Compensation during the period of work

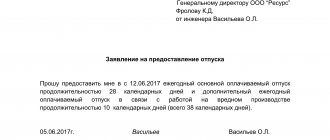

In this case, monetary compensation can be calculated for that part of the vacation that exceeds the standard 28 calendar days.

At the same time, the initiative to replace additional leave with payment belongs to the employee, and the employer resolves this issue only upon a written application from the employee (and the employer can also make a negative decision).

It is not allowed to replace with monetary compensation annual additional paid leave for pregnant women and employees under the age of 18, as well as annual additional paid leave for employees engaged in work with harmful and (or) dangerous working conditions for work in appropriate conditions.

Donor Employee Compensation

On the day of blood donation, as well as on the day of the related medical examination, the employee is released from work (Article 186 of the Labor Code of the Russian Federation).

If, by agreement with the employer, an employee goes to work on the day of blood donation (except for work with harmful or dangerous working conditions, when the employee cannot go to work on that day), he is given another day of rest at his request.

If an employee donated blood during the period of annual paid leave, on a day off or a non-working holiday, the employee, at his request, is given another day of rest.

note

The Russian Ministry of Labor believes that if an employee donated blood on a day off, then he has the right to two days off, which are paid based on average earnings. At the same time, no restrictions have been established when paying for these days (letter of the Ministry of Labor of the Russian Federation dated November 15, 2013 No. 14-1-204).

After each day of donating blood, the employee is given an additional day of rest. This day of rest, at the request of the employee, can be added to the annual paid leave or used at other times during the calendar year.

The basis for release from work is a certificate from the medical institution where the employee donated blood.

If an employee donated blood, then the employer retains his average earnings for the days of donation and the days of rest provided in connection with this (Article 186 of the Labor Code of the Russian Federation).

For information on how to calculate average earnings, see the “STS in Practice” guide.

Keep in mind: insurance premiums should be calculated on average earnings during this time. This was confirmed by the judges in the ruling of the Supreme Arbitration Court of Russia dated May 31, 2013 No. VAS-6428/13.

Expenses for remuneration of donor employees for the days of examination, blood donation and rest provided after each day of blood donation reduce the taxable profit of the organization (clause 20 of article 255 of the Tax Code of the Russian Federation).

EXAMPLE Employee of Aktiv JSC A.V. Somov donated blood for free on July 1 of this year. On July 2 of this year, Somov was given an additional day of rest. The billing period at JSC Aktiv is 12 calendar months preceding the event associated with the payment of average earnings. Somov’s salary is 15,000 rubles. In addition, in January, March and June of this year, Petrov received bonuses (1000 rubles each), provided for by the Regulations on bonuses. The calculation period for calculating average earnings will include July - December of last year and January - June of this year. Working hours and amounts paid (assuming that the employee worked the entire pay period) are tabulated:

| Months of the billing period | Actual number of working days | Salary earnings, rub. | Prizes, rub. |

| last year | |||

| July | 23 | 15 000 | – |

| August | 22 | 15 000 | – |

| September | 21 | 15 000 | – |

| October | 23 | 15 000 | – |

| november | 20 | 15 000 | – |

| December | 21 | 15 000 | – |

| this year | |||

| January | 20 | 15 000 | 1000 |

| February | 19 | 15 000 | – |

| March | 20 | 15 000 | 1000 |

| April | 22 | 15 000 | – |

| May | 19 | 15 000 | – |

| June | 20 | 15 000 | 1000 |

| Total | 250 | 180 000 | 3000 |

The total number of working days in the billing period is 250.

The total amount of payments to Somov for the billing period will be: 180,000 rubles. + 3000 rub. = 183,000 rub.

Somov's average daily earnings for the billing period will be equal to: 183,000 rubles. : 250 days = 732 rub.

For two days (one day for blood donation and one additional day of rest), Somov must be paid: 732 rubles. × 2 days = 1464 rub.

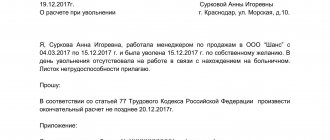

Compensation upon dismissal

When an employee is dismissed, most misunderstandings and conflicts arise, including in connection with the calculation of compensation for unused vacation. Briefly, this issue is regulated by Art. 127 of the Labor Code, but its application requires some specific knowledge.

For example, we must not forget that annual paid leave is provided to all employees without exception - including temporary, seasonal, part-time employees, etc. (Article 114).

It is also important that all amounts due to the employee, including compensation for unused vacation, must be paid on the last day of work (also known as the day of dismissal).

The employee should check that the accounting department has not forgotten anything. If you disagree with the amount of the amount paid and receive a refusal to recalculate, the employee should still receive compensation in the undisputed part, as well as a salary certificate.

Compensation payments

12.01.21 16:06

under agreements concluded before 1992

On behalf of the Government of the Russian Federation, since 2001, PJSC IC Rosgosstrakh has been paying compensation to certain categories of citizens under accumulative personal insurance contracts concluded before January 1, 1992 with the State Insurance of the RSFSR.

In accordance with Article 15 of the Federal Law of December 8, 2020 No. 385-FZ “On the Federal Budget for 2021 and for the Planning Period of 2022 and 2023,” payment of compensation continues under accumulative personal insurance contracts (mixed, children’s, wedding, pension) concluded before January 1, 1992, the insurance or redemption amount for which was not received as of January 1, 1992. Compensation can be received by policyholders or insured persons, as well as their heirs by law. These persons must be citizens of the Russian Federation.

What determines the amount of compensation?

- From the year of birth of the compensation recipient.

- if the year of birth is 1945 inclusive, compensation is paid in 3 times the amount of the balance of contributions as of 01/01/1992 minus previously received compensation.

- if the year of birth is from 1946 to 1991, inclusive, compensation is paid in 2 times the amount of the balance of contributions as of 01/01/1992 minus previously received compensation.

- From the year of expiration (termination) of the insurance contract.

In the event of the death in 2001-2021 of the policyholder/insured person who was a citizen of the Russian Federation on the day of death, the heirs are paid compensation for funeral services.

The procedure for payment of compensation is determined by Decrees of the Government of the Russian Federation No. 1093 of December 25, 2009, No. 1171 of December 28, 2010, No. 1249 of December 30, 2011, No. 1329 of December 18, 2012, No. 1169 of December 17, 2013 ., No. 1375 of December 16, 2014, No. 1364 of December 12, 2015, No. 1436 of December 22, 2016, No. 1552 of December 14, 2017, No. 1514 of December 12, 2018, No. 1707 of 12/18/2019, No. 1871 of 11/18/2020.

Information on the procedure for making payments, a list of required documents and application forms are posted in all branches of Rosgosstrakh, RGS Bank, as well as on the website.

PJSC IC "Rosgosstrakh": 8 (800) 200-0-900 (calls within Russia are free), for calls from a mobile phone - 0530 (free from numbers of all operators) PJSC "RGS Bank" (calls within Russia are free)

How to receive compensation payment

Check whether your personal savings insurance contract is subject to compensation:

- The contract must relate to one of the following types of insurance: mixed, children's, wedding, pension .

- Next, you need to pay attention to the start date of insurance, and if the contract was concluded before January 1, 1992 and was valid on this date , then your contract is subject to compensation.

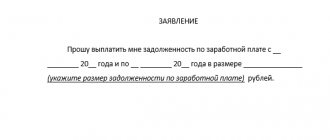

- 1. Write an application

- 2. Prepare documents

- 3. Send by mail

Please attach the following documents to your application:

- Copy of passport (2, 3 and 5 pages);

- A document confirming the change of full name (if necessary);

- If the heir of the policyholder or the insured applies for payment of compensation, then the following documents must be attached to the above documents:

- A copy of the death certificate of the policyholder/insured;

- One of the documents confirming the right to inheritance: A copy of the certificate of the right to inheritance by law or by will (may contain information either about the entire (share) of the property of the deceased, or about the inheritance of the insured amount under an accumulative personal insurance agreement);

- A copy of the notary's decree;

- A copy of the court decision confirming the right of the heir.

If the documents from points 1 and 2 are missing, you must contact the notary office at the place of registration of the deceased to fill out a notary request to calculate the amount of compensation. The request is sent by a notary to the Settlement Center for Compensation Payments in Ryazan (RCCP). RCCV prepares and sends the certificate to the notary. Based on a certificate from the RCCV, the notary issues the heir(s) a certificate of the right to inheritance under an accumulative personal insurance agreement.

The entire package of documents must be sent independently by mail to the Settlement Center for Compensation Payments (RCCP) at the address 390046, Ryazan, st. Vvedenskaya, house 110.

Questions and answers

We answer frequently asked questions about compensation payments

What are the deadlines for consideration and receipt of compensation payments (a full package of documents has been sent)? Where are the deadlines written and by whom are they regulated? Legislative documents regulating the procedure for making compensation payments do not establish time limits for considering citizens' applications.

Contributions under accumulative personal insurance contracts concluded before January 1, 1992 are recognized as internal public debt, and compensation is paid from the federal budget. That is why documents require careful verification and reasonable calculations. RCCB specialists inform clients in writing by Russian post about missing documents or refusal to pay.

Which letter should I send the documents by - regular, registered, with or without notification?

You can send documents by regular mail, registered mail, with or without notification. If you send by registered mail with notification, in this case you will have confirmation of receipt of the documents by the Settlement Center for Compensation Payments.

Can I send scanned documents by email to Ryazan? If yes, to what address?

At the moment, documents for payment of compensation can only be sent by mail of the Russian Federation, to the postal address: 390046, Ryazan, st. Vvedenskaya, 110.

I already received some kind of compensation in 2001 and received a second compensation from Ryazan. Will it be possible to receive another compensation this year?

Categories of citizens entitled to receive compensation are determined annually by the relevant article of the Federal Law on the Federal Budget, and the procedure for payments and the amount of preliminary compensation are determined by the Decree of the Government of the Russian Federation.

