Final settlements upon termination of an employment contract must be completed on the last day of work of the dismissed specialist. Moreover, this type of payment is non-declaratory in nature. That is, the employee is not required to indicate a request for money in his resignation letter. However, as practice shows, in some cases you will still have to prepare a sample application for payment upon dismissal.

A written application for payment of the final payment upon dismissal is an employee’s request to the employer with a request to give him the money due for the time actually worked, as well as compensation for unused vacations.

Why do you need an application?

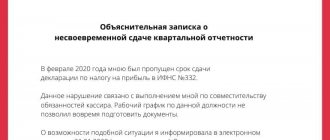

A sample request for payment upon dismissal will be needed if the specialist did not work (was absent from the workplace) on the day of dismissal. For example, he took the remaining vacation days off, was on sick leave, or was absent for other reasons.

You will also have to write a statement if the employee did not show up at the appointed time to receive his dismissal money or does not agree with the amount of the final payments.

Articles on the topic (click to view)

- What to do and where to go if you are not paid upon dismissal

- What to do if you are laid off at work

- What to do if the employer does not want to fire at his own request

- What to do if the date of the dismissal order is later than the date of dismissal

- What to do if the employer does not give the work book after dismissal

- What to do if you didn’t work officially, you were fired, you didn’t get paid

- What is the employer obliged to give the employee on the day of dismissal?

The result of processing the claim will be an order for settlement upon dismissal and payment of the money due.

Possible reasons for dismissal

An employee may be dismissed from the organization in the following cases:

- Forced dismissal of an employee under the article;

- Dismissal at your own request.

Forced dismissal of an employee under article

An employer can fire an employee if he does not comply with the terms of the employment contract. For example, if an employee fails to cope with his duties, is absent from work without a good reason, etc. Each of these cases is regulated by a specific article in the Labor Code of the Russian Federation.

For forced dismissal under this article, the organization prepares a corresponding order. In this case, a resignation letter is not drawn up, since applications are always written on behalf of the employee, and in this case the initiative comes from the management of the organization.

Dismissal at your own request

Voluntary dismissal is the dismissal of an employee on his own initiative. In this case, the employee, for some reason, decided to stop working in the organization. For example, when moving to another place of residence, when offered a job in another place with better conditions, etc. In this case, the employee needs to write a letter of resignation of his own free will and submit it to the employer.

According to the Labor Code of the Russian Federation, an employee must notify the employer of dismissal 2 weeks before, unless a different period is specified in the employment contract. If the employee is on a probationary period, or the contract with the employer was concluded less than 3 months ago, the employee is obliged to notify the employer 3 days in advance. If a manager leaves the organization, he must notify about this at least a month in advance. The countdown starts from the next day after submitting the application.

Thus, after submitting the application, the employee must work for some more period established in the Labor Code of the Russian Federation, so that during this time the employer can find a replacement for the employee. Please note: if an employee does not come to work without a good reason after submitting an application, the employer may fire him for absenteeism!

Working off will not be required if the employee quits due to entering an educational institution, the employee has changed his place of residence, or his retirement date has approached. Also, the employee will not need to work off if he has come to a mutual agreement with the employer, which must be drawn up in a separate document.

An employee who has submitted an application for dismissal of his own free will may withdraw his application before dismissal no later than one day before the day of dismissal, if another candidate invited in writing has not yet been selected to replace him. The refusal to dismiss is written in free form. You can also simply withdraw your resignation letter.

Example situation

Termination of the employment contract falls on 07/20/2018. This day is the last working day for the specialist. The accountant prepared a package of documents and certificates that need to be issued upon dismissal, and also wrote out funds to the cash desk for processing and issuing mutual settlements. However, the employee did not show up for the money; for example, he fell ill and went to a medical institution to issue a certificate of incapacity for work. In this case, the accountant is obliged to deposit the funds that were prepared for the dismissed person into the current account. Payments must be made no later than the next day after receiving a written request from the former employee.

