How can an employer request an explanation for absenteeism?

Absenteeism is the absence of an employee from the workplace for more than 4 hours. It is important to distinguish this from forced absenteeism, when absence from work is due to the actions of the manager.

Before receiving an explanatory note from an employee, you should prepare an absenteeism report, which includes testimony:

- immediate superior;

- at least two witnesses confirming the failure to appear.

Internal investigations into violations of discipline of any type can be carried out no later than within a month from the date of the commission of the offense.

Requirement to provide a written explanation

- non-compliance with labor safety standards;

- being late for work;

- absence from work for 4 hours or more;

- appearing at the workplace in a state of intoxication (meaning drugs and alcohol);

- damage to the tenant's property.

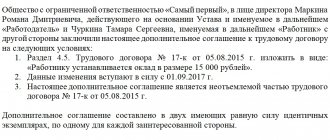

- the name of the company where the offending employee works;

- to whom the letter is addressed (full name and position of the employee);

- postal address if the request is sent by mail;

- Title of the document;

- if desired, contact an employee;

- the essence of the offense;

- link to article 193 of the Labor Code of the Russian Federation and information that the employee must respond within 2 working days;

- a request for a written explanation;

- deadline for providing an explanation to the employer;

- an application, for example, a memo from the head of the department where the employee works;

- date of writing the request;

- employer's signature;

- a column for the employee’s signature and the date when he received the notification.

The employer can demand an explanation either orally or in writing. However, a written demand is preferable as it will serve as evidence that it was actually made and an explanation was sought. In addition, such a document records the date of the disciplinary offense and indicates by what time the employee must give written explanations. 2 working days are given for this.

If employees violate labor discipline, for example, if they are late or appear at work while drunk, the employer must demand a written explanation from them. This must be done before disciplinary action is imposed on employees. This is stated in Part 1 of Art. 193 Labor Code of the Russian Federation. We’ll tell you in this article how to correctly make a request for an employer to provide a written explanation.

If an employee truly values his job, then it is in his best interest to provide an explanation. The employer must understand what his further actions are, so an explanatory statement from the employee is necessary. But if he never provides it, then this should not be interpreted as evidence of the employee’s guilt in a particular incident.

Step 3. Demand an explanation from the employee. This can also be done orally if the employee immediately provided an explanation. Otherwise, make the request in writing and hand it to the employee with a personal signature. If the employee refuses to receive the request, draw up a free form statement of refusal with the signatures of at least three company employees who will attest to the fact of the refusal.

The next controversial point is whether the reasons for absenteeism are valid. Since the legislation does not contain a list of such reasons, the decision is made by the employer, aware of the possibility of verifying the validity of recognizing the reason for absenteeism as valid in court in the event of a dispute with the employee. It should be noted that in such cases, the courts take into account the severity of the employee’s offense, attitude towards work, the impact of the employee’s absence on the work process, and the circumstances of the offense. Judges considered the following reasons for an employee’s absence to be valid:

Position 1. The lunch break should be included in the 4-hour period of absenteeism. If this is not done, then it is almost impossible to fire an employee for absenteeism. The fact is that the Labor Code of the Russian Federation does not define a working day as working time before and after lunch. This means that a lunch break cannot interrupt the period provided for in Art. 81 of the Labor Code of the Russian Federation (sub-clause “a”, clause 6, part I).

- participation in legal proceedings;

- unpaid leave due to an employee in accordance with the Labor Code of the Russian Federation;

- absenteeism from work after two weeks have elapsed since the employer’s written notice of the desire to resign;

- poor health (documented);

- illness of the child, which is confirmed by a doctor’s certificate, extracts from the medical record (even when the sick leave is opened only the next day);

- carrying out emergency repair work in the employee’s apartment (confirmed by a certificate from the HOA, housing office, etc.);

- the employee’s location on the way to the place of study and back;

- suspension of work due to the employer delaying payment of wages for more than 15 days (based on Article 142 of the Labor Code of the Russian Federation), even if the debt is partially repaid;

- serving an administrative punishment by an employee (administrative arrest).

If a dispute arises about the legality of dismissal, the employer must prove the fact of absenteeism. Therefore, it makes sense to resort to dismissal for absenteeism only if there is conclusive evidence that the reasons for absence from the workplace are not valid, as well as documented information about the employee’s absence for a 4-hour period.

Step 5. Internal investigation. Used when it is unknown whether the reason for absence was valid, or when the employee does not contact. If it is not clear whether the employee is at fault, then it is better to create a commission to conduct an investigation. The commission will draw up an official investigation report, which indicates the circumstances that were found out.

Contents of the explanatory note for absence from work

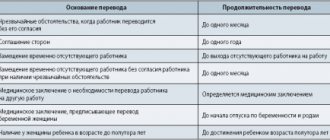

The list of compelling circumstances can be divided into two groups:

- legal grounds (being on sick leave, illness of a close relative, etc.);

- force majeure (natural disaster, accident).

