When can it be considered that the employer has not paid wages?

The procedure, place and timing of payment of wages are established in Article 136 of the Labor Code of Russia. Employers are required to pay employees every six months. Specific payment terms are indicated in contracts with employees, but not later than the period established by law.

Article 136 of the Labor Code specifies the deadline for payment of earned money - no later than 15 days of the period following the settlement period. That is, with a monthly salary, the employer is obliged to provide a payment for the month worked before the 15th of the next month.

The first day of late payment is considered to be the 16th. Once overdue, employees may notify the employer that they are ending their employment. At the same time, according to the law, the employee retains his average income.

The employee must return to his duties no later than the day following the day on which the employer notified them of his readiness to pay the money. In addition, for delays in payments, the employer faces administrative and, in some cases, criminal liability.

Delay of wages from the legal point of view

The procedure and timing of settlements with employees are regulated by Art.

136 Labor Code of the Russian Federation. According to parts 5 and 6, the salary must be issued directly to the employee at the location of the enterprise or transferred to a bank account. The frequency of payments is at least once every 15 days. Accordingly, the employee must receive two or more payments each month. The norms of the Labor Code of the Russian Federation do not determine the percentage of payments. Therefore, one of them may be larger in size than the other. For example, the system for paying employees may be as follows: the first payment includes only the salary at the tariff rate, and the second, in addition to the salary, includes bonuses and other additional payments.

Specific dates for payment of wages, in accordance with Part 4 of Art. 136 of the Labor Code of the Russian Federation, are determined in the collective labor agreement for all employees equally or are stipulated directly in the contract with each employee. Moreover, if the payment date falls on a weekend or holiday, then the calculation is made the day before.

For individual payments, special deadlines may be established within which the administration of the organization must make them. So, for example, vacation pay, according to Part 9 of Art. 136 of the Labor Code of the Russian Federation, are transferred to the employee no later than three days before the start of the vacation.

Accordingly, if an enterprise does not comply with these requirements and pays the employee at the wrong time or does not pay the due money at all, then we are talking about delayed wages.

Responsibility for delayed wages lies in the application of financial and other sanctions to the administration of the enterprise in accordance with the norms of the Labor Code, Code of Administrative Offenses and the Criminal Code of the Russian Federation - depending on the timing and amount of accumulated debt.

If necessary, you can go to court to collect wages.

What will happen to the employer for non-payment of wages?

Employers must take into account that if wages are not paid, employees have the right to refuse to work until they receive the money. In this case, employees can file a complaint against the owner of the enterprise. In this case, the employer will be held liable for violations of labor laws.

The owner of the company may be subject to administrative or criminal liability. To do this, the enterprise will be inspected to prove the existence of a violation. Depending on the severity of the violation, the employer may be imprisoned.

Administrative responsibility

In case of complete or partial non-payment of income to employees, the employer may be fined from 1 to 50 thousand rubles:

| Who will be fined? | Fine amount |

| Responsible persons at the employer's enterprise | Minimum 10, maximum 20 thousand rubles |

| IP | From 1 to 5 thousand rubles |

| Legal entities | From 30 to 50 thousand rubles |

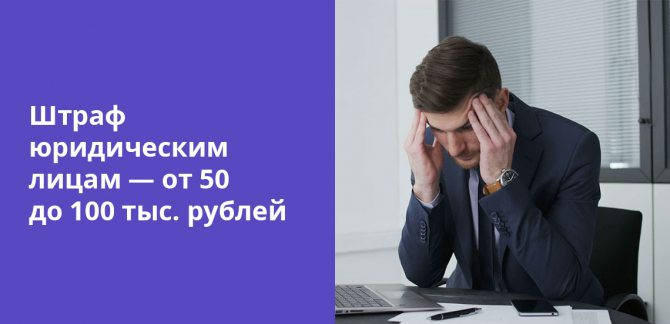

In case of repeated similar violations, the following is prescribed:

- Responsible persons of the employer - a fine of 20 to 30 thousand rubles or disqualification for 1-3 years.

- Individual entrepreneurs - from 10 to 30 thousand rubles.

- For legal entities - from 50 to 100 thousand rubles.

If an official is found to be the culprit, the fine is paid by both the employee who violated the contract and the employer. If the payment of earnings is delayed through no fault of the employer or other officials, the company owner can only get off with a warning.

It is even more difficult to hold accountable if the employer pays gray or black wages.

