Financial assistance for the birth of a child from the trade union 2021

Also, a lawyer’s advice will be an indispensable assistant and guide to the legislative framework. What questions do you have for administrative law lawyers? Administrative law is a very important branch, which, in essence, deals with the legal relations between ordinary citizens and officials of various authorities. Previously in Russia this area included: tax law, customs, medical, environmental and educational. The main point is to help the population navigate the administrative web in order to protect individual rights. For example, in executive bodies, the prosecutor's office, courts and other government agencies, it is sometimes impossible to reach them without the participation of a lawyer.

Whether or not to pay this support is decided by the organization in which the woman in labor is employed. Types of assistance at the birth of a child Benefits differ according to the type of payments. Thus, there are one-time benefits; they are paid only once upon birth or child care. With experience in a university trade union organization from 2 to 5 years, the amount of financial assistance for recreation is 60%, and with experience from 5 to 8 years - 80% of the amounts indicated in the table.

Is it possible to take into account insurance premiums accrued for the employee’s financial assistance?

According to paragraph 23 of Article 270 of the Tax Code, expenses of an organization in the form of amounts of financial assistance to employees are not taken into account when determining the tax base for corporate income tax.

However, other expenses associated with production and sales include amounts of taxes, customs duties, fees and insurance contributions to extra-budgetary funds accrued in the manner established by the legislation of the Russian Federation, except for those listed in Article 270 of the Tax Code of the Russian Federation (subclause 1, clause 1, article 264 Tax Code of the Russian Federation).

Specifically, insurance premiums accrued for payments that are not recognized as expenses when taxing profits are not mentioned in Article 270 of the Tax Code of the Russian Federation.

Thus, expenses in the form of insurance premiums, calculated including from payments that do not reduce the tax base for corporate income tax, are taken into account as part of other expenses on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

When can you receive financial assistance from a trade union - the procedure for mat payments, a sample application

- A document indicating the existence of an employment agreement with the relevant organization;

- Membership card;

- Copy of the passport;

- Application for issuance in free form, drawn up by hand or in printed form, indicating the reasons for the application;

- Official papers confirming the reason for the application (birth, marriage, death certificates, medical certificates, conclusions, prescriptions for drugs, extracts from the medical history or outpatient card, acts of the Ministry of Emergency Situations on the fact of the origin of a natural disaster, documents from law enforcement agencies confirming the status of the victim of the act terrorism, theft, robbery, etc.).

- Availability of a membership card;

- At least 12 months have passed since joining the organization (for citizens who are retired and have a membership document, they must pay contributions for at least 15 years);

- Payment is possible no more than once in the reporting period (calendar year, with the exception of special circumstances, including the death of close relatives, robbery, etc.);

- Submission by the needy employee of a reasoned application accompanied by documents confirming the reasons for the application;

- Drawing up a petition by the chairman of the primary trade union organization to pay a member in need of financial support.

Documentation

To acquire the right to benefits, you need to prepare the following documents:

- Parents' passports.

- SNILS of mother and father.

- For non-working persons - work books.

- A certificate from the company of the working half that this benefit was not received.

- A certificate from the labor exchange for a non-working citizen stating that he is registered with them or not.

- Birth certificate of the baby or birth certificate.

- Application for payment of benefits.

Additional materials may be required in different regions and depending on circumstances. For example, if the baby’s father is drafted into the army, he will have to submit a document from the military unit where he is serving to social structures. By the way, an increased amount of benefits has been established for children of parents in military service.

If the parents are employed, they need to decide which of them will draw up materials for receiving benefits. After the determination, one of the parents will have to request a certificate from the company’s accounting department stating that he was not paid benefits.

( Video : “Financial assistance at the birth of a child”)

To do this, he will need to provide:

- Your passport.

- A certificate from the maternity hospital about the birth of the baby, or a birth document.

- Statement.

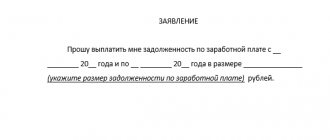

How to write an application for financial assistance

That is, even at the legislative level they understand how acute the need for workers is at such moments and that they need not only vacation, but also help allocated from the company’s own funds.

