Current labor legislation provides for the mandatory provision of paid leave (annually and additionally). There is also unpaid leave, so can an employer refuse leave at his own expense?

The main difficulties with this issue arise due to insufficient normative support. The Labor Code of the Russian Federation contains only one article on this matter. The article will discuss when an employer cannot refuse an employee, how to properly submit an application and other questions on this topic.

Providing leave

The Labor Code of the Russian Federation establishes two options for assigning leave in Art. 128:

- mandatory, enshrined in legal regulations, in this case the manager does not have the right to refuse and will be obliged to provide. The law provides for different lengths of vacation for different social groups. Each will be discussed in more detail below;

- negotiable in other cases. Since the law does not limit these relationships in any way, an employee can receive leave at any time for any period if he can agree on this with his manager. Most often, possible situations in which the employer grants extraordinary leave are established by local regulations of the enterprise. For example, leave due to a wedding. It is worth noting that the final decision will depend on the will of the employer, who will take into account all the circumstances at the moment. So, if there is no one to work at the enterprise, the chances of getting an extraordinary leave are quite small.

To avoid problems, it is always worth getting written confirmation of going on vacation. Since an unscrupulous employer will have the opportunity to impose a disciplinary sanction for absenteeism.

Legislative definition of forced leave

The Labor Code of the Russian Federation does not contain the term “forced leave”. Instead, the following options are used in practice.

- Administrative leave is non-working time without pay. According to Art. 128 of the Labor Code of the Russian Federation, these are days provided to the employee as free, at his request (for family reasons and other reasons that management considers valid). Its duration is established by contract. It is provided exclusively upon the employee’s application, in which he expresses his initiative (request). Thus, administrative leave cannot in any way be “forced”.

- The time when an employee is forced to miss work on the initiative of the employer , without his desire and/or consent, depending on the circumstances, can be classified as:

- forced absenteeism;

- suspension from work;

- simple.

All these cases must be paid (in some situations, nuances are possible). Let's take a closer look at them.

Forced absenteeism

It happens that an employee was fired illegally or suspended from work without relevant grounds. The court will restore his rights, and he will return to his position. In this case, the employer is obliged to fully pay for the time that the employee spent without work through no fault of his own (Article 234 of the Labor Code of the Russian Federation).

Of course, such absenteeism can hardly be considered a real vacation, but these days will be counted as work experience when it is necessary to calculate the time for regular annual leave.

Suspension from work

In some cases, the employer has the right, and sometimes even the obligation, not to allow the employee to work. The period of such “vacation” will last until the employee eliminates the reasons that caused the suspension. Among them:

- appearing at the workplace drunk, in a drug-induced delirium, or otherwise intoxicated;

- the employee has not undergone occupational safety training or knowledge testing in this area;

- if the position requires a mandatory medical examination, but the employee has not passed it;

- the person has been issued a medical certificate stating that work is contraindicated for his or her job function.

In all these cases, the initiative for the “vacation” belongs to the employer, and the “fault” lies with the employee, so these days will not be paid, and this is absolutely legal. It’s another matter if a mandatory medical examination or occupational safety training was not completed due to the fault of the employer. In this case, removal from work will be equivalent to forced downtime and will be paid in the same way.

Employees who are not completely healthy and who are prohibited by doctors from performing direct duties for more than 4 months should be transferred to an easier position. If there is no suitable position or the employee does not agree to it, the management should not allow him to work, the position will remain with him, but he will not receive a salary for the period of “medical leave”.

ATTENTION! The law does not prohibit the provision of accrual of monetary benefits for “medical” removal from work in a collective or individual employment contract.

Simple as a forced vacation

Downtime is a period when an employee is temporarily unable to fulfill his duties under an employment contract. The reasons may be different:

- economic;

- technical;

- technological;

- organizational.

This time, although employees actually do not work, is less than all other options related to vacation pay, because it remains working in the time sheet. This means that employees must formally be present at workplaces, although they do not have the opportunity to perform work. They will be able to use their own time if the employer officially allows it, indicating it in an internal regulation, employment contract or collective agreement.

Naturally, if the downtime is caused by the employee’s guilty actions, this time is not subject to payment.

