Land tax: what is it?

Every citizen who owns a plot of land is forced to pay land tax to the state. The land tax in question is paid every year. Payers are persons who own the land in question for life, can use it indefinitely, or whose property the land in question is included in.

Land tax is local . It is paid depending on the conditions that are accepted in the region where this site is located. The local range determines the rate, payment terms and benefits.

What taxes will citizens be exempt from?

1. The law provides for a reduction in the tax base for land tax by the cadastral value of six acres owned, permanent (perpetual) use or lifetime inheritable possession of privileged categories of citizens.

2. Reducing the tax base is possible only in relation to one plot of land at the taxpayer’s choice, of which he must notify the tax authority. In the event of failure to provide notice of such tax deduction by an eligible taxpayer, the deduction will be made in respect of the most valuable parcel of land.

Payment of land tax: current rate

Land tax for individuals is calculated according to current rates. They have a direct connection with what the municipal body offers. When it comes to a piece of land, the rate in question is any percentage that is not more than 0.3%. But it is important that the sites relate to one of the categories under consideration:

- They were agricultural lands. That is, they are part of zones that are considered agricultural, located in settlements where many are engaged in agricultural work or production in the areas in question.

- Occupied with housing stock, engineering infrastructure, housing and communal complexes. Moreover, these plots can be purchased or provided. It is important that they are received for housing construction and not for commercial purposes. If this is not the case, rates may change.

- Territories that are not used for business. For example, owners use them to develop their own subsidiary plots, grow garden or vegetable crops.

- Lands whose turnover is limited to meet the needs of defense and security of the state.

The federal tax for other territories is 1.5%. Differential tax rates may be established, depending on the category the territory belongs to and how it will be used. At the same time, the land tax remains unchanged if the taxpayer has entered into an SZPK agreement that encourages capital investment. Then the rate for them does not change while the agreement is in force. The main thing is that information about the agreement under consideration is entered into the SZPK database.

Payment of land tax from individuals on land in settlements

- Payment using payment cards VISA, VISA Electron, MasterCard, Maestro of all banks, American Express only for clients of Kazkommertsbank JSC, Altyn only for clients of Halyk Bank of Kazakhstan JSC.

- Payment in one click. Fast payment, without re-entering card data VISA, VISA Electron, MasterCard, Maestro.

- Payment by invoice application in the cash register and Internet banking of Eurasian Bank JSC, in the cash register of Kazpost JSC and in the PayPoint electronic money system.

- Log in to the portal and click on the “Pay online” button.

- Select the tax authority (at the place of registration of the taxable object) and indicate the amount of tax to be paid.

- Select one of the proposed online payment methods (see below).

- Confirm that the entered data is correct and continue making the payment.

- Enter the payment card details: number, full name of the owner, expiration date and CV code (if you select the first method).

- In your personal account (in the “Service payment history” section), review the payment receipt.

- If necessary, you can present a printed receipt to the Tax Committee to confirm that the tax has been paid.

We recommend reading: What Documents Are Needed for Registration of a Newborn Child in an Apartment

Land tax: who are the payers?

All individuals must pay land tax, provided that the land for which they pay money to the state is in their possession on the following grounds:

- By right of ownership;

- By right of use (provided that it is permanent and unlimited);

- By right of lifelong ownership of an inheritable nature.

They may have their own benefits, but they will not be completely exempt from tax.

Disabled people 2nd group

Not a single article of the Tax Code contains information about the complete exemption of disabled people of group 2 from paying land tax.

Article 391 of the Tax Code of the Russian Federation reveals the procedure for reducing the tax base and categories of taxpayers who have the right to take advantage of such privileges. Among them there are also disabled people of group 2, provided that it was issued before 01.01. 2004.

The maximum benefit by which you can reduce the amount for calculating tax is 10 thousand rubles. You can use it by providing documents confirming your right to receive benefits.

The basis document and application must be submitted to the tax office.

Complete tax exemption for disabled people of group 2 is possible only at the local level.

So, land tax benefits for disabled people of group 2 are established at both the federal and municipal levels (by decision of the authorized body).