In accordance with Decree of the Government of the Russian Federation No. 1093 of December 25, 2009, citizens of the Russian Federation born in 1945 inclusive are entitled to compensation in the amount of 3 times, minus previously received compensation. Citizens of the Russian Federation from 1946 to 1991 inclusive are entitled to compensation in the amount of 2 times, minus previously received compensation.

How do you know how much compensation is required? The entire amount for which it was once insured? How is the amount of compensation calculated?

It is not the insurance amount that is subject to compensation, but only the premiums paid as of January 1, 1992. The amount of compensation is calculated from the amount of contributions paid under the insurance contract as of 01/01/1992, using appropriate coefficients depending on the year of receipt of the insurance or redemption amount. You can calculate the approximate amount of contributions yourself by multiplying the premium under the insurance contract by the number of months that have passed from the beginning of the insurance contract to January 1, 1992.

I want to know how much I am owed for funeral services. Otherwise, maybe it’s not worth spending money on a notary, etc.

The amount to be paid depends on the amount of contributions paid under the insurance contract as of 01/01/1992.

You can calculate the approximate amount of contributions yourself by multiplying the premium under the insurance contract by the number of months that have passed from the beginning of the insurance contract to 01/01/1992. The amount of compensation for funeral services is calculated from the amount of contributions as of 01/01/92. If this amount is greater than or equal to 400 rubles, then compensation for funeral services will be 6,000 rubles. If the amount of contributions is less than 400 rubles, then this amount is multiplied by a factor of 15.

If several heirs, according to the certificate of the right to enter into an inheritance, refused in favor of only one heir, then what document should confirm this?

This fact is confirmed by the Certificate of Right to Inheritance (in the certificate, the notary indicates the fact of refusal of other heirs in favor of one).

The RCCV requires a certificate of citizenship of the deceased. For what? Where can I get it?

RCCV specialists require a certificate of citizenship when calculating compensation for funeral services. In this case, the recipient of compensation (heir) can have any citizenship, and the deceased must have had Russian citizenship at the time of death.

This can be documented as follows:

- Certificate of right to inheritance (the notary indicates in the column “Citizenship of the deceased” - Russian Federation.

- Request a certificate from the registry office.

- If you still have a copy of the Russian passport of the deceased, attach it to the application.

- Send an official request to the Federal Migration Service.

I was insured in the USSR, now I am a citizen of Ukraine or other Republics - am I entitled to compensation?

In accordance with current legislation, only citizens of the Russian Federation can receive compensation under insurance contracts.

I was insured in the USSR, a citizen of Russia, now I live permanently in another republic of the former USSR - am I entitled to compensation?

If the insurance contract was concluded on the territory of the Russian Federation and the last insurance premium was paid there, then you, as a citizen of the Russian Federation, have the right to receive compensation.

If I have a personal insurance contract concluded after January 1, 1992 on the territory of the Russian Federation, where should I apply for compensation?

By the Federal Law “On the restoration and protection of savings of citizens of the Russian Federation” of May 10, 1995, the state recognized as its internal debt only contributions paid to the state insurance organization before January 1, 1992. Contracts concluded after January 1, 1992 are not subject to compensation - To receive the insurance amount, please contact the insurance department where the insurance contract was concluded.

How to write a statement if we can’t remember anything about the contract? Where to go if the entire archive is destroyed?

The application should indicate, if possible, more complete information about the contract (full name of the policyholder and the insured, place of conclusion of the insurance contract, type of insurance, approximate start and end dates of the contract). Using these data, RCCV specialists search for an insurance contract in the electronic database of PJSC IC Rosgosstrakh. If there is no insurance contract, the Ryazan RCCV will notify you by letter. It should be borne in mind that all primary documents on expired insurance contracts and on contracts for which the insurance or redemption amount was paid were destroyed due to the expiration of the statute of limitations (Article 196 of the Civil Code of the Russian Federation). Branches of PJSC IC "Rosgosstrakh" electronically transferred databases of accumulative personal insurance contracts subject to compensation to the RCCV. Primary documents under insurance contracts were not transferred to the RCCV.

According to the Rules approved by Decrees of the Government of the Russian Federation dated December 25, 2009 No. 1093, payment of any type of compensation is made upon confirmation of the availability of deposits (contributions) under insurance contracts as of January 1, 1992.

Such documents include:

- insurance certificate;

- certificate of accrued compensation in the amount of 40% of the amount of insurance premiums paid before 03/01/1991 (in accordance with the Decree of the President of the USSR of May 6, 1991 “On compensation for losses from the depreciation of citizens’ cash savings under long-term contracts with state insurance bodies of the USSR”), issued state insurance authorities;

- a certificate from the employer confirming the transfer of insurance contributions from wages (with this method of payment of contributions) with the obligatory indication of the amount of contributions and the entire period of payment, certified by signature and seal. If the enterprise is closed, you can request this certificate from the city archive at the location of the enterprise. When an enterprise is liquidated, all data on employee salaries and deductions from them are transferred to the city archive. According to legislative documents, the listed information is stored in the archive for 75 years.

