19.07.2019

1

1429

4 min.

When going on a legally required vacation after a hard year of work, a person receives a payslip from which he sees that his vacation pay is less than his salary. Is this an accounting error or is there another reason? The answer to this question may be surprising. We will consider all the information on this problem in the article.

If the experience is less than a year

Vacation benefits are accrued to employees based on their average income received during the year preceding the vacation. In this case, only the income that depends on the work performed by the employee is taken into account.

How many days does it take to issue?

All citizens of the Russian Federation working under an employment contract have the right to paid annual leave. Its minimum duration is twenty-eight days (Article 115 of the Labor Code of the Russian Federation), and they can be divided into several parts (Article 125 of the Labor Code of the Russian Federation).

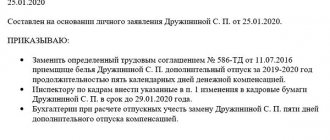

But some employees, by law, can take a leave of absence from work before the expiration of this period. In such cases, the subordinate must submit an application to management for consideration. An order is issued based on this document. It is drawn up on standard form T-6 or T-6a.

In order for the amount of the cash payment to be comparable to the salary in the month the employee went on vacation, his income for the previous 12 months is multiplied by an adjustment factor. The value of this indicator is calculated for each month of the reporting period.

What is a correction factor and when to apply it?

Law No. 34 of March 18, 2021 introduced an electronic form for transmitting information on labor and civil relations. In this regard, a new draft TC is being prepared. The government wants to make it possible to apply for leave electronically. This will simplify the document flow procedure.

To calculate average earnings, it is necessary to add up all labor payments to the employee and divide by the number of days he actually worked in the last working year. The result is the average employee's earnings per 1 working day. This number must be multiplied by the number of days of rest.

No changes have been made to this rule. Thus, the payment period for vacation pay in 2021, as in all previous years, is three days. However, the practical application of this rule has long been a matter of debate. It is not clear from the text of the article whether the payment period for vacation pay is 3 working or calendar days, and whether the payment day is included in the specified period. No separate methodological instructions were given in this regard, however, explanations from the Ministry of Labor did follow, although they were quite contradictory; there is also no uniform judicial practice on this issue.

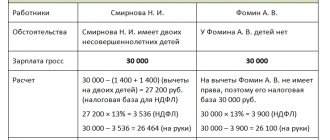

A few words about personal income tax

The process of crediting vacation pay is carried out using the usual method - card, cash at the cash desk. The payment of the required amount is reflected in the accounting report. Failure to comply with this rule will automatically result in the appointment of an official desk audit. This situation, in turn, will lead to rather unpleasant consequences for the employer. These may include fines and other equally serious sanctions.

Does an employer have the right not to pay vacation?

The first option is the most compromise and most adequate, you simply explain to the employer that by refusing to pay vacation pay, he violates Article 136 of the Labor Code of the Russian Federation and, accordingly, the rights of the employee. Invite the employer to pay you vacation pay, and if they refuse, you can move on to the next step, or you can send the employer a request in writing where you demand payment of vacation pay either by card or in cash, you can send such notice to the employer by mail with an inventory attachments and notification of delivery, or prepare 2 copies and hand them over to the employer, but here the employer must put an acceptance mark on the second copy and give it to you, but they may refuse to accept it, so it’s best to send the notification by mail and you’ll have an inventory in your hands and a little later you will receive notification of delivery. Before answering this question, you must first look at Article 114 of the Labor Code of the Russian Federation, this article states that the employer must provide the employee with annual leave during which the employee’s place of work (his position), as well as his average earnings, is preserved.

Please note => Contract for the provision of sewing services

What innovations give

If the company’s policy provides for the provision of vouchers to employees, then this condition was implemented before the innovations. If the employment contract does not provide for rest at the expense of the employer, then this law does not change anything.

Maximum amount

Since in most cases people go on vacation with their spouses, children or entire families, the legislation provides for the right to receive compensation for a trip not only to employees of the organization, but also to their relatives (clause 24.2 of Article 255 of the Tax Code of the Russian Federation):

Sometimes situations arise when an employee asks for leave from the next day for family reasons. Despite the fact that this is the employee’s initiative, paying vacation pay within such a period is a violation of labor laws. It entails administrative punishment (clause 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation): for officials - a warning or a fine in the amount of 10,000 to 20,000 rubles, for legal entities - a fine of 30,000 to 50,000 rubles.

If the employer does not object to unscheduled leave and is ready to pay vacation pay on the day of application, you should invite the employee to take, for example, unpaid leave for the next three days, and only then paid leave.

Deadlines for payment of vacation pay: what does “three days before” mean?

In some cases, courts take a different point of view. One of the latest cases regarding the timing of payment of vacation pay was considered in the Perm Regional Court. The court considered the payment of vacation pay on January 15 for vacation granted from January 18 and a number of similar situations to be a violation of labor legislation. In its decision, the court ruled that the period for payment of vacation pay must be at least three days. Similar precedents have happened before (see the ruling of the Chelyabinsk Regional Court dated September 17, 2021 No. 11-11043/2021 and the ruling of the Rostov Regional Court dated September 16, 2021 No. 33-11864). In this regard, we recommend not to take risks, but to ensure that there are at least three full days (72 hours) between the start of the vacation and the transfer of funds. Labor legislation does not prohibit transferring vacation pay in advance.

Who is entitled to vacation pay?

You should receive money for all days of vacation three calendar days before it starts or earlier - it depends on the speed of the accounting department. But not later than the Labor Code of the Russian Federation Article 136. Procedure, place and terms for payment of wages for this period.

