Have you ever been given a sick leave certificate at a medical facility? If not, then you are probably a lucky person. If yes, then you most likely noticed that instead of a text description, all sorts of uniform codes were used. For example, very often this document indicates code 02 as the cause of disability, the decoding of which remains a mystery to many ordinary people. Let's try to figure out what information may be hidden behind the numbers. Moreover, it is not at all difficult. We will also find out how sick leave is issued (cause of incapacity for work - code 02).

What is written on a sick leave sheet

The following data is entered into a document such as a certificate of incapacity for work:

- Full name of the sick patient (the basis is an identity card, namely a passport).

- The date, month and year of his birth.

- Floor.

- Name of the organization (factory) where the patient works (based on the patient’s words). If the patient works for an individual entrepreneur or is one himself, then the full name of the employer is indicated in this column.

- Information about where the sick leave was issued: at the place of work or residence.

- Patient Taxpayer Identification Number.

- Reason for disability.

- Date of opening and filling out sick leave.

- The period during which a person was unable to work.

- All kinds of violations of the regime.

- Other information.

- Conditions for calculating cash benefits.

All codes in the document, starting from the first to the penultimate one, are entered by the doctor who opens the sick leave. But the conditions for calculating disability benefits (in coded form) are entered by the employer, namely the employee dealing with these issues.

How to report to the Social Insurance Fund on sick leave with code 04 (work injury)?

I.I. Grechenko, author of the answer, Ascon consultant for accounting and taxation

QUESTION

The employee received an industrial injury, at first he was on sick leave under code 04, then the sick leave was extended under code 01.

When to send information to the Social Insurance Fund - when an employee returns to work or every time he calls in sick? What periods must be included in sick leave and are codes 01 and 04 summed up?

ANSWER

The company is obliged to report the incident to the territorial branch of the FSS of the Russian Federation within 24 hours. In other words, the organization is obliged to report the incident once.

The basis for payment of benefits for an industrial injury is sick leave with code “04” in the line “Cause of disability” and act N-1.

Taking into account the above, I believe that sick leave days with code “04” must be counted separately from days of incapacity for work with code “01”.

Information about the benefit paid is reflected in the reporting form 4-FSS, which must be submitted to the territorial body of the FSS of the Russian Federation no later than the 25th day (if submitted electronically) and the 20th day (if in paper form).

JUSTIFICATION

An industrial accident is an event as a result of which an employee received injury or other damage to health in connection with the performance of work duties (paragraph 10 of Article 3 of Law No. 125-FZ). If the injured employee is subject to compulsory social insurance, then the industrial accident is recognized as insured (part 7 of article 229.2 of the Labor Code of the Russian Federation).

In this case, the company is obliged to report the incident to the territorial branch of the FSS of the Russian Federation within 24 hours (clause 6, clause 2, article 17 of Law No. 125-FZ).

The form of the message is given in Appendix No. 1 to Order of the Federal Insurance Service of the Russian Federation dated August 24, 2000 No. 157 “On the creation in the Social Insurance Fund of the Russian Federation of a unified system for recording insured events, their analysis and determination of the amount of discounts and allowances to insurance rates, taking into account the state of labor protection.”

The basis for payment of benefits for an industrial injury is sick leave with code “04” in the line “Cause of incapacity for work” and act N-1 (clauses 58, 66 of the Procedure for issuing certificates of incapacity for work).

Calculate the average daily earnings for this benefit from all payments for the billing period for which contributions for injuries were accrued. And since there is no maximum base for them, the average daily earnings are not limited in any way.

The benefit does not depend on length of service - always calculate it from 100% of your average daily earnings.

The maximum benefit amount is practically unlimited. From 02/01/2019, the limit is RUB 309,135.44. per month. This benefit can only be received by those whose annual earnings exceed 3.5 million rubles. (Clause 2 of Article 9 of Law No. 125-FZ).

For the rest, consider the benefit as for a regular illness.

Pay the benefit for an industrial injury in full, including the first three days, at the expense of the Social Insurance Fund, reducing the accrued contributions for injuries (clause 7 of Article 15 of Law No. 125-FZ).

The benefit is fully subject to personal income tax, but not subject to insurance contributions (clause 1 of article 217, clause 1 of clause 1 of article 422 of the Tax Code of the Russian Federation).

The report on Form 4-FSS in Table 3 reflects if you paid insurance coverage to individuals, for example, temporary disability benefits due to an industrial accident.

