Text of Article 285 of the Labor Code of the Russian Federation in the new edition.

Remuneration for persons working part-time is made in proportion to the time worked, depending on output or on other conditions determined by the employment contract. When setting standard assignments for persons working part-time with time-based wages, wages are paid based on the final results for the amount of work actually completed.

Persons working part-time in areas where regional coefficients and wage allowances have been established are paid taking into account these coefficients and allowances.

N 197-FZ, Labor Code of the Russian Federation, current edition.

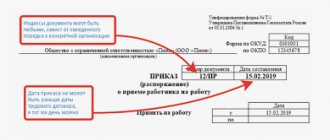

Registration of a part-time worker

In order to allow a part-time worker to work, you must sign an employment contract with him. To do this, the employee must bring to the enterprise a copy of his passport data, a copy of his education documents - if work conditions require it, and write an application for a part-time job. The hiring procedure is the same for both external part-time workers and internal ones - except that the internal part-time worker may already have the necessary documents stored in the HR department of the enterprise.

After receiving the documents, the employer and part-time worker sign an employment contract.

The contract must contain:

- official details of the document (name, date of preparation, addresses and signatures of the parties);

- clauses on the rights, duties and responsibilities of the parties (employee and employer);

- clause on the duration of the contract and the procedure for its termination;

- clauses on the employee’s work and rest schedule;

- clauses on payment for part-time work.

A part-time work contract can be drawn up on the basis of a standard employment contract that is used at the enterprise. It is only necessary to rewrite some points taking into account the peculiarities of the work of a part-time worker.

Commentary to Art. 285 Labor Code of the Russian Federation

1. Remuneration for persons working part-time is made according to general rules, but in proportion to the time worked, depending on output or on other conditions determined by the employment contract.

2. When part-time workers perform work in conditions deviating from normal conditions, increased wages are paid (see commentary to Articles 146 - 154 of the Labor Code of the Russian Federation), and when working in the regions of the Far North and equivalent areas, wages of part-time workers are paid with taking into account regional coefficients and percentage premiums (see commentary to Articles 316, 317 of the Labor Code of the Russian Federation).

3. In some cases, part-time workers are paid bonuses for continuous work experience (see, for example, Decree of the Government of the Russian Federation of February 28, 1996 N 213 “On bonuses for the duration of continuous work for medical workers holding part-time positions in health care organizations and social protection of the population" // SZ RF. 1996. N 10. Art. 953).

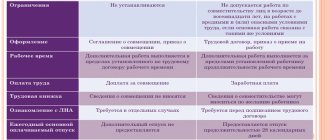

Part-time and combination

It is necessary to clearly distinguish between the concepts of part-time and part-time work, since these are two different categories that are formalized differently and paid differently.

A part-time worker is always an employee who performs other duties in his free time and such work can be indefinite.

A part-time worker is a person who, during his working hours, combines the performance of his main duties and additional ones. Such work is always temporary and cannot be performed without the written consent of the employee.

Remuneration for part-time workers and part-time workers occurs on different bases and is calculated differently. The first - based on the provisions of the employment contract, the second - by agreement of the parties. Usually this is a percentage of wages or a strictly agreed amount.

In addition, these two categories of employees are issued with different documents and are taken into account differently when filling out documents for the tax service. These two categories of workers - part-time and part-time workers - must be correctly taken into account and properly registered at the enterprise in order to avoid fines.

In addition, there is a certain circle of people who cannot perform part-time work:

- heads of enterprises and organizations;

- minors;

- performing work under harmful and difficult working conditions, if part-time work implies the same conditions.

Commentary on Article 285 of the Labor Code of the Russian Federation

The commented article determines that part-time work is paid at the same rates (tariffs, rates, salaries) as a similar main one, but in an amount corresponding to the part-time work performed, for the time worked. In this case, remuneration depends on production or other conditions that must be defined in the part-time employment contract.

If persons working part-time are set on a time-based wage, supplemented by standardized tasks based on technically sound standards, then in this case payment is made based on the final results for the amount of work actually completed.

If part-time workers work in areas where wage coefficients and bonuses are established, then they are paid taking into account these coefficients and bonuses <1>.

——————————— <1> See: information letter of the Department for Pension Issues of the Ministry of Labor of Russia dated 06/09/2003 N 1199-16, Department of Income and Living Standards of the Ministry of Labor of Russia dated 05/19/2003 N 670- 9, Pension Fund of the Russian Federation dated 06/09/2003 N 2523/5995 on the size of regional coefficients for wages of workers in non-production industries in the regions of the Far North and equivalent areas // Bulletin of the Ministry of Labor of Russia. 2003. N 9.

How is part-time work paid?

The main thing to remember when calculating part-time wages is that a part-time worker is the same employee as everyone else, he just works part-time or part-time, depending on his work schedule.

p>Wages for part-time workers are calculated on a general basis, taking into account all additional payments, bonuses, coefficients and allowances that are due to main employees.

For example, those performing work in the Far North and similar areas are entitled to a bonus for working conditions - this bonus also applies to part-time workers.

Contents of Art. 285 TK

At the beginning it is indicated that remuneration for part-time workers is processed in three main ways:

- in proportion to the time they worked;

- according to their production;

- on other principles specifically provided for in the employment contract.

Next, we consider the situation with payment for standardized tasks of part-time workers, payments to whom are made according to their working time. It is indicated that these payments are made based on the final results for the amount of work actually completed.

