It often happens at an enterprise that during the next inventory check, things that are listed in the documentation are missing. With every discrepancy, everyone starts to fuss - financially obligated, responsible people, management, and even subordinates, who are often asked. In the article we will talk about the shortage of goods and material assets (inventory) in the warehouse during inventory, and also describe how to document the posting.

Grounds for conducting an inventory of property

There is a misconception that maintaining a register and census is the prerogative of retail outlets, enterprises and factories that are also involved in sales. In fact, all organizations, even municipal or charitable, as well as private individual entrepreneurs, must regularly check all inventory for availability.

All material assets, which include furniture and household appliances, documents and even office supplies, are subject to recalculation. Depending on whether the organization has been prepared, the audit can be planned (on schedule, once a month) or unscheduled. To draw up a plan, write down a schedule according to which the responsible persons recalculate.

Reasons that may affect the conduct of an unscheduled inventory reconciliation:

- any natural disaster - fire, flood, destruction, as well as fire or flooding caused by workers;

- sale of a company or acquisition of a share, emergence of a new co-founder - any changes at the management level may lead to the need to find out the exact balance;

- theft, suspicion of theft, judicial or investigative proceedings.

Thus, an audit can be initiated for various reasons. But one thing remains mandatory - an order must be issued for the procedure, specifying the date and responsible persons.

How to register a shortage

The official reasons for the shortage may be the following:

- production and circulation costs (during transportation, storage of goods);

- costs at the expense of the guilty parties;

- costs when the perpetrators have not been identified or their guilt could not be proven in court.

Depending on the reason, you will expense the amount of the shortfall loss differently.

Production and distribution costs must be confirmed by primary documents - various acts of identified shortages and damage. You can develop them yourself, or use already familiar trade documents: TORG-2 (discrepancies when accepting goods), TORG-6 (container curtains), TORG-15 (damage, damage, scrap), TORG-16 (write-off of goods), TORG-20 (part-time work, sub-sorting, repacking of goods) and so on.

Investigations into the causes of shortages sometimes result in scapegoating the guilty employee. If the employee is a financially responsible person, compensation for damage can be recovered from him. Damage is calculated based on the purchase price of the missing item. Lost profits in the form of your markup are not taken into account. In any case, the employee must write a written explanation of the reasons for the shortage. Further, if you collect compensation from him, then formalize the decision with an order. This will be needed to write off as expenses or for a showdown with an employee in court.

If the employee is not a financially responsible person, or in court you were unable to prove his guilt, then you will not pin the damage on him. In this case, damage can be compensated by alternative methods (more on them below).

If the culprit is not identified, then you will not be able to reimburse the lost goods or write them off as expenses.

What is an inventory shortage?

The accounting department of any company is usually afraid of this term because when there is a shortage, it is much more difficult to tie up accounting loose ends than when there is a surplus. But the discovery of a shortage of products or material resources almost always occurs during an inventory of property.

A shortage of goods and materials is the absence of the required amount of money, goods or furniture, items belonging to the organization and recorded in the register. To carry out an audit, everything must first be put on the balance sheet - listed in the accounting documents. Only after these procedures can an inventory be carried out and indicators be verified.

Another feature of this process is the indication of the value of the item. If a computer is lost in a department, then employees who are financially responsible will compensate for the costs of purchasing it. Therefore, in accounting, when making an inventory, cost is always taken into account.

The pharmacy also has its own rules. Despite the fact that medications are purchased at cost, the full retail price may be withheld from the pharmacist or other person responsible for the shortage in the pharmacy when taking inventory of a person. The situation is the same with stores. This is because a shortage is considered a loss—the owner loses not only the purchase price, but also the money he would have received upon sale.

Shortages include spoiled product, broken items, and broken dishes. Typically, this category is displayed in accounting and is posted as written off as expenses. Sometimes compensation is still required, for example, from waiters for broken glasses, since they are responsible for it. However, if the damaged goods were nevertheless sold, but at a reduced price, the shortage includes the difference between the full and final receipt.

Shortage in informal employment

As practice shows, often heads of organizations do not sign an employment contract with a candidate when hiring. A person is hired and not registered according to the Labor Code of the Russian Federation, and they also do not sign an agreement on financial responsibility, entrusting him with certain property. An employee may make a mistake intentionally or through negligence, which will result in a large shortage.