When you don't get paid for your vacation

In exceptional cases, the vacation can be postponed for a year. At the same time, the organization cannot leave an employee without leave for more than two Labor Code of the Russian Federation Article 124. Extension or transfer of annual paid leave years. So an employer who does not need problems with inspection authorities will persistently send you on vacation.

Therefore, if vacation starts on Monday, when are vacation pay paid? Funds can be transferred on Friday. In addition, tax is also charged on vacation pay. This fact should not be forgotten when calculating funds.

If the day of payment of vacation pay falls on a weekend or non-working holiday, the money must be transferred on the previous working day. And if Mikhailov A.S. decided to go on vacation, for example, from May 23, 2021, vacation pay would have to be paid no later than May 18, 2021 (Friday).

What should an employee’s employer do in an “interesting situation”?

Thirdly, submission of documents and financial settlements with the Social Insurance Fund and the employee. If the staff is small and there is only one accountant, his workload increases significantly with each maternity leave. Although in theory everything is not so complicated.

According to experts, the established restrictions make the new benefit most interesting for those enterprises that pay their employees fairly high “white” salaries. As a rule, these are representatives of large and no less popular medium-sized businesses, whose managers pay for voluntary health insurance for employees and also provide them with another form of social support.

How many days before vacation are vacation pay paid? Deadlines for payment of vacation pay according to the Labor Code

Every employer should be clear about their responsibilities. The most important function of any manager is the timely payment of money to his employees. The Labor Code of the Russian Federation, the Code of Administrative Offenses of the Russian Federation and some other laws and regulations establish certain liability for non-payment of wages, or their payment, but not made on time. Annual paid leave must be included in a special vacation schedule and also agreed with the employee himself. It is also worth noting that the worker has the right to transfer vacation (however, this possibility exists for no more than two years in a row). Vacation can be divided; Moreover, each part of it should not be less than 14 days.

What amounts are taken into account?

After the first signs of pregnancy appear, a woman should be observed by her doctor. At the thirtieth week, the gynecologist issues a certificate of incapacity for work for 140 days (70 before and 70 after childbirth). In case of any complications, an additional sick leave is issued for 16 days.

Who pays for maternity leave - the state or the employer?

I couldn’t even imagine how many subtleties there are in this matter. From the employee’s side, everything seems so simple - she took maternity leave and that’s it, but from the employer’s side there is a lot of red tape. In large enterprises everything is more organized than in small private firms.

- that have harmful or dangerous working conditions;

- whose work is characterized by special conditions;

- that they have irregular working hours;

- that they work in the Far North or in a region that is considered equivalent to it.

Current regulatory framework

- female students who study full-time at universities , vocational and secondary technical educational institutions. They arrange the payment of financial support at the educational institution;

- women who do not have a permanent job due to staffing reductions at enterprises or their complete liquidation.

How is maternity leave paid if the employer is an individual entrepreneur?

If an employee works in an organization for less than 12 months, then the calculation period for him is the period from the date of his hiring to the last calendar day of the month preceding the month the vacation began (clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2021 No. 922) .

There are no restrictions when going on vacation. When calculating, it will be necessary to take into account the actual time worked. The days are not getting shorter. If a person has not worked for a long time, the calculation should take into account only those months, including partial months, when the employee was at work. Determine the actual outputs that will be taken into account when calculating in proportion. When the salary increases, a coefficient is calculated. The amount of new earnings is divided by the amount of earnings that was established before the increase.

There is a list of payments established by regulations that must be taken into account when making calculations. This list reflects the amounts received by the employee in fulfilling the obligation under the employment contract.

Design rules

A person has the right to go to it after working for at least six months in the company. If this is provided for by the agreement between the employee and the employer, the person may take leave earlier. This opportunity is available to: In all cases, the condition of continuity of service must be observed.

All citizens of the Russian Federation working under an employment contract have the right to paid annual leave. Its minimum duration is twenty-eight days (Article 115 of the Labor Code of the Russian Federation), and they can be divided into several parts (Article 125 of the Labor Code of the Russian Federation).

Vacation pay

Sales Manager N.N. Stebakov leave was granted from April 16, 2021. The billing period - from April 1, 2021 to March 31, 2021 - was fully worked out by him. The bonus for 2019 was awarded to him on April 6, 2021. Despite the fact that the annual bonus does not fall into the billing period, its amount must be taken into account in full when calculating vacation pay. While the employee is on vacation, he retains his place of work (position), as well as his average earnings (Article 114 of the Labor Code of the Russian Federation). Already from this norm of the Labor Code of the Russian Federation it is clear that vacation payment is made based on the employee’s average earnings. But in order to understand how vacation is paid, you need to determine for what period this average earnings are calculated, what payments are taken into account and what formula is used to calculate it.

If the experience is less than a year

In cases where this organization began an inspection at the request of an employee, then, in addition to financial liability, fines will also be imposed on the employer and those responsible for paying vacation pay in the amounts established by current legislation.

Responsibility for violation

For carrying out work in some specialties, employees are also entitled to additional leave, for example, teachers rest for at least fifty-two days annually, and even more in the north.

The type of leave of service includes the temporary period of time worked, rest and holidays, annual leave, periods of downtime, forced absences, leave without pay for up to 14 days, and time of incapacity for work.

If the period is worked out in full and leave is granted to the employee in calendar days, then the average daily earnings are determined as follows (Article 139 of the Labor Code of the Russian Federation, clause 10 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2021 No. 922):