Last modified: January 2021

It is unlikely that a reduction in wages at the initiative of the employer will please the employees themselves. However, such a measure is sometimes forced and the only way to preserve the employment relationship between a particular employer and employee. The situation is unpleasant, and raises doubts about the legality of reducing the employee’s salary, whether it is legal, since it is simply impossible to formalize a salary reduction without objective reasons and compliance with the procedure.

Whether the employer can reduce the salary depends on the circumstances that guarantee the rights of both parties.

Why is it necessary to notify of a salary reduction?

Adjustment of the essential terms of the employment contract (including salary reduction) is the basic right of the employer, provided that there is official justification for this - a change in organizational or technological working conditions (Article 74 of the Labor Code of the Russian Federation). But the exercise of this right is impossible without prior information and consent of the employee. A unilateral reduction in wages is unacceptable.

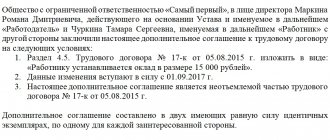

The employee’s consent is drawn up in free form by hand or in a printed document. Be sure to clearly state your consent to the salary reduction. Use this sample employee application for a salary reduction:

| To the Director of the State Budgetary Educational Institution of Children's and Youth Sports School "Gosuchetnik" I.I. Ivanov from the head groom P.P. Petrova AGREEMENT to change (reduce) wages Based on Article 72 of the Labor Code of the Russian Federation, I agree to reduce my salary to 30,000 (thirty thousand) rubles per month from July 1, 2020 due to a reduction in the workload from 8 to 6 hours per working day. 08.06.2020 Petrov / P.P. Petrov/ |

If a manager lowers a salary without the employee’s consent (on his own initiative), he violates his labor rights. As a result, the injured employee files a complaint with the regional labor commission or sues the organization. To avoid external checks and lengthy proceedings, inform the employee about changes in the terms of the employment contract in advance - at least two months in advance.

IMPORTANT!

The employer is obliged not only to notify the employee about the salary reduction, but also to offer him an alternative option - to agree or not to such a reduction, to choose one of the available vacancies according to his qualification level, or to resign of his own free will or due to a change in significant working conditions.

If an employee resigns, he must be paid the required compensation and severance pay equal to two weeks’ average earnings (Article 178 of the Labor Code of the Russian Federation).

Grounds for reducing the employee’s share of the salary at the initiative of the administration

Changes to the employment contract are made on the basis of an agreement drawn up with the employee. Failure by the employer to comply with the requirements for the procedure for reducing wages is the basis for holding him accountable. Reasons and grounds for a unilateral salary reduction A salary reduction at the initiative of the employer may be due to the following reasons:

- A decrease in the employee’s performance, his reluctance to develop and improve his skills in the future.

- The employee's inability to cope with new tasks when transferred to another position.

- False expectations regarding an employee (for example, when a hired employee starts working).

However, the employer does not have the right to reduce the employee’s salary at his own request or due to the crisis situation in the country.

In a number of situations, the essence of the dispute that has arisen between the parties to the labor relationship is so simple that it does not even require obtaining legal advice. Both sides of the conflict, at the moment it arises, immediately become clear who is right in the relevant situation, who is wrong and what needs to be done to resolve the dispute. In other cases, it happens that it is difficult to figure out “what’s what” without the participation of a lawyer.

In such situations, it makes sense for the interested party to invite a competent specialist to cooperate, who will explain how the position of each party complies with the requirements of the law, and will suggest how best to act in the current circumstances. This is usually more productive than spending time and effort on independent attempts to understand all the intricacies of laws and regulations, as well as the peculiarities of their interpretation and practice of application by the courts.

What is the procedure for informing

The employer notifies of the salary reduction no later than two months before the changes. The manager is required to justify significant changes to the employment contract. The means of information is notification to the employee.

There is no unified form - it is enough to prepare a message in any form justifying the reasons for the salary reduction and hand it over to the employee. Here's how to create such a notice:

- Use the organization's letterhead.

- Indicate the addressee - the employee's full name.

- Indicate the basic details of the document: number, date, place of publication.

- Describe the reasons for reducing wages. Provide in the text the name of the organization, the old and new salary values, documentary justification, and the effective date of these changes.