But if the fault comes from the employer, he is obliged to pay for the impossibility of providing labor guaranteed by the contract in the amount of at least two-thirds of the usual wages. The payment should be the same if the reason for the downtime did not depend on either the employee or the employer.

When you can't refuse

As mentioned earlier, labor legislation establishes cases in which management will not be able to restrict an employee on extraordinary leave:

- a pensioner working officially for a period of up to fourteen days annually;

- disabled person for up to sixty days each year;

- employees whose spouse died in the state civil service - for up to fourteen days;

- employees who have had a child or a close relative die – up to five days.

ATTENTION !!! Difficulties arise in determining the circle of close relatives. According to the Civil Code of the Russian Federation, relatives of the first two lines of inheritance (parents, children, spouse, grandparents, brothers) are considered close. However, in practice, another relative can also be recognized as a close relative. The key will be their level of relationship.

Thus, for example, a stepfather can be recognized as close. It is also worth noting that all of the specified periods do not have a lower limit, which means vacation can be granted for 1 day.

The list enshrined in Art. 128 of the Labor Code of the Russian Federation is not closed.

Other cases of granting unpaid leave are stipulated in other articles and regulations:

- Art. 173 and 174 of the Labor Code of the Russian Federation establish the right to leave in connection with admission and passing exams at a university;

- if there are children under fourteen years of age, or a child with a confirmed disability under eighteen, the employee can be confident in the freedom to take leave at any time for up to fourteen days. (Article 263 of the Russian Labor Code).

Some other Federal laws establish mandatory unpaid leave for civil and municipal employees, spouses of military personnel, participants in the Great Patriotic War, war veterans and some others.

There is often an opinion that according to the Labor Code of the Russian Federation or after maternity leave, the employer is obliged to provide unpaid leave. Based on Article 128 of the Labor Code of the Russian Federation, this is not so and there is no such basis, so you will have to negotiate on your own. The situation is similar with care for health reasons, so if the employer refuses, you should take sick leave.

For how long can unpaid leave be granted?

The current Labor Code of the Russian Federation establishes the duration of vacation for certain social groups. For others, this question remains vague. As a general rule, the duration of the vacation will depend on the consensus reached between the employee and the manager.

If an employee has several grounds for compulsory annual unpaid leave, you should not count on multiple vacations. Although this issue is not regulated in any way by law, in practice there is a custom according to which a term will be granted annually for the maximum of the grounds.

Each employer keeps records and statistics of vacations provided.

There are several reasons for this:

- makes it possible to refuse multiple leave within one year, although as a general rule leave should be granted;

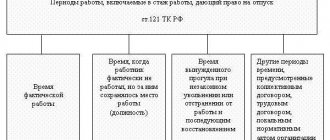

- The length of service will depend on the number of days of unpaid leave spent. According to Article 121 of the Labor Code of the Russian Federation, the employee’s length of service will increase, and with it the annual paid leave, if in one calendar year the employee has not spent more than fourteen days on vacation at his own expense. If this period is not included, the working year will be increased by the corresponding number of days.

Is there unpaid leave at the initiative of the employer?

Yes, it happens, although according to the law it should not happen. Employers often have reasons, most often of an economic nature, when they are forced to suspend work activities. Then they ask, and sometimes force employees to write an application for leave “at their own expense,” sometimes for a significant duration or for an unknown period. This is extremely disadvantageous for employees because:

- they will not receive payment for the days of forced freedom;

- if such leave lasts longer than 2 weeks, it cannot be taken into account when determining the length of service for paid annual leave;

- if an employee falls ill during a “rest”, sick leave will remain unpaid;

- since during such leave there are no contributions to the pension fund, this period will not be included in the pension period.

FOR YOUR INFORMATION! If an employee has written the required statement, he does not go on “forced” leave, but on ordinary administrative leave permitted by law. The statement confirms his intention and initiative.

Sometimes employees meet the employer halfway of their own free will, weighing the “disadvantages” of taking leave at their own expense with the complete loss of their job.

