Payroll fund - what is included in this concept and how is it different from the wage fund?

The two funds (wages and salaries) are interconnected, but are not identical.

Although the coincidence of these indicators is possible when a company saves on various types of payments (social and other) to its employees and, in addition to direct remuneration for labor (salaries), does not provide any other payments. Every company manager and individual entrepreneur must have an idea of what the wage fund includes. Based on the theoretical aspect, the wage fund (WF) is the totality of a company’s funds (both in cash and in kind) spent over a certain period of time on payments to the workforce.

First of all, the payroll includes salaries and bonuses, as well as various additional payments (for part-time work, for work at night, etc.). The listed elements are followed by incentive and compensating components of the payroll, as well as other payments (for example, accrued for time that is not worked, but is legally subject to payment). In general, the payroll includes the wage fund (WF), social and other payments.

The wage fund is a narrower concept than payroll, but both funds are formed and calculated using similar algorithms. We'll talk about this in the following sections.

Structure

The wage fund includes four groups :

- direct salary for working hours;

- salary for hours not worked;

- premium part;

- accruals for accommodation and meals.

Read our article about what wages are.

This includes various accruals, which include payment for unworked time. This also includes accruals for annual paid leave, as well as preferential hours for minors.

The bonus part is a one-time payment , which is received as a reward for the results of labor worked for many years at the enterprise, etc.

This is the price of food and housing, which, taking into account the legislation, is due to workers in certain sectors of the economy, as well as compensation for expenses for these needs in excess of what was planned.

Direct salary consists in turn of the following indicators:

- Salary, which is accrued for work done at tariff rates, salaries and as a percentage of revenue.

- The price of a product that is issued as salary in kind.

- Incentive additional payments, which are made based on the accrual rules at a particular enterprise.

- Premium part. These payments can be either permanent or occur from time to time.

- Compensation for work schedule and circumstances that forced you to work, for example, at night.

- Salaries for qualified personnel who were invited to train the organization’s workers.

- Salary for labor of those employees who worked part-time.

The wage fund also includes those finances that are paid to workers for their work. This refers to those citizens who work in permanent and temporary jobs, as well as funds due to persons under the law of the Russian Federation for unworked time (women on maternity leave, etc.).

payroll fund includes:

- Cost of services or products.

- Means that have a specific purpose.

- Admission and funding.

- Salary expenses are charges that are intended by the organization for individuals and are included in the initial cost of the goods.

How to calculate payroll: formula for calculating the balance

What does the wage fund include and how to calculate it correctly? This question is relevant for all businessmen - the salary component of the cost of goods or services often constitutes a significant share of it and affects the final financial result of the company.

Excessive savings on the payroll amount are fraught - meager salaries, lack of incentives and compensation payments do not contribute to high production indicators and obtaining decent profits. The result of such tight-fistedness of a businessman can be staff turnover, low labor productivity, the desire of individual team members to make up for the amount of remuneration received for work at the expense of the company’s property, etc.

The formula for calculating payroll is the sum of its various components. The number of elements of such a formula depends on the content of internal local acts. For example, if these documents provide for monthly payment to employees of wages (W), bonuses (PR), as well as financial assistance (MA) in addition to vacation pay (WTP), then the formula for calculating the payroll will look like this:

PHOT = Salary + PR + OTP + MP.

The algorithm for calculating the wage fund, the formula of which is presented above, is schematic, and the calculation of the payroll (as well as the calculation of the wage fund) in various companies can be carried out according to a more detailed or abbreviated version of the formula, depending on the composition of the payroll and the wages.

When accounting registers are used as a source of information for the formula, the wage fund for a certain period is calculated as follows. The data on the credit of the 70th account (“Settlements with personnel for wages”) is added from the debit of the accounts:

- the 20th, which reflects operations characteristic of “Main production”;

- 25th, where “General production expenses” are reflected;

- the 26th, reserved for “General business expenses”;

- 08th, where “Investments in non-current assets” are recorded;

- 91st, intended for “Other income and expenses”, etc.

The labor inspector of the State Labor Inspectorate of the Nizhny Novgorod Region, V. I. Neklyudov, explained how to conduct an analysis of the wage fund. Get trial access to ConsultantPlus and find out the official’s point of view for free.

How to calculate annual payroll

There is no single rule for calculating this indicator, since each company has its own characteristics and formation procedure, depending on the form of payment used, internal and regional regulations.

To determine the amount of labor costs, you must have the following documents:

- Staffing schedule. The document contains information on the number of personnel, names of positions indicating qualifications, rates and salaries.

- Time sheet. The document records the actual number of hours worked by each employee.

- Salary sheet. The document indicates all amounts accrued to recipients.

