Temporarily absent and temporary employees: legislation

Orders and report cards are the main documents where information regarding citizens is recorded after hiring. Based on this information, remuneration for labor is then determined.

If an employee is absent from the enterprise, a note is added to the passport. It gives a detailed description of the grounds, but this does not amount to the right to dismiss. The State Statistics Committee of the Russian Federation issued Resolution No. 1, which describes the coding for various reasons for absence. From the necessary information, note the description of the maintenance of salary for the period, or its absence.

Temporarily absent are those who have been absent from work for some time for serious reasons. That is, current legislation is not violated.

At the stage of company creation, management develops staffing schedules. They tell you how many people are required to complete a particular task in a certain time. A one-time absence of a subordinate does not cause serious damage. It’s another matter when the time period of such an event is long. Therefore, laws allow the registration of another person for the same position.

Performing the duties of a temporarily absent employee

An equally interesting form of attracting an employee to additional work is the replacement of one or two employees for a certain time (for example, a vacation period). In this case, there may be an expansion of the service area, that is, an increase in the volume of work, which exceeds the norms fixed by the employment contract.

For example, during an employee’s vacation there is one cleaner, whose contract provides for a work volume of 50 sq. meters, can be involved in cleaning an additional 20 meters. To do this, an agreement is signed with the employee if he can combine the specified amount (volume) of work in his main time.

Thus, we can conclude that expanding the service area is one of the key forms of replacing workers during their temporary absence, that is, during vacation or sick leave. But at the same time, such a combination can occur only in one profession, but not in vacant positions.

In order to officially formalize such involvement of workers in additional work during the vacation of another employee, the written consent of the subject of the labor relationship should be obtained.

Only after this can you sign an agreement that will be completely legitimate and complement the employment contract. After this, an order on temporary performance of duties is published, which must contain both the period of additional work and the amount of remuneration. In addition, the head of the organization can establish an additional payment to the employee, the calculation of which will be carried out in accordance with the internal charter of the enterprise.

What people can perform duties?

Responsibilities for each individual employee are developed individually at the enterprise. But the option of creating identical vacancies is allowed. Thanks to this, people can replace each other. This involves creating new responsibilities or expanding the list of those that already exist.

Management is allowed to use the labor of third-party employees by concluding fixed-term employment agreements with them. This is true if the initial staff is not very large.

There is also the so-called internal part-time job. It is assumed that one of the internal employees of the enterprise will be involved. It’s just that the labor regime will differ from the standard schemes that were used previously. But you can perform duties under this scheme only in your free time from your main position.

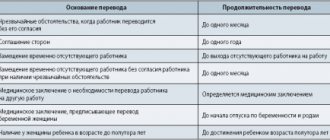

Reasons for introducing substitution

According to the Labor Code of the Russian Federation, all full-time employees have the right to equal pay and work, rest, and other additional guarantees. The following reasons are considered legal grounds for absence from work:

- Medical indications, or the need to obtain any special permits.

- Execution of government duties. An example is when they take part in military training.

- Advanced training, if management has previously issued a corresponding order.

- Training according to the schedule established by the institution.

- Illnesses, including pregnancy and childbirth.

- Business trip destination.

- Annual or administrative leave.

Additional payment for a temporarily absent employee: general provisions

Additional payment for temporarily absent employee

The right to an employee to receive additional payment for performing the work duties of another employee during the period of his absence is enshrined in Labor legislation. The surcharge is accrued if the following conditions are simultaneously met:

- one of the employees is temporarily absent from work due to vacation, illness, or other reasons, in connection with which his job duties are performed by another employee;

- an employee replacing a temporarily absent employee is not exempt from performing his own job duties as provided for in the job description.

Replacing a temporarily absent employee implies an expansion of the work responsibilities and area of responsibility of the replacement employee, without increasing the length of the working day (work shift).

What is the difference between VRIO and replacement?

Internal and external replacement are different procedures. The first case involves the involvement of one’s own employees, the second involves the use of external resources. Article 282 of the Labor Code of the Russian Federation confirms that deputies are persons who have a main workplace. But they are willing to take on additional responsibilities in their free time.

Excessive loads and overwork are prohibited according to legal requirements. Therefore, substitutes can work no more than 4 hours at a time. A complete replacement is permissible only if the monthly standard of hours is half and no more than the standard indicators.

A temporary replacement can only work within one shift, no more than 8 hours a day. But a deputy can work a full 12 hours when necessary. ACIOs more often remain internal employees. They have a main position with which they combine an additional one. For part-time workers, rehiring is relevant, even when it comes to internal transfers. They are listed in two places at the same time. Salary and vacation are processed in two places at once.

