Declaration form, procedure and deadline for submission

The property tax return for 2021 must be submitted on the form approved by Order of the Federal Tax Service dated August 14, 2021 No. SA-7-21/405. Moreover, if the declaration is submitted after March 15, then it is necessary to use the form as amended in accordance with the order of the Federal Tax Service dated July 28, 2021 No. ED-7-21/475.

Only legal entities must report; individual entrepreneurs are exempt from this obligation.

The deadline for submitting the declaration is set no later than March 31, 2021 .

The declaration must be completed in the following sequence:

- Title page.

- Section 2.

- Section 2.1.

- Section 3.

Calculation of property tax on real estate - CALCULATOR v1.2

If you have a tax burden on real estate - you are a happy person, you have real estate! Personal property tax is a tax paid by property owners on the property they own. This tax is regulated by the Tax Code of the Russian Federation, but many people do not know how to calculate it and ask this question. There is a special formula, quite simple, which will allow you to calculate the tax quickly and accurately - to do this you need to take the cadastral value (reduce it by the tax deduction) and multiply it by the interest rate, which depends on the type of property. Sounds simple? Yes! But remembering all the parameters of real estate types for calculating the interest rate and other important values is only possible for specialists who perform these calculations almost daily. Today, in the world of modern technologies, it is possible not to calculate the tax using a formula every time on paper, but to use a modern convenient service - ON-LINE CALCULATION OF THE COST OF PROPERTY TAX on the LIVLA country real estate website. LIVLA portal specialists have developed a convenient real estate tax calculator:

- the user just needs to enter the cadastral number and note the available benefits

- The calculator will receive all information for the tax by cadastral number (cost, footage, type of property, geolocation and others)

- As a result of the calculation, the user will receive: a description of the object

- address

- personnel cost

- description of the features of this calculation

- calculated annual tax

Title page

Let's look at what details need to be filled out on the title page.

TIN indicates a 12-digit taxpayer identification number.

Checkpoint is a 9-digit code assigned by the Federal Tax Service.

Correction number – the initial declaration has the value “0—”, then, in case of clarification, “1—”, “2—”, etc. are indicated accordingly.

Tax period - in the usual manner, when submitting annual reports, you must indicate code “34”; in case of reorganization, code “50”.

Reporting year – 2021.

Submitted to the tax authority (code) - indicate the code corresponding to the territorial branch of the Federal Tax Service to which the reporting is sent, the most commonly used is “281”

By location - indicate the code corresponding to the location of the property in respect of which the declaration is being filled out.

Taxpayer – full name of the company.

Title page (part 1)

This is followed by a block that is filled in in case of reorganization (liquidation) of the company.

Liquidation form (code) – indicate the code from Appendix 2 to the Filling Out Procedure.

TIN/KPP of the reorganized organization.

Title page (part 2)

Contact phone number – it is recommended to fill it out, since the inspector may have questions about filling it out.

Next, the total number of pages of the declaration is reflected, indicating the number of attachments .

Title page (part 3)

