Home / Labor Law / Vacation / Educational

Back

Published: 06/09/2016

Reading time: 6 min

1

2176

Not everyone who has received a higher education finds work in their profession, and some simply do not want to work in their field. If this happens, then two options appear: work where they will hire you or get a second higher education.

The Labor Code (Article 177) provides for the provision of paid study leave when receiving higher education for the first time. No such guarantees have been established in case of repeated training .

The decision to give a student leave for periods of sessions while receiving a second higher education or to refuse to provide it is in the hands of the employer. The bosses decide this based on their own interests. The situation is the same regarding payment for this vacation.

- When can leave be denied?

- When can you count on vacation? The employer himself sends you for training

- The employee studies on his own initiative to gain additional knowledge

When can leave be denied?

If an employee began training on his own initiative and the employer is not interested in him receiving a diploma, then he will most likely be denied student leave.

In this case, there are two ways to solve this problem:

- training in your free time;

- receiving leave without pay.

If for the first option you do not need to negotiate with the employer, then for the second you will need his consent.

Leave at your own expense is granted only if there is a good reason for this. Examples of valid reasons are not listed by law, and therefore whether to grant leave or not is decided without particularly relying on anything.

Second higher education: paid or free

You can apply for a first education for free, in accordance with Article 3 of Art. 5 of the Law on Education.

But there are options in which cases you can participate in a competition for free or receive a second education for free:

- If you are a military man (Article 19, paragraph 5): when the first diploma was received at a military higher education institution; liquidator, veteran of service in hot spots. Only education in government institutions will be free.

- If you are going to get a second degree in the field of art.

- If you win a grant: there are a lot of funds both in the Russian Federation and abroad.

- If education is paid for by the employer.

The cost depends on the educational institution, form of training and timing.

When can you count on vacation?

The employer himself sends for training

If the employer himself sends an employee for additional training, then they can enter into an agreement on this, which will stipulate all the necessary conditions.

A common practice is when an employer, sending an employee for training, takes on all the costs associated with this (payment of training costs, travel, accommodation, business trips). A vacation such as a business trip is issued and the employee is paid a salary for its period.

In return for such training, the employee undertakes not to resign for several years, and in the event of dismissal, to compensate the employer for the costs incurred for his education, on a proportional basis to the period not worked.

When using this scheme, admission to a university and registration of leave will consist of the following stages:

- Concluding an agreement with the employer on sending for training.

- Sending documents to an educational institution and enrollment in it.

- Obtaining information about the period during which the training will take place and documentary notification of this to the employer.

- Payment by the employer of the cost of studying at the university.

- Calculation and issuance to the employee of funds necessary for his training, for example, payment of travel, accommodation and daily allowance (if training takes place in another city).

- An employee’s report on the results of the training completed (results of tests and exams) and the funds spent (by providing receipts).

If there is extra money left, then it must be handed over to the cashier , and if a debt has arisen on the part of the employer (the money issued was not enough), then it is necessary to write a statement indicating the amount of funds spent in excess of the limit and the reason for the excess.

It should be noted that only employees who successfully complete the curriculum and successfully pass the final exams can count on tuition fees and student leave.

The employee studies on his own initiative to gain additional knowledge

The employee enters an educational institution and pays for the training himself in order to obtain additional knowledge and a diploma, which he needed to continue working with the same employer as before.

In this case, if an agreement has been concluded with the employer on the provision and payment of student leave when the employee receives a second education, or this point is provided for in the local acts of the enterprise, then the employee will receive both leave and payment.

The registration will take place as follows:

- On the eve of the session, the employee writes an application for student leave and attaches a certificate of summons from the educational institution.

- Based on these documents, the employer issues an order to grant the employee leave and informs the latter of this order.

If the employer refuses to conclude additional agreements regarding training and this is not provided for by any other acts of the organization, then he has every right to refuse to grant leave, even if he is interested in training the employee.

Terms of provision and payment

Student workers often wonder whether the employer is generally obliged to pay them for study leave or not? If all conditions are met, then it should.

Payment depends, as in the case of the main leave, on the student’s work experience in the current place . It is worth noting separately that payments do not depend on whether the employee is sent for training by the employing organization or enrolls independently.

When planning studies, an employee must understand who pays for study leave - the employer or the state. In Russia, the payment is borne by the employer; the state does not reimburse anything.

When an employee is sent by an enterprise, the employer pays the cost of the training program , and when enrolling independently, payment, if necessary, is fully provided by the student.

When receiving a second higher education awarding the same degree that was previously received by the employee, paid leave is not provided, since a prerequisite for granting educational (student) paid leave is the absence of the fact of having previously received a degree awarded based on the results of mastering the program.

In other words, leave is granted only if the employee’s skill level improves based on the results of completing an educational program according to the following step-by-step classification:

- average;

- bachelor's degree;

- specialty;

- master's degree;

- graduate school;

- doctor degree.

If this condition is met, payment does not depend on the specific training program and the qualification and degree awarded as a result of its completion.

To understand how study leave is calculated, it is enough to remember how the main leave is calculated. The calculation of the amount of payment depends on the employee’s length of service in the current position.

How study leave is calculated depends on the employee’s length of service:

- For workers who have been employed for more than a year, the calculation includes the total amount of wage payments for the past year. The amount is divided by 12 (according to the number of months), and then by 29.3 (the average calculation of the number of days in a month throughout the year). The resulting amount is multiplied by the number of days during which the employee is on vacation.

