Where are the rules for bonuses and deductions reflected?

An employee’s salary may consist of several components (Article 129 of the Labor Code of the Russian Federation).

One of them is payments that are stimulating in nature, i.e. intended to encourage employees and increase their interest in the results of their work. When determining the possibility of including incentive payments in the salary, the Labor Code of the Russian Federation, however, does not establish any specific rules for their calculation and payment, entrusting the development of these issues entirely to the employer (Article 135 of the Labor Code of the Russian Federation). Only a number of general requirements are legally defined, according to which the procedure for applying the incentive system should be:

- enshrined in internal regulations;

- agreed with representatives of the workforce;

- brought to the attention of each employee.

The role of such an internal regulatory act can be performed by:

- regulations on remuneration containing the relevant section;

- a document entirely devoted to incentive issues (regulations on incentives, bonuses, incentive payments);

- labor agreement, if the terms of bonuses are individual for a specific employee or the employer, which is a micro-enterprise, has decided that it does not develop regulations on labor issues (Article 309.2 of the Labor Code of the Russian Federation).

For more information about the wage structure and the documents describing it, read the article “The procedure for paying bonuses under the Labor Code of the Russian Federation.”

The incentive document usually reflects:

- description of the types and frequency of payment of applicable additional incentive payments;

- a list of those persons who have the right to receive remuneration of one type or another;

- indicators, the fulfillment of which entails the possibility of paying bonuses;

- a system that allows you to evaluate the amount of remuneration of each type;

- a description of the procedure for considering the results of assessing the right of each employee to receive bonuses and determining the specific amount of remuneration due to him;

- a list of grounds allowing to deprive an employee of the right to receive remuneration in whole or in part;

- a description of the procedure allowing an employee to challenge the results of the distribution of bonuses.

Thus, both the rules for calculating bonuses and the procedure in accordance with which the deprivation of the opportunity to receive it (deprivation of bonuses) is implemented are included in one internal regulatory act. At the same time, situations are possible when this act does not contain bonus deduction rules at all.

Since deprivation of a bonus, as a rule, leads to disputes with the employee, it is important to competently carry out the bonus deduction procedure. ConsultantPlus experts have prepared step-by-step instructions, explaining the nuances of depriving an employee of a bonus:

If you don't have access to the system, get a free trial online.

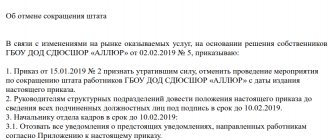

Sample order to cancel incentive payments

Thus, the size of the bonus for the chief doctors of children's city clinics of the Health Department of the South-Western Administrative District No. 10, 46, 81, 97 was set at 1.2% of the amount received from invoices.

Without the permission of the Health Administration of the Eastern Administrative District, an incentive payment was made to the chief physician of city clinic No. 191 in the amount of 17.2 thousand.

How to use an order to cancel an increase in the tariff rate? Is it possible to cancel the award? In other words, by their legal nature, they relate to that part of the salary to which the employee has the right only if he fulfills the appropriate conditions, including when he achieves certain results in his work.

Please note that the Regulations on remuneration and bonuses may be approved by order of the manager or be part of a collective agreement.

The diagram shows the latter option. Combination of positions In accordance with Part. Order to cancel the order. Then you can indicate the desired date for canceling the previously issued order.

However, the date is often not indicated, then the order is canceled immediately after the new one is issued.

Sample order to deprive an employee of a bonus

For example, a document may look like this: Order on depreciation June 8, 2021 Based on paragraph.

8 Regulations on bonuses To deprive the bonus of the senior mechanic of warehouse No. 2 Varennikov R.

V. based on the results of the 2nd quarter for improper performance of his official duties. I entrust the execution of this order to the Deputy Director for Organizational Work P. Rogozhkin.

Bonuses and other incentive payments related to wages are paid to employees in accordance with the wage conditions specified in employment contracts, based on the wage systems in force for a given employer 3.

In budgetary institutions, remuneration systems are established by local regulations, which are based on approximate provisions on remuneration approved by government bodies or the main managers of budgetary funds.

First you need to understand what is meant by combination. Combination is work that a person does in conjunction with his main activity within the working day for the same or another position for additional money. At the same time, the quality of the main work should not suffer.