- Describe in detail the legal basis for the employee’s further actions: consent or disagreement and what are the consequences of his disagreement.

- Give it to your manager for signature.

- Leave space for the employee's signature and decision.

Draw up a notification document in two copies. Leave one (with the addressee’s signature confirming receipt) at the organization, hand the second one over to the employee personally, by mail or by courier service. Remember: it is important not only to convey the information to the employee, but also to obtain written confirmation that the document has been delivered to him.

Reducing the amount of variable payments

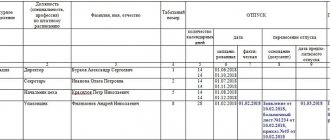

Undoubtedly, the employer is obliged to pay employees their official salaries. Can he deprive his employee of all or part of his bonus? It all depends on what is written in the employment contract (see table).

| Conditions of the employment agreement | What's in practice |

| It is stated that when a plan or some other indicator is met, the employer undertakes to pay a bonus | Depriving an employee of a bonus will be illegal. This means that the manager violated the terms of the employment contract concluded with the employee. |

| It is noted that the procedure for paying bonuses is determined by the bonus regulations | When making a decision you will need to be guided by it. If monthly bonuses are not mandatory in accordance with this document, then a downward change in wages due to non-payment of bonuses will be legal. |

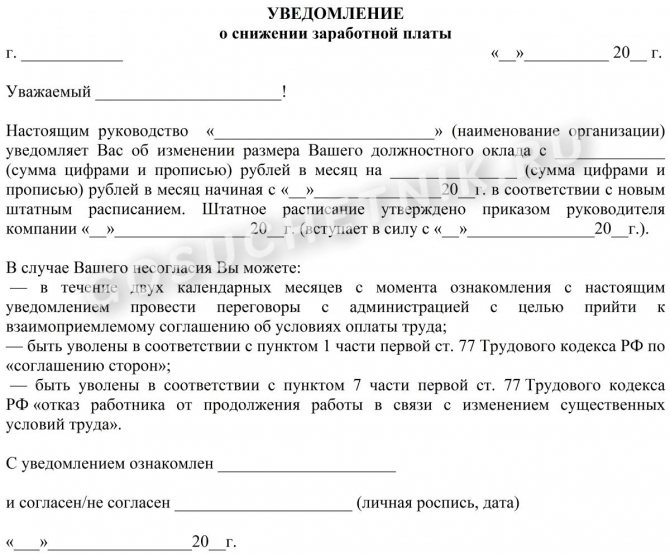

Sample notification

When drawing up a document, refer to the sample notice of salary reduction.

| NOTIFICATION about salary reduction Saint Petersburg 01.06.2020 Dear Petrov Petr Petrovich! Hereby, the management of the GBOU DOD SDYUSSHOR “Gosuchetnik” notifies you of a change in the size of your official salary for a storekeeper from 25,000 (twenty-five thousand) rubles per month to 23,000 (twenty-three thousand) rubles per month starting from 01.09.2020. Reason: new staffing table dated 06/01/2020, which will come into force on 09/01/2020. Please confirm your consent to the change in official salary by making a corresponding entry in the notification. Currently, the State Budgetary Educational Institution of Children's and Youth Sports School "gosuchetnik" has a vacant position of a building maintenance worker with an official salary of 25,000 rubles, to which you can be transferred. Please confirm your consent by making a corresponding entry in the notification. In the event of your refusal to change the official salary and the proposed transfer, the employment contract with you is terminated as of 09/01/2020 on the basis of clause 7 of part 1 of article 77 of the Labor Code of the Russian Federation. Director of the State Budget Educational Institution of Children's and Youth Sports School "Gosuchetnik" Ivanov Ivanov I.I. I have read the notice ________________ /_____________________/ and agree/disagree _____________________ “___”____________20__ |

What to do if the employee does not agree

If the employee agrees with the salary reduction, make the required changes to his employment contract. If the employee does not agree to a salary reduction, the employer:

- offers an alternative vacancy (including a lower-ranking or lower-paid position) based on the employee’s skill level;

- terminates the employment contract with the employee.

