This calculator is designed to calculate the number of unused days of annual leave on a specific date, for example, on the day of leaving the organization (dismissal) to determine the amount of compensation.

Calculations are carried out online without reloading the page. Enter your data in the lines of this form and you will receive an answer in the lower field of the calculator.

Online calculator for calculating compensation upon dismissal.

How the duration of vacation is calculated: basic rules

How to calculate the number of vacation days? An employer may have such a question, for example:

- when sending an employee on vacation and issuing him vacation pay;

- payment of compensation for unused vacation upon dismissal or without it.

In both cases, the calculation of calendar days of vacation occurs according to the general scheme. It is based on the basic holiday rule, which is contained in Art. 115 of the Labor Code of the Russian Federation: for each year of work, an employee is entitled to at least 28 calendar days of basic paid leave. As a rule, this is the period of time provided for rest for employees of most companies.

Vacation is extended for days of illness, performance of government duties, and in some other cases (Article 124 of the Labor Code of the Russian Federation).

Some categories of workers are entitled to extended vacations by law. These include:

- employees under 18 years of age;

- municipal and civil servants;

- educational staff;

- disabled people;

- drug control officials;

- investigators and prosecutors working in areas with special climates;

- other categories of workers.

An organization can set a different vacation duration by recording this in a local document.

Study the nuances of providing additional leave using materials from our website:

- “Additional leave for irregular working hours”;

- “The Supreme Court clarified how to calculate the duration of additional vacations”.

Thus, the first thing you need to do before calculating calendar days for calculating vacation is to determine the employee’s length of service in the organization.

In general, a person can take vacation for the first year of work in a new place after working for six months. But by agreement with the employer, you can go on vacation earlier. Holidays for subsequent years are provided at any time according to the vacation sequence established by the employer.

After the length of service has been calculated, you need to determine how many days of vacation the employee is entitled to. You need to proceed from the following: with the generally accepted 28-day vacation provided in calendar days, for each month worked the employee is entitled to 2.33 days of vacation (28 days / 12 months).

How to calculate the duration of vacation when working part-time (duration of vacation when working at 0.5 times the rate)? The answer to this question was explained in detail by ConsultantPlus experts. Get free trial access to the legal system and switch to a ready-made solution.

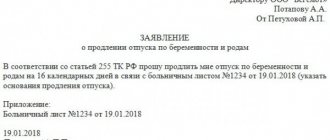

When is it allowed to take after maternity leave?

It is necessary to distinguish between the following types of rest periods that an employee is entitled to count on under current labor legislation:

| Paid annually | Every employee, regardless of gender, profession and family circumstances, has the right to an annual vacation, during which he retains his average earnings. The standard duration is 28 days annually, for some groups of workers it is longer. |

| Unpaid | Provided at the request of the employee without retaining his earnings. |

| For pregnancy and childbirth - BiR | It is provided to pregnant women in the last stages of pregnancy and lasts from 140 to 194 days, depending on the complexity of the birth and whether the citizen gave birth to one or more children. Issued with a sick leave certificate. |

| Child care - Swelling or maternity leave | Provided to an employee, male or female, in connection with the need to care for a newborn until he reaches three years of age. Premature exit from Swelling is allowed. |

Article 260 of the Labor Code of the Russian Federation resolves the question of whether it is possible to take leave immediately after maternity leave: yes, immediately after leaving parental leave, an employee has the right to take annual paid leave. For its provision, work experience is not taken into account - six months of experience is not mandatory. Speaking about when leave is due after leaving maternity leave, it is important to remember that the employee will receive such leave provided that he did not use it before or after sick leave for pregnancy and childbirth.

In addition to the freedom to choose when to take leave after maternity leave, the employee has the right to independently determine the duration of such rest she needs: she has the right to use the full duration established by the employer, which is usually 28 days.

Calculating vacation time

We begin counting the length of service from the date the vacationer was hired. In other words, the calculation is carried out not according to calendar years, but according to so-called working years.

Example

For an employee who was employed on 04/11/2020, the first working year will be the period from 04/11/2020 to 04/10/2021, the second - from 04/11/2021 to 04/10/2022, etc.

