There are situations when an employee needs to receive vacation days ahead of schedule, using a kind of “vacation advance”. If “shock work” then follows, as a result of which the vacation turns out to be spent, the situation is not fraught with anything. But if an employee quits without “covering” the rest days provided to him with working time, the employer remains at some loss. The law allows him to recover the “advance” issued in the form of vacation in cash.

Let’s look at cases in which an employer does not have the right to withhold funds from a departing employee for used vacation, and we’ll look at how to calculate the amount of withholding and correctly formalize this process.

Question: How to record the deduction from an employee upon dismissal of the amount paid for unworked vacation days, if the next paid vacation for the current working year was provided to the employee in advance in December of the previous calendar year? Deductions are made from the employee’s wages based on the relevant order of the manager. Upon dismissal in March of this year, the employee received a salary of 48,000 rubles. The amount of vacation pay for unworked vacation days accrued to the employee in December last year amounted to 8,000 rubles. It was paid to the employee minus the withheld personal income tax. Tax deductions for personal income tax are not provided to employees. According to the accounting policy for profit tax purposes, the organization does not create a reserve for upcoming expenses for vacation pay. Tax accounting uses the accrual method. View answer

How to calculate the number of vacation days upon dismissal

Payroll calculation should not be difficult, but the question of how to calculate leave upon dismissal is more complicated, since the number of days may exceed the basic duration.

This is possible due to previously unused or additional days. In order not to make a mistake, you first need to determine the total working time, which gives the right to receive annual paid rest (Article 121 of the Labor Code of the Russian Federation). In this case, it is necessary to take into account the specifics of providing additional vacation periods: for work under hazardous working conditions, etc. Then you need to determine the total number of days that are due for the entire period of work with the employer. If the number of days turns out to be fractional, then the number is rounded in favor of the employee (letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17). After this, based on the data from time sheets (or other labor accounting documents), the days that the employee has already used are subtracted from the result obtained.

As a result, the remaining quantity is calculated.

- Actual time worked (FOV ) = the last 12 months (or less, but actually worked) - excluded periods.

- Number of days per time worked (KDOV) = (FOV / 12 months) / (the required number of vacation days in the employment contract / 12 months).

- Number of vacation days (KDO) = KDOV +/- remaining days.

Holding limit

Art. 138 of the Labor Code of the Russian Federation limits the amount of deduction that an employee can make without the knowledge and consent of the employee to 20% of the payments due to him upon dismissal, and in some cases specified in federal legislation - up to half. If the resulting amount exceeds this value, the employer has several options:

- limit yourself to 20% of the salary, forgiving the employee the rest of the debt;

- invite the employee to deposit the remaining money into the cash register on a voluntary basis (coercive measures in the form of delaying the work book, etc. are prohibited);

- try to recover the missing funds from the former employee in court (Articles 382, 383 of the Labor Code of the Russian Federation).

FOR YOUR INFORMATION! If the employee does not want to contribute the missing amount, and the employer does not intend to return it through the court, this money will not be included in the tax base of the Unified Social Tax and the Pension Fund of the Russian Federation, for which it must be debited to account 91 “Other expenses” (clause 3 of Article 236 of the Tax Code of the Russian Federation and paragraph 2 of Article 10 of Federal Law No. 167 of December 15, 2001).

Which days are taken into account?

You can understand how to calculate compensation for unused vacation by determining the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service for calculating payments is rounded up, if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works for less than half a month, he will not receive compensation.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2021. Over the last working year, he worked for 4 months and 5 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 4 months. During this time of work he is entitled to 9.33 days of rest. See below for the formula we used to calculate unused days.

Important! There is no rounding of unused days. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

Calculation in non-standard situations

When calculating payment for unused vacation, the following situations may arise:

- The person resigning has worked for less than half a month - no compensation is awarded to him (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169).

- Income is present only in the month of dismissal. Then the average earnings are determined for this month by dividing the accrued salary by the calculated value of the average number of calendar days in it (clause 7 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922), which is calculated from the number 29.3 in proportion to the share of calendar days of work in the total number of days in the month of dismissal (clause 10 of the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922).

- There was no income in the billing period. Then, to calculate average earnings, they take the same period preceding it (clause 6 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922). If there is no income in it, then the average earnings are calculated from the salary or tariff rate (clause 8 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

- In the calendar year considered for calculating the number of days of vacation pay, there were vacations at one’s own expense, and their total duration for the year exceeded 14 calendar days. The difference between the actual length of vacation at your own expense and 14 calendar days should reduce the period for which the vacation will be paid.

- The employee took vacation in advance and then quits without working the entire calendar year related to him. Overpaid vacation pay must be withheld from him (clause 2 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), if there are no grounds for paying them in full.