- If the employee works for less than a year , then the total amount of payments is divided not by 12, but by the number of months worked. Next, a similar calculation mechanism is used.

Accountants are often interested in how to pay an employee for study leave, as well as what payment terms and how many days per year can be provided? The Labor Code regulates all aspects - both when study leave is paid and for how long it is given.

Watch a video about properly granting study leave to an employee:

If the leave was obtained fraudulently

If the employee did not notify the employer that he was receiving a second degree, and thus received paid student leave, which in fact he should not have received, then the funds paid to him for this period may be recovered by the employer.

However, in order to recover, it is necessary to establish the fact of deception on the part of the employee in court, and then return the money.

You will learn how to calculate child care benefits in our original material. Read about the legality of deductions from your wages in our article. What amount of compensation can you expect in case of late payment of wages? The link has all the information you need!

Is study leave paid when receiving a second higher education?

Labor legislation contains provisions that when a citizen receives education for the first time, he has the right to leave and appropriate compensation. For example, an employee has a secondary specialized education, but decided to get a higher education. In this case, all guarantees and compensation are retained. But if, with a higher education, a citizen wants to get another diploma, then the employer is not obliged to pay him for study leave.

Thus, as a general rule, study leave when receiving a second and subsequent higher education is not paid!

However, if the head of the enterprise considers it necessary to send an employee for training, then he can pay him leave for the period of the session. As a rule, such a provision is enshrined in an employment contract, student agreement or other acts of the organization. Therefore, we recommend that you familiarize yourself with the local legislation of the enterprise.

Higher education can be obtained both full-time and part-time (part-time). In addition, some universities also offer distance learning, which allows you to take exams using a computer with Internet access.

What is study leave?

Study leave is a type of leave provided to employees who study:

- in universities on part-time or part-time (evening) courses, provided on the basis of Art. 173 Labor Code of the Russian Federation; - in institutions of secondary vocational education (technical school, college) on part-time or part-time (evening) courses, provided on the basis of Art. 174 Labor Code of the Russian Federation; - in educational institutions of primary vocational education (college, training center), regardless of the form of training provided on the basis of Art. 175 Labor Code of the Russian Federation; - in evening (shift) educational institutions (school, gymnasium), regardless of the form of education, provided on the basis of Art. 176 Labor Code of the Russian Federation.

For an accountant: expenses for study leave

In order for the costs of paying for educational leave to be included in the expenses of the enterprise, it is necessary that the condition for paying for educational leave was initially specified in the employment contract and stipulated as an essential condition of the employment contract between the employer and the employee.

This condition is necessary, since in accordance with the provisions of Art. 255 of the Tax Code of the Russian Federation, labor costs are all expenses provided for by the Collective Agreement and (or) the Employment Agreement.

In the case where the enterprise does not have a concluded Collective Agreement, then the only document on the basis of which it is possible to formulate expenses for wages and maintenance of the employees themselves is the Employment Agreement, and then it is the norms reflected in the Employment Agreement that acquire the force of a local regulatory act and are documentary evidence of labor costs incurred by the enterprise.

Payment for study leave

Study leave must be paid no later than three days before its start in accordance with the provisions of Art. 136 Labor Code of the Russian Federation.

Questions often arise about how to pay for vacation if an employee leaves, for example, for four months: should the entire amount of vacation pay be paid at once or paid in monthly installments during the vacation?

The Labor Code does not provide for special rules for paying for long educational leaves.

Therefore, it is necessary to pay the entire amount no later than three working days before the start of the vacation.

The calculation of vacation pay for study leave should be made based on the procedure for calculating average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages.”

This procedure has been applied since January 6, 2008.

The calculation of the average salary for an employee’s educational leave is carried out regardless of his mode of work, based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

For those who combine study and work

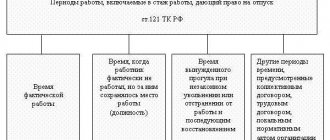

Study leave is the main guarantee provided for employees combining work and study. It is provided in calendar days, regardless of the actual duration of the employee’s work in the organization and can be paid (with the same average earnings) or not.

What kind of leave an employee is entitled to depends on: - on the form of training - full-time, evening or part-time, regardless of the type of training (externship, distance education, etc.); - depending on the type of education - secondary vocational, higher, postgraduate (doctoral, postgraduate or master's degree); - a number of other conditions.

Paid study leave

An organization must provide its employee with paid study leave if the following three conditions are simultaneously met.

- The educational institution has state accreditation (Articles 173-176 of the Labor Code of the Russian Federation), which is confirmed by a certified copy of the certificate. The organization can provide paid study leave to employees who study in educational institutions that do not have state accreditation. However, such a condition must be specified in an employment or collective agreement (Articles 173-176 of the Labor Code of the Russian Federation).

- This is the first time an employee has received education at this level (Article 177 of the Labor Code of the Russian Federation). However, the employer can provide paid study leave to an employee who is receiving education at a given level for the second time (for example, a second higher education), if he himself sent this employee to study in accordance with an employment or apprenticeship contract (Article 177 of the Labor Code of the Russian Federation).

- Successful employee training. It is considered that the training is successful if the employee has no debts and “unsatisfactory” grades.