It is necessary to understand that even an unofficially registered person, if he is at fault, is obliged to compensate for the damage caused to the enterprise. But in this case there are some nuances.

Labor relations are formalized by signing an employment contract. But, Art. 16 of the Labor Code of the Russian Federation provides that labor relations arise between the parties even when a person is actually allowed to perform his duties with the permission of the manager. Accordingly, if an employee has begun to perform his duties and management knows about this, then the employment relationship is considered to have begun. The absence of official registration upon actual admission to work with the consent of the employer does not relieve the parties from fulfilling the obligations imposed by law.

In this case, the employee's liability is limited to his average monthly earnings.

To compensate for the shortage, the management of the enterprise issues an order. If an employee admits his guilt, he can pay everything voluntarily. When the amount of compensation exceeds the average monthly salary, it is impossible to recover from an improperly registered employee.

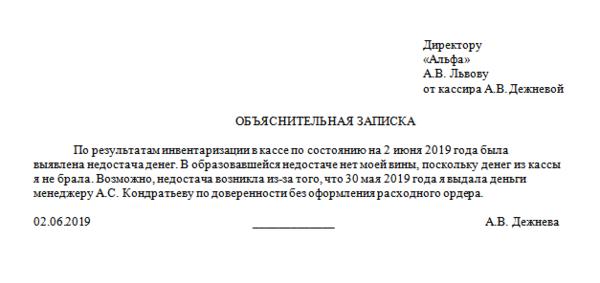

In any case, there is no point in avoiding writing an explanatory note regarding the shortage. The following must be indicated:

- absence of guilt (or presence, if the employee admits);

- circumstances that led to the shortage;

- lack of a signed employment contract;

- lack of documents confirming financial responsibility.

IMPORTANT : art. 56 of the Code of Civil Procedure of the Russian Federation provides for the obligation of everyone to prove the circumstances referred to. Accordingly, the employer will have to prove the existence of a deficiency, the employee’s guilt and responsibility, the existence of an employment relationship, and the employee must provide evidence of the absence of his guilt.

Issues related to shortages are complex and time-consuming, especially if there is also no proper documentation. An employee may face unlawful deductions from wages to cover shortfalls or be forced to repay more than their wages. In this case, it is better to seek legal assistance from our labor dispute lawyer.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Reasons for the shortage

The manager should not have a negative and misunderstanding attitude towards inventory, because often people go into the red not because of poor performance of duties, but for reasons that are completely unrelated to the employees themselves. They should be taken into account. Why the balance doesn't work out:

- Theft. Proving it is often quite difficult, especially if there are no CCTV cameras.

- Emergencies - fires, floods, damaged engineering systems (electricity went out for a day, a lot of food in refrigerators spoiled).

- Costs of defects, as well as damage to goods. They don’t charge money for trying on clothes, but while putting them on, they can get dirty or torn. I have to write it off.

- Error during sale. Sometimes products, especially products without a barcode, get mixed up.

- The person who is responsible for the inventory shortage may make a mistake in the calculations and write down the wrong data.

Since all of the above reasons are presented in a different order, you should first analyze what caused the shortage. Usually all responsible persons write explanatory notes for each case.

Inventory

When a product has spoiled, or there was an extra one from somewhere, or you have a gut feeling that something is wrong, you take it and count the balances.

For a small business, in its simplest form, this is inventory. In a good way, it should be carried out regularly and the schedule should be fixed in an internal document. And to conduct it unscheduled is a “wake-up call” from intuition. For inventory to be useful, the results must be documented in a document - an inventory sheet. If you find a shortage, there is, for example, a matching sheet. You can develop your own document forms. The main thing is that the documents must contain information about whether the quantity of goods actually corresponds or does not correspond to the data in the primary documents. In the future, such statements will serve as confirmation of losses incurred. Based on the results of the inventory, a shortage of goods or a surplus may be revealed.

