Types of assistance from the state

For vulnerable categories of citizens, there are 2 types of support from the state:

- Privileges. This type of support is intended to alleviate the financial situation of a special category of citizens—beneficiaries. The government provides support, including by reducing rent. Relaxations are established at the federal level, but sometimes at the expense of regional budgets. Discounts on utilities are issued only for one housing where the recipient is registered and lives.

- Subsidies. This type of assistance is also intended for beneficiaries, but not in the form of a reduction in fees. Subsidies imply cash payments or compensation for payments from the state. They are assigned to those families whose earnings are below the established minimum, and at least 22% of the total family income is spent on payments for living space. The percentage indicator is averaged; different minimums are set for different areas. In some cities, it is enough to spend 10% of your income to qualify for government assistance. But some beneficiaries receive a portion of their expenses back even if their expenses do not reach the established limit. These include liquidators of the Chernobyl Nuclear Power Plant, disabled people, and WWII veterans.

In Russia and Ukraine, citizens who are not included in the register of beneficiaries are not assigned either benefits or subsidies. But in Ukraine, the state provides a choice to preferential categories: they can receive either discounts on rent or compensation for part of the money spent.

Who receives assistance from the state and regional budget

When they talk about rent benefits, not all citizens mean the same thing. Some people only count on reducing the payment for renting a living space, based on the square footage of the apartment or house. Others include in this concept discounts on payments for other utilities provided by housing companies. For example, for heating, gas, water, garbage removal, major repairs, elevator and electricity.

Benefits are sponsored by the federal and regional budgets. Federal benefits are established throughout the Russian Federation. From the regional budget, reductions in housing and communal services payments are established separately for individual territories.

Federal benefits are allocated for several categories of citizens. Completely exempt from rent:

- Heroes of Labor of the Russian Federation;

- Heroes of Socialist Labor;

- full holders of the Order of Labor Glory.

A 60% discount on housing and communal services payments is received by:

- Family members of military personnel who died during service or after discharge, but with service of 20 years or more.

- Family members of employees of internal affairs bodies, fire service, customs, and the penitentiary system who died while performing their duties.

Compensation for utility bills in the amount of 50% is given to disabled people and families with a disabled child. Disabled people of groups 1 and 2 and their family members receive compensation of 50% of the fees for major repairs.

Reimbursement of half of the money spent on rent is received by:

- disabled people and WWII participants and their close relatives:

- persons who survived the siege of Leningrad.

Veterans of the Patriotic War receive a 50% refund only for housing costs and contributions for major repairs. Veterans receive compensation for housing and communal services only from regional budgets.

Also, 50% of rent costs will be compensated for those injured during the liquidation of the Chernobyl accident and those who received radiation at the Semipalatinsk test site.

Types of compensation for categories of beneficiaries

First of all, pensioners need social support. Let us remind you that men go for a well-deserved rest in Russia upon reaching 60 years of age, and women at 55 years of age.

Additional benefits in the field of housing and communal services are provided to participants of the Great Patriotic War, citizens who became disabled of groups 1 and 2 during the war period, during service. Benefits apply to people who have been exposed to radiation.

100% benefits for housing and communal services are provided to people awarded the title of Hero of Socialist Labor and Labor Glory awards.

Certain categories of pensioners have the following benefits for housing and communal services:

| WWII participants | 50% on housing maintenance costs | 50% on payment of housing and utilities |

| Invalids of war | ||

| Citizens who were prisoners during the war as minors | ||

| Military personnel who have become disabled | ||

| Heroes of Labor | 100% for housing maintenance costs | |

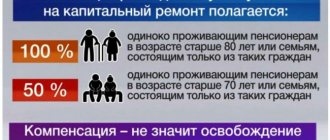

| Pensioners, 70 years and older | 50% on contributions for major housing repairs | |

| Pensioners, 80 years and older | 100% on contributions for major housing repairs | |

Regional benefits and subsidies

The regional government has the right to establish rent benefits in its administrative district. For example, in St. Petersburg, the local government returns half the amount spent on housing and communal services:

- home front workers during the Second World War;

- veterans of labor and war;

- pensioners whose work experience is 45 years for men and 40 years for women;

- rehabilitated after repression;

- women who gave birth and raised 10 or more children;

- Large families with up to 10 children receive a 30% discount on rent.

