How is the share allocated?

The legislation reflects: in a will, when there is no indication in it of a specific citizen who has the authority to distribute the property mass, the compulsory method is used.

Norm 1149 of the Civil Code provides for the possibility of reclaiming the specified part for:

- persons who are minors;

- children in the age group over 18 years of age, provided that they are disabled;

- husband or wife of the deceased who is disabled;

- parents who have lost their ability to work.

Citizens classified in the listed categories are included in the first priority of legal successors. These rules apply if the deceased's property is divided based on statutory provisions. Such relatives are not always included in the will. Each person can form a testamentary act during his lifetime to express his will regarding the fate of things after his death. The legislator does not establish restrictions on who can become a legal successor under a will. The indication may be to foreigners and even organizations.

ATTENTION !!! To open an inheritance estate, you will need to provide evidence that the citizen has died. Such confirmations must be sent to the notary's office. The notary is authorized to conduct inheritance business. Therefore, in the future, actions related to the allocation of a share take place in the presence of a notary. It is necessary to keep in mind the features related to the execution of testamentary acts. They are taken into account when distributing shares in property.

When a citizen draws up a will, he has the right to indicate that the things belonging to him, in full or some part of them, are divided between specific persons. It is allowed to reflect in the generated act the property that a person owns on the day the document is drawn up, as well as things planned for acquisition in the future. Only property that belongs to the deceased by right of ownership can be distributed among heirs.

Regardless of the will or the time of its preparation, relatives will be able to find out the contents of the document after the owner of the property passes away. This is due to the fact that the secrecy of this category of documents is established at the legislative level. When persons classified as obligatory legal successors have learned that they have not been included in the list of applicants for the inheritance, they have the right to declare themselves. They are allocated the established part. You will be required to provide documentation demonstrating your lack of ability to work.

Confirmation of lack of ability to work

The right of a citizen receiving a pension to the established portion of the inheritance mass is confirmed with the help of facts about incapacity for work. Most often, when inheriting, pensioners are the parents or husband/wife of the deceased.

The following evidence is used to confirm disability:

- reaching a certain age at which a citizen acquires pensioner status;

- a certificate indicating that the citizen took a well-deserved rest earlier than the established period (this is possible based on length of service, if there is a disability, etc.).

Regardless of the deed of gift, you will need to confirm that the retirement took place before the testator passed away. It is necessary to confirm the fact of retirement if the division of the inheritance occurs on the basis of a testamentary act and during the formation of a mandatory share. When a will is not drawn up, the above-mentioned citizens belong to the first priority of heirs and are given their due share of the property.

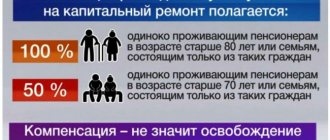

Benefits for pensioners when registering an inheritance

When a pensioner does not fit the categories to receive benefits, he must pay a state fee for a certificate of the right to inheritance on an equal basis with employed, capable citizens. However, for low-income people, incl. pensioners, additional discounts are provided depending on the region. For example, benefits for pensioners when registering a land plot as an inheritance include a low duty of 0.3% on the cadastral value. This payment amount is insignificant, the tax is minimal.

Calculation of state duty for pensioners on property has maximum rates under Art. 406. According to Art. 407, some citizens can take advantage of property tax benefits, incl. and pensioners. The amount of NI is calculated by the tax service. The amount is determined separately for each object of inheritance by pensioners.

Share allocation

In order to receive the mandatory share, citizens of retirement age must take certain actions. At the initial stage, a certificate is received confirming the death of the person. This paper is transferred to the notary office. You will need to find out what is reflected in the will. An important point is who is classified as the legal successor and the constituent parts of the inheritance mass. You need to fill out an application and send it to a notary. It indicates that the person wishes to accept part of the inheritance mass. This act reflects the fact of relationship between the applicant and the deceased. In addition, an indication of lack of ability to work is made.

ATTENTION !!! The size of the share depends on how many heirs the deceased has. Property is divided in equal parts using legal provisions. When a set share in the inheritance is allocated, the citizen can take only half of what would have passed to him on the basis of legislation. When the 6 month period expires, you will need to draw up an act confirming the rights to the mass. If you include real estate in it, you will need to register your authority with Rosreestr.