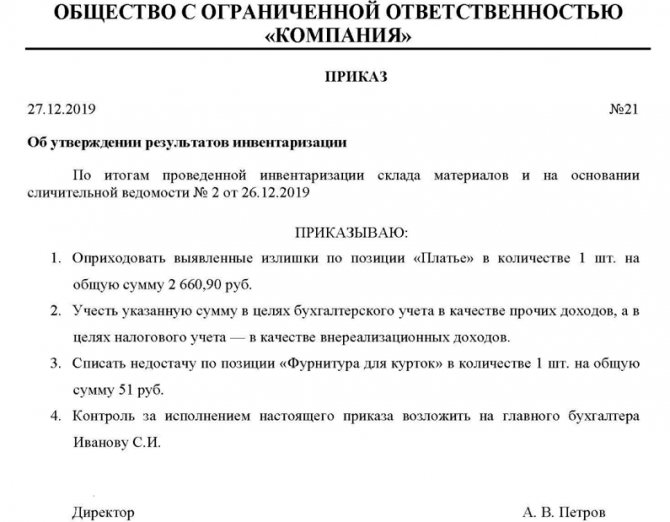

The procedure for registering a deficit

First, you need to collect all the documents confirming the transactions, including the inventory report and sales receipts. Based on this, a write-off order is drawn up and signed.

Otherwise, if the costs turned out to be too high or a large batch of goods was damaged, an internal investigation is carried out for negligence or theft.

Not everything is taken into account so scrupulously. There are certain categories of goods and materials that are not considered special values due to their cost, so any quantity can be recorded as expenses.

There is another option for registering a deficit - withholding from the culprit. Usually the amount is deducted from his salary. This happens in cases where guilt is proven.

How to account for shortfalls in taxes

The natural desire of an entrepreneur to write off the shortage as tax expenses leads us to a closed list of expenses in Article 346.16 of the Tax Code of the Russian Federation. As such, shortages and damage to goods are not mentioned in this list. But…

In paragraph 5 of Article 346.16 there is an article Material costs, to which, in addition to other costs, another article of the Tax Code (Article 254) includes losses from shortages and (or) damage during storage and transportation of goods within the limits of natural loss norms approved in the manner established Government of the Russian Federation.

What is natural decline?

During storage, the weight of the product may change due to natural reasons, for example, as a result of freezing, shrinkage, spillage, etc. or, for example, during transportation the product may be damaged due to natural fragility. Such losses of goods are considered natural loss; it is difficult to document, therefore, indicators are established by law to determine the amount of loss.

Norms of natural loss are established for each industry by the relevant ministries. For example, the norms of natural loss of food products are established by orders of the Ministry of Industry and Trade, the norms of medicines by orders of the Ministry of Health and Social Development. Moreover, these standards are developed taking into account storage conditions, transportation, climate and seasonality. They are still being approved, so there may be standards from the times of the USSR.

Try Elba 30 days free

Taking inventory is easy. Keep track of goods in Elba!

Values are usually set as a percentage of the weight of the product - they can be found in reference materials or directly in regulations.

The amount of natural loss is calculated by multiplying the quantity of a product by its rate of natural loss, and then by the unit cost of the product.

So, within the framework of this very natural loss, you can write off the shortage and damage to tax expenses.

Naturally, for the tax office you must have full ammunition available:

- inventory statements: form INV-19, INV-26;

- acts confirming the shortage;

- explanatory note from the employee, etc.

For organizations, calculations of natural loss can be made, documented in an accounting certificate.

But what to do when costs exceed the rate of natural loss and/or were incurred at the expense of a specific employee?

The closed list does not contain other conditions under which the loss of goods can be attributed to expenses, so we can immediately conclude: the simplified tax system tax can take into account shortages and damage to goods only within the established norms of natural loss.

Receipts from the guilty persons as compensation for damage are recognized as non-operating income. The amount of compensation will need to be included in the tax base on the date of compensation for damage by the guilty party.