The government of Nizhny Novgorod compensates expenses for utilities only for labor veterans whose monthly income does not reach 21,673 rubles.

Reduced payments and refunds apply only to a certain area of housing. Quadrature restrictions:

| Number of residents | Limit |

| 1 person | 33 sq. m |

| 2 people | 42 sq. m |

| 3 occupants or more | 18 sq. m for each |

If the housing area exceeds the established limits, the extra square meters. meters the state does not subsidize or pay for. That is, the beneficiary is obliged to pay the excess square footage at a 100% tariff.

Who can use benefits

Citizens living in St. Petersburg are entitled to privileges and subsidies for paying for services in the housing and communal services sector. These relaxations are regulated by regional and federal laws .

To determine whether a citizen can use privileges, it is necessary to take into account compliance with the conditions on the basis of which individuals are granted the benefit.

On the territory of St. Petersburg, preferences can be used by:

- citizens receiving low income. In this case, the living wage established in St. Petersburg is taken into account. When a person lives with relatives, their income is also subject to accounting;

- persons who have reached a certain age category and live in conditions that do not meet established housing standards (each region has its own standard).

The basis for calculating discounts and subsidies is a statement written by the beneficiary.

Categories of benefit recipients in St. Petersburg

Benefits for paying housing and communal services for pensioners in St. Petersburg are presented in the form of a 50% discount on payment for services in the housing and communal services sector.

This measure applies to:

- citizens who worked in the rear during the Great Patriotic War. The minimum duration of work must be six months;

- persons undergoing military service during the Second World War and home front workers who were awarded medals and orders;

- citizens who were repressed and rehabilitated;

- mothers with 10 or more children, provided that all minors are raised by a woman. These citizens were awarded the Order of “Parental Glory” or received the title “Mother Heroine”;

- persons who have worked in St. Petersburg for 20 years.

The listed preferences are regulated by the provisions of the Law of St. Petersburg No. 728-132 of 2011 “Social Code of St. Petersburg”.

Example of calculating benefits for a disabled person

To calculate housing and communal services benefits for a disabled person, let’s take the example of a family of 4 people. They live in Moscow, where 1 kV of electricity costs 5.8 rubles. One of the family members living in the apartment is disabled.

For 1 month, the family consumed 160 kW of electricity. The portion spent by the disabled person: 160 / 4 = 40 kV of electricity. 40 * 5.8 = 232 rubles - this is the discount amount provided for a disabled person. If there are two beneficiaries in a family, then calculations of housing and communal services benefits are made taking into account two people: 160/2 = 80, the amount of the benefit will be 464 rubles. In this way, you can calculate the total amount of savings for each utility service separately.

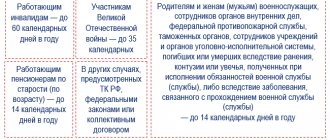

Request (application) for the provision of public services to certain categories of working pensioners (original, 1 pc.)

- Required

- Available without return

Sample

40kb, doc

Sample

38kb, doc

Document confirming relationship (kinship) with the deceased breadwinner (original, 1 pc.)

- Required

- Provided only for viewing (making a copy) at the beginning of the service

Represented personally by the applicant receiving a pension in connection with the death of the breadwinner, if the registration of the civil status act was carried out by the civil registry office of the city of Moscow before January 1, 1990, or by the registry office of other constituent entities of the Russian Federation before October 1, 2021, or by the competent authorities in the territory a foreign state, namely one of the following: - birth certificate of the deceased breadwinner;

- birth certificate of the child of the deceased breadwinner; — marriage certificate with the deceased breadwinner Death certificate of the breadwinner (original, 1 pc.)

- Required

- Provided only for viewing (making a copy) at the beginning of the service

Represented personally by the applicant receiving a pension in connection with the death of the breadwinner, if the registration of the civil status act was carried out by the civil registry office of the city of Moscow before January 1, 1990, or by the registry office of other constituent entities of the Russian Federation before October 1, 2021, or by the competent authorities in the territory foreign state

Document confirming the fact of assignment of a pension or lifelong maintenance in the city of Moscow (pension certificate or certificate) (original, 1 pc.)