Land tax 2021: who doesn't pay

The federal tax provides for certain benefits, according to which the following territories will be exempt from encumbrance:

- Properties included in the forest fund, considered a national park or nature reserve;

- Places where the federal highway and other roads pass;

- Property of the Russian Armed Forces (including military vessels), as well as the territories of shipbuilding companies and water funds;

- Lands on which religious communities and places of worship are located;

- Places where multi-apartment buildings and houses for people with disabilities are located.

Any object of this type can do without financial burdens in the form of taxes.

Property tax and special regimes

Legal entities and entrepreneurs using special regimes (simplified taxation, imputation, unified agricultural tax, patent) are exempt from paying property tax. This benefit is in a number of articles of the Tax Code of the Russian Federation: 346.1-3; 346.11-2.3; 346.26-4; 346.43-10.

Agricultural producers are exempt from paying property tax in relation to property used for the needs of agricultural production and sale of products, i.e. for business purposes. The same rule applies to other taxes. Exceptions are the norms of Art. 378.2 Tax Code of the Russian Federation. It talks about administrative and commercial property objects, for which the tax base is determined as the cadastral value. The benefit does not apply to them.

In order for a taxpayer working under a special regime to determine whether he is entitled to a benefit, two points need to be taken into account:

- Have the regional authorities adopted a legislative act on cadastral valuation of property, are these objects mentioned in Art. 378.2-1 of the Tax Code of the Russian Federation, whether the rules for calculating tax in connection with the assessment of objects at cadastral value have been approved, whether the actual assessment of cadastral value has been carried out at the beginning of the period (year).

- Does the taxpayer have buildings that house offices, premises intended for trade, or provision of services?

Overdue land tax: what are the consequences of missing the tax payment deadline?

Payment of land tax must take place within the specified period. Land tax for legal entities is no exception. The organization must pay the state according to the requirements. If the tax payment deadline is missed, you have to wait for the consequences - the collection of penalties. It is charged for each overdue day, increasing the amount of debt.

If the delay occurs at the end of the year, you will also have to pay a fine for land tax. When the error was unintentional, the fine will be 20% of the tax itself, and if it was intentional, then you will have to pay 40%. And no benefits will help in this case.

Do you need to pay land tax

Land tax refers to local taxes. The new Chapter 31 of the Tax Code “Land Tax” has been in force for two years now, which actually replaced the federal law “On Payment for Land”. However, the calculation of this tax still raises a lot of questions. Your rights to a land plot Issues of land legislation are regulated by the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation). Organizations are allowed to use land as private property (Article 15 of the Land Code of the Russian Federation). To do this, you need to buy land. However, at present, most firms own land plots on a permanent (indefinite) basis. Those. they do not have ownership rights and cannot dispose of the land. The owner of a building or structure located on a state or municipal land plot has the right to use it on the basis of ownership, permanent use or lease. If you have a building and the land is not privately owned, then you automatically use the site on a perpetual (permanent) basis. That's what it says in paragraph. 1 and 2 tbsp. 271 Civil Code of the Russian Federation. And it doesn’t matter whether you have documents or not. REMINDER: Currently, it is prohibited to provide land plots on conditions of permanent, unlimited use. This remains the case for firms that received land plots before the RF Land Code came into force. However, before January 1, 2008, organizations and entrepreneurs must re-register land plots occupied on a perpetual use basis into ownership or lease (Federal Law No. 192 of December 27, 2005). The purchase of land plots is discussed in Art. 36 of the Land Code of the Russian Federation. Who pays the land tax The main problem of the land tax is that many organizations (entrepreneurs) obliged to pay it are not aware of it. Article 388 of the Tax Code of the Russian Federation recognizes as payers of this tax organizations and individuals who own land plots on the right of ownership, the right of permanent (perpetual) use or the right of lifelong possession. Organizations and individuals do not pay tax in relation to land plots held by them under the right of gratuitous fixed-term use or transferred to them under a lease agreement. REMINDER: Individuals are citizens of the Russian Federation, individual entrepreneurs.

