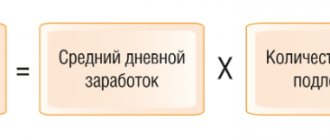

Calculation of average earnings

What formula is used to calculate SZ depends on whether the employee has fully worked the pay period. This is the 12 calendar months preceding the vacation.

Here is the formula for the case when the employee worked the entire pay period:

Average daily earnings = Earnings for the billing period / 12 / 29.3

Note: 29.3 is a constant indicator. This is the average monthly number of calendar days.

If the employee did not work fully during the billing period or there were deductible days (for example, sick leave, vacation, etc.), the formula is more complex:

Average daily earnings = Payments that are included in the calculation of SZ / (Average monthly number of calendar days × Number of fully worked months + Number of calendar days worked in partial months)

The last indicator, in turn, is considered as follows:

Number of calendar days worked in an incomplete month = Average monthly number of calendar days / Total number of calendar days in a given month × Number of calendar days in a given month attributable to hours worked

Example 1. The employee worked the entire billing period

The employee took leave for 28 calendar days. Earnings for the 12 months preceding the vacation amounted to 800,000 rubles.

Total average daily earnings are: 800,000 rubles / 12 months / 29.3 = 2275.31 rubles

Amount to be paid: 2275.31 * 28 = 63,708.68 rubles

Pay vacation pay at least 3 calendar days before the start of your vacation. For example, is Monday the first day of vacation? This means that on Thursday the day before, vacation pay should already fall into the employee’s wallet or card.

Example 2. The billing period has not been fully worked out

An employee's vacation is 14 calendar days from July 10 to July 23. Salary – 20,000 rubles.

The billing period is from July 1, 2021 to June 30, 2021.

In February, the employee took sick leave for 10 days (from February 3 to 12) and received a salary for this month of 11,578.95 rubles.

1. Let’s determine the payments that are included in the calculation of average earnings:

Total amount of payments, excluding February: 20,000 rubles * 11 months = 220,000 rubles

Payments from February: 220,000 rubles + 11,578.95 rubles = 231,578.95 rubles

2. Let’s calculate the number of days worked in February:

There are a total of 28 calendar days in February in 2021. 10 of them the employee was sick. This means that the days worked accounted for 18 calendar days (28-10).

For calculation purposes, 18,836 days were worked in February (29.3/28*18).

3. Let’s find the average daily earnings:

231,578.95 / (29.3 * 11 months + 18,836 days) = 678.85 rubles.

4. Calculate the amount of vacation pay:

678.85 * 14 = 9,503.9 rubles.

Compensation upon dismissal at will

- If the employee has worked for more than 6 months, but less than a year

Example 1. An employee worked for the company for exactly 7 months with a salary of 20,000 rubles/month. Then he found a new job and quit of his own free will. In 7 months, the employee earned 140,000 rubles. How to calculate monetary compensation for vacation?

First: we determine how many days of vacation the employee is entitled to:

2.33 days * 7 months. = 16.31 days

Second: we determine the amount of compensation. To do this, you must first calculate your average daily earnings:

We divide the total amount of salary received by the number of months worked and by the average monthly number of calendar days: 140,000 rubles. / 7 months / 29.3 days = 682.6 rubles.

Thus, we determine the amount of compensation :

682.6 rub. * 16.31 days = 11,133 rubles. 2 kopecks

- If the employee has worked for 11 months

Example 2. Let’s say that an employee worked under the same conditions not for 7 months, but for 11 months, after which he quit. How to calculate vacation compensation in this case?

11 months is actually a year worked, so in this case the employee is entitled to compensation for all 28 days:

682.6 rub. * 28 days = 19,112 rubles. 8 kopecks

- If the employee has worked for the company for less than six months

Despite the fact that the employee did not receive the right to paid leave, he nevertheless has the right to compensation (Article 122 of the Labor Code of the Russian Federation). In this case, compensation is paid, as in the previous examples, according to the proportional principle: average daily salary * number of unused vacation days . However, if the length of service in a given company does not exceed 15 days, no compensation is due.

Bonus in calculation of holiday pay

The employee received a bonus during the pay period. Should I take it into account when calculating vacation pay?

Yes, if this is a bonus for those months that fell within the billing period (Letter of the Ministry of Health and Social Development dated 03/05/08 No. 535-17).

Example 3. Accounting for bonuses when calculating vacation pay

The employee goes on annual paid leave for 28 calendar days. Earnings for the 12 months preceding the vacation amounted to 1,000,000 rubles. In addition, the employee received a monthly bonus of 5,000 rubles every month.

The employee’s income from the monthly bonus for the year amounted to 60,000 rubles. (5,000 rubles * 12 months).

Average daily earnings are: (1,000,000 rubles + 60,000 rubles) / 12 months / 29.3 = 3,014.79 rubles.

