What marks should also be made?

Let's consider both options. First, the employee was immediately discharged. The following marks must appear:

- Opposite code 24 in the line “Note about violation of the regime” should be the date of the missed appointment.

- Next in the table “Exemption from work” there should be a period - from the date of open sick leave to the date of the missed appointment.

- In the “Other” line, the code “36” is entered, which means “Apparently able to work” and the date the employee arrived for the appointment.

- Appointment date after no-show.

- The “Get Started” line will be empty.

- The “date” line will indicate the day on which the employee must appear.

The second option is extended sick leave:

- The date of the missed appointment will appear in the line “Note about violation of the regime.”

- The “Other” line will be blank.

- The “Start work” line will indicate the employee’s discharge date.

- Days of non-appearance of an employee after the date when he did not come for a scheduled examination, but came on another day (suppose there were 21 examinations, and the patient did not show up on that day - he came on the 23rd). These days must be entered in the “Exemption from work” table and signed by the doctor and the chairman of the medical commission.

Proper registration and correct filling of all fields of the sick leave certificate will help to avoid delays in the payment of compensation. Read our materials about how the period of incapacity for work is paid with codes 04, 01, 02, 09, 11, 05 and 020, as well as 31 and 32 in the “Other” column.

How to write code 36 and 24 on a sick leave certificate?

Markova did not come on the day prescribed by the doctor, January 19, but appeared on January 24, already completely healthy. The sick leave certificate contains code 24. The commission found the reason for non-appearance to be unjustified. Guardian – 9 years. The sick leave note contains the following marks:

- Code 24 with the date 01/19/2018,

- In the table “Exemption from work” the period is from 01/14/2018 to 01/19/2018,

- In the “Other” line, code 36 with the date 01/24/2018,

- The “Get Started” line is empty.

We calculate the allowance:

- From January 14 to January 18, we count as usual:

Markova’s income was 482,000 rubles in 2021, and 490,000 rubles in 2021.

How to pay if the “other” line contains this encoding?

The accountant must calculate the sick leave within 10 days after the employee brings him the certificate. The size of the payment depends on average earnings over 2 years.

The calculation is made as follows:

- The minimum and maximum amount of an employee’s income for the last 2 years (or from the date when contributions to the Social Insurance Fund began) is divided by 720 (the number of working days for 2 years).

- Then you need to calculate the minimum average daily earnings: the number of months over two years / 730.

- Multiply this amount by the number of days on sick leave.

- Multiply the result obtained by the experience coefficient.

This amount will be the payment of the employee’s sick leave. Sick leave is paid in fractions: the first 3 days are paid at the expense of the Social Insurance Fund, the subsequent days at the expense of the employer.

Example 1: An employee fell ill on October 13th. He had to come for an appointment on October 20, but he showed up on October 21 and was healthy. Payment will be made from October 13 to October 20 at the usual rate (based on all salary points).

Example 2: An employee came for an appointment on a different day (let’s say he needs to come to see a doctor on 22, but he came on 24) and was declared incapacitated. This means that the sick leave will consist of two parts.

It is necessary to pay for all days, but starting from the date that the employee did not come to the appointment, reduce the payment based on the minimum wage (clause 1, part 2, article 8 of the Law of December 29, 2006 No. 255 - Federal Law) i.e. – make a payment not exceeding the employee’s monthly salary.

Despite the fact that the employee did not show up for the appointment, i.e. - this day is not noted on the sick leave, it should still be paid, because in fact he was on sick leave.

Registration of sick leave is a serious procedure that requires the appropriate knowledge of an accountant or medical professional. You must be careful when filling out the codes.

If you find an error, please select a piece of text and press Ctrl+Enter.

Payment of sick leave in case of non-compliance with the regime

After the employee has submitted to the employer a closed certificate of incapacity for work with a note about the existing deviation from the regime, it must be established what was the reason for this. an explanatory note addressed to his employer.

with an explanation of what happened.

It is worth considering that the reason could be either a valid reason or an insufficient one to justify it. The first category of reasons, the reality of which may sometimes need to be proven, includes the following events:

- baby care;

- funeral of a relative or friend;

- poor health, which did not allow the patient to visit the medical center. institution.

