Answer

1. Yes, you can hire workers on a piece-rate basis (without salary).

But, please note, the employer is also obliged to establish a labor standard (production standard). In other words, when establishing a piece-rate wage system, the employer is obliged to provide employees with work, i.e. create conditions for employees to fulfill production standards, so that the salary of an employee who has worked a full month and fulfilled the labor standard is not lower than the minimum wage established by law.

If an employee completes the full working hours for the month, fulfills labor standards (job duties), but his monthly salary is less than the minimum wage, the employee will need to be paid extra.

See the explanation of Rostrud posted on the Website "Onlineinspektsiya.RF", 2019

2. The condition for piecework wages can be established in an employment contract without specifying specific piecework rates, for example:

“A piecework wage system is established for the employee. Wages are calculated based on piece rates established in the wage regulations and the amount of work completed by the employee.”

or

“The employee is set piecework wages for each type of work he performs separately. The amount of payment for each work performed is determined by the rates established by the Company.”

At the same time, the employee must be familiarized with the specified local regulatory act against signature.

See the materials for more details: How to reflect the condition of piecework wages in an employment contract?

When is the piecework remuneration system used?

A similar system is applicable in cases where the volume of work performed can be measured, for example, in the number of hours or in units of production. Even with this method of mutual settlements with employees, it is necessary to draw up an employment contract with each of them - piecework payment does not imply that the employee works without official registration.

It is advisable to use this form of settlements with personnel in the following cases:

- the need to establish additional motivation for employees;

- the need to increase production volume without compromising the quality of the goods produced;

- the need to accurately determine the quantity of products produced.

When setting wages based on results, it is important to ensure that there is no downtime in production due to the fault of the employer.

A sample employment contract with piecework wages is being developed for enterprises with temporary or seasonal work, for the provision of personal services. Hourly payment for consulting services is a type of such mutual settlements.

Rationale

The right to remuneration for work without any discrimination and not lower than the minimum wage established by federal law is guaranteed by the Constitution of the Russian Federation (Part 3 of Article 37 of the Constitution of the Russian Federation).

The following conditions are mandatory for inclusion in an employment contract: labor function, terms of remuneration (including the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments); working hours and rest hours (if for a given employee it differs from the general rules in force for a given employer); conditions that determine, if necessary, the nature of the work (mobile, traveling, on the road, other nature of work) and other things (Article 57 of the Labor Code of the Russian Federation dated December 30, 2001 N 197-FZ).

Remuneration systems are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms (Article 135 of the Labor Code of the Russian Federation).

That is, the employer independently determines the wage system depending on the specifics of production, categories of employees, etc. and consolidates it with collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms.

Wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). This definition is provided for in Part 1 of Art. 129 Labor Code of the Russian Federation.

Based on the contents of Part 1 of Art. 129 of the Labor Code of the Russian Federation, which reveals the concept of wages (wages), we can distinguish three components of wages, different in their content, purposes and bases for calculation, namely:

1) remuneration for labor depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed;

2) compensation payments;

3) incentive payments.

The monthly salary (including taking into account incentives and compensation payments) of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage (the minimum wage in a constituent entity of the Russian Federation, if the employer the relevant regional agreement applies).

At the same time, it is permissible for the components of the salary, including the salary (tariff rate), to be less than the minimum wage, if the total amount of the salary is not less than the minimum wage. These conclusions follow from the analysis of Art. 129, part 3 art. 133, part 11 art. 133.1 of the Labor Code of the Russian Federation, as well as Letters of the Ministry of Health and Social Development of Russia dated 07/09/2010 N 22-1-2194 and the Ministry of Labor of Russia dated 09/04/2018 N 14-1 / OOG-7353.

If the total salary is less than the minimum wage, then the employee should make an additional payment.

Piecework wages are used when it is possible to take into account quantitative indicators of the employee’s work results, since wages are calculated for the actual work performed (that is, for the number of products produced by the employee, work performed, services rendered). The calculation of wages under the piecework wage system is carried out according to piecework rates, which are determined based on the established grades of work, tariff rates and production standards (Article 129, Part 1, Article 132, Part 4, Article 143, Part 2, Art. 150 of the Labor Code of the Russian Federation). In this case, piece rates can be set both individually and for several workers.

When an employee with piecework wages performs work of various qualifications, his work is paid according to the rates of the work he performs (Article 150 of the Labor Code of the Russian Federation).

Labor standards - production standards, time standards, number standards and other standards - are established in accordance with the achieved level of equipment, technology, organization of production and labor (Article 160 of the Labor Code of the Russian Federation).

The employer is obliged to provide employees with work stipulated by the employment contract (Article 22, Labor Code of the Russian Federation). If this obligation is not fulfilled, the legislator imposes liability on the employer in the form of payment for downtime (Article 157 of the Labor Code of the Russian Federation).

It is necessary to pay attention that the employer must organize the work process so that during the accounting period the employee fully works out the standard working hours.