For a simplifier, the picture is not entirely favorable; not only can a shortage above the natural loss rate not be recognized as an expense, but the amount of compensation is also recognized as income, which must be taken into account when calculating the simplified tax system. For a simplifier, it is easier to arrange compensation in the form of selling the goods to the guilty party. After all, it doesn’t matter to the culprit which document he will use to compensate you for the damage, and the company will be able to write off the cost of goods sold upon sale and, of course, reflect the income from sales. If the culprit sells it at cost, there will be no taxes on such a transaction. There is an opportunity to optimize the tax. In principle, this method is suitable not only in the case of perpetrators, but also in the case of partial damage or damage to the goods. You can sell such goods at a discount, minimizing losses and tax burden.

Submit reports in three clicks

Elba will help monitor inventory balances and conduct inventories.

She will prepare reports and calculate taxes. Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How to write off shortages during inventory

Often, deterioration depends on customers, clients or natural wear and tear, time. In such cases, the registration procedure is as follows: you need to accurately calculate the loss expressed in monetary units, and then issue an order according to which this audit result should be included in the category of business expenses. In this case, you should carefully ensure that the monthly amounts do not exceed a certain norm, and also have confirmation in the form of cash receipts and explanatory notes, otherwise you may be charged with embezzlement.

There are predetermined standards, they are also called distribution costs. These include all shortages that were caused by the buyer. Let's take an example: in a grocery store, a customer accidentally broke an item; he is not obligated to pay for it. But if the amount of costs exceeds the norm, then you need to look for the culprit. For example, if the entire rack was hit, then perhaps the merchandiser is to blame for not arranging the products according to the rules.

And these requirements are most strictly imposed in government agencies. In a commercial company, managers often turn a blind eye, even when standards are clearly exceeded. But in the government structure, any value is part of the state budget, so the balance there is maintained very strictly. The shortage is seen as causing direct damage to the country. In Soviet times, this could have resulted in capital punishment. If the manager gives an order to write off the shortage based on the inventory results for a larger amount than required, then the fact will be considered as misuse of public funds and embezzlement. There is criminal liability for this.

Dismissal due to shortage

Dismissal is a rather unpleasant moment, especially if it is accompanied by a conflict between the parties to the contract. And if a person is financially responsible and quits when there is a shortage, then the problem worsens even more.

It is important to know that a shortage is not a basis for refusing to terminate the contract. Failure to comply with the dismissal deadlines entails adverse consequences for the employer.

If a person decides to resign of his own free will, he must notify the director 14 days in advance. Upon receipt of the application, the employer is obliged to conduct an inventory of the property. Moreover, this must be done before the employee quits.

Having identified damage, management can recover an amount by issuing an order within the limits of average monthly earnings. If the amount is larger and there is no admission of guilt, or if the employee has already resigned, the employer will go to court to recover the shortfall.

The employee is obliged to attend the inventory, as well as transfer the material assets entrusted to him to the new responsible person. Refusal to participate in the inventory and write an explanatory note in the future may adversely affect the position of the specialist.

Termination of labor relations in the event of a shortage does not exempt the perpetrator from compensation for damage to the enterprise. If the shortage is proven in court due to the fault of the dismissed employee, the judge will oblige him to compensate for the damage caused.

Consequences for the financially responsible person

The person responsible for inventory items writes an explanatory note addressed to his immediate superiors. This document is provided by management within two days from the date of the relevant request, usually it arrives immediately after accounting.

Based on this paper, a decision is made, which consists of writing off the company’s expenses or deducting losses from the employee. The verdict is rendered in accordance with the admission of the share of guilt by the MOL.

Agreement on full financial responsibility

Full financial responsibility can be individual or collective (team). The last option is used when sellers work in shifts.

Please note: the lists of works and categories of workers with whom these contracts can be concluded, as well as standard forms of these contracts, are approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85, and this document is registered with the Ministry of Justice of Russia.

Thus, the List of positions and works replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for shortages of entrusted property includes:

- positions of directors, managers, administrators, other heads of organizations and trade departments, their deputies, assistants, salespeople, commodity experts of all specializations;

- settlement work for the sale (sale) of goods, products and services (including not through the cash register, through the cash register, without a cash register through the seller).

A standard agreement on full financial liability can be supplemented with new conditions that do not contradict the Labor Code. However, the conditions provided for by the regulatory legal act of the Russian Ministry of Labor should not be excluded from it.