If the employer considers that the reason for violating the regime is valid, then he must issue an official order

, in which a direct instruction is given to the accountant that the amount of accruals on the certificate of incapacity for work must be kept unchanged on the basis of the employee’s explanatory note.

Next, we will analyze how sick leave is paid in the event of legal claims against an employee.

Algorithm for calculating benefits in case of violation of the regime

In situations where the patient does not present a valid reason as a result of which he was forced to neglect the rules of staying on the ballot, the amount of the benefit is reduced. In such situations, payments will be calculated as follows:

- The billing period

is determined . The basis is earnings for the 24 months preceding the opening of the certificate of incapacity for work. To pay for sick leave with violation of the regime in 2021, this period is 730 days. - Average earnings

are calculated . To do this, add up all the amounts received by the employee for the specified period, from which the employer made contributions to the Social Insurance Fund. The resulting total is then divided by 730. - The next step is calculating

disability compensation. Its size depends on the length of the insurance period.

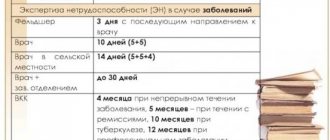

| Insurance experience | Amount of benefit |

| up to 6 months | not less than the minimum wage (minimum wage) |

| from six months to 5 years | 60 % |

| from 5 to 8 years | 80 % |

| more than 8 years | 100 % |

Formula for calculation:

| daily average earnings | × | volume benefits | × | amount of days disability |

Let's give an example

: gr. K. has closed sick leave for 10 days, her insurance experience is 15 years, her total earnings for the previous 2 years are 400 thousand rubles. Therefore, compensation for sick leave = (400,000 rubles / 730 days) × 100% × 10 days = 5479.45 rubles.

- If a deviation from the regime was made, then the amount of the benefit before the date of violation is calculated using the above formula. Payment after this date until the end of the period of incapacity is calculated depending on the minimum wage. For reference

: from July 1, 2021, the federal minimum wage is

7,800 rubles

. This is a minimum value; in constituent entities of the Russian Federation it may be higher. Therefore, payments are calculated depending on the minimum wage of a particular region.

We will calculate benefits in case of non-compliance with the regime

using the example of the previous paragraph. Let's say gr. K lives in the Amur region (minimum wage = 7800), she did not show up on time for an appointment with a doctor, as a result of which she was charged with violating the hospital regime under code “24”. This happened on the 8th day from the beginning of the opening of the certificate of incapacity for work.

Calculation:

- from days 1 to 7, accruals are calculated according to the standard scheme: (RUB 400,000.

Types of codes

Most of the fields of the document are filled in by the doctor of the medical institution, and some fields are filled in by the responsible person or an accounting employee. First of all, the doctor fills out the fields indicating the reason for receiving a certificate of incapacity for work and a note about violation of the regime. A sick leave may be issued for the following reasons:

- 01 – illness;

- 02 – injury not related to work;

- 03 – quarantine due to illness;

- 04 – industrial injury;

- 05 – gestation;

- 06 – production of prostheses in stationary conditions;

- 07 – disease from the list of occupational diseases;

- 08 – treatment in a sanatorium;

- 09 – caring for a disabled or disabled person;

- 10 – poisoning;

- 11 – disease from the list of social diseases;

- 12 – illness of a child under 7 years of age;

- 13 – caring for a disabled child;

- 14 – dangerous symptoms in a child as a result of the vaccine;

- 15 – HIV code.

Code 01 is the most common. It denotes any disease with the exception of diseases included in the special lists of the Ministry of Health. Domestic injuries and accidents not related to the patient’s work are coded 02. All types of quarantine for infectious diseases are coded 03. Industrial injuries include not only injuries received directly at the workplace, but also those received on the way to or from work.

Code 07 is set if the patient is diagnosed with a disease from a special list. The Ministry of Health document lists all possible diseases associated with the patient’s professional activities. These include toxic hepatitis, metal fever, berylliosis, silicosis and many others. Code 11 implies the presence of a social disease. On this list, tuberculosis comes first, followed by hepatitis, malignant neoplasms and diabetes. After an unsuccessful vaccination, a child may develop negative symptoms. This is indicated by code 14.

