Changes in legislation

Legislative acts allow the redistribution of any type of property mass, which includes cash, real estate, valuable collections, etc. In addition, it is possible to transfer not only property powers or obligations. Changes from 2021 relate to the timing during which inheritance powers are processed. In a situation where an apartment purchased with a mortgage is inherited, the successor, after entering into the status, continues to make payments to the banking organization. He will be able to avoid paying only on the condition that he completely refuses to receive the inheritance.

A testamentary act for a house and land plot, and other property can be formed at any age category. Therefore, when drawing up the act, you will need to write that the property is transferred to everything that had been accumulated on the day of the owner’s death. There will be no need to make changes to the testamentary disposition if the items are sold or, conversely, purchased.

ATTENTION !!! The terms and procedure for entering into the rights in question are currently new. They are associated with the fact that an inheritance fund is being created; in addition, the periods during which citizens must enter into their powers are changing.

Among other things, the adjustments affected the formation of an inheritance agreement and a testamentary act, which reflects the will of both spouses.

How is an inheritance fund created?

It is considered as a structure that is used to manage property owned by a specific person. The testator directly disposes of such a fund. It indicates who is included in such a fund. These may include individual citizens or legal entities. Citizens who are responsible for managing such a fund are given specific rights and obligations. The property classified as part of the property mass is transferred to the fund. In particular, we are talking about the personal capital of a citizen. These could be businesses or charitable foundations.

In a situation where funds are being created, then the entry into ownership will be shifted in time. For example, rights to an apartment after 6 months, according to the laws. However, when organizing a fund, the registration of the inheritance occurs on the day or one day after its formation. The employee of the notary office is responsible for checking the information in the databases, including whether the fund took place or not. They contact whoever runs such an organization.

ATTENTION !!! It is worth noting that all persons who claim to receive property belonging to the deceased must be notified of the process. They must agree to this procedure. If the formation of the fund in question does not occur, then the rules that were in effect previously apply. The heirs have the obligation to submit an application within six months and indicate that they wish to become the owners of the property remaining after the death of a relative.

After this point, the property is divided according to legal provisions or by testamentary instrument. After a six-month period, a certificate is generated reflecting the rights of ownership of the property.

Inheritance tax under a will

When drawing up a will, the owner of the property has the right to transfer it not only to individuals, but also to legal entities, as well as to the state. In the case of inheritance by an individual, the recipient does not have to be a relative: the owner, at his own discretion, distributes shares of the property among a certain circle of associates.

We can summarize: the abolition of tax upon inheritance of property does not exempt heirs from paying state fees for registration and issuance of certificates of inheritance. The amount of payment depends on the degree of relationship:

- 0.3% - for heirs of the first and second stages;

- 0.6% - for other heirs (Article 217 of the Civil Code).

The same rates are relevant for various types of property in the event of inheritance not under a will. Certain categories of heirs are exempt from the need to pay state duty. These include Heroes of the USSR and Russia, veterans, participants, disabled war veterans, full holders of the Order of Glory, etc.

The rest, when receiving an inheritance, are required to pay the fee established by law within the agreed period, depending on the type of property.

Joint will

Article 256 of the Civil Code of the Russian Federation indicates that a married couple has the opportunity to draw up a joint testamentary act. However, it can only include property that is classified as common property. These changes are spelled out in the new law. Entry into force will occur at the beginning of June 2021. How much it costs to draw up such a deed depends entirely on which notary office the husband and wife contact. They have the opportunity to choose any organization they wish. Tariffs vary everywhere.

In order for the drafted act to be recognized as valid, certain conditions must be taken into account. Including, both citizens must have legal capacity. This is assessed at the time they make the order. In addition, an assessment is made of whether the marriage union between them is officially concluded. Only marriages that are registered when applying to the civil registry office are taken into account. It is necessary to register information about the persons to whom the property mass is transferred.

