Violations of employers in the field of wages

Today, violations of labor relations in the form of unlawful delays in payment of wages to employees are widespread. However, this applies not only to salaries, but also to other payments.

It is a rare leader who has never violated these norms. Particularly common violations in this area are:

- non-payment of wages in whole or in part;

- wages not paid in full;

- remuneration made with items the free civil circulation of which is prohibited or limited;

- incorrect payroll;

- incorrect calculation of overtime pay;

- deprivation of bonus;

- setting a salary below the minimum wage and others.

Employers and their representatives may be held liable for such violations. The employer's responsibility for violating the terms of payment of wages is especially emphasized. The law names the head of the organization, as well as officials (managerial employees), as the representative of the employer - a legal entity. These persons, by virtue of various documents and job descriptions, are required to deal with paperwork related to remuneration. Depending on their responsibilities, these persons may be deputy managers, chief accountants, or heads of structural divisions.

Consequences for the employer if payments are delayed

Failure by the employer to comply with the terms of the employment contract, including delays in payments, entails any retaliation.

List of possible consequences:

- termination of employment of company employees if wages are not paid more than 15 days after the period specified in the employment or collective agreement (Article 142 of the Labor Code of the Russian Federation);

- payment for downtime caused by the employer based on average earnings;

- taking administrative and (or) financial liability measures, including payment of monetary compensation to employees. Administrative liability involves the imposition of a fine and suspension of the company’s activities;

- criminal prosecution;

- Initiation of bankruptcy proceedings by employees of the enterprise if payments are delayed for more than 3 months.

For more information about the employer’s liability for delayed payment of wages, read the article https://otdelkadrov.online/5762-vidy-otvetstvennosti-rabotodatelya-za-zaderzhku-vyplaty-zarabotnoi-platy-posleduyushhee-nakazanie.

It is worth noting: if salaries are paid to employees according to a gray or black scheme, then even in the courts it will be quite difficult to prove the facts of delay and non-payment, and it will be almost impossible to hold the employer accountable. Therefore, it is worth discussing in advance with the employer the issue of official payment of wages.

Who can be held accountable

Today, in order to increase the protection of workers from employers who violate labor laws, the Law of the Russian Federation dated July 3 has been prepared. 2021 No. 272 - Federal Law, which comes into force on October 3, 2021. This law will make adjustments to the articles of the Code of Administrative Offenses of the Russian Federation on violations related to non-payment of wages and other payments.

It is planned to increase the size of fines for repeated violations. Here it is necessary to pay special attention to the fact that if earlier for non-payment of wages or other amounts of money due to an employee, the employer could be held accountable under Part 1 of Art. 5.27, then in accordance with the novelties he will be liable under Part 6 of Article 5.27 of the Administrative Code.

Consequently, if, in addition to violations of delayed wages, other offenses that violate labor relations are discovered, the employee may be subject to several fines at once.

Part 1 art. 142 of the Labor Code of the Russian Federation established that the employer and his appointed representatives are responsible for violation of the rules on timely payment of wages to employees, as well as for other offenses provided for by law. It doesn’t matter here whether wages were delayed for one employee or for an entire team.

Law on delayed wages in 2021

According to the Labor Code (LC) of the Russian Federation (Part 6, Article 136) and the letter of the Ministry of Labor of the Russian Federation dated November 28, 2003 No. 14-2-242, wages must be paid to employees hired under an employment contract 2 times a month. The exception is situations when an employee is hired to perform any tasks under a civil contract. This option provides for the preparation of any payment terms that suit both parties. This agreement is stated directly in the contract.

Delays in wages under the Labor Code in 2021 are allowed for a period of no more than 15 days. This is stated in the amendments dated October 3, 2016 to Art. 136 Labor Code of the Russian Federation. This admission implies that the employer has the right to delay payment no more than 15 days after the end of the period for which it was accrued (Federal Law (FZ) No. 272 of 07/03/2016).

The dates of payment of wages must be recorded in at least one of the following documents:

- in the employment contract concluded between the employee and the employer;

- in a collective agreement;

- in internal regulations.

Administrative responsibility

Article 419 of the Labor Code considers the possibility of bringing to justice persons who have violated their obligations regarding monetary payments. There are several types of responsibility:

- material;

- disciplinary;

- civil law;

- administrative and legal;

- criminal

If we consider administrative liability, the latest edition of the Code of Administrative Offenses (Part 6, Article 5.27) contains a higher fine than the previous one. For example, for failure to pay wages on time or setting their amounts less than specified by law, the guilty responsible person, in addition to a warning, may also be fined in the amount of 10,000 to 20,000 rubles.

A legal entity is subject to a fine in the amount of 30,000 to 50,000 thousand rubles. For repeated offenses, an even more severe fine is expected, in the range of 20-30 thousand. In addition, the responsible person may be subject to disqualification for a period of 1 to 3 years. A legal entity faces a fine of 50 to 100 thousand rubles. Disqualification deprives an individual of the opportunity to hold a specific position or engage in related activities. Disqualification is imposed by a court, which makes a similar decision based on data from control and supervisory authorities.