Codes 14 and 15 can be entered on the sick leave sheet only with the patient’s permission. If a child is diagnosed as HIV-infected, the parents or guardian can give permission to enter the appropriate code.

If a certificate of incapacity for work is issued to care for a child, the relationship is coded in special cells:

- 38, 39 – mother or father, respectively;

- 40 – person appointed as guardian;

- 41 – trustee;

- 42 – any close person caring for the patient.

Important for receiving insurance payments are the fields where any violations of the treatment process are noted using digital codes. They may reduce the insurance compensation you receive.

- 23 – violation of the treatment process;

- 24 – failure of the patient to see his doctor within the specified period;

- 25 – going to work without a sick leave certificate;

- 26 – refusal of the patient to visit the medical commission;

- 27 – late arrival at the commission;

- 28 – violations that are not on the list.

Violation of the treatment process means refusal of prescribed medical procedures, replacement of a drug, non-compliance with a regimen, or unauthorized leaving of a medical institution.

On the certificate of incapacity for work there is a column “Other”. The following codes are entered there:

- 31 – issuing an additional sick leave to the patient (continuation of illness);

- 32 – the patient has been diagnosed with a disability;

- 33 – disability group changed;

- 34 – the patient died;

- 35 – refusal of the medical commission;

- 36 – the patient did not arrive for the appointment, but was declared healthy at the next visit;

- 37 – upon completion of inpatient treatment, the patient was sent for follow-up treatment.

Filling out sick leave by the employer with a violation of the regime and indicating code 36

/ 730 days) × 7 days = 3835.62 rubles;

Important

: if there were 30 days in a month, then the minimum wage is divided by 30. If the period after the fact of the violation affects 2 months, then a

separate calculation

. Let’s say the violation occurred on August 31, 2021, in this case the calculation will be carried out on the basis of one day in August and two days in September:

- (7800 rub. / 31 days × 1 day) + (7800 rub. / 30 days × 2 days) = 251.61 rub. + 520 rub. = 771.61 rub.;

- total benefit amount if there are 31 days in a month: 3835.62 rubles. + 754.84 rub. = 4590.46 rub.

It is obvious that violation of the sick leave regime quite significantly affects the material interests of the violator.

In accordance with paragraph 5 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n, the issuance and extension of certificates of incapacity for work is carried out by a medical worker after examining the citizen and recording data on his state of health in the medical record of an outpatient (inpatient) patient, justifying the need for temporary release from work.

According to Part 8 of Article 6 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, temporary disability benefits are paid to the insured person for calendar days falling on the corresponding period, for with the exception of calendar days falling within the periods specified in Part 1 of Article 9 of the said Law.

Taking into account this definition and the provisions of Article 13 of Federal Law No. 255-FZ of December 29, 2006, temporary disability benefits paid on the basis of a certificate of incapacity for work are calculated for calendar days falling on the period of temporary disability specified in a specific certificate of incapacity, which is calculated from the first to the last entry in the table “Exemption from work”, i.e. the period when the citizen was examined by a doctor.

Including a period of temporary disability on the certificate of incapacity for work when the citizen was not examined by a medical professional and was declared able to work at the next visit to the doctor, as in the first example, is unjustified, since this requirement is not provided for by the Procedure.

At the same time, if, after an untimely visit to the doctor, a citizen is still recognized as incapacitated at the next visit to the doctor, then the period of failure to appear to the doctor is entered on the certificate of incapacity for work. This is due to the fact that, in accordance with the decision of the medical commission, in this case the provisions of paragraph 14 of the Procedure can be applied and the issuance of a certificate of incapacity for outpatient treatment is carried out with the inclusion of the past days in the “Exemption from work” table.

Otherwise, if the period of non-appearance is not written down in the certificate of incapacity for work, then the citizen who appears for the next examination by a doctor and remains disabled will not be paid benefits for the period of non-appearance, which is a violation of the norms enshrined in Articles 7 and 8 of the said Law.