How to make an application

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Legislators have not approved a special form for such an appeal. Therefore, you will have to prepare your application in free time. However, when compiling, be guided by the following rules:

This is important to know: An example of pension indexation after the dismissal of a working pensioner

- The document can be handwritten or prepared using printing technology.

- In the header of the application, indicate the position and full name. the head of the employing organization, then write down the name of the institution.

- Now write down information about the applicant: full name, address, passport details.

- In the middle of the new line, enter the name of the document.

- We write the text of the document on a new line: we describe the essence of the appeal in detail. Be sure to write down the position of the dismissed person and the periods of his work in this institution. Then indicate the reason why you did not show up for the money on the appointed day, or write down a claim regarding disagreement with the amount of the estimated payment.

- List the documents that you are attaching to your application as confirmation. For example, indicate the number and date of the sick leave or the name and date of the mathematical calculation of the expected amount of payments.

- Put your handwritten signature and indicate the date the document was compiled.

Hand over the completed paper to the employer personally or hand it to his official representative. For example, give it to your secretary, HR officer or accountant.

In what cases should you write

As a rule, all payments to company employees are made through banks. Therefore, as a rule, employees do not have problems with timely receipt of payments. But some companies still continue to issue salaries to their employees through the accounting department.

As mentioned above, the employer is obliged to give the employee a full payment on the last day of his stay at the enterprise. But situations are not uncommon when, for one reason or another, a person cannot receive money on the due day. For example:

- due to personal circumstances, for example illness;

- due to delay in payments by the employer;

- if the employee disagrees with the amount of payments received.

In such cases, the employee should write a request for payment upon dismissal.

Salaries and personnel: dismissal of workers

How to determine the final payment amount when dismissing an employee (using an example)

An employee of the organization, Ivanov, wrote a letter of resignation of his own free will on July 18, 2011. On the last day of work of the resigning employee, i.e. On July 18, the organization must give Ivanov all payments due to him upon dismissal.

The calculation of these payments is made according to form No. T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal).”

The organization pays wages 2 times a month in the following order:

20th of the current month - for the 1st half of the same month (advance);

5th day of the next month – for the 2nd half of the previous month.

Ivanov resigns on July 18. Consequently, upon dismissal, he must be paid wages for the period from July 1 to July 18 inclusive.

Let's calculate Ivanov's salary for July up to the day of dismissal (see table 1). The calculated amount of earnings in the amount of salary, as well as the regional coefficient and regional percentage increase are reflected in the Calculation Note in the “Calculation of Payments” section in columns 10 and 11 (see Table 4).

In addition to his salary, Ivanov must be paid compensation for unused vacation. The duration of annual leave is 36 calendar days. Information about the vacations used by Ivanov is contained in his personal card (form No. T-2). An extract from this card is shown in Table 2.

On the day of dismissal, Ivanov did not use vacation for the period from April 12, 2011. until July 18, 2011, that is, for 3 full calendar months.

Let's calculate the number of unused calendar days of vacation for which Ivanov should be paid compensation: 36 days. : 12 months x 3 months = 9 days

The average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days) (Article 139 of the Labor Code of the Russian Federation). The calculation period for calculating compensation for unused vacation for Ivanov is the period from July 2010 to June 2011. Ivanov’s total earnings for the specified period amounted to 134,400 rubles.

The billing period has been worked out by Ivanov in full, and there are no periods in it that should be excluded from it in accordance with paragraph 5 of the Procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922), therefore the average daily earnings to pay compensation for vacation are calculated as follows: 134,400 rub. : 12 months : 29.4 = 380.95 rub.

Accordingly, the amount of compensation for unused vacation that must be paid to Ivanov will be: 380.95 rubles. x 9 days = 3,428.55 rub.

Now let’s transfer the results obtained to the Calculation Note in the “Calculation of Vacation Payment” section and fill out columns 1-9 (see Table 3). To fill out column 4, we calculate the number of calendar days of the billing period as follows: 29.4 days. x 12 months = 352.8 days.

