General provisions of transport tax

Paid annually (reporting period - 365 days - begins on January 1). General points are recorded in Chapter 28 of the Tax Code of the Russian Federation. The rate is regulated separately in the constituent entities of the Russian Federation. The upper threshold is determined by the code. The final size is calculated based on power and age.

It is important to know! Payers are all registered owners, regardless of legal status and type of funds. The list of objects is quite extensive. You also need to know which cars are not subject to transport tax.

Calculation formula

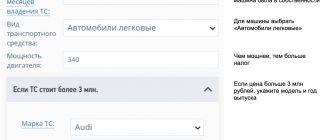

The final amount is determined by the following points: type of vehicle, year of release from the assembly line, power, tenure in the current period, current rate. The main part of the information is recorded in the technical passport.

The power of the mechanism is measured in horsepower. Tax legislation defines coefficients for different categories - up to 100 hp, 150, 200, 250 and above. When making calculations, use the value fixed by the code.

The tax amount is calculated using the simple formula A * B * C * D, where:

- A – power in hp;

- B – bet size;

- C – share in property (one owner – 1, two – 0.5, three – 0.33, and so on);

- D – ownership time (for newly registered cars it can be less than a year).

For expensive cars - from 3 million rubles - an additional multiplier is provided (valid for foreign cars and domestic vehicles).

Who has the right not to pay transport tax?

I would immediately like to clarify something from the above, namely, that the transport tax must be paid not by their owners (proprietors), but by the persons to whom the specified vehicles are registered (Article 357 of the Tax Code of the Russian Federation, hereinafter referred to as the Tax Code of the Russian Federation). So, the first reason why a person does not have a tax burden is the absence of a registered vehicle.

Here, of course, it should be noted that in order to use most vehicles for their intended purpose, registration is, as a rule, indispensable. For example, driving a car that is not registered in the manner prescribed by law is an administrative offense in accordance with Art. 12.1 of the Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation). But nevertheless, for tax purposes, registration is the basis for the occurrence of tax.

In particular, a moped (as defined by the legislation of the Russian Federation) or a bicycle also refers to vehicles. But they are not subject to transport tax, since their registration is not required (clause 1.2 of the Government of the Russian Federation of October 23, 1993 No. 1090, clause 1 and paragraph 2 of clause 2 of the Government of the Russian Federation of August 12, 1994 No. 938, clause 1 Order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001, paragraph 1, paragraph 51 of Order of the Ministry of Internal Affairs of Russia dated August 7, 2013 No. 605).

The second is the absence of grounds for the emergence of an object of taxation.

The list of vehicles that are subject to taxation is presented in paragraph 1 of Art. 358 Tax Code of the Russian Federation. They can be roughly divided into three categories:

- ground vehicles (cars, buses, motorcycles, scooters, snowmobiles, etc.);

- water vehicles (yachts, motor ships, boats, motor boats, sailing ships, etc.);

- air vehicles (helicopters, airplanes, etc.).

The list is almost comprehensive, but at the same time, paragraph 2 of Art.

358 of the Tax Code of the Russian Federation provides a list of vehicles that are not subject to taxation. For example, cars equipped for people with disabilities, tractors (other agricultural vehicles) used in agriculture by agricultural producers. Tax is not charged, including if the vehicle is wanted (with documentary evidence of theft) (clause 7, clause 2, article 358 of the Tax Code of the Russian Federation).

The third reason is the availability of transport tax benefits.

The Tax Code of the Russian Federation does not contain a list of persons entitled to benefits or tax exemptions. However, transport tax refers to regional taxes (Article 14 of the Tax Code of the Russian Federation). This means that the laws of the constituent entities of the Russian Federation may establish various preferences for the payment of this tax (clause 3 of article 12, paragraph 3 of article 356 of the Tax Code of the Russian Federation).

Information about the availability of benefits in a specific region of residence can be found out from reference and legal systems, by contacting the tax office at your place of residence in writing, or through the official website of the Federal Tax Service of Russia (electronic services, section “Reference information on rates and benefits for property taxes”).

So, for example, in Moscow, individuals are exempt from transport tax Art. 4 of Moscow Law No. 33 of July 9, 2008 “On Transport Tax” (hereinafter referred to as Law No. 33).