If the employee’s failure to comply with labor standards was due to the fault of the employer, the employer is obliged to pay the employee no less than his average salary, calculated in proportion to the time actually worked (Part 1 of Article 155 of the Labor Code of the Russian Federation). In this situation, the employer’s fault lies in failure to provide work.

It is necessary to take into account that in those jobs where this is necessary due to the special nature of the work, as well as in the production of work, the intensity of which is not the same during the working day (shift), the working day can be divided into parts so that the total working time did not exceed the established duration of daily work. This division is made by the employer on the basis of a local regulatory act adopted taking into account the opinion of the elected body of the primary trade union organization (Article 105 of the Labor Code of the Russian Federation).

In a situation where the employer cannot provide full employment to the employee, the law provides for the possibility, when concluding an employment contract, to establish the duration of working hours that is less than the normal duration of working hours with an accounting period of no more than one year and piecework wages. This opportunity allows the employer not to bear the costs of paying the employee’s unearned funds, taxes and insurance premiums on them. The conclusion of an employment contract for part-time work does not entail for employees any restrictions on the duration of the annual basic paid leave, calculation of length of service and other labor rights.

Extract from: How to establish piecework wages in an organization? (Expert consultation, State Labor Inspectorate in the Nizhny Novgorod region, 2021)

Piecework wages are used when it is possible to take into account quantitative indicators of the employee’s work results, since wages are calculated for the actual work performed (that is, for the number of products produced by the employee, work performed, services rendered). The calculation of wages under the piecework wage system is carried out according to piecework rates, which are determined based on the established grades of work, tariff rates and production standards (Article 129, Part 1, Article 132, Part 4, Article 143, Part 2, Art. 150 Labor Code of the Russian Federation). At the same time, piece rates can be set both individually and for a team of workers.

Accordingly, the employer needs to establish not only piece rates, but also a labor standard (production standard) (Article 160 of the Labor Code of the Russian Federation). At the same time, in order to meet production standards, the employer is obliged to ensure normal work conditions, which are listed in Art. 163 Labor Code of the Russian Federation.

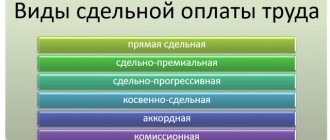

Depending on the method of calculation, the practice of labor relations has developed several types of piecework wages: direct piecework, piecework-bonus, piecework-progressive, indirect piecework, piecework and commission systems. The cases of application of these types of piecework wages are different, which the employer should take into account when choosing a form of payment based on piecework rates.

Guarantees for workers when establishing a piecework wage system

When establishing a piece-rate wage system, the employer is obliged to provide certain guarantees for employees (Articles 2, 112, 133, 150, 153, 163, 271 of the Labor Code of the Russian Federation):

- the salary of an employee who has worked a full month and fulfilled the labor standard should not be lower than the minimum wage established by federal laws and regional acts;

- in cases where, taking into account the nature of production, workers with piecework wages are entrusted with performing work that is charged below the grades assigned to them, the employer is obliged to pay them the difference between grades;

- for work on non-working holidays, additional remuneration is paid; payment for work on a weekend or non-working holiday is carried out at no less than double piece rates;

- provide normal conditions for employees to fulfill production standards;

- the procedure for piecework payment for minor workers.

Normative base

There are two important and immutable rules enshrined in the Labor Code of the Russian Federation:

- It is necessary to conclude an employment contract with each employee, which will spell out all the conditions of his work and rest in the organization.

- Each employer has the right (without going beyond the current Labor Code of the Russian Federation) to independently establish such working conditions, including the type of payment.

Based on this, it follows that any employer can assign to its employee one of the types of remuneration permitted by the Labor Code of the Russian Federation, in particular:

- time-based (the employee will receive a salary for a month of work or a fixed rate per unit of time - a day or an hour);

- piecework (the amount of earnings will depend on prices and the number of products produced per month);

- commission (the employee is set a percentage (commission) for goods sold (work, services)).

These types of earnings can be used either separately from each other or of a mixed nature. All this depends on the specific working conditions in the organization, but must be specified in the contract when hiring an employee. The type of remuneration is an essential condition of the TD, therefore, in the event of any changes in this matter, the parties will have to enter into an additional agreement. (Article 57, 135 of the Labor Code of the Russian Federation).

Establishing piecework wages

Before establishing piecework wages in an organization, the employer should:

- establish standards for production and service time, on the basis of which piece rates for specific types of work or operations are determined;

- establish categories, since the work must be differentiated by complexity (ETKS and professional standards are used to determine the category);

- establish tariff rates and piece rates (tariff schedule).

