According to the Labor Code of the Russian Federation, there are different ways to pay employees. Every employer has the right to choose the one that best suits him. However, it must be taken into account that the working conditions of workers must comply with the requirements that the law imposes on employers when they prefer one or another system for calculating and issuing wages. In other words, not all work can be paid by the piece and not always a salary is due for work. This article will discuss time-based payment, its features, types, disadvantages and advantages.

How to calculate earnings for time-based wages ?

How is time-based wage system different from other systems?

Before moving on to a detailed analysis of the “time-based” system, it should be noted that it is widespread in all developed countries. In Russia, more than 30% of workers receive payment using the time method.

Question: I work officially, the pay is hourly plus bonuses, the work is not temporary, but that month a week before the end of the month they said that I don’t need to go to work, I work in a call center, we provide services to the bank. They said that the base had ended, but at the same time we sat at home and did not work, naturally, we did not pay anything for it. Is this legal? View answer

What is the essence of the time payment system? With “time work,” the employee’s salary depends on the time actually worked, but only if all the functions assigned to him are effectively performed. In order for a company to be able to pay staff salaries according to this principle, it must comply with a number of certain conditions, such as:

- control over the time actually worked by each person;

- awarding salary grades and qualifications to employees based on the results of their education and work experience;

- determination of salary amounts based on the functions performed.

Let's decipher the concept. Time pay is a type of salary that is received by an employee with a certain qualification for the time he actually worked.

Attention! Time-based pay can be applied to both core personnel and temporary employees and part-time employees.

In turn, “time work” can be of several types: simple, mixed, with a standardized task, and time-bonus.

How to calculate earnings with a time-bonus wage system ?

What is a time wage?

Each enterprise has its own specific form of remuneration. This is due to the specifics of production. For example, in one company employees are paid for the quantity of products they produce, and in another - for the time actually worked.

The manager himself determines what kind of salary he will have in production. But nevertheless, this issue is coordinated with the trade union organization. Every employee who gets a job can find out about his salary in advance. The type and form of monthly payments is prescribed in the employment contract.

In the Russian Federation, only 30% of enterprises have time-based wages, although, for example, in the USA this figure has exceeded 70%. Now let’s decipher the concept itself.

Time wages are a type of salary where the amount of employee payments directly depends on the hours, days or months actually worked. This takes into account special working conditions and qualifications of specialists.

Simply put, a time-based form of remuneration is when wages are paid not for the quantity (volume) of work performed, but for the time it is performed. That is, the hours of work that were spent on completing a particular task are paid.

Salaries are calculated based on the completed working time sheet. There, the standard keeper indicates how many hours or days the employee worked.

“Time bill” as a payment method: types and features

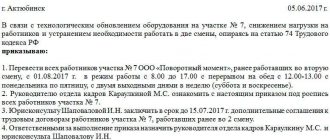

As the Labor Code of the Russian Federation states, wages for hired workers are set by the employer. At the same time, he is obliged to be guided by the letter of the law, the remuneration systems and regulations adopted within the company, the collective agreement, as well as the conditions specified in individual employment contracts. Before introducing a new payment system at an enterprise or switching from one type of calculation and issuance of salary to another, the employer is obliged to coordinate and approve this with the trade union body, if there is one.

There are several types of time payments:

- Simple . This is the employee’s salary in its pure form for the time worked by him de facto. The basis here is the tariff rate. To calculate a simple “time clock”, you can take different periods: hours, days, weeks or a month.

- Time-based bonus payment with a standardized task . This method of payment includes the nuances of both “time work” and piecework payment. Thanks to this form of payment, employees can rest assured that specific tasks will be provided both to themselves, at their individual workplaces, and to the structural department as a whole. Thus, several goals are achieved at once: higher quality of finished products, savings in material resources, as well as collective, and therefore more fruitful, work. Ultimately, employees’ salaries include both “overtime” for time reliably worked and an additional bonus for results, that is, fulfillment of the set plan.

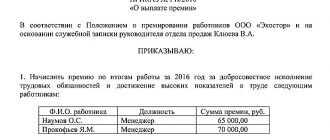

- Time-bonus system . Here, in addition to simple “time work,” the manager can assign a bonus to the employee. The amount of bonuses is determined individually, depending on the qualitative and quantitative indicators of labor. For employees, this method of payment is quite often an excellent motivator, because if the bonuses are economically justified and worthy, then the employees work with triple the energy.

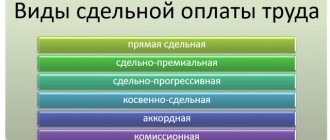

- Mixed system . It consists of elements of “time work” and piecework payment. Here it is worth briefly explaining what a “piecework” system is. Its meaning is that payments are made to an employee for a specific quantity of goods produced or services sold in a certain period of time. As a rule, this payment method is used when the quantity of products manufactured or services provided can be measured in units. In other words, the higher the amount of work done, the higher the salary. Actually, the main advantage of the “deal” is that the salary directly depends on the final results of the work performed. Therefore, during a transaction, to increase labor efficiency, the employer does not need to make any special efforts, since the “self-motivator” of employees is activated. True, piecework payment also has disadvantages: in the pursuit of quantity, employees often sacrifice quality, and in the event of any production problems, for example, equipment breakdown, employees do not receive any compensation payments.

Comparative characteristics of time and piecework wages

Each form of salary has its pros and cons. It is impossible to say unequivocally which one is better and which one is worse. Each company has its own type of salary.