- Required

- Provided only for viewing (making a copy) at the beginning of the service

To be submitted by applicants from among persons receiving a pension from the pension service of the federal executive body or lifelong maintenance. An

identification document of the applicant confirming registration at the place of residence in the city of Moscow and its duration. (original, 1 pc.)

- Required

- Provided only for viewing (making a copy) at the beginning of the service

Work book (original, 1 pc.)

- Required

- Provided only for viewing (making a copy) at the beginning of the service

Certificate of employment indicating the position held (original, 1 pc.)

- Required

- Available without return

Certificate of income of an individual, Form 2-NDFL, for 6 consecutive months before the month of applying for monthly compensation payment. (original, 1 pc.)

- Required

- Available without return

Provided by applicants whose monthly compensation payment is determined taking into account their salary. If the period of work is less than 6 months, then the certificate is provided for all full months of work before the application.

Innovations in 2021

Utility prices have changed since 2021. The increase occurred in January and June. In January, tariffs increased by 1.7%, and in June - by 2.4%. This happened due to an increase in the amount of VAT established by the state. Tariffs will continue to rise in 2021.

The two-stage increase in rent tariffs serves to synchronize tax and tariff legislation. Also, changes in the amount prevent tariffs from rising above the projected inflation target.

Registration of preferences

The procedure for obtaining preferences for utility payments is quite long. For each expense item, you need to inquire what standards are provided separately in each service provider organization. If you need to reduce the cost of paying for electricity, you need to contact the company that provides your home with electricity, and to reduce the heating tariff, you need to contact the heating network.

Required documents:

- statement;

- passport;

- a document that determines the preferential category;

- a document indicating ownership of the house;

- receipts for payment of services for previous periods;

- certificate of family composition.

Some cities add other information to the basic kit. The exact list of documents is indicated in the company to which the discount application is submitted. If there is a rent arrear, they first pay it off and then apply for benefits.

List of relaxations for pensioners of St. Petersburg

There are several forms in which relief is provided. There are certain differences between them. The benefit is represented by a discount on housing and communal services, which is taken into account in the payment document. Can be obtained from the organization that manages the house or from the service provider. The subsidy has the form of compensation , that is, first the citizen pays the entire amount. Then part of the money is returned to his account. To obtain it, you need to visit government authorities.

Benefits for pensioners in St. Petersburg for housing and communal services are provided under certain conditions.

In most cases, preferences take the form of compensation. Its size for pensioners is 50%.

This relaxation applies to:

- water drainage;

- gas supply to the house;

- provision of electricity;

- water supply;

- heating;

- housing maintenance.

The table provides information about benefits in St. Petersburg:

| Category | Benefit |

| Home front workers, mothers with 10 or more children, repressed and rehabilitated persons | 50% for utility bills |

| Citizens over 70 years of age | 50% discount on major repairs |

| Persons 80 years of age and older | 100% for major repairs |

| Pensioners | 50% for phone payment |

Important! If a citizen who has retired lives in a house that is not equipped with a centralized heating system, he has the right to apply for a fuel subsidy. The cost of purchasing and delivering materials used for heating premises is taken into account.

Conditions for providing subsidies in St. Petersburg

In order to take advantage of the relaxation, a citizen must meet certain conditions.

You will be able to apply for a benefit if:

- the citizen is the owner or tenant of the premises;

- Utilities are paid at the rate of 14% of the pensioner’s income.

The preference in question also applies to family members of a citizen. In this case, the wealth of each of them is taken into account.

If the amount of payment for services in the housing and communal services sector after summing up income is 14% or more, a relaxation is assigned.

Please note: initially, the citizen will need to pay the accrued amount in full, and then provide receipts confirming payment to the City Center for Housing and Communal Subsidies. If a positive decision is made, a subsidy is transferred to the pensioner’s account.

Discounts for major repairs in St. Petersburg

This type of relaxation is intended for citizens who have reached a certain age category. Government agencies provide several discounts.

A citizen can use:

- 50% discount. This relaxation applies in situations where the person is 70 years of age or older;

- exemption from paying contributions for major repairs if the citizen is over 80 years old.

To use the above forms of benefits, you will need to contact a company providing services in the housing and communal services sector. Documentation of status will be required.

Payment of compensation for using a telephone in St. Petersburg

Housing and communal services benefits for pensioners in St. Petersburg in 2021 also apply to payment for landline telephone services. The payment is compensatory in nature and equals 50% .