The grounds for dismissal are personal desire (clause 1, part 1, article 77) or the employee’s refusal to continue working due to a change in significant working conditions (clause 7, part 1, article 77 of the Labor Code of the Russian Federation).

Sometimes an employer asks you to write a statement requesting a salary reduction, citing lack of work or a reduction in the employee’s workload. According to the law, this is not a basis for reducing wages (Articles 72 and 74 of the Labor Code of the Russian Federation).

Article 135 of the Labor Code of the Russian Federation. Setting wages (current version)

Bonuses can be paid based on one or a group of agreed indicators. Experts identify four main groups of bonus indicators that stimulate workers for individual labor results. These include:

1) quantitative indicators: fulfillment and overfulfillment of production targets for product output and nomenclature, percentage of fulfillment of production standards, ensuring uninterrupted and rhythmic operation of equipment, compliance with or reduction of planned deadlines for repair work, carrying out work with a smaller number compared to the standard, reducing the labor intensity of products and etc.;

2) quality indicators: improving the quality of products, the percentage of products delivered from the first presentation, reducing the percentage of defects, increasing the product grade coefficient, etc.;

3) saving resources used: economical use of raw materials and materials, saving fuel and electricity, reducing costs for maintenance and repair of equipment, etc.;

4) rational use of technology: meeting the deadlines for the development of new equipment and progressive technology, maintaining technological discipline, increasing the equipment load factor, etc.

The condition for bonuses is usually work during the accounting period and achievement of established indicators. One of the most important conditions for bonuses is compliance with labor discipline. Employees who have met bonus targets, but are absent from work or appear at work in a drunken state, or have committed another disciplinary offense (for example, violating technological rules for manufacturing products) do not acquire the right to a bonus in full. As a rule, they are either not awarded a bonus (in case of serious misconduct), or the bonus is paid to them in a smaller amount than to employees who have fulfilled both the indicators and the terms of the bonus. This is a common rule included in bonus provisions. Unfortunately, many economists view this situation as a reduction in bonuses or deprivation of bonuses. In fact, no deprivation of the bonus occurs. The employee simply does not acquire the right to a bonus or does not acquire the right to a bonus in the established (basic) amount, since he has not fulfilled all the conditions for the bonus.

The size of the bonus is determined, as a rule, as a percentage of the tariff rate (salary). The size of the bonus for a specific employee is determined by the manager (employer - individual entrepreneur) taking into account the degree of fulfillment of indicators and bonus conditions.

The frequency of bonuses is monthly or quarterly. It is possible to establish bonuses that are paid based on the results of work for the year.

Regular bonuses, paid according to pre-approved indicators (in accordance with the bonus system), form part of the salary. They must be distinguished from one-time (one-time) bonuses, which are an employee’s encouragement for special achievements in work and are paid for completing particularly important tasks, in connection with holidays or special occasions, based on the results of shows or competitions (Article 191 of the Labor Code).

6. Remuneration systems as a percentage of revenue, grader systems, taking into account the employee’s contribution to the overall results of the organization’s activities, etc., have also become widespread.

7. The remuneration system of any employer is established in accordance with labor legislation and other regulatory legal acts containing labor law norms. This means that the terms of remuneration for each employer must be based on those guarantees provided by the Labor Code, federal laws, decrees of the President of the Russian Federation, decrees of the Government of the Russian Federation and other regulatory legal acts. The legislator specifically emphasizes the inadmissibility of worsening the employee’s position or diminishing the rights established at the state level (Part 6 of the commented article).

The Constitutional Court of the Russian Federation also draws attention to this. The Determination dated 01.10.2009 N 1160-О-О notes that remuneration systems are developed on the basis of the requirements of labor legislation and must guarantee to each employee the determination of his wages, taking into account the criteria established in the legislation, incl. working conditions.

When establishing a remuneration system, each employer must equally comply with both the norm that guarantees an employee who has fully worked the standard working hours for the month and fulfilled labor standards (job duties) a salary not lower than the minimum wage, and the requirements of Art. Art. 2, 22, 130, 132, 135, 146 and 147 TK, incl. the rule on establishing for employees engaged in heavy work, work with harmful and (or) dangerous and other special working conditions, wages in an increased amount compared to tariff rates, salaries (official salaries) provided for identical types of work, but with normal working conditions.