But no one can list all the expected expenses, which is why many employees write an application for assistance in advance, given that a wedding, for all its positive aspects, is a very expensive event.

We recommend reading: What payments are due for 3 children in 2021 in the Krasnodar region

Application for financial assistance in connection with treatment, surgery

An employer who values his employees, of his own free will or at their request, can help them financially if they need funds for treatment or surgery.

The law of the Russian Federation does not limit the amount of compensation for funds spent on treatment; the only limit is related to the amount not subject to taxes and contributions to social funds - the amount of such assistance should not exceed 4,000 rubles. per year for 1 person. In any case, the decision to authorize the payment, as well as the amount, is made by the employer.

Since this assistance is of an individual nature, it is not included in the employee compensation system. It is paid from the profit fund or unused funds for expenses.

An employee application is required to provide this assistance. In it, in addition to the usual details - “header”, title of the document, requests for financial assistance - you need to indicate the event due to which the employee urgently needs funds or compensation for expenses. There is no need to go into detail, describing the diagnosis and expenses; this information is provided in the documents attached to the application.

The decision to assign payment or refuse remains with the manager. If the decision is positive, an order is issued and funds are credited.

Sample application for financial assistance in connection with treatment or surgery

To the General Director of Fizkultprivet LLC, Alexander Rostislavovich Samodelkin, from the teacher of the chess section, Leonid Alekseevich Ferzenko

STATEMENT

In connection with the injury received as a result of a road traffic accident, I ask you to provide me with financial assistance for the expensive treatment ahead of me, including surgery.

I am attaching the following documents to the application:

- certificate from the traffic police about the accident;

- a copy of the sick leave certificate;

- a prescription issued by the attending physician;

- cash receipts for purchased medications;

- contract for paid surgical intervention;

- extract from the medical record.

06.25.2017 /Ferzenko/ L.A. Ferzenko

Financial assistance from the trade union

- on the basis of an application by a trade union member for financial assistance and a decision of the trade union body of the unit at the expense of the trade union budget within the limit established for this unit;

- on the basis of an application by a trade union member for financial assistance and a resolution of the presidium of the trade union committee at the expense of the trade union budget of the primary trade union organization.

Financial assistance is provided to a trade union member registered with a primary trade union organization “on the basis of a personal application, in the event of permanent disability, death or in connection with temporary disability of a trade union member and (or) member(s) of his family (children, including including stepsons and stepdaughters, aged from 5 to 18 years, parents of a trade union member from among non-working old-age or disability pensioners), caused by an accident at work or at home.

Application for financial assistance due to a difficult life situation

The employer has the right to provide financial support to employees in any ups and downs of life, although it is not obliged to do so. His good will should be reflected in the local documentation of the organization: the law allows you to determine the parameters of such assistance independently, the main thing is not to contradict the Labor and Tax Code of the Russian Federation. What employers and employees should remember in connection with financial support:

- payment of assistance cannot be permanent, this payment is one-time and individual in nature;

- exceeding the amount of 4000 rubles. per year leads to mandatory deduction of interest from it to social funds;

- the amount to be paid is determined solely by the employer and cannot be disputed.

The employer should be notified of life difficulties that require financial support to overcome in writing. The application is submitted to the head of the organization. It must explain the reason for the request for help, supporting it with documentary evidence. The employer can offer help to the employee himself, but it is still better to write a statement.

The amount is calculated depending on the expenses incurred to overcome difficulties (these, of course, need to be confirmed).

A difficult life situation is one in which, as a result of poverty, the life of an employee or his family may be disrupted. The law includes the following circumstances:

- the appearance of a dependent relative over 65 years of age or the employee reaching this age;

- difficulties in finding a job for an able-bodied family member (assigning him the status of unemployed);

- the presence of small (minor) children or one child in the family;

- disability of one of the family members.

Some employers do not allow difficulties to be described in the application, limiting the applicant to the vague wording “due to difficult financial situation.”