Forcing you to write an application “at your own expense”

Whatever circumstances the employer may have, if he is unable to ensure the fulfillment of the employment contract on his part - the provision of a workplace, work and wages, then such a contract should be terminated. The employer has no right to force the person to go on administrative leave instead. This issue is covered in detail in the special Explanation of the Ministry of Labor of the Russian Federation dated July 27, 1996 No. 6.

Such a violation provides for administrative liability for each employee who is forcibly “happy” with a vacation:

- for individual entrepreneurs working with personnel – from 1,000 to 5,000 rubles;

- for officials – from 1,000 to 5,000 rubles;

- for enterprises (legal entities) – from 30 thousand to 50 thousand rubles.

NOTE! Employers often use the wording “due to production needs” as a reason for going on forced leave. This is a substitution of concepts: production necessity may force employees to be called to work overtime, on a day off or on a holiday, but in no way reduce their working hours. In any case, such a need must be paid in accordance with the law.

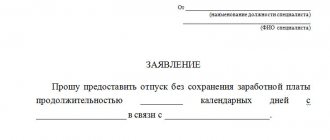

Correct design

Unpaid leave can only be assigned on the initiative of the employee. Thus, the employer’s desire to temporarily suspend an employee due to a reduction in workload is completely illegal. When making an application, be sure to indicate the reason and the desired date.

IMPORTANT !!! After reviewing the application by management, a mark of consent or refusal must be made. Based on the decision of the manager, prepares an order for unpaid leave. The order is drawn up in a special form and must contain an indication of the type of leave, its duration and start date.

Leaving before the order is issued is highly discouraged. The employer will have the right to impose a disciplinary sanction on the employee, up to and including dismissal under Art. 81 Labor Code of the Russian Federation.

According to Art. 20 of the Labor Code of the Russian Federation, the order must be signed by an authorized person of the enterprise and the employee himself. Nowadays, electronic document management is allowed. This provision is enshrined in Art. 312 of the Labor Code of the Russian Federation.

Return of an employee from vacation at the request of the employer

This issue is in no way regulated by the Labor Code of the Russian Federation. However, in accordance with Art. 125 of the Labor Code of the Russian Federation, an employee is allowed to return from paid rest only with his consent.

The Labor Code does not contain a single rule providing for the application of the law by analogy; accordingly, such a provision is not mandatory with unpaid leave. Although, of course, if the parties reach an agreement, this option is possible. Thus, the employer’s unilateral decision to return an employee from vacation is illegal.

ATTENTION !!! In conclusion, it is worth saying that, as a general rule, this type of leave is provided by the employer without any problems if there are serious reasons. Therefore, you just have to submit an application and wait for the order. But the law stipulates situations when the manager does not have the right to choose: he is obliged to provide leave.

Annual unpaid leave of fourteen days or more is not counted toward seniority and will not count toward your next paid leave. It is worth remembering that unpaid leave is voluntary - under no circumstances can an employer force you to take such leave. Violation of this rule will entail the imposition of administrative liability on management.

Vacation: procedure for granting, payment, accounting and tax accounting

Legal basis

Employees are provided with annual leave while maintaining their place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation).

Annual basic paid leave is provided to employees for 28 calendar days.

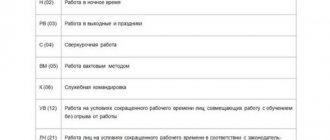

Annual additional paid leave (exceeding 28 calendar days) is provided:

— workers engaged in work with harmful and (or) dangerous working conditions (Article 117 of the Labor Code of the Russian Federation);

— employees with a special nature of work (Article 118 of the Labor Code of the Russian Federation);

- employees with irregular working hours (the duration is established by a collective agreement of at least 3 days) (Article 119 of the Labor Code of the Russian Federation);

- employees working in the regions of the Far North and equivalent areas (the list was approved by Resolution of the Council of Ministers of the USSR dated January 3, 1983 No. 12);

- in other cases provided for by the Labor Code and other federal laws.

Employers can independently establish additional leaves for employees. The procedure and conditions for granting these leaves are determined by collective agreements or local regulations (Article 115 of the Labor Code of the Russian Federation).

