The chief accountant is the leading employee of the organization. The chief accountant can leave the workplace at his own request or on the initiative of the employer who is not satisfied with the employee. There are no special instructions for dismissing the chief accountant - he is an ordinary employee. Rely, as usual, on articles 75, 76, 77, 79 and 81 art. Labor Code of the Russian Federation. The chief accountant can be relieved of his position under the following conditions:

- liquidation of the company;

- at your own request;

- in case of violation of the employment contract;

- upon expiration of the fixed-term employment contract;

- in case of inconsistency with the position held.

Dismissal at your own request

If the chief accountant himself decides to leave the company, he writes a letter of resignation addressed to the director 2 weeks before leaving. The law does not allow a director to retain an accountant in his position, although managers often resist the departure of such an important specialist, at least until they find a worthy replacement. But the employee just needs to register his application in the office - and after two weeks he has every right to leave his job.

It is better to reach an amicable agreement with the chief accountant and quickly look for a new employee: then the accountant will be able to transfer the affairs to him and convey all the accounting tricks of the company to his successor. If there is no successor, the outgoing chief accountant draws up written instructions and tries to convey all important information to the director.

New employee

By the time the chief accountant prepares to leave his position, it is important for the director to find a person capable of holding this position. Doing this when the chief accountant has already left is highly not recommended if there is an objective opportunity to find a specialist in advance. Without a new employee on staff, the old chief accountant will not be able to transfer matters to him, and he, in turn, will have to independently deal with the current documentation. This state of affairs is fraught with the possibility of making annoying mistakes in work, for which the new chief accountant most likely will not be to blame, because no one prepared him. We have heard so many stories from our colleagues when the new chief accountant had to work 11-12 hours a day for several months just to sort out all the paperwork. We recommend that directors be more humane in this matter and not create additional problems.

Moreover, it is important to note here that the new employee has every right to demand that the old chief accountant provide documents from previous reporting periods in order to check them for errors. He also has the right to report any shortcomings to his immediate superior - the general director.

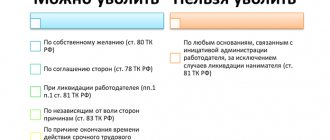

Dismissal at the initiative of the employer

To dismiss a chief accountant at the initiative of the employer, grounds from the Labor Code are required. It will not be possible to fire an accountant due to personal hostility or dissimilarity of character.

Labor Code offers a large list of grounds for dismissal:

- failure to fulfill one's duties;

- absenteeism;

- appearing at the workplace under the influence of alcohol or drugs;

- violation of clauses of the employment contract;

- reduction of position or staff;

- inconsistency with the position, etc.

If you fired the chief accountant in violation of the law or internal company regulations, he may go to court. The court may side with the plaintiff, and then you will have to reinstate the former employee to the position he occupied.

Nuances and features of the procedure

The chief accountant is an official in an organization who carries out the main work of accounting for the financial flows of the enterprise. The process for terminating this official has some nuances and is slightly different from the procedure for terminating a regular employee.

The Labor Code in Article 59 indicates that it is permitted to conclude a fixed-term employment contract with this official. In accordance with Article 70, his probationary period is six months.

There are several types of dismissal of the chief accountant:

- by agreement of the parties;

- on their own initiative;

- at the initiative of the employer;

- due to circumstances that do not depend on the decision of the parties;

- due to the expiration of a fixed-term employment contract.

The employer has the right to dismiss this official due to the fact that he makes unreasonable financial decisions and conducts activities that bring losses. In accordance with paragraph 4 of Article 81 of the Labor Code, attention is drawn to the fact that when the owner of a company, enterprise or organization changes, the new manager has the right to dismiss not only his deputies, but also the chief accountant. In the job description, the director can prescribe with the employee the procedure for terminating the employment contract.

If the employee is not in a permanent job, but only on a probationary period, then his work is reduced to three days, and on the last working day he is required to be fully paid and issued a work book.