At the same time, the employer (jointly or taking into account the opinion of the representative body of workers) is free to choose the method of accounting for the quantity of labor (piecework or time-based payment), accounting for the quality (including complexity) of labor and qualifications of workers (choice of the tariff system and its parameters) , determining the size of the main (tariff) part of wages, establishing bonus systems, incentive payments and allowances to the extent that they are not defined by labor legislation and other regulatory legal acts containing labor law norms.

As for compensatory additional payments and payments, the obligation to pay them, the terms of payment and the minimum amount are, as a rule, determined by labor legislation. The employer can only establish the amount and clarify the payment procedure (see commentary to Articles 146 - 148, 151, 154).

Special rules for establishing a remuneration system are established for employees of organizations financed from the budget (see commentary to Article 144).

8. The remuneration system must be reflected in a collective agreement, agreement of any type (in practice, these are agreements concluded at the industry, inter-industry, professional levels) or local regulations.

The employer and employee representatives have the right to choose the legal form of establishing the rules of remuneration that seems preferable to them. It is important to keep in mind the rules of correlation between various sources of labor law. Thus, a local regulatory act cannot worsen the situation of workers in comparison with a collective agreement, and a collective agreement cannot worsen the situation in comparison with an agreement concluded at a level higher than the organization (industry, professional, etc.).

In practice, the remuneration system is usually established by a collective agreement or local regulations. There is also this option: some of the rules are established by a collective agreement, some by local regulations.

In recent years, the practice of including in the collective agreement as an appendix provisions on remuneration, bonuses on various grounds, and payment of remuneration based on the results of work for the year has become widespread. When using this model of legal regulation, it is important to remember that the annex to the collective agreement is an integral part of it. Thus, the provision on remuneration, which is an annex to the collective agreement, becomes part of it, and not an independent local regulatory act.

In the case where a collective agreement is not concluded in an organization or the remuneration system is not defined in it, it is established in a local regulatory act. Typically, such an act is called a wage clause. It is possible to establish a remuneration system by several local regulations that are in systemic unity, for example, regulations on the tariff system, regulations on bonuses, regulations on incentive bonuses and regulations on compensatory additional payments.

9. A local regulatory act establishing a system (or some elements) of remuneration is adopted taking into account the opinion of the representative body of workers. The procedure for taking into account opinions is determined by Art. 372 TK.

10. Part 3 of the commented article mentions a special type of legal act - unified recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of organizations financed from the relevant budgets. The need to adopt such an act was first determined by Federal Law dated August 22, 2004 N 122-FZ. Currently, there are Unified Recommendations for the establishment of remuneration systems for employees of state and municipal institutions for 2014 at the federal, regional and local levels, approved. by decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations dated December 25, 2013, Protocol No. 11.

The recommendations define:

— principles for the formation of federal, regional and municipal wage systems, which include, in particular, ensuring that the wages of each employee depend on his qualifications, the complexity of the work performed, the quantity and quality of labor expended; provision by the employer of equal pay for work of equal value; ensuring an increase in the level of real wages of employees of public sector institutions;

— a list of standards and conditions of remuneration regulated by federal laws and other regulatory legal acts of the Russian Federation;

— the procedure for establishing remuneration systems for employees of state and municipal institutions;

— basic approaches to the formation of remuneration systems for employees of state and municipal institutions;

— the procedure for the formation of remuneration systems for employees of federal government institutions, heads of state and municipal institutions, their deputies and chief accountants, etc.

The recommendations also establish the rules for the formation of wage funds in state and municipal institutions; features of the formation of remuneration systems for pedagogical workers of state and municipal educational institutions, employees of state and municipal health care institutions, employees of state and municipal institutions of culture, art and cinematography.

11. The current version of the commented article provides a legal mechanism for overcoming disagreements between the parties to the Russian Tripartite Commission in the preparation of uniform recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of organizations financed from the relevant budgets. In the event that the parties were unable to reach an agreement, the recommendations are approved by the Government of the Russian Federation, and the opinion of trade unions and employers' associations is brought to the attention of the constituent entities of the Russian Federation.