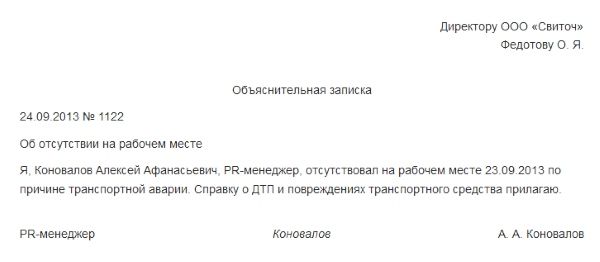

The written explanation is drawn up in free form; there is no standardized form. But there are universal design requirements. In particular, the following blocks of information will be displayed:

- Introductory part. The position and full name of the manager, as well as the legal name of the enterprise, are indicated. Information about the employee himself is also displayed here, namely full name, position held and the department in which the citizen works.

- Title.

- Explanation text. Contains dates (hours) of absence, as well as a brief statement of the reason for absence from work.

- List of attached documents.

- Date and signature.

Sample

An example of a correctly composed explanatory note:

Features of dismissal of a truant

Unlike dismissal on personal initiative, parting with a truant worker requires compliance with regulations and going through stages that involve an attempt to communicate with the absentee and obtain an explanation.

Before dismissing a truant worker, you must make sure that his actions qualify as a violation of labor discipline and there is no reason to assume that there are objective valid reasons that forced the employee to be absent from the workplace.

The documentary basis for terminating a contract with a truant worker will be an official request for an explanation of the reasons for non-appearance, sent to the employee the day before. In the absence of feedback or provision of unclear explanations, management reserves the right to terminate the employment contract on the basis of Art. 81 labor legislation.

Despite the lack of clear explanations under what circumstances an employee has the right to be absent without prior agreement with the employer, there are clear indications of what is considered absenteeism, giving the right to unilateral termination of the contract:

- absence from work for the whole day; 4-hour absence, excluding lunch time; violation of the working day regime established at the enterprise more than 3 times during the year.

The violator is dismissed with an entry in the work book with reference to clause 6, part 1 of Art. 81 Labor Code of the Russian Federation.

Sequencing

The procedure is presented in several stages:

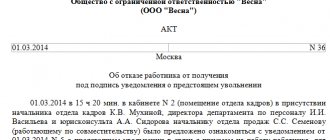

- After absence from work, the administration records the fact of violation by drawing up an act, memo, or report.

- Based on the submitted document, management initiates proceedings and sends an official request to the absent person about the reasons for absence (according to Article 193 of the Labor Code of the Russian Federation).

- When receiving feedback, the explanations provided are reviewed to determine if the reason is valid. If they are considered disrespectful, or if no explanation is received from the employee, management decides to impose a penalty. An employee cannot be fired for a single absence from work; usually, they are limited to a reprimand. In case of systematic violations (3 times or more in the last year), the administration has the right, on its own initiative, to dismiss the truant.

- The manager orders the issuance of an order to terminate the contract with the offender and sends it to the employee for review.

- When an employee hides or refuses to sign a document, the relevant services of the enterprise draw up a statement of refusal.

- Next, they make the last entry in the employment record with reference to dismissal under the article, prepare payroll and documents for transmission to the employee.

Request for explanatory note

To do this, a letter is sent to the employee requesting an official explanatory note.

The structure of the request letter requires the indication of all important parameters and circumstances, but there is no separate form for such a document.

As a rule, the request is written in the following sequence:

- The number assigned during document registration.

- Date of preparation.

- Name of the form.

- Information about the organization (including addresses and contacts).

- Information about the recipient (position, full name, address).

- The main part with a statement of the fact of absence, recorded in the act, the duration of the absence, the wording “without specifying the reasons.”

- Next, they formulate a requirement to appear to give explanations within 2 days.

- In order to have grounds for subsequent dismissal, further in the text they warn about the consequences of ignoring the employer’s requirements.

- The document is signed by the head of the enterprise, indicating the position and decoding.

After drawing up the paper, a problem arises with conveying information to the attention of the absent employee. Since notice of dismissal for absenteeism requires urgent communication, a telegram or valuable letter of notification is sent to the absentee, or transmitted by e-mail or other means of telecommunication.

It is in the interests of the employer to find out the reason for the absence, since otherwise there is a risk of challenging the dismissal and filing a lawsuit demanding reinstatement and payment of compensation for the period of absence.

Is it possible to refuse to give explanations?

Detecting the fact of a violation is not enough to impose a penalty. Management must take the following actions:

- obtaining information about an offense;

- preparation of an order addressed to a personnel employee to conduct an internal investigation;

- collection of evidence;

- requesting an explanatory note;

- drawing up the conclusion of an internal investigation;

- issuing an order to impose disciplinary sanctions;

- familiarizing the offender with the decision made;

- transfer of the order for implementation to the personnel department, as well as to the accounting department, if a monetary penalty is provided.

IMPORTANT! It is impossible to apply punishment without receiving an explanatory note from the employee.

But if the worker refuses to give an explanation, then after two days the manager has the right to draw up a corresponding act. This is an administrative document in which the manager, the personnel employee, as well as three representatives of the team sign, confirming the truant’s refusal to give explanations.