In conclusion, the article examines the situation with the payment of part-time workers in the area where regional coefficients and salary bonuses apply. In this case, payment for their work activities is made taking into account these coefficients and additional payments.

The considered article establishes the general principles of payment for part-time workers. Particularly important is its indication of the procedure for remuneration for their labor in territories where the relevant legislation provides for special coefficients and additional payments to personnel.

Part-time salary

The specifics of calculating wages for a part-time worker are regulated by Article 285 of the Labor Code of the Russian Federation.

As a rule, part-time workers are paid based on hours worked. Therefore, the minimum wage for part-time workers is lower than for main workers, even taking into account all the bonuses, incentives and allowances.

The legislation does not limit either the number of part-time jobs or the number of hours that a part-time worker can spend on other duties in his free time from his main job. But for civil servants, a part-time working day cannot exceed four hours.

However, sometimes in enterprises it happens that a part-time worker receives a salary equal to the salary of the main employee and even exceeding it. This is a rather risky move on the part of the administration, since the main workers, receiving wages according to the payroll, may be outraged by this state of affairs and complain to the State Labor Inspectorate about wage discrimination. Theoretically, this should not happen, because a part-time worker works half as much as the main employee, and under the same conditions, according to the law, remuneration should be carried out equally for everyone. At the same time, the Labor Code provides for the possibility of setting wages for part-time workers not according to the number of hours worked, but according to other conditions.

For example:

- by the number of assembled production units;

- by the quantity of goods sold;

- by volume of services sold.

Thus, for half a working day, a part-time worker with higher qualifications, better skills and greater efficiency can earn more than the main employee. If this point is stipulated in the employment contract, the employer has the right to pay a part-time worker greater amounts than the main employees of the enterprise receive - the law will not be violated, and the labor commission inspector will not have any questions for you.

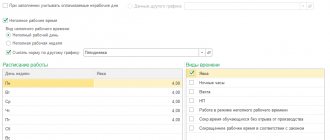

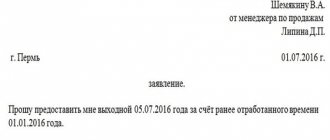

Legal days

The second advantage of working part-time is the opportunity to work on weekends without criticism from regulatory authorities. And here’s why: as a general rule, a part-time worker cannot work more than four hours a day, and in a month - more than half the monthly working time standard for the corresponding category of workers (Article 284 of the Labor Code of the Russian Federation). On days when the employee has a day off at his main place, he can work part-time full time. At the same time, there is no need to draw up a separate order for work on a day off and, accordingly, it is not necessary to pay double for it either, since a part-time worker works in any time free from his main job, fulfilling the established norm. To record working hours, you can use a time sheet, the form of which was approved by Order of the Ministry of Finance dated February 10, 2006 No. 25n. It should also reflect the time the part-time worker worked.

Minimum wage for part-time work

Since a part-time worker has all the rights and social guarantees of an ordinary employee, the provisions on the minimum wage (minimum wage) also apply to him - according to the Labor Code, the employee cannot receive less than this amount. At the same time, the legislation stipulates that the minimum wage is established subject to fully worked working hours; accordingly, a part-time worker who has worked half the established working time during the billing period receives half the minimum wage for part-time workers. If a part-time worker has worked a quarter of the established working hours, he receives a quarter of the minimum wage, and so on.

In this case, when calculating wages, taking into account all allowances and coefficients, the amount may be less than the minimum wage. For example, from January 1, 2013, the minimum wage per month is 5,205 rubles per month. Your part-time worker works at a quarter of the rate, a quarter of 5205 rubles is 1301 rubles. After making all the calculations, the amount you must pay to your part-time partner is 1000 rubles - that is, it turns out to be below the established minimum.

What to do in this case? The law provides for additional payment up to the minimum wage for part-time workers. That is, the employer pays an additional 301 rubles to the part-time worker from the above example to get the minimum wage.

Additional payment in the form of bonuses

So, since a part-time worker does not have the right to work more than four hours a day, he therefore cannot claim full wages. At the same time, from the provisions of Article 285 of the Labor Code of the Russian Federation, it follows that remuneration for a part-time worker may include not only payment depending on output, but also other payments provided for in the employment contract. Therefore, in practice, you can do this: establish in the contract the payment of a quarterly bonus in the amount that is necessary for the part-time worker to receive the promised salary in full.

For example, according to an employment contract for external part-time work, the employee’s salary is 10,000 rubles. At the same time, he is promised that he will receive 18,000 rubles a month. In order for the employee to receive the full amount in hand, the contract must provide for a quarterly bonus in the amount of 24,000 rubles. This bonus is paid based on the results of work for the quarter based on the order of the manager. As a result, the employee receives all the money due to him.

The second advantage of working part-time is the opportunity to work on weekends without criticism from regulatory authorities.

Once again, we draw your attention to the fact that the condition for the payment of bonuses must be specified in the employment contract . Only in this case can the bonus be taken into account when calculating income tax as labor costs. In confirmation of what has been said - letter of the Ministry of Finance dated February 5, 2008 No. 03-03-06/1/81. By the way, if the premium is paid from net profit, then it does not need to be taken into account in tax accounting and, accordingly, insurance contributions to the Pension Fund and the Social Insurance Fund do not need to be charged.