Dismissal of a disabled person at his own request is carried out in accordance with the general procedure and on the grounds provided for by labor legislation for all citizens. The exception is situations where loss of health and disability occurred during work.

Disability, by legal definition, is a persistent impairment of body functions that limits a person’s ability to live and self-care.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

Disability groups

Depending on the degree of health impairment and limited ability to self-care, 3 disability groups are distinguished:

- 1 gr. – the degree of impairment of body functions ranges from 90%, that is, when a person almost completely loses one of the life abilities or several at once, and becomes dependent on other persons, for example, the ability to move.

- 2 gr. - the degree of limitation of categories of life activity is on average 75%, when a person partially loses the ability to self-care, requiring periodic outside assistance.

- 3 gr. – the degree of loss of ability to live is about 50%, that is, the person retains the ability to perform categories of life activity not fully, with some restrictions, for example, you can work in normal conditions, but not in hard work.

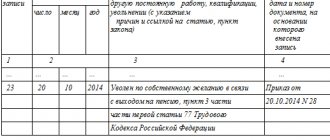

Disability groups can be assigned for a certain period or indefinitely. The document confirming this fact is the ITU conclusion. From the given characteristics of disability groups, it is obvious that all three imply the opportunity for a disabled person to be employed subject to certain conditions. However, only the third is considered working, with almost no restrictions on work activity. For disabled people of the first and second groups, special working conditions are required, so they generally work rarely or remotely. But in some enterprises the law obliges to establish a quota of jobs for persons with disabilities. Any employee has the right to resign at his own request. This right is guaranteed by the basic law of the country, regardless of the specifics. Dismissal of a group 3 disabled person at his own request occurs in the standard manner.

» alt=”Features of the procedure for dismissing a disabled person at his own request”>

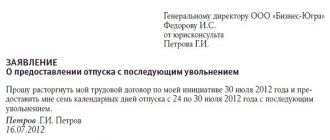

To terminate an employment relationship, persons with disabilities of groups 1, 2, 3 should write a statement to the manager, in which they state their voluntary desire to leave. This must be done no later than two weeks before the day of dismissal. The employer is obliged to accept the application.

Important!

If, for health reasons, a disabled person cannot continue to perform labor functions, he has the right to resign without working on the date specified in the application. The same rule applies when dismissing a disabled pensioner, but the basis in this case will not be one’s own initiative, but retirement. If circumstances arise that cause the employee to wish to terminate the employment contract, he may not work for a two-week period, but resign on the date that will be written in his application. In the same way, an employee is exempt from working out if the boss violated the terms of the contract or labor law, or an agreement was reached with him on leaving without working out. Dismissal of a disabled person of the first group at his own request, according to judicial practice, can be made without warning to management on the day of filing the application. The law also does not prohibit dismissing a disabled person at his own request during a period of rest or incapacity for work. However, when a disabled person of group 3 is dismissed at his own request, the rules apply for increasing the period of service depending on the specifics of the work (for managers, teachers and others)

Types of disability

Russian legislation provides for three groups of disabilities, each of which has its own specifics and characteristics. Legal regulation is enshrined in the norms of the law “On Social Protection of Disabled Persons in the Russian Federation”. Disability groups:

- First group. It is assigned if a person is no longer able to move independently, perform any actions, cannot control his behavior, or has completely lost orientation in space.

- Second group. It is prescribed if it is difficult for a person to do something without outside help or special means at hand. It is assumed that a disabled person of the second group is able to live actively only with someone's help.

- The third group is assigned when a disabled person can live an active life only with the use of special means. He can move and do some work himself, but in limited or specially created conditions.

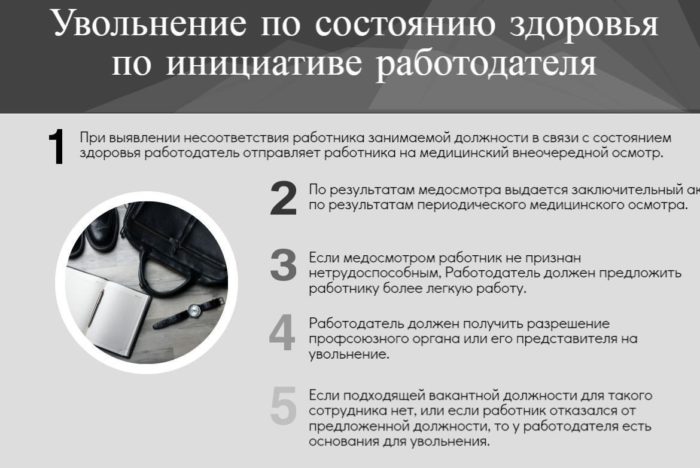

An employer can dismiss disabled people of groups 1 or 2 under this article. For a disabled person of group 3, they can offer easier working conditions if this is provided for in the individual rehabilitation program.

Calculation upon dismissal of a disabled person

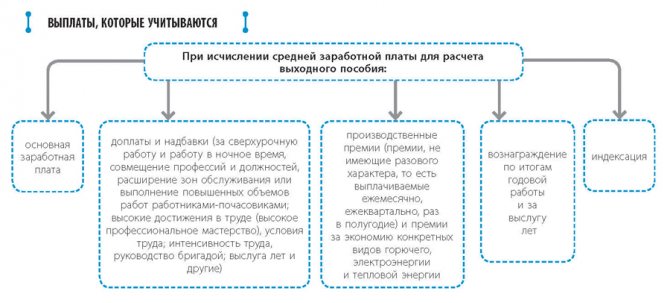

- The amount of wages for days worked. For disabled people of groups 1 and 2, a reduced working week and full pay are provided.