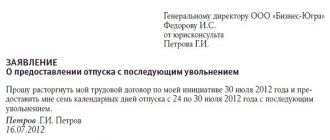

Dismissal by agreement of the parties

Dismissal by agreement of the parties is initiated by the employer or the accountant himself. The parties discuss the nuances of the process, agree on conditions, compensation, deadlines, payment and what will happen if the agreement is violated. For example, that the chief accountant works until he finds a replacement employee, and then transfers the cases to him within two days. The agreement is drawn up in free form - it will be useful if one of the parties violates the terms.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

"Paper" procedures

A characteristic feature of the chief accountant is that he may be entrusted with the need to maintain personnel records. If so, then he will prepare the dismissal documents himself. Of course, the resigning Chief Accountant is no less, if not more, interested in completing all the papers upon dismissal correctly, so as not to harm, first of all, himself. This includes a dismissal order, a corresponding entry in the work book, payment of wages and unused vacation for the period, etc. If the employee turns out to be conscientious, then he will organize all procedures fully in accordance with the Labor Code of the Russian Federation, but, as mentioned above, it makes sense for the director to take this process under his personal control. Check how correctly the order was drawn up, how much wages he calculated for himself, how he calculated vacation and sick pay, how many of them he took into account vacations “at his own expense,” whether he has in storage all previously drawn up applications - for this, at a minimum, It makes sense to pay close attention.

Dismissal procedure

If this is dismissal at one’s own request or by agreement of the parties, the procedure is as follows:

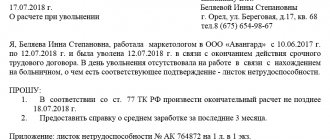

- The employee submits an application addressed to the director. Writes the text in free form, briefly indicates the reasons for dismissal, and signs and dates it at the end.

- The manager adheres to the deadlines for dismissal: in general - two weeks, during the probationary period - three days, with the agreement of the parties this is a contractual period. If an employee goes to study or retire, this is the start date of study or retirement. If the manager has violated labor legislation or local regulations, the employee indicates in the application a deadline at his own discretion, and it must be observed.

- On the last day of work, the manager signs the dismissal order. The employee is introduced to him by signing.

- On the same day, the accounting department issues a certificate of earnings for the last two years of work. You will need it in your new workplace.

- The accounting department also draws up a document with personalized information that was sent to the Pension Fund during its work.

- The notice of dismissal is entered into the personal card in form No. T-2.

- A settlement note on termination of employment relations is drawn up in form No. T-61. There is no need to familiarize the employee with this document.

- They issue wages, compensation for unused vacation and other compensation, if applicable.

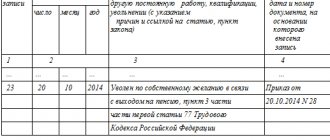

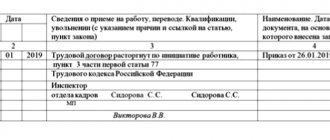

- They make an entry in the work book: entry number, date of dismissal, reason for dismissal with reference to the article of the law (“The employment contract is terminated at the request of the employee, clause 3 of Article 77 of the Labor Code of the Russian Federation”). The book, income certificate, personal information and certified copies of documents that the employee may have asked for are issued on the last working day.

If you fire an accountant due to a reduction in position, for absenteeism or other violations of the work schedule, then instead of the first two points of the instructions, you will have to take other measures - in each case your own. After this, starting from point 3, the steps are the same.

Dismissal: some advice to the chief accountant

We don't want to work anymore. Freedom for the chief accountant!

Situation.

Elena Kostina, the chief accountant of one of the Moscow companies, decided to change her job. She was offered a higher salary and better conditions. And at my previous job, not everything went smoothly: the director saved on literally everything. It was useless to start talking about subscribing to books, installing a legal reference system, and even more so about seminars. In addition, the boss had a bad habit of confusing the official and unofficial cash register. And Elena learned about many calculations only after checking with suppliers and customers.