What does severance compensation mean?

When talking about compensation for leave upon dismissal, we usually mean its most general case, which applies to absolutely all employees.

This is compensation upon dismissal in the form of vacation pay due for vacation not used during the period of work. Every employee has the right to annual paid leave, and at the time of dismissal, part of it (and sometimes even several years of leave) may be unused. Art. 127 of the Labor Code of the Russian Federation obliges to pay this part in case of dismissal, no matter what its actual duration turns out to be. The reason for termination of the employment contract does not matter when calculating compensation upon dismissal. How to calculate days of compensation upon dismissal? The duration of standard annual leave is 28 calendar days (Article 115 of the Tax Code of the Russian Federation). However, for some categories of workers it is extended (Articles 116–119, Article 348.10 of the Labor Code of the Russian Federation). Vacation pay upon dismissal is calculated based on the length of vacation that is due to a particular person, taking into account the extension, if any. Holidays do not include holidays.

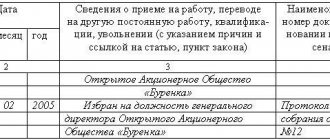

The beginning of the year to which the annual leave will relate is determined individually by each employer for each specific employee - from the first day of his employment for this job (clause 1 of the Rules on regular and additional leaves, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), and the end may be shifted if, during the calendar year calculated from the starting date, the employee experienced periods that were not included in this length of service (Article 121 of the Labor Code of the Russian Federation).

Calculation of compensation for dismissal in 2021 is also carried out for persons signed under a fixed-term (up to 2 months) employment contract (Article 291 of the Labor Code of the Russian Federation) or for part-time work (Article 93 of the Labor Code of the Russian Federation). For a fixed-term contract, vacation pay is calculated based on the fact that each month worked corresponds to 2 working days of vacation.

There is no need to accrue compensation for unused vacation upon dismissal to employees:

- drawn up under a GPC agreement (Article 11 of the Labor Code of the Russian Federation);

- those who worked less than half a month (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169).

The accrued compensation upon dismissal is subject to insurance premiums, personal income tax and is paid along with other amounts due to the employee on the last day of his work activity (Article 140 of the Labor Code of the Russian Federation).

ConsultantPlus experts have made an analytical selection on legal disputes with employees regarding the payment of dismissal compensation. Get trial access to the system and find out court decisions on the most common questions.

Read about whether it is possible to receive vacation pay compensation without resorting to dismissal.

Responsibility for non-payment of compensation for unused vacation

If the employer does not pay the resigning employee compensation for unused vacation, and the labor inspectorate finds out about this (for example, the employee writes a complaint), then the employer will be fined. The amount of the fine is (Part 6, Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- from 30,000 rub. up to 50,000 rub. — for a legal entity-employer;

- from 10,000 rub. up to 20,000 rub. — for officials of the legal entity-employer;

- from 1000 rub. up to 5000 rub. - for individual entrepreneurs.

By the way, if the employer pays compensation for unused vacation, but in violation of the established deadline, then along with this compensation the employer is obliged to pay the employee another compensation - for the delay in labor payments (Article 236 of the Labor Code of the Russian Federation).

Reflection of compensation for unused vacation in certificate 6-NDFL

Material compensation for vacation in full is subject to personal income tax. Upon dismissal, the employee receives salary and compensation minus tax. In 2021, employers submit tax returns in Form 6 of personal income tax every quarter. Let's figure out how to reflect the amount of compensation for unused vacation in this calculation.

In Form 6 Personal Income Tax, 2 blocks of lines 100-140 are filled out separately: for salary and for compensation.

To reflect the PO:

- in line 100, enter the date of recognition of income in the form of wages for the last month;

- in line 110 - the date of personal income tax withholding (date of salary payment);

- in line 120 - the deadline for transferring the tax is the following day of salary payment.

To reflect compensation for unused vacation:

- in line 100, indicate the date of income recognition (last business day);

- in line 110 - the date of tax withholding (day of payment);

- in line 120 - the deadline for transferring the tax is the following day after the payment of compensation.

In lines 130 and 140 of section 2, enter the appropriate amounts.

Design features

Requirement of Art. 122 of the Labor Code of the Russian Federation establishes that paid leave is provided to the employee annually on the basis of the vacation schedule (Article 123 of the Labor Code of the Russian Federation). During the vacation, the “vacationer” retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation), but he cannot be fired.

An employee can be dismissed only when he: has begun to perform his official duties; wrote an application for leave with subsequent dismissal, in this case the last working day will be considered the last working day, and the day of dismissal will be the last day of rest (Article 127 of the Labor Code of the Russian Federation).