The listed acts are filled out by personnel and accounting department employees. These documents are used by the organization’s specialists to make accurate calculations.

For an approximate calculation of the annual payroll volume, it is enough to know the average monthly salary and number of personnel. Formula for calculating the annual wage fund:

SMZ × PE × 12 , where:

SMZ – average monthly salary;

PE – number of personnel.

What is included in the wage fund: its composition and structure in the balance sheet

The wage fund is one of the elements of the payroll, which is the amount of funds expressed in monetary form intended to pay wages to members of the workforce.

The composition of the wage fund, as well as the composition of the payroll in general, largely depends on the intra-company structure and the content of local “salary” acts (provisions on wages, bonuses, etc.). In addition to payments - remuneration for labor (at tariffs and rates), the wages and salaries include bonuses, rewards and incentive payments.

There are 4 main components of the FZP:

- direct salary;

- payment for unworked time (vacation, downtime, etc.);

- incentive payments (bonuses, bonuses for length of service, etc.);

- “supporting” payments (free or partial compensation to workers for food, utilities, fuel, etc.).

The structure of the FZP balance sheet varies from company to company. For example, the structure of the “salary” fund of a small consulting firm may look like this:

Total payroll – 100%, including:

- administration – 35%;

- consultants – 40%;

- accounting – 15%;

- technical personnel – 10%.

With regard to the formula for calculating the payroll, the same algorithms and approaches are used as for calculating the payroll described in the previous section.

The wage fund, like the payroll fund in general, requires a scrupulous and attentive approach, so self-respecting companies regularly draw up estimates of the “salary” fund, and also engage not only in its planning, but also in regular analysis. We'll talk about this further.

Composition of the salary fund

The wage fund includes several components:

- Actually wages for hours worked:

- payments due to salary, tariff rate or percentage of sales of goods or services;

- cost of products, if the company has a product calculation;

- payments to invited coaches (training masters) who improved the qualifications of permanent employees;

- payments to employees who worked in multiple positions.

- Wages for unworked working hours:

- official leave fees;

- payments for preferential work to certain categories of employees (women working in the Far North or rural areas, disabled people, teenagers);

- fees for study leave for advanced training;

- payments to employees temporarily hired to work for government or public structures;

- payments to workers temporarily hired to work in agricultural activities (harvesting, preparing livestock);

- fees for the period of undergoing compulsory medical examination;

- payment for downtime (if it was not due to the fault of the worker himself);

- payments due to temporary disability;

- payments for maternity leavers.

- Compensatory payments for work under particularly difficult circumstances or labor conditions:

- compensation according to locality coefficients (for work in the desert, mountains, Far North);

- compensation for work in dangerous or hazardous work;

- compensation for overtime work;

- compensation for work at night;

- compensation for work in several shifts in a row;

- compensation for work on holidays and weekends;

- compensation for a couple of days of rest necessary to recover after long working hours;

- compensation for business trips.

- Incentive payments:

- payments in connection with dismissal (severance pay);

- payment in connection with pension;

- payments to pensioners who continue to work after retirement;

- payment of insurance premiums (including for compulsory medical insurance);

- payment of vacations for travel vouchers, excursions, recreation and treatment;

- payment of vacation pay for people exposed to radiation after the explosion at the Chernobyl plant;

- payments for additional skills (knowledge of several languages, special skills, academic or professorial degrees);

- rewards for longevity.

- Premium payments:

- reward for good performance during the reporting period;

- compensation payments for vacation that was not used;

- one-time incentives in connection with anniversaries and holidays.

Example of an order for a one-time reward for good work

- Payment of work-related expenses:

- payment for food using coupons at the enterprise;

- payment for housing during business trips (cost of utilities and rent);

- payment for educational materials;

- payment for travel to and from work (on shift or during business trips);

- financial compensation due to special family circumstances (death of family members, illness);

- income from dividends, interest;

- payment for the use of personal transport for work purposes;

- payment of copyright for the use of an invention or idea;

- payment for expenses related to the preparation of documents and visas for trips abroad for work.

What is the payroll estimate?

The main purpose of the payroll budget is the systematic use of “salary” funds. Typically, calculations are made for the year, broken down by quarters or months. From the estimate it should be clear in what areas the funds are spent, as well as the values of the payroll components.

A separate breakdown of “salary” expenses is made by employee categories (administration, main production personnel, etc.). This allows you to control the use of funds and use the necessary “salary” information for internal planning purposes.

The estimate can be drawn up not only for the main elements of the wages, but also for payments of a social nature and others.

Payroll estimates are an element of planning that is more typical for large enterprises that employ specialists of the appropriate level and qualifications and maintain approaches to planning from the time of the planned (socialist) economy. In modern commercial structures, this document is less common or has a different name. We'll talk about the planning process in the next section.

