A simple piecework wage system

With a simple piece-rate wage system, wages are calculated based on the piece rates established in the organization and the quantity of products (work, services) produced by the employee.

Salary can be calculated as follows:

Wage

= Piece price per unit of finished product x Quantity of manufactured products

The piece rate is determined by the formula:

Hourly (daily) rate / Hourly (daily) production rate = Piece rate

The production rate is the amount of products, work, and services that each worker must produce per unit of working time.

Production standards are determined by the management of the organization. The size of the hourly (daily) rate must be established in the Regulations on remuneration and staffing of the organization.

Example. Simple piecework wages

The hourly rate of A.N. Ivanov, an employee of Passiv LLC, is 200 rubles/hour. The production rate is two parts per hour. During April of the reporting year, Ivanov produced 95 parts. The piece price for one product is: 200 rubles.

: 2 pcs. = 100 rub./pcs. Ivanov’s salary for April of the reporting year will be:

100 rubles. × 95 pcs. = 9500 rub.

Remuneration at an hourly rate in the 1C program: Salaries and personnel management 8

To calculate payment at an hourly rate, the program uses a predefined type of accrual, Payment at an hourly rate (section Settings - Charges

).

In order for this accrual to be available in the list of accruals, it is necessary to select the

Apply hourly

checkbox Hourly (section

Settings - Payroll calculation - link Setting up the composition of accruals and deductions

). The accrual type in the program is already configured and ready for use.

Accrual Payment at an hourly rate

can be assigned to an employee as a planned document

Hiring

.

On the Remuneration

, it is indicated that the employee is assigned a planned accrual

of Payment at an hourly rate.

In order for the monthly Bonus (percentage) of 100% to be accrued for Payment at the hourly rate, it is necessary to add the monthly Bonus (percentage) 100% to the list of the Calculation base

accrual Payment at an hourly rate.

Changes in wages can be made using the following documents:

- Personnel transfer (section Personnel – Hiring, transfers, dismissals

);

- Changes in planned accruals and Changes in wages (section Salary – Changes in employee pay

), intended to reflect changes in working conditions (planned accruals) of one or more employees.

Changes to the hourly tariff rate are made using the document Change of wages. The document is intended to change the employee’s current accruals, as well as the procedure for calculating his advance payment from a certain date to a permanent period. It allows you to avoid entering the Personnel Transfer document if the employee only needs to change such conditions.

Next, the accrual and calculation of payment at an hourly tariff rate is carried out when calculating wages for the month directly using the Payroll document.

To calculate the result of payment at an hourly rate, the employee’s hourly rate is multiplied by the number of hours actually worked by the employee:

Result = TariffRateHourly * TimeInHours

The size of the employee's hourly wage rate is determined at the time of filling out the Payroll document and is recorded in a line in the tabular part of the document as the Hour indicator. tariff for charging Payment at an hourly rate. The accrual result is calculated based on the tariff rate indicated in the line of the tabular part of the document.

The number of hours actually worked during the period is determined by the deviation method: the time falling during periods when the employee was absent from the workplace is excluded from the standard hours according to the employee’s schedule. The absence of an employee must be registered in the program with specialized settlement documents, i.e. the employee must be accrued for the time of absence.

If the employee’s hourly wage rate changed during the billing month, then the payment is accrued and calculated separately for each period of the month during which a certain accrual amount was in effect. In this case, when automatically filling out a document, the line for calculating payment at an hourly rate for an employee is divided into several lines: one for each accrual amount and period of its validity.

Piece-bonus wage system

With a piece-rate-bonus system of remuneration, the employee is awarded bonuses in addition to wages.

Bonuses can be set either in fixed amounts or as a percentage of wages at piece rates.

Wages under the piecework-bonus wage system are calculated in the same way as under a simple piecework wage system. The bonus amount is added to the employee's salary and paid along with the salary.

