What it is

To accurately calculate the hourly tariff rate in 2020, you need to consider:

- employee's monthly salary;

- type of workweek (5-day or 6-day, 40-, 36- or 24-hour);

- number of working hours in 2021

For reference, the most common type of workweek is 5 days, 8 hours a day. Teachers, service workers, and some other categories work 6 days a week, but their total working time per week will be 40 hours (usually their work schedule in hours is as follows: 7 + 7 + 7 + 7 + 7 + 5 = 40).

Regarding the duration of a 5-day work week:

- Adolescents under 16 years of age and employees of production facilities producing chemical weapons should work no more than 24 hours a week;

- no more than 36 hours a week - teachers, workers in industries with harmful and dangerous working conditions, etc.

Medical workers, depending on their position and specialty, have a 24-, 30-, 33-, and 36-hour work week.

How to calculate salary

We have already looked at how to make calculations based on an employee's annual earnings. But sometimes situations arise where data from one or several months is used.

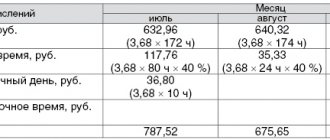

To find out the hourly wage rate for a certain month, if the salary is known, we again turn to the production calendar, but we look at the number of working hours not for the year, but for specific months (the numbers will be very different if there are public holidays in the month in question).

Example 4.

Let’s take the most “difficult” months: February, March, April 2019.

A storekeeper works 40 hours a week.

His salary is 30,000 rubles.

How to calculate

Let's consider 2 calculation options: for 40 and 24 hours of work per week. To calculate the hourly tariff rate from the hourly salary, the formula is used:

Example 1: 40 hours per week.

Let’s say a proofreader at a publishing house works 5 days a week, 8 hours a day.

Salary - 20,000 rubles per month.

The number of working hours in 2021 at 40 working hours per week is 1970.

Hourly tariff formula: 20,000 × 12 /1970 = 121.82 rubles.

Example 2. 24 hours a week.

A 15-year-old teenager works as a courier for a publishing house.

Salary - 15,000 rubles per month.

The number of working hours in 2021 with a 24-hour work week is 1179.6.

Formula for calculating the hourly tariff rate for 2021: 15,000 × 12 / 1179.6 = 152.5 rubles.

How to register

The registration procedure corresponds to the standard scheme of interaction between the employee and management and the services involved in personnel matters.

Before you begin registration, you should discuss how to place a 0.5 bet:

- The moment of transition to a new schedule.

- Choice of part-time (up to 4 hours at ½ rate) or working week (with additional days off).

When working part-time on maternity leave, they often prefer the part-time option, when parents and relatives share the responsibilities of caring for the baby by day of the week.

The scheme of actions when switching to part-time is presented below:

- Discussion of employment conditions in the new schedule. It should be borne in mind that during this period of work, an employee is unlikely to be able to count on career growth, and in the event of layoffs, he falls into the “first wave” if the law does not provide protection due to the presence of young children or other social status.

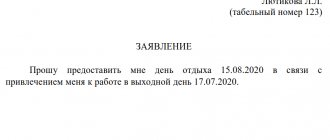

- The employee writes a statement according to the sample provided by the personnel service. The application addressed to the manager states a request to be enrolled part-time in a specific position. The document is signed and dated.

- After receiving a management visa, the application is transferred to the personnel department to prepare the appropriate order and receive the necessary personal papers from those applying for a job at the enterprise. The order reflects the name of the position, the amount of earnings, the regime, and the date of enrollment. If necessary, include some special conditions for the performance of duties.

- When drawing up the contract, the inclusion of mandatory clauses is taken into account. After signing, one copy remains with the employee, the second is stored at the enterprise.

Mandatory details include the following items:

- General points describing the conditions of employment, features of the working day, work and rest hours.

- Employee rights.

- Responsibilities under the contract.

- Terms of payroll.

- Description of the conditions for carrying out work activities (including hazardous types of work).

- Information about the signatories - the employer and the employee signing the document.

If necessary, the clauses of the contract are supplemented based on the specifics of employment. The main thing is that the introduced points do not contradict the basic norms of civil and labor legislation.