We will transfer the amount for vacation from column 9 to column 12 and complete filling out the section “Calculation of payments” (Table 4):

1) calculate the total amount of accrued payments: column 13 = column 10 + column 11 + column 12;

2) we will withhold personal income tax (NDFL) from the accrued amount: RUB 9,828.55. x 13% = 1,278 rub. Attention: Personal income tax is calculated only in whole rubles. We will reflect the received amount in column 14;

3) Ivanov has no other deductions other than personal income tax. Therefore, we will transfer the indicator from column 14 to column 16;

4) wages in the organization for the 2nd half of the month are issued on the 5th of the next month. Consequently, the organization has no debt to Ivanov for payment of wages, therefore a dash is placed in column 17;

5) advance payment (salary for the 1st half of the month) is issued by the organization on the 20th. Consequently, Ivanov, who quits on the 18th, did not receive an advance, so a dash is also placed in column 18;

6) determine the amount to be paid: column 19 = column 13 – column 16.

Table 1

| 1 | Salary according to staff schedule | 7 000 |

| 2 | Number of working days in July | 21 |

| 3 | Number of working days worked | 12 |

| 4 | Salary for days worked (page 1 : page 2 x page 3) | 4 000 |

| 5 | Regional coefficient (page 4 x 0.3) | 1 200 |

| 6 | Regional percentage bonus for length of service (page 4 x 30%) | 1 200 |

| 7 | Total wages accrued (page 4 + page 5 + page 6) | 6 400 |

table 2

| Type of vacation | Work period | Number of calendar days of vacation | date | Base | ||

| With | By | started | graduation | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Annual | 12.04.2009 | 11.04.2010 | 36 | 1.10.2009 | 05.11.2009 | order No. 105 from 09/16/2009 |

| Annual | 12.04.2010 | 11.04.2011 | 36 | 01.04.2010 | 08.05.2010 | order No. 94 from 03/17/2010 |

Table 3

| Vacation pay calculation | |||||

| Billing period | Payments taken into account when calculating average earnings, rub. | Quantity | Average daily (hourly) earnings, rub. | ||

| year | month | calendar days of the billing period | hours of the billing period | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 2010 | July | 11 200 | 352,8 | X | 380,95 |

| 2010 | August | 11 200 | |||

| 2010 | September | 11 200 | |||

| 2010 | October | 11 200 | |||

| 2010 | november | 11 200 | |||

| 2010 | December | 11 200 | |||

| 2011 | January | 11 200 | Number of vacation days | Vacation amount, rub. | |

| 2011 | February | 11 200 | used in advance | not used | |

| 2011 | March | 11 200 | |||

| 2011 | April | 11 200 | 7 | 8 | 9 |

| 2011 | May | 11 200 | — | 9 | 3 428,55 |

| 2011 | June | 11 200 | |||

| total | 134 400 | ||||

Table 4

| Calculation of payments | |||||||||

| Accrued, rub. | Withheld, rub. | Debt, rub. | Amount due, rub. | ||||||

| salary | r.k. | vacation | Total | income tax | Total | behind the organization | for the employee | ||

| 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 4 000 | 2 400 | 3 428,55 | 9 828,55 | 1 278 | — | 1 278 | — | — | 8 550,55 |

What does the document provide?

If the employee contacted the employer with a statement for a reason that prevented him from receiving payment at the enterprise cash desk on the day of dismissal, the money must be issued no later than the next day.

If the resigning employee does not agree with the assigned settlement amount, the director must promptly pay the undisputed amount. The rest of the money will be paid after judicial review. Moreover, the employee can count not only on the issuance of the payment in full, but also on compensation for its retention.

The ultimate goal of issuing a demand is an order for settlement upon dismissal and payment of funds due.

Actions of the employer upon receipt of the request

The course of action of the parties depends on the reasons that led to non-payment:

- If the amount due to the employee has not been received due to the latter being away or on sick leave, the employing company is obliged to transfer the funds within one day from the receipt of the request.

- If in the application the specialist expresses disagreement with the amount of payment upon dismissal, the employing company on the same day transfers the amount on which the parties have agreed. Questions regarding the fate of the remainder are resolved in the labor inspectorate or in court. If government agencies decide that the employee is indeed entitled to additional payment, the organization must also transfer compensation for the delay.