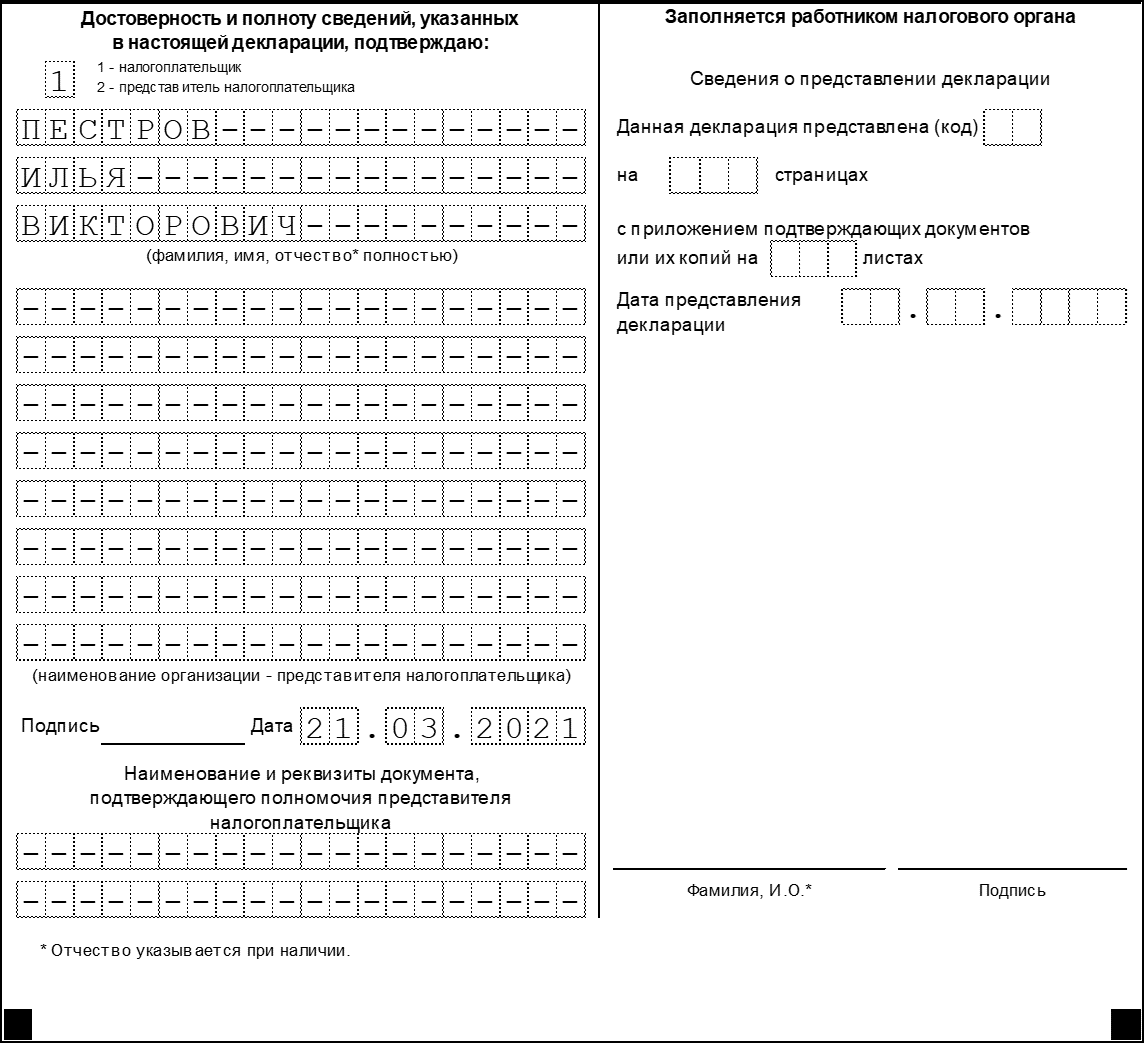

Filling out the title page ends with a block containing information about the person confirming the accuracy and completeness of the information provided . The right side is filled out by the tax inspector.

Title page (part 4)

Section 2

This section is intended for calculating the tax base and calculating the amount of tax.

Line 001 reflects the code of the type of property (Appendix No. 5 to the Filling Out Procedure). The most common code is “03”; the remaining codes are narrowly targeted.

for line 002 :

- “1” if the section provides information on real estate related to the execution of the SZPK

- “2” if the section provides information on real estate not related to the execution of the SZPK

Line 010 is for the OKTMO code.

Section 2 (part 1)