Not to be confused with part-time work, which is regular work in your free time from your main activity, and possibly with another employer.

The procedure for canceling incentive payments assigned to company employees

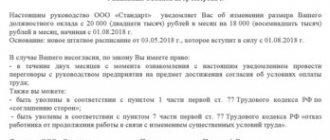

In connection with the upcoming changes, we ask you to read this notice: full name, employee position.” The notice can also reflect the employee’s consent to work under the new conditions.

The notification must be sent to the employee no later than 2 months before the expected date of cancellation of bonuses (Article 74 of the Labor Code of the Russian Federation). WE CANCEL I.A. INCENTIVE ALLOWANCES.

Tusheva, expert at Zarplata magazine When switching to austerity mode, companies first of all cancel incentive payments.

Is it possible to cancel the award?

The exemplary wage regulations in force in various industries provide for the possibility of canceling certain incentive payments.

— payments for intensity and high performance results; — payments for the quality of work performed; — payments for continuous work experience in a scientific institution; - bonus payments based on performance results.

As we see, failure by an employee to fulfill his job duties cannot in itself be grounds for the head of a budgetary institution to cancel an incentive payment.

Is it necessary to issue an order to cancel additional payments?

Otherwise, instead of saving money, there is a risk of getting bogged down in litigation with employees.

Incentive payments are additional payments and allowances, bonuses and other incentive payments that are an integral part of wages (Article 129 of the Labor Code of the Russian Federation).

* Such payments include, for example, additional payments for performing additional duties, bonuses for completing a special task, bonuses for knowledge of a foreign language, team management, mentoring, savings on raw materials and consumables, and others.

The need to notify the employee about the reduction or withdrawal of incentive payments

If the TD (additional agreement to the TD) specifies specific dimensions, then Article 74 of the Labor Code of the Russian Federation will have to be applied.

Now to your stimulus payment.

For example, an excerpt from the Regulations on Remuneration: INCENTIVE PAYMENTS (BONUS) 1. Additional payments (bonuses) may be established to encourage employees who have worked for a long time and to retain qualified personnel, but are not mandatory.

Source: https://myeconomist.ru/obrazec-prikaza-ob-otmene-stimulirujuschih-vyplat-19287/

What may be the grounds for deprivation of a bonus?

Each employer may have its own reasons for depriving a bonus. Most often, the text of the internal regulatory act includes in this capacity the following that took place during the bonus period:

- disciplinary action received by the employee;

- the disciplinary offense he committed (regardless of the fact that a disciplinary sanction was imposed in connection with this offense);

- dismissal;

- incomplete period of work.

The size of the share by which the premium is reduced (in the full amount of remuneration or in some part of it) is determined:

- or by indicating this share directly in the text of the normative act;

- or its establishment by an additional decision of the manager.

As one (or the only) basis for deprivation of bonuses, a regulatory act may establish the decision that the manager makes regarding the deprivation (or reduction) of a bonus.

If the internal regulatory act does not contain rules for depreciation, then the decision to deprecate or reduce the size of the bonus will be made only by the manager.

In each specific case of deprivation (or reduction) of a bonus, the reason for this must be documented. Particular attention here should be paid to documents related to disciplinary offenses and disciplinary sanctions, which require strict adherence to the rules for their execution. Deprivation of a bonus for a disciplinary offense (disciplinary sanction) that is not documented or executed in violation of the established procedure will be considered unlawful.

In relation to deprivation of bonuses for disciplinary action, the following sequence of events must be observed: violation - punishment - deprivation of bonus. The second link in this chain may drop out if the regulatory act stipulates that deprivation of bonuses arises as a consequence of the commission of a documented disciplinary offense. If a normative act specifies a disciplinary sanction as a basis for deprivation of a bonus, then the employee cannot be deprived of a bonus for a violation of discipline for which it was decided not to apply punishment.

For more information about disciplinary offenses and the rules for formalizing punishments for them, read the material “Disciplinary offense under the Labor Code of the Russian Federation - concept and signs”.

When is an order from the head of the organization required to deprive him of bonuses?