The duration of annual basic and additional paid vacations for employees is calculated in calendar days and is not limited to a maximum limit. Non-working holidays falling during the period of the annual main or annual additional paid leave are not included in the number of calendar days of leave (Article 120 of the Labor Code of the Russian Federation).

The right to use vacation for the first year of work arises for the employee after six months of continuous work with this employer. By agreement of the parties, paid leave may be granted to the employee before the expiration of six months. Leave for the second and subsequent years of work can be granted at any time of the working year in accordance with the order of provision of annual paid leave established by a given employer (Article 122 of the Labor Code of the Russian Federation).

The order of provision of paid vacations is determined annually in accordance with the vacation schedule approved by the employer, taking into account the opinion of the elected body of the primary trade union organization no later than two weeks before the start of the calendar year. The vacation schedule is mandatory for both the employer and the employee. The employee must be notified of the start time of the vacation against signature no later than two weeks before its start (Article 123 of the Civil Code of the Russian Federation). The vacation schedule is drawn up according to the unified form No. T-7 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

Paid leave must be provided to the employee annually. According to Art. 124 of the Labor Code of the Russian Federation, in exceptional cases when the provision of leave to an employee in the current working year may adversely affect the normal course of work of an organization or individual entrepreneur, it is allowed, with the consent of the employee, to transfer the leave to the next working year. In this case, the leave must be used no later than 12 months after the end of the working year for which it is granted.

It is prohibited to fail to provide annual paid leave for two years in a row, as well as to not provide annual paid leave to employees under the age of eighteen and employees engaged in work with harmful and (or) dangerous working conditions.

By agreement between the employee and the employer, annual paid leave can be divided into parts. Moreover, at least one part of this vacation must be at least 14 calendar days (Article 125 of the Labor Code of the Russian Federation).

Part of the annual paid leave exceeding 28 calendar days, upon written application of the employee, can be replaced by monetary compensation. When summing up annual paid leave or transferring annual paid leave to the next working year, monetary compensation can replace the part of each annual paid leave exceeding 28 calendar days, or any number of days from this part (Article 126 of the Labor Code of the Russian Federation).

Vacation pay calculation

The procedure for calculating the amount of vacation pay and compensation for unused vacation is established by Art. 139 Labor Code of the Russian Federation and pp. 9 – 12, 14 Regulations on the specifics of the procedure for calculating average wages, approved. Government Decree No. 922 dated December 24, 2007.

The average daily earnings for vacation pay are calculated for the last 12 calendar months preceding the month in which the employee is granted vacation by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days):

SD = ZPr: 29.4: 12, where

SD – average daily earnings;

ZPr – the amount of wages accrued for the billing period.

The amount of vacation pay is determined by multiplying the average daily earnings by the number of days in the period to be paid:

O = SD x CD, where

О – amount of vacation pay (vacation compensation);

KD – number of calendar days of vacation.

Example

The employee goes on vacation from 08/01/2011 to 09/05/2012 (36 calendar days). The employee worked the entire billing period from 08/01/2011 to 07/31/2012. During this period, his earnings amounted to 420,000 rubles. The average daily salary for vacation pay is RUB 1,190.48. (420,000: 29, 4: 12), the amount of vacation pay is 42,857.28 rubles. (RUB 1,190.48 x 36 calendar days).

If one or more months of the billing period are not fully worked out or time is excluded from it in the prescribed manner, then the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.4), multiplied by the number of full calendar months, and the number of calendar days in incomplete calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.4) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month.

Formula for calculating average daily earnings for an incompletely worked billing period:

SD = ZPr / [(29.4 x KPM) + Σ (29.4: KDm x KDo)], where

SD – average daily earnings;

ZPr – wages actually accrued for the billing period;

KPM - the number of fully worked calendar months;

KDm - the number of calendar days in a month not fully worked;

KDO - the number of calendar days actually worked in an incomplete month.

The amount of vacation pay is calculated using the formula:

O = SD x CD, where

О – amount of vacation pay;

KD – number of calendar days of vacation.