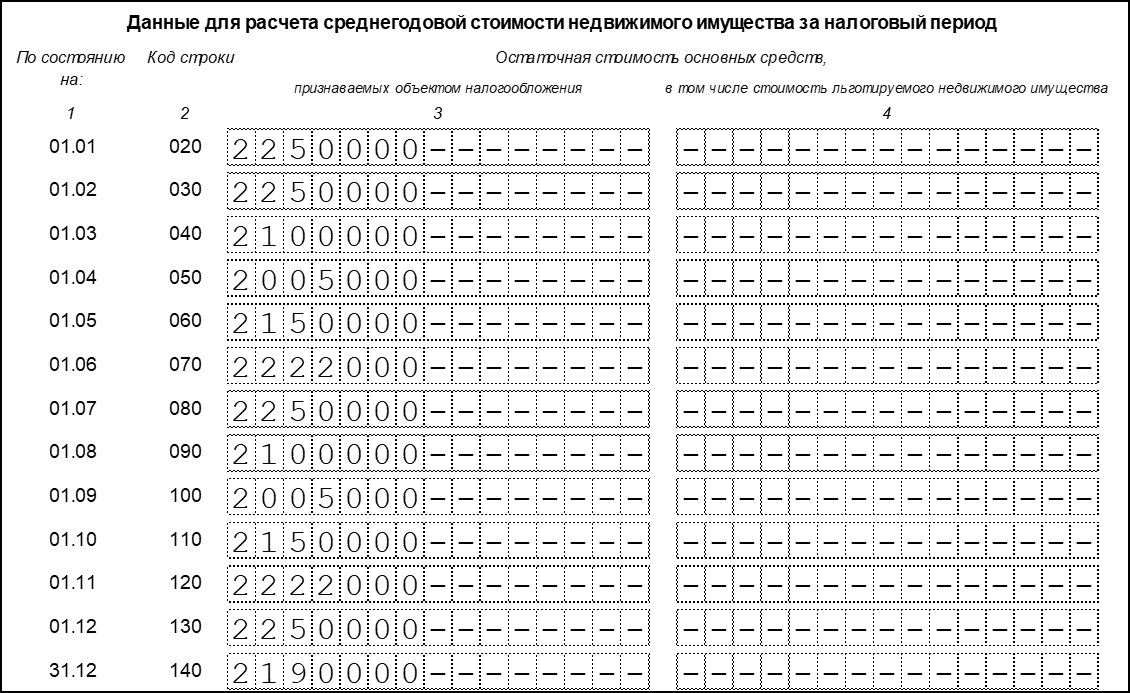

In lines 020-140 it is necessary to provide monthly information about the average annual value of the property. Column 3 is filled in if there is preferential property.

Section 2 (part 2)

Line 150 gives the arithmetic mean of lines 020-140.

Line 160 is for the benefit code, which consists of two parts:

- Code from Appendix No. 6 to the Filling Out Procedure.

- Filled in provided that the first part contains the code “2012000”. In this case, the second part indicates the law of the subject of the Russian Federation establishing the benefit.

Section 2.1

This section is intended to reflect information about the real estate property.

In accordance with Section IV of the Filling Out Procedure, if the cadastral number of the object is indicated in line 020 , the remaining lines of Section 2.1 do not need to be filled out. Otherwise, it will be necessary to enter detailed information about the location of the taxable property.

At the end of Section 2.1, line 040 indicates the code OKOF (All-Russian Classifier of Fixed Assets) and line 050 the residual value as of December 31 of the reporting period.

Section 2.1

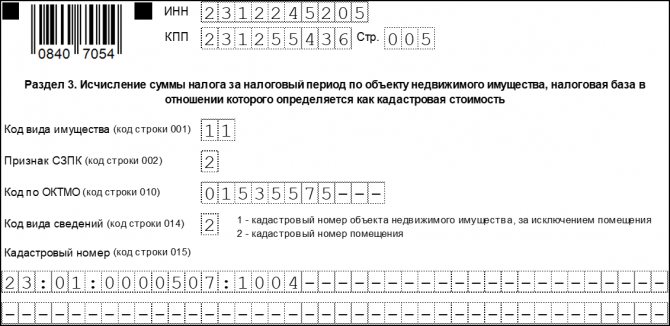

Section 3

The section is completed in relation to property, the tax base for which is determined in accordance with its cadastral value.

Line 001 is filled out in accordance with Appendix No. 5 of the Filling Out Procedure. In our case, code “11”, which corresponds to real estate objects, the tax base for which is determined as the cadastral value

Line 002 is filled in similarly to line 002 from Section 2.

In line 014, you must indicate the property property attribute:

- “1” for property other than premises

- "2" for premises (for example, garage)

Line 015 is for the cadastral number of the property.

Section 3 (part 1)