ATTENTION !!! If one of the citizens has personal property, then he has the opportunity to dispose of it when creating the specified document. If several legal successors are provided, then the deed reflects the size of the shares relative to each person.

Sometimes situations arise when a marriage union is recognized as inconsistent with reality. Also, when the relationship between spouses is dissolved, the document in question is subject to termination. If two citizens have formed a single will, then after the death of one of them, it is subject to change.

Formation of inheritance contracts

These changes will also apply from the beginning of June 2021. A distinctive feature of this act is that after the death of a citizen it will not be necessary to obtain consent from legal successors regarding the acceptance of the mass. This means that the property mass is transferred on the basis that the citizen has died. To form an agreement, you will need to contact a notary. This applies to situations where the distribution of objects classified as real estate occurs. In addition, rules have been established according to which registration of paper with the Rosreestr authorities will be mandatory. Citizens have the opportunity to enter into contracts with both individuals and legal entities.

IMPORTANT !!! The applicant may be a person who is under age. In such a situation, when forming such a paper, his legal representatives must be present. It’s not just parents who are considered this way. The legislator also includes guardians among them.

As with the usual method of distributing the inheritance, the rules of compulsory share apply to persons who are minors or lack legal capacity. The agreement is applied to protect the rights of both parties. This paper will require an assessment of the items that will be transferred.

To ensure the properties of legality, it is necessary to appoint a person who will perform supervisory functions. This person ensures that obligations are fulfilled accurately. In addition, you can reflect the conditions that must be met before accepting the inheritance. For example, this may be a duty related to providing comfort to the deceased's pet.

The agreement can be terminated if certain conditions are met, including:

- the presence of a mutual agreement;

- appeal to a judicial authority (in this case, only one of the parties can act as an initiator).

In some situations, the act in question is considered to be inconsistent with reality. In particular, this happens when a citizen refuses to fulfill the duties assigned to him by paper. By the time the documentation is signed, the party is recognized as having lost legal capacity. At the same time, this fact will need to be confirmed with documents. In addition, this can happen when the conditions specified in the agreement are not fulfilled for valid reasons. For example, if a person has health problems.

Inheritance services

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION FEDERAL TAX SERVICE

LETTER dated August 24, 2012 N OA-3-13/ [email protected]

Taking into account the provisions of paragraph 2 of Art. 207 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. 183 days of stay in the Russian Federation, upon reaching which an individual will be recognized as a tax resident of the Russian Federation, are calculated by summing up all calendar days in which the individual was in the Russian Federation for 12 consecutive months. Days spent outside the Russian Federation, regardless of the purpose of departure, are not taken into account, except for cases expressly provided for by the Code (short-term (less than six months) treatment or training). The issuance of documents confirming the status of a tax resident of the Russian Federation (hereinafter referred to as Confirmation) is carried out by the Interregional Inspectorate of the Federal Tax Service for Centralized Data Processing (MI FTS for Data Center). Documents substantiating the actual presence of individuals on the territory of the Russian Federation may be certificates from the place of work issued on the basis of information from the work time sheet, copies of a passport with marks from border control authorities about crossing the border, receipts for hotel accommodation, registration documents for place of residence (stay), issued in the manner established by the legislation of the Russian Federation. To obtain a Certificate of Confirmation of the status of a tax resident of the Russian Federation, the following documents must be submitted: a) an application in any form indicating: - the calendar year for which confirmation of the status of a tax resident of the Russian Federation is required; — the name of the foreign state to whose tax authority the confirmation is submitted; - last name, first name, patronymic of the applicant and his address; — taxpayer identification number - an individual (if any), which is indicated in the document confirming the tax registration of this individual with the tax authority of the Russian Federation; — list of attached documents and contact phone number; b) copies of documents justifying receipt of income in a foreign country. Such documents include: — agreement (contract); — decision of the general meeting of shareholders on the payment of dividends; — documents confirming the right to receive a pension from abroad; — other documents; c) a table for calculating the time of stay on the territory of the Russian Federation; d) copies of all pages of general Russian and foreign passports. Detailed information on the procedure for confirming the status of a tax resident of the Russian Federation is available on the website https://www.nalog.ru (banner “Confirmation of tax resident status”).