The number of documents to be completed depends on whether the employer uses the following forms:

- unified (for the case under consideration - on the basis of Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1);

- own (approved independently in accordance with the law of December 6, 2011 No. 402-FZ);

- for public sector organizations (by order of the Ministry of Finance dated March 30, 2015 No. 52n, as well as departmental ones, for example, by order of the Federal Antimonopoly Service of the Russian Federation dated July 1, 2016 No. 887/16).

If unified ones are used, the personnel service prepares two orders: on providing rest to the employee (Form No. T-6); on termination of an employment contract with an employee (form No. T-8).

The same principle applies to settlement documents.

If the employer uses unified forms, the accounting service prepares two documents:

- note-calculation on the provision of rest (form No. T-60);

- settlement note upon termination of an employment contract (form No. T-61).

In public sector organizations and extra-budgetary funds, document forms of class 05 (order No. 52n) are used, in particular, the OKUD form 0504425. If unified forms are not used, then the documents are drawn up in the manner established by the budget legislation of the Russian Federation (for the public sector) or by the organization itself in accordance with Law No. 402-FZ.

Labor Code of the Russian Federation on vacation and vacation pay

The law states that employees can be given leave at any time if this does not contradict production needs (Article 122 of the Labor Code of the Russian Federation). As a general rule, the length of service required to provide full leave is six months. Having received 28 days of rest guaranteed by law, in 6 months the employee actually worked only 2 vacation weeks. The calculation is that the remaining paid vacation time will be worked out in the second half of the year. Full leave is worked for at least 11 months.

Question: How to calculate and report insurance premiums when withholding for unworked vacation days in the event of an employee’s dismissal? View answer

The law does not prohibit providing vacation before the 6 months the employee has worked, and in subsequent years of work, vacation can be scheduled even at the very beginning of the working year or at any other time.

If an employee leaves his position before he has already worked the “time off” and paid time, the employer has the right to recover funds spent on vacation pay for such an employee (Article 137 of the Labor Code of the Russian Federation).

NOTE! Withholding vacation pay is the employer’s legal right, but it is not his responsibility. The employee’s opinion is not taken into account; the employer’s decision remains within his own competence.

How is accounting reflected in the deduction of overpaid vacation pay to an employee for unworked vacation days upon dismissal?

Indexation of average earnings with salary increases

It happens that an increase in tariff rates, that is, an employee’s salary, occurred before or during a vacation. Then the average earnings need to be indexed and vacation pay will have to be recalculated.

Three indexing options are used:

- Let's say the salary was increased during the reporting period, which means that all payments are taken into account in the calculation of vacation pay from the beginning of the period until the month of the salary increase. To do this, you need to multiply the salary or vacation pay by the increase factor (Kpv): Kpv = He / Os, where He is the new salary, and Os is the old salary;

- The increase occurred later than the billing period, but before the start of the vacation, which means the entire calculated average earnings are multiplied by the Kpv (increase coefficient);

- The increase happened during vacation - only part of vacation payments is increased, starting from the date of introduction of new salaries.

Is it possible to replace vacation with monetary compensation without dismissal?

Replacement with monetary compensation without dismissal is permissible only for the part of the vacation period exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation). This happens upon a written request from the employee. Days exceeding the main vacation can be replaced with money. Only those categories of employees who are entitled to additional days of rest (disabled people, teachers, doctors, northern workers, etc.) can receive cash remuneration instead of rest. Or if the employer has provided additional days for rest in the company’s local regulations. And then, not in all cases.

- The legal norm uses the wording “can be replaced,” which leaves the employer the right to refuse the employee financial compensation. Payment of money instead of providing extra days of rest is at the discretion of management.

- Vacation will not be replaced with money for pregnant women, minors and workers in hazardous and hazardous industries.

It is also not possible to accumulate vacation days for the previous year, and then take part of the double vacation over 28 days in cash. Article 126 of the Labor Code of the Russian Federation, when summing up and transferring vacations from one year to another, allows for the replacement of only part of more than 28 days in each year.

Determining the amount of payments to be taken into account

To calculate average earnings, you should take into account all types of payments provided for in the remuneration system and used by the employer. In this case, the sources of payments do not matter (clause 2 of the Regulations). Such payments include, in particular:

- wage;

- bonuses and rewards;

- payments related to working conditions and working hours (coefficients and percentage increases in wages, additional payments for work under harmful and (or) dangerous and other special working conditions, at night, on weekends and non-working holidays).

To calculate average earnings, social payments and other payments that do not relate to wages (for example, material assistance, payment for the cost of food, travel, training, utilities, recreation) are not taken into account. The basis is clause 3 of the Regulations.

When calculating average earnings, the amounts accrued for the billing period specified in paragraph 5 of the Regulations are also excluded.