Sample application for financial assistance due to a difficult life situation

To the General Director of Kolovrat LLC, Anton Leonidovich Evstigneev, from the caretaker Liliya Nikolaevna Rusinskaya

STATEMENT

I ask you to provide my family with the financial assistance necessary to prepare my three children for the start of the school year.

I am attaching to the application:

- certificate of family composition;

- certificate of a mother of many children;

- cash receipts for stationery and school uniforms.

08/18/2016 /Rusinskaya/ L.N. Rusinskaya

Help from the trade union at the birth of a child

The user of the Woman.ru website guarantees that the placement of materials submitted by him does not violate the rights of third parties (including, but not limited to copyrights), and does not damage their honor and dignity. The user of the Woman.ru site, by sending materials, is thereby interested in their publication on the site and expresses his consent to their further use by the editors of the Woman.ru site. All materials on the Woman.ru website, regardless of the form and date of publication on the site, can only be used with the consent of the site editors. How much do parents now pay for the birth of a child? Changes to the procedure for assigning and paying state aid to families with children have come into force in Ukraine. They touched upon the procedure for issuing benefits for child care until the child reaches the age of three, the press service of the Regional State Administration reports.

Whether or not to pay this support is decided by the organization in which the woman in labor is employed. Types of assistance at the birth of a child Benefits differ according to the type of payments. Thus, there are one-time benefits; they are paid only once upon birth or child care.

When and to whom is financial assistance provided from the trade union?

Current legislation does not clarify the concept of financial assistance from a trade union . However, such payments can be established if the organization has a trade union, which approves the corresponding regulations.

IMPORTANT! In practice, many provisions on providing financial assistance to members of trade union organizations contain the condition that financial assistance can be transferred to employees who are members of this organization and pay membership fees for a period of at least 6 months. This is necessary to prevent abuse by workers who have not paid contributions or have not worked in the organization for long.

How to write an application for financial assistance from an employer

The structure of an application for financial support is no different from a similar document drawn up in other situations.

To complete it, you need to take a sheet of paper, A4 size, and place the “header” of the form in the upper right corner, which displays the following information:

- Position and full name the head of the company (in the dative case).

- Position, division and full name. the petitioner (in the genitive case).

- Then, in the middle of the page, the name of the form is written: - “Application”.

- Next, in the text part, you need to display a request describing the situation, displaying the basis for payment and attaching copies of materials certifying the birth of the baby. If the payment is due in accordance with the Regulations on material support adopted in the collective agreement or in the employment agreement, then it is necessary to refer to it and display the amount of support assigned in the above acts.

- At the end of the form is the signature of the applicant and the date of filing.

On the received application, the boss stamps a visa and passes the form to the personnel officers to prepare the order.

Sample application for financial assistance from an employer

Order for payment of financial assistance

When forming an order for the accrual of one-time financial support, the boss is required to refer to the existing legislation of the Russian Federation and internal regulations.

An order for the provision of financial support to a colleague does not belong to a unified form and therefore is filled out in a free style. At the same time, its structure must be respected, according to similar official documents. The text of the order can be divided into the following sections:

- "Head" of the order:

- The name and details of the company are recorded here.

- FULL NAME. boss

- Date and place of registration

- Number in order.

- Next, in the middle of the line, fill in the word “Order”.

- Then the descriptive part of the order states:

- The reason for issuing financial benefits with reference to the applicant’s appeal, attached documents, legislation of the Russian Federation and internal regulations.

- Required amount and date of issue of funds.

- Information about the working person to whom the benefit is allocated.

- Payment method: cash or non-cash transfer to a bank card.

- In the next paragraph, an employee is appointed who is responsible for carrying out the entire procedure.

- At the end of the drawn up order, the boss puts his signature.

- Below is the signature of the employee responsible for executing the order.

Note: The order can be issued on company letterhead. You can create an order either manually or using printing technology. A list of documents from the petitioner must be attached to the order.

