The situation with absenteeism is no different from other types of termination of relationships (downsizing, agreement of the parties, etc.). An employee whose employment contract was terminated due to absenteeism has the right to document his illness within the period established by law (30 days).

After which the organization will perform the calculation on the sheet. It should be remembered that only a document confirming that the former employee himself is sick will be accepted; care for a relative or child will not be paid, even if applied within the allotted period.

What are the negative aspects for an employee when dismissed by agreement of the parties?

– this wording of dismissal allows you to dismiss an employee even in a situation where termination of an employment contract is prohibited by labor legislation;

– an employee will not be able to change his decision to dismiss if the application for dismissal by agreement of the parties has already been signed by the head of the enterprise;

– judicial structures with such a formulation of the reasons for dismissal always side with the employer.

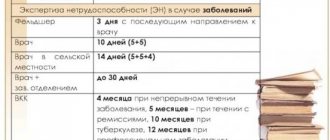

What will be the amount of payment for a certificate of incapacity for work?

In a situation where an employee falls ill while still in an employment relationship with the employer, the sick leave benefit is calculated in accordance with the employee’s length of service.

How does length of service affect the amount of temporary disability benefits?

| Length of employee experience, years | Corresponding percentage of payments from the average salary, % |

| Less than 5 years | 60,0% |

| From 5 to 8 | 80,0% |

| More than 8 years | 100,0 |

Situation 1: an employee quit, didn’t get a job, and a week later went on sick leave

Who pays the benefit

Sick leave is paid if the insured event occurred when the person was employed and within 30 calendar days after dismissal (Clause 5 of Federal Law No. 255-FZ of December 29, 2006). The first three days are paid by the employer, now a former one, the rest is paid by the Social Insurance Fund (clause 3, 255-FZ). This rule applies to sick leave listed in Part Art. 5 255-ФЗ:

- sick leave due to illness or injury;

- patient care;

- quarantine of the insured person or his child;

- prosthetics;

- aftercare.

A former employee can apply for such benefits within 6 months from the date of restoration of working capacity or establishment of disability (clause 5, clause 12 of the 255-FZ).

In case an employee got another job, but did not tell you about it, you can take a statement from him confirming that at the time of going on sick leave he was not working anywhere. If it later turns out that this is not so, the FSS will have claims against the employee, and not against the company.

If your situation is different, the Standard. They will answer you within 24 hours - in detail and with links to laws.

How do we calculate benefits?

We make the calculation based on 60% of average earnings. The employee's insurance length is not taken into account (Part 7, 255-FZ).

On June 1, Vasily left the company after working for 12 years. On June 5 he was on sick leave. His benefit was calculated based on 60% of his earnings, although his insurance coverage was more than 8 years.

How do we reflect such benefits in accounting?

After an employee quits, payments must be made to account 76 “Settlements with various debtors and creditors”, and not 70.

Since the employee is no longer involved in the main activities of the company, his benefit is not related to the sale of goods, provision of services or performance of work (clause 5 of PBU 10/99). This means that the costs can be attributed to other expenses (clause 12 of PBU 10/99).

Accounting records are prepared:

- calculation of benefits - Dt 91.2 Kt 76;

- personal income tax calculation - Dt 76 Kt 68;

- payment of benefits - Dt 76 Kt 51 (50).

How to fill out the FSS register

When creating the Register of Information, in column 32 you need to indicate code 47 (Appendix No. to the FSS Order No. 26 dated 02/04/2021). In the field of the certificate of incapacity for work “Calculation conditions”, code 47 is also indicated.

How to fill out the “Calculation conditions” field on sick leave for a dismissed employee