In accordance with the Standard Form of a Full Liability Agreement:

- the employee undertakes to participate in inventory, audits, and other verification of the safety and condition of the property entrusted to him (letter of the Ministry of Finance of Russia dated July 15, 2008 No. 07-05-12/16);

- determination of the amount of damage caused by the employee to the employer is made in accordance with current legislation.

How to recover the shortfall from the guilty parties

The consequences can be serious, including criminal penalties + compensation for costs. Most often, management positions and senior accountants are sanctioned. The level of financial responsibility is discussed during employment and specified in the contract. Sometimes the responsibility may be collective or partial. Then the shortage is removed from all employees.

The deficit is withheld from wages. First, the result of the inspection and a conclusion on it from management with a decision on penalties are provided. Then this amount is deducted from the next paycheck. If the culprit at this moment goes through the dismissal procedure, then the debt is deducted from the last salary. If an employee refuses to pay the funds, he can be held accountable through the court.

Withholding damage from an employee's salary

Regulatory regulation

The employee has the right to voluntarily compensate for the damage caused or request payment in installments (Part 4 of Article 248 of the Labor Code of the Russian Federation). In the case of installment payments, the employee submits to the employer a written obligation to compensate for damages, indicating specific payment terms.

The employee also has the right to make one-time compensation for damage caused to the company if he has the appropriate funds. You can agree with the employee on compensation for damage not in cash, but in kind.

If you decide to make deductions from wages, you must remember that the Labor Code of the Russian Federation imposes certain restrictions on the maximum amount that will not be paid to the employee.

The total amount of all deductions for each salary payment cannot exceed 20% of the amount due to the employee (Article 138 of the Labor Code of the Russian Federation, Part 1, Article 99 of the Federal Law of October 2, 2007 N 229-FZ).

Calculation

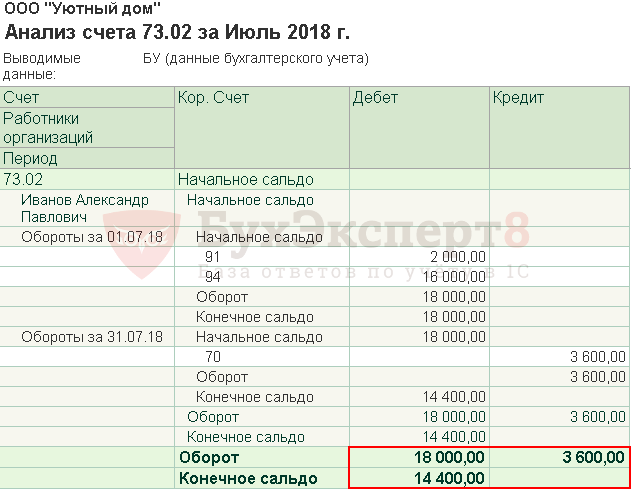

According to the conditions of our example:

- the average monthly salary of an employee is 30,000 rubles;

- amount to be recovered—RUB 18,000;

- 3,600 rubles are withheld from the employee’s salary by agreement with the employer. per month.

Since the employee’s average monthly earnings are greater than the amount of damage, based on the order of the manager, the amount of damage in full, 18,000 rubles, can be withheld from the employee.

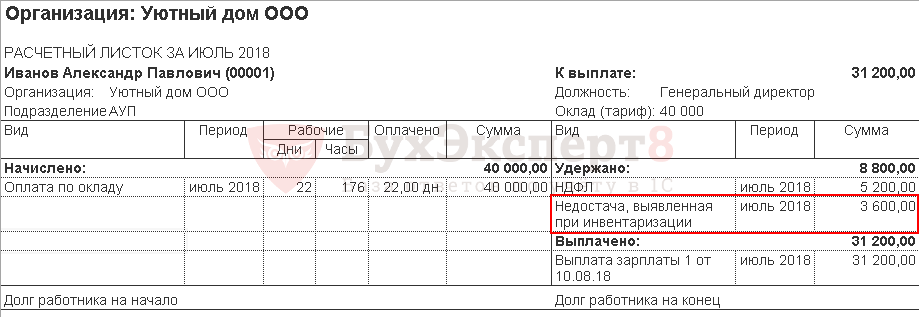

For July 2021:

- wages accrued - 40,000 rubles, personal income tax - 5,200 rubles;

- the employee’s income after withholding personal income tax will be 40,000 – 5,200 = 34,800 rubles.