In general, Elena had reasons for dismissal. However, the boss set a condition for her: she must transfer the affairs. But he didn’t specify who. Because the director did not have a candidate for the vacant position of chief accountant. Yes, he was in no hurry to look for anyone. Elena fell into a trap. The director refused to sign the resignation letter.

Tip #1

. If you decide to leave, the director cannot stop you. When dismissing “at your own request” (clause 3 of Article 77 of the Labor Code), you simply must notify management of your decision in writing. If the director refuses to sign your application, simply register it with the office or secretary. If this is not possible, send the application by registered mail with acknowledgment of receipt and a description of what was sent. After two weeks, you can, with a clear conscience, not go to work (Article 80 of the Labor Code).

Tip #2.

If the director blackmails you by saying that he won’t give you your work book, don’t be afraid. This will only get him into more trouble. If you are not given a book or the wrong reason for dismissal is indicated in it, you can go to court. And the company will reimburse you for all lost earnings from the moment of dismissal until you receive the work book in your hands or make correctional entries (clause 35 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Government Decree of April 16, 2003 No. 225). The day of dismissal in this case will be the day the work book is issued.

Tip #3.

If a replacement has not been found for you within two weeks, you can leave without transferring the case. The law does not oblige you to do this. However, do not forget that you are not exempt from administrative liability for violations committed by you during the period of work in the company. For example, you may be punished for a gross violation of accounting rules in the amount of 20 to 30 minimum wages (Article 15.11 of the Administrative Code). True, only a court can do this and only within one year from the date of violation (Article 4.5 of the Code of Administrative Offenses).

Therefore, when dismissing, try to properly formalize the transfer of affairs. Both the newly hired chief accountant and another responsible person appointed by the manager can receive them from you. As a last resort, hand over all documents to the director against signature.

A good place is worth fighting for

Unfortunately, even if the chief accountant is quite happy with his position, there is no guarantee that he will not have to “fight” for it.

Situation.

Galina Perova, chief accountant from Vladivostok, has been working in one of the manufacturing companies for five years and is happy with everything: her colleagues, her salary, and her work. “Relationships with only one of the managers, the production director, did not work out,” complains Galina.

The shares of the company she works for have been transferred to other people. And her ill-wisher constantly hints to the chief accountant that he will advise the new owners to fire her - after all, the Labor Code has a rule according to which, if the owner of the company’s property changes, the chief accountant can be fired without additional reasons (clause 4, article 81).

Advice.

Even if the composition of the shareholders or members of your company has completely changed, continue to work and try to prove yourself from the best side to new people. And explain to those who like to read the Labor Code that it is impossible to dismiss the chief accountant under paragraph 4 of Article 81 in this case.

The Supreme Court, in the Plenum Resolution No. 2 of March 17, 2004, clearly stated: the owner of the company’s property is the company itself as a society or partnership. And participants or shareholders only have certain rights in relation to the company (to distribute profits, for example). Therefore, a change in the composition of participants or shareholders is not a change in the owner of the property. This means that there is no reason to fire the chief accountant.

The chief accountant is not responsible for everything

Situation.

After a tax audit, your company was assessed additional taxes, penalties and fines. When asked who is to blame and what to do, the director found the answer: the chief accountant is to blame and, perhaps, it is worth firing him - so that there will be no more such “sorrows”.

The company’s lawyer confirmed that the employer can fire the chief accountant “for making an unfounded decision that resulted in damage to the organization’s property” (clause 9 of Article 81 of the Labor Code). The prospect of getting an unpleasant entry in your work book has become quite real.

Tip #1.

It's no secret that tax authorities often find non-existent violations. Carefully study the inspector's decision, prepare your objections and try to convince the manager to challenge the inspection's findings. And postpone the issue of your dismissal until the court’s decision.

Tip #2.

If you still have an unpleasant entry in your work book, try to challenge it.