An administrative document for deprivation of a bonus is not always drawn up. It does not need to be compiled if:

- the basis for deprivation is present in the normative act on bonuses;

- from the same act the amount of reduction (deprivation) of remuneration is unambiguously determined;

- there is an employee’s signature confirming familiarization with this act;

- the fact of occurrence of the relevant grounds is confirmed by correctly executed documents.

However, it will be necessary to draw up an order for the reduction of bonuses if the normative act on bonuses:

- the right to determine the share of bonus reduction is left to the manager;

- the reason that gave rise to the issue of deprivation of bonuses is not provided as grounds for this, but the manager is additionally given the right to make decisions in this regard;

- the decision made by the manager is indicated as the only basis for deprivation of the bonus;

- There is no depreciation procedure provided.

Do I need a memo to deprive a bonus for drunkenness?

Showing up at work while intoxicated is a type of one-time gross violation of labor duties (subparagraph “b”, paragraph 6 of Article 81 of the Labor Code of the Russian Federation) and, according to Art. 192 of the Labor Code of the Russian Federation requires the imposition of a disciplinary sanction on an employee.

The list of penalties for violation of labor discipline is closed and does not include such type of penalty as deprivation of bonuses. Therefore, there can be no talk of a memo regarding the deprivation of bonuses for drunkenness. But such a note will be required to document the fact of a disciplinary offense and bring the employee to disciplinary liability.

The issue of deprivation of a bonus for appearing at work while intoxicated may arise as a consequence of a disciplinary offense if the regulatory document provides for such grounds for deprivation of bonuses as the presence of:

- Disciplinary action - in this case, after a decision on punishment for a disciplinary offense is made, which the employee is familiarized with in the proper manner, deprivation of the bonus will follow automatically. However, before a decision on recovery is made, i.e., on the basis of the availability of only those documents that record the fact of a violation, it will be unlawful to deprive the employee of a bonus.

- Disciplinary offense - for this reason, depreciation will automatically follow if there is a complete set of documents documenting the very fact of the commission of the offense, regardless of whether a decision will be made in the future to punish it.

- A decision made exclusively by the head of the organization (including this is also true for a situation where the regulatory document does not contain a procedure for depriving bonuses) - here, in the process of distributing bonuses, the personnel service, as a rule, requests data on disciplinary offenses that occurred during the bonus period and punishments for them. This data may take the form of a memo.

To learn about situations in which a bonus may be recognized as accrued unreasonably or illegally, read the article “Unreasonable accrual and payment of bonuses.”

The role of the memo

This type of document is a method of internal communication between managers. The purpose of its use is to provide information about violations of an employee or an entire department. The immediate superior draws up a memo about the deprivation of the bonus and indicates the fact of the subordinate’s misconduct. The law does not approve a sample memo, so it is drawn up in free form. The structure of the document is as follows:

- The name of the organization is written at the top of the service card.

- Title of the document.

- Date and serial number.

- Description of the fact that served as the reason for the deprivation of bonuses.

- Proposal for punishment in the form of deprivation of a cash bonus.

- Full name, position and signature of the applicant.

In the future, the notice of deprivation of the bonus is the basis for issuing an order to deprive the bonus.

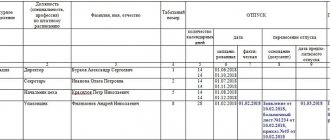

Sample order to deprive an employee of a bonus

An order to deprive an employee of a bonus does not have a set form and is drawn up in the same way as all other orders created by a specific employer.

The required data to be included in it will be:

- Full name of the employee deprived of the bonus;

- the name of his position and the structural unit in which he works;

- the reason that served as the basis for deprivation of the bonus;

- the size of the share of reduction (deprivation) of remuneration;

- the period for which the depreciation is carried out.

When an employer has an internal regulation on bonuses and this act contains a section devoted to the procedure for depreciating bonuses, it is appropriate in the order to provide a reference to its paragraphs, from which it follows that the decision to not pay the bonus is legal and that this procedure must be formalized by order.

If we are talking about deprivation of a bonus in connection with a disciplinary sanction, then the text of the order may contain references to the document number that documented the fact of issuing this sanction.