In addition to the application, when forming the established part, you need to collect other documentation. This is a decision issued by a judge or a paper confirming the conclusion/dissolution of a marriage relationship. This is necessary in order to confirm the existence of a relationship between persons. In addition, a pension certificate is required. The legal successors may present documents establishing the right to certain property. If these acts are not submitted, the employees of the notary office themselves formulate requests to the competent authorities.

When the exercise of rights to the part in question occurs, it is imperative to comply with the rules on deadlines. The application must be submitted within the period reflected in the legal acts. If the deed is received by the notary later, then they refuse to allocate a part of the property mass. The restoration of this period is implemented in a certain order. You will need to indicate that there are valid reasons why the pass was allowed. Examples of such reasons are a serious illness, for treatment a person was hospitalized.

IMPORTANT !!! When a citizen submits an application for the allocation of a compulsory share, he needs to take into account that, simultaneously with the property, the debts of the deceased are transferred to him. The law indicates that it will not be possible to formalize rights only to the assets of the deceased, since debts are part of the estate. This rule applies even if the assignee is a pensioner or low-income person.

Therefore, before giving consent to accept the inheritance mass, you need to find out what exactly is included in its composition. If the deceased has large debts, then in all situations it will not be beneficial to make demands regarding the allocation of a mandatory share.

How is the share determined?

If a person of retirement age is a close relative of the deceased, then he belongs to the first priority of legal successors. This means that in the absence of a testamentary act, all the property of the deceased is distributed in equal shares among all heirs assigned to the same line. For example, if a citizen has 4 heirs, then each of them is entitled to ¼ of the property. If the division of the inheritance is carried out on the basis of the law, the pensioner has no advantage in terms of increasing shares in the received property.

It is worth considering the following nuances that arise when inheriting by virtue of a will:

- the priority is the allocation of obligatory shares from the property that is not included in the will;

- if there are not many of these things and they are not enough to allocate a share to the obligatory legal successor, the inheritance due to the citizens specified in the will is used;

- the amount of the obligatory share cannot exceed half of what the citizen would be entitled to by law.

In some situations, changing the size of shares is allowed. Therefore, when determining the size of the share for citizens of retirement age, the amount of property that would pass to the person upon inheritance on the basis of the law is taken into account. It is necessary to identify all the persons who are part of the first priority. If there are 4 heirs, then the size of the share of the obligatory legal successor is equal to 1/8 of what is included in the total estate. A certificate is issued to confirm the existence of rights to the property. You can get it from a notary office. This act allows you to legally receive property included in the inheritance mass. It will be necessary to register rights to real estate.

Grounds for receiving a mandatory share

The grounds include the following.

- Lack of ability to work. Old age or disability pensioners have the right to a compulsory share.

- Disabled dependents. In addition to lack of ability to work, they must be supported by the deceased person for at least 1 year. Sometimes they are asked to live with the deceased person for at least 1 year before his death.

If a person is disabled, then the representative of his property interests is an employee of the guardianship authorities or a guardian.

The recipient of the inheritance has the right to refuse the obligatory share. The waiver will be absolute—the person will not be able to transfer the property to another person.

If the pensioner does not take any actions aimed at entering into inheritance rights, then by law he thereby waives the share due to him. It will be divided among the remaining heirs.

Also, a pensioner may be denied the mandatory part. For example, a person was recognized as an unworthy heir and excluded from the general list of inheritance recipients. The basis is a court verdict in a criminal case that was initiated due to the commission of a crime against a deceased person, or other unlawful actions of a pensioner.

Design features

If the basis for allocating a mandatory share is an application prepared by a pensioner. The composition includes property that is inherited on other grounds. For example, these are provisions of law or a testamentary act. Such situations may arise provided that the will reflects provisions for the distribution of part of the property. For example, a citizen indicated during his lifetime that after his death only half of the property should be divided. The rest is subject to distribution based on laws.

IMPORTANT !!! If a pensioner is part of the first priority, then he takes part in the division of property. He is entitled to the same share as other legal successors. When a retired citizen submits an application for the allocation of a compulsory share, the amount received as a result of legal inheritance is included in its composition.