When calculating vacation days for an employee’s worked period, we take into account the time when he:

- worked directly;

- did not actually work, but his position was retained;

- was on vacation at his own expense (but no more than 14 calendar days per year);

- forced to skip work due to illegal dismissal or suspension;

- was suspended without undergoing a mandatory medical examination through no fault of his own.

The answer to the question of whether vacation days are excluded when calculating vacation pay is partly positive. So, we exclude from the experience:

- periods of unpaid leave exceeding 14 days;

- "children's" holidays;

- time away from work without good reason.

Example

The employee was hired by the organization on 07/11/2019 and worked until 03/20/2021 without leave. He was sick from 02/12/2021 to 02/21/2021.

First, the number of months in the worked period is determined.

12 months (07/11/2019 – 07/10/2020) + 8 months and 10 days (07/11/2020 – 03/20/2021) – 10 days of illness = 20 months.

Number of vacation days: 28 / 12 × 20 = 46.67 days.

Severance compensation calculator

An employee who decides to sever his relationship with the employer through voluntary dismissal must follow the following algorithm:

- First, he submits a corresponding application to the personnel department, or directly to a private entrepreneur. The application must indicate the period after which the employee will no longer return to work.

- In turn, an individual entrepreneur or the management of a legal entity will take into account the period after which the employee will not return to the workplace and look for an appropriate replacement.

- On the last day of work, the individual entrepreneur or the accounting department and personnel of the enterprise must issue the employee his work book, with all the necessary entries, and also make a payment.

An example of a resignation letter would be as follows:

- in the upper right corner there is a “header”, where the name of the employer is indicated, as well as the personal details of the director;

- then the employee’s personal data and his position are written;

- lower in the center, you need to write “Application”;

- then follows the text, which indicates that the employee wants to resign of his own free will, and also specifies the period after which he will no longer return to work;

- Then the date of writing is put, and the person signs.

When all issues are agreed upon, the employer must issue a special personnel order, in which it is indicated that the person is subject to dismissal on a specific date, and indicate in it what amount he is entitled to as compensation.

The sample of such an order is no different from other personnel orders (for example, appointment to a position).

A sample application can be found here.

At the same time, a private entrepreneur must understand that upon dismissal, a person must familiarize himself with this order and put his signature on it. A copy of it is issued only at the personal request of the employee, after signing all the necessary papers.

This application example is universal and can be written by hand or printed. This document is the basis for dismissing an employee.

On the last day of work, as stated above, all payments due to him must be made.

It is important to know that there are situations in which a person wants to quit while on sick leave or vacation. This practice sometimes baffles entrepreneurs. There's nothing wrong with that. The employee simply writes in the application that his last day of work will be the date of his vacation or sick leave.

In this case, the settlement period, as well as other legal subtleties, will be carried out after leaving sick leave or vacation.

Let's try to calculate compensation for unused vacation upon dismissal using an example, and for this we will derive the SDZ and the number of “unused” days using formulas (without a calculator).

Example: Panfilov I.L. has been working at OJSC Cinema since April 10, 2014, resigning on August 15, 2021. Annually to I.L. Panfilov. There are 28 days of rest according to the calendar. During his work at OJSC Cinema, he used 20 days in October 2014, 14 days in May 2015, 28 days in July 2021, that is, a total of 62. Monthly labor payments to I.L. Panfilov. — 30,000 rubles including bonus. Let's calculate how many rest days Panfilov has left for 2014-2016:

Over a three-year period from 2014 to 2021. Panfilov I.L. Allotted 84 days for rest (3*28), he used 62 days. The number of unused days for previous periods is 22.

How to calculate compensation for unused vacation upon dismissal?

To calculate the amount due for vacation, you must adhere to the following rules:

- For the calculation, an indicator such as average earnings for 1 day is taken. To do this, first add the average earnings for 12 months.

- Amounts for sick leave, vacation or other compensation payments are not taken into account.

- To calculate the amount of vacation pay per month, take a coefficient of 2.33. This number represents the division of 28 days of vacation into 12 months.

Before making direct calculations, it is necessary to find out how many days of vacation the employee did not take. To do this, the entire length of service at the enterprise is determined, as well as the periods during which the right to leave is not granted.