Taking into account the above, we believe that sick leave days with code “04” must be counted separately from days of incapacity for work with code “01”.

This calculation must be submitted to the territorial body of the Federal Social Insurance Fund of the Russian Federation no later than the 25th (if submitted electronically) and the 20th (if submitted in paper form).

Why do you need to encode information?

What is the purpose of coding? And it is as follows:

- fully preserve confidential information about the patient’s illness;

- minimize the likelihood of any counterfeit;

- desire to use medical forms economically and compactly;

- have the opportunity to cooperate with various medical institutions abroad;

- significantly simplify (sometimes a doctor’s handwriting is very difficult to read) and optimize the activities of HR workers.

On a note! Not only the personnel officer, but also the patient himself can familiarize himself with the decoding of these codes: it is presented on the back of the sick leave. Just turn it over and read it.

Who needs these codes

The most important part of the certificate of incapacity for work is the columns in which codes are entered indicating certain reasons why patients cannot be at work and carry out their professional activities as usual. Several cells are allocated for this encoded information:

- the first two are the main code (numbers from 01 to 15);

- the next three are an additional code (numbers from 017 to 021);

- the final two are a clarifying code (fixed if the diagnosis has been clarified).

Why do you need to use so many codes? Who needs them? And they are needed both by medical workers and by management (that is, the employer).

What are the additional three-digit numbers and what do they mean?

Three-digit numerical values are added to the main code “02”, which are also recorded in special cells on the sick leave sheet. Codes:

- «017» – treatment in a special medical institution.

- «019» – therapeutic treatment in rehabilitation clinics.

- «021» – release due to illness or injury caused while intoxicated (drugs, alcohol or toxic).

In the event that a two-digit code fully indicates why the employee was not present at the workplace, the additional three digits are not written. But if you need to indicate an additional one, the doctor enters it immediately after the main code.

Basic codes

So, let's take a look at the list of basic codes that the doctor writes in the first two cells of the medical document:

- 01 – the presence of any disease that does not require the patient to be at work.

- 02 is a sick leave code indicating a person’s incapacity for work as a result of being injured.

- 03 – quarantine is declared, preventing a person from being at work.

- 04 – the patient received an injury (or consequences after it) directly at the workplace.

- 05 – leave was granted for the period of pregnancy and childbirth.

- 06 – the need for prosthetics in a medical hospital.

- 07 – exacerbation of a previously identified disease or detection of an illness associated with professional activity.

- 08 – rehabilitation period in a sanatorium after an illness.

- 09 – exemption from work, which is issued in case of caring for a sick close relative.

- 10 – other circumstances entailing the release of a person from the need to be at the workplace.

- 11 – a disease specified in a special list (for example, mental disorder, hepatitis, diabetes mellitus or other similar ones) approved by the government.

- 12 – the need to care for a child (under 7 years of age) who has one of the ailments listed in the list of diseases approved by the Ministry of Health and Social Development.

- 13 – presence of disability in a child who needs care.

- 14 – a case when a child is diagnosed with a malignant disease or certain complications arise after vaccination.

- 15 – caring for a child with HIV infection.

How is a domestic injury paid?

When calculating the amount for sick leave, the following are taken into account:

- insurance experience;

- average earnings for the last two years;

- the number of sick days indicated on the sick leave form.

The bulletin is issued regardless of where the patient is being treated:

- outpatient;

- in a day hospital;

- in a hospital setting.

The number of days of incapacity for work is counted in calendar days, including weekends and holidays.

For minor injuries, sick leave is given for 3 days. Read about paying for sick leave for child care in this article.

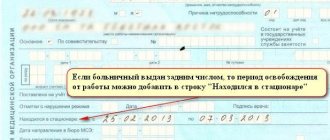

The period for which a certificate of incapacity for work is opened in the event of a domestic injury has limitations, as with other diseases:

- over 15 days is extended by decision of the medical commission;

- if painful phenomena persist and there is no positive prognosis after 4 months, a medical and social examination is appointed to resolve the issue of disability;

- in some cases, the VKK may extend sick leave for a maximum period of up to 10 months.

Injury means the inability to perform specific job duties, which is taken into account when the patient is discharged.

For example, if an office worker has a cut on the left hand, sick leave will be issued for the period when daily dressing changes are required in a clinic. Final healing will take place at the workplace. If there is a similar wound on the right hand, which is the working hand, then the certificate of incapacity for work will be closed during the final adjustment. Find out about calculating temporary disability benefits here.