Notice of explanation (sample and form)

Before bringing a worker to disciplinary liability, the employer is obliged to demand an explanation from the employee. If this is not done, then prosecution is illegal, since the procedure is violated. In order to comply with these requirements in personnel proceedings, a document such as a notice of explanation is used. A sample notification and form are given below.

This notice must be prepared in 2 copies. One explanatory demand will be handed to the worker, and the second will remain with the employer to confirm the fact of notification. To do this, the worker must make a receipt on the employer’s copy of the request for explanations.

It will not be possible to avoid liability under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation to duly notified taxpayers who did not appear at the tax authority without compelling reasons or valid reasons (resolution of the Eighth Arbitration Court of Appeal dated May 31, 2021 No. 08AP-1355/2018 in case No. A81-3222/2017; Perm Regional Court dated October 6, 2014 in case No. 44a-689/2014; Krasnoyarsk Regional Court dated July 25, 2014 No. 4a-509/2014).

Currently, the tax authorities are secretly considering the issues of financial and economic operations of the analyzed organizations as part of summoning their representatives to the inspectorate upon notification in accordance with subsection. 4 clause 1 art. 31 of the Tax Code of the Russian Federation, often violating the rights of taxpayers. This may be due to the fact that the said norm does not contain a closed list of cases of summons, which the tax authorities interpret as a basis for applying this norm for almost any reason. However, it should be taken into account that the unified form of notification requires a detailed description of the grounds for the summons related to the payment, withholding of taxes and fees, identified circumstances of violation of tax legislation, and the conduct of a tax audit. After the abolition of commissions for the legalization of the tax base (except for personal income tax and insurance contributions), the tax authority, in describing the grounds for calling the taxpayer, often indicates the need to provide explanations on the financial and economic activities of the inspected person, as well as its relationships with certain counterparties. In this case, the actions of the fiscal authority are not entirely correct, since the tax authority is assigned the responsibility to monitor compliance with legislation on taxes and fees, and not over the financial and economic activities of taxpayers, and these are not identical concepts. Consequently, in the situation under consideration, there are no legal grounds for summoning the taxpayer to the tax authority, since the requirement to provide explanations on financial and economic activities does not contain clarification of the specific norm of the legislation on taxes and fees, which applies to the financial and economic activities of the summoned taxpayer.

The summoning of the taxpayer (manager or representative by proxy) to the tax authority is carried out on the basis of a notification, which can be sent electronically via telecommunication channels (hereinafter referred to as TCS), by registered mail or delivered to the representative personally against signature.

It is necessary to note that in case of sending a notification in electronic form according to TKS, clause 5.1 of Art. 23 of the Tax Code of the Russian Federation establishes the taxpayer’s obligation to generate and send to the tax authority an electronic receipt of acceptance of this notification (or notification of refusal to accept in the event of technical failures) within 6 days from the date the document was sent by the tax authority. In case of failure to fulfill this obligation within 10 days from the date of expiration of the deadline for submitting a receipt, the tax authority has the right to initiate the suspension of transactions on bank accounts in accordance with clause 3 of Art. 76 of the Tax Code of the Russian Federation (Letter of the Federal Tax Service of the Russian Federation dated May 11, 2021 No. AS-4-2/8820).

Tax authorities, in accordance with the legislative norms set out in subparagraph. 4 paragraphs 1 art. 31 of the Tax Code of the Russian Federation, are vested with the authority to call taxpayers to give explanations on issues of completeness and timeliness of accrual and payment of taxes and fees. Fiscal authorities can exercise this right both within the framework of a tax audit, for example, in order to clarify the position of the person being inspected regarding detected violations, and outside the framework of the audit if there are facts and circumstances indicating that the taxpayer under investigation has received an unjustified tax benefit.

The second most important condition for the proper execution of dismissal for absenteeism is correct documentation (the general procedure for dismissing an employee for absenteeism is given, for example, in the letter of Rostrud dated October 31, 2007 N 4415-6). Article 193 of the Labor Code of the Russian Federation requires that even before applying a disciplinary sanction, the employer requires an explanation from the employee in writing.

- Document the fact of absenteeism (a report is drawn up in the presence of witnesses or a report from the head of the unit).

- Request to provide an explanatory note in writing.

- If the reason for absence is valid, the internal investigation is closed. Otherwise (and also in the absence of explanations), an appropriate act is drawn up and a decision on punishment is made.

- If the employer decides to terminate the employment relationship due to absenteeism, an order is prepared and an entry is made in the work book.

- A notification is sent (optional procedure).

Since absenteeism refers to gross violations of labor duties by an employee, for which the most severe disciplinary sanction is provided - dismissal (Article 192 of the Labor Code of the Russian Federation), the author believes that there is no need to legislate the concept of long absenteeism.

The specific form of the supporting document is not established by current legislation. In practice, employees submit notes written by hand or typed on a PC in accordance with the form established by the organization (if there is none, in free form).

It is important to observe the 30-day period, after which it is too late to formalize the dismissal (if the employee has returned to duty). And if a disciplinary offense was discovered 6 months after the return of the dishonest employee, the incident is cancelled.