It is necessary to take into account that the part of the inheritance that passes to a person by law, sometimes the size of the obligatory share is taken into account. Therefore, we can conclude that the legislator in the third part of the Civil Code gives the right to receive compulsory shares to pensioners. This applies to persons included in the first priority of legal successors.

As an exception, the provisions of Article 1148 of the Civil Code are considered. It says that if the deceased person has no relatives, the right to inheritance is given to persons who are his dependents. As an example, this is a woman with whom a citizen cohabited during his lifetime. These may also include persons who lived in the same residential premises with the deceased citizen. In other cases, the property of the deceased is divided between persons who were related to him.

Is a pensioner a disabled heir?

Heirs who belong to the class of disabled persons are considered to be pensioners who have reached the age of fifty-five and sixty years of age for women and men, respectively. It should be noted that persons who purchased a pension on a preferential basis are not included in the list of disabled heirs.

e) independent inheritance by disabled dependents of the testator as eighth-rank heirs is carried out, in addition to cases where there are no other heirs by law, also in cases where none of the heirs of previous orders has the right to inherit, or all of them are excluded from inheritance (Article 1117 of the Civil Code of the Russian Federation), either deprived of the inheritance (clause 1 of Article 1119 of the Civil Code of the Russian Federation), or none of them accepted the inheritance, or all of them refused the inheritance.

For information. On November 15, 2007, the Constitutional Court of the Russian Federation issued a ruling refusing to accept for consideration the complaint of citizen I. N. Mikhailov about the violation of his constitutional rights by paragraph ten of Article 2 of the Federal Law “On State Pension Provision in the Russian Federation” and subparagraph 3 of paragraph 2 of Article 9 of the Federal Law “On labor pensions in the Russian Federation."

The fact is that Mikhailov, due to special working conditions, upon reaching 50 years of age, was assigned an old-age labor pension. He believed that he had the right to an obligatory share in the inheritance. However, the court denied him this on the basis of the above-mentioned articles of the pension legislation. This led to an appeal to the Constitutional Court of the Russian Federation.

Experts from e-Nasledstvo.ru answer: According to clause 1 of Article 1149 of the Civil Code of the Russian Federation, the right to an obligatory share in the inheritance is given to minor or disabled children of the testator, his disabled spouse and parents, as well as disabled dependents of the testator who are subject to inheritance.

This concept is used to establish the grounds for the emergence of the right to a pension under state pension provision and the procedure for its appointment.

Disabled heirs are persons of retirement age, that is, women who have reached 55 years of age and men who have reached 60 years of age.

It is worth noting that persons who retired on preferential terms (for example, due to difficult working conditions) are not included in the circle of heirs as disabled.

In order for an heir to be recognized as a disabled dependent, it is necessary that he was dependent on the deceased for at least a year before his death and that he was disabled by the day the inheritance was opened. Thus, simply “doing nothing” without good reason will not be grounds for recognition as a dependent and receiving a mandatory share in the inheritance.

Please note that confirmation of the fact of retirement is only important when inheriting under a will and registering a mandatory share.

05.05.2018

For example, the representative of the first line of inheritance by law is the disabled spouse of the deceased, as well as his father. The spouse is deprived of the right to inheritance because she is not indicated in the will.

Legally, she can claim half of the inheritance. The second part of the property will go to the second heir - the father of the testator. However, there is a will, and therefore property is distributed in accordance with it.

The incapacitated spouse receives a mandatory share equal to 25% of the inheritance.

When the testator does not have relatives and other heirs who are indicated in the lists of the law, then disabled dependents are classified as heirs of the eighth stage. Sometimes, during registration, serious difficulties may arise in obtaining property, because the Civil Code of the Russian Federation does not clearly indicate disabled dependents.

c) a person who received from the deceased for a period of at least a year before his death - regardless of family relations - full maintenance or such systematic assistance that was for him a constant and main source of livelihood, regardless of receiving his own earnings, pensions, scholarships and other payments.