For injuries to the head, upper limbs, and torso, discharge occurs after removal of the sutures. Such decisions are not regulated by law. The attending physician accepts them based on the appropriateness and health status of the patient. You should also know that only a doctor can correct an error on a sick leave certificate.

If a domestic injury occurs during the employee’s regular vacation, then sick leave during the vacation is issued and paid on a general basis. The vacation period is extended by the number of days noted in the bulletin.

Diseases not related to domestic trauma

Code 02 is not entered if there is:

- exacerbation of a chronic disease;

- infectious infection;

- oncology;

- emergency surgery;

- planned operations.

- caring for a sick child or other family member;

- injury at work;

- isolation due to quarantine;

- childhood diseases.

The causes of disability listed above are coded 01, 03, 04, 07, 09, 10, 11, 12, 13, 14, 15.

Additional codes

Now let’s find out what additional codes are put down in the next three cells of the disability sheet:

- 017 – the need for treatment in a special-purpose medical institution.

- 018 – staying in a sanatorium (or resort) after undergoing treatment for an injury received as a result of an accident at work.

- 019 – therapeutic activities carried out in rehabilitation clinics.

- 020 – maternity leave provided in addition to the main one.

- 021 – release due to illness or injury resulting from intoxication (drugs, alcohol or toxic).

Important! If the reason for the employee’s absence from his place is fully reflected in the first two cells of the sick leave sheet, then the next three do not need to be filled out. But if such a need exists, then the medical worker enters both the main code and the additional one.

Decoding numbers: what does it mean?

An entry with code “02” means that the insured person received a domestic injury not related to work. That is, the damage to the body occurred during non-working hours and not at the workplace.

The cause of disability is indicated by two main codes and five explanatory codes: addition code “3” and change code “2”. Diseases are indicated by codes from “01” to “15” (read more about what it means and how to decipher an entry on a sick leave certificate with code 01 here).

The amount of the benefit mostly depends on the code written on the sick leave certificate . If disability is assigned, then the reason due to which the health of the insured person was impaired is indicated.

Payment of sick leave for a domestic injury

What is sick leave? This is a medical document that indicates the reasons for a person’s temporary disability and on the basis of which he can receive (for the entire period of absence from work) a certain amount of money.

How is sick leave paid? That is, what factors are fundamental in determining the amount intended to be paid to the employee?

- The insurance record of the person presenting sick leave for payment. Moreover, if this length of service is up to 5 years, then the amount of the benefit will be equal to 60% of the average salary; if from 5 to 8 years, then the employee receives 80% of the PPP; and if more than 8 years, then he has a chance to get 100%.

- Average annual earnings.

Important! Keep in mind that there are significant limitations in determining average earnings per year. So, in 2021, its largest amount was 670,000 rubles. That is, even if, during the actual calculation, your average annual income significantly exceeds this figure, the value that is officially determined to be the highest will be taken into account in the calculation of hospital compensation.

- Average daily earnings.

- The number of days during which the employee may be absent from work.

Important! If the reason for the employee’s absence is illness (for example, the flu) or a domestic injury, then payment for the first three days is the responsibility of the employer directly, and the subsequent days are paid exclusively from the Social Insurance Fund (SIF) - see Law No. 255-FZ (clause 1, part 2, article 3).

Code 02 on sick leave - what does it mean, explanation

This code, in contrast to code 01, means a traumatic injury to the insured person during non-working hours/not at the workplace or otherwise - an injury received at home. Read about calculating sick leave for pregnancy and childbirth here.

Types of domestic injury:

- bone fracture;

- spine;

- sprain, affecting the ability to move and perform hand movements;

- burns;

- cuts with large blood loss;

- penetrating wounds;

- frostbite;

- bruises with hematoma formation;

- concussions with characteristic signs;

- dislocations of joints with impaired motor function.

In the video - sick leave payments:

These reasons for the employee’s absence from the workplace are considered valid and are subject to payment in accordance with the general procedure.

Example of calculating hospital compensation

Theoretically, of course, everything is extremely clear. Let's see how in practice you can independently determine the amount due to you.