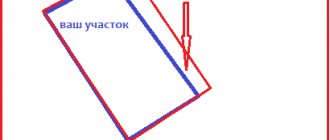

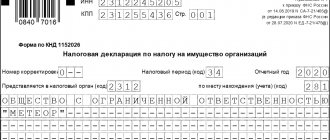

The transition to a simplified taxation system or payment of a single tax on imputed income does not exempt from payment of land tax. The organization owns the land with the right of free use. The agreement with the owner was concluded for a period of 20 years. Should an organization pay land tax? No. In this situation, the use agreement is concluded for a certain period - 20 years. The company rents the building. Does the tenant have to pay tax on the land on which it is located? In accordance with Art. 652 of the Civil Code of the Russian Federation, under a lease agreement, only the building is transferred for temporary use. Those. the building still remains on the balance sheet of the lessor. He will continue to pay tax for the corresponding land plot, unless otherwise specified in the property lease agreement. Relations related to land lease are not subject to tax legislation, but are regulated by the Civil Code of the Russian Federation. In other cases, land tax is paid. Very important! A land lease agreement concluded for a period of more than one year is subject to state registration. Note! Many companies rent premises. Some inspectors believe that the organization must pay land tax. The arbitrators do not support the inspectors (for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated July 14, 2005 in case No. A26-108/2005-217). The judges stated that land tax is paid by land owners, except tenants (Article 388 of the Tax Code of the Russian Federation). The tenant of the premises does not have any rights to the land. REMINDER: Land tax under the right of lifelong inheritable ownership must also be paid. But this applies only to citizens (Article 21 of the Land Code of the Russian Federation). What is the basis for paying land tax? Ownership of land arises in an enterprise after its state registration, which has been carried out since January 31, 1998 in accordance with Federal Law No. 122-FZ dated July 21, 1997 (as amended on July 18, 2006). ) “On state registration of rights to real estate and transactions with it.” The specified rights to land plots are certified by the issuance of a certificate of ownership of the land plot. If the organization has not yet registered its rights, then it is still recognized as the owner of the plot on the basis of government acts, certificates and other documents certifying land rights that were issued to the organization before Law No. 122-FZ came into force. This is stated in the letters of the Ministry of Finance dated June 20, 2006 No. 03-06-02-04/88, dated October 27, 2006 No. 03-06-02-04/149. REMINDER: Tax authorities are guided by the concept of “the unity of fate” of real estate and the land plot underneath it. If you own real estate, you are required to pay tax for the land on which it is located. What is a cadastral valuation? To establish the cadastral value of land plots, a state cadastral valuation of land is carried out (Article 66 of the Land Code of the Russian Federation). Any piece of land has a real price, which directly depends on its quality. The more fertile the land, the correspondingly higher its value. Each land plot must have its own cadastral number. When completing a purchase and sale transaction, this number will be recorded both at the Land Committee and at the Registration Chamber. State cadastral registration of land plots is carried out in the state land cadastre system by entering information about the land plot into the Unified State Land Register. What does the amount of tax depend on? The amount of land tax depends on the cadastral value of the land plot and the established tax rate for land tax. The higher the cadastral value, the higher the tax amount. The cadastral value is determined based on cadastral valuation data, the results of which are approved by the executive authorities of the constituent entities of Russia on the basis of calculations made by the Federal Cadastre Agency of the property. Local authorities should inform the taxpayer about the cost of the site, or it is worth contacting the local authority for regulating land relations (for example, the Department of Land Resources). The cadastral value is determined on a specific date - January 1 of the year, which is the tax period for the tax. However, for tax purposes it cannot be changed during the year unless there have been changes in the results of the state cadastral valuation of land due to the correction of technical errors or a corresponding court decision has been made. Tax base Taxpayers (organizations, entrepreneurs) determine the tax base independently. According to Art. 390 of the Tax Code of the Russian Federation, the tax base for land tax is defined as the cadastral value of land plots. Based on Art. 391 of the Tax Code of the Russian Federation, the tax base is determined for each land plot as its cadastral value as of January 1 of the year. The tax base is determined separately in relation to shares in the common ownership of a land plot, for which different persons are recognized as taxpayers or different tax rates are established. Tax rates Tax rates are regulated by the laws of municipalities (clause 1, article 394 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation establishes the maximum tax rates: - 0.3% for agriculture and areas occupied by housing and communal services; — 1.5% for all other lands. REMINDER: Local authorities can independently differentiate the size of rates within these limits depending on the categories of land. An individual entrepreneur owns a plot of land, which is located on the territory of two municipalities. How should the tax be calculated in this situation? The tax base for the part of the site located on the territory of each municipality is formed as a share of the cadastral value of the site, in proportion to the share of the area that it occupies in this territory. The tax amount is then calculated as the product of the cadastral value calculated for the corresponding part of the site area and the rate in force in the territory of the municipality where the land is located. Such clarifications are given in the letter of the Ministry of Finance dated December 27, 2005 No. 03-06-02-02/108. Accordingly, each amount of tax is transferred to “its” budget. Please note that in this case it is necessary to submit a separate calculation for land tax to the inspectorate of all municipal districts in whose territory the site is located. Calculation of land tax Calculation of land tax in the general case does not cause difficulties. To calculate the tax for the tax period, you need to multiply the tax base (cadastral value as of January 1) by the tax rate corresponding to the category of the land plot. The amount of tax payable to the budget at the end of the year is equal to the annual tax amount minus advance payments made. The situation is more complicated when the plot is not owned for a full year. Then, to calculate land tax, you need to know: 1) the number of months of the reporting period, 2) the number of full months of ownership of the land plot during the reporting period, 