Registration of a certificate of incapacity for work in the event that a citizen, after the issuance or extension of a certificate of incapacity for work, does not appear for an appointment, is carried out in accordance with Chapter IX of Procedure No. 624n. If at the next visit the citizen was recognized as able to work, the code “24” is indicated in the “Notes on violation of the regime” line of the certificate of incapacity for work, the date of untimely attendance at the doctor’s appointment is indicated in the “Date” line, the corresponding code is indicated in the “Other” line in the corresponding cells “36” and the date of appearance as able-bodied.

If the citizen is incapacitated for work, then the specified code “36” is not entered on the certificate of incapacity for work and the line “Other” with the allocated cells is not filled in.

In these cases, the provisions of paragraph 2 of part 1 and paragraph 1 of part 2 of Article 8 of the Federal Law of December 29, 2006 No. 255-FZ are applied, according to which in the event of failure of the insured person to appear for a medical examination on time without good reason, the amount of temporary disability benefits , assigned for the period from the day on which the specified violation was committed and until the end of the period of incapacity is limited to the minimum wage for a full calendar month (in the first case, from February 20 to 23, the benefit is calculated from the minimum wage, in the second - from February 20 until recovery ).

It should be taken into account that the basis for reducing benefits is the failure of the insured person to appear on time for a medical examination or for a medical and social examination without good reason.

Additional codes

In addition to the main fields, the document has additional columns. This is “Add. code" and "Code. ism". The first field contains the following data:

- 017 – the sick person is being treated in a special sanatorium;

- 018 – sanatorium treatment is associated with an industrial injury;

- 019 – the patient is undergoing rehabilitation at the Research Institute of Balneology;

- 020 – increased maternity leave;

- 021 – illness or injury occurred under the influence of alcohol, drugs or other substances.

Code 021 reduces the amount of insurance payments for the entire duration of the treatment process. In this case, the calculation is carried out not on the basis of average earnings, but on the basis of the minimum wage.

This principle of calculating the insurance amount applies even if the patient does not have any indication of violating the regime.

Field "Code. "izm" is filled in if the diagnosis has changed during treatment. If changes are not required, the field remains blank.

What fields are indicated to the employer?

In addition to the information fields where the place of work and other data is indicated, the employer fills out coded fields. This is the line “Calculation conditions”. Two-digit codes fit into it:

- 43 – if the employee was exposed to radioactive radiation;

- 44 – work is performed in the Far North;

- 45 – the employee has an established disability group;

- 46 – the employment contract was concluded for a period of up to six months;

- 47 – the insured event occurred within 30 days from the date of dismissal;

- 48 – the employee violated the treatment regimen for a valid reason;

- 49 – if the disease lasts more than 16 weeks;

- 50 – if the disease lasts more than 20 weeks;

- 51 – the employee did not have time to earn enough to pay for the insurance premium or the amount of earnings is less than the minimum wage.

Codes 46, 49 and 50 are not indicated if the cause of the illness is code 11. In addition, codes 49 and 50 are indicated only for persons with disabilities. It often happens that an employee is subject to several codes. For this purpose, additional fields are provided in the “Calculation Conditions” column.

conclusions

In principle, it is not necessary to know the sick leave codes, but quite often controversial cases arise and then you can check that the attending physician has filled out the form correctly.

Other codes on the sick leave certificate You can also see encoded information in the following cells on the sick leave certificate:

- "Additional code." For example, if these cells contain code 021 (illness or injury resulting from alcohol/drug/toxic intoxication), then the benefit may be paid in a smaller amount;

- Relationship code. This code is filled in if sick leave was issued in connection with caring for a sick family member. For example, code “38” (“Mother”) means that the employee-parent was caring for her sick child. In this case, it will be indicated that the cause of disability is 09 on the sick leave;

- Code indicating violation of the regime. Let’s say the code “24” may be indicated on the sick leave.