In addition, you can use a discount on cable television and network radio services. The pensioner has the right not to pay half of the accrued amount.

Refund of part of the amounts paid

The application and the rest of the documentation for the refund are submitted to the MFC or the social protection department of citizens. Basic list:

- photocopies of passports of all family members;

- document on family composition;

- certificate of ownership of real estate;

- documents that confirm relationship for each family member;

- certificate from the BTI;

- six-month receipts for utility payments to check the absence of debts;

- documents for each family member about his personal income;

- a photocopy of the work record book, an extract from the savings book;

- certificate from the employment center, only for the unemployed.

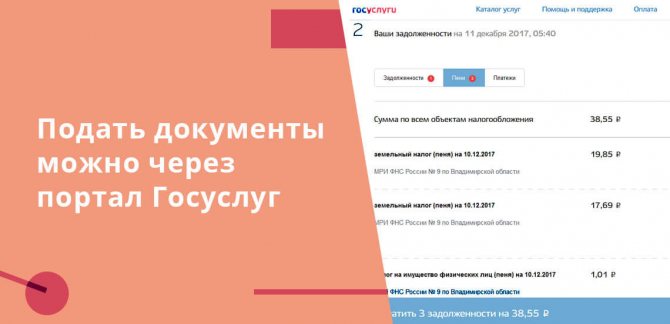

You can submit documents during a personal visit to the MFC or social protection department or online through the State Services portal. The application processing period takes a maximum of 10 days.

When calculating the amount of compensation, the total income of all family members is taken into account. But for each individual tenant you will need a 2-NDFL certificate. The compensated amount can be sent directly to the company’s account and taken into account in future payments. Or the money can be sent to the utility account of the beneficiary.

You will need to re-register compensation twice a year. Moreover, it is recommended to do this until the middle of the month. When sending an application in the first 2 weeks of the month, subsidies are accrued in the current month. And if you submit documentation in the second half of the month, benefits begin only in the next month.

If, while receiving subsidies, the beneficiary has debts or delays of 2 months or more, then the right to compensation disappears. Utilities are suspending compensation. To receive funds again, you will need to pay off the debt and apply for subsidies again.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How to get a subsidy for utility bills

To take advantage of the subsidy and corresponding reimbursement of expenses, the beneficiary submits an application to social security at their place of residence. The period for reviewing papers is 10 days. If the application is submitted between the 1st and 15th of the current month, then the subsidy is established from the beginning of this month. If the documents were sent to the authority in the second half of the month, then it begins to apply from the beginning of the new month.

Another way is to document the benefit using the Unified Government Services Portal or MFC, which offers similar services to residents of populated areas.

It is important to remember that if a refusal to provide compensation is received, a citizen has the right to appeal it in court and expect a comprehensive consideration of all the circumstances of the case.

What documents are needed to apply for compensation?

Along with the application you must submit:

- passport;

- pensioner's ID;

- a document on the basis of which a citizen lives in an apartment or house (certificate, rental agreement or warrant);

- a certificate from the management company confirming that there are no debts on utility bills;

- utility bills;

- salary certificate for all people living together;

- certificate of family composition.

This is a list of key documents. Regions may expand this list and request additional papers that must be submitted to social security.

Subsidy application form

Sample application for a subsidy to pay for housing and utilities

How the benefits work

Documents are reviewed within 10 days and a decision is made by the social security authority: to assign a subsidy or to refuse. Monetary compensation is paid to the beneficiary to the current account specified in the documents, opened in the bank.

Benefits for utility bills are provided for a period of six months. After six months, the package of documents must be updated and resubmitted. Social protection specialists have the right to check the submitted documents and make various requests.

Grounds for suspending subsidy payments

Payment is suspended if:

- the beneficiary moves to another residential address;

- the income of at least one of the family members changes, significantly affecting the procedure for submitting compensation;

- specialists are presented with deliberately false information and forged papers;

- Utility debt is allowed for more than 2 months in a row.

Thus, social protection authorities in Russia offer several options for benefits and compensation for pensioners to pay for utility services, which will significantly reduce the burden on the family budget. For detailed information about housing and communal services benefits for pensioners, contact the social security department at your residence address.

For pensioners who are currently applying for benefits, we invite you to watch a video on this topic:

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya