Is annual leave required by law after maternity leave?

Maternity time includes two time periods. The first is sick leave issued in connection with pregnancy and impending childbirth, the second is caring for a child under three years of age. During this time, the employer does not have the right to dismiss the employee; in addition, it is his responsibility to issue benefits that will be paid to the woman during absence from work.

During this time, the pregnant woman is listed as employed, and accordingly, she accumulates annual leave. In accordance with the law, she has the right to use it immediately after the end of parental leave (Article 260 of the Labor Code).

ATTENTION! Annual leave after maternity leave can be taken out regardless of the employees’ existing vacation schedule and length of time worked.

Example 2. Calculation of annual leave 3 months after maternity leave

Let’s assume that after returning from maternity leave Egorova M.V. worked part-time in September, then full October and November 2021. And from 12/01/2020, in agreement with management, she goes on annual paid leave. In this situation, the billing period should be determined according to the general rule described in clauses 10-11 of Regulation No. 922) - from 12/01/2019 to 11/30/2020, since there is earnings and actually worked days in the given 12 months, parental leave also excluded. Those. It is impossible to shift the calculation period to the time preceding the excluded period as in example 1.

By the way, the general rule for calculating vacation pay also applies in cases where a woman takes annual leave after her BIR leave.

The procedure for granting the next paid leave after maternity leave

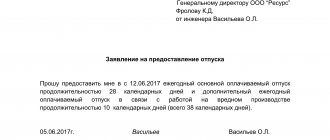

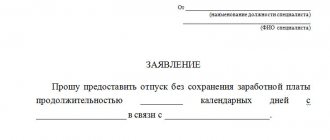

Registration of non-vacation leave after maternity leave is initiated by the employee herself by drawing up an application. The Labor Code does not provide for an official form for this document, and a woman can draw it up in free form.

The standard application contains the following information:

- Full name of the employee;

- Full name of the person to whom the document was sent;

- full name of the organization indicating its form of ownership;

- the essence is a request for another leave immediately after maternity leave;

- expected start date of vacation;

- Date of preparation;

- the applicant's handwritten signature.

If local regulations of an enterprise establish the need to use a company letterhead for drawing up applications, then the document must be drawn up using it.

The application is submitted to the head of the structural unit. Sometimes the responsibilities for receiving and processing such documentation may be assigned to accounting employees, the management secretariat, or the personnel department.

Requirements for granting basic leave

The Labor Code of the Russian Federation guarantees all officially employed employees legal leave for a period of twenty-eight days. Before going on vacation, each employee can receive a paycheck, and representatives of special professions receive a longer period of rest:

- specialties with a high level of danger;

- professions that involve constant moral stress;

- employees of chemical or processing industry enterprises with increased levels of harmful substances.

The collective agreement signed by the employee upon hiring may have some mitigating circumstances in the area of guaranteed vacation. Rest days can be extended; during this period, the employee can receive additional money from management.

The Labor Code dictates rules according to which an employer never has the right:

- call a specialist to the workplace ahead of schedule;

- dictate to subordinates the rules and regulations for going on vacation;

- reduce the period of rest from work duties;

- carry out reductions or layoffs after rest;

- refuse to process wages and vacation pay.

Vacation can be taken at any period that will be beneficial to the employee, but before going on vacation it is necessary to agree on all the details with the management of the enterprise. After maternity leave, each employee can absolutely legally take advantage of another type of vacation, and at the same time receive payment from the enterprise. Practice shows that new employees cannot always count on summer vacation, this is due to the fact that each employee must work for a certain period of time at the new enterprise. For the first time, you can take a break from work duties after six months of working in an organization, because any individual has the right to request leave in advance. Maternity leave never has such restrictions and is provided to everyone under the same conditions.

An employee can also divide twenty-eight days into two parts to make his vacation more productive and rational. It is best to carry out such a procedure after a year of work at a certain enterprise, so as not to resort to the need to rest in advance. Before going on advance leave, the employee must write a statement addressed to the head of the enterprise.