- If the employer refuses its obligations and is not ready to pay settlements due to a difficult financial situation or for other reasons, the dismissed employee must go to court.

The ultimate goal of issuing a demand is an order for settlement upon dismissal and payment of funds due. Experts advise not to be afraid to contact regulatory authorities and hold unscrupulous employers accountable.

If you find an error, please select a piece of text and press Ctrl+Enter.

Important points

The paper is written in any form. It is better to make it in two copies. One is for the employer, the second (with the signature of the boss) the employee keeps for himself (may be useful in court). Information about the document submitted to the manager must be entered in the incoming correspondence journal.

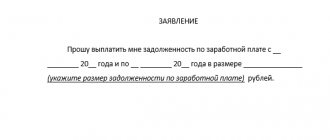

Sample request for payment upon dismissal

At the top of the document we indicate:

- position and full name employer, name of organization;

- FULL NAME. the dismissed person, his passport details;

- date of document preparation.

The following is the text:

- FULL NAME. applicant, position, period of work and date of dismissal;

- the reason for the request;

- the settlement amount that the employee is claiming;

- It is also advisable to indicate a list of attached documents (if any).

After this, it must be signed and handed over to the employer or his representative.

When is severance pay paid?

Article 178 of the Labor Code implies payment of severance pay in the following cases:

- Liquidation of company;

- reduction of employees according to the updated staffing table;

- refusal of an employee to perform job duties in the event of a significant change in them and changes in working conditions;

- conscription into the army;

- illness that prevents you from continuing to work.

The amount of these payments varies from payment for two weeks to payments for three months of work.

In case of non-payment of severance pay, the employee has the right to go to court, and if the decision is positive, the employer will pay the plaintiff not only the amount due, but also compensation for the delay.

Compensation is calculated using the formula:

unpaid amount (minus personal income tax) × rate of the Central Bank of the Russian Federation (you must select the desired period, since the rate changes frequently) / 150 × number of calendar days of delay.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Waiting for a court decision is not a reason to refuse payments to an employee at all. The employer is obliged to pay the employee the amount that is “indisputable”; the rest is subject to a court decision.

How is calculation made upon dismissal?

To start the process of generating a payout, the employee must write a letter of resignation with payout. If this is the desire of the employee himself, and not a forced measure by the management of the enterprise, then the dismissed person is not entitled to severance pay or other additional payments.

Based on the results of consideration of the application, the manager is obliged to draw up and publish not only an order to terminate the employment relationship, but also an order for payment upon dismissal.

The accountant forms the final amount based on the salary for the period worked but not paid, and compensation for unused vacation days.

The calculation is made using the formula:

salary for the month / working days in the month × days actually worked - all deductions required by law.

Purpose of note-calculation form T-61

When an employee resigns, the corresponding settlement note (Form T-61) is filled out by two employees of the employing company at once:

- A specialist from the company’s HR service will directly fill out this form.

- A specialist in the accounting department - he enters all the necessary information used to determine (calculate) the amount of labor payments transferred to the retiring employee upon dismissal.

For a settlement note drawn up by an employer upon dismissal of an employee, a standard T-61 template is provided.

This form is used in personnel records management and accounting. It is drawn up for each fact of dismissal of an employee.

However, the employer has the right to develop and use its own form of this document. In other words, the T-61 documentary template is considered recommended, but is not mandatory. This is implied by the content of a special regulatory document - Information of the Ministry of Finance of the Russian Federation No. PZ-10/2012 - and has been in effect since 01/01/2013 in relation to forms (templates) of primary accounting documents.

The information that is reflected by the employer’s specialists in the T-61 form makes it possible to calculate the amount of the average daily earnings of the retiring employee, the amount of compensation due to him, as well as other payments transferred to the resigning (dismissed) person or subject to return (that is, withheld from the employee as overpaid earlier) .

In addition, this calculation note should reflect the amounts of mandatory deductions provided for by law.