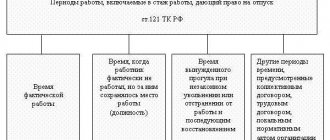

For example, the time when an employee was suspended from work due to his fault is not included in the length of service that gives the right to leave. Also, the time when the employee was on parental leave does not give the right to leave. This rule is established in Art. 121 Labor Code of the Russian Federation.

When calculating vacation, all time worked and periods are taken when:

- the employee did not work, but his position was retained. This applies to vacation days, weekends, holidays;

- absenteeism is not the fault of the employee;

- vacation at your own expense, but not more than two weeks.

After determining the period for which vacation is due, it is necessary to calculate the amount of average earnings per day.

To determine this indicator, the total income for the period required for calculation is taken, which then needs to be divided by 12. And then this amount is divided by 29.3 - the number of days in a month on average.

Let's look at the calculation of vacation pay using a simple example:

Upon dismissal of Fedorov I.S. he has 20 days of unused vacation. His monthly salary is 25 thousand rubles.

KO (vacation pay compensation) = Salary for 12 months / (12*29.3)* per number of vacation days

KO = 25 thousand rubles. /29.3 *20 = 17064.84 rubles.

Another example:

Sidorov V.S. I worked at the company for only 6 months. The total annual amount of his salary is 200,000 rubles.

KO= (200000 /29.3) /12*14= 7963 rub.

If all due payments were not paid by the employer on the day of dismissal, the employee can appeal the actions of the former manager. You can appeal to the court, the labor inspectorate and the prosecutor's office at the same time.

A complaint can be filed either individually or collectively if, for example, several workers at one company did not receive payments. If the employee decides to file a claim, the period for filing a lawsuit is only three months.

You can understand how to calculate compensation for unused vacation by determining the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how much time a year the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service for calculating payments is rounded up, if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works less than half a month a year, he will not receive compensation.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2021. Over the last working year, he worked for 4 months and 5 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous years, compensation is accrued for 4 months. For 4 months of work, he is entitled to 9.33 days of rest. See below for the formula we used to calculate unused days.

Important!

The Labor Code of the Russian Federation does not provide for rounding of unused days. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

The number of days of unused vacation is determined based on the fact that a full year of experience giving the right to it corresponds to 28 calendar days, and each full month corresponds to 2.33 calendar days. When the last month of service turns out to be incomplete, then, when calculating compensation upon dismissal, it is taken into account as full if the number of days of work in it exceeds half a month, and is not taken into account when the period worked in it is less than half a month (clause 35 of the Rules on regular and additional holidays approved by the USSR People's Commissariat of Labor on April 30, 1930 No. 169).

How to calculate days of compensation upon dismissal? The duration of standard annual leave is 28 calendar days (Article 115 of the Tax Code of the Russian Federation). However, for some categories of workers it is extended (Articles 116–119, Article 348.10 of the Labor Code of the Russian Federation). Vacation pay upon dismissal is calculated based on the length of vacation that is due to a particular person, taking into account the extension, if any. Holidays do not include holidays.

It is possible to check the manual calculation of compensation upon dismissal via the Internet. To do this, you will need to enter into the appropriate program all the information it requests, taking into account the features described above. The program will process the entered data and issue the estimated amount of compensation.

The beginning of the year to which the annual leave will relate is determined individually by each employer for each specific employee - from the first day of his employment for this job (clause 1 of the Rules on regular and additional leaves, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), and the end may be shifted if, during the calendar year calculated from the starting date, the employee experienced periods that were not included in this length of service (Article 121 of the Labor Code of the Russian Federation).

- more than 11 months and they have all entered the length of service that grants the right to leave;

- from 5.5 to 11 months, but is forced to resign due to reduction in numbers, due to enlistment in military service, assignment to study or other work, or due to revealed unsuitability for work.

In general, the calculation of compensation for an employee on a fixed-term employment contract is no different from a regular one - an open-ended contract. If vacation on a fixed-term contract is set in calendar days, then compensation is calculated using the general formula (see above).

We recommend calculating compensation for unused vacation in proportion to the time worked by the resigning employee. Despite the explanations of Rostrud given in letter dated March 4, 2013 No. 164-6-1. They say the full compensation rule only to workers who are in their first year of employment with a given employer.

Maternity leave (maternity leave) is included in the length of service that gives the right to paid leave. But maternity leave is not included . It is included in the length of service only if the employee works part-time or at a remote workplace.

Thus, if the entire period for calculating the length of service for vacation, the employee was on maternity leave (and did not work remotely or part-time), and before that she was on maternity leave, then the average daily earnings must be taken for the 12 months that preceded the maternity leave. vacation.

It seems strange that when working part -time, you are also entitled to leave. In fact, this is true. When working for the same company under two different contracts, the right to vacation arises under both contracts. This means the right to compensation for unused vacation too.

Some categories of workers (for example, teachers) are entitled to a different number of paid days of rest - 36 instead of 28. Doctors are provided with additional paid days of rest. For such cases, the calculator for calculating unused vacation upon dismissal 2021 contains the “other” column, where the required number of calendar days for a specific situation is entered.

An online calculator for calculating compensation for unused vacation in 2021 is used when an employee decides to quit, but during his work he has accumulated vacation days that he did not take off: the accounting department must calculate his monetary compensation. Let's see how to do this.

Sometimes it happens that an employee wants to take a vacation before dismissal - in this case, two registration options are possible, which are described in detail in the article “Vacation followed by dismissal.” And to make calculations without errors, use an online calculator for calculating voluntary dismissal 2020; it will help you quickly and easily calculate the amount that needs to be paid to the employee. It is important to remember that citizens who resign or are dismissed for other reasons are also entitled to compensation.

- 28 - to all employees;

- 30 - disabled workers;

- 31 - minors or employees with irregular working hours;

- 35 - employees engaged in work with harmful (2, 3 or 4 degrees) and (or) dangerous working conditions;

- 44 - persons who work in areas equated to the regions of the Far North;

- 52 - to persons working directly in the Far North.

- periods when the employee was absent from work without good reason;

- the time when the employee was on parental leave;

- periods without pay if they lasted more than 14 calendar days during the working year.

- The salary increased during the pay period. Then all payments taken into account when calculating vacation pay from the beginning of the billing period to the month of salary change are multiplied by the KVP.

- The salary increased after the pay period before the start of the vacation. The entire calculated average earnings are multiplied by the increase factor.

- Salary increased during vacation. Only part of the vacation pay increases, starting from the effective date of the new salaries.

The beginning of the year to which the annual leave will relate is determined individually by each employer for each specific employee - from the first day of his employment for this job (clause 1 of the Rules on regular and additional leaves, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), and the end may be shifted if, during the calendar year calculated from the starting date, the employee experienced periods that were not included in this length of service (Article 121 of the Labor Code of the Russian Federation).

Important! There is no rounding of unused days. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

Article 127 (hereinafter all references to the Labor Code of the Russian Federation) stipulates that such compensation is mandatory. It is paid by default. Example: an employee wrote a letter of resignation, indicating the date. In fact, he did not ask for leave; accordingly, the accounting department is preparing a calculation with financial compensation for this period.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2021. Over the last working year, he worked for 4 months and 5 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 4 months. During this time of work he is entitled to 9.33 days of rest. See below for the formula we used to calculate unused days.

- first, the first working year is taken from the date of employment, the completion date is determined taking into account unaccounted periods - this is 12 full calendar months of service;

- then the second year is taken, the date of its completion is determined - this is another 12 months;

- further calculations are carried out by working years until the date of calculations arrives;

- the result is the length of service in months. Remaining days less than 15 are discarded, days 15 or more are rounded up to a full month.

- 1 - the first date is the day of employment with this employer. Enter the date in digital form - two digits for the date, two for the month, four for the year. You can enter the day manually, or select it on the calendar that appears when you click on the line.

- 2 - the second date is the day on which the calculation of non-vacation leave is carried out, for example, the moment of dismissal of an employee or another. You can also enter the date in the correct format manually or select it from a calendar.

- 3 - the third line is intended to reflect the number of rest days taken during work with the employer in this organization; you should add up all periods of annual leave and indicate the resulting number in line 3.

