Land tax has been paid by land owners since 1999 - since the advent of the updated Tax Code. Revenues from it go to the local budget. The only exceptions are urban and agricultural lands.

The tax rate is:

- 0.3% of the cadastral value of the land. Used when calculating tax for land occupied by individual buildings or subsidiary plots. This includes land for livestock farming or horticulture.

- 0.7 - 1.5% - for other objects. Their list is specified in the regulatory legal acts of municipalities.

The calculation and payment of the tax burden are established by local legislation. It is this that determines who is entitled to land tax benefits, guided by federal regulations.

Who is eligible for benefits?

The legislation establishes categories of persons who have the right to partially pay or not pay land tax at all. This includes:

- disabled children;

- disabled people;

- WWII participants;

- labor veterans;

- Participants are liquidators of the Chernobyl nuclear power plant consequences.

- heroes of the USSR and Russia.

It is worth noting that this list is not exhaustive. Each region has its own. Let's look at the most common categories of people applying for benefits and find out whether they are entitled to them.

Veterans of Labor

The following are recognized as labor veterans:

- persons who have honorary awards of the USSR or Russia and who have the length of service required to grant a pension;

- persons who have 40 and 30 years of experience for men and women, respectively, if they began working during the Second World War before reaching adulthood.

Current federal legislation does not provide for land tax benefits for labor veterans. Article 387 of the Tax Code gives municipal authorities the right to establish the amount of non-taxable amounts for this category of persons. As practice shows, municipalities are in no hurry to take advantage of this right. In addition, now the title “Veteran of Labor” is practically not awarded.

Pensioners

In the early 90s. This category of the population was exempt from paying land taxes. With the update of the Tax Code in 2005, this privilege was abolished. Now pensioners pay land taxes in full on an equal basis with the working population.

Tax benefits are possible at the municipal level. Thus, tax privileges depend on the location of the land plot. You can find out whether benefits are available and what their size is from the regulations governing taxation at the local level. It can be downloaded from the official website of the municipality.

In addition to benefits, authorized bodies have the right to establish requirements, upon fulfillment of which an individual can take advantage of the opportunity to reduce tax or not pay it at all. Most often, these are: permanent registration in the territory of the municipality, lack of official employment, etc.

The procedure for obtaining tax benefits and the scheme for their payment can be found at the territorial tax office.

To reduce the tax base, a pensioner must provide:

- pensioner's ID;

- land documents confirming ownership;

- passport;

- work book (if necessary).

Thus, land tax benefits for pensioners are the exclusive prerogative of the local government level. Mainly used as a measure of social support for low-income groups of the population.

How to apply for a benefit?

An application for the selection of a “preferential” site, as well as for the provision of the subsidy itself, can be submitted in several ways.

In this case, the most preferable way to submit an application would be to fill it out in person with a tax authority employee. In this case, all defects will be corrected immediately.

The other option is very convenient because it requires significantly less time and effort. This is filling out an electronic application form on the tax service website, in the “Personal Account of the Taxpayer”. But this requires credentials from your Personal Account on the State Services portal. Simply registering will not allow you to submit an application. During the application process, you can consult with tax specialists either online or by phone.

IMPORTANT !!! If you do not have a taxpayer’s Personal Account, or the opportunity to write a statement in person, you can use the services of the Russian Post to send the entire package of documents. This method is the least desirable, since there is no way to immediately correct errors.

The application is sent only to the division of the tax service to which the address of the land plot is assigned. Transfer of applications between departments under jurisdiction is not provided.

Copies of a number of documents are attached to the application:

- confirming identity;

- certifying land rights;

- confirming the right to receive benefits (pension certificate, disability documents, order book and other circumstances entailing a tax reduction).

The period for consideration of the application and package of documents should not exceed 30 days.

Many experienced lawyers advise applying even to those pensioners who should automatically receive tax discounts. This will protect against possible “forgetfulness” of the tax authorities.

Disabled people 2nd group

Not a single article of the Tax Code contains information about the complete exemption of disabled people of group 2 from paying land tax.

Article 391 of the Tax Code of the Russian Federation reveals the procedure for reducing the tax base and categories of taxpayers who have the right to take advantage of such privileges. Among them there are also disabled people of group 2, provided that it was issued before 01.01. 2004.

The maximum benefit by which you can reduce the amount for calculating tax is 10 thousand rubles. You can use it by providing documents confirming your right to receive benefits.

The basis document and application must be submitted to the tax office.

Complete tax exemption for disabled people of group 2 is possible only at the local level.

So, land tax benefits for disabled people of group 2 are established at both the federal and municipal levels (by decision of the authorized body).