Criminal liability

If the violation is serious, the employer may be held criminally liable in accordance with the Criminal Code of the Russian Federation:

| Violation | Fine | Maximum period of forced labor | Maximum period of suspension from work | Deprivation of liberty |

| Partial non-payment of income to employees for 3 months or more | Up to 120 thousand rubles or according to annual earnings | 2 years | 1 year | Up to 1 year |

| Complete non-payment or payment of wages in an amount below the minimum established in the region | 100-500 thousand rubles or the amount of three years’ earnings | 3 years | 3 years | Up to 3 years |

| The same violations, but which entailed serious consequences for workers | 200-500 thousand rubles or according to the amount of income for a period of 1-3 years | — | 5 years | From 2 to 5 years |

Features of applying criminal liability to an employer or other legal entity. face:

- We need evidence of the company owner's personal interest in violations. The fact of a violation is not enough to impose criminal penalties.

- Partial non-payment is considered to be payment of up to 50% of earnings.

- Grave consequences mean the death or illness of an employee and his close relatives. The connection of these circumstances with violations of non-payment of income must be proven.

A maximum sentence of up to 5 years is accepted in very rare cases. To do this, you need to prove the existence of a very serious offense and serious consequences for the employees of the enterprise. To hold the employer accountable, the employee files a complaint with law enforcement agencies. They conduct an inspection of the enterprise and initiate proceedings regarding the violation.

Responsibility for delayed wages

The labor inspectorate has the right not only to make decisions on the forced collection of unpaid wages from the employer, but also to punish him administratively.

Administrative liability for delayed wages

If a company does not pay wages to employees on time, it will be fined by the labor inspectorate. The size of the fine does not depend on the number of days of delay and will range from 30,000 to 50,000 rubles. The fine for late payment of wages for a company director or chief accountant is from 10,000 to 20,000 rubles, for individual entrepreneurs – from 1,000 to 5,000 rubles (Clause 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

For repeated violations, an increased fine is provided. The official will pay a fine of 20,000 rubles. up to 30,000 rub. And the company will be punished in the amount of 50,000 to 100,000 rubles. (Clause 7, Article 5.27 of the Administrative Code).

Financial liability for late wages

If wages are delayed, the employee has the right to receive monetary compensation or interest from the employer for the delay in wages (Article 236 of the Labor Code). Compensation is calculated based on 1/150 of the key rate of the Bank of Russia, which was in effect during the period of delay.

To calculate compensation, the period from the date following the deadline established by the company for the payment of wages to the date of actual payment of wages, inclusive, is taken into account. As debt they take the amount that the employee should receive in hand, and not the accrued salary.

The employer calculates the amount of compensation independently. The formula is:

amount of wage arrears × 1/150 of the Bank of Russia key rate × number of days of delay = compensation.

An example of calculating compensation for delayed wages. The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40% of the salary;

- 5th – final payment.

The organization paid all salaries for January on February 22. The amounts owed and the delay period were:

- 250,000 rub. (advance payment for January) – 33 days – from January 21 to February 22;

- 300,000 rub. (final payment for January) – 17 days – from February 6 to February 22.

Along with the arrears of wages, the organization paid compensation for the delay. Its size is not established in the collective agreement, so the calculation is made based on 1/150 of the key rate, which is 6.25% in January, and 6% in February (conditionally).

Therefore, the amount of compensation will be:

- for late advance payment for January: RUB 3,345.83. ((RUB 250,000 × 11 days × 1/150 × 6.25%) + (RUB 250,000 × 22 days × 1/150 × 6%));

- The total amount of compensation is 5385.83 rubles. (RUB 3,345.83 + RUB 2,040).

What rights do employees have in case of non-payment of wages?

Refusal of labor obligations is one of the methods of punishing an employer that company employees can use. You can refuse to work if your wages are overdue for 15 days or more. But not everyone can take advantage of this opportunity:

- Work cannot be suspended during a state of emergency.

- Military and government employees cannot refuse employment obligations.

- Those whose work involves servicing particularly dangerous industries or ensuring the livelihoods of citizens cannot refuse to work.

All other employees may not go to work from the 16th day of delayed earnings. At the same time, they must notify the owner of the company in writing about their refusal to fulfill their job duties. If there are many employees who refuse to work, the company’s activities will be frozen. This is an effective way to punish a violator. The company will lose profit and will not be able to fulfill its obligations on time.

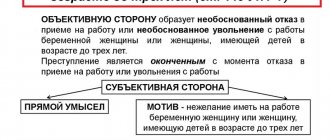

Who can be considered responsible for violations

In the Criminal Code, in Article 145.1, the head of the organization is defined as the guilty person. There is no clear definition of who is recognized as a responsible official, so in practice this is most often the director of the enterprise.

It is very difficult to hold another person, for example, an accountant, accountable for non-payment of wages to employees. This is done only if it is proven that he was involved in a conspiracy, inducement to commit a violation, or was an accomplice to the crime. An accountant may also be considered a violator if the manager gave orders for payments on time, but the accountant, due to inattention or intentionally, did not give the money to employees.

