Legislative regulation

To fully understand the essence of the mat. responsibility, let's look at what it is - a financially responsible person?

Financially responsible persons (MRP) are employees who are financially responsible for the property of the enterprise entrusted to them. That is, in the event of damage to property, such employees will reimburse its cost.

Full financial liability (ML) (according to Chapter 39 of the Labor Code of the Russian Federation) occurs only when it comes to:

- about authorized persons who have financial liability initially under federal law

- on identifying shortages of valuables that were entrusted to the employee under agreements or according to any one-time documents;

- property damage intentionally, or while in a state of intoxication ;

- about illegal misconduct, as a result of which the employer’s property was damaged ;

- about causing property damage as a result of improper performance of the MOL, or complete failure to fulfill his direct duties;

- on the disclosure of important and protected information.

MO is assigned to the employee by appropriate order.

, financial liability is imposed by the state from the very beginning . These include the positions of senior officials at the enterprise: chief accountant, director of the enterprise, as well as all his deputies.

In this case, in accordance with Article 277 of the Labor Code of the Russian Federation, the head of the organization is obliged to be responsible for any material and property damage if it was caused to his organization.

The condition for full MO must be enshrined in a separate agreement (Article 244 of the Labor Code of Russia) and reflected in the employment contract as one of the necessary conditions. This is done so that the employer can subsequently be absolutely sure that he can legally recover from his subordinate an amount equivalent to the damage caused.

This process (appointment of MO persons) is carried out in accordance with all the requirements of the Min. Labor , No. 85.

This document states who can be the financially responsible person. The list is a key factor when concluding employment contracts with employees.

Order on the appointment of resp. persons perform two functions at once:

- officially approves the powers of a specific official;

- establishes a list of the enterprise’s property accountable to this person.

At the same time there is no standardized form of this document ; the template for the document on the appointment of the MOL is currently drawn up based on all existing employment contracts, agreements and agreements signed and carried out with this employee, and based on Articles 242 and 244 of the Federal Labor Code .

Here you can find a free form for an order to appoint a mat. responsible.

At the same time, the time when the document can be issued is not strictly tied to the employee’s hiring , or to any other time frame. This is due to the fact that the time of checkmate. The responsibilities of a company employee and the time of his hiring to the company may vary.

When an object of responsibility appears (and this can happen at any time, regardless of when the employee was hired), it will immediately be placed under the responsibility of a specific official selected from the regular employees. Then financial responsibility will be established.

Watch the video about the nuances of swearing. responsibilities:

Who appoints the person in charge?

Depending on the type and scale of the enterprise, the person who appoints responsibility for individual sectors also changes. If the company is small, then the manager himself can distribute the powers and responsibilities

In some cases, he may appoint himself ; this also requires filling out an order.

If the company has several divisions, then the head of one of them is responsible for appointing a responsible person. In particularly large enterprises there are entire departments that control the performance of duties and powers and delimit areas of responsibility between employees.

The act is filled out in the personnel department or in the secretariat. Afterwards, the order is submitted to the manager or head of the unit for signature.

The act must also be signed by employees who are appointed as authorized persons in specific areas.

Appointment procedure

Instructions on how an employer should act when choosing and assigning mat. responsible person:

- the workplace is prepared , it is checked how materially and technically it is provided;

- a candidate is selected . In this case, all important characteristics are taken into account: education, experience in this field, absence of medical contraindications, etc.;

- the candidate is fully explained his labor and authorized duties , working conditions, guarantees, payment is negotiated, and the candidate is also provided with intra-organizational regulatory documentation;

- two contracts are concluded: an employment contract and a contract on full individual medical education;

- the employee is officially hired: for this, an order is issued in form N T-1/N T-1a, then a personal card is issued for the employee and a corresponding entry is made in the work book;

- is issued to appoint mat. responsible employee , about his capabilities and full set of responsibilities. The employer's inventory and materials are received and transferred, which are used during production and sales.