Maria Agureeva, legal consultant, said that in practice, judges recognize dismissal under paragraph 9 of Article 81 as legal if the employer proves: he knows exactly what decision of the chief accountant led to a violation of the law; this decision is clearly wrong and unqualified; payment of a fine (or other damage) seriously affected the financial condition of the company.

If the company cannot convince the judges on at least one of the specified conditions, the wording of the dismissal of the chief accountant will have to be changed.

Tip #3.

Roman Dozorov, legal expert at the Rodichev and Partners legal bureau, advises using other arguments in your defense.

Article 53 of the Civil Code establishes that the manager is the executive body of the company, through which it acquires rights and assumes responsibilities. It is the manager who makes management decisions on behalf of the company (concludes contracts, manages property and funds).

Federal Law No. 129-FZ of November 21, 1996 “On Accounting” also establishes that “responsibility for organizing accounting and compliance with the law when performing business transactions” lies with the head of the company. The chief accountant, in accordance with paragraph 2 of Article 7 of Law No. 129-FZ, is responsible only for the formation of accounting policies, maintenance of accounting records, and timely provision of complete and reliable financial statements.

This means that if a company violated the requirements of the law and, for example, reduced the tax base, then responsibility for this lies with the manager. And there can be no talk of dismissing the chief accountant for a wrong decision.

Svetlana BLINOVA, Alena ANDROPOVA

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition

How to avoid problems when dismissing a chief accountant

The chief accountant has access to important information of the organization. To protect yourself, follow a few conditions.

- Dismiss legally according to the established procedure. This will help avoid lawsuits if the employee considers himself fired unfairly.

- Draw up competent contracts that stipulate the accountant’s responsibility for disclosing secrets. This will protect against information leakage.

- Duplicate data. This will protect against information loss. There is a risk that the accountant may change or destroy data to which he has access.

- Duplicate the position of chief accountant with his deputy. He will insure the company in case of dismissal during the search for a new chief accountant.

Other grounds for dismissal of the chief accountant

Also, the chief accountant, like other employees, can be dismissed during the liquidation of the organization, or when the owner of the property changes .

In case of liquidation, all employees are notified two months before dismissal. The chief accountant is no exception. If he helps the liquidator, he can formalize it under a GPC agreement.

When the owner of the organization’s property changes and the employment contract is terminated on this basis, the new owner is obliged to pay compensation to the manager, his deputy, and the chief accountant in an amount not less than three times their average monthly earnings (Article 181 of the Labor Code of the Russian Federation).

Compensation for unused vacations must also be paid.

In what cases can you not work out

If there is a good reason

According to Art. 80 of the Labor Code of the Russian Federation, in special cases, the employer is obliged to dismiss an employee from the organization (including the chief accountant) without any work. There must be a good reason for this:

- admission of an employee to an educational institution;

- retirement;

- violation by the employer of labor legislation (for example, delay of wages);

- other cases.

This is also important to know:

How to correctly formalize dismissal by agreement of the parties

“Other cases” include:

- the need to move to another locality;

- a situation when the wife (husband) of an employee is transferred to work in another city or country;

- loss of the opportunity to work at a given workplace due to health problems (in this case, the employer must be presented with a medical report confirming this fact);

- the need for constant care for a sick relative.

If a person has a legal reason not to work for 14 days, he must write a statement indicating the reason for the urgent dismissal. In this case, the boss must dismiss the employee on the day indicated in the application.

If the employee is on probation

Also, special rules for terminating a contract at will apply to employees on a probationary period.

According to Art. 71 of the Labor Code of the Russian Federation, the period within which it is required to notify the manager of the decision made is reduced for the employee to 3 days.

The countdown of working hours begins on the next day after the director receives a resignation letter from the employee. The employee will receive payments and a work book after three days.

Responsibility after dismissal

The procedure for receiving and transferring cases is quite capacious and does not always fit within the two-week work period. Therefore, the accountant may be held liable even after the day of dismissal.

If such an employee does not submit the acceptance and transfer certificate, then the employer, within a year after the termination of the employment contract, has every right to file a lawsuit against such an accountant.