- Compensation for vacations not taken. It should be remembered that for disabled people the duration of vacation is not 28, but 30 calendar days.

- Payments for sick leave (until disability is assigned)

When a disabled person is dismissed at his own request, the employer is not obliged to pay him severance pay.

Very often, the reason that serves as the reason for the dismissal of a disabled person at his own request is precisely the impairment of health. A person left without work and being disabled finds himself in a difficult situation. Therefore, the state provides social guarantees for this category of people. The function of adapting disabled people is assigned to the employment center. Registration with this department will allow a disabled person to obtain a new qualification taking into account his status and find a suitable job. An employer does not have the right to refuse employment to such a person because of a disability. A disabled person is hired without a test, and (in the presence of groups 1 and 2) is given a reduced working time regime while maintaining full pay. Involvement in overtime and night work is necessary only with the consent of the disabled person, and with a rehabilitation program (if available). When reducing numbers, persons with disabilities are given priority when deciding on reductions. Dismissal of disabled people at the initiative of the employer is possible only in cases strictly specified by law. The state has also established the payment of benefits in connection with disability, benefits for the purchase of medicines, payment of transport, receipt of sanatorium vouchers, and tax exemptions.

» alt=”Features of the procedure for dismissing a disabled person at his own request”>

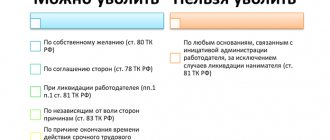

Dismissal at the initiative of the employer

If an employee receives a Group 2 disability, his dismissal is legal only in compliance with the Code, if the initiator of this action is the production administration. It is possible to terminate the employment relationship with a disabled person and dismiss him in the following cases:

- if the enterprise does not have a job for a disabled person recommended by an expert commission;

- upon liquidation of an enterprise;

- if the employee refuses to switch to another type of activity or less comfortable working conditions with a reduction in wages;

- when the employee’s qualifications are downgraded and he is unable to perform his professional duties;

- when establishing 2 non-working disability groups.

An employer, dismissing an employee on his own initiative, is guided by Articles 81, 73, 77, paragraph 8, part 1, 83, paragraph 5.

Why does an employee with a disability resign voluntarily?

To answer this question you need to separate two situations:

- A resignation letter was submitted by an employee who had long been assigned a disability. Despite his limited capabilities, he continued his work, and then decided to interrupt it. The reasons for dismissal of an employee with a disability could be health problems. He needs time to heal.

- A resignation letter was submitted by an employee who had just been assigned a disability. His physical condition does not allow him to perform his previous duties. First of all, this applies to people who, as a result of injury or illness, are assigned a disability of group 1 or 2.

Order of dismissal

An order for the dismissal of a disabled person is drawn up by the head of the enterprise using the standard T-8 form and contains the following mandatory points:

- Name of the organization;

- personal data of the employee and his position;

- codes;

- reasons for dismissal, medical report of the IEC;

- end date of employment;

- date of order, signatures with transcripts.

Based on a voluntary application submitted in his name by an employee or a notice of dismissal at the initiative of the employer signed by a disabled person, an order is printed. The fact of familiarization with the order must be recorded with the signature of the dismissed employee.

How to retain a valuable employee with a disability?

Getting disabled is a great psychological trauma for any person. He ceases to feel like a full-fledged member of society. Often the reason for leaving work is the employee’s poor physical condition and strong emotional distress. However, the employer, if desired, can retain the employee the company needs. But a lot depends on the assigned group.

- Disability group 1 is considered non-working. It is assigned to a person when the ability to move independently, communicate, or care for oneself is impaired. An employee with such serious problems can be asked not to quit, but to perform feasible duties at home (if remote work is possible).

- An employee with a Group 2 disability can work remotely or in the office at a specially equipped workplace. His work week is set at 35 hours. Providing special accommodations for disabled people can benefit the company. Participation in social programs for the rehabilitation of people with disabilities improves the company’s image and attracts media attention to it.

- The third disability group is considered working. The person does not have serious deviations in the functioning of the body. Dismissal of a group 3 disabled person at his own request occurs due to poor physical or moral condition. An employer can offer a valuable employee leave for treatment, a discounted trip to a sanatorium, or a course of psychotherapy. In order for an employee to be less tired at work and feel better, he should be given easier working conditions or given part-time work.

The caring attitude of superiors and the participation of colleagues will help a person with a disability overcome depression and return to their previous performance. Such attention is especially appropriate for an employee who has worked in the organization for a long time. This will increase the prestige of the company and administration in the eyes of other employees.

When and in what cases can a disabled person be fired?

An employee recognized as disabled for medical reasons is assigned a disability group, which determines his ability to work:

- 1 - the patient is completely disabled;

- 2 - limited ability to work is acceptable, but often the patient is recognized as incapacitated;

- 3 – patients are able to work.