If one of these documents is provided, the RCCV will consider the issue of payment again.

Why do they request repeated documents if they were previously sent to the Ryazan Settlement Center?

To avoid the return of funds from the bank to the Federal Treasury, it is necessary that on the date of calculation of compensation all documents are valid (the applicant’s full name does not match the full name specified in the agreement, the passport is expired, the bank details have been changed and the personal name is closed account, etc.). That is why RCCV specialists make a repeated request for documents.

Is it possible to transfer compensation to the account of another person, for example to the account of the husband?

No. The transfer of compensation is carried out by the Federal Treasury Department only to the applicant’s account.

I already have an open account with my bank. Can I get compensation for it?

The details of the applicant's bank account are: bank name, INN, K/s, BIC, R/s, KPP and 20-digit personal account number. Thus, you can provide details that meet the above requirements for any bank. However, it will not be possible to transfer compensation to your already opened account in the following cases:

- A personal account has more or less 20 digits.

- An account is indicated that is not intended for transferring compensation (currency, metal, fixed-term, closed, etc.).

- The recipient's bank requires additional information (card number, additional account, etc.) in the payment purpose.

- The personal account of a non-individual is indicated (for example, individual entrepreneurs who are equated to legal entities).

Procedure for calculating compensation

When calculating and checking the amount of compensation for unused vacation, the following circumstances should be taken into account.

- Full compensation for vacation is due only to those employees who have worked a full working year (that is, at least 11 months). In other cases, compensation is calculated in proportion to the number of months worked, with partial months rounded in one direction or another.

- If an employee is dismissed before the end of the working year for which he has already received annual paid leave, the employer may make deductions from his salary for unworked vacation days.

- If an employee is found to have unused vacation days for previous years of work, then upon dismissal, all of them must be compensated, regardless of how much time has passed. In this case, only the employee’s salary for the last year is taken into account.

You might be interested in the How Long Should We Work mind map, which takes a closer look at the rules governing working hours.

Or read HERE about the procedure for terminating an employment contract.

Formula for calculating compensation for unused vacation

To directly calculate compensation, we will need the following data.

- Number of unused vacation days: KDNO = KDO : MG x MR, where:

- KDO - the total number of days of compensated leave;

- MG – number of months in a year;

- MR – the number of whole months actually worked.

- Work experience in the organization giving the right to leave: SR = (PM x 29.3) + (KD - ND) x 29.3/KD, where:

- PM – full months worked;

- KD – the number of calendar days of the month not fully worked;

- ND – days not included in the length of service, i.e. not counted as workers (sick leave, time off, personal leave, etc.).

- Average daily employee’s earnings for the last working year: SDZ = SV: SR, where:

- SV – the sum of all payments for the billing period, excluding sick leave, vacation pay, financial assistance, etc.;

- SR – length of service calculated in days in the organization.

Having all the above data, we can easily calculate the amount of compensation for unused vacation: KO = SDZ x KDO, where SDZ is the average daily earnings, KDO is the number of unused vacation days.

Compensation for unused vacation: calculation, accounting, taxes

In practice, it is not uncommon for an employer to pay compensation to an employee for unused vacation. In what cases is it permissible to replace vacation with monetary compensation? What are the features of calculating this type of payment? Is monetary compensation for part of the vacation exceeding 28 calendar days included in labor costs? Is monetary compensation for unused vacation days subject to UST? We will try to answer these questions in this article.

Requirements of the Labor Code regarding the provision of leaves to employees

Article 122 of the Labor Code of the Russian Federation defines the employer’s obligation to annually provide the employee with paid leave of 28 calendar days ( Article 115 of the Labor Code of the Russian Federation )[1]. Transferring vacation to the next year is allowed (by agreement of the parties) only in exceptional cases (in particular, when an employee going on vacation in the current year may negatively affect the organization’s activities). In this case, the employee must use the days of the transferred vacation no later than 12 months after the end of the working year for which the vacation was granted.

An employer is prohibited from not providing an employee with annual paid leave for two years in a row ( Article 124 of the Tax Code of the Russian Federation ). At the same time, employees under the age of 18, as well as those employed in jobs with harmful and (or) dangerous working conditions, are obliged to provide leave annually.

Thus, the law establishes strict restrictions for employers regarding the provision of leaves to employees. However, in practice, workers often accumulate unused vacation time from previous years. In this case, the employer retains the obligation to provide the employee with these vacations or pay him monetary compensation for their unused days.

In what cases is monetary compensation paid for unused vacation?

Cash compensation for unused vacation is paid upon dismissal ( Article 127 of the Labor Code of the Russian Federation ), as well as upon a written application from the employee for part of the vacation exceeding 28 calendar days ( Article 126 of the Labor Code of the Russian Federation ).

It should also be taken into account that replacing vacation with monetary compensation is not allowed:

- pregnant women;

- employees under eighteen years of age;

- workers engaged in heavy work and work with harmful and (or) dangerous working conditions.