3) the tax rate, 4) the tax base (cadastral value). The company sold its land plot. Do I need to pay land tax for the period in which ownership of it was terminated? Clause 7 art. 396 of the Tax Code of the Russian Federation establishes that if ownership of a land plot is terminated before the 15th day of the month, the company must pay tax for the period from January 1 to the 1st day of the month of termination of the right. If the right to a land plot is terminated after the 15th day of the month, then the tax must be paid from January 1 to the 1st day of the month following the month of termination of the right. Advance payments for land tax Land tax is transferred through advance payments, if provided for by the legislation of municipalities. The amount of advances is determined separately for each quarter as one fourth of the total tax amount. Very important! The reporting periods for land tax are quarterly, half-yearly and nine months. But this does not affect the procedure for calculating advance payments. In other words, advance payments are determined not on an accrual basis, but separately for each quarter. Payment deadlines The deadlines for payment of advance tax payments are also set by local authorities. However, they do not have the right to demand payment of tax for the year before February 1 of the next year (clause 1 of Article 397 of the Tax Code of the Russian Federation). Land tax benefits Chapter 31 of the Tax Code of the Russian Federation provides for the following types of benefits: - in the form of a tax-free amount; - in the form of a non-taxable area of land; - in the form of exemption from payments; - in the form of a reduction in the amount of tax. Benefits at the federal level are listed in Art. 395 and paragraph 5 of Art. 391 Tax Code of the Russian Federation. In addition, municipalities can provide benefits (clause 2 of Article 387 of the Tax Code of the Russian Federation). The taxpayer who has rights to them must submit supporting documents to the tax office at the location of the land plot. An individual entrepreneur owns three land plots of different sizes in the territory of one district, where local authorities have provided a land tax benefit in the form of a non-taxable amount. Is it possible to take advantage of the discount for each of the plots? It is forbidden. The benefit can only be applied to one plot of land. Clause 5 Art. 391 of the Tax Code of the Russian Federation provides that the tax base is reduced by the corresponding amount by only one taxpayer in relation to a site located on the territory of one municipality. Thus, the entrepreneur has the right to choose which area to reduce the tax base. If the difference between the tax base and the non-taxable amount turns out to be negative, then no tax is paid, because the base is “reset to zero”. REMINDER: If an organization (entrepreneur) has several plots located on the territory of one municipality, then it can determine for which of them the benefit will be applied. Tax return for land tax The new form of tax return for land tax and the procedure for filling it out were approved by Order of the Ministry of Finance dated March 29, 2007 No. 27n. This Order comes into force for reporting for 2007 no later than February 1, 2008. It must be submitted to the tax authority at the location of the land plot. If a taxpayer has several land plots in the territory of one municipality, then one declaration must be submitted. Note! 1. Not only organizations, but also individuals - individual entrepreneurs (in relation to those lands (or parts) that they use for business activities) must submit advance calculations and tax returns. 2. Taxpayers - individuals (not entrepreneurs) pay tax and advance tax payments on the basis of a tax notice sent by the tax authority (clause 4 of Article 397 of the Tax Code of the Russian Federation), therefore they do not need to submit a tax return. Very important! If a company has a land plot on which both housing and communal services facilities and industrial enterprises are located, then the land tax is calculated separately: at a rate of up to 0.3% for the plot occupied by housing and communal services facilities, and at a rate of up to 1.5% for the remaining area (letter of the Ministry of Finance dated September 1, 2006 No. 03-06-02-06/89). Data for calculation must be taken from technical documentation (technical passport of the facility, urban planning plan of the land plot). When preparing a tax return for land tax, you should fill out two separate sections 2 “Calculation of the tax base and tax amount”. In this case, line 050 indicates, respectively, the cadastral value of the site, which is occupied by housing facilities, and the remaining area, and line 220 (200) indicates the tax rate. Let's summarize In conclusion, I once again draw the attention of those who have recently become landowners or are just planning to purchase a plot of land or a building to several important points. 1. Firms that own real estate (including land plots) are registered with the inspectorate at the place of its location (clause 5 of Article 83 of the Tax Code of the Russian Federation). This means that the tax must be calculated according to the rules established in the regulatory act of the given territory, and the reports must be submitted to the local Federal Tax Service (clause 1 of Article 389, clause 3 of Article 397 of the Tax Code of the Russian Federation). 2. The obligation to pay land tax for the buyer of a land plot arises from the moment of state registration of ownership of this property. In this case, the seller of the plot remains a taxpayer of land tax until the state registration of termination of ownership. The date of state registration of rights is the day the corresponding entries on rights are made in the Unified State Register of Rights (letter of the Ministry of Finance of Russia dated September 23, 2005 No. 03-06-02-04/75). 3. When purchasing a building located on a leased land plot, the buyer actually becomes a tenant of the plot. Moreover, this happens from the moment of registration of ownership of the property and regardless of whether a lease agreement was concluded in the prescribed manner between the new owner of the building and the owner of the land. Therefore, the buyer must pay a fee for the plot of land on which the purchased building is located. The Russian Ministry of Finance reported this in a letter dated September 12, 2005 No. 03-06-02-04/70. Justifying their position, specialists from the financial department referred to the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 24, 2005 No. 11. 4. If the plot is divided between several owners, then the title document may not contain the information necessary to calculate the tax, namely the share attributable to the owner. In this case, this indicator is determined by dividing the area of the land share specified in the document by the total area of the land plot (letter of the Ministry of Finance of Russia dated September 1, 2005 No. 03-06-02-02/74). discuss the article Elmira Bagautdinova, expert - tax consultant, member of the Chamber of Tax Consultants of Russia