Planning procedure

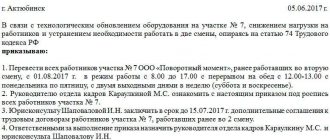

To form a fund it is necessary to carry out a number of activities. Order:

- the staffing table, the form of payment to employees hired by the organization, various basic and additional regulations are studied;

- the number of employees is calculated relative to the planned production volume;

- the final result is calculated.

Payroll planning

When using planning, the results of past periods are taken into account. With this option, the steps are as follows:

- analysis of the amount for the previous year;

- development of optimization measures;

- study of all factors that have affected or may affect the amount of costs.

After these steps, calculate the required amount for the next annual period.

Payroll planning

Based on the fact that the wage fund includes a significant share of the company’s total expenses, an important issue is the preliminary (planned) determination of the structure and size of the payroll.

The payroll planning process can be represented by the following algorithm:

- Collect information about the structure of the company, the number of personnel and its movement, data on average salaries, production targets; study the staffing table and internal local acts related to payroll (provisions on wages, bonuses, etc.).

- Predict the average number of personnel for the planned time period.

- Choose a planning structure (decide on the main planning parameters and the level of detail of indicators), draw up an estimate.

- Calculate the payroll, choosing the most acceptable method of calculating it.

Read the internal local acts in the material “Regulations on remuneration of employees - sample 2020”.

The predicted payroll allows for timely analysis and control of its use.

Tariff system when calculating estimated wages

Construction organizations use a tariff system when calculating payroll in estimates. This approach ensures that workers are paid according to their qualifications and the level of complexity of the work they perform. Tariff rates are set in accordance with qualification categories. Tariff coefficients mean the ratio of the tariff rate of the corresponding category to the tariff rate of the first category. Currently, a tariff system has been adopted, which is represented by 1-6 categories, where 6 is the highest category.

When drawing up an estimate and regulatory framework, the average salary level is indicated by the salary of an employee with a category of 4.1.

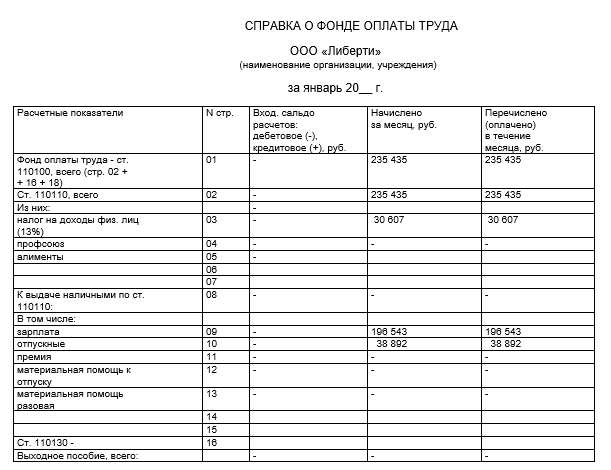

Certificate of monthly wage fund - sample

Commercial structures may need this document in the following circumstances:

- when applying for a loan from a credit institution;

- the bank may request a certificate to confirm the integrity of the company in the sense that the money withdrawn from the account actually goes to pay for labor;

- when carrying out control activities by specialists of the Federal Tax Service or insurance funds.

For structures of budget subordination, this document is mandatory.

The certificate may contain information not only about the amount of the wage fund for the month, but also for another period. Moreover, the document can be drawn up both according to expected indicators and actual payments.

There is no standardized form for this document. We have prepared a template that should be suitable for organizations and individual entrepreneurs, since it includes all the information required in such cases. We offer information about the monthly wage fund on our website.

PHOT: what does it include?

The successful operation of an enterprise is impossible without a clear understanding of the structure and charges for the payroll.

The concept includes all upcoming expenses of the organization aimed at paying for the services of employees. To understand what the payroll consists of, it is necessary to include in the total amount not only the salary part of the deductions, but also bonuses, payment of allowances, other types of compensation and bonuses in favor of the staff.

The indicator is taken into account when analyzing the performance of each structural unit, department, and the entire enterprise, in order to improve the payment system and optimize costs. This parameter also plays an important role when calculating future pension payments, because contributions to the Pension Fund and the Social Insurance Fund are made taking into account the enterprise fund.

To correctly assess the indicator, you need to understand what the payroll consists of. Its structure includes:

- Employee salaries paid regularly, regardless of the staff's performance.

- The output of the enterprise in the volume that is directed to the benefit of employees as part of the remuneration of employees for their work.

- Encouragement and monetary rewards for distinguished employees.

- Expenses for free food, if it is organized at the enterprise.

- Bonus for earned experience, length of service, continuous long-term work in the organization.