The management can file a claim even if there is an act, but in this case it will be very difficult to prove the guilt of the former employee, because the fact that he did his job efficiently will be documented.

Employer's liability

Quite often, the departure of such an important employee as the chief accountant is extremely unpleasant for the employer. Due to the reluctance to lose a valuable employee and waste time searching for a new one, an employer can create situations that prevent dismissal. For example:

- the employer refuses to accept the resignation letter from the chief accountant. In this case, you should prepare the document in two copies and send it to the employer through the secretary. In this case, it is necessary to ensure that the receipt of paper is recorded in the incoming correspondence log. One of the copies with a mark on the date and time of receipt of the application must remain in the hands of the employee. The period until departure will be counted from the date indicated in the document. The application can also be sent to the employer by registered mail with acknowledgment of receipt. In this case, the date of dismissal begins to count from the date of receipt of the correspondence indicated on the returned notice;

- If the employer was unable to find a new employee, he has no right to keep the resigning accountant at work. In this case, the chief accountant must transfer matters to the head of the organization. Let us note that labor legislation does not generally impose on the accountant the obligation to transfer affairs to the successor;

- if the employer does not want to return the work book to the employee on the day of departure, you should know: such actions are unlawful and are grounds for filing a complaint with the labor inspectorate or court

Features of the dismissal of the chief accountant

The dismissal of a chief accountant is an event that is significantly different from the termination of an employment relationship with an ordinary employee.

After all, an accountant solves all the main financial issues of the organization, and also accompanies the procedures for receiving income and making expenses, and is responsible for paying taxes. No one but him knows all the intricacies of accounting work and business management in the organization, not even the manager. Therefore, upon dismissal, the chief accountant is obliged to provide all the necessary information about his work to the boss or the new employee. Providing this information is called referral.

All chief accounting employees are required to transfer their affairs - the further work of the entire enterprise depends on these matters.

The responsibility of the chief accountant remains with him upon dismissal for all his decisions made during his work.

How to fire a retired chief accountant

In order to dismiss a retired chief accountant without the risk of a lawsuit on his part, you must comply with the regulations provided by law for terminating a relationship on a specific basis, for example:

- in case of loss of trust or violation of the employment contract, document the facts (conduct an audit, legal examination of documentation, etc.);

- inconsistency with the position - create a certification commission, conduct certification and record its results, offer the employee a vacant position corresponding to his competencies (if any).

For each situation, the law establishes a certain algorithm for the employer’s actions. Since a non-specialist cannot have absolute knowledge of the legal field, the best thing to do is to consult with a lawyer before dismissing an employee.

In case of voluntary resignation, the chief accountant must submit an application, and the manager must issue 2 orders (to dismiss the employee and transfer the affairs to another specialist).

Working off

14 days after submitting the application are spent transferring the affairs to the chief accountant appointed to the vacant position. The employer has no right to extend this period. It is possible for a retired chief accountant to be dismissed without work - on the day that the specialist indicated in the application. This benefit is provided once: if the pensioner finds a job again, he will not be able to quit without working.

The transfer of cases

To ensure that the retirement of the chief accountant does not provoke a disruption in business processes at the enterprise, and that the specialist himself does not have any complaints in the future, it is important to properly organize the transfer of affairs.

- Issue an order, indicating in it the specialist authorized to accept the case. If necessary, you can appoint a commission in whose presence the transfer will take place.

- Draw up an act of acceptance and transfer of cases. Record an inventory of the documentation accepted by the authorized person. The document must be certified by the signatures of both parties to the process and executed in the required number of copies.

The employee assigned to receive cases must receive from the departing employee:

- original documents relating to the accounting policies of the enterprise;

- reporting confirming that it has been submitted to regulatory authorities;

- accounting and tax registers;

- acts of reconciliation of settlements with tax authorities, counterparties, extra-budgetary funds, etc.;

- inventory records;

- company property in safekeeping (keys to the safe and office, seal, statutory documentation, etc.).