About additional payments and compensations, guarantees

The principle of mandatory remuneration for any amount of work performed is one of the main ones when building working relationships between the parties. But substitution and part-time work differ from the usual work patterns that are used in enterprises. Therefore, remuneration is organized differently.

Replacing an ACT involves special additional payments in accordance with current legislation. The parties agree on amounts in advance, based on the specified scope of work.

But most often, managers simply enter the condition for additional payments into all local regulations applicable to employees. So as not to waste time and effort on developing individual proposals. Typically, standards are used for certain positions. The time actually worked is taken into account.

Part-time work involves the organization of a separate position, so the order of remuneration will also be different. Part-time workers can count not only on annual leave, but also on other guarantees provided for different categories of employees. In the replacement mode, they only pay extra for duties performed during the specified time period.

Remuneration of an acting official

During the director's business trip, the head of the HR department was appointed to act as his head, who had a personal allowance for his main job. Payment for the combination for 2 weeks was paid from the director’s salary. As a result, in 2 weeks her salary was higher than that of the director. Will the tax authorities have any claims regarding the validity of attributing expenses to income tax?

According to Art. 129 Labor Code of the Russian Federation wages (employee remuneration)

- this is remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other

compensation payments) and incentive payments

(

additional payments and

incentive allowances, bonuses and other incentive payments).

Salary (official salary)

– this is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month, without taking into account compensation, incentives and social payments.

At the same time, the salary of each employee depends on his qualifications, complexity

the work performed, the quantity and quality of labor expended and is not limited to the maximum size (

Article 132 of the Labor Code of the Russian Federation

).

Wage

the employee

is established by an employment contract

in accordance with the current employer’s remuneration systems (

Article 135 of the Labor Code of the Russian Federation

).

Thus, the salary and bonus established by the employment contract for the head of the personnel department are recognized as legitimate.

Art. 60.2 Labor Code of the Russian Federation

It is established that with the written consent of the employee, he may be entrusted with performing, during the established duration of the working day (shift), along with the work specified in the employment contract, additional work in a different or the same profession (position) for additional pay.

To perform the duties of a temporarily absent employee without release from work

, determined by the employment contract,

the employee may be assigned additional work

in either another or the same profession (position).

Term

during which the employee will perform additional work,

its content and volume

are established by the employer

with the written consent of the employee

.

The employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule, notifying the other party in writing no later than three working days in advance.

In accordance with Art.

151 of the Labor Code of the Russian Federation , when performing the duties of a temporarily absent employee

without release from work determined by the employment contract,

the employee is paid additionally

.

The amount of additional payment is established by agreement of the parties to the employment contract

taking into account the content and (or) volume of additional work.

That is, in your case, additional payment is mandatory

.

Amount of surcharge

regulated only by agreement between the employer and

the maximum amount is not limited

.

For income tax purposes

in accordance with

Art.

255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances,

compensation accruals related to working hours or working conditions

, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

Labor costs include

, in particular, accruals of an incentive and (or) compensatory nature related to working hours and working conditions, including

bonuses

to tariff rates and salaries for night work, multi-shift work,

for combining professions

, expansion of service areas, for work in difficult, harmful, especially harmful working conditions, for overtime work and work on weekends and holidays, performed in accordance with the legislation of the Russian Federation.

Since in your case the additional payment for combination is established in accordance with the Labor Code of the Russian Federation, for profit tax purposes it is recognized as economically justified.

The Ministry of Finance of the Russian Federation, in letter dated October 29, 2009 No. 03-03-06/1/702, also reported that labor legislation does not limit the amount of additional payment for combining professions (positions)

, expanding service areas, increasing the volume of work

, or performing the duties of a temporarily absent employee without release from work

.

Therefore, according to the provisions of Art. 255 of the Tax Code of the Russian Federation, the taxpayer has the right to recognize as expenses

for wages,

additional payment for

combining professions (positions), expanding service areas, increasing the volume of work or

performing the duties of a temporarily absent employee

without release from work

in the amount determined by agreement of the parties to the employment contract

.

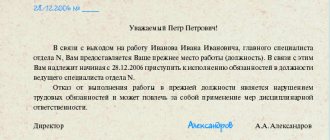

Recommendations for design

A mandatory requirement is the execution of an order for the organization. There is no unified form developed at the legislative level for the document. A situation is allowed when the personnel department prepares an order independently. Written information includes:

- position for which the employee is assigned responsibilities;

- FULL NAME;

- additional payment for fulfilling obligations in an unusual manner.

The need to issue separate orders arises in cases where absence from work is not related to the initiative of the manager. Or when other special types of design are not used.

The issue is usually resolved in orders and messages related to business trips or vacations. Both subordinates interested in resolving the issue are always familiarized with the resolutions. Then the information is placed in a personal file associated with a particular citizen.