- 4 - the fourth line is necessary to indicate the number of days excluded from the vacation period; the law provides for periods that do not give the right to paid rest, these include maternity leave, time off at your own expense (only those that exceed 2 weeks per year), absence from work without good reason. You should count the total number of such days and enter the resulting number in line 4.

- 5 - the fifth line is the duration of paid leave in days, in general it is 28 days, but sometimes this parameter can change. If you are in doubt about the duration of your vacation, look at the employment contract, where this duration is always specified in the appropriate clause.

- Calculate the length of service (from the date of acceptance into the organization to the day of calculations, inclusive). If there are periods that are not included, they should be skipped, postponing the end of the working year.

- Determine how many days of vacation are due for each full month worked (divide the annual duration by 12).

- Multiply the number of months of service by the number of vacation days provided in one month - as a result, we get the total number of vacation days that the employee earned during his work.

- To determine days not taken off, subtract those already used from the total duration from step 3.

- 1 - click on the line and find the date 09/10/2016;

- 2 - similarly click on the second field and find 11/25/2019;

- 3 - indicate 56 (28 + 28);

- 4 - we contribute 14 (during the first working year, Potapov took 28 days off at his own expense, 14 of which are not included in the vacation period);

- 5 - leave 28.

- 1 working year - from 09.10.2016 to 09.23.2017 (the end date was shifted by 14 days due to the vacation at one’s own expense) - 12 months. length of service;

- 2nd working year - from 09/24/2017 to 09/23/2018 - 12 months;

- 3 working year - from 09/24/2018 to 09/23/2019 - 12 months;

- 4 working years - from 09/24/2019 to 11/25/2019 - 2 months. 2 days - rounded up to 2 months.

The salary of a dismissed employee is calculated and paid to him in accordance with the salary or tariff rate. It is not difficult to calculate the amount that a person actually earned. The main thing is to remember that all time actually worked from the beginning of the month is paid, including the last working day. Let's look at an example of calculation upon dismissal.

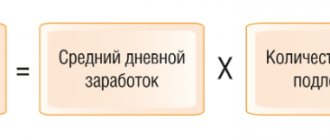

The amount of compensation for unused days is calculated as vacation pay. The size of the payment depends on the average daily earnings of a particular employee (ADE). Taking this value and multiplying it by the number of days, we get the amount of compensation.

You can understand how to calculate compensation for unused vacation by determining the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months.

If more than half a month has been worked, the length of service for calculating payments is rounded up, if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction.

But if an employee works for less than half a month, he will not receive compensation.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2021. Over the last working year, he worked for 4 months and 5 days.

Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 4 months. During this time of work he is entitled to 9.33 days of rest.

See below for the formula we used to calculate unused days.

Important! Rounding of unused days (Labor Code Article of the Labor Code of the Russian Federation) is not provided. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

Let's try to calculate compensation for unused days upon dismissal using an example, and for this we will derive the SDZ and the number of “unused” days using formulas (without a calculator).

Example: Panfilov I.L. has been working at OJSC Cinema since April 10, 2014, resigning on August 15, 2021. Annually to I.L. Panfilov. There are 28 days of rest according to the calendar.

During his work at OJSC Cinema, he used 20 days in October 2014, 14 days in May 2015, 28 days in July 2021, that is, a total of 62. Monthly labor payments to I.L. Panfilov. — 30,000 rubles including bonus.

How to correctly calculate the vacation period if it falls on a holiday

In Art. 120 of the Labor Code of the Russian Federation establishes a rule according to which non-working holidays that fall on vacation are not included in the vacation itself. In practice, there are two options for calculating vacation days:

- The vacation period is indicated by its start date and the number of calendar days. In this case, the employee returns from vacation 1 day later.

Example 1

Leave was granted to the employee from 03/04/2021 for 14 calendar days. March 8 is a holiday, so he should start work not on March 18, 2021, but on March 19, 2021.

- The vacation period is indicated by its start and end dates. In this case, the days of rest used are considered to be the days of the corresponding time period minus holidays.