Such persons include, in particular (exemption from tax for one vehicle of their choice):

- Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees;

- veterans, disabled people of the Great Patriotic War, military operations;

- disabled people of groups I and II;

- one of the parents (adoptive parents), guardian, trustee of a disabled child;

- persons who own passenger cars with an engine power of up to 70 hp. With. (up to 51.49 kW) inclusive;

- one of the parents (adoptive parents) in a large family;

- other persons specified in paragraph 1 of Art. 4 of Law No. 33.

At the same time, tax exemption is not provided for passenger cars with engine power over 200 hp.

With. (over 147.1 kW) water, air vehicles, snowmobiles and motor sleighs. To receive the benefit, you must submit an application and copies of title documents to the tax office.

The fourth reason is failure to receive a tax notice from the tax authority regarding the payment of transport tax.

For some taxes, including transport taxes, an individual (who is not an entrepreneur) pays the tax only on the basis of a tax notice received from the tax inspectorate (clause 3 of Article 363 of the Tax Code of the Russian Federation).

In this case, the obligation to pay tax arises only after receiving it. After all, it is in the tax notice that the amount to be paid to the budget will be indicated, which the tax authority calculates independently (clause 2 of Article 52 of the Tax Code of the Russian Federation, clause 3 of Article 363 of the Tax Code of the Russian Federation).

However, it should be remembered that from January 1, 2015, individual taxpayers have an additional obligation to report to the tax authorities about the availability of taxable items in the event of failure to receive a tax notice within the period established by law (clause 2.1 of Article 23 of the Tax Code of the Russian Federation). Failure to fulfill this obligation is subject to liability under Art. 15.6 Code of Administrative Offenses of the Russian Federation. This should also be taken into account when purchasing a vehicle.

We hope this material will find practical application. We wish you good luck!

Which cars are not subject to tax?

You can find out for which cars you do not have to pay transport tax from paragraph 2 of Article 358 of the Tax Code of the Russian Federation. The list includes the following categories of cars:

- converted for citizens with disabilities;

- acquired in accordance with the procedure established by law through social protection authorities;

- stolen, if the theft is officially confirmed through statements to the police;

- agricultural machinery (tractors, combines, milk tankers, etc.) used for the production and transportation of relevant products;

- at the disposal of authorities;

For the listed types of vehicles, benefits apply throughout the country. Subjects can independently supplement the list and decide what other types of cars do not need to be taxed. Local authorities also set a lower threshold - how many horsepower should you pay car tax on? In particular, for the Orenburg region the limit is 100 hp.

To obtain a complete exemption from the duty, you must submit an application to the Federal Tax Service, attaching a package of supporting documents (for example, a certificate from the Central Internal Affairs Directorate about the theft).

Federal legislation: complete list of beneficiaries

Transport tax (TN) is included in the regional group, and all funds received from this type of payment are sent to the budget of the subject of the Federation at the place of payment. This distribution is quite logical, because in the future this money is spent on the development of road infrastructure in a particular region. In this regard, the tax rate, as well as the main list of beneficiaries, is regulated by local authorities.

Nevertheless, the state has determined a list of those who may not pay transport tax in any region of our country, based on federal legislation, without regard to local legal norms:

- Passenger vehicles intended for people with disabilities, subject to their receipt through contacting social services. protection.

- Passenger vehicles issued by social authorities. protection in a manner regulated by law, provided that its power is less than 100 hp.

- Motor boats equipped with an engine less than 5 hp. Also, rightfully so, the owners of rowing boats do not pay anything here.

- Vehicles whose owners determine the main type of activity is cargo transportation or passenger transportation. We are talking about watercraft and aircraft.

- Agricultural machinery and special vehicles (vehicles equipped for transporting livestock, poultry, milk tankers, etc.), owned by agricultural producing enterprises.

- Owners of river and sea fishing vessels are also not tax payers.

- Vehicles listed as stolen, which has documentary evidence.

- Aircraft used for transporting patients and belonging to the medical service.

- Water vehicles that are listed in a special international register of ships.

Owners of all of these types of transport receive a 100% benefit from the state, and any tax questions regarding the payment of technical tax are illegal.