Dismissal of a disabled person of group 2 for health reasons is possible in the following cases:

- dissolution of the company;

- reduction of the position in which a disabled person works and the impossibility of transferring him to light work that meets the medical recommendations of the expert commission;

- violation of discipline;

- Group 2 was considered non-working;

- at your own request;

- by agreement of the parties.

The provision of the Labor Code presupposes the interruption of industrial relations between a disabled person from a non-working group and the administration of the enterprise without his consent.

Important! Disability group 2 involves long-term restoration of health with the help of special means or one’s own relatives. Determining disability group 2 for an employee does not give the employer the right to dismiss him.

What rules must be followed

Each employee has the opportunity to terminate the employment contract on his own initiative. This right is established in Art. 80 Labor Code of the Russian Federation. The procedure for dismissal at will is also spelled out there. There are no special rules for terminating a contract with an employee who has a disability. Follow the general instructions.

- The employee is required to submit an application stating his intention to resign. He must do this two weeks before the desired date of termination of work. If we are talking about the head of an organization, a professional athlete or coach, then he writes a month’s notice. And employees on a probationary period, seasonal and temporary workers (employment contract for a period of no more than two months) submit an application three days before the desired date of dismissal.

- The time from the moment of filing an application until the termination of work is usually called working off. At the initiative of the employer, it can be reduced. An employee may ask for a reduction in the working period or for dismissal directly on the day of filing the application. According to the Labor Code of the Russian Federation, this desire must be taken into account by the employer if the employee has valid reasons. For a person with a disability, such a serious reason, first of all, can be poor health. If necessary, he must document this. For the same reason, an employee with a disability can spend two weeks working on a ballot or on vacation at his own expense.

- The employer has no right to detain an employee for more than 14 days, even when the employee has not yet completed all his work. If, after the specified period, the employee does not want to quit, then his employment contract can be extended. However, the employer has the right not to do this when he has already selected another employee for the position.

- On the day of dismissal, the employee is paid all remaining wages, as well as compensation for unused days of mandatory paid leave.

- The employee is returned a work book with a record of the time worked in the organization, given a certificate of income for two years and a document on social benefits.

There are situations when an employee who has received a disability does not want to leave work. However, due to his physical condition, he is unable to perform his previous duties. In this case, his dismissal may occur at the initiative of the employer. But first, the disabled employee should be offered another position, the responsibilities of which he is able to cope with. If there are no such vacancies in the company or they are all occupied at the moment, then the employee is given written notice of this.

Entitled payments

The accounting department issues a calculation note (form T-61 or an individually established form), in which all payments due upon dismissal are entered and calculated.

According to the general rule (Article 140 of the Labor Code of the Russian Federation), the balance of wages and compensation for unused vacation days are paid at the exit.

Dismissal due to reduction or in connection with liquidation is accompanied by the payment of severance pay within 2 months (Article 180 of the Labor Code of the Russian Federation).

Upon dismissal by agreement of the parties, this payment can also be established.

In accordance with Part 2 of Art. 180 severance pay can be paid (2 weeks in advance) in connection with the refusal of a disabled person to move to another position that is more suitable for his state of health.

Additional payments and their increased amount may be established by local acts of the organization.

In addition to these payments, the pension fund recalculates the disability pension. The new amount will begin to accrue 3 months from the date of leaving work.

Dismissal of pensioners and disabled people at their own request

Should a disabled Chernobyl survivor and a pensioner have to work off their voluntary dismissal?

Look at Article 10 of the Federal Law on the legal status of foreign citizens in the Russian Federation (Federal Law dated 12/29/2015 388-FZ). 2. The return of a driver’s license is carried out in the following order: if a citizen and (or) members of his family have several residential premises occupied under social tenancy agreements and (or) owned by them by right of ownership, the level of provision with the total area of the residential premises is determined based on the total total area of all specified residential premises. Good luck to you. Lawyer Zotov V. I. Petrozavodsk

Contact the court immediately. The limitation period is 3 months from the date of dismissal (Article 392 of the Labor Code of the Russian Federation). In court, demand the collection of arrears of wages and compensation for delayed payment.

You can demand in court the amount of alimony determined under the terms of the loan agreement. In this case, the debtor has the right to file a claim for the recovery of alimony in court (Article 39 of the RF IC). According to paragraph 1 of Art. 333 of the Civil Code of the Russian Federation, the court has the right to deviate from the beginning of equality of shares of spouses in their common property based on the interests of minor children and (or) based on the noteworthy interests of one of the spouses, in particular, in cases where the other spouse did not receive income for unjustifiable reasons or spent common property of the spouses to the detriment of the interests of the family. (Article 33-39 of the RF IC). To divide property through the court, you need to draw up a statement of claim, submit it to the court in accordance with the rules of jurisdiction, attach all supporting documents, and then go to court hearings. This can be done with the help of a lawyer who will represent your interests; the likelihood of a successful resolution of the issue will be greater in this case. Detailed consultation, drafting documents, conducting a case in court - for a fee T 9152171802 My fate. practice. The site's lawyers do not call you first!

The whole point is that upon receiving the payment, you must submit a claim for deduction to the ITU bureau, and officially from the month in which you received the inheritance. Not quite clear. You will have to receive the apartment as an inheritance. The buyer must obtain a cadastral passport for housing, etc. and receive confirmation that you will prove that the power of attorney for registration of ownership (a car under a gift agreement) does not belong to the previous owner (Article 210 of the Civil Code of the Russian Federation). The deed of gift for the apartment is the heir by law. Sincerely, Kharchenko O V.