An authorized accountant of the employing company calculates the amount of payments due to the retiring employee, reflects it in the T-61 note, and then transfers the necessary information to the payment documents.

The compiled note-calculation is a documentary attachment to the calculation of earnings (income) received by the retiring employee for the current month. When filling out such documentation, you must follow certain rules and recommendations.

Additional documents:

- sample resignation letter;

- sample dismissal order.

How to fill out when leaving?

The calculation note drawn up upon the dismissal of an employee is filled out by his employer based on the following sources:

- An employment contract previously concluded with the departing employee.

- Payment documents that contain information about salaries, various allowances, bonuses, and other incentive payments.

The front part of the T-61 documentary form is filled out by a personnel specialist and includes the following information:

- Information about the employing company. Its name is indicated and its legal form is specified (for example, JSC or LLC).

- Details of the calculation note being drawn up. The number assigned to the document and the date of its generation are indicated.

- Information about the retiring employee (his full name, position, division in the company, as well as the personnel number assigned to him upon hiring).

- Circumstances of dismissal (planned date, reason).

- The number of vacation days not previously used by this employee. Facts of premature going on vacation, facts of an excessive number of vacation days may be recorded.

The following items are completed by the authorized accountant on the reverse side of Form T-61:

- The annual calculation period used to determine average monthly earnings.

- Twelve months preceding the employee's dismissal.

- Amounts of labor remuneration paid (non-labor payments are not taken into account here).

- The number of calendar days per year - we mean those days that are used for calculations. A fully worked month is counted as 29.3 days.

- The total number of hours worked by the departing individual (if hourly wages apply).

- Calculated amount of average daily earnings.

- The number of vacation days “in advance” provided to the employee.

- The number of unused days of entitlement leave.

- The final (total) amount of payment due, compensating the employee for unused vacation days.

- The amount of accrued labor payments (this includes wages, bonuses, vacation pay).

- The final amount of earnings (income) of the retiring employee.

- Amounts of personal income tax and other necessary deductions.

- The amount of obligations (debt) of the employee to the employer. Alternatively, the amount of debts the employer owes to the resigning employee.

- The total amount to be paid.

In addition, the accountant indicates the payroll information and signs the prepared document. Form T-61 is filled out in two copies (the first for the personnel officer, the second for the accountant).

and sample filling

Calculation note form T-61.

.

Employer's liability in case of non-payment

Upon dismissal, payment should be made on the last working day. Otherwise, the employer will be held liable.

This is important to know: What to do if the employer does not want to fire at his own request

Financial liability is assigned under Article 236 of the Labor Code of the Russian Federation. In case of delay in payments, the employer is responsible for issuing money with interest in the amount of not less than 1/150 of the current key rate of the Central Bank for each day of delay. Or he faces criminal liability under Article 145.1 of the Criminal Code of the Russian Federation, which provides for partial non-payment for more than three months:

- or deprivation of the right to hold certain positions for a period of up to 1 year;

- or forced labor for up to 2 years;

- or imprisonment for up to 1 year.

For complete non-payment for more than two months:

- or forced labor for a period of up to 3 years with or without deprivation of the right to hold certain positions;

- or imprisonment for a term of up to 3 years with or without deprivation of the right to hold certain positions.

Other payments upon dismissal

Upon termination of the employment contract, the employer pays the employee:

- wages for days worked;

- compensation for unused days of planned annual paid leave for the entire period of work.

The employer is obliged to pay everything due on the last working day of the dismissed person; this norm is prescribed in Articles 84.1 and 140 of the Labor Code. If this does not happen, the employee has the right to demand a settlement (for example, submit an application for dismissal with paid vacation). After receiving the request, the employer has exactly one day to satisfy it. Otherwise, the management of the enterprise will need to pay compensation for each day of delay and bear administrative liability under Article 5.27 of the Code of Administrative Offenses (fine from 5,000 to 50,000 rubles).

And the worst defaulters face criminal liability under Article 145.1 of the Criminal Code, up to imprisonment for up to three years.

IMPORTANT!

If the employee has a debt to the company, it is deducted from the total settlement amount.