Let's say citizen Ivan Ivanovich Ivanov was absent from work due to a domestic injury (or due to the flu) for 10 days (note, calendar days). Ivan Ivanovich’s average daily earnings is 1,600 rubles, and his insurance experience is 7 years. The benefit amount will be 12,800 rubles (1,600 x 10 x 80%). Of these, 3840 rubles (1600 x 3 x 80%) will be paid by the employer, and the remaining amount will be 8960 rubles from the Social Insurance Fund.

Deadlines for submitting sick leave to guarantee receipt of benefits

A sick leave certificate issued due to illness, disability - code 02 (deciphering is presented above) - or for other circumstances, the employee must present before six months (or rather, 6 months) have passed from the date indicated in the medical document (and exactly in the column “by what date”).

Remember! In case of delay, sick leave benefits are not paid. For example, if the last day on sick leave is May 15, then the latest date for presenting the document is November 15. If you do this even a day later, you will not receive benefits.

What is the code on the sick leave certificate?

It is important to enter the code correctly on the sick leave certificate.

Today, new forms of certificates of incapacity for work are used; when filling them out, a medical professional indicates the cause of the disease by recording the corresponding set of digital values.

This method of data entry helps save time for the medical worker himself, as well as for the company’s accountant, who will be involved in calculating hospital payments.

The list of such codes is established by the Ministry of Health and Social Development in Order No. 347n.

Based on the norms of this document, the code used when filling out a certificate of incapacity for work for a person injured at work is entry 04.

Number of days for which benefits will be paid

There are certain deadlines for assigning and paying sick leave:

- The period for consideration and assignment of benefits is 10 calendar days. The countdown begins from the day the sick leave is presented. This is stated in Law No. 255-FZ (Part 5, Article 13, Part 1, Article 15).

- Payment of benefits is made at the earliest (after it is assigned) date of payment of the next salary in accordance with the same Law (Part 8, Article 13, Part 1, Article 15).

On a note! For each day of delay, you have the right to demand compensation in accordance with the Labor Code of the Russian Federation (Article 236).

Number of paid days on sick leave

If an employee is sick or absent from work due to disability - code 02 (explained above), then the benefit must be guaranteed to be paid for the entire period of exemption from performing his professional activities (or more precisely, for all calendar days indicated in the medical document) . This is clearly stated in Law No. 255-FZ (Part 1, Article 9). Moreover, there are no restrictions on the maximum duration of the paid period. The only exceptions are sick leave benefits for employees hired for temporary work or with disabilities.

Important! If an employee falls ill or is absent from the workplace due to incapacity for work - code 02 (explained above) during the next paid leave, then benefits are paid for the entire period of incapacity for work. The vacation (by agreement) is either extended or postponed to another convenient time. This seems very fair.

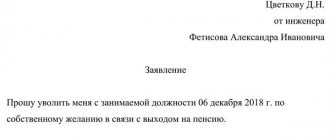

Documents for registration of industrial injury

It is necessary to collect a certain package of documents.

When the commission, after conducting an investigation, determines that the employee has suffered an injury that is considered work-related, the person has the opportunity to receive additional monetary benefits.

To receive them, you must collect a package of documents established by law and submit them to the FSS.

To receive funds, the following documents are required:

- completed application (form 1);

- conclusion of a medical expert commission on the level of lost ability to work;

- a document containing data on the need for medical rehabilitation and its program;

- certificates that indicate the costs of treatment and rehabilitation of the injured person.

The above documents are submitted directly by the employee.

To assign and transfer funds, a certain package of information must be submitted by the employer to the Social Insurance Fund. This information includes:

- An order to create a commission at the enterprise to investigate the accident. In cases where the activities of such a commission have been extended, an order is required to change the timing of the investigation;

- An act, the form of which is established by Resolution of the Ministry of Labor No. 73 of October 24, 2002. Please note, when there are several victims, or there is a death, an act is filled out, form 4;

- A medical document that contains information about the injury and its severity. In cases where the employee died as a result of an injury, a death document is provided;

- A person’s employment document containing data on the period of employment and the concluded agreement between the employee and the organization (copies are provided);

- Work schedule of the person;

- Document on site inspection (photos and video materials attached);

- Documents that reflect information received from eyewitnesses of the incident;

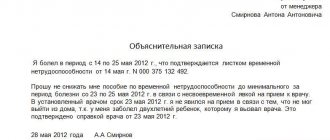

- An explanatory note drawn up by the victim himself;

- Extract from the journal on safety briefings;

- Form 8, in which, after issuing a certificate of incapacity for work, the consequences of the injury must be reflected.