Primary trade union organization

2 REGULATIONS On the conditions and procedure for providing financial assistance to trade union members in the Territorial Trade Union Organization of Employees of Institutions of the City Education System 1. General provisions 1.1. These Regulations determine the conditions and procedure for providing financial assistance to trade union members registered with the Territorial and primary organizations of the All-Russian Trade Union of Education. A trade union member is a member of the labor collective, registered with the primary trade union organization, attending meetings of the primary trade union organization, actively participating in its work and paying trade union dues on time Material assistance to trade union members is provided from the funds of the organization's trade union budget (trade union dues) The decision to provide financial assistance to trade union members is made by the governing body of the trade union organization Material assistance is usually provided once a year on one of the grounds in the form of a cash payment In exceptional cases, it is allowed to provide financial assistance to trade union members repeatedly. The amount of financial assistance depends on the applicant’s trade union experience and on the financial capabilities of the trade union organization. Financial assistance to a trade union member is individual in nature and cannot be used for another purpose. All amendments to this Regulation are made by decision of the Territorial Committee trade union organization. 2. Directions for providing financial assistance Financial assistance is provided to members of the trade union: - for partial compensation of the costs of expensive treatment; — for the purchase of expensive medicines and medical equipment; — for dental treatment and prosthetics; — for paid inpatient treatment; — to perform surgical operations for vital indications; — in connection with a natural disaster (fire, flooding); — in connection with the theft of personal property (with supporting documents);

We recommend reading: Number of foreign citizens in Russia 2021

1 MOSCOW CITY ORGANIZATION OF THE TRADE UNION OF WORKERS OF PUBLIC EDUCATION AND SCIENCE OF THE RUSSIAN FEDERATION TERRITORIAL TRADE UNION ORGANIZATION OF WORKERS OF INSTITUTIONS OF THE CITY EDUCATION SYSTEM Primary trade union organization of GBPOU PT 47 named after V.G. Fedorov “APPROVED” at a meeting of the trade union committee, minutes 15 “19” June 2021 Chairman of the PPO Dragun T.B. REGULATIONS on the provision of financial assistance to trade union members registered with the Primary Trade Union Organization. GBPOU PT 47 named after V.G. Fedorov MOSCOW 2021

Insurance premiums with financial assistance

Financial assistance can be different.

If financial assistance is part of the wage system, it must be subject to insurance contributions.

For example, employees may be paid financial assistance for vacation. As the judges note, such financial assistance is stimulating and depends on length of service. This payment is part of the remuneration system. It must be subject to insurance premiums.

Financial assistance is not subject to contributions (Article 422 of the Tax Code of the Russian Federation):

- citizens in connection with a natural disaster or other emergency in order to compensate for material damage caused to them or harm to their health, as well as people affected by terrorist acts on the territory of the Russian Federation;

- an employee in connection with the death of a member (members) of his family - spouses, parents, children, adoptive parents and adopted children (Article 2 of the Family Code);

- for an employee at the birth (adoption) of a child - during the first year after birth (adoption), but not more than 50,000 rubles for each child;

- an employee not more than 4,000 rubles per employee per billing period.

Financial assistance provided to employees in connection with other circumstances is subject to insurance contributions in accordance with the general procedure.

Financial assistance from the trade union - payment procedure

The law does not establish the possibility of paying financial assistance to trade union members. At the same time, the legislation does not establish a ban, so these amounts can be paid to members of a trade union organization both from the employer and from the trade union.

By virtue of Art. 2 Federal Law “On trade unions, their rights and guarantees of activity” dated January 12, 1996 No. 10-FZ, a trade union is an association of citizens bound by common professional interests, created to protect such interests. Trade unions can operate in various forms, in particular, within one organization, within a region, or an entire country (union of trade unions).

Material aid

The provision of one-time financial assistance is carried out on an individual basis based on the student’s personal application and the provision of relevant documents, formalized by order of the university rector upon the proposal of the elected body of the primary trade union organization of students (students’ trade union committee). From the scholarship fund, benefits are paid to students who register with a medical institution in the early stages of pregnancy, as well as maternity benefits. Students with children are provided with New Year's gifts from the funds of the university and the primary trade union organization of students. One-time financial assistance from the funds of the primary trade union organization of students can be paid to student members of the trade union who belong to socially vulnerable categories and have a difficult financial situation.