Calculation of compensation for unused vacation

The amount of compensation for unused vacation upon dismissal (including for organizations that use summarized working time recording) is calculated as follows:

| Compensation for unused vacation upon dismissal | = | Average daily (hourly) earnings for the billing period | X | Number of days (hours) of vacation not used while working in the organization |

The calculation of the average daily (hourly) earnings for payment of compensation for unused vacation is carried out according to the rules established by Art. 139 of the Labor Code of the Russian Federation and the Regulations on the calculation of average wages [2], and is calculated for the last three calendar months (unless a different calculation period is provided for by the collective agreement) [3] by dividing the amount of actually accrued wages by the estimated number of days (hours actually worked) for the billing period.

Upon dismissal...

The most common case when monetary compensation is given for unused vacation is the dismissal of an employee. Let us note that upon dismissal, an employee, upon his application, may be granted all unused vacations (both main and additional), except if his dismissal is associated with guilty actions. The day of dismissal of the employee will be considered the last day of his vacation. In this case, the vacation granted to the employee is paid, and, accordingly, compensation for unused vacation upon dismissal is not paid.

Please note : compensation for unused vacation is also paid to employees who leave the organization by transfer (on the basis provided for in paragraph 5 of Article 77 of the Labor Code of the Russian Federation ).

In practice, when determining the number of vacation days to which an employee is entitled while working in an organization, certain difficulties arise. The fact is that the Labor Code of the Russian Federation provides for a specific procedure for calculating days of unused vacation only for employees who have entered into an employment contract for a period of up to two months - by virtue of Art. 291 of the Labor Code of the Russian Federation, compensation is paid to them at the rate of two working days per month of work. For other categories of workers, the mechanism for such calculation is not specified in the Labor Code of the Russian Federation.

The following calculation option is generally accepted. If an employee has worked in an organization for 12 months, which includes the vacation itself ( Article 121 of the Labor Code of the Russian Federation ), then he is entitled to an annual vacation of 28 calendar days. In other words, full compensation is paid to an employee who has worked for the employer for 11 months ( clause 28 of the Rules on regular and additional leaves , hereinafter referred to as the Rules )[4]. If the resigning employee has not worked the period that entitles him to full compensation for unused vacation, compensation is paid in proportion to the days of vacation for the months worked ( clause 29 of the Rules ).

When calculating the terms of work that give the right to compensation for leave upon dismissal, surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to more than half a month are rounded up to a full month ( clause 35 of the Rules ).

Compensation is paid in the amount of average earnings for 2.33 days (28 days / 12 months) for each month of work.

Example 1.

The employee worked for the organization for 10 months. Upon dismissal, he is entitled to compensation for 23.3 days (2.33 days x 10 months). If he had worked for 11 months, he would have received compensation for a full month - 28 calendar days.

Thus, the 11th month of work gives the employee the right to receive compensation for 4.7 days (28 - 23.3).

Please note : these standards for the payment of compensation worsen the situation of dismissed employees who have worked for less than 11 months, compared to persons dismissed after 11 months of work. However, an attempt to challenge the provisions of clause 29 of the Rules in the Supreme Court of the Russian Federation was unsuccessful ( Decision of the Supreme Court of the Russian Federation dated December 1, 2004 No. GKPI04-1294 , Determination of the Supreme Court of the Russian Federation dated February 15, 2005 No. KAS05-14 ), since, according to the judges, the principle of proportional calculation of compensation is fully consistent with the similar principle contained in Art. 291 Labor Code of the Russian Federation . The very fact that paragraph 28 of the Rules provides for the right of an employee who has worked for at least 11 months upon dismissal to receive full compensation for unused vacation cannot in itself indicate the presence of any contradictions between paragraph 29 of the Rules and the provisions of Articles 3, 114 and 127 Labor Code of the Russian Federation.

Some organizations use a different method of calculation, which is reflected in the collective agreement (or wage regulations). Since the working year is divided into approximately 11 months of work and 1 month of vacation, each month the employee earns the right to vacation in the amount of 2.55 days (28 days / 11 months). From a mathematical point of view, this method of calculation is more correct and does not worsen the terms of payment of compensation for unused vacation upon dismissal of employees. However, its use will lead to an increase in labor costs, and this will most likely be regarded by the inspection authorities as an understatement of the tax base for income tax. If disagreements arise with the tax authorities, you will only have to defend your position in court.

Example 2.

I. I. Ivanova started working on 08/02/03. In 2004, she was on regular annual leave from June 1 to June 28 (28 calendar days). In 2005, I. I. Ivanova was not on vacation. In April 2006, she wrote a letter of resignation of her own free will (from 04/24/06).

The employee's salary is 10,000 rubles. per month. In addition, she was awarded:

- in January 2006 - a bonus based on the results of work for 2005 in the amount of 3,000 rubles. and a monthly bonus for meeting production targets in December 2005 - 500 rubles;

- in February - bonus for meeting production targets in January 2006 - 600 rubles;

- in March - bonus for meeting production targets in February 2006 - 700 rubles;

- in April - bonus for meeting production targets in March 2006 - 800 rubles. and a bonus based on the results of work for the first quarter of 2006 in the amount of 2,000 rubles.