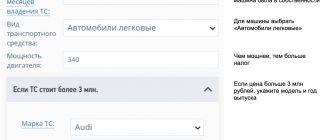

Benefits for disabled people on land tax

The amount of assistance and the procedure are regulated at the regional level in accordance with established standards. The Tax Code has clearly established rules, but sometimes they are waived: they can increase the amount of the benefit or provide it to categories of citizens not specified in the legislation. Therefore, it is advisable to find out the necessary information from local authorities. But in 2021, the Federal Tax Service launched a special online service where you can find out accurate information about the benefits existing in the region, the list of documents required to obtain and the persons who are entitled to a tax reduction.

The disabled category includes people who, for certain reasons, have developed health problems that limit normal life activities. Not only people belonging to one of the 3 groups, but also disabled veterans of military operations, including the Great Patriotic War, have the right to benefits.

To prove their status, a person must have a certificate confirming that they have passed a medical and social commission, which will indicate the disability group and the presence of limitations in their ability to work.

The Tax Code of the Russian Federation establishes 3 ways to use the benefit:

- complete exemption from fees;

- reduction of tax amount;

- taxes operating within one municipality, i.e. cities, which are established by local authorities.

Often the amount and type of benefit provided to a person is determined by taking into account the disability group, physical condition and the budget allocated to the area in which the person lives.

The legislation describes a standard rule, according to which the amount of the tax base is reduced by 10,000 rubles. This applies only to one person and within the city, regardless of the type of land ownership. The right to this assistance applies only to 1 plot of land.

1 group

Disabled people in this category have serious problems with the musculoskeletal system; it is difficult for them to move and care for themselves. Their certificates indicate that they are not capable of working. Consequently, they are awarded the greatest privileges and concessions. Group 1 disabled people are included in the list of persons who, by law, are exempt from paying land tax. This rule applies in all areas and cannot be changed.

2 groups

This includes people with limited work ability who can work themselves but require reduced hours and breaks. For disabled people of group 2, land tax is not a problem, because some of them are exempt from paying taxes - this is what the authorities of St. Petersburg have decided.

The rest are subject to the standard rule of deducting a certain amount from the cadastral value of the plot, which should not exceed 10,000 rubles. This benefit is allowed to be used by disabled children who have not reached the age of majority if they own a plot of land.

3 groups

Such disabled people rarely receive bans or restrictions from work, since their pathologies are considered moderate in severity. People can easily do without outside help and lead normal life activities. Citizens included in this category can move freely around the city without the help of third parties and have official employment.

In connection with these disabled people of the 3rd group in most cases pay the full cost of the land tax. It is almost impossible for them to obtain any financial or other assistance from the state regarding this issue. The only option is to fall into one of the categories of persons who are completely exempt from taxation. These include:

- Participants in hostilities during the Soviet era.

- Liquidators of nuclear and atomic disasters, including the Chernobyl Nuclear Power Plant.

- Persons awarded the Order of Military Glory and who are Heroes of the USSR or the Russian Federation.

- Disabled people of the second group.

- National minorities living in the Far North, Siberia and Far Eastern territories.

If there are documents or information confirming membership in the above-described groups of persons, then the chance of receiving tax benefits increases. With only a certificate of assignment of disability group 3, you should not expect to receive benefits. Therefore, you need to obtain other papers that will help in obtaining a subsidy.

Disabled people of 3 groups

A disabled person is an individual who is limited in life activity as a result of illness, injury or defect from birth. Group 3 disability is established for 1 year or for life. A certificate is issued to an individual. It is this document that serves as the basis for obtaining a tax benefit.

Federal legislation does not exempt this category of citizens from paying full taxes. Municipalities are vested with this power. In accordance with Article 391 of the Tax Code of the Russian Federation, disabled people have the right to reduce the taxable cadastral value by 10 thousand rubles.

An individual applying for this benefit is required to provide documents confirming his right to the inspectorate at the location of the land plot.

Land tax benefits for disabled people of group 3 are associated with a reduction in the amount for calculating the tax.

Types of benefits

First of all, it is worth considering the type of benefit that is provided for disabled people in Part 5 of Art. 391 Tax Code of the Russian Federation. Its essence lies in reducing the tax base (that is, the cadastral value) for the payer by 10 thousand rubles . As a consequence of this, the final tax amount is also reduced, since it is calculated directly from the cadastral value.

The specific amount of the tax discount in monetary terms depends on what rate is applied and can be:

- 30 rub. (at a rate of 0.3%);

- 150 rub. (if the rate is 1.5%).

In the case when the cost of the plot is less than 10 thousand rubles, the tax base becomes equal to 0. Accordingly, this leads to the fact that the tax is also equal to 0, so the obligation to pay it from the landowner in such a situation is completely removed.

As for regional benefits, they may include the following:

- complete tax exemption;

- receiving a certain discount on its amount (usually 50%);

- reduction of interest rate on tax;

- the opportunity to reduce the tax base by a larger amount than established by law.

As a rule, quite significant tax deductions are usually established in large cities and regional centers, where the cost of land is very high. In addition, the possibility of applying benefits and their size directly depend on the financial capabilities of a particular region - the more funds in the budget, the more significant the benefits provided will be.