The employee must be familiarized with the order to deprive him of bonuses against his signature.

A version of such an order is available on our website.

Order on the cancellation of incentive payments and additional payments for personnel

For unification, the document should reflect the following points:

- deadline for completing this work;

- its volume;

- position and content of work;

- the amount of payment for performing these functions.

The order is signed by the manager and the employee, who must be familiarized with the order. Often an employer is faced with a situation where there is a position, but for some reason the person is not there. During the employee’s absence, a combination of positions can be arranged for one of the existing employees.

Regulatory framework and features The provisions that regulate combination and part-time work are presented in the Labor Code of the Russian Federation - these are articles 60.1 (part-time work) and 60.2 (combination). Labor Code of the Russian Federation First, you need to understand what is meant by combination.

Combination is work that a person does in conjunction with his main activity within the working day for the same or another position for additional money.

Order to cancel surcharges and allowances

for a year, the Order established an additional payment “for professionalism” in order to increase the material interest of workers. For managers and specialists, a fixed amount. For workers, a percentage of their basic earnings.

The Employment Contract contains the clause “The employee has the right to receive remuneration based on the results of his work in accordance with the provisions in force at the enterprise.”Additional. no agreements were drawn up.

Due to the difficult economic situation, the company decided to cancel the established additional payments from 2015.

Is it necessary to issue an order to cancel surcharges from 2015 or is it enough that the surcharge was established for a year?

Sample order to cancel incentive payments

The court was skeptical about the employee’s refusal to sign the clause.

He indicated that the employer provided only a copy of the report. The employer did not submit the original of this document to the court. Moreover, the act did not indicate either the place or time for the employee to familiarize herself with the new position.

Moreover, the workers who signed it worked in other cities.

This followed from their employment contracts. But the employer did not provide documents that would confirm that he called them to the central office.

The court questioned these workers as witnesses, but they gave contradictory testimony. Therefore, the court did not take their testimony into account.

The court concluded that the employer did not familiarize the employee with the new bonus provision. If the abolition of bonuses leads to an unacceptable reduction in the employee’s salary, this reduction must be compensated either by increasing the amount of guaranteed payments, or by a corresponding reduction in the volume of work, establishing a part-time working schedule, etc.

We record incentive payments not established by the Labor Code of the Russian Federation

Prescribe this procedure in a local regulatory act, which should be adopted in accordance with the requirements of labor legislation, for example, approved by order and familiarized with it to employees under a personal signature. Step 3. Make changes to employment contracts with employees to indicate the possibility of receiving incentive payments.

This must be done in order to consolidate the employer’s obligations to employees in a document that is kept directly by the employee. 21 Art.

We are canceling incentive bonuses

A collective agreement is concluded for a period of no more than three years and comes into force on the day it is signed by the parties or on the date determined by the collective agreement ().

In order to change the size or cancel altogether the bonus (allowance) established by the collective agreement or its annex, for example, it is necessary to make changes to its text. Changes are made in the same order in which it was concluded, or in the order defined in it itself ().

Order to cancel surcharge

In our article we talked about additional payments that can be accrued to employees in the form of compensation and incentive measures, and also provided a sample order for additional payment to employees.

In some cases, additional payments to employees are one-time in nature, and the order for their payment is the basis on which additional payments are accrued to employees.

For example, an additional payment to the salary of an employee who was on sick leave or on a business trip.

But in some cases, the surcharge order is valid for a certain period of time.

For example, when combining professions (positions), the employer’s order establishes both the fact of the combination and the amount of additional payment for the combination.

The period during which the employee performs additional work and, accordingly, receives additional payment, is established by the employer with the written consent of the employee and is also reflected in this order ().

At the same time, the employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule.

To do this, you just need to notify the other party in writing no later than 3 working days in advance. Accordingly, when the need for combination disappears, the employee will not be entitled to additional payment. The cancellation of the surcharge is usually formalized by order.

The employer decides for himself how to draw up an order to cancel the additional payment. Usually it indicates the reason why the accrual of the surcharge is suspended, full name.

and the position of employees for whom additional payments will no longer be made.