Example 2

Leave was granted to the employee from 03/02/2021 to 03/15/2021. There are 14 days according to the calendar. But due to the fact that the March 8 holiday falls during this period, the vacation is considered to be used in the amount of 13 days.

When making calculations for vacation in an incomplete month, you should also take into account calendar days that fall within the period worked, and not just working days (actually worked). Thus, holidays, as well as weekends that do not fall under the periods listed in paragraph 5 of the Regulations approved by government decree No. 922 dated December 24, 2007, must be included in the calculation of vacation days as those that fall under the worked period .

Find out how to extend your sick leave during vacation here.

You can confirm the conclusions and calculations we have made with the help of the Personnel Guide “Annual Basic Paid Leave” of the ConsultantPlus system. To do this, get a free trial access to K+.

Is it possible to divide the vacation into parts?

Extract from ILO Convention No. 132 of 09/06/2011

The law allows for the possibility of dividing vacation into several parts. However, the provisions of Article 125 of the Labor Code of the Russian Federation and ILO Convention No. 132 of September 6, 2011 cannot be violated. These documents establish the employee’s rights to rest and indicate how it can be divided into several parts.

It is specified that the first part of the holiday provided should be 14 days. However, nothing has been written about the second part. Thus, division by any number of days is allowed. However, the employer is reluctant to allow it to be split into 2–3 days. To protect themselves from such actions, some companies draw up an employment contract so that the employee has the right to leave only 14 days of rest, regardless of the provisions of the current legislation. This is not considered a violation, since the right to rest is being exercised.

If the employer does not protect himself in this way, then there is a possibility that some citizens will write an application for only 5 days, but actually rest for 9 days (plus 4 days off). In this case, weekends will not be included in the payment.

Leave schemes

There is additional rest for work in hazardous work. It is also not directly mentioned in the Convention and the Labor Code. This means that it is also subject to division at the discretion of the employee in agreement with the employer.

It is allowed to call an employee to production only with his consent on the basis of Article 125 of the Labor Code of the Russian Federation, but for this there must be a production necessity. Refusal to interrupt vacation is not considered a violation of labor discipline. Moreover, the employer cannot call to work minors who have partial legal capacity or are completely emancipated, pregnant women and people who work in difficult or dangerous conditions.

How to calculate vacation days in 2020-2021 (example)

Let's give an example of calculating the days of the billing period for vacation in 2021, taking into account the subtleties and nuances outlined above.

Let’s say an employee got a job at the company on June 17, 2018.

During his work period he:

- was ill from 12/04/2018 to 12/12/2018 and from 02/12/2019 to 02/19/2019;

- took vacation at his own expense from 04/07/2019 to 04/13/2019 and from 08/24/2019 to 09/13/2019;

- was on paid leave from 06/02/2019 to 06/22/2019, from 03/30/2020 to 04/19/2020, from 08/29/2020 to 09/11/2020.

On January 15, 2021, he decided to quit, having first taken off all the days that he did not use during his work.

See also “How to properly arrange leave followed by dismissal?” .

Let's see how many vacation days are due per year if the company has a standard vacation duration of 28 days.

Step 1. Determine the length of service

The total length of service from 06/17/2018 to 01/15/2021 will be 2 years 6 months and 29 days.

We do not touch periods of illness and vacation. They are taken into account in the length of service that gives the right to leave, as non-working periods during which the employee’s place of work is retained.

Vacation at your own expense can be included in the length of service within 14 calendar days per working year. We have 2 such periods:

- for the working year from 06/17/2018 to 06/16/2019 - 7 days (from 04/07/2019 to 04/13/2019);

- for the working year from 06/17/2019 to 06/16/2020 - 21 days (from 08/24/2019 to 09/13/2019).

The second period does not fit within the 14-day limit, which means that 7 days of excess will have to be excluded from the length of service.

Thus, the vacation period is 2 years 6 months and 22 days. Round up to full months, discarding 7 days, and we get 2 years and 7 months.

Step 2. Calculate the number of vacation days that the employee is entitled to for the specified period

This is 56 days for 2 full years and another 17 days for an incomplete year of work (28 days / 12 months × 7 months = 16.33 days. Rounding was done according to the rules adopted by the organization (in accordance with the recommendations set out in the letter of the Ministry of Health and Social Development of the Russian Federation dated 07.12 .2005 No. 4334-17) in favor of the employee. Total 73 days.