Example

The employee goes on vacation from 08/01/2011 to 09/05/2012 (36 calendar days). The employee worked the entire billing period from 08/01/2011 to 07/31/2012. The following are excluded from the billing period:

— sick time from 10/10/2011 to 10/20/2011 – 11 calendar days;

— leave without pay from December 26, 2011 to December 30, 2011 – 5 calendar days;

— business trip from 04/09/2012 to 04/12/2012 – 4 calendar days.

The actual salary accrued to the employee for the billing period (excluding temporary disability benefits and average earnings for business trips) amounted to 420,000 rubles.

To calculate average daily earnings, determine:

1) number of months worked in full – 9;

2) the number of calendar days in incomplete months and the number of calendar days worked in these months:

– October 2011 – 31 and 20;

- December 2011 - 31 and 26;

- April 2012 - 30 and 26.

Average salary for vacation: 420,000 rubles. : [(29.4 x 9) + (29.4: 31 x 20) + (29.4: 31 x 26) + (29.4: 30 x 26)] = 420,000 rub. : 333.71 calendar days = 1,258.58 rubles.

Vacation pay amount: RUB 1,258.58. x 36 calendar days = 45,308.88 rubles.

In cases where an employee works part-time (part-time, part-time), the amount of vacation pay is calculated in a similar way:

- if the billing period has been worked out in full, then the average daily earnings are determined by dividing the actual earnings for the billing period by 29, 4 and 12;

- if the billing period has not been fully worked out, then the average earnings are calculated by dividing the actual earnings for the billing period by the number of days and partial months in this period: (29.4 x number of full months) + (number of calendar days of partial months).

The average daily earnings for payment of vacations provided in working days, as well as for payment of compensation for unused vacations, are determined by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week. And the amount of vacation pay is by multiplying the average daily earnings by the number of working days of vacation.

Reflection in accounting

Vacation pay payable to the employee is reflected in the credit of balance sheet account 70 “Settlements with personnel for wages” in correspondence:

— with production cost accounts (20, 23, 25, 26, 29);

— with an account for accounting expenses for the sale of finished products, distribution costs in trade (44);

— with a reserve account in cases where the organization creates a reserve for vacation pay (96).

At the same time, it is necessary to accrue insurance contributions for compulsory social, pension and health insurance on the amount of vacation pay in correspondence with the same accounts as vacation pay:

Debit 20, 23, 25, 26, 29 Credit 69;

Debit 44 Credit 69;

Debit 96 Credit 69.

Personal income tax must be withheld from accrued vacation pay: Debit 70 Credit 68, subaccount “Calculations with the budget for personal income tax.”

According to Art. 136 of the Labor Code of the Russian Federation, payment for vacation is made no later than 3 days before its start. In this regard, the employer is obliged to accrue and record vacation pay due to the employee within this period.

As for “rolling” vacations, which begin in one month and end in another, then, in our opinion, they should be fully charged to the appropriate cost accounts in the month in which the employer becomes obligated to pay vacation pay. This follows from clause 18 of PBU 10/99 “Expenses of the organization” (approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n), according to which expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other forms of implementation.

However, some accountants, based on the same paragraph 18 of PBU 10/99, include “carrying over” vacation pay as expenses in those months in which the vacation occurs. In this case, the credit of balance sheet account 70 reflects the entire amount of vacation pay due to the employee, and the debit to the cost accounting accounts includes only the amount related to the current month. The amount of vacation pay due for the next month is debited to balance sheet account 97 “Future expenses.” The next month, the amount of vacation pay recorded in the debit of account 97 is written off as expenses (Debit 20, 23, ... Credit 97). This method of accounting for vacation pay is used to avoid differences between accounting and tax accounting.

Taxation

According to paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, expenses for wages retained by employees during vacation are classified as expenses that reduce the tax base for income tax. Clause 4 of Art. 272 of the Tax Code of the Russian Federation establishes that labor costs are recognized as an expense on a monthly basis, based on the amount accrued in accordance with Art. 255 of the Tax Code of the Russian Federation of labor costs.

According to the Ministry of Finance of the Russian Federation, expenses for “rolling” vacations should be distributed in proportion to the days of vacation that fall on each reporting (tax) period (see letters dated December 23, 2010 No. 03-03-06/1/804, dated June 1, 2010 No. 03-03-06/1/362).