Buy a book

Salary 2021 with a detailed description of all remuneration systems, rules for calculating and paying taxes in 2021

Example. Salary calculation for piecework-bonus payment system

Turner 3rd category S.S. Petrov has a piecework wage system. The piece rate for a 3rd category turner is 80 rubles. for one finished product. According to the Regulations on bonuses, if there is no defect, employees of the main production are paid a monthly bonus of 3,000 rubles. In April, Petrov produced 100 products. Petrov’s basic salary for April of the reporting year will be: 80 rubles/piece.

× 100 pcs. = 8000 rub. The total amount of Petrov’s accrued wages for April of the reporting year will be:

8,000 rubles. + 3000 rub. = 11,000 rub.

General information

A piece rate is a form of employee remuneration in which the amount received directly depends on the volume of work performed and units of production produced. You can introduce this option for paying staff if you can calculate the result of labor and track its quality.

In most cases, time wages are used. According to this scheme, remuneration is received, for example, by health workers, teachers, administrators, security guards, accountants, etc. Piece-rate pricing is a suitable calculation option for welders, turners, copywriters, taxi drivers, repairmen, etc.

Piece-progressive wage system

With this remuneration system, piece rates depend on the quantity of products produced for a given period of time (for example, a month). The more products a worker produces, the higher the piece rate.

Example. Application of piecework-progressive forms of remuneration

The following piece rates are established:

| Number of products produced per month | Piece rate |

| up to 110 pcs. | 80 RUR/pcs. |

| over 110 pcs. | 85 RUR/pcs. |

During April of the reporting year, employee A. N. Somov produced 120 products.

Somov’s salary for April of the reporting year will be:

(110 pcs. × 80 rub.) + (10 pcs. × 85 rub.) = 9650 rub.

How is the “Piece Earnings” indicator determined?

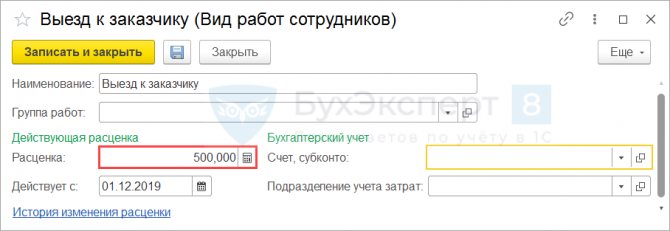

Piece Earnings indicator is calculated by type of work, which is stored in the Types of Work (Settings - Types of Work). In the form of a directory element, you must indicate the Price for the work, and also indicate the date Valid from .

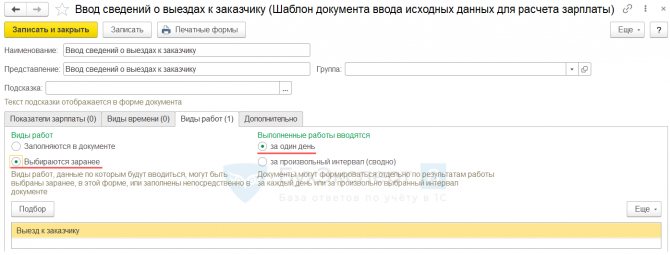

Data on the volume of work by employee is entered in the document Data for salary calculation . The appearance and procedure for working with the document depends on the settings of the Source Data Entry Template .

Let's look at piecework payment using examples.

Example 1. Direct piecework wages

According to the employment contract, calculation of wages for local network repair specialist R.G. Anemonov. is carried out depending on the number of visits to the customer. The cost of one trip is 500 rubles. Daily Anemonov R.G. provides information on the number of visits to clients. Information is promptly registered in the program. Data on the number of trips by R.G. Anemonova. for December are presented in the table.