Step 3. Determine the number of unused vacation days

During his work, the employee took leave three times:

- From 06/02/2019 to 06/22/2019. This period was a non-working holiday on June 12, so not 21, but 20 days of rest were used.

- From 03/30/2020 to 04/19/2020. There were no holidays here, and the vacation was 21 days.

- From 08/29/2020 to 09/11/2020. There were no holidays here either, and the vacation was 14 days.

A total of 18 days remain unused (73 – 20 – 21 – 14). Their employee can take time off immediately before dismissal - from 12/21/2020 to 01/15/2021 (including New Year holidays). So, the calculation of vacation in 2021 - an example with a detailed description, has been made.

Can I go on vacation if I have worked for less than 12 months?

The provisions of the Labor Code of the Russian Federation allow an employee to exercise the right to rest before he has worked a full calendar year.

Here is what is stated in Article 122 of the Labor Code:

- Leave must be granted annually;

- The first right to use it appears after six months of work at one enterprise.

However, it is acceptable to write a leave application before the expiration of the due date in the following cases:

- pregnancy and childbirth;

- the employee's age is less than 18 years;

- adoption of a child less than three months old;

- transfer from another organization.

A full list of situations when you can get leave before six months after employment is specified in a number of federal laws.

Calculation of vacation in 2020-2021: total amount of vacation pay

Vacation pay is calculated using the formula:

OTP = SDZ × CHDO,

Where:

SDZ - average daily earnings;

NDO - number of vacation days.

Example

From March 21, 2021 to April 17, 2021, the employee was granted 28 days of vacation. The period from 03/01/2020 to 02/28/2021 has been fully worked out. An employee receives a monthly salary of 32,000 rubles. In December 2021, he received a bonus of 5,500 rubles. based on the results of work for November 2020.

Salary = 32,000 × 12 + 5,500 = 389,500 rubles.

SDZ = 389,500 / 12 / 29.3 = 1,107.79 rubles.

OTP = 1,107.79 × 28 = 31,018.12 rubles.

Note! If errors are identified in the calculation of vacation pay, they should be recalculated. If you overpay, you must deduct it from the employee’s salary strictly with his consent. If you underpay, pay extra.

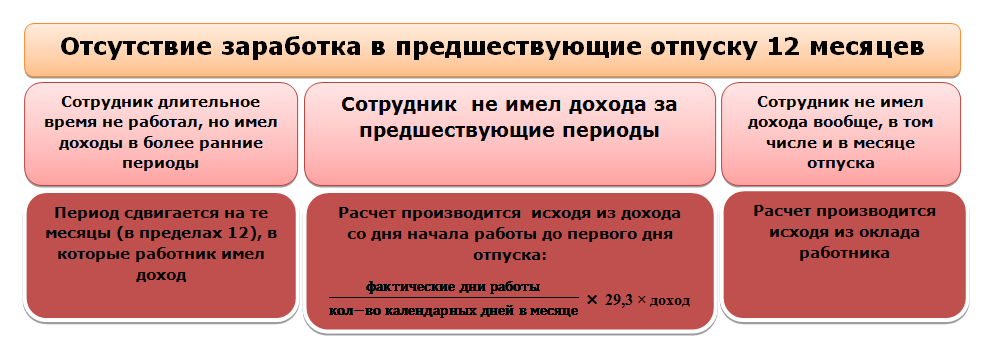

How to calculate vacation pay if there is no income in the billing period?

How to calculate vacation pay for the year if the billing period includes months with no income or only those that are excluded from the calculation? Actions here will depend on the availability of income in other periods:

- if it was present in the periods preceding the calculation period, then the calculation period is shifted to those months when the income was;

- if there was no income in the previous billing periods, then the calculation is made based on the data for the days worked in the month of going on vacation;

- if there is no income even in the month of going on vacation, then the calculation is based on the salary (tariff rate).

For the first option, the formulas for calculating vacation pay will be the same as those given in the previous section.