AutoJurist legal assistance

What does code 36 on a sick leave mean? Cause of disability codes on a sick leave: decoding Disease codes on sick leave mean the following: Code on a sick leave What does it mean 01 Disease 02 Injury 03 Quarantine 04 Accident at work or the consequences of this accident 05 Maternity leave and childbirth 06 Prosthetics in a hospital 07 Occupational disease/its exacerbation 08 Aftercare in a sanatorium 09 Caring for a sick family member 10 Other condition (for example, poisoning) 11 Socially significant disease (hepatitis, tuberculosis, etc.).

Taking into account this definition and the provisions of Article 13 of the Federal Law of December 29, 2006.

Disability codes on sick leave

Caring for a disabled child is paid for 120 days a year, the time period for each case of illness is not limited. 14 Caring for a child with a complication after vaccination or with oncology An employee has the right to take out a certificate of incapacity for work at any time of the year without restrictions on the number of days. 15 Caring for a child with HIV infection Additional code (3 characters) 017 Referral for treatment to a specialist. sanatorium Payment according to the main code 018 Sanatorium treatment for work-related injuries 019 Treatment in research institute clinics 020 Additional leave for complicated childbirth 021 Incapacity for work due to alcohol intoxication, drug addiction or substance abuse. Sick leave payments are calculated based on the minimum wage, and not on the employee’s average salary.

Code “Violation of the regime” 23 Unauthorized violation of the treatment regime Until the date of violation, sick leave is paid according to the main code.

What codes are used on sick leave?

In illness documents for the employer, the diagnosis from the medical record is not indicated.

The reason for release from work is indicated in general groups: illness, injury, child care, etc. Each group is assigned a numerical designation, which is indicated on the form. They are divided into:

- Basic. They contain a list of diseases. The main one is always indicated.

- Additional - for long-term treatment in a sanatorium, resort institution, additional maternity leave and illnesses due to drug addiction and alcoholism. Additional is indicated in addition to the main one.

- Others. They contain notes about violation of the medical regime, about the extension of sick leave, about the establishment of disability, etc. Others are indicated in addition to the main and additional ones.

Depending on the digital designations in the form, the accountant calculates temporary disability benefits and sends the data to the Social Insurance Fund.

How is sick leave paid if there is a note about violation of the regime?

If the citizen is disabled, code 36 is not entered and the line “Other:” is not filled in.

If the certificate of incapacity for work contains a note about violation of the regime, then it is impossible to calculate temporary disability benefits in full. From the day when the violation of the regime occurred, the amount of the benefit cannot exceed the minimum wage for a full calendar month (using regional coefficients in the relevant territories).

From the book you will learn: to whom and when a certificate of incapacity is issued; how to calculate

How to write code 36 and 24 on a sick leave certificate?

Billing period – 2016-2017, 730 days. The number of sick days is 5. We calculate the average daily earnings: (482000+490000) / 730 = 1331.51 rubles.

More than 9 years of experience, we take 100% of average earnings. We calculate the benefit for 5 days: 1331.51 * 5 = 6657.55 rubles.

- Day 01/19/2018 We pay based on the minimum wage:

In 2021, the minimum wage is 9489 rubles, average daily earnings: 9489 * 24 / 730 = 311.97 rubles. Allowance for 1 day: 311.97 * 1 = 311.97 rubles.

- We calculate the total benefit amount:

6657.55 + 311.97 = 6969.52 rubles.

- The period from January 20 to January 24 is officially considered Markova’s absenteeism and is not paid.

Sample report on violation of hospital regulations The Social Insurance Commission can formalize the results of the reasons for non-compliance with medical requirements in the form of a report.

The Social Insurance Fund clarifies the procedure for filling out sick leave certificates

Decoding the disability codes on the sick leave + sample of filling out the sick leave

There is no need to understand the doctor’s often “unreadable” handwriting.

- Minimizing the likelihood of errors.

- Maintaining medical confidentiality.

- Opportunity to cooperate with medical institutions abroad.

Important! The decoding of the codes is on the back of the form.Therefore, understanding the numbers and clarifying the reasons for an employee’s absence is not difficult. (understand how to calculate insurance premiums for 72 hours) 3000+ books purchased All numerical codes reflecting the grounds for disability were developed and prescribed by a special order of the Ministry of Health and Social Development of the Russian Federation.