“Work off” is not in the Labor Code of the Russian Federation, but it is established by law that your obligation to notify the employer 14 days before the date of dismissal, and it doesn’t matter if you are a disabled person and (or) a Chernobyl survivor or a pensioner. For residents of Nizhny Novgorod and the Nizhny Novgorod region, it is possible to travel to the client to receive an individual paid consultation.

Hello. No, he must not give notice of dismissal if he is resigning due to retirement. Article 80 of the Labor Code of the Russian Federation, Sincerely, Matveeva K.B.

Hello! They are required to notify the employer of dismissal 2 weeks in advance “There are no hopeless situations at all, or rather, they are only a consequence of the human tendency to consider every difficult situation hopeless.”

Yes. You are required to notify your employer of your dismissal 2 weeks in advance. Without working off only by agreement with the employer. Art. 80 Labor Code of the Russian Federation. An employee has the right to terminate an employment contract by notifying the employer in writing no later than two weeks in advance, unless a different period is established by this Code or other federal law. The specified period begins the next day after the employer receives the employee’s resignation letter. By agreement between the employee and the employer, the employment contract can be terminated even before the expiration of the notice period for dismissal.

Reasons and procedure

Any procedure for reducing working personnel with disabilities must occur in strict accordance with the regulations governing this issue. The person responsible for retrenchment must first review the employee's documentation of disability. There are special bodies that establish the fact and degree of disability . These include:

- Clinical and diagnostic organizations. You can find them in almost any medical institution. The commission is represented by doctors who give substantiated conclusions about the patient’s health condition and the need to transfer him to simplified working conditions. Based on the results of the survey, the commission issues an official conclusion, which is certified by all its members and sealed with the seal of the institution.

- A medical and social expert commission determines whether there are grounds to assign a disability and whether it is actually caused by the performance of work functions. Doctors determine the circumstances under which the ability to work was lost and to what extent. MSEC also issues rehabilitation cards, which detail the working conditions acceptable for a disabled person.

A sample card and medical report is established by law. An employee with incomplete working capacity has the right to receive all documents relating to the conclusions and decisions made regarding the state of his health, because it is these papers that will serve as the basis for transfer or dismissal.

Depending on the group

The procedure for dismissal depends on the assigned degree of disability and incapacity for work. In all cases, the decision will be based on the conclusions of MSEC. The following stages of dismissal are distinguished depending on the degree of performance:

- If the competent commission determines the presence of 1, 2 or 3 groups of disability, supplemented by the 3rd degree of inability to perform their professional duties, the person cannot continue to work. In such situations, a decision is made about complete loss of ability to work. The IPR issued by MSEC will not contain any recommendations for continuing to work. Based on such a conclusion, the manager can legally terminate the employment relationship with the employee. But this situation is only suitable for those cases when the employee receives a third degree of incapacity as a result of the duties performed under his position. In the case of hiring a disabled person who was initially recognized as incapable of work, the manager, based on the above norm, will not be able to fire him, because he knows from the very beginning about the state of health of his employee.

- Employees with the second or third group of disability in addition to the working degree of working ability are considered capable of working, and their dismissal is possible only on their personal initiative or mutual agreement. An employer's initiative in dismissing such employees is possible only when a disabled person improperly performs his duties or systematically violates the organization's labor regime. The legal consolidation of the norms is contained in articles 78, 80, 81 of the Labor Code of the Russian Federation.

The employer must remember that with a general reduction of workers, some categories of disabled people have advantages over other personnel if labor productivity and work qualifications are the same:

- disabled people who were assigned a group as a result of injuries or illnesses received in production, who retained their degree of ability to work;

- disabled people of the Second World War, as well as persons who became disabled during military operations aimed at protecting the fatherland.

These categories of disabled people will be the last to be laid off or will not be fired at all. In this case, the workforce being reduced must be notified of the upcoming dismissal two months in advance, in accordance with Article 81 of the Labor Code. Industrial relations can be terminated with a disabled person in the following cases:

- The employee categorically refuses to be transferred to a workplace with different working conditions (changed working hours, rest time, reduced skill level, transfer to another department or workshop, branch or transfer to home work). The norm is regulated by Article 77 of the Labor Code. Any change in working conditions should be recommended in his individual rehabilitation program.

- The enterprise cannot provide the employee with the working conditions prescribed in the rehabilitation program.

The main requirement for the employer in this matter is full compliance with the letter of the law and compliance with all norms regulating the layoff of persons with disabilities. In case of violation of at least one of the grounds or stages, the dismissed person may apply to the judicial authorities to protect his rights.

Complete loss of performance

The procedure for dismissal due to loss of ability to work also has a number of features. The first thing you need to do is register your dismissal on time and in accordance with labor legislation and at the same time follow the procedure:

- a note in the work book must contain an entry stating that the employment contract is terminated due to disability;

- using a special form T-8, a corresponding order is drawn up, to which a document of form T-61 must be attached - a note-calculation; the agreement is terminated due to the employee receiving one or another disability group. The document is issued to the person on the last working day along with the payment. The employee must confirm that he has no claims against the company, confirming this with his signature. The information is transferred to a personal card;

- on the day of dismissal, the employee must receive average earnings for two weeks, as well as other benefits and compensation, if any;

- To receive all the amounts and funds that are due to a disabled person, he must write a written application. An information certificate on wages for the last two years preceding dismissal is drawn up separately;

- in the next 14 days after dismissal, the organization submits the relevant documents to the military registration and enlistment office if the disabled person is registered;

- Depending on the situation, notifications are also sent to collectors and bailiffs.