Nevertheless, we provide a comparative description of different types of remuneration for workers.

| Criteria for evaluation | Forms of remuneration | |

| Piece wages | Time salary | |

| Where is it used? | In enterprises where any product is produced, or where quantitative indicators are valued | In the service sector, services, in the case of project orders. That is, where the quality of the work performed is valued |

| Dependence of wages on labor productivity | Salary directly depends on the volume of work performed. The higher the labor productivity, the more the employee will earn | There is no dependence, or it is indirect. The employee receives the salary due to him, even if he works at half capacity (unless a bonus is provided) |

| Who benefits? | Beneficial for the employer, because he pays only for the product produced | Beneficial for the employee. He doesn’t have to try, because he’ll still get his salary |

| Salary stability | Unstable. If an employee is absent from work (even for a good reason), he will still not receive wages for the days missed | Stable, i.e. guaranteed |

| Availability of motivation | Present. Employees always strive to do more to get a higher salary | If bonuses are not provided, then the employee has no motivation. After all, he is guaranteed to receive a salary |

| Quality of work performed | Often quality wants to be better, because workers strive to do more without thinking about the quality of the work performed | If an employee receives a bonus for quality work, then he will try his best to get an increased salary. Accordingly, the quality of the work performed will be high |

Advantages and disadvantages of time-based wages

The main positive side of “time-based work” is the cohesion of the team. In addition, with a time-based wage system, the employer may not closely monitor the quality of the products, since it is already quite high. The special working atmosphere, usually present in enterprises that practice a time-based payment system, prevents the outflow of labor, therefore the turnover rate in such companies is much lower.

Despite the fact that the advantages of “overtime” are more than obvious in many cases, it also has certain disadvantages.

For example, since the volume of work performed is not particularly important, there is no motivation for higher labor productivity, that is, employees in some cases may simply “sit their pants” at work.

To avoid this, many employers have to pay increased attention to controlling the volume of output, as well as incur losses due to unstable productivity.

Advantages and disadvantages

Positive aspects of using the method:

- regardless of the volume of plan implementation, performers will receive payments in accordance with the tariff system established in the organization;

- since the size of tariff rates depends on the level of qualifications of specialists, this accrual method helps motivate performers to improve their professionalism;

- simple economic calculation.

You may be interested in: How is overtime paid?

Disadvantages of this method of accrual:

- workers do not have the opportunity to increase their wages by increasing the amount of output;

- the introduction of additional staffing positions is required to strengthen control over the production of products;

- there is no possibility of increasing output, since subordinates have no desire to increase output;

- payments with the accrual method for hours worked are lower than with piecework wages.

Despite the listed disadvantages, the time-based form of payment is well suited for conveyor-type production, as well as for remunerating the labor of remote employees (web developers, programmers, etc.).

Conditions for introducing a time-based payment system at an enterprise

In order for a company to introduce time-based wages, it must be able to provide the following conditions:

- keep a timesheet of the time actually spent by employees at their workplace;

- develop and apply standards and maintain conditions to ensure higher labor productivity;

- carry out tariff assessments for all workers on temporary work.

To correctly calculate time-based wages, accountants should use documents such as time sheets and payroll records and the employee’s personal card with the tariff rate indicated in it and the amount of additional payments due to him.

Simple

This is the simplest type of payment, which is carried out only for the amount of time worked.

Pros. There are more of them for the employee - he is guaranteed to receive his money just for being present at the workplace, but the quality of the work he performs is not taken into account.

Minuses. Lack of employee motivation to work better and improve their professional skills, unfair approach to remuneration - conscientious and unscrupulous employees will receive the same wages.

Example. Let's consider how an employee's wages will be calculated according to this system using salary and tariff rates:

The company operates a five-day (forty-hour) working week. The employee's salary is 23,000 rubles. Number of working days and hours:

- in January – 15 days (120 hours);

- in February – 20 days (160 hours);

- in March – 21 days (168 hours).

Of these, February, January and March were fully worked, but in February the employee took free leave (5 calendar days).

How is an employee dismissed for medical reasons? What is the algorithm of actions?

What is the threat of black wages to an employer? How can an employee prove that he is right?

How is an individual entrepreneur's current account closed? When is this extreme step necessary?

This means that the salary for these months will be:

- in January – 23,000 rubles;

- in February – 23,000/20 * (20 – 15) = 17,250 rubles;

- in March – 23,000 rubles.

If you apply the tariff rate, the salary will be calculated as follows:

Daily tariff rate – 1,250 rubles.

Salary:

- in January – 15 * 1,250 = 18,750 rubles;

- in February – (20 – 5) * 1,250 = 18,750 rubles;

- in March – 21 * 1,250 = 26,250 rubles.

The hourly tariff rate is 170 rubles.

Salary:

- in January – 120 * 170 = 20,400 rubles;

- in February – (160 – 5*8) * 170 = 20,400 rubles;

- in March – 168 * 170 = 28,560 rubles.

As can be seen from the calculations, the salary is paid regardless of the number of working days in the month, but with the application of tariff rates, the salary in each month will be different.

Who uses time payment

Separately, it is worth mentioning who most often uses the time-based wage system. As a rule, these are those enterprises and organizations that provide various types of services to the population.

Also quite often, employers use “time work” in relation to certain categories of highly qualified specialists, such as engineers, doctors, lawyers, etc.

Thus, the time-based wage system, despite some of its disadvantages, is the most preferable for many employers. It allows you to save wages, keep employees from moving to other companies and at the same time ensure a fairly high quality of work performed.