The duration of the billing period in the organization is 3 months. The billing period has been fully worked out.

Let us remind you that when an employee is dismissed, the calculation of payments due to him (including compensation for unused vacation) is made in the unified form No. T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)” [5]. So, we present a step-by-step calculation of compensation for the unused vacation of I. I. Ivanova.

1) Let's determine the amount of actually accrued wages for the billing period (January - March 2006). It includes:

- the employee's official salary for three months in the amount of 30,000 rubles. (RUB 10,000 x 3 months);

- bonus based on work results for 2005 in the amount of 750 rubles. (RUB 3,000 / 12 months x 3 months);

- bonuses for meeting production targets in the amount of 1,800 rubles, including: 500 rubles. (since it was accrued in the month that falls within the billing period), 600 and 700 rubles.

Please note : the monthly bonus for meeting production targets in March 2006 (800 rubles), as well as the quarterly bonus based on the results of work for the first quarter of 2006 (2,000 rubles) are not taken into account, since they were accrued in the month outside limits of the billing period (in April).

Thus, the amount of actually accrued wages in the billing period will be 32,550 rubles. (30,000 + 750 + 1,800).

2) Calculate the average daily earnings for the billing period: (32,550 rubles / 3 months / 29.6 days) = 366.55 rubles.

3) Determine the number of vacation days that remain unused. Let us remind you that an employee is granted leave for the time he has worked, and not for the calendar year. In other words, the calculation of the period for the right to receive leave begins from the date when the employee began work, and not from the beginning of the calendar year.

The first working year of I. I. Ivanova ended on 08/01/04, the second - on 08/01/05. During this time, the employee is entitled to 56 days of vacation (28 days x 2 years).

From August 2, 2005 to April 24, 2006, the third working year lasted, including 7 full months and one incomplete (from 04/02/06 to 04/24/06). Moreover, the latter is equal to a full working month, since it includes more than 15 calendar days[6]. Thus, I. I. Ivanova, in her third year of work in the organization, earned 8 full months of vacation, that is, she had the right to 19 days of paid vacation (2.33 days x 8 months = 18.64 days).

The total number of vacation days earned by I. I. Ivanova is 75 (56 + 19). Consequently, upon dismissal, she is entitled to compensation for 47 days (75 - 28).

4) So, let's calculate compensation for unused vacation: 366.55 rubles. x 47 days = 17,227.85 rub.

Please note : there are cases when, when calculating compensation, accountants determine the number of days of unused vacation in the last working month in a simplified version. In their opinion, if an employee quits before the 15th, he does not have the right to vacation days for the last month, if after the specified date, accordingly, he has such a right. However, this approach is incorrect and can lead to errors when calculating compensation payments. Therefore, the calculation should be made according to the established rules: take into account how many days in total the employee worked in the first and last months of work in the organization, and also be sure to calculate the length of service that gives the right to annual paid basic leave ( Article 121 of the Labor Code of the Russian Federation ).

If the employee continues to work in the organization...

Article 126 of the Labor Code of the Russian Federation allows the employer ( Attention! This is his right, not an obligation), by agreement with the employee, to replace the latter part of the vacation exceeding 28 calendar days with monetary compensation. At the same time, it is impossible to compensate the main vacation for the current year with money ( Letter of the Ministry of Finance of the Russian Federation dated 02/08/06 No. 03-05-02-04/13 ).

Unfortunately, this article does not clearly define the situation and can be read in two ways. On the one hand, we can assume that out of the available number of days of unused vacation (for example, an employee has not been on vacation for 3 years, which means he has accumulated 84 days of vacation), he must take 28 days off in any case, and the remaining 56 days (84 - 28) ask to replace it with monetary compensation.

On the other hand, Art. 126 of the Labor Code of the Russian Federation can be assessed as follows. Let’s assume that the employee is entitled to a basic vacation of 28 days and an additional vacation of 3 days, which is added to the main one. He didn't receive them for two years. As a result, 56 days of basic vacation must be provided with days of rest, and only the accumulated additional 6 days can be compensated in cash.

This duality will persist until amendments are made to the Labor Code of the Russian Federation. the Letter of the Ministry of Labor dated April 25, 2002 No. 966-10 will apply , according to which, due to the uncertainty of the legislative wording, two options for paying monetary compensation are possible. The choice is made by agreement of the parties. That is, the employer and employee must agree on how many days of unused vacation for previous years should be replaced with monetary compensation.