- the maximum amount of deductions per month in accordance with Art. 138 Labor Code of the Russian Federation 31,200 *20% = 6,240 rubles.

Since the maximum amount of deductions from an employee’s income in July is greater than the amount specified in the agreement between the employee and the organization, the amount of damage can be withheld in the amount of 3,600 rubles.

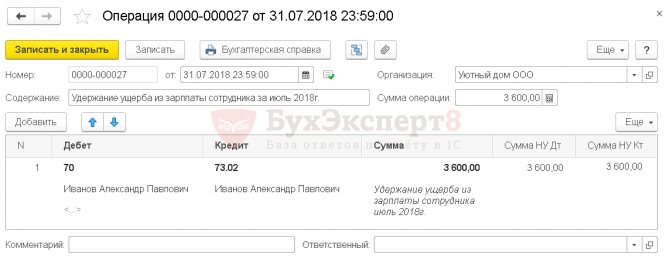

Accounting in 1C

To deduct damage from an employee’s salary, create a document Transaction entered manually, type of operation Transaction through the section Operations – Accounting – Transactions entered manually.

Please indicate:

- from - date of salary accrual;

- Debit - “Settlements with personnel for wages”; Subconto - Ivanov Alexander Pavlovich , the MOL is indicated from the directory Individuals , from whom the amount of the shortfall is subject to recovery.

When creating a document Statement to the bank or Statement to the cashier, the amount payable for this employee will be indicated minus deduction. PDF

Control

To check accrued and withheld amounts, we will generate:

- pay slip on the Reports in the Payroll , select Pay slips ;

- report Account analysis for account 73.02 in the section Reports – Standard reports – Account analysis (can be detailed by day).

On the payslip, the amount of damages withheld is reflected in the Withheld .

The employee's debt to the organization has decreased.

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Inventory procedure

- Inventory of goods and materials: 1C

- Shortage of goods and materials. The culprit has been identified

- Shortage of goods and materials. The culprit has not been found

- Surplus of goods as a result of inventory

- Payroll

- Salary payment

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Deduction for shortfalls from sick leave amounts Hello! The store took inventory and as a result, a shortage was identified....

- Withholding compensation for damage Please tell me how to set up compensation for damage to an enterprise as a percentage of earnings...

- Withholding compensation for damage in the ZUP 3.1.5 Please tell me how to set up compensation for damage to an enterprise as a percentage of earnings...

- Property Damage Retention Hello! ZUP program 3 Release 3.1.5.129 Tell me how to configure...

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Explanatory: how to reflect the shortage

In the document, the financially responsible person indicates, in addition to his personal data:

- when the incident occurred;

- a detailed description of the event - what happened, for what reasons, whose fault;

- the sequence of one’s own actions is an attempt to prevent an incident.

You must sign, initial and date the explanatory note.

A sample of its preparation

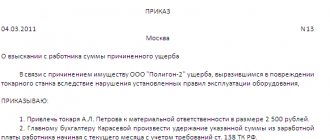

Shortage order

Based on the explanatory note, a decision must be made:

- the employee is guilty;

- innocent;

- it is necessary to assemble a commission to investigate.

As a result, a paper must be written to confirm one of the three intentions. It states:

- a brief description of the situation;

- persons involved;

- resolution.

Drafting sample

Shortage in stock

Warehouses have a constant flow of inventory items, so goods are often lost here. Let's figure out why this happens.

Causes

- Lost documents or filled them out incorrectly. The invoice arrived, they issued the commodity units according to it, but did not put it in the book.

- Lack of equipment, poor accounting conditions.

- Unforeseen factors that led to damage.

- Theft.

What to do

It is worth conducting an investigation according to the above standards, that is, start by obtaining explanatory notes, then issue an order. On its basis, make either a write-off as an expense or a recovery from the culprit. We also recommend installing CCTV cameras to monitor possible acts of theft.

How to avoid

We recommend keeping records using special devices and programs. Based on them, lists and documents are independently generated. This greatly simplifies all warehouse activities - deliveries and shipments. You can order such equipment and software at.