date Number of visits to clients 02.12.2019 3 03.12.2019 2 04.12.2019 1 05.12.2019 4 06.12.2019 2 09.12.2019 2 10.12.2019 1 11.12.2019 4 12.12.2019 2 13.12.2019 3 16.12.2019 2 17.12.2019 1 18.12.2019 3 19.12.2019 3 20.12.2019 4 23.12.2019 1 24.12.2019 2 25.12.2019 2 26.12.2019 3 27.12.2019 3 30.12.2019 1 Total 49 It is necessary to set up the calculation of piecework wages for R.G. Anemonov, enter primary data into the program and calculate R.G. Anemonov’s wages. for December 2021

According to the conditions of the problem, piecework earnings of R.G. Anemonova. cannot be compared with time-based payment, so in the calculations we will use the Piece Earnings , which we set up earlier in the section Setting up Piece Payment Accruals .

Let's create a new Type of work and indicate its Price .

Let's set up a Template for entering initial data for entering information about the piecework earnings of R.G. Anemonov. Let's define the basic settings of the template:

- because according to the conditions of the task, only one Type of work , it is more convenient to use the document Data for salary calculation with an already specified Type of work , so as not to indicate it every time in the document. Therefore, we will indicate in the template that Types of work are selected in advance and add the required Type of work using the Selection ;

- data on the number of visits to clients is recorded in the program daily, so set the switch Work completed is entered in the position For one day .

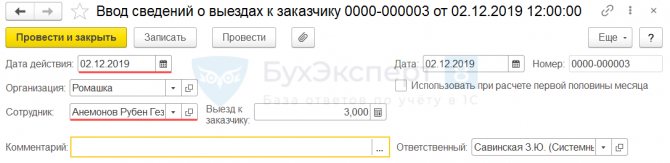

To enter data on the number of trips Anemonova R.G. to the customer for 12/02/2019 we will create a document Data for salary calculation . Let's fill in the Valid Date , indicate the Employee and the number of trips.

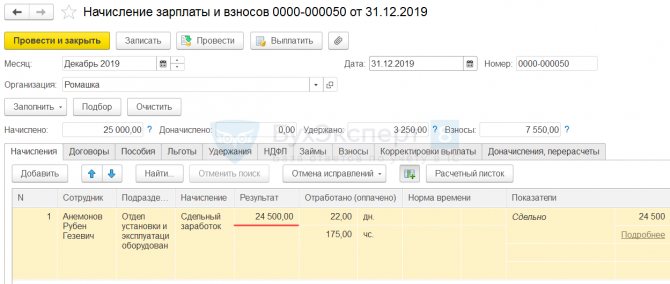

We will create similar documents for each day of work of R.G. Anemonov. To calculate an employee’s salary for December 2021, we will create a document Calculation of salaries and contributions . As a result of automatic calculation, the employee was credited 24,500 rubles.

Let's check the calculation of piecework payment:

- 500 (cost of 1 trip) * 49 (number of trips per month) = 24,500 rubles.

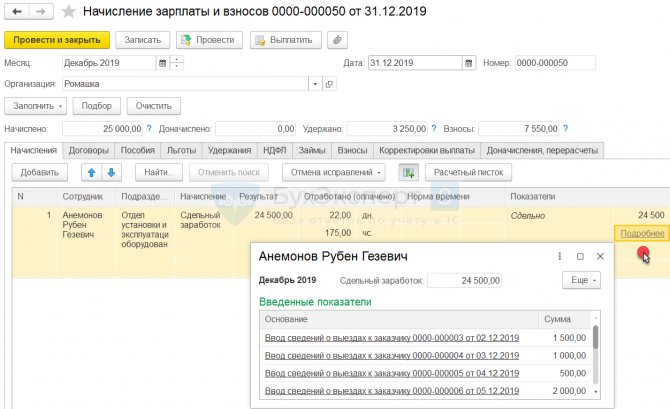

By clicking the link More details , you can open a breakdown of the amount of Piece earnings in the context of documents Data for salary calculation .