If the employer assigns responsibility to an employee from the company’s staff, then the whole procedure is simplified and boils down to the fact that it is necessary to conclude this agreement with the current employee and issue an appropriate order on this basis.

Only one contract can be concluded with one employee. In this case, the agreement can be of two types: as a collective mat. responsibility, as well as individual responsibility.

According to the law, it is impossible to conclude a full medical agreement with minor citizens. By law, employees who have not reached the age of majority bear full responsibility only for causing property or any other damage (intentional, or caused as a result of alcohol, drug or other intoxication).

In budgetary institutions

Who can be a financially responsible person in a budgetary institution? Such enterprises, like commercial organizations, imply the presence of financially responsible persons. An agreement on full financial responsibility is concluded with them.

It is obvious that budgetary institutions do not have some of the positions from the above list (for example, workers in the depository sector, areas with the circulation of money and securities). Therefore, when talking about financial responsibility in budgetary institutions, we must mean cashiers, storekeepers, wardrobe maids, building superintendents, and warehouse managers.

List of positions

Before appointing one or another company employee financially responsible, you must first make sure that this employee, or rather his position, is included in the list established by Regulation No. 85 of the Ministry of Labor of December 31, 2002.

For example, this list clearly includes the positions of cashiers, transport controllers, storekeepers and managers. warehouse, heads of construction sites, laboratory doctors, heads of pharmacy points. All these positions are subject to an individual type of mat. responsibility.

Collective, or brigade type, full mat. responsibility is imposed on such areas of activity as: accepting cash payments through the cash register, depository services, sales of goods, delivery of cargo, luggage, mail, etc.

You can read about the collective responsibility agreement here.

However, the employee does not become responsible for the property immediately after taking ownership of it, that is, without the official designation of the employee as the responsible person, he will not be responsible for the property.

List of positions of financially responsible persons according to the Labor Code of the Russian Federation

Articles of the Labor Code of the Russian Federation and Resolution No. 85 of the Ministry of Labor of the Russian Federation determine the lists of positions and works that may be involved in financial liability.

Any employee should read these lists carefully.

Let's consider the list of positions according to the Labor Code of the Russian Federation, which includes MOL:

- Cashiers, controllers of any enterprises. Regardless of the field of activity, these people are always financially responsible.

- The list of MO positions includes employees who work in areas related to deposits, securities trading or finance.

- Workers who work in the expert field.

- Methodologists, laboratory assistants, library staff.

- Managers of pawnshops, lockers, warehouses and other places where someone's property is stored.

- Managers in management positions - storekeepers, wardrobe maids, commandants, forwarders, head nurses.

- The list of positions subject to MO includes managers from the fields of trade, food, service, and hotel business.

- Heads of pharmaceutical companies and pharmacies.

List of works during which MO may occur:

- sale of various goods or services;

- payment and acceptance of payments of any type and form;

- expert works;

- work related to deposits, securities or finance turnover;

- repair work on cars, household items, jewelry, nuclear resources;

- work to ensure the safety of someone's property.

Important! The lists of work with individual and collective financial responsibility are absolutely the same.

We have figured out who is the financially responsible person in the enterprise, let’s move on to the next paragraph of our article.