Calculation of taxes on compensation for unused vacation

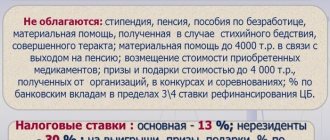

Personal income tax

When paying compensation for unused vacation, the employer is obliged to calculate and pay personal income tax on this amount ( clause 3 of Article 217 of the Tax Code of the Russian Federation ). Since compensation for unused vacation upon dismissal must be paid to the employee on the day of dismissal ( Article 140 of the Labor Code of the Russian Federation ), the tax withheld from it must be transferred to the budget upon its actual payment ( clause 4 of Article 226 of the Tax Code of the Russian Federation ), in particular, no later than the day of actual receipt of cash from the bank for payment of compensation or on the day of transfer of this amount to the employee’s account or, on his behalf, to the accounts of third parties ( clause 6 of Article 226 of the Tax Code of the Russian Federation ).

Cash compensation in lieu of leave exceeding 28 calendar days, paid at the request of the employee and not related to dismissal, is usually paid along with the salary for the corresponding month ( clause 3 of Article 226 of the Tax Code of the Russian Federation ).

UST, contributions to the Pension Fund and compulsory social insurance against accidents at work

Subclause 2 of clause 1 of Art. 238 of the Tax Code of the Russian Federation determines that compensation for unused vacation paid to a resigning employee is not subject to the Unified Social Tax ( letters of the Ministry of Finance of the Russian Federation dated September 17, 2003 No. 04-04-04/103 , UMTS for Moscow dated March 29, 2004 No. 28-11/21211 ), as well as contributions to compulsory pension insurance ( clause 2 of article 10 of the Federal Law of December 15, 2001 No. 167-FZ [7]) and contributions to compulsory social insurance against industrial accidents and occupational diseases ( clause 1 of the List of payments , for which insurance premiums are not charged to the Federal Social Insurance Fund of the Russian Federation , hereinafter referred to as the List [8], clause 3 of the Rules for the accrual , accounting and expenditure of funds for the implementation of compulsory social insurance against industrial accidents and occupational diseases [9]).

For compensation paid upon the written application of employees who continue to work in the organization, different taxation rules are established. According to the Ministry of Finance, such payments are subject to UST on a general basis ( letters of the Ministry of Finance of the Russian Federation dated 02/08/06 No. 03-05-02-04/13 , dated 01/16/06 No. 03-03-04/1/24 , Federal Tax Service for the city of Moscow dated August 15, 2005 No. 21-11/57993 ). In addition, the accountant should not forget about contributions to the Social Insurance Fund.

| If, in accordance with the provisions of Chapter 25 of the Code, the costs of paying compensation to an employee for unused vacation, not related to dismissal, reduce the tax base for the organization’s income tax, then this payment is subject to taxation with the unified social tax. Otherwise, the specified compensation is not recognized as an object of taxation by the unified social tax ( Letter of the Ministry of Finance of the Russian Federation dated January 13, 2006 No. 03-03-04/1/24 ). |

Please note : Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 14, 2006 No. 106 clarifies that paragraph 3 of Article 236 of the Tax Code of the Russian Federation does not give the taxpayer the right to choose for which tax (unified social or income tax) to reduce the tax base for the tax by the amount of the corresponding payments. In other words, if the taxpayer has the right to attribute compensation payments for unused vacation to expenses that reduce the taxable base for income tax, then he must accrue unified tax on them.

Example 3.

In accordance with Art. 119 of the Labor Code of the Russian Federation, the organization provides an employee with irregular working hours with annual additional paid leave, the duration of which is determined by the collective agreement and is 3 calendar days.

At the request of the employee (in agreement with the administration), part of the unused vacation exceeding 28 calendar days is replaced by monetary compensation.

Due to the fact that the specified compensation payment is taken into account for profit tax purposes on the basis of clause 8 of Art. 255 of the Tax Code of the Russian Federation , it must be subject to unified social tax.

Please note : there are cases when local tax authorities insist on levying unified social tax on compensation for unused vacation not related to dismissal, if this payment was not taken into account as expenses for profit tax purposes. It should be noted that the courts on this issue take the side of taxpayers (see, for example, resolutions of the FAS UO dated December 21, 2005 No. F09-5669/05-S2 , TsO dated December 15, 2005 No. A64-1991/05-10 , SZO dated January 28 .05 No. A66-6613/2004 ).

Let us give one more opinion on this issue. But let us immediately note that it is quite risky and will inevitably lead to disputes with the tax authorities. The essence of this approach is as follows: based on paragraphs. 2 p. 1 art. 238 of the Tax Code of the Russian Federation, all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government related to the performance by an individual of labor duties within the limits established in accordance with the legislation of the Russian Federation are exempt from UST. The replacement of part of the annual paid leave with compensation is provided for in Art. 126 Labor Code of the Russian Federation . The concept of compensation is not established in tax legislation, therefore it should be used in the meaning in which it is used in the Labor Code of the Russian Federation ( clause 1 of Article 11 of the Tax Code of the Russian Federation ). Consequently, all the requirements established by Art. 238 of the Tax Code of the Russian Federation , and there is no need to accrue unified social tax for the amount of compensation paid based on written statements from employees (regardless of whether such payments are taken into account for profit tax purposes).