Example 2. Piece-rate wages taking into account salary

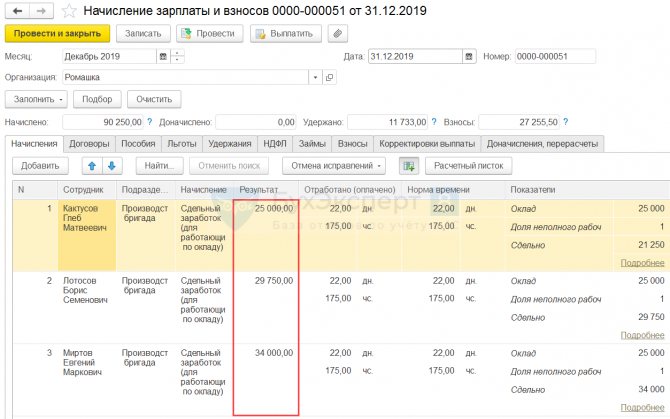

Salaries of employees of the production team Kaktusova G.M., Lotosova B.S. and Mirtova E.M. calculated depending on the quantity of products produced, but not less than 25,000 rubles.

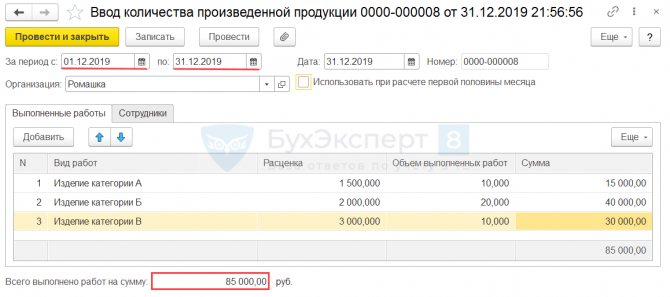

The team's employees produce 3 types of products with different prices. Data on the quantity of products produced are recorded for the month as a whole. In December 2021 Products produced:

Product type Price, rub. Volume of production Total cost, rub. Category A product 1 500 10 15 000 Category B product 2 000 20 40 000 Category B product 3 000 10 30 000 The total cost of products produced per month (RUB 85,000) is distributed among employees depending on the coefficients:

- Kaktusov G.M. – 0.25;

- Lotosov B.S. – 0.35;

- Mirtov E.M. – 0.4;

It is necessary to set up the calculation of piecework wages for the production team, enter primary data into the program and calculate employee wages for December 2019.

According to the conditions of the problem, the piecework earnings of workers are compared with wages, so in the calculations we will use the standard accrual Piecework earnings (for salaried workers) .

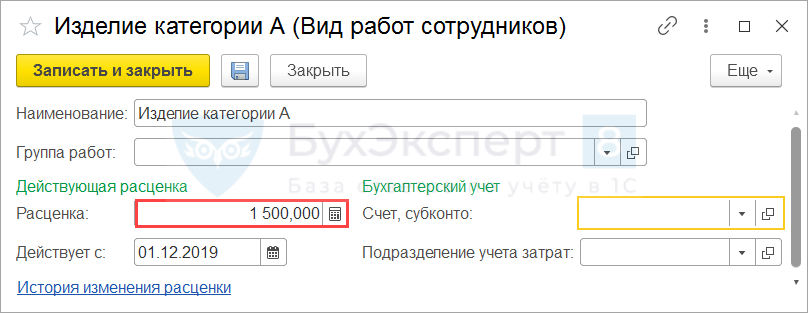

Let's create a new Type of work for a product of category A and indicate its Price .

In a similar way, we will create Types of work for products of categories B and C.