We recommend reading: How to record a birth certificate in public services

Bryansk State University named after academician I.G. Petrovsky, in accordance with the Federal Law of December 29, 2021 No. 273-FZ “On Education in the Russian Federation,” provides students with various types of social support.

How is the benefit amount calculated for different categories of mothers?

The same state regulation for calculating funds assumes calculations in three categories:

- For women in labor who were employed before pregnancy and had an official relationship with the employer on the basis of an official employment contract;

- Women in labor who were not employed and were not registered with the employment service;

- Women in labor who did not have an official place of work and were not registered with the Central Health Commission.

Women of each of these categories must provide documents to calculate the amount of payment. And the availability of relevant certificates and statements directly affects the amount of benefits received. If you want to get detailed information about who is entitled to a lump sum benefit upon the birth of a child, then here you go.

So, if the applicant for the social security payment was employed when calculating the lump sum benefit, then she will receive a larger amount. Slightly less will be provided to those who were registered and looking for work. For others, a minimum benefit amount is provided.

Typically, for the latter category of expectant mothers, calculations of one-time support are not carried out. For those who have the prospect of receiving a larger amount, the amount is calculated in accordance with income and length of service, as well as taking into account the course of the pregnancy period.

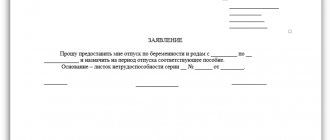

How to fill out a maternity aid mat for a trade union

06/20/2021 /Rostovsky/ A.P. Rostovsky Application for financial assistance for vacation Financial assistance paid in connection with vacation can be called differently in local regulations: vacation pay, allowance, vacation bonus, “health benefits” and etc. The trade union organization provides material assistance on various grounds for the purpose of financial support for members of the organization (on personal applications). The content of the article:

A big and joyful event for every woman and family is the birth of a child. According to the law, a woman has the right to go on maternity leave when her pregnancy reaches 30 weeks. Then she is on legal maternity leave, which involves a period of up to three years. The state provides a number of benefits before and after the birth of a child.

What assistance can an employer provide at the birth of a child?

The organization has the right to pay the employee 50 thousand rubles at a time as financial assistance in connection with the birth of a child.

According to the general rule established by paragraph 7 of clause 8 of Article 217 of the Tax Code, this assistance is not subject to personal income tax if it is paid:

- during the first year of the child’s life;

- in an amount not exceeding 50 thousand rubles for each child.

If these conditions are met, a payment of 50 thousand rubles in connection with the birth of a child is not subject to insurance premiums (letter of the Ministry of Finance of Russia dated 07/08/2019 N 03-04-06/50324).

At the same time, each of the parents will be able to claim a payment in the specified amount, even regardless of the fact that they work in the same company. The non-taxable limit for them in this case will be 100 thousand rubles (letters of the Ministry of Finance dated 07/08/2019 No. 03-04-06/50324, dated 03/21/2018 No. 03-04-06/17568).

Previously on the topic:

Financial assistance to an employee can be different: consequences for contributions

One-time assistance to family members of a former employee is not subject to personal income tax

Exemption of material assistance from personal income tax and insurance premiums: there are similarities

Help from the trade union at the birth of a child

V1. Final provisions 6.1. This Regulation is valid for all members of the trade union of employees of educational institutions of the city of Zheleznodorozhny from the moment of approval until the adoption of a new one. 6.2. Control over the implementation of the Regulations belongs to the Audit Commission of the Trade Union Council. A report on the use of financial assistance funds is carried out once a year at a meeting of the chairmen of primary trade union organizations (Council). 6.3.