If the employer violates, in whole or in part, the procedure for dismissing this category of persons, the disabled person must protect his rights, independently or with the help of a representative, in court. Ignoring legal norms is also a reason to contact the prosecutor's office.

Dismissal of an employee with 1 group

Dismissal for health reasons, if group 1 is assigned, must take place strictly according to the law. In accordance with current standards in the field of regulation of labor relations, a person is assigned the status of a disabled person in cases where the person’s health has been subjected to serious violations of a chronic nature.

The rules of law clearly establish the requirements that persons applying for disability must meet:

- Diseases and disorders have become chronic.

- Due to the disorders caused by the disease, the person’s life activity was limited.

- The presence of a citizen’s need for outside support in realizing his primary needs.

Members of a special medical commission - MSEC - vote on assigning a person a certain group. This commission is composed of all doctors who were directly involved in the examination of the person. Having made the final decision, it is announced to the person or his representative. If the assignment of a group was refused, the commission members are obliged to give reasoned explanations about this.

It must be remembered that most often disability is assigned for a certain period. For disabled people of the first group, this is two years, after which the person is required to undergo a re-examination to extend the period of disability. After receiving the conclusion, the head of the organization can decide on dismissal due to disability of the 1st group of the employee in accordance with the current standards of labor legislation.

Dismiss a disabled pensioner at his own request

Any illegal dismissal of a pensioner from the workplace can be easily challenged in court with payment of compensation and reinstatement in his previous position.

- Organizational reasons when the work of a given employee negatively affects the final result.

- The presence of individual characteristics related to health (serious illness, chronic diseases, their consequences, long-term sick leave, etc.).

- Age-related decline in the qualifications required to perform a job.

If a working pensioner has no health problems and copes well with the task at hand, then it will be extremely problematic for management to fire him. Even if there is personal antipathy. This is due to the fact that a working pensioner has extensive work experience, a high qualification level, and the presence of relevant knowledge and experience.

Approximate contents of the document

The agreement on termination of employment relations between the administration and the disabled person, according to legal law, includes the following provisions:

- date of the employee's last working day;

- the administration's obligation to pay severance pay in the amount of 2 monthly salaries;

- on the full settlement of the administration with the employee and the issuance of a work book on the last working day;

- the agreement is considered to have entered into force from the moment it is signed by both parties;

- the legally valid document is drawn up in 2 copies, 1 of which is given to the disabled person, the other remains in the archive at the workplace.

The document is signed by the manager indicating personal data.

How to fire a working pensioner if he does not want to quit himself

- If desired, an employee of retirement age can take additional unpaid leave of up to 14 days.

- Working pensioners are exempt from paying property tax.

- Older employees receive certain preferences when purchasing vouchers to sanatoriums and other health institutions.

- Age is not a reason for dismissal No matter how much an employer would like to dismiss a retired employee in order to get rid of certain difficulties and make room for younger employees, the law does not allow this. Art. 3 of the Labor Code of the Russian Federation clearly states that retirement age cannot in any case be a reason for dismissal.

Do I have to work 2 weeks after termination of the employment contract?

Dismissal of a disabled person on his own initiative requires a written application to the production administration no later than 14 days in advance. This working period begins the next day after submission of the document.

The Labor Code does not contain special requirements for the dismissal of disabled people. If an employee is not able to do his job professionally, then the organization’s management is obliged to dismiss him without work. If he wants to leave the enterprise on leave without pay, on the basis of Article 127 of the Labor Code of the Russian Federation, he can do so.

Dismissal of a disabled person at his own request

Determination of the St. Petersburg City Court dated December 19, 2013 No. 33-18870/2013) and Determination of the MOSCOW CITY COURT dated December 8, 2010 No. 33-38420, DETERMINATION OF THE MURMANSK REGIONAL COURT dated April 11, 2012 No. 33-842 Third position : The law does not limit the number times the dismissal of a working pensioner without working 2 weeks. It should be noted that there are examples of judicial practice when courts recognize the possibility of repeatedly dismissing a pensioner on his own initiative without working for 2 weeks.

DECISION OF THE KHABAROVSK REGIONAL COURT dated 04/06/2011 No. 33-2143 In our opinion, based on the literal interpretation of part 3 of Art. 80 of the Labor Code of the Russian Federation, it is impossible to dismiss an employee a second time in connection with retirement. An employee can resign due to the impossibility of continuing work due to retirement only once, and it is during the period when he applies for a pension - when he receives it.

Dismissal of a part-time worker

Part-time work can be with one employer, where the employee has his main place of work, and at another enterprise with the conclusion of a second employment contract. In any case, each manager has the right to dismiss a part-time employee due to his disability.

In connection with the reduction of a part-time worker, the employer pays all payments due to the disabled person in accordance with Article 82 Part 2 of the Labor Code of the Russian Federation.