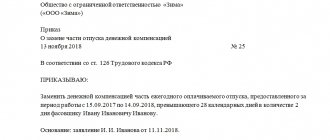

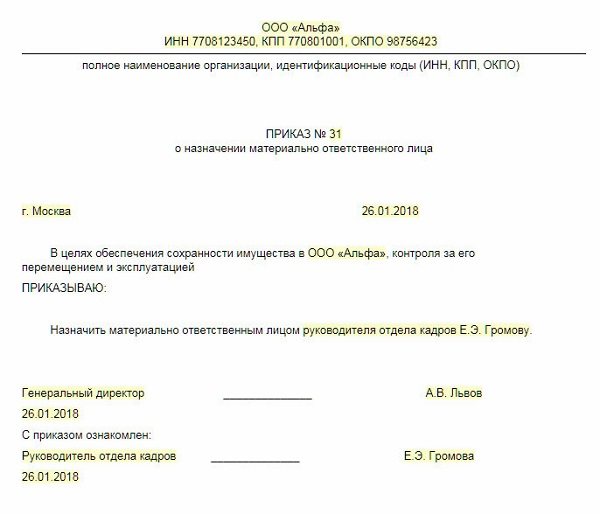

Sample order

Since this document does not have a unified form, it is drawn up in any form , and all rules for the preparation of primary accounting documentation must be observed. These rules are established by the Federal Law “On Accounting” dated December 6, 2011 N-402-FZ.

The form must contain the following information:

- name of the enterprise , its location and basic information about it;

- registration number and date of the document;

- Full name gen. the director of the enterprise, or another person who has the authority to issue orders and instructions;

- a brief indication of the purpose of issuing the order (preamble), also indicating a reference to the legal act on the basis of which it was issued (for example, the Labor Code);

- the essence of the order and the signature of the management of the enterprise;

- signatures of all employees affected by the order, which indicates that they are familiar with the document.

Sample order for the appointment of mat. responsible person:

When working part-time

Article 282 of the Labor Code of the Russian Federation gives a clear definition of part-time work. This is the performance of regular work under the terms of an employment contract during time free from main employment. A person can work part-time both at his main place of employment and in other companies.

Can a part-time worker be a financially responsible person?

If a person performs financially responsible work, then in any case he enters into an agreement on financial responsibility.

This also applies to part-time workers. Only persons under 18 years of age are exempt from financial liability. They are not accepted for responsible positions at all.

The concept of financial liability is fully defined by the laws of the Russian Federation. The legislation contains lists of positions and jobs in which financial liability arises. When hiring a person for such a position, it is necessary to conclude a financial liability agreement.

If a liability situation arises, you first need to determine whether the employee is really at fault.

If there is a causal connection between his actions and the damage caused, then the damage will have to be compensated in full.

The procedure for compensation can be voluntary, administrative or judicial.

The terms of compensation are usually set individually - by the employer, the court or by agreement of the parties.

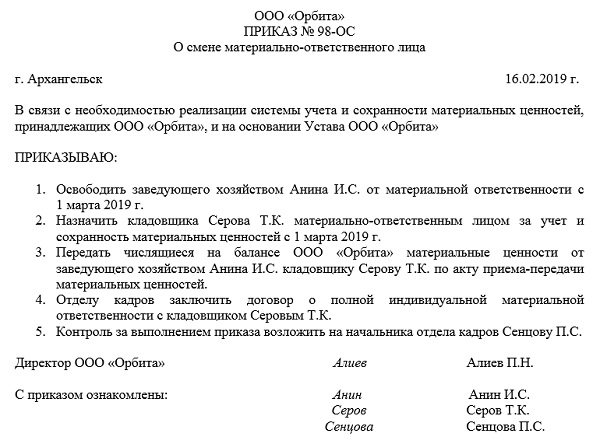

Actions with the responsible person

Before accepting a person to the staff, mating agreement is signed responsibility (although it may be signed later).

The process of changing or dismissing a MO at your own request is absolutely the same as for other employees. It is fully described in Chapter 13 of the Labor Code of the Russian Federation.

In accordance with the law, an employee must submit a letter of resignation fourteen days in advance. When this period expires, he will be given documents, and a cash settlement will also be made. According to the law, the dismissal procedure cannot last more than two weeks.

Inventory is a mandatory condition for an enterprise, in accordance with the requirement of the Ministry of Finance in order No. 119n. In this case, the document on material assets is transferred to the chief accountant of the enterprise , and if there are no complaints, then it is signed.

Dismissal of a MOL without inventory is illegal!

The property of the enterprise is transferred by a resigning or replaced employee to another employee , usually from the staff, which is confirmed by a transfer act signed by the employees of the organization who participated in the inventory. After this, you can quit without any problems.