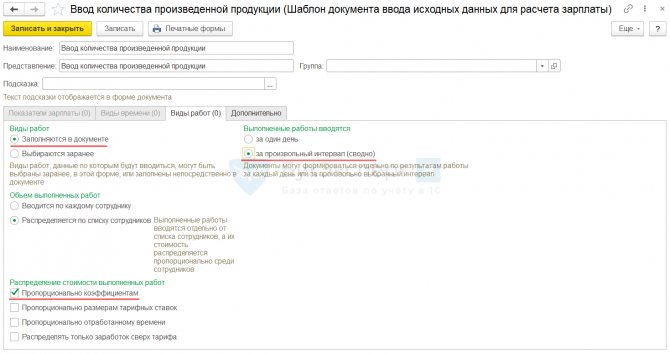

Let's set up a Template for entering initial data to enter information about the quantity of products produced. Let's define the basic settings of the template:

- because The template for entering the initial data will be the same for each type of product, we will set up a single template and indicate that Types of work are filled in in the document ;

- data on the volume of output is recorded in the program cumulatively for the month, so set the switch Completed work is entered in the position For an arbitrary interval (cumulative) ;

- observing the conditions of the problem, we set the setting that the volume of output is distributed among the list of employees according to the method Proportional to coefficients .

Let's create a document Data for salary calculation to enter information about the volume of production. We will indicate in the document that data on piecework earnings is entered for the period from 12/01/2019 to 12/31/2019. On the Work Completed , fill in the Types of Work and Volume of Work Completed . The tabular indicators Price and Amount , as well as the final indicator Total work completed for the amount will be filled in automatically.

On the Employees , fill in the list of employees, as well as Coefficients . Amount indicator for each employee will be calculated automatically.

Let's create a document Calculation of salaries and contributions to calculate employee salaries for December 2021. As a result of the automatic calculation of the amount of accruals for Lotosov B.S. (RUB 29,750) and Mirtov E.M. (34,000 rubles) coincide with the amount of their piecework earnings. The amount of piecework earnings of Kaktusov G.M. (21,250 rubles) turned out to be less than the salary established for the employee (25,000 rubles). As a result, Kaktusov G.M. the larger of the compared amounts was accrued (RUB 25,000).

Indirect piecework wage system

The indirect piecework wage system is used, as a rule, to pay workers in service and auxiliary industries. Under such a system, the wages of workers in service industries depend on the earnings of workers in main production, who receive wages on a piece-rate basis.

With an indirect piecework wage system, the wages of workers in service industries are set as a percentage of the total earnings of workers in the production they serve.

Example. Application of indirect piecework form of remuneration

To the employee of auxiliary production of Aktiv LLC S.S. Petrov established an indirect piecework wage system. Petrov receives 3% of the earnings of primary production workers. In November of the reporting year, the earnings of primary production workers amounted to 560,000 rubles. Petrov’s salary for November will be: 560,000 rubles.

× 3% = 16,800 rub. Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » Can an employee with piecework wages have a monthly standard of hours less than according to the calendar? In such cases, should the employer pay for additional days off due to the inability to provide the employee with work?

Question.

If an employee is on a piecework wage, can he have a standard number of hours per month that is less than according to the calendar? If there are 120 hours in January, and we put 100 hours on their report card and put 100 hours on their schedule. Wouldn't it turn out that we have to pay them for additional days off, under the article that the employer cannot provide work?

Answer

In accordance with Article 150 of the Labor Code of the Russian Federation, when an employee with piecework wages performs work of various qualifications, his work is paid at the rates of the work he performs.

Art. 150, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on October 5, 2015) {ConsultantPlus}

Piece workers' wages depend on the amount of work they perform.

If there are non-working holidays in a month, piece workers are not able to work on these days. Accordingly, they lose part of their salary.

Therefore, for non-working holidays, when piece workers were not involved in work, they were entitled to additional remuneration.