For example, in Moscow, the amount of reduction in the tax base for disabled people of groups 1 and 2, as well as disabled people since childhood, the Second World War and combat operations is 1 million rubles. In St. Petersburg, these payers are exempt from paying land tax in full, receiving a 100% discount on it.

Land lease for 49 years with subsequent purchase can only be provided to citizens of the Russian Federation. Do you want to rent land for private plots? How to do this correctly is described here. Non-residential premises can be converted into residential premises. The detailed algorithm is in our article.

Land tax: features

- Calculated from the cadastral value of the site. If it is revalued, the amount may increase up to 1.5 times.

- In most regions of Russia, the amount of cadastre value far exceeds the market value of a plot of land.

- Tenants of the site are exempt from the tax.

- The cadastral value may be reduced by court decision. To do this, the applicant must prove that it exceeds the market price of the land. An independent assessment will be required.

- Preferential categories of persons are mainly established at the local level. So in Yekaterinburg, pensioners, including working people, are exempt from tax.

- The tax must be paid by 1.10. Failure to pay will result in fines and penalties.

- In the future, land and property taxes will be combined.

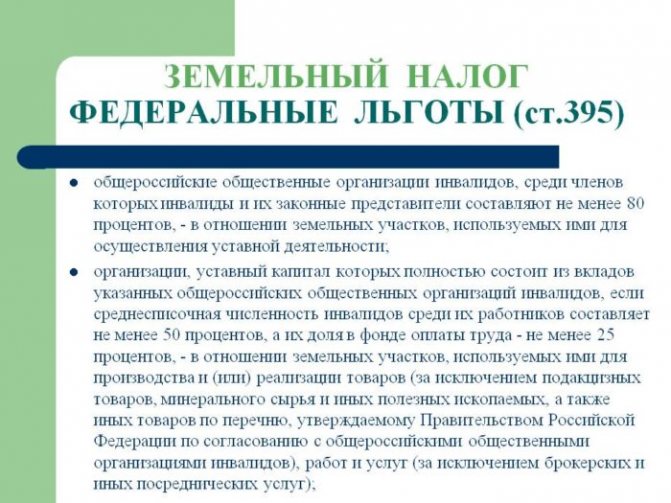

What categories of citizens of the Russian Federation, in accordance with the law, do not pay land tax at all?

The law classifies the following persons as such beneficiaries:

- citizens belonging to small ethnic groups by origin living in the Far North, Siberia and the Far East, provided they live in these territories;

- organizations of the above-mentioned citizens (communities) who try to preserve the traditions and customs of small nationalities and use land plots for this;

- land tenants.

This is an exhaustive federal list of preferential categories of taxpayers. It can be expanded by municipal legal acts, but in no way narrowed (including in the Moscow region), since this tax goes to the local budget.

Consultation regarding whether the owner of a land plot belongs to the category of beneficiaries or is obliged to pay the tax in full must be provided by the tax service.

Benefits for land tax in Moscow

In addition to the list of persons who are exempt from tax on the basis of federal legislation, in Moscow no tax is levied on:

- members of large families;

- military members who have lost their breadwinner;

- minor children;

- disabled people of groups 1 and 2.

50% of the calculated tax burden is paid by employees of enterprises financed from the local budget. Employees of enterprises financed from several budgets can apply for 25%.

Thus, benefits for land tax for individuals in 2014 depend largely on the region.

Legislative framework for collecting land taxation

The 31st chapter of the Tax Code of the Russian Federation is devoted to the type of tax under consideration. Land tax goes to the budget of the locality and, accordingly, refers to local taxes and fees. That is why federal legislation in the form of the Tax Code is supplemented by regulations of local administrations. They cannot in any way worsen the taxpayer’s position in comparison with what is prescribed in federal law.

This type of tax is paid and applies not only to individuals, but also to various organizations. Taxable land does not necessarily have to be owned by organizations and citizens. Any type of land use is also sufficient, with the exception of a lease agreement.

Tenants or persons using land free of charge, but not being its owners, do not pay tax.

- The tax is imposed on any plot of land, excluding:

- for any reason, plots of land withdrawn from circulation;

- lands occupied by any museum-reserves, objects of cultural value of the highest degree and monuments of archaeological heritage;

- lands covered with forests;

- land plots occupied by water bodies belonging to the Russian Federation;

- land around a multi-storey building.

The tax amount reaches 1.5% of the value of the land plot. The basis is the cadastral value of the land plot. Moreover, previously 80% of the cadastral value of the land plot was taken as a basis, but from this year the full value is used to calculate the tax. Accordingly, the tax amount has increased since 2021. The applied cadastral value can be challenged by filing a claim in court. If the judge makes a positive decision, the taxpayer will be refunded the overpayment for the last three years.