The code is indicated in four places on the hospital form. They contain:

- Types of kinship.

- Root causes of employee disability.

- Other.

- Indications of violations of the regimen prescribed by the doctor.

Calculation conditions.

All codes, except the last one, are entered by the doctor. The conditions for calculating benefits are fixed by the employer.

Violation of the sick leave regime: how to calculate benefits

If there was such a reason, calculate benefits for all days of sick leave in the usual manner (Article 8 of Law No. 255-FZ). Read also

“Maximum and minimum sick leave in 2021”

Valid reasons for absenteeism To do this, it is enough to take written explanations from the employee why he did not show up for an appointment with the doctor on time, and supporting documents, if any. But in order to assess the validity of the reasons for absence, a social insurance commission from among the employees or a social insurance commissioner is needed if there are few employees in the organization (clause

11 Regulations, approved. Government Decree No. 101 dated 12.02.94 (hereinafter referred to as the Regulations); P.

1.1, 2.2 of the Standard Regulations, approved.

How is violation of the sick leave regime paid in 2021?

Payment for the period of temporary disability for officially employed citizens is guaranteed by the Labor Code (LC) of the Russian Federation. Article 183 of the Labor Code of the Russian Federation

:

“In case of temporary disability, the employer pays the employee temporary disability benefits in accordance with federal laws”

It happens that a citizen accidentally or deliberately violates the regime

, prescribed by the attending doctor. How sick leave is paid in such a case and whether it is possible to receive sickness compensation in full is discussed in this review.

How to pay for sick leave in 2021 with a violation of the regime

No. 375. Sick leave with violation of the rules is paid in full, reduced amount or not paid at all. First of all, it depends on the code specified by the doctor: Violation code Type of violation Examples, comments Refusal to comply with the doctor’s requirements, leaving the medical institution, moving to another area The patient does not comply with the prescribed daily routine or refuses to take prescribed medications Failure to show up for appointments doctor on the appointed day The patient came to the doctor already recovered or the patient could not visit the doctor due to deterioration of his condition Early return to work The employee went to work while ill Refusal to undergo a medical examination With codes 26 and 27, a person is not considered disabled Attendance for medical examination. examination later than the appointed date Other violations The code does not prevent payment of sick leave in full

Therefore, the clinic must issue a certificate of incapacity for work and discharge the citizen to work from the date following the date of the scheduled appearance at the clinic, putting code 24 - “late appearance for an appointment with a doctor” and in the line “Other” code 36 - “appeared able to work.”

Thus, the days following the date when the employee was supposed to see a doctor do not belong to the period of temporary incapacity for work. Attention: Several cells are allocated for them:

- two – the code itself (from 01 to 15); three – to indicate an additional cipher (017-021); two – the changed code is recorded here, if necessary (the diagnosis has been clarified).

There are several purposes for using codes, in particular: Compact and economical use of the form. Simplifying and optimizing the work of HR staff.

There is no need to understand the doctor’s often “unreadable” handwriting.

What does code 36 on a sick leave mean?

Answer to the question:

According to clause 58 of Section IX of the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n, when filling out the section “TO BE COMPLETED BY A DOCTOR OF A MEDICAL ORGANIZATION” of the certificate of incapacity for work in the line “Notes of violation of the regime”, type of violation code 24 means late attendance for an appointment to the doctor.

In accordance with clause 61 of Section IX of the above Procedure, in the line “Start work” in cells “from -” the date of restoration of working capacity is indicated the next day after the citizen is examined and recognized as able to work. In the line “Other:” a two-digit code 36 is indicated in the case where the citizen, after issuing or extending a certificate of incapacity for work, did not appear for an appointment, but was declared able to work at the next visit.

Therefore, the clinic must issue a certificate of incapacity for work and discharge the citizen to work from the date following the date of the scheduled appearance at the clinic, putting code 24 - “late appearance for an appointment with a doctor” and in the line “Other” code 36 - “appeared able to work.”

Thus, the days following the date when the employee was supposed to see a doctor do not belong to the period of temporary incapacity for work.