When additional duties are removed from the employee, such an order simultaneously confirms that the combination is terminated and, accordingly, the additional payment is no longer accrued. The order to withdraw additional payment from an employee must be familiarized to such employee against signature. When canceling the additional payment for combining, the order (sample) may look like this:

How to correctly issue an order to cancel the allowance and what reason to indicate?

Answer to the question: According to Art.

In accordance with Article 57 of the Labor Code, the conditions of remuneration (including the amount of the official salary, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments) are a mandatory condition of the employment contract.

Therefore, the employer has the right to change the amount of wages established by the employment contract unilaterally in accordance with Article 74 of the Labor Code only if the following conditions are met: First.

If the previous conditions of remuneration cannot be maintained for reasons related to changes in organizational or technological working conditions. Second.

If the employee is notified in writing of the upcoming changes, as well as the reasons that necessitated such changes, no later than two months in advance.

In a situation where the remuneration system is changed not due to a change in organizational or technological working conditions, the conditions of remuneration of workers can be changed only with the consent of the latter by concluding additional agreements to employment contracts according to the rules of Art. 72 of the Labor Code of the Russian Federation, while unfounded reductions in wages (including the abolition of bonuses) cannot be carried out even with the consent of the employee.

Thus, in this situation, you can only withhold a previously paid bonus from an employee if the employee himself agrees to return the money. Cases of retention at the initiative of the administration are given in Article 137 of the Labor Code.

If the employee agrees to cancel the bonus established by mistake, then we believe that the order and cancellation should be made on the current date. Example: Closed Joint Stock Company "Alpha" ORDER No. 58 on making additions to the order for the employment of E.V. Ivanova (order No. ____ dated ______________)

Moscow 02/04/2013 Due to the mistake made, I ORDER: 1. About _________________________________ payment of the bonus for……… to the official salary 2. Accounting departments should be guided by this order when calculating salaries.

3. The HR department should familiarize _________________________ with this order against signature.

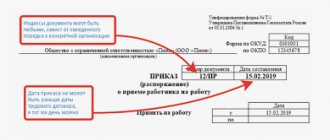

Reason: additional agreement to the employment contract dated No. Director /_______________ The order was read by: “___”_____________________, _________________ Details in the System materials: 1. Answer: How to issue an order to hire an employee. Hire an employee by order issued on the basis of a concluded employment contract.

the order must comply with the terms of the contract. This is stated in Article 68 of the Labor Code of the Russian Federation.

For persons with whom the organization will enter into civil contracts (contracts, paid services, etc.), admission orders are not needed.

Labor legislation does not apply to them (). Issue an order for employment according to a unified, approved, or according to.

The employee must be familiarized with the order for his employment within three days from the moment he actually started work.

The order is brought to his attention against signature.

Before concluding an employment contract, the employee must be familiarized (under signature) with the collective agreement and other internal documents regulating labor activity. This procedure is provided for by parts of Article 68 of the Labor Code of the Russian Federation.

Used in the answer "" Nina Kovyazina, Deputy Director of the Department of Education and Human Resources of the Ministry of Health of Russia 01/13/2015 With respect and wishes for comfortable work, Ekaterina Zaitseva, HR System expert

Decision of April 18, 2013

The specified payment is established personally for each employee and can be withdrawn in any month by decision of the manager, which is directly established by clause.

6.8 Remuneration Regulations. The employer’s powers in this case are not limited by the obligation to pay all existing employees PPC in a specifically defined amount.

Gradation when assigning PPC allows the employer to stimulate workers to work and increase productivity and is not a means of discrimination against a specific employee, since all wage payments provided for in the employment contract are made in favor of the employee.

The payment of a personal increasing coefficient to 88 employees is not relevant to the circumstances of the case, since the right to pay a personal increasing coefficient to individual employees is provided for by the current employer’s remuneration system.

Results

The need to issue an order to deprive a bonus does not always arise. It is not needed if all the conditions necessary for non-accrual (deprivation, reduction) of bonuses are specified in the internal regulatory act and the employee is familiar with this act. But an order will be required if the internal regulatory document either does not contain a description of the bonus deduction procedure or provides for the participation of the manager in the decision-making process regarding the deprivation of bonuses. Such an order must be brought to the attention of the employees to whom it applies, against signature.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.