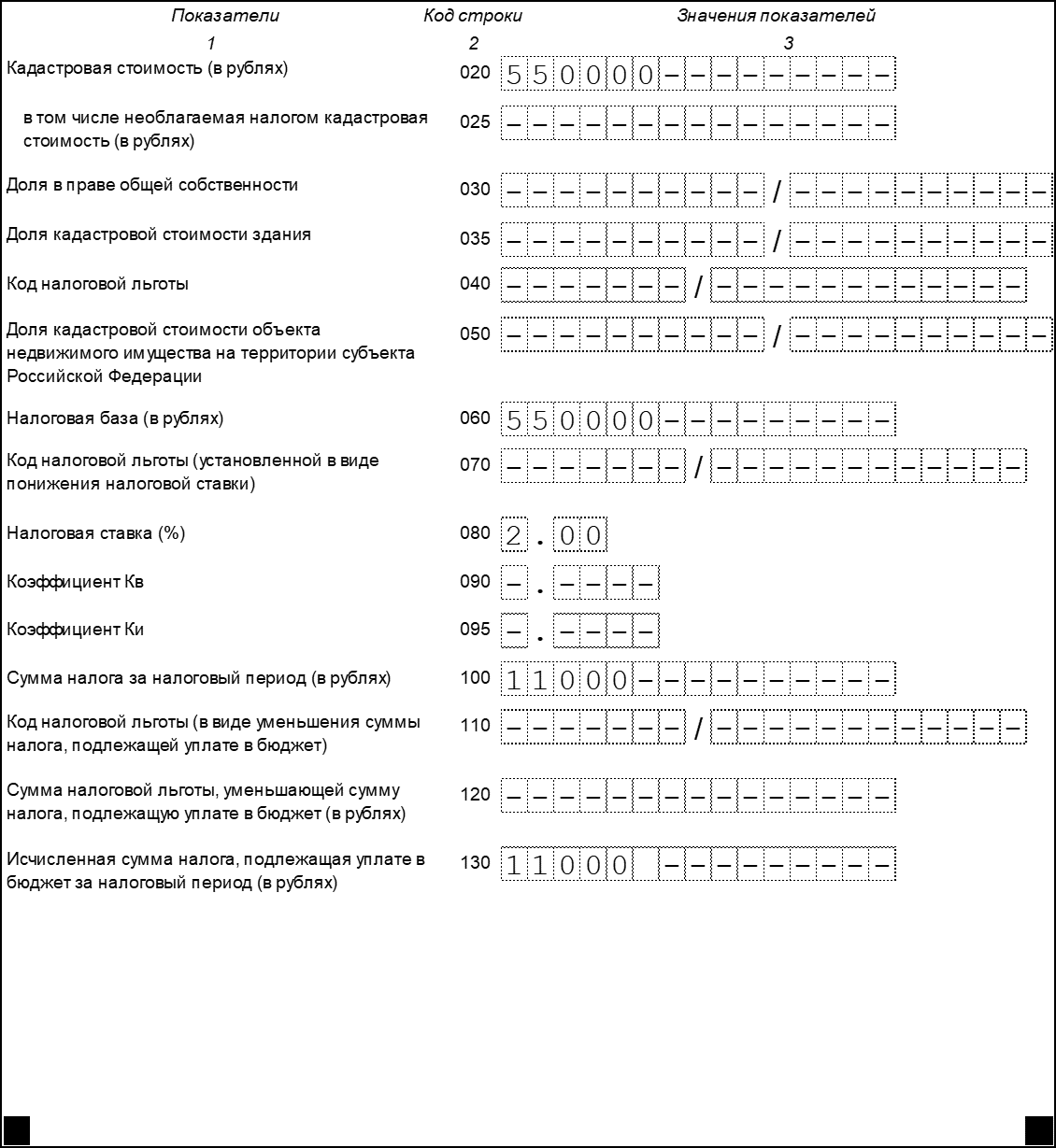

Line 020 indicates the cadastral value of the property as of January 1 of the reporting period, including the non-taxable value on line 025 .

Line 030 is filled in if there is equity participation.

Line 035 is filled in if the cadastral value has not been established for the taxable object, but it is available for the building in which the object is located. In this case, the share of cost is determined.

Line 040 is filled in based on the codes from Appendix No. 6 to the Filling Procedure.

Line 050 displays the share of the cost of the object if it is located on the territory of several constituent entities of the Russian Federation.

In line 060 the value of the tax base is entered, which is defined as the difference between lines 020 and 025. If there are values other than zero on lines 030 and 050, then the resulting difference must be multiplied by these values.

If there are grounds for applying a reduced tax rate, then the relevant information must be reflected on line 070 .

Line 080 indicates the final tax rate taking into account available benefits.

Line 090 corresponds to a coefficient that is calculated provided that the property has been owned for less than a year (the ratio of the number of full months of ownership to the number of months in the tax period).

The coefficient on line 095 is indicated in the event of a change in the cadastral value due to a change in qualitative or quantitative characteristics and is calculated as the ratio of the number of full months in the tax period during which the cadastral value indicated in line 020 was in effect to the number of months in the tax period.

Line 100 indicates the tax amount, when calculating which you need to take into account the non-zero values of lines 090 and 095.

in line 130 , taking into account the tax benefits reflected in line 120 .