Example of an order to change the MOL:

Inventory under special conditions

A non-standard case is the circumstance when a change in responsibility occurs due to his death.

Reference! Normative legal acts in this area do not establish the procedure for when an inventory must be carried out in the absence of an accountable person.

https://www.youtube.com/watch?v=ytdevru

The reason for the absence of the MOL is indicated in the order to begin the inventory, to which is attached a copy of the document confirming the death of the employee. The same is noted in the inventory lists and certified by members of the commission.

The procedure for conducting inventory in both of the above cases should be formalized in the accounting policy of the enterprise.

Based on the information presented, we can conclude that for clearly planned work of an enterprise and to prevent damage or theft of property belonging to it, it is impossible to do without MOL, as well as without carrying out an inventory.

Regardless of the reason for which it is carried out, whether it is mandatory or unscheduled, it must be carried out in accordance with the same rules:

- decision of the manager, confirmed by an order to conduct an inventory;

- the creation of a commission operating on a permanent basis, which usually includes representatives of the directorate, financial, economic and audit departments;

- collecting data for the purpose of checking the compliance of the property available and reflected in the documentation;

- registration of results: attributing the shortage to the financial results of the organization and presenting demands to the financially responsible person.

At the same time, in order to prevent unforeseen circumstances and prevent an employee from evading the obligation to be responsible for damage to assets after an inventory, it is recommended to be especially careful in preparing all the necessary documents accompanying the hiring of a materially responsible person.

If you find an error, please highlight a piece of text and press Ctrl Enter.

Who is financially responsible?

Most often it is based on an offense.

Therefore, an explanation is taken from the guilty person - just as in case of disciplinary violations.

In order to bring a person to financial responsibility and force him to compensate for the damage, the elements of the offense must be present.

Without a violation, prosecution is impossible.

For matrimonial liability to occur, 4 mandatory conditions must be met:

- the injured party suffered real (actual) damage;

- the person who caused the damage is really guilty;

- there is a causal connection between the culpable act and the damage caused;

- There are no circumstances that could exempt the culprit from compensation for damage.

Important! Financial liability occurs both after the action and inaction of the culprit. If he did nothing personally, but neglected the opportunity to prevent the damage, he is still considered guilty.

Compensation for damage

If for some reason an MO employee causes damage to the property entrusted to him, which leads to specific monetary losses to the employer, then the latter has the right to expect to recover compensation for this damage. The same applies to shortages if the employee works with values.

It is legally possible to hold an employee under two types of liability: limited and full:

- In the first case, the MOL compensates for damage from its own average earnings, regardless of the amount of damage caused . The shortfall can be withheld in parts from his salary.

- Full liability is compensation for the entire amount of damage caused . Moreover, the perpetrator has the right to compensate for losses not only in cash, but to provide similar property in replacement of the one that was damaged, or to personally correct the consequences of his own actions.

Acceptance certificate

A document confirming the fact of transfer of material assets to the responsible person is called an act of acceptance and transfer.

This document indicates the property of the enterprise, which passes under the responsibility of the employee (without the right of personal property) before starting work.

https://www.youtube.com/watch?v=ytpressru

When signing this document, MOL assumes full responsibility for the safety of the property entrusted to it.

He has no right to use it for personal purposes or appropriate it for himself.

Acceptance and transfer certificates are drawn up on the basis of the organization’s Charter in 2 copies between the head of the enterprise (general director) and the employee. Both copies have equal legal force for both parties.

Release from liability

The Labor Code stipulates situations when persons can be exempted from swearing. responsibilities:

- Management absolves the employee from the consequences of his actions because of his professional skills and experience .

- Damage to property was caused, but it was not caused by the direct actions of the employee, while he himself acted in accordance with instructions .

- Damage to property was caused in order to avoid further destruction/to save people in an emergency situation.

Legal practice shows that it is better not to bring the resolution of all formal and monetary issues of management with the MOL to court, since due to the specifics of such cases, most of them last for whole years .