The founders of the enterprise cannot be punished, since they do not directly participate in management. They can be held liable only if the founder and director of the company are the same person.

The founder himself may be held liable during bankruptcy proceedings. But even in this case, a number of conditions must be met:

- The list of creditors' demands in bankruptcy includes debts for issuing money to employees.

- During the trial, it was revealed that the activities of the founders had a negative impact on the work of the enterprise.

Then the owner is obliged to repay the company’s debts from personal funds.

Criminal punishment and the peculiarities of its application

The most severe measure of liability for non-payment of wages on time is the application of criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation. This provision presupposes the presence of two independent elements of a crime. Thus, for Part 1 to apply, two conditions must exist:

- Salaries are paid partially for three or more months in an amount less than half of what the employee is entitled to.

- The reasons for incomplete payment are the selfish interest of the employer. That is, if an enterprise cannot pay its employees in full due to objective reasons, for example, there is simply no money in its accounts and there is no way to replenish them, then it is impossible to bring the management to criminal liability.

The penalty for this act varies from a fine to 120 thousand rubles to a year in prison.

To use Part 2 of Art. 145.1 of the Criminal Code of the Russian Federation it is necessary that:

- the enterprise did not pay wages at all or paid less than one minimum wage per month;

- the debt period exceeded two months;

- the reason for the debt is the employer’s self-interest.

The severity of the sanctions in this situation will be greater: a fine of up to 500 thousand rubles or imprisonment for up to three years.

If, in the presence of any of the specified parts 1 or 2 of Art. 145.1 of the Criminal Code of the Russian Federation, if additionally serious consequences occur, for example the death of a person, then the employer will face a fine of up to 500 thousand or imprisonment for up to five years.

Features of bringing to criminal liability for non-payment of wages

In Art. 145.1 of the Criminal Code of the Russian Federation also has a note that allows the management of the enterprise to avoid a fine or imprisonment. If the committed act did not entail serious consequences, was committed for the first time and within two months from the date of initiation of the criminal case the debt to the employees was fully repaid, the guilty person is released from liability under this article.

Where to contact in case of violation

A complaint against the head of an enterprise can be filed with the labor inspectorate. A letter describing the essence of the complaint can be submitted personally to an inspector, by mail, or on the organization’s official website. Evidence of non-payment of wages must be attached to the complaint.

Labor inspectors will conduct an inspection and issue an order to eliminate violations. An employee can also file a complaint about non-payment of wages to the prosecutor's office or the investigative committee.

If after contacting these authorities the situation has not changed, you can move on to more serious measures - filing an application for non-payment of wages in court. In this case, you can demand from the employer not only the payment of money earned, but also compensation for the harm caused. The following must be attached to the application:

- Work book or contract.

- Pay slips, statements about the amount of income, the procedure for making calculations.

- An extract on the collection of taxes to the Pension Fund.

- Order of dismissal if the employer did not pay wages upon dismissal.

The employer will also be required to pay a penalty in the amount of 1/300 of the rate of the Central Bank of the Russian Federation of the amount of the debt for each day of delay in payments.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » What are the legal consequences for the employer in the case of hiring an employee without drawing up an employment contract and failing to pay him wages for the last month

Question:

The man worked unofficially, no employment contract was drawn up with him, and no salary was given for the last month. What threatens the employer if a statement is written against him to the relevant authorities; Where should I write a statement in this case?

Answer:

In accordance with Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, evasion of registration or improper execution of an employment contract or conclusion of a civil contract that actually regulates labor relations between an employee and an employer -

shall entail the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from five thousand to ten thousand rubles; for legal entities - from fifty thousand to one hundred thousand rubles.

Art. 5.27, “Code of the Russian Federation on Administrative Offenses” dated December 30, 2001 N 195-FZ (as amended on July 13, 2015, as amended on July 14, 2015) {ConsultantPlus}

Financial liability for non-payment of wages.

If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the Central Bank refinancing rate in force at that time. Bank of the Russian Federation from unpaid amounts on time for each day of delay starting from the next day after the established payment deadline until the day of actual settlement inclusive. The amount of monetary compensation paid to an employee may be increased by a collective agreement, local regulation or employment contract. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault.

Art. 236, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on July 13, 2015) {ConsultantPlus}

Administrative liability for non-payment of wages.

Persons who have committed violations of labor legislation, including delays in payment of wages, may be brought to administrative liability in accordance with Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation in the form of:

— warning or fine in the amount of 1000 to 5000 rubles. - for officials;

- a fine in the amount of 1000 to 5000 rubles. — for individual entrepreneurs;

— a fine from 30,000 to 50,000 rubles. - for legal entities.