Vacation pay calculation

The algorithm for determining the amount of vacation pay is based on average earnings during the billing period of twelve months. When taking annual leave immediately after maternity leave, twelve months prior to the date of registration of child care are taken into account. That is, income received in the form of benefits during the period of temporary disability due to pregnancy and childbirth is included in general calculations.

As you know, the standard number of sick leave days according to BiR is 140. In this case, payment for vacation days is calculated for the billing period, which includes the duration of sick leave and 225 calendar days worked before leaving (365 - 140). In special cases of pregnancy, the estimated time used to calculate the amount of vacation pay after maternity leave consists of the following segments:

- childbirth with complications - 156 days of sick leave and 209 days of work;

- multiple pregnancy – 194 days of sick leave and 171 regular days;

- adoption of a child under 3 months of age (confirmation of the fact of adoption is required by providing relevant documents for the child) – 70 days of sick leave and 295 working days.

The indicated values are relevant for cases where registration was carried out immediately after maternity leave. If a woman, after the end of her time caring for a child up to 3 years old, has worked for some period of time, and then decides to go on annual vacation, then the months are replaced in the billing period. The calculation is carried out for the 12 months of work preceding the maternity leave.

Average earnings

Each day off is paid based on average earnings for the pay period. When calculating, the following income for labor is taken into account:

- wage;

- planned bonuses and allowances;

- sick leave benefits according to BiR.

Not included in calculations:

- vacation accruals;

- travel allowances;

- one-time bonus accruals;

- subsidies;

- benefits for caring for children with disabilities.

The algorithm for calculating the average daily income in cases of taking official leave immediately after maternity leave does not differ in any way from the usual:

Summarized income for the billing period / Number of days in the period

How to count vacation days

Days are counted in two stages. According to the Labor Code, for every 30 days worked, a citizen receives 2.33 days of annual paid rest. Accordingly, during the period of sick leave for pregnancy and childbirth, the woman will be accrued:

- 140 days are 4 months and 20 days, while 20 days are rounded in favor of the employee, respectively 5 months;

- 5 * 2.33 = 11.65 days of rest.

The second stage involves adding the day of maternity leave with the number of available but unused days.

IMPORTANT! If the total number of days does not reach the maximum of 28, then the employer is obliged to provide them in advance. The rule is relevant only for cases of registration immediately after the end of the maternity period.

Calculation example

An example of calculating vacation days after maternity leave using the following data:

- date of employment – 03/01/2016;

- the date of registration of sick leave according to the BiR for a period of 140 days is 09/01/2017;

- number of days used – 28.

Thus, the duration of time according to the BiR will be:

- First working year: 03/01/2016 – 02/28/2017 – 12 full months. Second working year: 03/01/2017 – 08/31/2017 – 6 full months.

- Total length of service in the organization: 18 full months.

- Number of earned days off during the entire period of work in the company: 18 * 2.33 = 41.94.

- Number of unused rest days: 41.94 – 28 = 13.94.

- Rest days according to BiR in 140 days: 11.65.

- Total duration: 11.65 + 13.94 = 25.59 (rounded in favor of the employee - 26 days).

The period of annual paid time off under the conditions described above is 26 days. The employer will be required to provide two additional days in advance to this value.

Features of calculating maternity leave

The calculation of the period of one hundred and seventy days, which is paid and provided to every pregnant woman, has special rules and regulations. The first seventy days before the birth are paid in full, calculated on the basis of the employee’s average salary. Seventy days after childbirth are paid only partially; the payment amount corresponds to forty percent of the woman’s average monthly earnings. Practice shows that before giving birth, many women refuse to pay benefits, since wages are often more significant. The legislation of the Russian Federation allows not only mothers and fathers, but also other relatives to take maternity leave while raising a child. However, in order to obtain permission for this type of vacation, it is necessary to provide the management of the enterprise with evidence that no other family member has taken advantage of the opportunity to go on maternity leave.

Note!

Basic and maternity leave are calculated independently of each other, therefore, every woman can take advantage of all types of rest that the state guarantees to her.