Acting State Advisor of the Russian Federation 3rd class A.L. OVERCHUK 08.24.2012

Deadline adjustment

Article 1154 of the Civil Code of the Russian Federation talks about how to determine the deadline for entering into inheritance powers. The law previously stipulated that citizens claiming property must visit a notary's office within six months. It begins to count from the moment the owner died. Currently, six months are initially allocated so that the heirs of the first group can formalize their rights. If they did not apply to the notary or refused the property estate, then after this time the next person in line has the opportunity to claim the estate. For each category of legal successors, a period of six months is now set.

The new rules indicate that when forming an inheritance agreement or when forming funds, the rights of ownership of the estate are transferred much earlier. For example, powers are transferred within a few days. Such provisions are especially important for those who own a business. This is necessary so that the company does not cease to function. A citizen always has the opportunity to use the standard option of dividing the property mass.

Payment of duties

Since 2006, the tax on entering into inheritance legal relations has ceased to apply. Since then, the so-called tax duty has been used. This means that taxes are not directly levied. At the same time, the heirs will have to pay a fee. Its value is determined in legislative acts. Payment of the fee is provided at the notary's office. The amount of such a contribution depends entirely on the closeness of the relationship with the deceased and what is included in the inheritance mass.

ATTENTION !!! It is indicated that citizens classified in the first two categories of legal successors must pay a fee of 0.3 percent. They are calculated from the value of the property mass.

The law reflects a limit on the amount for such a duty. It cannot exceed more than 100 thousand rubles. For other categories of legal successors, the amount is doubled. This means that they will have to pay 0.6 percent.

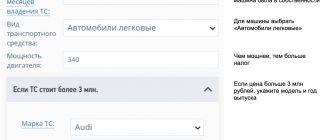

In the situation under consideration, it does not matter what property is to be transferred. This may include elements of real estate or personal belongings of the deceased. In addition, it has been established that the specified amounts will be required to be paid upon receipt of ownership of accounts, shares or real estate, vehicles. The same rules apply to other properties as well. The law reflects groups of persons who have the opportunity not to pay such fees.

These include:

- persons holding the title of Full Knight of the Order of Glory;

- those who are Heroes of the USSR or the Russian Federation;

- citizens who have the status of a WWII veteran.

It is worth noting that the fee must be paid not only in the situation where the distribution of property occurs on the basis of legal acts. If the deceased has drawn up a testamentary act, the legal successors still pay the fee. Often the amount varies depending on the territory of residence of the heirs. Notary office employees charge fees for carrying out technical work.

The essence of inheritance tax

The current legislation of Russia provides that the receipt of funds or property of citizens into ownership is subject to tax. The obligation to pay it rests with the inheritors, and the amount depends on the liquid value of the property.

At the same time, many wealthy Russians at one time transferred their assets to offshore companies. After their death, receiving an inheritance for relatives with low incomes turned into a difficult pregnancy. As a result, in July 2005, Russian legislators abolished inheritance fees under a will in relation to funds, material assets, movable and immovable property (Law No. 78-FZ).

But still, the recipient of the bequeathed property must pay a state fee when opening an inheritance case. Until mid-2005, it was also necessary to pay tax, the amount of which depended on family ties. The fees were paid by the heirs depending on the order:

- for children, spouses, parents, the tax rate was up to 5% of the property’s valuation;

- for brothers, sisters, grandparents – up to 10%.

- for other relatives not belonging to the first two groups - up to 20%.

The regulation and collection of tax was carried out on the basis of instructions formed from various regulatory legal acts (RLA). Currently, the term “inheritance tax” means the payment of state duty, the regulation of which is described in Chapter 63 of the Civil Code.