Living together with the testator for at least a year before his death is a condition for calling to inherit only the disabled dependents of the testator, named in paragraph 2 of Article 1148 of the Civil Code of the Russian Federation (from among the citizens who are not included in the circle of heirs specified in Articles 1142 - 1145 of the Civil Code of the Russian Federation);

- Since this category of heirs is called to inherit according to the law on equal rights with those called up in line, they have the right to accept the inheritance in accordance with paragraph 1 of Art. 1154 of the Civil Code, the general period is six months from the date of opening of the inheritance. If such a deadline is missed, they have the right to restore it (Article 1155 of the Civil Code).

- The implementation by dependents of their inheritance rights is carried out in the general manner - by submitting an application to a notary or by actually taking possession of the inherited property (Article 1153 of the Civil Code). At the same time, upon receipt of a certificate of the right to inheritance, in accordance with paragraph 1 of Art. 333.38 of the Tax Code, representatives of the specified category of heirs, who are such due to their minority, are exempt from the state duty, and who are such due to disability (groups 1 and 2), pay only half of the state duty.

- If the specified category of heirs is represented by minors, incapacitated or limited in legal capacity citizens, the division of the inheritance and the allocation of the share due to them is carried out taking into account the rules established in Art. 37 Civil Code. Thus, any reduction in the share due to such an heir is permissible only with the permission of the guardianship and trusteeship authority.

- Like all other heirs, this category has the right to both unconditionally and directed at another heir to refuse the inheritance (Article 1157 of the Civil Code). However, a directed refusal is permissible only in the case of inheritance by law - refusal of an obligatory share is unacceptable (clause 1 of Article 1158 of the Civil Code).

What share of the inheritance is a pensioner entitled to after the death of a relative? If the pensioner is the spouse or parent of a deceased citizen, by law he will be included first in the list of heirs. This means that in the absence of a will, all assets and funds of the deceased will be distributed among the first priority heirs in equal proportions.

Guided by paragraph 1 of Art. 1068 of the Special Part of the Civil Code of the Republic of Kazakhstan assumes that persons who are classified as heirs according to the law, who are disabled at the time of opening of inheritance rights, are not included in the established queue, which has the opportunity to be called to inherit, will inherit according to the law in equal rights with the specified queue, if during of the last year of the life of the owner of the inheritance were supported by him, regardless of whether they lived under the same roof with the testator.

This means that if a dependent falls into the second line of inheritance and has been supported by the testator for more than a year and does not live together with him in the same living space, he is in any case entitled to a share of the inherited property on equal rights with the heirs of the first stage. To resolve this situation, confirmation of the fact of being a dependent is required. The fact of stay is established on the basis of the entry into force of a court decision.

- A statement in which a disabled citizen agrees to care for him. If a person is declared incompetent, the application must be submitted through a representative. In this case, it is additionally necessary to provide a document on guardianship.

- Application from a citizen who will care for a disabled person.

- A certificate stating that the person still does not receive a pension. It must be taken to the Pension Fund of the Russian Federation (at your place of residence).

- A certificate confirming that the disabled person does not receive any unemployment benefits.

- Passport.

- Work record of the citizen who will provide care.

- Certificate of full-time study of a person who is currently caring for a disabled person.

If children, spouse or parents establish that they are not listed among the heirs under the will, they have the right to a compulsory share - for this they need to confirm their incapacity for work. Our lawyers know the answer to your question. If you want to find out how to solve your particular problem, then ask our duty lawyer online.

How is disability confirmed? The right of pensioners to an obligatory share in the inheritance is confirmed by the fact of disability. Due to objective reasons, the most common cases are when the parents or spouse of a deceased citizen are pensioners.

It is for this reason that a person has to prove his inability to work according to judicial procedures.

Disabled spouse and parents who have reached retirement age.

Disabled dependents - include citizens who are not included in the circle of heirs. Compensation payment for care Resolution of the Government of the Russian Federation dated June 4, 2007 No. 343 approved the Rules for making monthly compensation payments to non-working able-bodied persons caring for disabled citizens.

For the purposes of this Federal Law, the following basic concepts are applied: labor pension - a monthly cash payment in order to compensate insured persons for wages and other payments and rewards lost by them due to the onset of incapacity due to old age or disability, and for disabled family members of insured persons - wages and other payments and remunerations of the breadwinner lost in connection with the death of these insured persons, the right to which is determined in accordance with the conditions and standards established by this Federal Law.