For which cars the rate is reduced?

Low values are provided for low-power vehicles. It is believed that this is how the state encourages citizens to purchase inexpensive cars with low power. Most Russians really try to buy such cars so as not to increase their own expenses. Before purchasing, many citizens are interested in the question of how much horsepower is tax-free. In this case, each subject of the Russian Federation has its own conditions.

Power

This value directly determines the final fee amount. The lowest is up to 100 hp. For such cars, one horsepower costs 2.5 rubles. The higher the indicator, the more expensive the car tax. Sometimes technical documentation provides data in kilowatts. Horsepower is used for the calculation, so the value should be translated: ratio 1.36 hp. – 1 kW.

Regional authorities set different minimum values. To find out how many horses must pay transport tax, you need to contact the Federal Tax Service.

Age

Age is calculated from the date of manufacture of the vehicle. The Ministry of Finance of the Russian Federation set out the corresponding explanations in a letter dated January 18, 2012.

The provisions are valid throughout the Russian Federation. Tax authorities calculate age starting from January 1 of the year following the year the car was manufactured.

For example, for a car with a power higher than 250 hp and more than 5 years old, the rate is 45 rubles per horsepower; after 7 years, the amount increases to 70.

Procedure for designing benefits

The first step is to contact the Federal Tax Service to find out whether preferences are available in a particular subject of the Russian Federation. Only after this can benefits be issued to citizens who have retired.

The next step is collecting documents:

- TIN number;

- identification document;

- pension certificate and its copy;

- documents for vehicle inspection in 2021. You will need a passport, vehicle registration certificate and registration certificate.

Additional papers and certificates may be required, of which the tax service will notify the citizen. Documents must be submitted in the form of copies, but always have the originals with you. Next comes a visit to the Federal Tax Service at your place of residence, where you will need to fill out an application for benefits.

How to fill out an application for transport tax benefits

The application must indicate the object of taxation and the purpose of the subsidy. If a citizen changes a vehicle, he must also notify the Federal Tax Service about this and submit a new application.

Application example:

After submitting a package of documents to the service, it takes time to receive the result. The main thing is to submit the application no later than December 1 of the year in which the transport tax must be paid. Federal Tax Service employees are given 10 calendar days to review the application, after which a decision must be made.

Thus, the process of obtaining transport tax benefits for older people has its own characteristics. You can independently calculate its size before submitting documents to the authorized bodies. The main advantage of providing preferences in this area is the opportunity to reduce tax costs ( mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of their property, economic management or operational

) more than half.

Categories of beneficiaries

Subjects, that is, taxpayers, are all vehicle owners. These can be individuals and legal entities. For some categories of the population, the law provides benefits - exemption can be full or partial.

Individuals

According to the provisions of the Tax Code, certain categories of citizens have the right to take advantage of benefits. The authorities of the constituent entities of the Russian Federation provide additional conditions. Such individuals include:

- citizens with disabilities, for converted cars (includes groups 1 and 2);

- pensioners;

- individuals who received a car through social security authorities with a power of up to 100 hp;

- owners of stolen cars;

- veterans, large families, parents and guardians of citizens with disabilities and others.

Legal entities

The list of legal entities is also fixed in Article 358 of the code. These include owners of agricultural equipment, organizations transporting employees, veterinary care vehicles and others. But there are certain restrictions. For example, for agricultural enterprises the amount of revenue from the sale of products must be more than 50%.

Advice! A complete list of persons entitled to receive benefits is listed on the Tax Service website. You can also find out which vehicles in the region are not subject to transport tax.

Penalty for non-payment

Fees are paid within certain deadlines, and violations result in penalties. The following types of punishments are prescribed: fine, penalty, seizure of property, writing off funds from accounts, ban on traveling abroad of the Russian Federation.

Attention! Collection is carried out forcibly if a person evades payment. The tax authority submits an application to the court at the place of registration of the debtor, then the case is transferred to the bailiff service.

Vehicle tax is a mandatory annual payment (and an additional reason to consider a car a luxury). Owners are required to know the size, payment terms and information about which cars are not subject to transport tax. It is better to familiarize yourself with the fees and possible benefits before purchasing a car.