- Compensation for temporary disability certificates.

- Payment for absenteeism due to no fault of the staff.

- Bonuses when transferring employees to positions with lower pay.

- Travel and accommodation expenses for employed citizens who work on a rotational basis.

- Remuneration for externally hired workers (individual entrepreneurs or legal entities) for the purpose of performing a specific amount of work.

- Pension contributions to employees forced to retire under special circumstances (in case of a work-related injury or disability).

The concept does not include other expenses of the enterprise related to employees:

- dividend payments;

- interest-free loans to hired personnel from the company’s funds;

- social insurance benefits paid from budgetary funds;

- bonuses to employees who have shown high labor results over the year;

- providing targeted financial assistance to an employee in need;

- compensation payments related to inflation.

A detailed study of all components of deductions will be required to figure out how to calculate the wage fund, excluding from it one-time, irregular transfers organized through Social Security.

Difference from FZP

Often, when discussing enterprise funds allocated to pay employees, words about the salary fund are heard. Although its purpose is similar to the previous concept, the payroll fund is a narrower indicator that combines exclusively salary deductions after deducting social benefits, advances, and other payments for the period of time under consideration.

To understand what the payroll includes, you can use an example:

- The company paid employees 450 thousand rubles for the month, including salaries for the previous month (220 thousand rubles) and an advance payment for the current period (150 thousand rubles).

- Considering that part of the deductions comes from advance payments, the payroll for the current month remains the same - 450 thousand rubles, and the full salary is 370 thousand rubles.

It is not difficult to determine what is included in the wage fund - these are payments to employees in accordance with the accepted payment system, current rates, salaries, agreed prices for services:

- salary;

- surcharge;

- allowance;

- bonus;

- compensation for working conditions.

- What is wage indexation

This does not include social contributions in favor of employees, and the amount is formed exclusively from payments related to the work of hired personnel.

In rare cases, the payroll and wage indicators may coincide if the organization does not pay incentive amounts, and the labor income of the staff consists only of the salary under the contract, taking into account the time spent and the bonus included in the earnings structure.

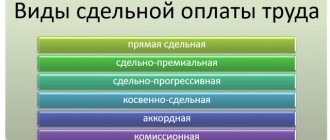

Types of fund

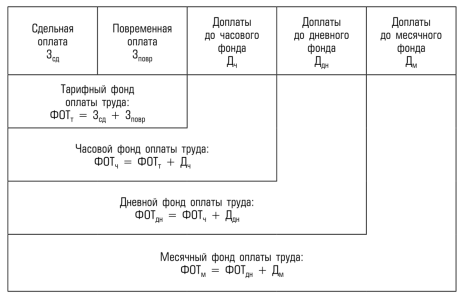

The fund is calculated for a specific period of time. Based on this, the following payroll options are distinguished:

- Annual, with calculation for the last time period. This indicator is used more often to clarify the amounts spent on labor.

- Monthly, with consideration of indicators for the selected month. Necessary for drawing up reports and analyzing current performance indicators of the enterprise.

- Day. Indicators of payment per day are used less frequently, and are often associated with the need to analyze the situation with salary costs.

- Hourly. Calculation of the indicator per hour of work is used only in companies that use the hourly payment method.

Results

The wage fund includes all payments earned by employees in cash and in kind (salaries, bonuses, compensation, allowances, etc.), as well as social and other payments.

The formation of the payroll is carried out taking into account the local “salary” acts in force in the organization (collective agreement, provisions on remuneration, bonuses, etc.).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legislative regulation

According to Federal Law 201077-3 (Payment in non-budgetary organizations), there are three funds:

- Payroll-1 – wage fund for full-time employees of the organization;

- Payroll-2 – wage fund for freelance workers;

- Payroll-3 – is formed directly from the company’s profit.

Payroll for civil servants and government officials is separately regulated. It is regulated directly by the President of the Russian Federation (Federal Law 79-FZ) or, if we are talking about a subject, by the legislative body of that subject.

Formula for calculating monthly payroll

To determine the monthly fund, use a modified formula for finding the annual indicator:

FOT m = Szp * H , where

Payroll m – monthly wage fund;

Сзп – average monthly salary;

H – average number.

A conscious and balanced approach when planning the activities of any enterprise is the key to stability and successful development in the future. Payroll is one of the most important financial indicators, the correct calculation of which will become a fundamental factor in forecasting work activity and developing a set of measures aimed at stabilizing the company’s balance sheet.

Since the fund is formed by enterprises that independently engage in their own financing, when planning and calculating this indicator, it is necessary to separately allocate funds for the formation of reserve funds. Such measures will help not only to repay debts to staff, but also to reserve the remaining excess funds.