When determining the amount of financial assistance, the following are taken into account: family composition, presence of dependents, wages, health status, work experience, trade union experience, etc., which must be indicated in an extract from the minutes of the meeting of the trade union committee of the educational institution. 4.4. Financial assistance is issued personally to a member of the Trade Union or the chairman of the trade union committee if there is a personal application from the employee and passport data. 4.5. For the funeral of an employee, a trade union member, financial assistance is given to the chairman of the trade union committee of the primary organization. 4.6.

Sample application for financial assistance to the trade union organization of the cultural department

All these situations should be spelled out in the charter of your union or in an appendix to the charter and apply uniformly to all union members. But each situation must be confirmed by documents for accounting purposes of the expenditure of trade union funds. For funerals of close relatives - a death certificate.

What employers and employees should remember in connection with financial support: Requirements for the content and execution of the application Depending on the source of funding, the application can be completed:

Application for financial assistance in connection with the death of a relative

The grief that comes to a family not only has an emotional impact on all relatives, but also, as a rule, makes a significant hole in the budget. The employer, taking care of the staff, can help the bereaved employee a little financially. In this case, the funds are paid from the organization’s profit fund; these expenses have tax benefits.

To do this, the organization’s local regulations must stipulate this possibility and its regulations. For this purpose, a special Regulation may be created or the relevant information should be contained in the employment contract or collective agreement. Usually, not only the employee who has lost a loved one has the right to such a payment, but also, conversely, his relatives if the employee himself has died.

The first document required for the accrual of this type of financial assistance is the employee’s request, drawn up in the form of an application. In addition to the request for one-time financial support, the text must indicate:

- Full name of the manager (general director);

- all employee data (position and full name);

- degree of relationship with the deceased (close relatives in connection with whose death financial assistance is provided are brothers and sisters, children or parents of the employee);

- you can indicate the amount that the employer is asking for (it cannot be more than two months’ salary);

- a list of documents confirming relationship and death attached to the application;

- date, painting with transcript.

ATTENTION! It does not matter whether the amount of assistance is indicated in the application; in any case, the manager enters it into the Order, on the basis of which it will be calculated.

Sample application for financial assistance in connection with the death of a relative

To the General Director of Zarathustra LLC, Nikipelov Roman Olegovich, from the manager of the supply department, Anatoly Petrovich Rostovsky

STATEMENT

I ask you to provide me with financial assistance in connection with the death of a close relative - Rostovsky’s brother Mikhail Petrovich.

I am attaching to the application:

- certificate of family composition;

- death certificate of Rostovsky M.P.

06.20.2017 /Rostovsky/ A.P. Rostovsky

When and to whom is financial assistance provided from the trade union? legal advice

From the above rules it follows that if there is financial opportunity, the institution has the right to prescribe in a local regulatory act the payment of financial assistance for one reason or another and issue it to employees.

In this regard, we can conclude that the issue of the procedure for payments in relation to the head of the trade union body is resolved either by the adoption by the trade union of the relevant Regulations, or on the basis of the charter of the trade union, or by enshrining the relevant provisions in the collective agreement of the employing organization.

How can financial assistance be paid to the chairman of the trade union committee?

It is important to note that the chairman of the trade union committee can be released from his main job through dismissal on the grounds provided for in paragraph 5 of Part 1 of Art. 77 Labor Code of the Russian Federation. If the trade union has legal status. person, he becomes the employer for the chairman of the trade union committee, and if he does not have it, the higher trade union body, which is a legal entity, can become the employer. face.

At the legislative level, the procedure for paying financial assistance to the chairman of the trade union committee is not established. Payment for the labor of the trade union committee is carried out either from the funds collected from membership dues or from the funds of the employer. In this regard, we can conclude that the issue of the procedure for payments in relation to the head of the trade union body is resolved either by the adoption by the trade union of the relevant Regulations, or on the basis of the charter of the trade union, or by enshrining the relevant provisions in the collective agreement of the employing organization.

***

Thus, the specific procedure for paying financial assistance from the trade union is determined by the internal documents adopted by it - either the charter or regulations. These acts may reflect the procedure, amount, terms of payments and other issues related to their implementation.