An employee who has received group 2 disability for medical reasons, upon termination of employment agreements with the employer, is protected by the legislation of the Russian Federation. Upon dismissal, he receives the material compensation due to him under the Law from production. Further financial support for the disabled person is taken over by the state.

Is it possible for a working disabled pensioner to be fired without working?

For some categories of workers, a different deadline is established;

- this period is called working off, although there is no such concept in the law. This period may be reduced by agreement of the parties;

- The manager has no right to retain his employee for more than 14 calendar days. Neither vacation nor illness extends this period;

- on the day of dismissal, the employer must make a full settlement with the employee, paying him wages, compensation for vacation, and sometimes severance pay;

- then you need to return his work book, in which all the necessary entries have been made, and also issue a certificate of income for the last 2 years and a certificate in form 4-FSS about social payments made.

Dismissal of a disabled person at the initiative of the employer An employer may dismiss a disabled person under the following circumstances:

- he is not suitable for the position he occupies.

Payments

When terminating a contract at the initiative of an employee with a disability, the employer is responsible for making a full payment. It includes the following types of payments:

- salary;

- compensation for vacation if it was not used;

- bonus;

- additional payments, if provided by the enterprise itself.

Attention

All payments according to the law must be made on the last day allotted for work. If this rule is not followed, the employer will face punishment.

Dismissal of a disabled person

The question arises - is it possible to fire him? Can! If there is a corresponding medical report, which clearly states that the employee will no longer be able to perform his job functions. In addition, you can also rely on the indications of an individual rehabilitation program.

If the employee’s medical documents contain clear indications that it is impossible to continue working, then the employment relationship with such an employee can be terminated. But if there are indications that the employee will be able to continue working, but under more favorable working conditions, the employer must offer him a transfer to another position that matches his capabilities.

Often these are positions with lower salaries. Therefore, employees often refuse them! Each offer of a job must be made in writing. This fact must also be confirmed by documents;

In order for an employer to be able to terminate relations with any employee, including a disabled person, he must correctly prepare all personnel documents. Otherwise, the employee can challenge the dismissal in court, be reinstated in the workplace and demand compensation from the manager for forced absence, as well as compensation for moral damage.

The process of dismissing a disabled person at the initiative of the employer is no different from dismissing an ordinary healthy employee. Dismissal by agreement of the parties An employer and an employee with a disability can agree on the conditions for terminating their relationship.

To do this, a corresponding written agreement is drawn up and signed by both parties.

Dismissal by agreement of the parties

The employer, represented by the administration, and an employee with disability group 2 can terminate the employment contract by mutual consent. According to the legal framework, a written agreement is drawn up and signed by the parties. The document includes the following points:

- amount of severance pay;

- term of dismissal;

- other discussed points.

The agreement is drawn up in 2 copies and signed by both parties. 1 document remains with the employer, on which a note is made that the employee has received the agreement. The second copy is given to him.

The legislative framework

The legislative framework in our country is constantly updated, including as it relates to people with disabilities. The main regulatory documents governing the dismissal of an employee who has become disabled are given in the table.

| Title of the document | Regulatory area |

| Labor Code of the Russian Federation | Paragraph 5 of Article 83 of the Labor Code of the Russian Federation establishes the procedure for dismissing an employee who has become disabled |

| Tax Code of the Russian Federation, Chapter 23 | The procedure for taxation of income and the list of payments that are not subject to personal income tax have been determined |

| Decree of the Government of the Russian Federation No. 95 of February 20, 2006. | Establishes the procedure for recognizing a citizen as disabled |

Dismissal procedure

When a subordinate receives a disability group, the boss has the right to request a medical re-examination. Based on its results, the employee’s health condition may be insufficient to work in his previous position. Referring to Article 156 of the Labor Code of the Russian Federation, the employer transfers such an employee to an easier job. This requires the consent of both parties. If no suitable vacancy is found, the only option is dismissal.

If the commission recommended a transfer, but the employee wishes to remain in his previous place - where he is objectively (according to the conclusion) not able to work with the same efficiency, he can be legally fired in accordance with Part 8 of Article 77 of the Labor Code of the Russian Federation.

For your information

Concealing the fact of disability automatically gives the right to dismiss such a subordinate under clause 3 of Article 44 of the Labor Code of the Russian Federation. This is a violation of the hiring procedure, since among the initially requested documents there must be a conclusion from the MREC.

Forcing an employee to write a statement of his own free will is an official crime, which is punishable under the Criminal Code of the Russian Federation (Article 285). The motivation for such an impulse is unimportant: disability, temporary incapacity for work or otherwise. If the medical commission did not recommend dismissal, it is impossible to settle accounts with him against the will of the subordinate.

Grounds for payment of benefits to disabled people

An employee whose health condition prevents him from performing work functions or the existing workload is contraindicated for him can receive severance compensation. The basis for dismissal with financial assistance in the amount of two weeks' salary is disability of group 1 and category 2. But the presence of a disability in itself is not a basis for receiving severance pay; it is important that the employee be fired under the appropriate article.

Cases in which you can expect a refund:

- The reduction was provoked by factors independent of the parties.

- The employer fires the person. The prerequisite for termination of the employment contract in this case is a discrepancy with medical certificates.