Thus, when setting wages at piece rates, the employer must:

- issue an order to establish or transfer the relevant categories of workers to piecework wages;

- fix this procedure in a local regulatory act of the organization (for example, draw up and approve a regulation on piecework wages or reflect it in a collective or employment agreement). The regulations must list all professions and positions for which a piece-rate wage system is established, and must also describe each type of piece-rate payment, indicating rates, bonuses and allowances. At the same time, prices for piecework wages are the main part of the salary, which must be indicated directly in the employment contract with the employee or in an appendix to it;

- familiarize employees with both local legal acts under their personal signature two months before the payment system comes into force (Part 2 of Article 74 of the Labor Code of the Russian Federation);

- make changes to employment contracts in the form of additional agreements.

In addition, due to the fact that the staffing table contains information about the remuneration of workers, it is also necessary to make changes to it. With piecework wages, payment depends on the results of the work performed. In this case, in column 10 “Note” it is advisable to indicate the following: “Piece-piece payment/Piece-piece bonus payment, etc.” Next, it is advisable to provide a link to the local regulatory act that determines the procedure for establishing wages, as well as its amount for a certain standard of production.

Thus, remuneration at piece rates is used in cases where it is possible to accurately record the volume of work performed, and there is also the possibility of technical standardization of labor. To establish wages at piece rates, the organization must develop labor standards, establish piece rates and introduce grades, as well as create normal working conditions for performing labor functions. The conditions for remuneration at piece rates are established by a local act of the organization, as well as in labor or collective agreements, and in the staffing table. Question: How to establish piecework wages in an organization? (Expert consultation, State Labor Inspectorate in the Nizhny Novgorod region, 2021)

Document provided by ConsultantPlus

How is payroll calculated?

To clearly present the sample by which piecework wages are calculated under the relevant employment contract, it is necessary to determine, first of all, the calculation procedure. It is determined by taking into account the number of units produced by the contractor.

One unit has a certain cost, therefore, the final indicator will be formed depending on the volume completed.

where T is the employee’s tariff; NP – production rate; Salary – salary of the performer.

If piecework payment is applied:

where PV is the period of time required to complete the entire volume of work, calculated in hours; C – the cost of one hour of work, expressed in rubles.

For a more visual representation, let's look at examples.

Example 1

In one day, according to the norm, a milling machine operator must produce 120 pieces of parts on his machine. Its daily rate is 1200 rubles. In one month, a worker will produce 2,400 pieces of products.

You need to determine a piece rate. To do this, you need to divide the daily tariff by the standard quantitative indicator.

The wages of a milling machine operator will be equal to the product of the price multiplied by the number of manufactured products:

Example 2

If the price is set not per piece, but per time indicator, the calculation will have a slightly different form.

The milling operator should spend no more than ½ hour on one operation. The tariff rate per hour is 130 rubles. In 1 month, the employee performed 600 transactions.

The piece rate is determined:

Based on the calculation, the direct salary for the month worked will be calculated:

An employment contract for piecework wages can take a number of forms, since the actual payment for the “transaction” itself may differ.

Despite a number of nuances, payment for work performed based on results is a fairly profitable option for both parties to the employment contract.

The main thing is to correctly formulate the employee’s work attitude. A man must:

- have a certain incentive to perform a sufficient amount of work;

- produce labor based not only on quantitative, but also on qualitative indicators.

However, it is possible to work on a deal only when the volume of work can actually be measured in a number of ways, for example, counting the number of parts manufactured by a machine operator or measuring the volume of work performed by builders, for example, masonry laid by masons. Where this is physically impossible, an employment contract should be concluded on a time-based basis.

State legislation allows you to vary the methods of remuneration for work and in every possible way encourage workers to produce high-quality work and exceed established standards.

Legislative regulation of the issue

Article 11 of the Labor Code of the Russian Federation is the main document, which specifies all the standards related to this area. Articles 131 and 132 of the same Code are devoted to the forms by which work is paid.

The very procedure for the piecework form of remuneration involves several types of scheme when it is implemented.

Piece-premium variety

The worker is awarded bonuses if certain conditions are met:

- a large number of products produced;

- good level of work quality;

- exceeding plans.

The system provides an incentive to increase the quality and quantity of work and the overall level of productivity. The number of defects is less, the same applies to labor costs.

Piece rates: where and how to register them?

The condition of payment is necessarily included in employment agreements; this is stated in Article 57 of the Labor Code of the Russian Federation. But below only the following concepts are mentioned:

- incentives;

- allowances;

- salary.

Piece rates are not described in any way. That is, such a system may not be described in the text of the contract. But how, in this case, does the employee himself know what his remuneration is?

Article 135 of the Labor Code of the Russian Federation tells us that when resolving such issues, the manager himself makes the final choice depending on the system currently used. Below is a list of documents where such systems can be prescribed:

- local acts;

- the agreement itself;

- collective agreement.

Local acts deserve a separate discussion. They are accepted taking into account the opinions of their subordinates. The main thing is that the guarantees in these documents are no less than in the current labor legislation.

In other respects, managers receive complete freedom. The same applies to the choice of the system by which labor is paid.

The adoption of the Remuneration Regulation is the most common step in this case. The document is not required to be drawn up, but it makes life easier for both parties. Employees will have a more accurate idea of what their wages depend on.