Section 3 (part 2)

From January 1, 2021, everyone will pay property tax

At the moment, users of special regimes (STS, UTII, patent, Unified Agricultural Tax) do not pay property tax for legal entities. In general.

However, there are a number of objects for which the tax base is determined based on the cadastral value. Property tax relief does not apply to such objects.

The procedure for classifying a taxpayer’s specific real estate as such objects is quite labor-intensive:

- A cadastral assessment of the property must be carried out.

- Real estate must correspond to a certain type of object specified in the Tax Code of the Russian Federation (shopping centers, offices, etc.).

- This type of object must be confirmed by regional law as an object of taxation.

- The region must draw up a list of specific objects that will be taxed based on cadastral value. The list contains the exact addresses/cadastral numbers of real estate properties.

Despite the fact that most constituent entities of the Russian Federation have prepared fairly extensive lists, the overwhelming majority of real estate is still not included in them. That is, it was subject to property tax based on the residual rather than the cadastral value, and was not subject to taxation at all in the case of users of special regimes.

On January 1, 2021, Federal Law No. 325-FZ of September 29, 2019 comes into force, which effectively abolishes this benefit for users of special regimes and changes the procedure for calculating property tax for everyone else.

Property tax based on cadastral value will need to be charged on all real estate if it has such a value. It will not matter whether the property is mentioned in the regional list, what type of property it is, etc.

This will happen due to changes in paragraphs. 4 clause 1 art. 378.2. At the moment, this paragraph includes residential buildings/premises that are not fixed assets for accounting purposes, that is, for example, purchased/built for resale.

After the change, the wording will be as follows:

“4) other real estate objects recognized as objects of taxation in accordance with Chapter 32 of this Code, not provided for in subparagraphs 1 - 3 of this paragraph.”

Please pay special attention to the fact that Chapter 32 is a chapter on property taxes for individuals, not legal entities. There, the object of taxation is defined differently (Article 401 of the Tax Code of the Russian Federation).

The following property is recognized as the object of taxation:

1) residential building; 2) apartment, room; 3) garage, parking place; 4) a single real estate complex; 5) an unfinished construction project; 6) other building, structure, structure, premises.

The list is actually open!

Moreover, for the property specified in paragraph 4 of paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation, it is not required to be included in the list indicating specific addresses. The list is required only for property from clauses 1 and 2 of clause 1 of Art. 378.2, i.e. for shopping centers and offices (clause 1, clause 7, article 378.2 of the Tax Code of the Russian Federation). For the property specified in paragraphs. 4 clause 1 art. 378.2 of the Tax Code of the Russian Federation, it is only sufficient that this type of property is confirmed by regional law as an object of taxation.

Such a formulation already creates certain conflicts.

For example, it is not clear whether it will be necessary to impose property taxes based on the cadastral value of a shopping center that is not included in the regional list. After all, at the same time it will fall not only under paragraph 1 of paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation as a shopping center, but also under paragraph 4 of paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation as “another building, structure, structure,” and the latter type does not require inclusion in the regional list.

Until the end of the year, all interested parties should closely monitor their regional legislation. Judging by past experience, most regions will not have time to react to such a change and add/change the type of taxable object in their regional law on corporate property tax, and in 2021 everything will remain unchanged. However, there will be those who will have time to do this.

It is more convenient to monitor changes in legislation with the Glavbukh system.

For example, along with changes to the property tax, dozens of other slightly less important changes were made to the Tax Code. More details can be found in the Glavbukh System.