In accordance with the explanations of the FSS (in particular the Perm FSS"), in such a situation, for the day defined as the day of appearance for inspection, the benefit should be accrued in an amount based on the minimum wage, and not on the average earnings of the worker. And days of incapacity for work after the employee had to appear for an appointment with a doctor are not subject to payment, because incapacity for work during the specified period has not been confirmed.

At the same time, in this situation, it is advisable to indicate “NN” in the work time sheet precisely for unclear reasons (if these days are not days off for the employee). We do not recommend classifying absence during this period as absenteeism, since it is difficult to actually establish the moment when the employee was obliged to start work. You can replace this code after receiving the employee’s explanations with “T” - disability without benefits.

Details in the materials of the Personnel System:

1. Legal basis:

SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION

The Department of Insurance in Case of Temporary Disability and in Connection with Maternity has considered the appeal regarding the procedure for filling out a certificate of incapacity for work and reports.

You will find important information about the Maximum time spent on sick leave in the material here.

1. In accordance with clause 6 of the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n, in the case where a citizen who is disabled on the day of discharge from the hospital is able to work in the medical organization to which he was sent to continue treatment, the medical organization fills out the line “Get to work” on the certificate of incapacity for work and closes it.

In the case under consideration, code 31 was assigned by a medical organization - a hospital, but the citizen did not show up for an appointment at the clinic on the appointed day, and later showed up already able to work.

In this case, the clinic has no grounds for issuing a certificate of incapacity for work - continuation for the past time (for the time of missing an appointment with the doctor), since it did not establish the fact of the citizen’s temporary incapacity for work.

Consequently, the clinic must issue a certificate of incapacity for work and discharge the citizen to work from the date following the date of the scheduled appearance at the clinic, putting code 24 - untimely attendance at an appointment with a doctor and in the line “Other” code 36 - was able to work.

2. In accordance with clause 58 of the Procedure, in the line “Cause of disability” in the cells “code _ _” the corresponding two-digit code is indicated; in the cells “add. code _ _ _" an additional three-digit code is indicated; in the cells “measuring code. _ _" the corresponding two-digit code (from those listed above) is indicated in the event of a change in the cause of temporary disability.

We believe that the cells “measuring code. _ _” must be filled out by a medical organization that establishes the fact of continuation of temporary disability for another reason.

Head of the Insurance Department

in case of temporary disability

and in connection with motherhood

PERM REGIONAL BRANCH

SOCIAL INSURANCE FUND OF THE RF

Question 3: An employee of our organization presented a certificate of incapacity for work, which indicated the period of release from 02/08/2010 to 02/11/2010, in the line “Get to work” the entry was made: “I appeared able to work on 02/15/2010.” In what order is sick leave payable in this case?

Answer: Clause 61 of the Procedure for issuing certificates of incapacity for work by medical organizations, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated 01.08.2007 N 514, stipulates that in the case when a citizen, after issuing or extending a certificate of incapacity for work, did not show up for an appointment, but at the next visit was recognized as able to work, in the line “Start work” on the certificate of incapacity for work, the following entry is made: “Apparently able to work” (indicating the date of appearance).

Thus, according to the certificate of incapacity for work, your employee did not show up for an appointment on 02/11/2010, and upon his next appearance on 02/15/2010, he was recognized as able to work.

We wrote more about Codes of reasons for incapacity for work on sick leave here.

In accordance with Art. 8 of the Federal Law of the Russian Federation of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, the failure of the insured person to appear without good reason at the appointed time for a medical examination is grounds for reducing the amount of temporary disability benefits. In this case, from the day when the violation was committed, temporary disability benefits are paid in an amount not exceeding the minimum wage established by federal law for a full calendar month.

Therefore, in your situation, temporary disability benefits for the period from 02/08/2010 to 02/10/2010 are subject to assignment and payment on a general basis; 02/11/2010, in the absence of valid reasons for failure to show up for an appointment, payment is made in an amount not exceeding the minimum wage for a full calendar month; the period from 02/12/2010 to 02/15/2010 is not subject to payment, since temporary disability for these days was not certified by a certificate of incapacity for work.