Who is exempt from paying property taxes for individuals? Legal advice

Not at all. If persons exempt from paying real estate taxes do not indicate the object of taxation in the application, the state will do this for them. There is no need to worry about this - the citizen will be exempt from tax on property with a higher cadastral value. Such rules apply in Russia today.

In Russia, tax obligations cause a lot of trouble. However, sometimes you can free yourself from them. Some categories of citizens may not pay property taxes. Below we will talk in more detail about how to obtain the appropriate benefit. Who has the right to it? Where can I apply for an exemption from real estate taxes?

Exemption from land tax for pensioners - grounds for receiving and registration of benefits

In accordance with Art. 395 of the Tax Code, citizens - indigenous small-numbered peoples (communities) of the North of the country, Siberia, and the Far East are completely exempt from this tax. The exemption applies to land used by residents for farming and commercial production, i.e. while they continue their traditional way of life.

For these citizens, the mandatory payment, like the land tax for pensioners, is formed taking into account a reduction not by the amount of 10 thousand rubles, but by the cadastral value of six hundred square meters of land. When owning several plots of land, the tax benefit according to the new principle can be used for one object at a time at the payer’s choice.

We recommend reading: Helping those in need improve their living conditions

Who can be exempt from paying land tax in the Russian Federation in 2021

- land owners;

- users of land unless it is re-registered in accordance with the Land Reform Law;

- developers, if there is an encumbrance with development rights;

- the user owner, if there is a corresponding encumbrance;

- persons who have the right to use the site if municipal or state real estate is allocated for mining.

- single citizens who have an income of less than 0.5 times the subsistence level;

- orphans, children and guardians who live together;

- single-parent families;

- rehabilitated persons who are subject to political repression;

- large families, if the children have not reached the age of majority;

- families that have a child with a disability.