In examples of how to calculate vacation pay for the year in the remaining cases, the formula given in the previous section will be transformed as follows:

- for the second option, from the terms shown in brackets, the one obtained as the product of the number 29.3 by the total number of months in the billing period will disappear;

- in the third option, income will be replaced by the salary (tariff rate), and instead of the part contained in brackets, the number 29.3 will have to be used.

Vacation pay indexation

How to act in a situation if the salary changed during the billing period, that is, it increased?

First of all, you need to refer to clause 16 of Resolution No. 922, which sets out the procedure for indexing vacation pay. It depends on the moment at which the increase in salaries (tariff rates) occurred. So, in particular, it should be taken into account that when calculating average earnings, it is necessary to index the payments that are taken into account when determining average earnings and which were accrued in the billing period for the months preceding the increase.

The Letter of the Ministry of Labor dated May 12, 2016 No. 14-1/B-447 clarifies that the calculation should include payments (tariff rates, salaries (official salaries), monetary remuneration) in the month of their last increase and correlate them with tariff rates (official salaries ) established in each month of the billing period.

Example

The employee was granted annual paid leave from February 1 to February 28. In the previous year, his salary was 29,000 rubles. But since January it was raised to 31,000 rubles. All days during the period preceding the vacation (12 months) were worked in full.

In this case, the billing period will be from February 1 of the previous year to January 31 of the current year. If the company had a salary increase during the billing period, then the indexation coefficient needs to be determined. To do this, you need to divide the new salary by the old one:

31,000 rub. / 29,000 rub. = 1.0689655

The indexation coefficient should be applied to salaries accrued in February-December. The month of salary increase is January. Accordingly, all payments starting from February to December (11 months) need to be indexed. From February to December of the previous year, you should take 29,000 rubles for the calculation, and in January take into account the new amount - 31,000 rubles:

(RUB 29,000 * 1.0689655 * 11 months) + (31,000) = RUB 371,999.99

The following is the average daily earnings:

RUB 371,999.99 / (12 months 29.3) = 1,058.02 rub.

At the final stage, the amount of vacation pay will be calculated:

RUB 1,058.02 * 28 = 29,624.57 rub.

Please note that indexation is carried out if the salaries of all employees without exception or an entire structural unit or an entire department are increased. If the salary increase affected an individual employee, this does not mean that you should index his vacation pay.

With universal wage indexation, the average earnings of each employee for the billing period are indexed:

- by the coefficient of increase in his salary (tariff rate);

- by the cumulative increase factor.

Clause 16 of Resolution No. 922 states that in the case of bonuses that are set in a range of values or in absolute amounts, additional payments and allowances do not need to be adjusted.

Accrual of vacation pay taking into account sick leave in the billing period

Let's say an employee goes on vacation from July 1 to July 28. His monthly salary is 20,000 rubles. At the same time, from May 16 to May 22, he was on sick leave. In May, he was credited 16,500 rubles for days worked. How to calculate vacation pay?

First of all, you should determine the billing period. In this case, it will be from July 1 of the previous year to June 30 of the current year.

20,000 is the salary established for the employee by the employment contract. 11 months fully worked are included in the calculation. In May, only payments for time actually worked are included.

(RUB 20,000 * 11 months) + RUB 16,500 = 236,500 rub.

The number of days is determined by calculation. In fully worked months, the constant 29.3 is used - this is the average monthly number of calendar days.

The number of days that are included in the calculation, but were not fully worked, is determined by calculation. To do this, 29.3 must be divided by the number of calendar days in the month that was not fully worked (there are 31 days in May), and multiplied by the number of days that remain:

(29.3 / 31 * 24) + (11 * 29.3) = 22.68 + 322.3 = 344.98 days

Next 236,500 rub. * 344.98 days = 685.55 rub.

We multiply the resulting amount by the number of vacation days:

RUB 685.55 * 28 days = 19,195.32 rubles.

Results

Calculating vacation days and payment for it is easy. The main thing is to know the basic rules (and, as we see, they have not changed in 2020-2021) and take into account some, for example, “holiday” nuances. The rest, as they say, is a matter of technique.

Our vacation pay calculator will help you calculate vacation pay or check your calculation.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.