If the guilty person is prosecuted again for a similar violation, then liability arises under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. Punishment under this rule provides for:

— fine from 10,000 to 20,000 rubles. or disqualification for a period of one to three years - for officials;

— fine from 10,000 to 20,000 rubles. — for individual entrepreneurs;

— fine from 50,000 to 70,000 rubles. - for legal entities.

It should be noted that a person can be brought to administrative responsibility for a violation that entails disqualification no later than one year from the date of commission of such an offense. This conclusion follows from the provisions of Part 3 of Art. 4.5 Code of Administrative Offenses of the Russian Federation.

Guide to HR issues. Wage. Responsibility for non-payment of wages {ConsultantPlus}

Criminal liability for non-payment of wages

Currently, criminal law provides for liability for non-payment of wages, pensions, scholarships, benefits and other payments. Responsibility can be assigned not only to the head of the organization, but also to the head of a branch, representative office, or other separate structural unit of the organization (Article 145.1 of the Criminal Code of the Russian Federation).

In case of partial non-payment of wages, pensions, scholarships, allowances and other statutory payments for more than three months, the specified managers face (Part 1 of Article 145.1 of the Criminal Code of the Russian Federation):

- a fine of up to 120,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to one year;

— deprivation of the right to hold certain positions or carry out certain activities for a period of up to one year;

— forced labor for up to two years;

- imprisonment for up to one year.

Partial non-payment means making a payment in the amount of less than half of the amount payable (Note to Article 145.1 of the Criminal Code of the Russian Federation).

In case of complete non-payment of wages, pensions, scholarships, allowances and other payments established by law for more than two months or payment of wages for more than two months in an amount below the minimum wage established by federal law, the specified managers face (Part 2 of Article 145.1 of the Criminal Code of the Russian Federation):

— a fine in the amount of 100,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to three years;

— forced labor for a term of up to three years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years;

- imprisonment for a term of up to three years with or without deprivation of the right to hold certain positions or carry out certain activities for a term of up to three years.

If non-payment (partial or complete) has resulted in grave consequences, the head of the organization (branch, representative office, separate structural unit) may be held liable in the form (Part 3 of Article 145.1 of the Criminal Code of the Russian Federation):

— a fine in the amount of 200,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of one to three years;

— imprisonment for a term of two to five years with or without deprivation of the right to hold certain positions or carry out certain activities for a term of up to five years.

It should be noted that both administrative and criminal liability can occur only in the presence of guilt (Article 2.1 of the Code of Administrative Offenses of the Russian Federation, Article 14 of the Criminal Code of the Russian Federation). Non-payment of wages entails criminal liability only if the enterprise, institution or organization has funds and the non-payment is due to self-interest or other personal interest of the head of the organization (branch, representative office, separate structural unit).

Guide to HR issues. Wage. Responsibility for non-payment of wages {ConsultantPlus}

Information about facts of violation of labor legislation and other regulatory legal acts containing labor law norms can be reported to the State Labor Inspectorate in the Udmurt Republic or filed a claim in court.

A selection of documents.

Form: Complaint (statement) to the state labor inspectorate about violation by the employer of labor legislation in the form of late payment of wages, compensation for unused vacation, interest for delayed payment of wages (Prepared for the ConsultantPlus system, 2015) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, September 2015.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE (www.ntvpkedr.ru).

How to avoid such violations

The managers of the enterprise can treat conscientiously the fulfillment of obligations to employees, including the payment of wages. But difficulties still arise sometimes. Accountants are required to take into account labor, tax, civil rights and many other nuances. At the same time, they receive complaints not only from employees, but also from tax authorities and other inspection services.

In order to avoid possible difficulties, it is more convenient for companies to outsource payment calculations. This is especially beneficial for those enterprises that have already had problems in this area.

One of the obvious advantages of outsourcing is that the risk of errors and inaccuracies in calculations is reduced to a minimum. When a specialized company handles the calculation and issuance of wages, the risk of receiving sanctions under labor and tax laws is almost eliminated. In addition, all employees can connect to a salary project at the bank. In this case, all employees will receive money on their bank cards on the same day, as soon as the outsourcing company or accountant transfers the database to the bank.

Find the best conditions for cash settlement services in Russian banks →

The chief accountant or entrepreneur-employer can take on more important tasks. An enterprise or company will reduce the cost of maintaining a separate position of a financial accountant. Even if errors are identified in the calculations, the responsibility will fall on the outsourcing company; this is stipulated in the contracts for the transfer of part of the tasks and functions.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Valentina Belenkova

07/05/2020 at 21:42 My position was reduced, and by court decision, I was reinstated in the same or equivalent position.

The writ of execution ended up in the bailiff service. They just used strong hypnosis. But I had no time for jokes... I was approaching retirement age, and at that time my mother was ill... So they ignored the execution of the court decision... Reply ↓