If your enterprise uses “1C: Accounting” in any delivery, “1C: UPP” or 1C for a construction organization, and you plan to carry out inventory only on barcodes (you will not use RFID), then a special driver for inventory is completely suitable for you from Cleverens, the delivery package of which includes all the programs and processing necessary both for printing labels and for working with the data collection terminal.

If you are using 1C, but you plan to implement RFID, then another program is suitable for you - Cleverence: Property Accounting. Also, there are software products for stores and warehouses that will help optimize and automate inventory accounting, as well as eliminate cases of shortages during inventory.

See how Magazin 15 helps automate the inventory process in a chain of building materials hypermarkets. As a result of implementation, the process became much simpler and made it possible to abandon the involvement of outsourcing companies.

Consequences of inventory. Surplus, shortage, mis-grading

The retail store conducted an inventory, during which the following were identified: misgrading of goods, shortages (the culprits were identified) and surplus goods. How to correctly reflect these transactions in accounting if the store keeps records in sales prices?

In accordance with clause 2 of PBU 5/01 “Accounting for inventories”

, approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n,

goods are part of inventories

acquired or received from other legal entities or individuals and intended for sale.

Therefore, when accounting for goods, surpluses and losses of goods, one should be guided by the Methodological Guidelines for Accounting of Inventories

, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n

(hereinafter referred to as the Method of Instructions)

.

Inventory procedure

property and financial obligations of the organization and registration of its results is established

by the Methodological Guidelines for the Inventory of Property and Financial Obligations

, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49

(hereinafter referred to as Order No. 49)

.

To ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of inventories

, during which their presence, condition and assessment are checked and documented.

In order to organize ongoing control over the safety of inventories, promptly identify possible discrepancies between accounting data and their actual availability for individual items and (or) groups in places of storage and operation, organizations conduct inspections

.

Procedure for conducting inspections

, including the definition of specific names, types, groups of stocks to be checked, the timing of the check, etc.,

is established by the head of the organization

, as well as by the heads of the organization’s departments on behalf of the head of the organization (clauses 21, 23 of the Methodology).

When conducting an inventory, surpluses, shortages and mis-grading of goods may be identified.

.

Based on the results of inventories and inspections, the organization must make appropriate decisions

to eliminate deficiencies in storage and accounting of goods and compensation for material damage.

Surpluses identified as a result of inventory

goods are purchased

at market prices

, and at the same time their cost is included in commercial organizations

for financial results

(clause 29 of the Methods of Instructions).

Moreover, under the current market value

refers to the amount of money that

can be received as a result of the sale of goods

(clause 9 of PBU 5/01).

DEBIT 41 CREDIT 91

subaccount “Revenue”

– identified surplus goods are reflected.

Organizations engaged in retail trade, if goods are recorded at sales prices

, information about trade margins (discounts, markups) is reflected in account 42 “Trade margin”.

Therefore, the trade margin on capitalized surplus goods is reflected:

DEBIT 41

subaccount “Goods in retail trade”

CREDIT 42

.

Clause 29 of the Methodology established that the amounts of shortfalls

and damage to goods

are written off from accounting accounts at their actual cost

, which includes

the accounting price of goods

and the share of transportation and procurement costs related to these goods.

The procedure for calculating the specified share is established by the organization independently.

In accordance with the Instructions for using the Chart of Accounts... for shortages and damage to valuables, entries are made by debiting account 94 “Shortages and losses from damage to valuables” from the credit of the accounts accounting for these valuables.

DEBIT 94 CREDIT 41

– the identified shortage is reflected;

| DEBIT 94 CREDIT 42 |

– the amount of the trade margin on the goods identified as a result of a shortage is reversed.

If part of the missing goods was within the limits of natural loss

, then it is written off as selling expenses:

DEBIT 44 CREDIT 94.

If the persons responsible for the shortage have been identified, then according to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged

compensate the employer for

direct actual damage

.

Lost revenues

(lost profits)

are not subject to recovery from the employee

.

Under direct actual damage

means, in particular, a real decrease in the employer’s cash assets.