Download an example of a part-time employment contract (99.5 KiB, 1,866 hits)

Minimum size

The legislation does not establish a minimum hourly wage rate in 2021. But when calculating it, it is necessary to take into account the following: the minimum monthly salary of an employee who has worked the full working time cannot be lower than the minimum wage. From January 1, 2019, the federal minimum wage is 11,280 rubles. It is obvious that the hourly wage rates of workers for 2021 will not be lower than those calculated from the minimum wage.

The hourly tariff rate from the minimum wage for a 40-hour work week is calculated using the formula:

If a regional minimum wage has been established in the region where the organization operates, the company should focus on it. For example, in Moscow the minimum wage is 20,195 rubles, and in St. Petersburg - 18,000 rubles.

Estimated time of tariff rate

The estimated time here is 1 hour. For other types of vehicles this is the day and month.

To find out an employee's income per hour, his monthly salary is divided by the number of working hours per month. The latter is defined in different ways. According to the production calendar approved by the Russian government for 2021, it is:

- with a 40-hour work week - 1979 hours;

- at 36 hours - 1780.6;

- at 24 hours - 1185.4.

And if each of these numbers is divided by 12 (the number of months in a year), we get the average number of working hours per month. But the result will not be entirely objective, since months have different numbers of working days.

For ease of calculation, we will use the indicator for each month, which is given in the production calendar.

How to calculate overtime

Calculating the hourly tariff rate is necessary to correctly pay the employee for overtime hours. According to the Labor Code, for the first 2 hours the rate per hour of work is multiplied by 1.5, for subsequent hours - by 2.

Example 3.

An urgent job arose that cannot be “postponed until tomorrow,” and the proofreader worked 11 hours instead of 8. Then he will be paid for 3 hours (using the average hourly wage rate in 2021 from Example 1):

121.82 (hours) × 2 (first 2 hours of processing) × 1.5 (increasing factor) + 121.82 (hours) × 1 (third hour of processing) × 2 (increasing factor) = 609 ,1 ruble.

IMPORTANT!

Teenagers under 18 years of age cannot be involved in overtime work, so we will not provide formulas for courier workers.

Salary and bonuses for a part-time employee

Part-time wages are cut in proportion to the time spent.

The illustrator’s price tag of 70,000 rubles and half the rate is reduced to 35,000 rubles.

Taxes for an employee are calculated based on their actual salary. Piecework pay will decrease because the employee has time to do less.

The remaining bonuses of working for hire remain the same as for full-time employment.

A person rests for 28 days every year, receives money twice a month, gets sick with compensation for earnings, goes on maternity leave for three years and can demand a heater in winter. In general, the length of service for a pension does not decrease.

A part-time employee is even entitled to a lunch break of at least 30 minutes. The Ministry of Labor recalled this in Letter No. 14-2/B-1012. Except for shifts shorter than 4 hours, you can go without lunch here.

Lead employees in Elba

The service will calculate taxes and prepare all necessary reporting for employees. And you don’t have to understand the legislation and fill out the forms yourself.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

I was hired full time plus 0.75 salary, how many hours should the working day be?

I was hired full time and plus 0.75 salary. How many hours should a working day be?

02 September 2021, 13:25, question No. 2094690 Vera, Chelyabinsk Collapse Online legal consultation Response on the site within 15 minutes Answers from lawyers (1) 350 answers 114 reviews Chat IDvokat, Chelyabinsk

Moscow Vera, hello. It is impossible to answer clearly how long your working day should last, since it depends, firstly, on who you work (there are categories of professions where the maximum length of the working week is less, for example, doctors), and secondly, on what kind of schedule you have (5- day, shift or floating), and thirdly, whether you belong to the category of persons for whom a shortened working week is established.

However, in any case, the question remains of how you were registered, taking into account part-time employment in general at 1.75. Since according to T.K. RF. You can register an employee for a maximum of 1.5 pay rates (1.0 main and 0.5 part-time).

Hiring a part-time employee

In order to indicate the number of rates in personnel documents and set up part-time work schedules, you must first select the “Part-time work is used” checkbox in the personnel records settings (section “Settings” - “Personnel records”).

In the Hiring document, we can set different rates for employees. For example, 1 (bet), 18 (eighth of the bet), 14 (quarter of the bet), 13 (third of the bet), 12 (half of the bet), 23 bets (two thirds of the bet), an arbitrary number of bets, and we can also indicate the bet in the form decimal fraction.