“Question: In our company, piece workers work in shifts. The night shift starts at 20.00 and ends at 8.00 the next day. Break - from 1.00 to 2.00. According to the schedule, some employees' work shifts fall on the nights of April 30 to May 1, then from May 4 to May 5. How to pay piece workers on May 1, 2, 3 and 4? Are they entitled to additional remuneration for the non-working holiday on May 1? After all, the holiday was only part of the shift. Is there such a reward for May 4th? Is it necessary to pay it for May 2 and 3, if these days were days off for them according to the employees’ schedule? (“Salary”, 2015, N 5) {ConsultantPlus}”

In accordance with Art. 112 of the Labor Code of the Russian Federation, employees, with the exception of employees receiving a salary (official salary), are paid additional remuneration for non-working holidays on which they were not involved in work. The amount and procedure for payment of the specified remuneration are determined by the collective agreement, agreements, local regulations adopted taking into account the opinion of the elected body of the primary trade union organization, and an employment contract. Amounts of expenses for the payment of additional remuneration for non-working holidays are included in the full amount of labor costs.

Art. 112, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on October 5, 2015) {ConsultantPlus}

Thus, in months that include non-working holidays, the employer is obliged to additionally pay for these days to piece workers and employees who have an hourly (daily) tariff rate, even if they do not work on such days. The amount of additional payment is determined by the employer independently in a local regulatory act of the organization (for example, regulations on wages) or in a collective and (or) employment agreement

{Article: How non-working holidays are paid for piece workers and workers with an hourly (daily) tariff rate (Shapoval E.A.) (“General Book”, 2009, N 1) {ConsultantPlus}}

There are no special codes for reflecting such days in the time sheet for this category of workers. As a rule, they are reflected by the letter code “B” or the number “26”. The column under the code is not filled in. But so that the accountant can see for how many non-working holidays it is necessary to pay compensation to piece workers, you can enter an additional designation, for example, the letter code “VK”. In addition, you can add the number of such days to the final table by adding a special column to it.

Article: Filling out the working time sheet in case of “deviations” (Shapoval E.A.) (“General Ledger”, 2015, No. 20) {ConsultantPlus}

Selection of documents

Question: ...During the inspection, it was established that an employee with piecework wages was not given additional payment for non-working holidays. The employer did not have a local regulation establishing the amount and procedure for paying remuneration to employees who do not receive an official salary for non-working holidays. Is it lawful to issue an order obliging the employer to issue a corresponding act and pay the employee additional remuneration for non-working holidays in accordance with this act? (Expert Consultation, 2014) {ConsultantPlus}

Article: How non-working holidays are paid (Shapoval E.A.) (“General Ledger”, 2010, No. 2) {ConsultantPlus}

Question: Should an additional payment be paid for non-working holidays from 01/01/2013 to 01/08/2013, on which an employee with piecework wages was not involved in work, if this employee was on annual paid leave from 12/26/2012 to 01/13/2013 ? (Expert Consultation, 2013) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, December 2015.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

Employee motivation

Often, a manager, in an effort to increase the interest of employees in their work activities, uses a combined calculation procedure: piecework rates and a fixed amount of remuneration.

As a rule, in such cases, the employee is guaranteed to receive a small monthly salary. It allows you to provide for essential needs during the low season. In addition to this salary, the employee is paid for each unit of product sold or produced.

Conditions for switching to piecework payment

It is advisable to introduce such a system at an enterprise if:

- Accounting for manufactured goods or services provided has been established.

- The supply of materials, raw materials and other resources for production is carried out uninterruptedly.

- The company has an effective quality control system.

- Adequate tariff schemes and production standards have been developed.

- It is possible to track quantitative indicators of the activities of each individual employee.

- The company needed to significantly increase its sales/production level.

Important indicators

To determine the piece rate, you need to know some additional quantities. Among them:

- Production rate. It represents the minimum number of units that must be produced or sold in a certain period of time. As a rule, hourly, monthly, and daily norms are established.

- Tariff rate. It represents the minimum guaranteed amount of remuneration for an employee per month. The rate is set in accordance with qualifications. It is worth saying that salary is only part of the salary. In addition to the tariff, it may include social payments, bonuses, etc.

- Tariff schedule. It is a scheme for calculating payment for work in accordance with its complexity and qualifications of the employee.