Amount to be paid: 3,014.79 * 28 = 84,414.12 rubles.

How to calculate compensation for unused vacation when the period worked is incomplete

Compensation for unused vacation is paid regardless of the reason for which the employee quit.

But if he quits without working for a full year, when calculating compensation for unused vacation, it must be taken into account that the employee will be paid in proportion to the time worked, if this time is less than 11 months.

An exception is if the employee quits due to:

- liquidation of an organization, reduction of personnel or staff, reorganization or temporary suspension of work;

- entry into active military service;

- revealed unsuitability for work.

Such employees are entitled to receive full compensation if they have worked for the company from 5.5 to 11 months.

Previously on the topic:

Formula for calculating the number of days of unused vacation upon dismissal

Compensation for unused vacation in proportion to time worked

How to calculate compensation for unused vacation in 2021?

Special calculation of vacation pay in working days

Before this, we counted vacation pay in calendar days. Employers accrue vacation in working days in two cases:

- seasonal workers,

- if a person works under an employment contract that is valid for up to two months.

Formulas:

Amount of vacation pay in working days = Average daily earnings × Number of working days of vacation

Average daily earnings = Actual accrued wages / Number of working days according to the calendar of a 6-day working week

Actually accrued wages are payment for the work that the employee received from the first day of work until the start of vacation.

Example 4. Calculation of vacation pay for a seasonal worker

The employee goes on vacation for 12 working days. The actual accrued wages amounted to 600,000 rubles. The number of working days according to the calendar of a 6-day working week for six months is 111 days.

Average daily earnings: 600,000 rubles / 111 days = 5,405.41 rubles

Vacation pay: 5,405.41 rubles * 12 days = 64,864.92 rubles.

The legislative framework

- Article 122 of the Labor Code of the Russian Federation implies the obligation of all employers to provide compulsory leave to each employee. In the amount of twenty-eight calendar days, with payment according to the average salary.

- Article 126 of the Labor Code of the Russian Federation provides for the fact that if the number of days exceeds 28 days, according to the application, compensation in the form of an increase in wages is possible. In accordance with the necessary calculations.

- As an exception, the following persons do not have the right to compensation: underage workers, pregnant women, workers with the status of “hard work”, “dangerous conditions”, “hazardous work”.

- Article 291 of the Labor Code . An employment contract concluded for a period of up to two months, the number of days of compulsory vacation is calculated based on the calculation of one full working month - one day of vacation.

- Art. 124 of the Labor Code of the Russian Federation prohibits not providing vacation to employees for two working years in a row.

Part-time work, payment of compensation for vacation

- Employees who work part-time are entitled to vacation in the same way as at their main job, 28 calendar days for a full working year.

- Art. 322 of the Labor Code of the Russian Federation, the duration of the vacation is determined by the summation of the main and additional vacations.

- Art. 286 Labor Code of the Russian Federation . Part-time workers are provided with their main place of work.

- The procedure for calculating average monthly earnings is the same as for the main place of work.

- Provided that the employee combines part-time work at his main place of work, calculations are carried out separately.

- Study leave is not granted.

When calculating vacation pay for a part-time employee, refer to the hours worked, since when working part-time, the working day should not be accustomed to four hours a day. All allowances and bonuses are taken into account. Payment is made on time, as in the main job.

Accordingly, deductions are possible subject to previously taken advance leave.

How many vacations can you receive compensation for?

In Russian labor legislation there is no such thing as transferring vacation; moreover, it is prohibited to postpone paid vacations for more than two years in a row.

This is possible only in individual cases, at the request of the employee. The exception again is workers in hazardous work, hard work and under 18 years of age, according to Art. 124 part 4, provision of annual leave to such employees is mandatory. But such employees are also accrued additional leave. An employee with this status can take his main vacation and receive compensation for additional vacation.

Example

An employee who works at an enterprise and has harmful work experience. Due to this, he is accrued basic vacation days and an additional 15 days for hazardous work. According to the previously drawn up vacation schedule for the current year for employees of the enterprise, he is entitled to vacation in the month of June, which is 43 calendar days (summing up the main + additional). The employee wishes to receive partial compensation. To do this, in June, he submits a written application to the manager for payment of compensation for the additional leave provided, and the provision of the main one, according to the schedule.

Such compensation will be accrued no less than 3 days before the start of the main one ( Article 136 of the Russian Labor Code ).

In practice, they manage to collect the number of vacations until the employee is fired, which is not economically profitable.

In cases where more than one vacation has already accumulated, the state inspectorate has every right to oblige the employer to provide all vacations in accordance with the drawn up instructions. If a large number of vacation days are accumulated, by agreement of the parties, a decision may be made to dismiss after all days of vacation have been granted.

There are types of leave that are not subject to compensation:

- Additional leave for Chernobyl victims.

- Types of social leave.