Material liability

Federal Law No. 272 provided for serious changes to the Labor Code and the Code of Civil Procedure (Code of Civil Procedure), the purpose of which is to prevent violations of the payment of wages. Latest version of Art. 236 of the Labor Code contains the rule that if a manager violates the deadlines for the payment of wages and other payments (vacation pay, severance pay) payable to an employee, then he is obligated to pay these amounts, with the addition of interest.

Updated Art. 236 also increased the value of these percentages.

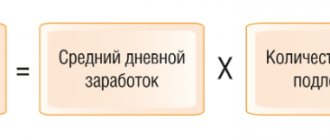

If in the previous legislation the amount of such interest was limited to 1/300 of the Central Bank refinancing rate of amounts not paid on time for each day of delay, starting from the next day of the payment deadline and ending with the day of actual settlement, now the amount of interest has been increased and reaches 1/150 of the Central Bank key rate .

The monetary compensation intended for the employee can be increased by a collective agreement, employment contract or local regulatory document. The employer is obliged to pay this compensation even in the absence of his fault. It follows from this that the employer’s responsibility has doubled, and in addition, there has been a change in the base reference point: the refinancing rate has been replaced by the key rate.

Algorithm of actions for an employee in case of delay in salary

Additionally

, there are certain cases when stopping work is unacceptable:

- workers of rescue and emergency services, military, firefighters;

- in a state of emergency;

- civil servants;

- workers who service particularly hazardous types of production and equipment;

- workers who ensure the livelihoods of the population (ambulance, water supply, gas supply, energy supply, heating, communications).

Based on legal norms, if wages are delayed for more than 15 days, the employee can take the following actions:

- write a notice to the employer stating that due to a delay in payments of more than 15 days, he ceases to perform his official duties. This document must be drawn up in 2 copies, one remains with the employer, and on the other the responsible person who accepted the notification must sign for acceptance. This is necessary to ensure that the employee does not have to register absenteeism, and to prove the legality of the actions in court (if necessary). It should also be taken into account that the employer will have to pay for the period of suspended work;

- do not go to work until written notification from the employer of the intention to issue wages;

- file a claim in court for violation of civil rights.

If the period of delay in wages exceeds 3 calendar months, then the employee, in addition to the actions listed above, can file an application with the arbitration court to declare the company in which he works bankrupt. The court will accept the case for consideration if the employer’s debt to employees is at least 300 thousand rubles.

In addition to the actions listed above, the employee has the right to report a violation of his rights to the following authorities:

- to the Federal Labor Inspectorate;

- to the prosecutor's office at the location of the company where the employee works;

- to court (a sample statement of claim for non-payment of wages can be found here).

If at an enterprise or organization the salaries of several employees are delayed, then it is better to defend your rights together. Collective applications to government agencies will be processed faster than individual ones, and they will also have a greater chance of a positive result.

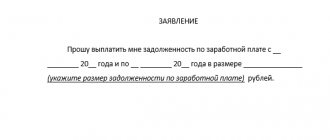

When contacting all government agencies, you must submit a written application indicating the fact of the delay in wages, the timing of the delay, the exact details of the company and your personal data. If available, provide supporting documents.

Watch the video for expert advice on how to collect your salary if you are delayed.

Criminal liability

The most severe is criminal liability. It threatens the employer in the event that he has paid wages to employees irregularly for 3 months or has not paid them at all for two months. He may be punished by restriction of freedom for up to 5 years.

In the same circumstances, when the employer, being an individual entrepreneur or simply an official, delays for a long time the payment of amounts intended for salaries to employees, the Criminal Code has provided for the corresponding liability. Article 145.1 (Part 1) of the Criminal Code lists different types of punishments intended for heads of organizations, as well as structural departments and branches, as well as individual entrepreneurs for non-payment of salaries for 3 months.

If a salary is not paid in an amount of up to 120,000 rubles or equal to the amount of annual maintenance, the official may be sentenced to deprivation of the right to occupy leadership positions, and the individual entrepreneur may be deprived of the right to engage in entrepreneurship for 1 year. More stringent measures are contained in Part 2 of the article, which provides for sanctions in the form of forced labor or restriction of freedom for a period of 1 year.

What to do if your salary hasn't been paid

In such situations, it is not recommended to give up, but to take active action. Underpayments or delays in wages constitute a serious offence. Therefore, you should understand what happened and try to defend your rights.

Before going to the Labor Inspectorate and other authorities, it is necessary to talk with the management or chief accountant of the enterprise to identify the reasons for what happened and the possible timing of repayment of wage arrears. If the dialogue does not achieve results, you can contact more serious institutions - the Labor Inspectorate and the court.