The ability to change an employee’s rate during work is available in the “Personnel Transfer” document (section “Personnel” - “Hiring, transfers, dismissals” or “All personnel documents”).

Please note that on the “Payment” tab of the “Hiring” or “Personnel Transfer” documents, the employee’s accruals are indicated in full in accordance with the staffing table. If the rate changes, the planned wage fund will be calculated automatically.

Enter the site

RSS Print

Category : Labor legislation Replies : 4

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Latest (1) »

| Andrey (guest) | |

| guys, please help a beginner. that there is a job, say, as a cleaner at 1.25 rates. For “one rate” - I understand it as work within the normal working hours (full or shortened), but what else is -0.25, combination? Please, don’t laugh and don’t get angry if everything is so stupid, it’s just that it turns out that in elementary questions it’s a dead end. Thanks to everyone who responded | |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Ciardi [email hidden] Belarus Wrote 23799 messages Write a private message Reputation: 3510 | #2[73468] April 8, 2009, 16:25 |

, specialty or position

compared to the main job

. In addition, internal part-time work must be performed outside the working hours under the main employment agreement, contract. Part-time work is formalized by a separate agreement (contract)

Combination of professions

is allowed only with the employer for whom the employee works under an employment agreement or contract. When combining professions and positions, the work is performed on the basis of one employment contract, a contract within normal working hours

with additional payment

th in the amount established by agreement of the parties to the employment contract. If an employee, along with his main work stipulated by the employment contract, performs an additional amount of work in the same profession or position, then we are talking about expanding the service area or increasing the volume of work performed. When combining, an additional agreement is drawn up to the existing agreement (contract). I would like to draw the moderator’s attention to this message because:

Notification is being sent...

| Andrey (guest) | #3[73470] April 8, 2009, 16:46 |

Notification is being sent...

| Ciardi [email hidden] Belarus Wrote 23799 messages Write a private message Reputation: 3510 | #4[73473] April 8, 2009, 5:34 pm |

Chiardi wrote:

If an employee, along with his main work stipulated by the employment contract, performs an additional amount of work

in the same profession or position, then we are talking about expanding the service area or increasing the volume of work performed.

this is a type of combination

I want to draw the moderator's attention to this message because:Notification is being sent...

| Mr. Dismantler [email hidden] Belarus, Minsk Wrote 17771 messages Write a private message Reputation: 2237 | #5[73512] April 8, 2009, 20:49 |

Notification is being sent...

EVERYTHING WILL BE FINE! AND VERY SOON! INCLUDING WITH US!« First ← Prev.1 Next → Latest (1) »

In order to reply to this topic, you must log in or register.

Part-time work and maintenance of child care benefits for up to 1.5 years

Let us also consider the special case of working part-time when an employee on maternity leave goes part-time.

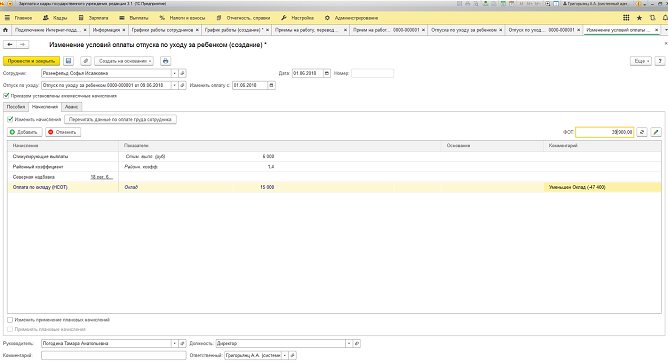

To register an employee’s exit from parental leave, you must enter the document “Changing the terms of payment for child care leave” (section “Human Resources” - “Child Care Leave” or section “Salary” - “Parental Leave”) .

In the document, on the “Accruals” tab, you need to check the “Change accruals” checkbox and indicate the list of accruals that are valid after the employee returns to work.

When on maternity leave, the employee goes to work on a part-time basis, so it is necessary to indicate the appropriate work schedule. A change in the schedule is registered in the document “Change in the work schedule by list” (section “Personnel” – “All personnel documents” – “Change in the work schedule by list”).

Calculation of salaries for the month is documented in the document “Accrual of salaries and contributions” (section “Salary” – “Accrual of salaries and contributions”). Also, on the “Benefits” tab, the employee will receive child care benefits for a child up to 1.5 years old for a whole month.