If, in particular, the employee is charged with financial liability in full for damage caused to the employer during the performance of the employee’s job duties, or a shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document is discovered, then the employee is obliged to compensate the direct actual damage in full

(

Art. 242, 243 Labor Code of the Russian Federation

).

Amount of damage

damage caused to the employer due to loss and damage to property

is determined by actual losses, calculated on the basis of market prices in force

in the area on the day the damage was caused, but

not lower than the value of the property according to accounting data,

taking into account the degree of depreciation of this property (

Article 246 of the Labor Code of the Russian Federation

).

Note!

Total amount of all deductions

for each payment of wages

cannot exceed 20%

, and in cases provided for by federal laws - 50% of wages due to the employee.

When deducting from wages under several executive documents, the employee must in any case retain 50% of the wages ( Article 138 of the Labor Code of the Russian Federation

).

If the guilty parties are identified, the shortage of goods is written off at the expense of the guilty persons:

DEBIT 73

subaccount “Calculations for compensation of material damage”

CREDIT 94

.

According to the Instructions for using the Chart of Accounts... for the credit of account 94 “Shortages and losses from damage to valuables”

amounts are reflected in the amounts and values accepted for accounting on the debit of the specified account

.

Difference

between the amount recovered from the guilty persons for missing material and other valuables and the value listed in the organization’s accounting records,

is taken into account in the credit of account 98 “Deferred income

” .

On account credit 98

“Deferred income” in correspondence with account 73 “Settlements with personnel for other operations” (sub-account “Calculations for compensation of material damage”) reflects

the difference between the amount to be recovered from the perpetrators and the cost of shortages of valuables

.

As the debt accepted for accounting under account 73 “Settlements with personnel for other operations” is repaid, the corresponding amounts of the difference are written off from account 98 “Deferred income” to the credit of account 91 “Other income and expenses”.

There is an opinion that posting debit 73 credit 98

The difference between the sale and purchase price of the goods is written off at the expense of the guilty person.

However, the amount of the trade margin

in this case,

it is essentially lost income of a trading organization

.

And, as we have already noted, lost income

(lost profit)

art.

238 of the Labor Code of the Russian Federation directly prohibits collection from employees .

Based on a literal reading of the Instructions for using the Chart of Accounts... it follows that this posting ( DEBIT 73 CREDIT 98

) reflects the difference between the amount to be collected from the employee (that is, taking into account the requirements of the Labor Code of the Russian Federation, without trade margins) and the book value of the goods.

Such a difference may arise when the full amount of the shortage is not recovered from the employee or the market price of the goods at the time the shortage is written off is higher than its book price.

Let us repeat that most experts do not see anything reprehensible in writing off trade margins at the expense of the guilty employee.

But we considered it necessary to warn you about the possible consequences.

Partial deduction from salary

employee amount of shortfall:

DEBIT 70 CREDIT 73.

In accordance with clause 5.3 of Order No. 49 on permitted misgrading

financially responsible persons must provide detailed explanations

to the inventory commission

.

Mutual offset of surpluses and shortages as a result of regrading

can

only be allowed as an exception

for the same audited period, for the same audited person, in relation to inventory items of the same name and in identical quantities.

A similar provision is contained in paragraph 32 of the Methodological Instructions.

In the case when, when setting off the shortage

surplus by re-grading,

the cost of missing goods is higher than the cost of goods found in surplus

, the specified difference is attributed

to the guilty persons

.

If the specific culprits of the shortage are not identified

, then the differences are considered as a shortage in excess of loss norms and are written off to the financial results of a commercial organization:

DEBIT 41 CREDIT 91

– surplus goods have been capitalized, which can be used to offset surpluses and shortages;

DEBIT 94 CREDIT 41

– a shortage of goods is reflected.

If the difference (shortage) formed on account 94 is attributed to the guilty parties, then:

DEBIT 73 CREDIT 94

– a shortage exceeding the surplus is written off at the expense of the guilty person.

If the culprits of the shortage are not identified:

DEBIT 91-2 CREDIT 94

.

If, as a result of mutual offset of surpluses and shortages, the value of the surplus is higher than the value of the shortage

:

DEBIT 41 CREDIT 91-1

;

DEBIT 91 CREDIT 94

.