Since monetary compensation in return for part of the vacation exceeding 28 calendar days is provided for in Art. 126 of the Labor Code of the Russian Federation , and the Tax Code does not establish other rules, then by virtue of clause 1 of Art. 11 of the Tax Code of the Russian Federation, the norms of the Labor Code of the Russian Federation are subject to application. Thus, in this case, all the requirements established by Art. 238 Tax Code of the Russian Federation . Therefore, it is not necessary to accrue UST for the amount of compensation paid upon the written application of employees who continue to work in the organization (regardless of whether such payments are taken into account or not taken into account for profit tax purposes). There is also positive arbitration practice in the case considered (see, for example, resolutions of the FAS North-West District dated 02/04/05 No. A26-8327/04-21 , dated 11/07/05 No. A05-7210/05-33 ). A taxpayer who has decided to replace part of the vacation exceeding 28 calendar days with monetary compensation has the right to take this payment into account in labor costs in accordance with clause 8 of Art. 255 Tax Code of the Russian Federation . At the same time, there is no need to accrue UST for this payment.

Let's say a few words about contributions for compulsory insurance against accidents at work: they are not calculated on the amount of compensation for unused vacation ( clause 1 of the List ).

income tax

When calculating corporate income tax, the amount of monetary compensation for unused basic leave not related to dismissal, paid in accordance with labor legislation, is taken to reduce the tax base. The basis is clause 8 of Art. 255 of the Tax Code of the Russian Federation (see, letters of the Ministry of Finance of the Russian Federation dated January 16, 2006 No. 03-03-04/1/24 , Federal Tax Service of Moscow dated August 16, 2005 No. 20-08/58249 ). Moreover, if the employer and employees have reached an agreement to pay monetary compensation for all days of unused vacation, then the unused vacation is combined, including for those periods when the Labor Code of the Russian Federation was in force , which did not allow such compensation, except upon dismissal employee.

As for monetary compensation in exchange for additional vacations provided under a collective agreement (that is, on the employer’s own initiative), such expenses are not taken into account for tax purposes. This point of view, in particular, is presented in the Letter of the Ministry of Finance of the Russian Federation dated September 18, 2005 No. 03-03-04/1/284 .

It should be noted that not all experts agree with it. The fact is that the Ministry of Finance, referring to clause 24 of Art. 270 of the Tax Code of the Russian Federation , equated the costs of paying compensation to the costs of paying vacations. But in the Tax Code of the Russian Federation these concepts are separated: the amount of compensation for unused vacation is included in labor costs on the basis of clause 8 of Art. 255 of the Tax Code of the Russian Federation , and vacation pay - in accordance with clause 7 of Art. 255 Tax Code of the Russian Federation . At least for this reason it is impossible to put an equal sign between them. At the same time, in Art. 270 of the Tax Code of the Russian Federation only talks about the costs of paying for additional vacations (and not compensation for unused vacations).

From the foregoing, we can conclude that the Tax Code of the Russian Federation does not prohibit taking into account, when calculating income tax, the costs of paying compensation in return for additional vacations (regardless of whether such vacation is provided for by labor legislation or collective and (or) employment agreements). It is clear that such a point of view is unlikely to be accepted by regulatory authorities, so you will most likely have to defend your case in court.

[1] There are categories of employees who, in accordance with the Labor Code and other federal laws, are granted extended basic leave, but they are not considered within the framework of this article.

[2] Regulations on the specifics of the procedure for calculating average wages, approved. Decree of the Government of the Russian Federation dated April 11, 2003 No. 213.

[3] A collective agreement may establish a different settlement period for payment of compensation for unused vacation (for example, 6 months, a year), if this does not worsen the situation of employees (Article 139 of the Labor Code of the Russian Federation).

[4] Clause 28 of the Rules on regular and additional leaves, approved. People's Commissariat of Labor of the USSR 04/30/30 (valid to the extent that does not contradict the Labor Code of the Russian Federation).

[5] Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

[6] If the employee had quit, for example, on April 10, 2006, then she would not have been entitled to compensation for the last part-time working month, since she was at work for less than 15 calendar days.

[7] Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation.”

[8] Decree of the Government of the Russian Federation dated 07.07.99 No. 765.

[9] Approved. Decree of the Government of the Russian Federation dated March 2, 2000 No. 184.

Example of compensation calculation

Let’s say an employee has a standard vacation of 28 calendar days.

His work experience in this organization was 9 months and 6 days, during which he did not take regular annual leave, was on leave for 2 days in October, and was on sick leave for 10 days in November.

For the entire period of work, he was paid a salary of 336,800 rubles.

Upon dismissal, he is paid compensation for unused vacation, which is calculated as follows.

- Number of days of compensated vacation: 28: 12 x 9 = 21.

- Work experience in the organization: (7 x 29.3) + (31 – 2) x 29.3/31 + (30 – 10) x 29.3/30 = 252.

- Average daily earnings of an employee: 336,800: 252 = 1,336.51 rubles.

- Compensation for unused vacation: 1,336.51 x 21 = 28,066.67 rubles.