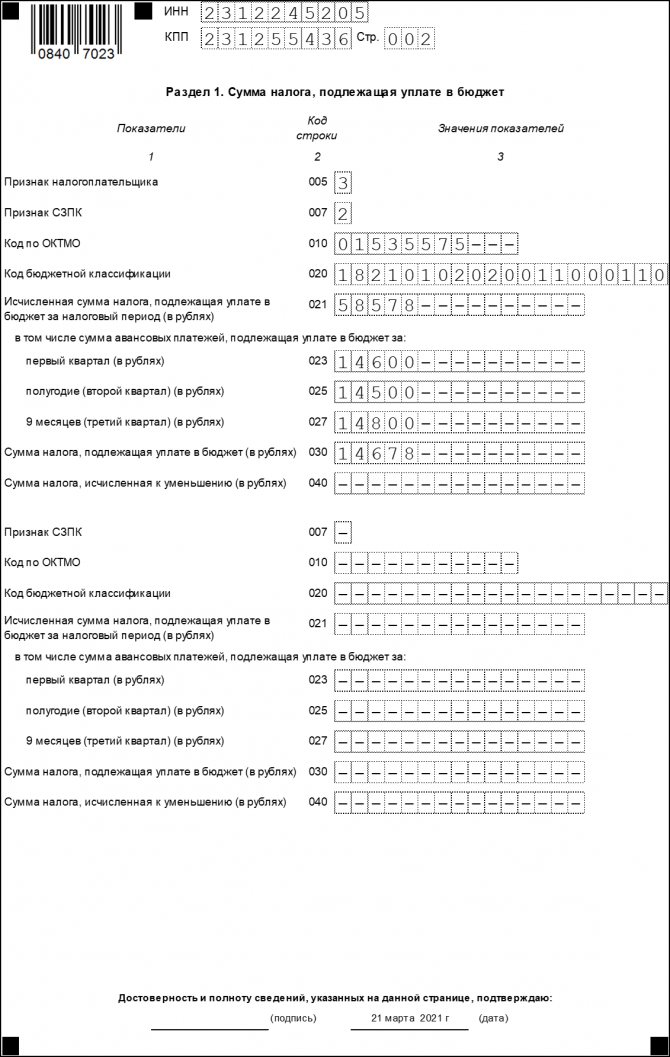

Section 1

Section 1 is final and displays the amount of property tax payable to the budget.

It is worth noting that there may be several of these sections within one declaration. The number of sections corresponds to the number of OKTMO codes.

Line 005 indicates the taxpayer's characteristics:

- “1” if during 2021 regulatory legal acts of the Government of the Russian Federation were applied, according to which the deadlines for payment of advance payments were extended

- “2” if, during 2021, regulatory legal acts of the highest executive authorities of the constituent entities of the Russian Federation were applied, according to which the deadlines for payment of advance payments were extended

- “3” if the acts from paragraphs “2” and “3” were not applied during the reporting period

Line 007 is filled in similarly to line 002 from Section 2.

In line 021 the calculated amount of tax for the reporting period is entered, which is determined as the sum of lines 260 of Section 2 and 130 of Section 3.

Lines 023-027 are intended for advance payments that were made by the taxpayer during the reporting period.

Line 030 reflects the amount of property tax payable to the budget, which is calculated as the difference between the calculated tax (line 021) and the amount of previously made payments (lines 023-027).

Section 1

From 2021, according to the cadastre, any real estate will be taxed

Organizational property tax is calculated based on the tax base established for a particular taxable object. The basis for calculating property tax for organizations can be the average annual value of a fixed asset or the cadastral value of an object.

For example, until January 1, 2021, residential properties included in fixed assets are taxed on the basis of paragraph 1 of Article 374 of the Tax Code of the Russian Federation, based on the residual value. And residential buildings that are not included in fixed assets - on the basis of Article 378.2 of the Tax Code of the Russian Federation - based on the cadastral value.

From January 1, 2021, this routine that is familiar to everyone will change.

Based on Federal Law No. 325-FZ of September 29, 2021, the list of objects subject to corporate property tax at cadastral value has been changed (subclause 4, clause 1, article 378.2 of the Tax Code). A new position has been added to it, according to which, from January 1, 2021, those objects that are currently subject to property tax for individuals may be subject to property tax for organizations at the cadastral value:

- residential buildings;

- apartments;

- rooms;

- garages;

- parking spaces;

- unified real estate complexes;

- unfinished construction projects;

- garden houses;

outbuildings;

other buildings, structures, structures, premises.

Of course, all of them are not listed in the updated list. They are hidden in it under the name “other objects”. And the decryption was given by the Ministry of Finance in a letter dated October 2, 2021 No. 03-05-04-01/75869.

In addition to these “other” objects, three currently active positions remain on the list:

- administrative, business and shopping centers;

- non-residential premises intended for offices, retail facilities, catering and consumer services;

- real estate of foreign organizations that do not operate in the Russian Federation through permanent representative offices.

But the fourth item that closed this list - “residential buildings and residential premises not taken into account on the balance sheet as fixed assets in the manner established for accounting” - is no longer in the list of objects subject to property tax at cadastral value will. It is this that is replaced by “other objects”.

The authorities of the constituent entities of the Russian Federation will decide which real estate of legal entities should be taxed according to the cadastre starting from the new year.

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition