No later than January 20 of the current year, information about the average headcount for the past year must be submitted to the Federal Tax Service at the location of the organization. This must be done annually (clause 3 of Article 80 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated July 17, 2012 No. 03-02-07/1-178, dated February 14, 2012 No. 03-02-07/1-38) . If a company submits information late, controllers may impose two fines at the same time - on the organization and the director. This indicator will also be needed to know whether an organization must submit tax reports to the Federal Tax Service in electronic form (clause 3 of Article 80 of the Tax Code of the Russian Federation).

note

To calculate the amount of income tax paid at the location of a separate division, you will need the average number of employees.

The field “Average headcount” must be filled out in the calculation using Form RSV-1 of the Pension Fund of the Russian Federation, and the line “Number of employees” – in the calculation using Form 4 – Social Insurance Fund. To calculate the amount of income tax paid at the location of a separate division, you will also need this indicator.

The average number of employees for any period (year, quarter, half-year, 2 - 11 months) is calculated on the basis of the average number of employees for each month included in this period. I'll tell you about the procedure for calculating.

Why do we need the average headcount parameter?

Concepts such as the planned or standard number of employed workers are mostly used in economics as a regulator of the staffing level of enterprises and are defined as the optimal number of workers required for highly productive labor at a particular enterprise.

Question: What is the penalty for failure to submit (late submission) of information on the average number of employees for the previous period? View answer

The average number of personnel (ASN) is an indicator that stands apart. It is used in special cases:

- the ability of an LLC to use preferential tax schemes (STS) depends on the indicator;

- based on the SSC parameter, the need for telecommunication networks is determined when submitting reports;

- The tax authorities calculate the average salary in an LLC based on the SCH indicator.

The SSC report is a mandatory document that is provided by all organizations and individual entrepreneurs, regardless of their organizational and legal status. The document contains information for the past reporting year.

Important: for LLCs or individual entrepreneurs registered in the middle of the reporting year, the obligation to submit a report on the average headcount begins one month after the creation of the company. At the end of the calendar year, such entities submit another report on a general basis.

A special procedure for calculating the SCH is used for LLCs registered during the reorganization measures of the predecessor organization (liquidation, re-registration). Such newly created companies must calculate the average headcount taking into account information about the employees of the previous organization.

Question: What should be indicated in the information about the average headcount if the organization employs only external part-time workers? View answer

How to count part-time workers

It all depends on the basis on which part-time employment is applied.

If part-time work is an initiative of the employer or a legal requirement, such workers are considered a full-time employee. And if part-time work is established by an employment contract, staffing schedule or with the written consent of the employee, then in proportion to the time worked in the following order (clause 79.3 of Rosstat instructions No. 711):

- Calculate the total number of man-days worked. To do this, divide the man-hours worked by the length of the working day, based on the length of the working week:

- with a 40-hour work week - by 8 hours (with a 5-day work week) or by 6.67 hours (with a 6-day work week);

- at 36-hour - by 7.2 hours (with a 5-day work week) or by 6 hours (with a 6-day work week);

- at 24-hour - by 4.8 hours (with a 5-day work week) or by 4 hours (with a 6-day work week).

An example of calculating the “man-days” indicator to determine the average number of part-time workers from ConsultantPlus There are two employees at Alfa LLC - Sidorov A.D. and Samokhin N.I. work on a part-time basis. One - 6 hours a day, the other - 5 hours a day. Both employees have part-time working hours by agreement of the parties. In July 2020, Sidorov A.D. worked 23 days, Samokhin N.I. - 22 days. The organization operates on a five-day workweek schedule, so the working day is 8 hours (40/5). You can view the entire example in K+ by getting free trial access.

- The average number of part-time workers for the reporting month is determined in terms of full employment. To do this, divide the person-days worked by the number of working days according to the calendar in the reporting month. At the same time, for days of illness, vacation, absences, the hours of the previous working day are conditionally included in the number of man-hours worked.

Let's explain with an example (for a regular 40-hour 5-day work week).

The organization had 7 employees working part-time in October:

- four worked 23 days for 4 hours, we count them as 0.5 people (4.0: 8 hours);

- three - 3.2 hours a day for 23, 15 and 10 working days, respectively - this is 0.4 people (3.2: 8 hours).

Then the average number will be 2.8 people:

(0.5 × 23 × 4 + 0.4 × 23 + 0.4 × 15 + 0.4 × 10) / 22 working days in October.

For information on how long working hours can be, read the material “Normal working hours cannot exceed?” .

Algorithm for calculating the average headcount

The average headcount is calculated on the basis of primary documents reflecting the daily presence of employees at their workplaces. Such primary sources are:

- time sheets T-12 and T-13;

- personnel orders (on hiring, dismissal);

- orders for business trips, vacations of all types.

Question: How to take into account the only employee - an external part-time worker - when filling out Form 4 - Social Insurance Fund in terms of wages and average headcount? View answer

To fully calculate the SCN, data on all employees who are in an employment relationship with the employer are taken into account. It does not matter what type of contract is used for execution - an employment agreement/contract, a contract for temporary/seasonal work. If business owners/founders appear on payroll records, then, regardless of their employment status, information about these individuals must be taken into account in the calculations.

You need to know: all calendar days of the month are taken into account in the calculations of the MSS - including weekends and holidays. The number of working people is calculated based on the working day preceding the day off.

Workers hired on home-working terms are taken into account in the list of LLCs as full-fledged units.

The number of employees: what is it and how to calculate it

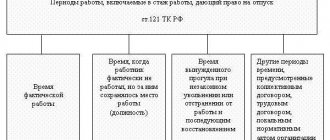

The headcount is the number of personnel in an organization on a specific calendar day of the month. It includes all employees with whom employment contracts have been concluded, including temporary and seasonal ones. And not only those who actually worked that day, but also those who were absent from work, for example, on a business trip, on sick leave, on vacation (including at their own expense) and even skipped work (see the full list). in paragraph 77 of Rosstat instructions No. 711).

Categories of workers not taken into account in the payroll are given in paragraph 78 of Rosstat instructions No. 711. In particular, these are:

- external part-time workers;

- working under GPC agreements;

- owners who do not receive a salary from the organization, etc.

Employees on maternity leave or “children’s” leave are generally included in the payroll, but are not taken into account in the average payroll. But if they work part-time or at home while maintaining benefits, they are taken into account in the SSC (clause 79.1 of Rosstat instructions No. 711). From 2021, an employee fired on Friday does not need to be included in the payroll for Saturday and Sunday (clause 76 of Rosstat instructions No. 711).

Categories of employees not taken into account in the calculation of the SCH

Each LLC employee who shows up for work or is absent for a valid reason is to be included in the calculation of the average headcount. Only employees classified in the following categories are not taken into account:

- employees permanently employed in another company, working in an LLC on an external part-time basis;

- founders or managers who do not have income in the form of wages;

- young mothers on maternity leave (including child care);

- lawyers and military personnel;

- employees sent on a foreign business trip;

- students signed up for a student agreement with a scholarship;

- students and applicants on leave without pay to take the examination session;

- persons working under GPC agreements;

- employees who have announced their resignation and do not perform their job duties before the expiration of the contract.

It should be remembered: in the calculations of the SCH intended for the Pension Fund and the Social Insurance Fund, both external part-time workers and people working under civil contracts must be taken into account.

Total number

After this, the average number of all employees for each month is calculated using the formula:

| average number of full-time employees for each month | + | average number of part-time workers for each month |

In this case, the result obtained should be rounded to whole units: a value less than 0.5 is discarded, and 0.5 or more is rounded to the nearest whole unit.

EXAMPLE The work schedule of the organization is 5 days a week, 8 hours a day. As of June 1, 2021, 34 people work in the company under employment contracts, of which: 30 people are full-time, two are part-time, two more – by agreement with the employer, they work part-time. In June 2021, the number of hours worked by these employees will be 210 hours. None of the organization’s employees were on parental leave or unpaid educational leave during the period under review. On June 20, one the employee quit. On June 23, a new employee was hired. There are 21 working days in June 2021. The number of full-time workers on the payroll is: for June 1 - 19 and for June 23 - 30 (27 days) - 30 people; for June 20 - 22 (3 days) - 29 people. The average number of fully employed workers for June will be 29.9 people ((27 days × 30 people + 3 days × 29 people) / 30 days). the number of part-time workers will be 1.25 people (210 hours / (8 hours × 21 days)). The average number of all employees for June 2021, taking into account rounding, will be 31 people (29.9 + 1.25).

Formula for calculating MSS

To calculate the monthly average headcount, you need to know the initial data:

- duration of the calendar month (in days);

- the amount of all employees subject to accounting for a calendar month (in man-days).

The quotient of dividing the sum of man-days by the number of calendar days will be an indicator of the average headcount for the current month.

You need to know: the average headcount for a quarter, half-year or year is determined by the arithmetic average method. To do this, the monthly indicators of the SCH are summed up and divided by the number of months in the required period.

When calculating the SCH for the year for new organizations, the following rule is applied: regardless of the actual number of calendar months in which the newly created organization operated, the total number of months in the denominator of the formula is taken to be 12.

An example of calculating the average number of employees of an organization

In this example we have no part-time workers. Everyone works full time.

| Billing month | Initial data (number of employees) | Calculation of indicators |

| January | from 01 to 31.01.2016 - 16 people | 16 |

| February | from 01 to 25.02.2016 - 17 people from 26.02 to 28.02.2016 - 18 people | Since from February 1 to February 25, 25 days there were 17 people in the company and 3 days - from February 26 to 28 - 18 people, we get: (17 x 25 + 18 x 3) / 28 = 17.1 |

| March | from 01.03 to 31.03.2016 - 18 people | 18 |

| April | from 01.04 to 30.04.2016 - 18 people | 18 |

| May | from 05/01 to 05/04/2016 - 18 people from 05/05 to 05/31/2016 - 17 people | Since from May 1 to May 5 there were 18 people, and from May 5 to May 31 there were 17 employees, we get: (4 x 18 + 27 x 17) / 31 = 17.1 |

| June | from 01.06 to 30.06.2016 - 17 people | 17 |

| July | from 01.07 to 31.07.2016 - 17 people | 17 |

| August | from 01.08 to 31.08.2016 - 16 people | 16 |

| September | from 01.09 to 30.09.2016 - 16 people | 16 |

| October | from 01.10 to 25.10.2016 - 16 people from 26.10 to 31.10.2016 - 17 people | (26 x 16 + 5 x 17) / 31 = 16.2 |

| November | from 01.11 to 30.11.2016 - 17 people | 17 |

| December | from 01.12 to 20.12.2016 - 18 people from 21.12 to 31.12.2016 - 16 people | (20 x 18 + 11 x 16) / 31 = 17.3 |

| Average headcount as of 01/01/2017 | ( 16 + 17,1 + 18 + 18 + 17,1 + 17 + 17 + 16 + 16 + 16,2 + 17 + 17,3 ) / 12 = 16,89Result – 17 |

Should the founder and entrepreneur be taken into account?

As a general rule, the owner is included in the average payroll only if he works in his company under an employment contract and receives a salary. The founder, who is paid dividends but not a salary, must be excluded from the calculations.

In practice, the following situation is common: the director is the owner appointed by the general meeting of founders (without an employment contract). There are no clear instructions as to whether such a director should be included in the average headcount. Typically, in such circumstances, directors are counted as a unit, despite the absence of an agreement.

But if the only founder acts as a director, then, in our opinion, he cannot be taken into account in the average headcount. The fact is that the only founder is not able to hire himself and pay himself a salary. This was also recognized by the Russian Ministry of Finance (see “Ministry of Finance: the director - the only founder should not pay his own salary”). This means that such a manager a priori cannot relate to the company’s personnel.

An individual entrepreneur is also not taken into account in the average headcount, because, like the sole founder, he is not able to conclude an employment contract with himself.

How to calculate the average number of employees per month (full-time)

First of all, it is necessary to find out what the number of employees was (accounted for according to the above rules) on each of the calendar days of the month, including weekends and holidays. The number on a non-working day is assumed to be equal to the number on the previous working day.

The number for each day of the month must be summed up and divided by the number of calendar days of the month. The resulting number should be rounded to the nearest whole value (a remainder of less than 0.5 is discarded, a remainder of 0.5 or more is rounded up).

Example 1

The organization operates on a five-day work week schedule. All employees are employed full time. The number of people on each day of the month is shown in Table 2. The average headcount for the month is 17,097 (530: 31 days), after rounding it takes the value 17.

Day of the month Number of employees taken into account when calculating the average headcount 1 15 2 14 3(Sat.) 14 4(sun.) 14 5 16 6 17 7 17 8 18 9 20 10(Sat.) 20 11(Sun.) 20 12 20 13 20 14 18 15 18 16 18 17(Sat.) 18 18(Sun.) 18 19 17 20 17 21 16 22 16 23 16 24(Sat.) 16 25(Sun.) 16 26 16 27 15 28 17 29 17 30 18 31(Sat.) 18 Total: 530

Sometimes organizations do not work for a full month. This happens to companies created in the middle of the month, or to those who are engaged in seasonal business. The average headcount for an incomplete month is calculated in exactly the same way as for a full month: the headcount indicators for each day are summed up, and the resulting result is divided by the number of calendar days of the month. Simply put, if there are 31 days in a month, then you need to divide by 31, regardless of how many days are actually worked.

Keep timesheets and prepare all personnel reports in the “Kontur.Personnel” service

Example 2

The company began operating on March 28, 2021. The number of people on each day of the month is shown in Table 3.

To find the average headcount, the accountant divided the total number by 31, since March has 31 calendar days. It turned out that the average number for March is 1.71 (53: 31 days), and after rounding it takes the value 2.

Day of the month Number of employees taken into account when calculating the average headcount 28 10 29 10 30 15 31 18 Total 53

How to calculate the average number of full-time and part-time employees

If some of the employees are employed full-time, and the other part is employed part-time, the average number of employees should be calculated as follows. First, determine the average number of employees on the full schedule for each month of the reporting period. Then find the average number of employees on the incomplete chart for each month of the reporting period. Add the resulting values, divide by the number of months in the reporting period and round.

Example 7

The organization has full-time employees. There are also employees who are hired at 0.5 rates. The accountant determined the average number of those and others separately for each month of the reporting year (see Table 5).

The average headcount for the year is 16.42 ((155 + 42): 12 months), after rounding it takes the value 16.

| Month | Average number of full-time employees | Average number of employees per 0.5 rate |

| January | 10 | 5 |

| February | 10 | 5 |

| March | 15 | 4 |

| April | 10 | 4 |

| March | 9 | 3 |

| June | 15 | 3 |

| July | 16 | 3 |

| August | 14 | 3 |

| September | 14 | 2 |

| October | 14 | 3 |

| november | 13 | 3 |

| December | 15 | 4 |

| Total: | 155 | 42 |

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free