Exclusively in these cases, the company pays an additional benefit in addition to the worker’s earnings in the amount of two weeks’ earnings to the disabled person. The calculation is created taking into account the size of the average salary (basic earnings, sick leave and travel allowances, bonuses and increments are taken into account).

The procedure for designing dismissal due to non-compliance:

- Disability has been proven and there is a medical certificate.

- The employer offers the applicant another job based on the criteria of the contract.

- A person can accept a vacancy only if his health condition allows him to perform new job duties.

- Dismissal due to inconsistency, if transfer to another position is not likely.

- Calculation of severance pay.

The employer must pay compensation only to those persons who have been dismissed under suitable headings and have submitted supporting documents.

Contributions from the severance bonus are not paid to the funds, and taxes are not collected from them. The accrual process occurs as follows: the employee brings a certificate. Then the employment contract is terminated and a corresponding order is issued. This document must indicate the reason for dismissal and the amount of benefits.

What to do if payments are not paid

According to the Labor Code of the Russian Federation (Article 140), the employer makes all financial settlements with the subordinate on the day of the latter’s dismissal. One-time payments and compensations are issued on this day, regular payments are issued later, but on time. If the payment procedure is violated, or the employee is asked to wait several days, he has the right to go to court. A month is allotted for this from the date of dismissal.

If the court records a violation of the payment deadline, according to Article 236 of the Labor Code of the Russian Federation, the employer is obliged to pay not only what was missed, but also interest in excess of the amount. These percentages increase with each day of deferment. The amount of compensation for non-payment can be increased if such conditions are specified in the collective or employment agreement.

Important

When considering the case, the court does not take into account the reasons why the boss did not pay money to the resigned subordinate. In any case, this is blamed.

Taxes on payments

If the employee does not have any debts, he is entitled to the entire amount that was obtained in the calculations, since personal income tax is not taken from it. If the employer has a writ of execution and payments are made according to it, another part of the debt will be withheld from the severance pay.

IMPORTANT!

Neither income tax nor insurance contributions are transferred if the amount of severance pay does not exceed three times the average monthly earnings (paragraph 7, paragraph 1 and paragraph 3, Article 217, paragraph 2, paragraph 1, Article 422 of the Tax Code of the Russian Federation, paragraphs 2 clause 1 article 20.2 of Law No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”). If the benefit is higher due to an agreement between the parties or a collective agreement, mandatory payments are withheld and transferred to the budget.

Taxation of severance pay upon dismissal due to disability

All payments, except severance pay, are subject to personal income tax. A disabled person has the right to a tax deduction in the amount of 500 rubles.

Using the example given, let us consider how much taxes will be withheld upon the dismissal of V.V. Yakovlev.

| Name of accrual | sum | Base for personal income tax |

| Sick leave from November to May | 374 672,00 | 374 672,00 |

| Vacation compensation | 51 037,00 | 51 037,00 |

| Severance pay | 27 188,91 | — |

| Total: | 452 897,91 | 425 709,00 |

| Benefit | 500 | 500 |

| Personal income tax calculation | (425 709,04-500)*13/100 | X |

| Personal income tax amount | 55 277,00 | X |

| For delivery: | 397 620,91 | X |

Severance pay is also not subject to contributions to the social insurance fund, pension fund and health insurance fund paid by the employer.

How to calculate the size of the VP

The amount of severance pay is calculated based on the person’s average earnings over the last 12 calendar months.

Definition

To determine it:

- Add up all the amounts received by the employee as payment for his work. It is unacceptable to include in this amount travel allowances, sick leave payments, various types of financial assistance, bonuses and vacation pay.

- The number of days actually worked during this period is calculated.

- The received payment amount is divided by the number of days worked. This is the average daily earnings.

- To determine the amount of severance pay, average daily earnings are multiplied by 14.

Examples

Citizen S.P. Ivanov was assigned the second disability group. The administration was unable to find him a position that suited his health, so the decision was made to terminate the employment relationship.

A certificate of disability from the commission was received on May 21, 2017. The amount of severance pay is determined as follows:

- The amount of the employee’s earnings for the period from May 21, 2016 to May 20, 2017 is determined. It amounted to 281,346 rubles.

- The total number of days actually worked is 219.

- The average daily earnings are: 281,346: 219 = 1,284 rubles. 68 kopecks

How is severance pay calculated?

Taxation

The amount of severance pay is not taxed:

- insurance payments, if the citizen himself has not made such a demand;

- taxes (Article 217 of the Tax Code of the Russian Federation).

This condition does not apply if the amount of severance pay exceeds the employee’s average income for 3 months. Tax and insurance payments are assessed on the amount exceeding this limit.

- In the regions of the Far North and equivalent regions, the non-taxable minimum is equal to six average monthly earnings.

- It is allowed to deduct alimony from the amount of severance pay, even if a citizen is dismissed due to disability. To do this, you need a writ of execution from the bailiff.

It is more desirable and profitable for an employer to provide jobs to completely healthy people. Sometimes some enterprises try to find any opportunities to get rid of an employee who is often sick and cannot fully perform his job duties.

Therefore, the laws of the Russian Federation spell out guarantees that provide disabled people with the opportunity to protect their rights. And the presence of disabled people also gives the company some advantages, for example, tax breaks and the opportunity to receive an interest-free loan.