The calculation of the main rest period is of a completely different nature; each employee will be able to calculate the amount of benefit payments after knowing her average income. If desired, a young mother can refuse the main leave after caring for the baby. The employer has no right to influence the timing of maternity leave, which must be specified in medical documents. Forcing people to go on vacation during a period convenient for the enterprise is considered a gross violation of the laws of the Labor Code of the Russian Federation. Before an employee leaves, the employer must plan in detail for replacement, layoffs, or hiring of new employees in order to normalize the organization's activities.

How are vacation pay calculated after maternity leave?

Each employee can take paid leave after 6 months of work. You can go on vacation before the end of six months by agreement with your employer. The vacation schedule is drawn up taking into account the wishes of the employees of the department or other unit. The schedule is approved by management. Without observing this schedule, a woman who plans to return from maternity leave has the right to take official leave. By agreement with the employer, she can take leave before or after maternity leave. This procedure is also possible if she has already taken annual leave. The employer in this situation provides her with rest in advance, that is, for the next reporting period. If a woman was on vacation, granted to her in advance, and then decided to leave her job, part of her vacation funds is deducted from her dismissal payments.

Calculation of annual leave after maternity leave occurs in the standard way. The algorithm of actions is specified in Article 139 of the Labor Code of the Russian Federation. When calculating, you need to correctly determine the following indicators:

- number of vacation days;

- billing period;

- average annual earnings;

- vacation pay.

According to the provisions of the Labor Code of the Russian Federation, a woman who has returned from maternity leave has the exclusive right to receive annual leave immediately. She must be given a vacation period of 28 days; in some situations, these days can be extended in time, but not reduced. In addition, when calculating the allotted rest time, days unused before maternity leave, accrued to the woman before going on sick leave for pregnancy and childbirth, can be taken into account.

The number of days of annual leave is calculated as follows:

- Vacation days unused by the employee before maternity leave are calculated.

- The days due for sick leave lasting 140 days are calculated.

- The amounts add up to each other.

The duration of maternity leave is 140 days, which corresponds to 4 months and 20 days. These days are rounded up to 5 months. With an annual leave duration of 28 days, 2.33 days are allotted for each month. We multiply this figure by 5, it turns out 11.65 days. Typically, the employer rounds these days to 12.

In the process of calculating the money a woman is due for her vacation, you need to pay attention to the billing period. According to the Labor Code of the Russian Federation, the billing period is 12 months. This year precedes the annual vacation period. An employee who returned to work after maternity leave without working for 140 days, which were provided to her by law and up to 3 years to care for an already born child. The actual duration of a woman’s maternity leave depends on the nature of the birth and the number of children born.

Sick leave for pregnancy and childbirth is included in the billing period. Does not include parental leave. Based on this, when calculating average earnings, payments accrued to the employee’s bank account during this time are taken into account. If, after the expiration of the sick leave, a woman immediately went to work, then she does not have any excluded periods. Therefore, the calculation period is 12 months before the month of registration of the annual paid vacation. If a woman did not return to work after 3 years, that is, after maternity leave, then she had no income in the previous year. Therefore, the calculation should be based on the 12 months preceding the start of her maternity leave.

The amount of average earnings per day also plays an important role in the process of calculating vacation pay. The calculation of average earnings includes the following indicators:

- the amount of salary that was received during the billing period;

- bonuses, allowances, surcharges.

IMPORTANT: If the company has increased salaries, then indexation is carried out.

Income not subject to accounting:

- vacation pay;

- one-time bonuses;

- payment for business trips;

- one-time benefits;

- subsidies;

- prizes received as a result of winning competitions;

- bonuses that were paid to employees for the holiday;

- benefits for caring for a disabled child.

The calculation procedure is standard. The amount of income for the billing period is determined. All accrued indicators are added up. The number of days actually worked by her is determined. If the month is worked in full, then the number of days is equal to the coefficient 29.3. If the month is not fully worked, then the number of days is calculated as calendar days worked, which are divided by the total number of calendar days, multiplied by 29.3.

Formulas for calculation:

Average earnings = income / number of full days X 29.3 + number of days in partial months

Calculation of vacation pay for annual holidays:

Vacation pay = average earnings X days of vacation