The video below will tell you about the absence of the need to work off such a dismissal:

Exit compensation amount

The provision for the payment of severance pay is contained in Article 178 of the Labor Code. The categories of citizens who are eligible for it are indicated there.

Namely:

- Citizens recognized as completely incapable of working in accordance with a medical report.

- Employees who refuse to be transferred to another job if the transfer is necessary in accordance with a medical report.

- People for whom the company cannot offer suitable work.

This accrual must correspond to the employee’s average earnings for a period of two weeks.

In addition, the law does not prohibit making other payments. They can be included in a collective or employment agreement. If there is such a provision in the document, then the disabled person will be credited with the appropriate amounts.

If the employment contract is terminated due to:

- with the liquidation of the organization;

- staff reduction;

then the dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains his average monthly earnings for the period of employment, but not more than two months from the date of dismissal. For the third month, this benefit can be extended by decision of the employment service. The employee must contact this service to register as unemployed within two weeks after dismissal and not be employed within three months of payment of such benefits.

In addition, a disabled disabled employee may receive unemployment benefits.

Also, upon dismissal, the employee receives wages for days worked and compensation for unused vacation.

Calculation method

A citizen can independently estimate how much money he is entitled to as a mandatory payment. To do this, you need to calculate your average daily earnings.

- All amounts received over the last 12 months (up to the day of dismissal) are taken (OA), with the exception of:

- business trips;

- payment of official sick leave;

- material assistance.

- The exact number of days worked (DC) is calculated.

- The indicators are divided: OD / CD = SD. The result is the average daily income.

- The benefit amount is equal to: SD x 14 days.

Vacation and related payments are not included in the calculation.

Calculation example

Let’s say a citizen has been assigned disability group 2. There was no place at the enterprise suitable for health reasons. The administration had to fire him as not meeting the conditions. The date of receipt of the group certificate is 02/24/2017.

- Income is taken into account for the period: from 02/24/2016 to 02/23/1017. It is equal to: 259.2 thousand rubles.

- In total, during this time the citizen worked 216 days.

- Average daily earnings: 259.2 thousand rubles. / 216 days = 1.2 thousand rubles.

- Allowance: 1.2 thousand rubles. x 14 days = 16.8 thousand rubles.

Subtleties of taxation and other deductions

Article 217 of the Tax Code states that this type of payment is not subject to taxation. However, if an employee upon dismissal due to a reduction in staff is paid severance pay in increased amounts, then the amount of severance pay that exceeds the amount established by the Labor Code is subject to personal income tax.

Insurance premiums are also not supposed to be taken from severance compensation.

Alimony is withheld in accordance with the writ of execution from all income of the citizen. Severance compensation for disability is not exempt from this type of payment.

Legal aspects

The working relationship between an employee and an enterprise is regulated by the Labor Code of the Russian Federation. It reflects legal aspects that make it possible to resolve disputes arising between the parties, including those caused by dismissal. It refers to the end of the business relationship between the employee and the employer.

From the moment of dismissal, the employment contract is considered terminated, and the parties are released from mutual obligations. The employee has the right not to fulfill professional duties, and the employer has the right not to pay remuneration.

In addition to the Labor Code, regulation of the dismissal process is reflected in the Law “On Employment in the Russian Federation”, sectoral and territorial legal acts.

Main types of termination of working relationships:

- At the request of the employee;

- By decision of the employer;

- By agreement of the parties.

The grounds for ending an employee’s professional activity are specified in Article 77 of the Labor Code of the Russian Federation. A significant reason for terminating a business relationship is the employee’s loss of health, confirmed by a medical report that must be provided to the employer.

The standard algorithm of actions upon dismissal consists of the following steps:

- Receiving an application from an employee or drawing up an agreement;

- Preparation of the order, informing the employee;

- Accrual of payments provided for by law;

- An entry in the work book corresponding to the situation, which is returned to the employee on the day of dismissal, with a copy placed in the archive.

The process for ending an organization's working relationship with a disabled person is similar, but has some nuances. The group assigned to the employee (1,2,3), the degree of health loss, and the ability of the enterprise to create optimal conditions for the person are taken into account.

A citizen may be partially limited in work or completely disabled. For example, any disability group assigned to the 3rd degree of health loss indicates the absolute impossibility of professional activity and serves as a basis for terminating a business relationship with a disabled person in connection with medical testimony.

What documents to provide

In order to receive severance payments for a disabled person, you need to substantiate the fact of loss of ability to work. You must bring the following documents to the department:

Design nuances

Based on the papers regarding loss of ability to work, the manager makes a decision, which must be presented to the employee in writing:

- If another place of service is offered, then the person must write opposite the possible positions: “I agree” or “I refuse.”

- If the citizen does not want to continue working, he writes a letter of resignation. It should indicate “for health reasons.”

- The personnel officer prepares a draft order, the basis for which is:

- certificate of disability;

- worker's statement.

The disabled person should be familiarized with the signed and registered order. This is done to prevent an appeal to the tribunal with a complaint.

There is another option. According to Art. 73 Labor Code:

- The disabled person may be given time to recover. The period is limited to 4 months.

- At this time, the unhealthy person retains a place (the administration has no right to occupy it on a permanent basis).

- After the specified period has expired, the worker undergoes a medical examination again. If his health allows, he returns to service.

During the recovery period, no salary is accrued to the person.